It is the opening day of the week, your coffee has brewed perfectly, and your favourite track is playing in some corner of the room. You skip your step as you groove towards the door to receive your morning newspaper and mail.

Skimming through bills and subscription stubs, a crisp mail from the Internal Revenue Service presents itself to sever your day in half.

A letter sent by the IRS can be so much as a punch in the gut, but we ask you to take three deep breaths and compose yourself for a minute as you read.

Now, what? Read the quick guide to create an action plan for dealing with the IRS notice.

- What to do if your business gets an IRS tax notice?

- Why did the IRS notify me?

- List of Do's and Don'ts

- What happens if I disregard an IRS notice?

- Who is likely to get audited by the IRS?

- How to avoid IRS letters in the future?

- Key Takeaways

What to do if your business gets an IRS tax notice?

The IRS works for The Government of The United States Of America, and it must collect tax instead of it, so it must stay vigilant and prevent illicit activities. It does not intend to deny your claim but verify if it is genuine or relevant to your lawsuit.

The IRS will always communicate via mail and never email or call. Anyone trying to get through email or call is most definitely a scam.

While you try to understand, book your tax advisor for a quick meet-up to discuss the next steps.

Take deep breaths and call the tax advisor

A state of panic can make you skip this step. Hence, the reminder. Panic will make things worse. Take the time to calm yourself first.

Please take a minute to open the letter carefully and read it slowly and thoroughly in its entirety.

More often than not, users start dreading before opening any document from the IRS because there is some issue going on with your taxes.

But the first and foremost thing to do after opening the letter is to determine if the letter is genuine and not fake. There are some pointers that one can keep in mind while considering the letter:

Check the credentials

The IRS will never use Email, Phone Calls, or Social Media to reach out to your business. Letters are the natural way the IRS will contact you. Any other medium is likely a fraudster and should be reported as phishing. Beware of such pop-ups or calls claiming to be them.

The IRS will never call you to inform you about due taxes, ask for immediate payments or local authorities' involvement, or ask for debit card/ credit card details. The IRS will never send you links via phone to verify your identity or share information.

Although the IRS has been constantly trying to prevent identity theft, including false email, it is advised never to trust a document unless verified genuine in all aspects.

Be aware of what to expect if it's from the IRS

The letter will arrive in a government envelope with the IRS seal on the cover and the introductory note.

Every mail the IRS sends out has a unique code marked on the top right corner of the letter, usually specified by the letters CP or LTR followed by a serial number.

Any notice without the notice number is a scam and should be reported. Cross identifies its integrity by dialling the phone number mentioned under the notice to check if it is an original document.

A genuine document will include your truncated tax ID number, the specific year(s), and the reason in question.

Jot down the essential details from the notice

Note down the year in question, the reasoning, the deadline and the mode of payment mentioned.

The notice will also state your rights as a taxpayer and not threaten to imprison or deport. It will clearly state the payment options directly to the U.S. Treasury.

A specific period will be mentioned under which one needs to get in touch with the IRS in the letter. Please respect the due date, do not ignore it at any cost.

Ignorance or denial are your worst enemies

There is absolutely no reason why a business should ignore an IRS notice because it will not resolve itself unless they have all the details they want.

All the issues regarding the notice will be clearly explained and will provide you with a thorough outline of the required actions you need to take.

One must acknowledge the gravity of the situation and its urgency. The IRS has complete data provided by Third Parties and the data filed by you, which is monitored and tallied to separate suspicious information from others.

If some issue is spotted, they send out letters and give ample time to explain.

Why did the IRS notify me?

If the IRS is trying to get in touch with your business, under no conditions are you supposed to ignore it and take it seriously because things can start going downhill.

Even though Identity fraud has become a rampant problem in America, most of the letters received by the business are accurate.

The IRS can mail you a letter under the circumstances:-

● Balance due

● Owed a larger/smaller refund.

● Question regarding your tax returns

● Verification of identity

● Additional information based on your present knowledge.

● To notify about changes in your recovery.

● To inform you about a delay in tax returns.

Maintaining bills and receipts in a yearly order makes it easier to locate why the IRS might be trying to get in touch with your business.

As mentioned above, there could be many reasons the IRS might be trying to get in touch with your business.

The first notice it sends out is for the balance due, on failing to meet with your tax return duties, forgetting to pay returns, or in the event of not receiving tax returns.

The IRS will be sending you a notice asking you to make amends. Pull out the record of accounts for the given tax year and your account transcript and return transcript.

Here are two tips you must keep in mind:

Stick to the year in question, and gather all the records

It is advised to mentally prepare to abide by the specific topic in question, year and only respond to that. By sticking to the question, one can put itself in a favourable standing by not opening any new doors for the IRS to question.

Stick to the specified year in question and try to gather all your documents from that year, tally, and check if the notice is correct.

The IRS either sends a mail to inform you about the proposed changes or has spotted some error in their records against your business that require additional information to proceed with the necessary adjustments.

To make amends, you log into the IRS website and provide the additional details and documentation they need to file to be on their way.

