Mr. Ram Krishan worked in a Private school for ten years as a teacher and diligently contributed to his EPF account each month. The amount was deducted from his salary. His employer was also making the same contribution towards the account.

Luckily, Mr. Ram Krishan got a great offer at a Public (government school) at a much higher salary scale, and he moved. He was worried about how his PF account will be transferred to his new job.

This is where EPF declaration form no. 11 comes into the picture.

EPF declaration form no. 11 helps employers check if an employee is already a member of the EPF system. If an employee's salary exceeds Rs. 15,000, and if the employee works for an organization with more than 20 employees, the employer must register him with the EPF.

The employer must continue the PF obligation if the employee is already a member of EPFO. EPF declaration form no. 11 contains the employee's PF history and can help employers automatically transfer PF accounts.

This article will cover all you need to need to know about this form. Here's an overview of all that will be covered:

- What Is EPF Declaration Form No. 11?

- About The Employees' Provident Fund And Miscellaneous Provisions Act, 1952

- Applicability

- Key Features Of EPF Declaration Form No. 11

- Purpose Of EPF Declaration Form No. 11

- Sample Of EPF Declaration Form No. 11

- How To Get EPF Declaration Form No. 11 Online

- How To Fill The EPF Declaration Form No. 11

- Declaration By Present Employer

- Benefits Of EPF Declaration Form No. 11

- Responsibilities Of Subsidiary Employers

- International Workers

- Key Points Related To EPF For International Workers

- Excluded Workers

- Conclusion

- Key Takeaways

What Is EPF Declaration Form No. 11?

EPF declaration form no. 11 is a self-assessment form employees must complete when joining an organization covered by the Employee Provident Fund (EPF) program under the EPF Act of 1952. All details for your previous EPF account must be provided on the form.

This form is also used to automatically transfer the amount from your old PF account to your new EPF account.

Previously, employees had to fill out Form 13 to transfer the PF to their new EPF account. However, after the introduction of the modified EPF declaration form no. 11, the automatic transfer request is included in the form itself.

About The Employees' Provident Fund And Miscellaneous Provisions Act, 1952

This law establishes reserve funds, pension funds, and deposit insurance funds for employees. The Employee Provident Fund Organization (EPFO) is one of India's largest social security organizations in terms of the number of insureds and the number of financial transactions undertaken.

Applicability

The Employee Payment Fund and other pension laws provide for a contribution fund for the future of a retired employee or his surviving dependents in the event of an employee's premature death.

It applies to all of India except Jammu and Kashmir and applies to:

- Factories engaged in any of the industries listed in Schedule 1 and employing 20 or more people

- Other entities that employ 20 or more people, or classes of such entities authorized by the central government

- Other entities so notified by the central government, even if they employ less than 20 employees

- Contractors (excluding apprentices employed under the Apprenticeship Act or the standing order of the institution and temporary workers) who receive wages up to 15,000 rupees

Online filing of nomination can be done at https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Key Features Of EPF Declaration Form No. 11

- EPF declaration form no. 11 is a tax return form that employees must submit when starting new employment at an organization that offers an EPF (Employees Provident Fund) program

- This form contains basic employee information such as name, date of birth, contact details, previous employment details, and KYC details (Aadhar, bank account, PAN, etc.)

- If you change jobs to a new employer and contribute to the EPF with your previous employment, you will need to submit both EPF declaration form no. 11 and Form No. 13 (for the transfer of the old PF account) to the new EPF account)

- EPFO issued a notice (September 23, 2016) regarding the new EPF declaration form no. 11; the new Form 11 is a one-page tax return and is a simplified version of the existing Form 11.

- Last updated (September 27, 2017): EPFO has released the revised EPF declaration form no. 11; this new compound filing form replaces the existing EPF declaration form no. 11 and can be used for automatic EPF account transfers when changing jobs

- According to the notification, any existing EPF member using the UAN (Universal Account Number) feature to apply for a transfer of funds should also replace the declaration form (new EPF declaration form no. 11) with Form No. 13

- If a UAN number has been assigned and the previous employer has confirmed the KYC details, you can submit the new EPF declaration form no. 11 to the new employer

You can access this new EPF declaration form no. 11 from the UAN Member Portal. You do not need to submit Form 13.

