The backbone of your firm is inventory. To meet client demand, you must maintain enough inventory on hand but not so much that your storage expenses are out of control. An inventory system can be used in this situation.

Merchandise businesses can record their inventory with either a periodic or perpetual inventory system.

A periodic inventory system records merchandise transactions periodically, usually at the end of the year. Whereas with a perpetual inventory system, all transactions, along with inventory costs and sales of merchandise get recorded immediately as they occur.

Real-time inventory tracking is dependable with the perpetual inventory system. Poor inventory management can result in a wide range of problems. There are a lot of potential issues. Yet, these are a few to provide you with an overview of the possibilities:

- Running out of money is the worst thing you can do since it ties up your cash in inactive items (also known as carrying costs).

- Missing stock can result in late orders and dissatisfied customers.

- Excess stock wastes space and ties up cash.

- Poor replenishment causes tension.

These are problems that could have a significant impact on how your organization runs.

In this guide, we will be explaining what a perpetual inventory system is, its advantages, and whether or not it is the right inventory management practice for your small business accounting.

What Is Perpetual Inventory?

Perpetual Inventory is a computerized point-of-sale system.

- It records inventory variations in real time.

- It is a new technology gaining popularity in the retail industry.

- It eliminates the need for manual inventory inspections.

- It reflects the number of goods on hand and offers a detailed view of inventory changes.

- It also provides immediate reporting of the amount of inventory in stock.

Increasingly, warehouses and the retail sector adopt perpetual inventory methods. It can minimize understatements due to missing inventory. It can also reduce overstatements due to phantom inventory.

Companies that use a material requirement planning (MRP) system for production must also maintain perpetual inventory. Companies can use the following formula to calculate their perpetual inventory's ending inventory:

Ending Inventory = Beginning inventory + Receipts - Shipments

When using this approach, a business needs to make more effort to maintain thorough records of the products it has on hand. Instead, purchases are noted as debits to the inventory database.

Direct expenditures for labor and materials are included in the cost of products sold. It also contains direct factory overhead expenses. A firm maintains records of its inventory through routine physical counts. It is done under a periodic inventory system, which is different from a perpetual inventory system.

Understanding Perpetual Inventory

A perpetual inventory system is superior to the more conventional periodic inventory system. Perpetual inventory systems allow immediate tracking of sales and inventory levels, except in cases where the perpetual inventory differs from the physical inventory count due to loss, breakage, or theft.

The perpetual inventory does not need manual adjustment by the company's accountants.

Transactions Recorded Under the Perpetual Inventory System

Businesses that use a perpetual inventory system count their inventory and document transactions. It includes:

- Inventory purchased,

- Inventory sold,

- Inventory moved out of warehouses,

- Inventory transferred to other production departments, and

- Inventory that has become obsolete or is discarded for reasons such as breakage and theft.

When combined, these transactions show the current inventory levels.

What Is a Perpetual Inventory System?

A perpetual inventory system is an inventory management method that records each sale or purchase of inventory in real-time, through automated software.

With a perpetual inventory system, each sale or purchase of merchandise is updated on a real-time basis automatically, thus providing you with a full financial picture of your inventory levels.

- The inventory count is updated in real-time using inventory management software and procedures.

- It entails that staff members utilize barcode scanners to capture sales, purchases, or returns as they happen.

- Employees input this data into a dynamic database that keeps track of every update.

- The system is distinguished from the periodic approach by the automatic or perpetual updating of the inventory. This is what gives the technique its name.

- Perpetual inventory has become a more robust and viable choice for many firms in recent years. It is due to advancements in inventory management software and its ability to be integrated with other business systems.

- The flexibility of perpetual inventory software to interact with other corporate systems gives it its true worth.

For instance, the financial and accounting departments depend on real-time inventory data. Integrating inventory management with financial systems helps ensure correct tax and regulatory reporting.

Inventory might make up a significant part of your reported assets. Salespeople can manage expectations and deliver a better customer experience. It has a direct influence on your reputation.

Marketers may position the business to meet anticipated customer demand. It is done by understanding customer behavior in the context of historical trends.

If you want to learn more about inventory accounting, and how to properly streamline your inventory management process, head over to our complete guide on inventory management.

Increased Usage of Perpetual Inventory System

In the past, perpetual inventory systems were not commonly employed. It took time to reliably and swiftly record and analyze the vast volumes of data. Besides, technological advancements have enhanced business and accounting procedures recently.

Computers and scanners may now be used to handle inventory monitoring systems. It makes perpetual inventory tracking less onerous.

Who Uses a Perpetual Inventory System?

When business owners or management need up-to-date information about inventory levels, then using a perpetual inventory system is the way to go.

- Large businesses prefer perpetual inventory systems. These are the businesses that have large amounts of inventory. From new and small to medium-sized organizations, look for scalability. Cycle counts, which are required for a periodic system, are challenging to conduct in large enterprises.

- Having an updated database of products may make it simpler for a company with many retail locations to manage inventories.

- Small businesses looking to expand, or want to take more control over their merchandise, also prefer a perpetual system, as there are plenty of intuitive and low-cost perpetual software options in the market today.

- Other companies that need eternal inventory are those that specialize in drop shipping. In this, manufacturers send products straight to clients or in trade and distribution.

- The inventory is constantly changing in these businesses. Returns and exchanges are also ongoing. A perpetual system or constant updates are needed to understand which stocks are available at any given moment.

When Would You Use a Perpetual Inventory System?

