The Uttar Pradesh Shops and Commercial Establishments Act, also known as The U.P Dookan Aur Vanijya Adhishthan Adhiniyam or Uttar Pradesh Shops and Establishments Act, was enacted on 26th December 1962. The Uttar Pradesh Shops and Establishments Act is also referred to as the U.P. Act XXVI of 1962. This article discusses the various provisions of the Uttar Pradesh Shops and Establishments Act, including information about the compliance forms all shop owners must submit to the concerned authorities every year.

For the convenience of understanding, this article has been divided into the following subsections:

- Uttar Pradesh Shops and Establishments Act - An Introduction

- Uttar Pradesh Shops and Commercial Establishments Act - The Meaning of a Commercial Establishment and a Shop

- Uttar Pradesh Shops and Establishments Act - The Purpose

- Uttar Pradesh Shops and Establishment Act - Exemptions

- Uttar Pradesh Shops and Establishments Act - Registration of Commercial Establishments and Shops

- Uttar Pradesh Shops and Establishments Act - Compliance Forms

- Form A - Notice of Weekly close day or an alteration

- Form B - Notice of Specifying close days

- Form C - Notice of Weekly Holiday

- Form D - Register of Deduction from wages

- Form E - Register of Fines & Realization

- Form F - Notice of absence

- Form H - Register of Leave

- Form K - Register of Shops & Establishments

- Form L - Application form for Registration & statement of facts

- Form N - Notice of Change

- Form O - Notice of loss of Registration Certificate

- Conclusion

- How Can Deskera Assist You?

- Key Takeaways

Uttar Pradesh Shops and Establishments Act - An Introduction

The Uttar Pradesh Shops and Commercial Establishment Act, also referred to as The U.P Dookan Aur Vanijya Adhishthan Adhiniyam or Uttar Pradesh Shops and Establishments Act, was passed by the U.P. Legislative Council in Hindi on 25th September 1962. Subsequently, it was cleared by the U.P. Legislative Assembly on 1st November 1962. The President of India gave his assent to the Act on 18th December 1962 according to the Indian Constitution’s Article 201. The Act was listed in the Uttar Pradesh Gazette Extraordinary on 26th December 1962.

The Uttar Pradesh Shops and Establishments Act was amended twice - vide the Uttar Pradesh Dookan Aur Vanijya Adhishthan (Sanshodhan) Adhiniyam 1976 (Act No. 54 of 1976) and Uttar Pradesh Dookan Aur Vanijya Adhishthan (Sanshodhan) Adhiniyam 2017 (Act No. 29 of 2018).

The Uttar Pradesh Shops and Establishments Act 1962 and the Uttar Pradesh Shops and Establishment Rules 1963 (U. P. Dookan Aur Vanijya Adhishthan Niyamavali, 1963) apply to all commercial establishments and shops operating in the Indian State of Uttar Pradesh. Let’s understand the definition of ‘Commercial Establishment’ and ‘Shop’ in the following section.

Uttar Pradesh Shops and Commercial Establishments Act - The Meaning of a Commercial Establishment and a Shop

Section 2(4) in Chapter-I of the Uttar Pradesh Shops and Establishments Act clearly specifies the meaning of a ‘Commercial Establishment.’

According to the Act, a commercial establishment is a premise where any manufacture, business, and trade for profit or anything directly or indirectly related to these activities is carried on. ‘Commercial establishment’ also refers to any premise where printing or journalistic work is carried on.

Moreover, any establishment dealing with insurance, banking, shares, stocks, brokerage is also referred to as a commercial establishment. Furthermore, cinemas, theatres, and other places of entertainment and public amusement are also termed commercial establishments.

Lastly, a commercial establishment is also referred to as the premise of a factory where the Factories Act 1948’s provisions do not apply.

Section 2(16) in Chapter-I of the Uttar Pradesh Shops and Establishments Act clearly specifies the meaning of ‘Shop.’