Purpose Of EPF Declaration Form No. 11

It serves the following purposes:

- If a new employee were previously a member of the Employee Provident Fund Scheme, they would continue to receive the benefits of the scheme under the new employee ID

- If the new employee was not a member of EPFO during their previous employment or was not previously employed and their salary exceeds Rs. 15,000, they may choose to opt out of the PF contributions; they are called disqualified employees

- You can also use EPF declaration form no. 11 to automatically transfer PF amounts from your old account to your new account

- This return also allows the Funds Department to maintain a comprehensive database containing key employee information and is useful in inspections, audits, cross-checks, or fact checks

Sample Of EPF Declaration Form No. 11

How To Get EPF Declaration Form No. 11 Online

You can download the EPF declaration form no. 11 from the EPF website. When you fill out the form, you will have to provide the following information:

- Employee name

- Employee's date of birth

- Father/husband's name

- Gender

- Mobile number

- Email ID

- Relationship between employees and EPS and EPF systems

- Previous employment details like UAN, last working day, system certificate number, etc.

- Education details

- Marital status

- KYC details such as bank account number and driver's license

- Passport (for foreign employees)

- The employer must also submit the following documents:

- Employee date of joining

- Provident fund ID number of the employee

- Employee UAN

- Verification of employee data

How To Fill The EPF Declaration Form No. 11

After filling in the Personal data of the employee, you must fill in the details of previous employers and employee participation records in EPF and EPS:

- Whether you were a former member of the 1952 employee's Provident Fund scheme

- Whether you were a former member of the employee pension plan, 1995

If an individual marks "yes" to participate in any of the programs, some additional data points will need to be provided:

- UAN or universal account number

- Previous PF or Provident Fund account number

- Departure date from the last employment in dd/mm/yyyy format

- System certificate number (if issued)

- Pension payment order (PPO) number, if issued

Details of KYC:

- A certified copy of the following documents must be attached to this form

- Bank account and IFSC

- Adhaar number

- Taxpayer number (PAN)

International workers need to provide the following information additionally:

- Country of origin

- Passport ID number

- Passport validity

Undertaking by the Employee

Read the declaration on the form and sign the commitment declaration. Remember to include the date and place where you signed the pledge.

Declaration By Present Employer

The current employer will need to take the necessary steps, fill in the relevant information, and sign and seal. They must also provide a statement detailing the employee's disclosure.

This declaration contains the following:

- Employee joining date

- PF ID number or the Member ID of the employee

- Employee UAN

- Verification of KYC credentials

Employees need to fill out EPF declaration form no. 11 and submit it to the employer. The employer signs the form and stamps it. Then, you can submit it to your local EPF office.

Benefits Of EPF Declaration Form No. 11

- If a new employee was previously a member of the EPF scheme, that employee will continue to enjoy the benefits of the scheme but will use the new member ID

- You can use this form to automatically transfer your pension amount from your old account to your new account

- The EPF declaration form no. 11 also helps the Provident Funds department create a complete database containing key employee information; in addition, it is of great help in examining, billing and auditing, cross-checking, or confirming data

Responsibilities Of Subsidiary Employers

- All new entrants will have to formally fill the EPF declaration form no. 11 within one month and upload the information to UAN within 25 days by the end of each month

- Communicate and confirm the details of the UAN created by the EPFO to all existing members of the fund within 15 days of receiving the UAN

- Responsible for employee UAN activation within 15 days of distribution of this information

- Seed the KYC data (PAN, Aadhaar, and bank account details) for these members within one month of receiving the UAN

- If the member does not have an Aadhaar card, the employer must receive an Aadhaar confirmation within one month of receiving the UAN

- Each time an employer receives Aadhaar information from an employee, within 15 days, he must upload the details to the UAN portal

- The application must be completed by the employer in all respects as follows before being sent to the EPFO

- All relevant KYC information must be linked to the UAN

International Workers

The term "international worker" is intended for two groups of people:

- Indian workers who are currently working or have worked in other countries where India has signed an SSA or a social security benefit agreement

- Non-Indians working in India, as specified by the Employees' Provident Funds & Miscellaneous Provisions Act, 1952, who fall within the scope of the statutory law.

Previously, international workers working in India were excluded from the scope of the Employee Provident Fund. However, all qualified international workers (i.e., non-excluded members) are now required to become members and pay the required membership fees under the EPF program.

Key Points Related To EPF For International Workers

Workers from abroad are also required to fill out EPF declaration form no. 11 at the time of registration. However, you should be aware of the following:

Social security agreements are bilateral measures to protect the social security interests of workers dispatched to other countries. Since it is a mutual arrangement, it generally guarantees equal treatment and avoidance of double coverage.