Perpetual inventory systems are helpful for individuals who must constantly comprehend margins and profitability. Big businesses use a perpetual inventory system with lots of products or by companies who seek to grow new businesses over time.

- According to experts, perpetual inventory systems are the way of the future, particularly for product companies.

- They are becoming more affordable and practical for usage by even small organizations.

- More real-time product identification and advancements in all areas relating to transmitters in and on products are what this business is moving toward in the future. The future is bright for this business. These are automatic methods of identification. You can always find it, no matter where you store it.

- Each time the company makes a sale or buys new goods, adjustments are recorded by software into a sales revenue account. The accounting records will accurately represent the balances in the affected accounts. It is a method of registering sales.

The price charged is also recorded by the software. It would help if you were aware of the selling price, the purchasing price, and the affected accounts to record transactions in a perpetual system.

The cost to the client of the product is its selling price. The costs related to the product, such as shipping, receiving, and storage expenses, are included in the purchase price.

Periodic vs Perpetual Inventory System

While we explained above the main difference between periodic and perpetual inventory systems, we only covered some core features that differentiate the two.

With a perpetual inventory, all transactions involving costs of merchandise get recorded immediately as they occur. For instance, take grocery stores - each time a product is bought and scanned, the system updates inventory levels in the database.

In a periodic inventory system, on the other hand, reports of inventory and cost of goods sold aren’t kept daily, but periodically, usually at the end of each fiscal year, or at the end of each month.

You can choose the system depending on your items' nature, perishability, and physical handling. It is also based on how big or tiny and how much room they take up. The way your business receives and stocks the product also affects its nature. Some products are unitized because they come in separate bins and have little pieces.

The perpetual and periodic systems also differ in the following additional ways:

Updating Your Accounts: A perpetual system allows for ongoing inventory and general ledger updates with each transaction. Updates to the general ledger only take place during physical counts in a periodic system rather than based on transactions.

Determining Cost of Goods Sold (COGS): In a perpetual system, the software system keeps track of transactions in real time. It can thus always offer COGS.

After an accounting period, a periodic inventory system determines COGS in a lump sum following a physical inventory. Before the end of the accounting period, it is impossible to decide on an exact COGS.

Implementation Method: Permanent systems need to be implemented using the software. It is because of the vast number of transactions they keep track of. Periodic systems enable manual implementation without the need for any software.

Record Transactions: A perpetual inventory system requires software because it is impossible to maintain records manually. There may be thousands of transactions to track.

Yet, the software is optional for a periodic system. In a periodic inventory system, you might manually keep track of your inventory.

Cycle Counting: Cycle counting is the practice of businesses counting segments of their inventory. The goal is to do an entire inventory throughout a set period. They only count some of their stock at a time, but they make tiny adjustments based on the results.

Businesses only use cycle counting, also known as sampling, in a perpetual system. Because they cannot establish a baseline while using a periodic inventory system, they do not use cycle counting.

Stock-keeping Method: With perpetual inventory, you can use alternate counting techniques, like cycle counting. It is not possible with periodic systems.

Cycle counting lets you divide your inventory into several pieces for individual counting. It then assimilates that data into your central databases. In this manner, it is unnecessary to count the entire inventory simultaneously.

Recording Purchases: Purchases are entered in either the inventory account for raw materials or the merchandise account in a perpetual system. Without including any unit-count data, investments in a periodic system are logged into the purchases asset account.

Investigating: A perpetual system makes available transactions at a detailed level. As a result, it is simple to conduct inquiries into inventory-related problems.

These analyses are more complex in periodic systems since the system accumulates data at a high level. It is challenging to identify process errors using this data.

Even by GAAP requirements, perpetual or periodic systems are suitable for any business. Each is better suited to various sizes of enterprises. Because permanent systems are more timely, they are better suited to companies with significant sales volumes.

Perpetual methods are also better appropriate for businesses with many retail locations. Periodic systems make it harder for these kinds of groups to make decisions.

Being able to check inventory levels and the cost of goods sold, in real-time, can save your employees and your business a considerable amount of time and money.

If you want to learn more about the details and uses of periodic inventory, head over to our guide on the periodic inventory system.

Perpetual Inventory vs Book Inventory

The main difference between perpetual inventory and book inventory is that perpetual inventory is an ongoing process that is constantly updated and book inventory is an annual process that is only updated once a year.

- Perpetual inventory systems track inventory in real-time, allowing managers to make better decisions about ordering, pricing, and stock levels. Book inventory is a snapshot of inventory at a single point in time and does not provide the same level of accuracy and detail as a perpetual inventory system.

- Perpetual inventory systems are typically more expensive than book inventory systems, but they can save time and money by providing more accurate and up to date information.

- Book inventory is simpler and less expensive, but it may not provide the same level of accuracy as perpetual inventory.

- With a perpetual inventory system, managers can easily identify trends and make informed decisions about ordering and pricing. With a book inventory system, it is more difficult to identify trends as the information is only updated once a year.

- Perpetual inventory systems are typically more complex and require more time and effort to set up and maintain. Book inventory systems are simpler to set up and maintain, but they are not as accurate or detailed as perpetual inventory systems.

Perpetual inventory systems are more suitable for larger companies that need to track stock levels accurately and in real-time. Book inventory systems are more suitable for smaller companies that do not need to track stock levels as accurately.