Often, businesses are required to prove their identity to the IRS to confirm that they are who they claim to be or in light of an income you did not report in your taxes. Or, to ascertain an accurate refund value, they might ask for your pay statements, bank statements, letter of the employer, etc.

A notice doesn't imply you are being accused of anything

The notice might be addressed to inform you about the changes in your tax refunds or delay in processing your refunds; there are many reasons why the IRS would adjust your tax returns.

After you file your taxes, the refund you were supposed to receive might change due to market reasons. After applying for refund notification letters, they will also send a mail to inform about a smaller or larger refund. 2021 witnessed extensive delays in refund proceedings for taxpayers, out of which many did not receive full or any refund.

List of Do's and Don'ts

The best course of action mentioned by the IRS, 'Read, Respond and Pay,' means carefully reviewing the mail and determining why your business is being contacted about a particular year because they will be expecting a reply.

Only after you have cautiously reviewed the notice and ascertained whether you Agree/Disagree or Partially Agree with the statement should you proceed with the best course of action.

Apart from the suggestion above, we have also curated a list of dos and don'ts.

Here's what you should do:

Take professional help

It is considered prudent to acquire some professional aid, advice, or opinion in any case above. The role of a tax professional is crucial when it comes to filing taxes and even more so when your business receives an IRS notice.

A tax professional can help reduce your payments and list the various options for responding to the notice. They are competent in understanding the intricacies of tax calculations to help your business stay secure. They can also help you get hold of your statements and transcripts that need to be attached.

Reply to the notice, no matter what

If you agree with the altered charges or any other reason, tallying with your accounts can help clarify the doubt so you can go ahead and pay the extra costs.

Although, in cases where you partially/don't agree with the stated charges, you are still required to submit a signed formal reply to the IRS stating why you do not agree with the charges. You must also supplement your claim by attaching the required documents and bills backing your mail.

One must read every facet of the letter thoroughly, determining its authenticity and honouring the particular reason your business is in question. Right underneath the letter number on the top right-hand corner will be mentioned the same year the mail is about.

Pay attention to the instructions

The "What you need to do" section should state the precise action you need to take to fulfil the notice. Follow the steps given to work along with the IRS.

Usually, the IRS receives first-hand data through third-party sources such as employers.

When you receive a W-2 or 1099 from your employer, the same is reported to the IRS through automated payment systems.

Still, suppose you have a second source of income through interests or a second job that you did not register in your taxes, or some mismatched information in the taxes you filed or due to some error by the third party.

In that case, the IRS might send you a letter asking for all the details of your second income and making tax changes.

Keep a record of all the notices and receipts as they may come in handy. Receipts and statements help provide proof of transaction and relevance to your income. When there is a lack of information regarding your business and its role, it sends a comprehensive proposal to adjust your payments, income, or deductions.

Here's what you must avoid

Respond, don't ignore or deny

Under no circumstance are you supposed to ignore the IRS notice because putting it off will not make it go away but keep piling on to it as tax debt that will lead to severe problems?

You are expected to respect the period mentioned by the IRS in the notice because they are very particular about the deadline and can lead to a heavy fine.

It would be best if you were not cavalier about the notice because that can lead to penalties and interest charges added to your tax. The second reason is to be safer by adhering to the notice, thereby preserving its right to appeal so your business is in a better position to negotiate.

Stay cautious of the deadline

If you are worried about being unable to pay the entire lump sum amount at once, you can get in touch with the IRS and set up a payment plan, and even if you cannot pay the total amount charged, you are expected to pay off as much as possible.

Suppose you continue to ignore the letter for a longer duration in a recurring pattern. In that case, the IRS will assume that you are intentionally trying to evade taxes and committing tax fraud, which is a felony under the United States Law and can get severely legal in tax courts.

If it is your first time with due additional tax as a penalty, you can directly call the IRS and request a penalty abatement that would skim off the extra charges levied on your account, although the tax shall remain the same.

Side note

It is essential to check every step before considering the document authentic. Usually, there is no need to call the IRS. You can set up your payment plan or other queries and respond online. Contact options are available on the website, but only trust the number mentioned on the top right-hand side of the notice if you have to call.

The user is expected to have all the required documents and tax returns, and letters while calling. Also, he needs to verify his identity. One of the most common letters the IRS sends is verifying the identity that requires the business to submit proof.

Identity theft and tax fraud are significant issues in the United States, where many people have lost everything. Verifying the IRS is as equally correct as trying to confirm your business's identity.

Do not believe in spam because the IRS only uses mail or a direct agent to contact an individual or company. The IRS will never send a message through social media or text to send a notice or receive additional information.

What happens if I disregard an IRS notice?

Regardless of the scenario, you should never disregard an IRS notice or letter. You must handle the matter correctly and promptly by the deadline specified on the notification or letter. Failure to comply could have the following consequences on your tax account and rights:

● Late responses and inadequate information will increase interest and penalty costs.

● If you disagree, you will lose your right to appeal (to challenge).

Who is likely to get audited by the IRS?