Currently, India has SSAs (Social Security Agreements) with Belgium, Germany, Switzerland, the Grand Duchy of Luxembourg, France, Denmark, South Korea, the Netherlands, Hungary, Finland, Sweden, the Czech Republic, Norway, Austria, Canada, and Australia, Portugal, Quebec, Japan.

(Qualified) international workers are required to enroll in the program from the day they start working in India.

- PF provisions apply even if salaries are paid to such employees outside India

- For split salaries, PF contributions are calculated based on the total salary earned by the individual

- Indian workers gain international worker status only through employment in countries where India has signed the SSA

- They will retain this status until they claim benefits under a social security program covered by SSA.

- Employees who are required or qualified to become members of the PF at the earliest are required by their employer to provide information about themselves and their agents for transmission to their agents. You need to provide this on request.

Excluded Workers

If a new employee was previously hired and was not a member of EPFO or was not previously hired - in the case of employment, the salary base is monthly Rs 15000 for new employment. If it exceeds 15,000, they may choose not to contribute to EPS or EPF.

This type of employee is known as an "excluded employee." Excluded employees are also those who have withdrawn the retirement fund pension

Conclusion

The main purpose of establishing the Employee Provident Fund was to improve employees' quality of life and provide them with the safety and benefits of their citizens.

EPF declaration form no. 11 contains important data about the employees. Employees must provide all the details when they join the organization. EPF declaration form no. 11 is used by the employer in preparing the new employee's paperwork. All his details need to be updated and specified in the UAN portal by the employer.

EPF declaration form no. 11 is submitted for employee pension and reserve declarations. Employees eligible for the PF program were also required to complete the EPF declaration form no. 11, which you can easily download from the official government website.

How Deskera Can Assist You?

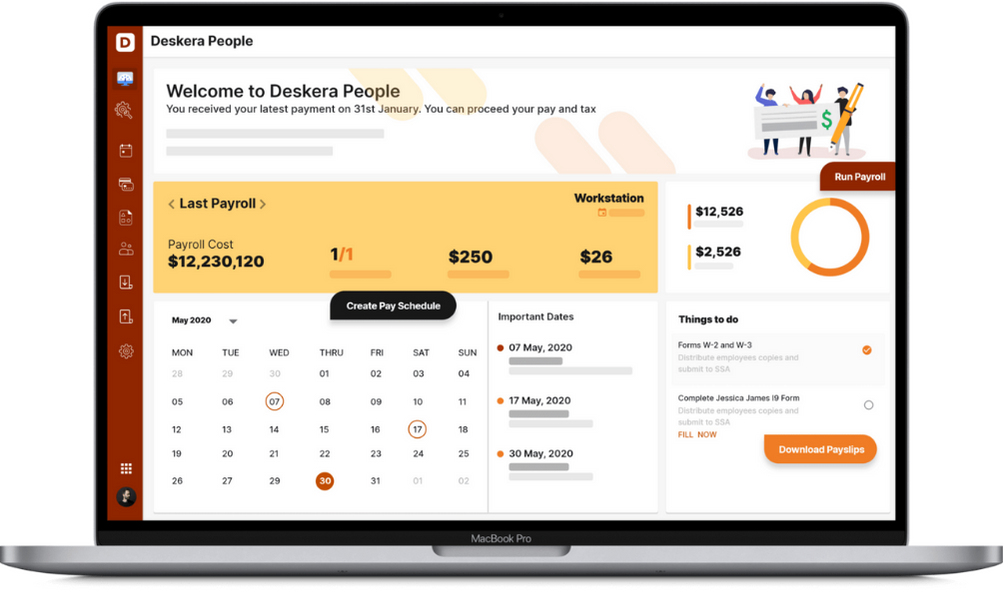

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning and uploading expenses, and creating new leave types make your work simple.

Key Takeaways

- EPF declaration form no. 11 is mandatory for all employees joining the new organization as EPF and EPS declarations

- There is only one EPF declaration form no. 11 that needs to be filled out by the employees for the old and new organizations

- Previously there were two different forms( Form 13 also), but each employee joining a new organization only needs to fill out EPF declaration form no. 11

- EPF declaration form no. 11 is used to enroll employees in both funded and pension funds

- Anyone working for an organization with an Employees Provident Fund and a family pension plan must fill out this form as an order

Related Articles