Metrics to Consider While Choosing a System

There are arguments for and against perpetual inventory, as you might have inferred from the section above. The viability of each case depends on specific aspects of your company:

The Volume of Transactions and Inventory

Which of these two approaches is best depends mainly on the quantity of your inventory. The advantages of the perpetual inventory system outweigh the drawbacks for most organizations with extensive stocks.

- The system is a cost-effective solution for organizations with extensive inventories.

- The time and effort needed to count their merchandise physically is the only reason for this. When you combine those two factors, the effect multiplies!

- The perpetual technique generates many transactions that result in massive databases. These databases are helpful for all company processes.

- Only businesses with low inventory volumes may afford periodic inventory systems. While it's not a guarantee, there's a reasonable probability that your transaction volume is also low.

Businesses like auto dealerships and diamond businesses with the modest transaction and inventory volumes but high-value products often find the periodic technique easier to use. It is especially true when ensuring there are no anomalies.

Location Diversity

Inventory management becomes extremely difficult if your company operates out of several sites. It moves its stock frequently.

- The perpetual system is by far the superior option in such circumstances.

- It eliminates the possibility of error by creating a centralized inventory database that all locations share.

- Periodic systems would need managing many databases and more work to ensure that the data is consistent. Such a business would find it impractical to perform periodic inventory counts.

- It would be due to the significant increase in time and financial expenditures.

Budget

The most apparent factor is undoubtedly your financial situation. Specifically, if you can afford to invest in the early setup costs of a perpetual system.

The infrastructure needed to implement this strategy accurately is substantial. It comes at a cost that small enterprises might not be able to bear.

How Does the Perpetual Inventory System Work?

Every time merchandise is bought or sold, the perpetual inventory system will update inventory levels automatically. This constant updating allows businesses to be aware of their best-selling goods and services and what inventory is running low on supply.

Compared to a periodic inventory system, this form of inventory accounting offers a more precise and effective way to account for inventory. Here is a detailed explanation of how this kind of inventory system functions.

Here is the step-by-step process of how the automation of the perpetual inventory system works.

Step #1: Update inventory levels on the point-of-sale system

As soon as a product is sold, the inventory management system integrated with the POS (point-of-sale) system debits the primary inventory across all sales channels.

A point-of-sale or POS system is the hardware that enables businesses to make sales at a physical store. Through a barcode scanner, the POS system calculates the price of the item and updates the inventory count to show that the item is sold.

After the customer pays through a credit card or cash, the POS system processes the payment, creating a digital receipt.

Step #2: Update Cost of Goods Sold

The cost of goods sold (COGS) is automatically updated and recalculated using the information from the previous phase. You can use the first-in, first-out (FIFO), last-in, first-out (LIFO), or weighted/moving average costing method that you like.

Step #3: Reorder Point Automation

The sale also triggers an automatic update on inventory levels.

Businesses dealing with inventory have minimum required stock levels they need to maintain for every type of good. Whenever a stock amount falls below this minimum, the system sends a notification suggesting you order more stock.

This is known as a reorder point.

A perpetual inventory system uses the business's historical data to automatically update these reorder points and keep inventory levels optimal at all times.

Step #4: Purchase Order Automation

The system updates reorder points and generate the purchase orders necessary for restocking with zero human interference.

In other words, it can be set up to automatically issue purchase orders whenever stock levels fall below the required threshold.

Step #5: Warehouse Management Software

A perpetual inventory system comes with a warehouse management system (WMS), software designed to support and optimize distribution management.

So, employees can use the WMS to quickly scan the product whenever inventory is sent to a warehouse. The product will then automatically appear in the inventory management dashboard, available for sale on all sales channels.

How Does a Perpetual Inventory System Track Inventory?

When a transaction, such as a sale or a receipt, the product database is updated as part of a perpetual inventory system. The perpetual inventory system keeps track of the goods.

- Each product has a unique tracking code—a barcode or RFID, for example—that identifies it and keeps track of its amount.

- The tracking code keeps track of its whereabouts and other pertinent information.

- Employees scan new products into the computer system and their information when they arrive at a business.

- It would be easier to manage every transaction in a company with a computerized inventory system. It is particularly challenging in businesses that sell a variety of products.

- A big box retailer, for instance, carries thousands of items. Daily deliveries of more commodities are made by its supply chain, which the staff then scan into their database. When the product is originally scanned, the employee must add the product's data if it is new.

- This extra information comprises a description, the product code or SKU, and the location in the store where customers can purchase it. This scan changes the amount of stock already on hand if the retailer already carries the item.

The database subtracts one of these products from its count each time a consumer purchases one. The store manager can check the database any time to see how much of that product is currently in stock and whether more needs to be ordered. An effective inventory control system is required.

For instance, the system must ensure that workers quickly scan any new inventory. Physical counts to reconcile the database are uncommon but essential. Over time, theft, loss, and damage can affect the genuine inventory total.

Formulas in Perpetual Inventory

When to order more inventory? How much to order? How much is lead time required before placing an order? And how much stock do you need to maintain on hand for safety? It can all be determined by using inventory management formulas.

FIFO

FIFO stands for First-In-First-Out, and it’s based on the assumption that the first merchandise bought is the first one sold.

To better visualize this method, you can think of FIFO as a queue. The first person that’s queued, is also the first person to go out. Businesses value their stock using the FIFO (first-in, first-out) cost flow assumption. This assumption states that the first products placed in inventory are also the first items sold.

As a result, the inventory that is still on hand after the time period is the most recent. A cost flow assumption is an inventory accounting technique determining the value of the ending inventory and the cost of goods sold. It uses the original value of products from the beginning inventory of a period and purchases of new inventory made during that period.