According to the Act, a ‘Shop’ refers to a premise where any retail or wholesale business or trade is conducted. It also includes places where customers are provided with some services. The definition of ‘Shop’ also includes all godowns, warehouses, and offices that are connected to such businesses or trades.

Uttar Pradesh Shops and Establishments Act - The Purpose

It is mandatory for all shops and commercial establishments operating in the Indian State of Uttar Pradesh to follow the rules laid in the Uttar Pradesh Shops and Establishment Act 1962 and the Uttar Pradesh Shops and Establishment Rules 1963 (U. P. Dookan Aur Vanijya Adhishthan Niyamavali, 1963).

The Uttar Pradesh Shops and Establishments Act has been enacted to protect the rights of the employees working in all commercial establishments and shops in Uttar Pradesh. The Act contains the rules that must be followed by the management of the shops and commercial establishments coming under the purview of the Uttar Pradesh Shops and Establishments Act. The Act contains guidelines on the following categories:

- Records maintenance

- Rules for employment of children and women

- Work conditions

- Maternity leaves and benefits

- Holidays

- Opening and closing hours of shops and commercial establishments

- Closed days

- Earned, sickness, and casual leave

- Hours of business, including hours of work and overtime

- Terms of service

- Rest intervals

- Payment of wages, including salary, bonus, and allowances

- Registration of shops and commercial establishments

- Appointment and powers of the Inspector, Chief Inspector, and Deputy Chief Inspector

Uttar Pradesh Shops and Establishment Act - Exemptions

According to Section 3(1a, b, c, d, e, f) in Chapter I, the provisions of the Uttar Pradesh Shops and Commercial Establishment Act, also referred to as The U.P Dookan Aur Vanijya Adhishthan Adhiniyam or Uttar Pradesh Shops and Establishments Act, will not apply to the following:

- Employees working in the capacity of a supervisor, manager, or other confidential positions of a commercial establishment or shop where five or more people are employed. However, the Act also specifies that the total number of exempted employees must not exceed 10% of the total employees in the commercial establishment or shop

- Any employee whose primary duty is intermittent in nature, such as a canvasser or traveler

- All offices of local authorities or the Government

- Reserve Bank of India’s offices

- Any establishment established to treat sick, destitute, mentally sick, or infirm people

- All family members of the employer

Uttar Pradesh Shops and Establishments Act - Registration of Commercial Establishments and Shops

According to the Uttar Pradesh Shops and Commercial Establishment (Amendment) Act or Uttar Pradesh Dookan Aur Vanijya Adhisthan (Sansodhan) Adhiniyam 1976, all commercial establishment or shop owners operating in the Indian State of Uttar Pradesh must register their business within three (3) months of the business commencement. However, the period was later extended to six (6) months as per the Uttar Pradesh Shops and Commercial Establishment (Amendment) Act or Uttar Pradesh Dookan Aur Vanijya Adhisthan (Sansodhan) Adhiniyam 2017.

The 2017 amendment of the Uttar Pradesh Shops and Establishments Act also states that all shop and commercial establishment registration applications must be submitted to the Inspector. The Inspector will verify the application, and if found complete and correct in all respects, the Inspector will grant the Registration within one (1) business day from the submission date and enter it in the register mentioned in Section 4A of the Act.

Uttar Pradesh Shops and Establishments Act - Compliance Forms

According to the Uttar Pradesh Shops and Establishment Act 1962 and the Uttar Pradesh Shops and Establishment Rules 1963 (U. P. Dookan Aur Vanijya Adhishthan Niyamavali, 1963), all shop owners or entrusted persons must fill and submit the following compliance forms according to the compliance schedule published by the Government of Uttar Pradesh:

Form A - Notice of Weekly close day or an alteration

According to Rule 7 of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishments Act, all commercial establishments and shops shall maintain the Form A on the weekly close day.