Take action to avoid receiving mailings in the future once you've resolved the issue. A Taxpayer can avoid many of them by completing a correct tax return. An IRS notice will definitely be issued due to careless mistakes. Check the math, study the guidelines, and sign on the bottom line when completing your return.

The chances of getting audited are slim: according to IRS data from 2009, only 1% of all returns are audited. However, some tax return items do put you in danger of being audited. Here are some warning signs to look out for:

● Year after year, a home business loses money. The IRS could consider this a pastime rather than a legitimate business.

● Deductions for home offices. The IRS may be sceptical if you claim a large percentage of your living space as a home office.

● There are a lot of itemized deductions. On a $60,000 salary, claiming $40,000 in deductions will certainly attract IRS attention.

How to avoid IRS letters in the future?

We should learn from mistakes and try to prevent them from happening again by being on time with our filing and keeping a detailed income account. A business should keep a meticulous record of all its receipts and bill statements as they come in handy while claiming a deduction on your tax return. Here's a list of pointers to keep in mind:

Record everything in an organized manner

Organizing and keeping track of all information statements, notices, and other tax documents such as W-2s and 1099s or both to have a clear idea of returns to be paid. By filing them beforehand, a business sheds the load of being sent a letter.

A company should include all its income from sources covering sales, dividends, interests, commission, etc. By stating all its income without hiding or failing to mention a source, the business clarifies its intention to the IRS; without committing a felony on U.S. soil.

Honesty towards the IRS is the best policy while dealing with it. Even if you do not have a contract of employment, you are still expected to disclose your correct income through a very intricate system of its own. It has its root deeply embedded in the U.S.A. and keeps records of everyone.

Notify the IRS about amends, if any

After filing returns, if there are any changes in your returns, you need to file the amended returns in the stipulated time frame to avoid penalties. Missing out on filing your tax return form is a common mistake incurred by the IRS, for which they allow you to make amends even after you have filed taxes.

The first and foremost barrier is the statute of limitations, or the time frame the business provides to make amends. The IRS allows amends for-.

1- Change in income

2- Addition or removal of deductions

3- Changing of filing status.

Updating your current personal information is up to date in the IRS database. Many people in America have suffered because of forgetting or failing to update their personal information, including new addresses, marital status, etc.

If the IRS sends a notice and it gets delivered to your former address, it would not be their problem while time runs out.

Although receiving a notice with a clear head and some professional help may look daunting, your business can help resolve issues with the IRS.

How Can Deskera Assist You?

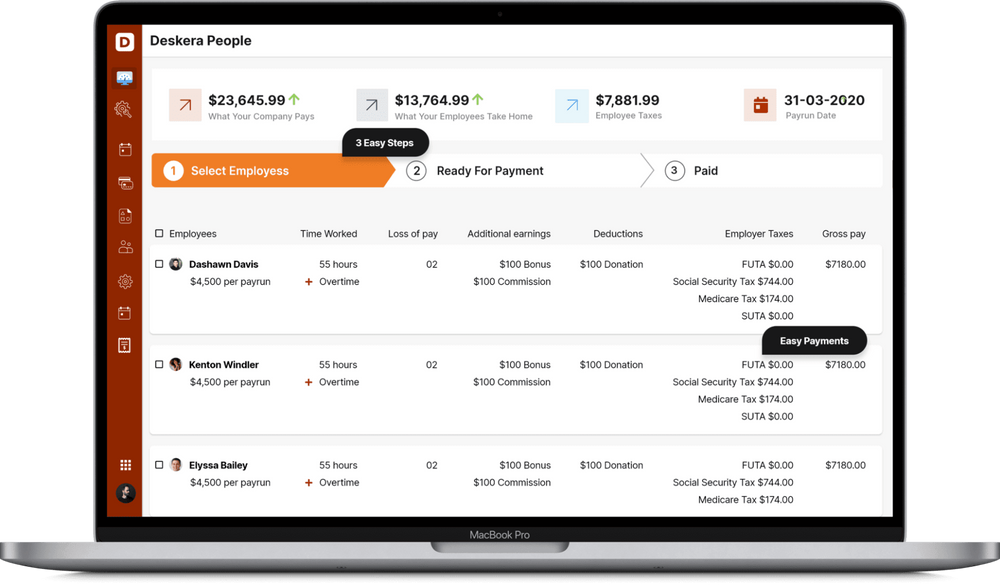

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- Do Not Panic̣ Do Not Ignore. The IRS provides ample time to fulfil the notice after thoroughly reading it.

- Decide if you comply with the given charges, adjustments, or modifications in the notice.

- Keeping the IRS updated on any changes in personal information or tax returns is your only way to avoid the IRS notice.

- Consult a tax professional. A tax professional can help you in many ways, including acquiring required bills and statements.

- This is the time to take necessary action. Either way, you must respond to the IRS within the given time frame or contact an IRS agent to set up a feasible payment plan.

- You can write a cheque to the IRS if you agree with the charges or if you disagree, you can state your reasons with proof and mail it to them.

Related Articles