- Businesses base their decisions on the weighted average cost, FIFO, and LIFO cost flow assumptions (WAC).

- The merchandise inventory account is augmented with more goods. • The stock-based accounting tenet of FIFO (first-in, first-out) is described.

- Using the system, you may keep track of inventory sales and give each unit a cost.

- With the help of modern information systems, you can precisely track the cost of your goods and their inventory.

- This approach is more thorough than other methods since it maintains track of the cost of purchases and the actual inventory count.

LIFO

The LIFO method, or Last-In-First-Out method, assumes that the most recently purchased merchandise is sold first.

A better way to visualize LIFO is by imagining a stack of plates. The first plate (the one you placed at the bottom), will be the last one to go out because you’ll first have to remove all the plates that were placed on top of it.

Weighted Average Method

Businesses value their inventory using a Weighted Average Cost (WAC) cost flow assumption. The average cost of goods sold for all inventory is known as WAC. Accountants carry out this differently in a perpetual system as opposed to a periodic system. It is also known as the moving average cost method.

Every inventory item should have a standard average price when you sell or buy something utilizing the WAC. In a perpetual system, you wouldn't determine the WAC using a formula for a particular time period. The average unit cost, COGS for a time period, and ending inventory for a time period can all be calculated using WAC.

Formula: Cost of goods available for sale / Total number of units in inventory

Economic Order Quantity (EOQ)

Economic order quantity, or EOQ, is a formula that helps organizations determine the correct order amount. It reduces factors like expenses, warehouse space, and stockouts.

EOQ = √2DS/H

D =Demand in units per year

S= Setup costs (per order, generally including shipping and handling)

H = Holding cost per unit per year

Finished Goods

The stock accessible to clients for purchase and can be fulfilled is finished goods inventory. Sellers can determine inventory cost using the finished goods inventory formula.

Formula: (COGM – COGS) + Value of Previous Year's Finished Goods

Cost of Goods Sold (COGS)

In a perpetual inventory system, the expenditure account grows, and sales costs rise as you sell things. The costs of sales, often known as the cost of goods sold (COGS), are the outright costs related to producing commodities over a specific period. These costs do not include distribution or sales costs, only labor, and material costs.

COGS = BI + P - EI

BI=Beginning inventory

P=Purchases for the period

EI=Ending inventory

If you don't have an actual beginning inventory, you can calculate the beginning inventory as whatever stock is left over from the prior period. The accounting period may be in calendar months, quarters, or years.

The COGS is rolling and updated after each transaction in a perpetual system, but you can compute it for a period using the COGS formula.

Gross Profit

In a perpetual system, you could occasionally have to make an educated guess about how much ending inventory there was for a given period. It could be when creating financial statements or if the stock was destroyed. Start with the initial inventory and the cost of the purchases made during the period to determine this estimate.

Consider the scenario where you must estimate the ending inventory for the current month. The gross profit as a percentage of sales, the total sales for the period, the initial inventory, and the purchases for the period are the values you need to know to calculate this.

Gross Profit = Revenue - COGS

It is crucial to be aware of the following:

- Gross profit as a proportion of sales

- Beginning inventory for the period

- Purchases made during that period, and

- Sales during that period.

Keep in mind that whichever inventory method a business decides to go with, it does not affect performance. These methods only have an effect on the way income taxes are reported.

For instance, depending on price fluctuations, a company that wants to appear less profitable in an accounting period in order to pay fewer taxes, can decide to opt in for LIFO instead of FIFO.

If you want to learn more about how to use these inventory methods, check out our guide on the different inventory valuation methods, with business examples.

Advantages and Disadvantages of Perpetual Inventory System

Advantages of Perpetual Inventory System

For all sizes of e-commerce firms, a perpetual inventory system offers many benefits. It assists in eradicating labor costs and human mistakes in addition to helping in the real-time tracking of inventory data.

Let's examine the reasons that e-commerce companies decide to use a permanent inventory system. The following ways represent how perpetual inventory can save you money:

Real-time Updates

A perpetual inventory system recognizes changes in inventory levels, as soon as a sale or purchase takes place.

This constant inventory tracking provides businesses with the advantage of always knowing which goods may be running low so that they can respond on time and avoid stock-outs or shortages.

And if you’re managing a big business that operates in several locations and uses several warehouses, a perpetual inventory system allows you to manage everything with ease, through one central automated system.

Thorough Paper Trail Available

Through your whole e-commerce supply chain, a perpetual inventory system monitors inventory movements. You can uncover strategies to improve your supply chain. It can be done by using this data to gain a deeper understanding of any process bottlenecks.

Decreases Inventory Management Costs

Inventory replenishments and holding expenses are managed and reduced with real-time data. Labor costs may get reduced with perpetual inventory systems. Perpetual inventory systems automate many manual operations.

Year-end Inventory Balance

Year-end inventory balance is calculated instantly. It is because a perpetual inventory system continuously accounts for inventory. This makes it easier to ensure that the inventory quantities you disclose for accounting purposes are accurate.

Integration with Other Systems

The record accuracy it brings to other systems is a crucial benefit of having a perpetual inventory system. For instance, customer care representatives may now provide consumers with precise shipping availability information.

The materials management team can plan how many extra units must be manufactured or purchased from suppliers. It can be done by consulting the inventory records. The accounting division may now calculate the ending inventory balance for month-end reporting.

Decreased Frequency of Physical Inventory Counts

Physical inventory counts no longer need to be performed regularly with a perpetual inventory system, given that every physical count requires a company to halt its warehouse operations for the count period. It is a significant advantage.

Additionally, this implies that external auditors are not required to see an inventory count. Instead, they are given an inventory report that contains the locations and unit quantities of the goods, which they may compare to the actual inventory.

Precise Demand Forecasts

Demand forecasting is made simple with a real-time inventory system. You can analyze historical inventory and sales data to forecast upcoming sales cycles and ensure you have the correct inventory quantity.

Planning and Forecasting

The perpetual inventory system helps businesses improve their demand forecasts by analyzing the data trends from historical transactions.

Businesses can get a better understanding of their customer’s buying patterns, along with insight on best-selling products and growing segments.

Save Time and Minimize Error

There’s nothing better than automating tedious, repetitive, and time-consuming tasks for you and your employees!

A perpetual inventory system saves your business time, money, and prevents a handful of human accounting errors that can occur along the way.

Disadvantages of Perpetual Inventory System

Technological Dependence: Implementing perpetual inventory systems necessitates a sizable technological infrastructure. This infrastructure comprises both software and hardware tools. It includes warehouse management software, barcode/RFID scanners, and point-of-sale systems.

Employee Training: Personnel training is required in terms of time and financial resources. In contrast, manual procedures are often used in periodic inventory systems to count and record your inventory.

These procedures can also be used to make adjustments to your inventory ledgers. It can still be the more practical choice for tiny enterprises with modest inventory volumes and tight budgets.

Margin-of-Error: Even if computers are less likely to make mistakes than people, it is still conceivable. Especially since some procedures need some human interaction (such as scanning items), physical counts are required to confirm inventory data.

It is also due to the propensity for human beings to engage in dishonest behaviors like theft. Periodic inventory techniques and physical inventory checks make more sense for companies that sell high-value, low-volume goods. Such as jewelry shops and auto dealerships.

Breakage Of Items: For quick record keeping, inventory levels can be updated using buy and sales data. Any object that is damaged, spoiled, or unsaleable is regarded as a part of the inventory.

The perpetual inventory system is at a disadvantage if there isn't an actual physical count to update the broken item's data.

Advantages of Periodic Inventory System

The periodic inventory approach has several obvious benefits:

- Improved Accuracy: The periodic inventory system ensures the accuracy of the inventory records since it allows for a physical count of each item in the inventory. This means that the inventory numbers are recorded accurately, reducing the risk of discrepancies.

- Cost Savings: Periodic inventory system helps to reduce costs associated with maintaining inventory. Since a physical count is not done continuously, the costs associated with labor and time to count the items are reduced.

- Effective Control: This system provides effective control over the inventory. With a periodic inventory system, the inventory can be monitored more closely and any discrepancies can be detected more quickly.

- Time Savings: Since there is no need to constantly update the inventory records, the periodic inventory system saves time and resources. This allows businesses to focus their efforts on other tasks.

- Easy to Implement: The periodic inventory system is relatively easy to implement and requires minimal investments. This makes it an attractive option for businesses that want to manage their inventory without spending too much money.

- Increased Efficiency: The periodic inventory system helps to improve the efficiency of inventory management. This is because it allows for the efficient tracking of inventory items, enabling businesses to make informed decisions about how to manage their inventory.

- Reduced Risk of Theft: The periodic inventory system helps to reduce the risk of theft since it is easier to detect any discrepancies between the physical count and the inventory records. This helps to ensure that all inventory items are accounted for and that any discrepancies are quickly detected.

Journal Entries for Perpetual Inventory

When dealing with inventory accounting, you’ll likely find yourself journalizing transactions. Below you’ll find some of the most common journal entries you’ll need, to do accounting for your inventory.

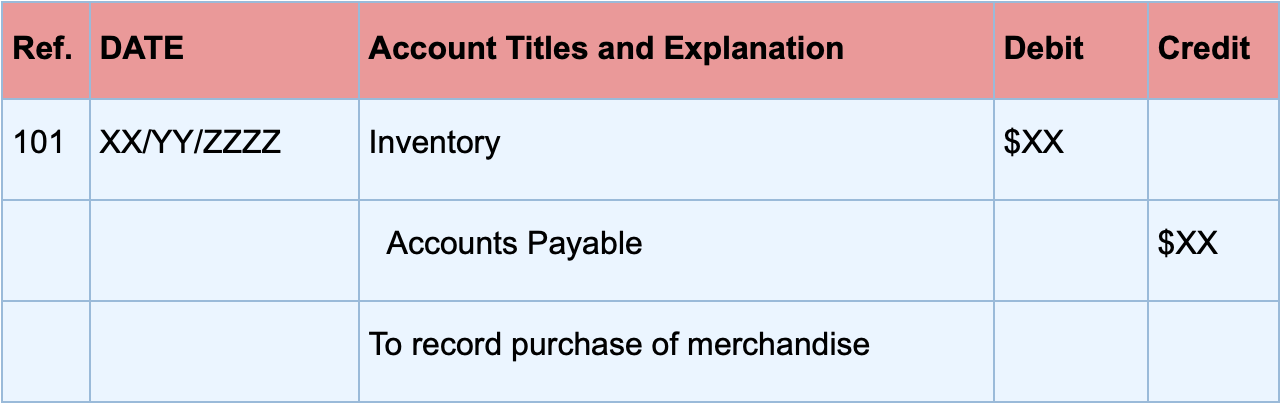

1. Purchase of Merchandise at Cost

To record the purchase of merchandise at cost, inventory is debited and accounts payable credited, as shown below:

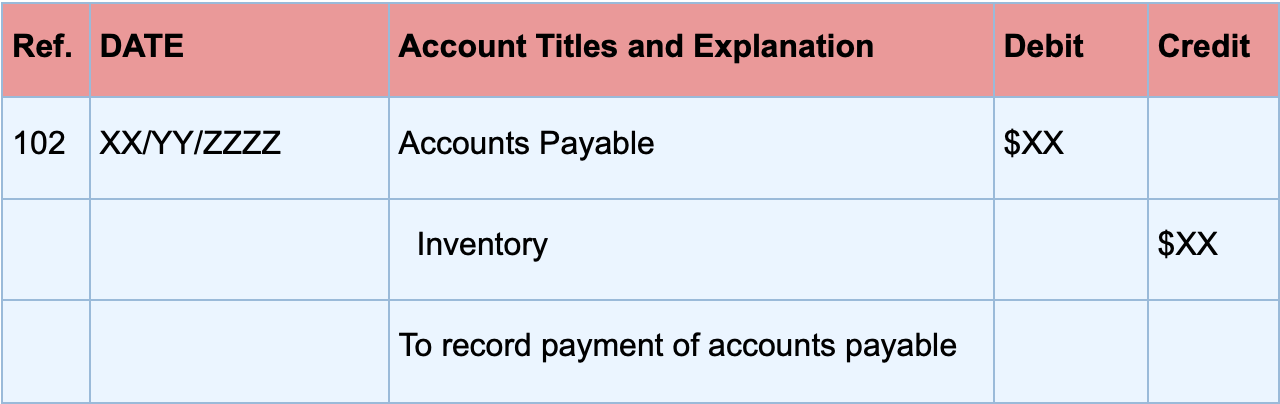

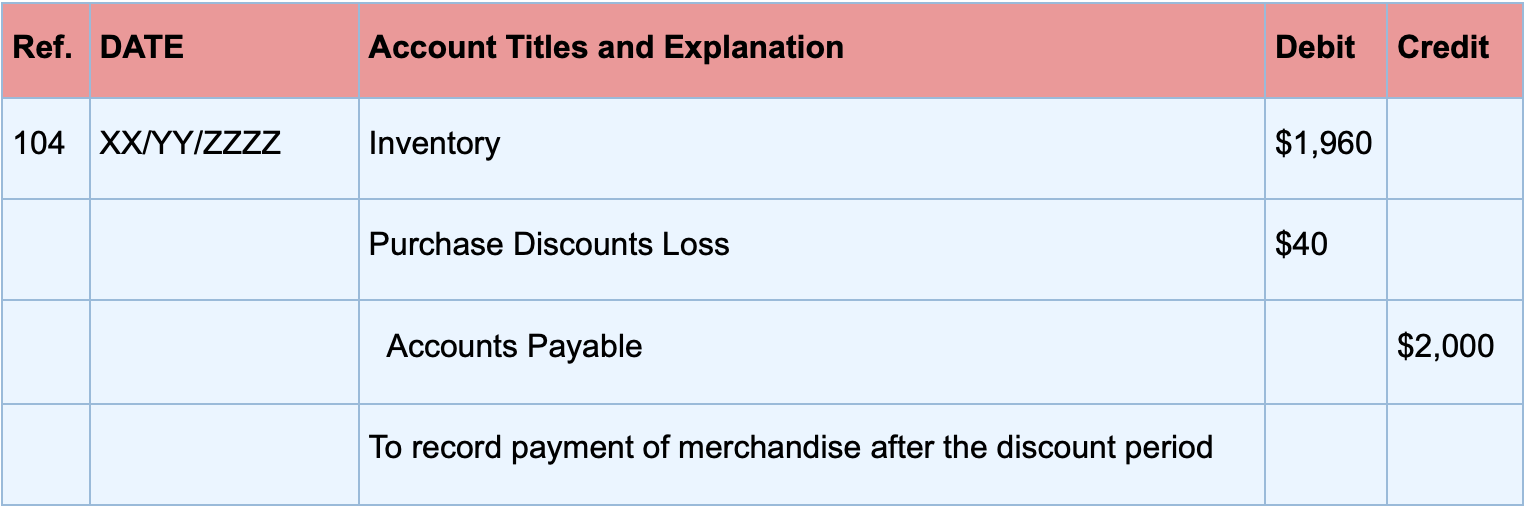

2. Payment of AP

The journal entry for making an invoice payment would look like this:

3. Credit Terms

Typically, manufacturers and wholesalers will sell goods on credit. These credit terms are written down in the seller’s bill or invoice.

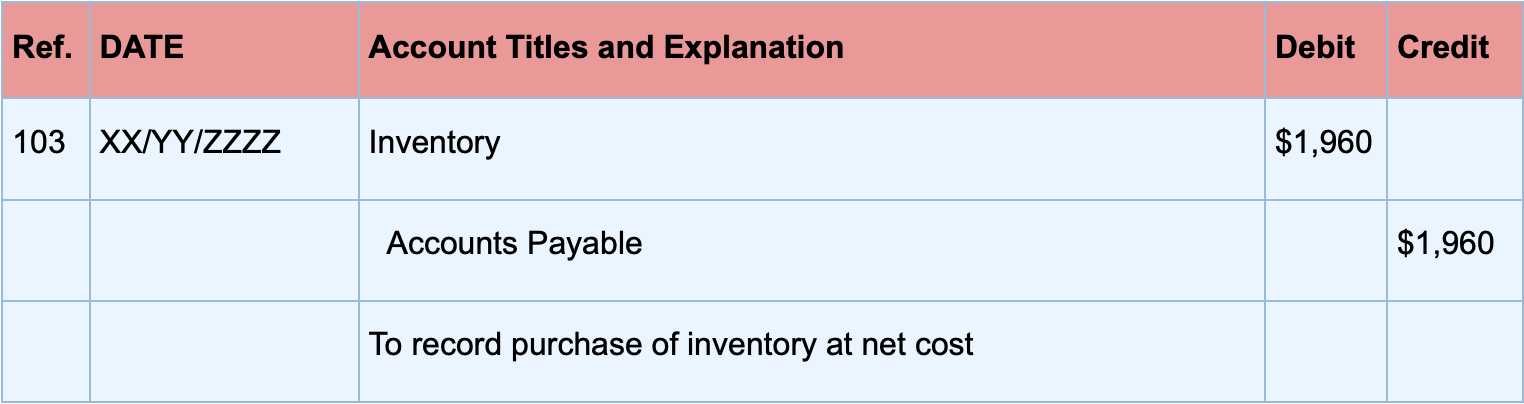

For the sake of our example, let’s assume that on April 1st, the company purchases another $2,000 worth of merchandise, on credit, with payment terms 2/10 net 30.

A 2/10 net 30 payment term means that the buyer has 30 days to pay back its vendor, but can get a 2% discount if they pay within 10 days.

Now, Company XYZ records their purchases at net cost, which is the invoice price of $2,000 minus the 2% available discount, which amounts to $40.

Therefore, the company will record this purchase as follows:

If the company fails to pay within 30 days, and losses the discount, the following journal entry will be made to record the loss:

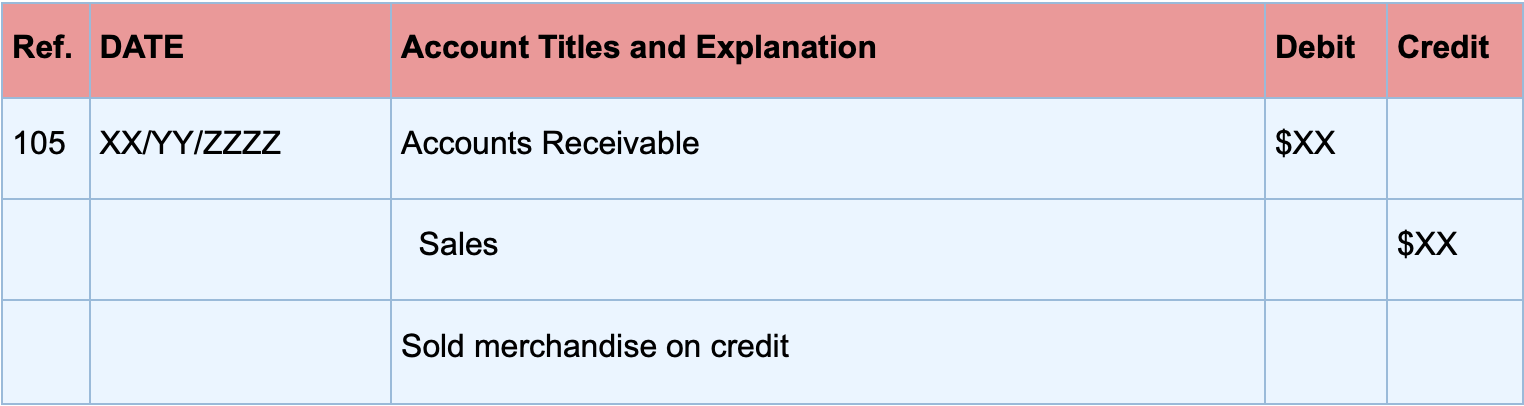

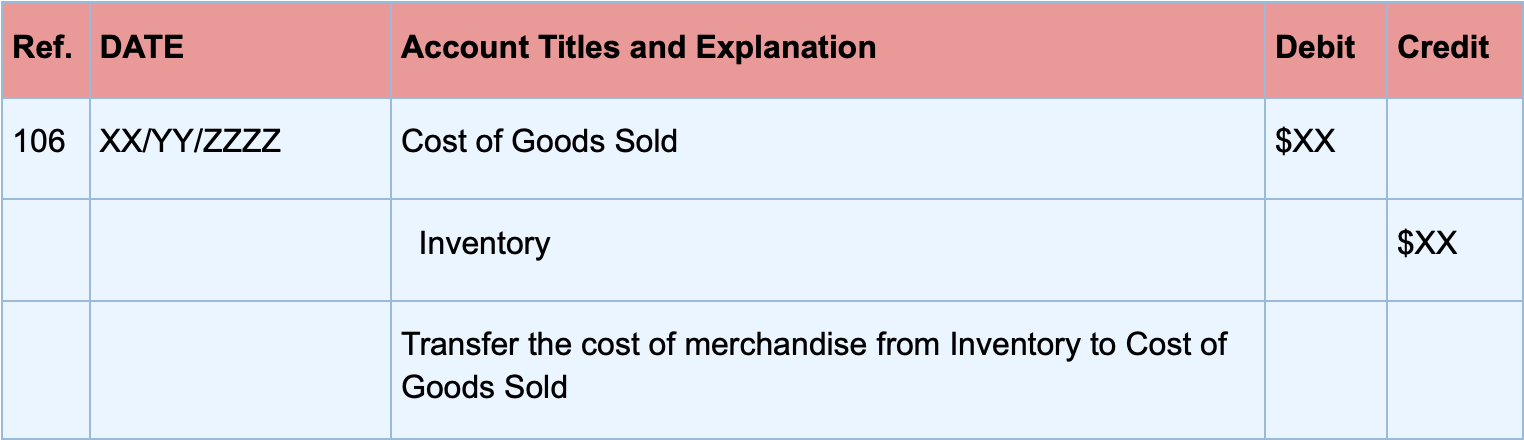

4. Sale of Merchandise

When a business sells merchandise, two journal entries need to be created: one to recognize the sale, and another to record the costs of goods sold.

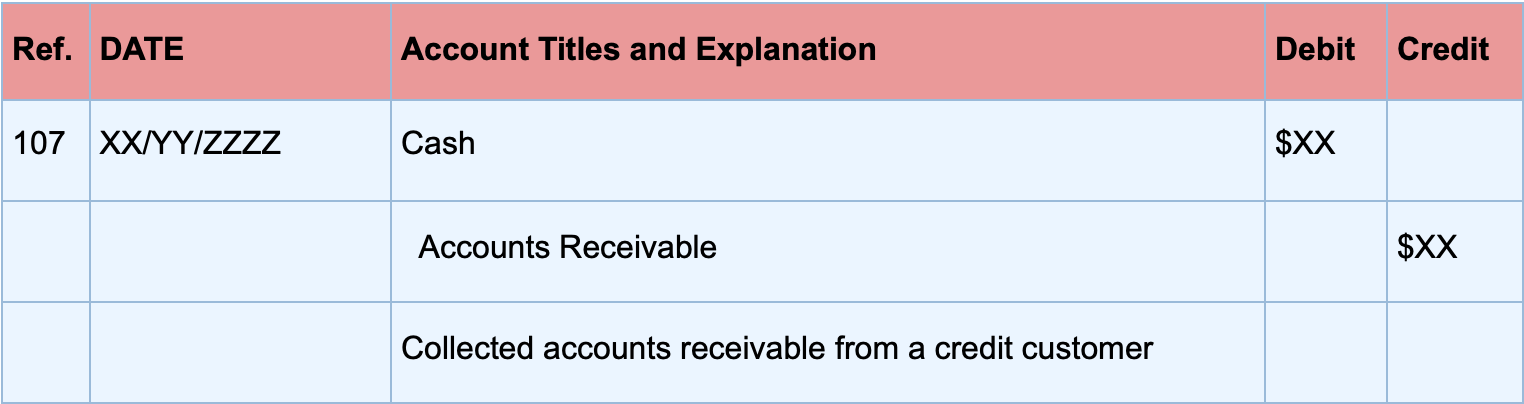

5. Collection of AR

Cash collection of accounts receivable is recorded as shown below:

Want to learn more about the different types of accounts and how to properly journalize them? Head over to our guide on journalizing transactions, with definitions and examples for business.

How Can Deskera Help You?

As a manufacturer, you must keep track of your inventory stock. The condition of your inventory has a direct impact on production planning. It also has a direct impact on people and machinery use and capacity utilization.

Deskera MRP is the one tool that lets you do all of the above. With Deskera, you can:

- Control production schedules

- Compile a Bill of Materials

- Produce thorough reports

- Make your dashboard

Deskera ERP is a complete solution that allows you to manage suppliers and track supply chain activity in real-time. It also allows you to streamline a range of other company functions.

Deskera Books allows you to manage your accounts and finances better. It helps maintain good accounting standards by automating billing, invoicing, and payment processing tasks.

Deskera CRM is a powerful tool that organizes your sales and helps you close deals rapidly. It enables you to perform crucial tasks like lead generation via email and gives you a comprehensive view of your sales funnel.

Deskera People is a straightforward application for centralizing your human resource management activities. Not only does the technology expedite payroll processing, but it also helps you to handle all other operations such as overtime, benefits, bonuses, training programs, and much more.

Conclusion

Global industry leaders favor the perpetual inventory system as their preferred accounting technique. Yet, it needs a suitable technology environment to operate in. If your business can manage the initial fees, get the right software, and keep the system error-free. It is unquestionably the better way for accounting and inventory management.

For e-commerce companies that are expanding quickly, a perpetual inventory system is the best option. A periodic inventory system has weaker stock control and a significant likelihood of discrepancy. You can centralize inventory management, optimize stock levels, and do much more with a perpetual inventory system.

You've decided to open a small convenience shop in your city. You must choose between a periodic inventory system and a perpetual inventory system. It is done during the initial setup process. Select the best approach for your business, and then research to support your choice.

Key Takeaways

- Perpetual inventory systems use point-of-sale systems to track product sales right away.

- Demand forecasting, order management, data analysis, and other inventory management capabilities are all included in fulfillment technology.

- The perpetual inventory method needs to make an effort to keep track of counts of physical goods.

- Being cautious is always a good idea, so it is strongly advised to conduct physical inventory counts routinely. It is also strongly advised to confirm that your data agrees with what the ledgers reflect.

- In contrast to periodic inventory systems, which use recurring product counts for record-keeping, perpetual inventory systems preserve constant inventories of all the products.

- A perpetual inventory system will give your business an accurate view of inventory and stock levels anytime, anywhere, without the trouble of manually processing every transaction by hand.

Related articles