The shop owner or occupier must submit this Form to the Labor Inspector. The Labor Inspector will acknowledge the Form. The shop occupier or owner must photocopy the acknowledged Form and display it in a prominent place for employees to see.

Form B - Notice of Specifying close days

According to Rule 8(1) of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishments Act, all commercial establishments and shops shall maintain the Form B. This Form contains information on the weekly close day and public holidays to be observed by the concerned commercial establishment or shop.

The list must include all prominent national and festival holidays acknowledged by the Labor Inspector. The shop owner or occupier must display it at a prominent place in the shop for all employees to see. The Form must be signed and acknowledged by the Labor Inspector before January end of every year.

Form C - Notice of Weekly Holiday

According to Rule 9 of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishment Act, all commercial establishments and shops shall declare the day on which each employee working in the shop is entitled to get a holiday. The shop owner needs to enter the name of the employee and the date on which the weekly holiday is allowed.

Form D - Register of Deduction from wages

According to Rule 12(8) of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishments Act, all commercial establishments and shops shall maintain the register of deduction from wages in Form D. Form D contains the period of the register, name and address of the shop or commercial establishment, name of the employee, rate of wages including dearness allowance, the amount and date of the deduction imposed, the reason for the deduction.

Form E - Register of Fines & Realization

According to Rule 12(8) of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishments Act, all commercial establishments and shop owners or occupiers must maintain the Form E if they desire to impose a fine on any employee after informing him in writing.

The information the shop owner has to enter in Form E includes the name of the employee with the number in the register of employees, rate of wages, fine realized or remitted, rate of realization or disbursement, the signature of the employer or of his agent, etc.

Form F - Notice of absence

According to Rule 17 of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishments Act, all women employees willing to receive maternity benefits must submit a notice under Section 24(1) of the U.P. Dookan Aur Vanijya Adhishthan Adhiniyam, 1962 before taking leaves for an extended period.

Form G - Register of Attendance & Wages

According to Rule 18(1)(a) of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishments Act, all shop or commercial establishment owners or occupiers must maintain a record of the employees’ attendance and wages in Form G. Form G contains information like name and address of the employee, work hours, overtime hours, wages earned (basic, D.F.A., and overtime), advance, etc.

Form H - Register of Leave

According to Rule 18(i)(b) of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishments Act, all shop or commercial establishment owners or occupiers must maintain the register of leave in Form H. Form H contains information about the earned, sickness, and casual leaves availed by employees and the balance remaining.

Form K - Register of Shops & Establishments

According to Rule 2-A(1) of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishments Act, all shop or commercial establishment owners or occupiers must maintain the register of shops in Part I and the register of commercial establishment in Part II of Form K.

Form K contains information like the registration certificate, number and date of Registration, name of the shop/commercial establishments, nature of business, date of commencement of business, etc.

Form L - Application form for Registration & statement of facts

According to Rule 2-A(2) and Section 4-B(1) of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishments Act, all shop or commercial establishment owners or occupiers must fill and submit the application for registration – statement of facts in Form L. Form L contains information about the shop or commercial establishment, names of employees, total number of employees, etc.

Form N - Notice of Change

According to Rule 2-A(6) of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishments Act, all shop or commercial establishment owners or occupiers must inform the Labor department about any changes in the organization.

Form O - Notice of loss of Registration Certificate

According to Rule e 2-A(10) and Section 4-D of the Uttar Pradesh Dookan Aur Vanijya Adhishthan Niyamavali, 1963, which is a part of the Uttar Pradesh Shops and Establishments Act, all shop or commercial establishment owners or occupiers must fill the Form O if they lose the registration certificate and need a duplicate one.

Conclusion

The Uttar Pradesh Shops and Commercial Establishment Act, also referred to as The U.P Dookan Aur Vanijya Adhishthan Adhiniyam or Uttar Pradesh Shops and Establishments Act, is a key legislation covering all shops and commercial establishments in the Indian State of Uttar Pradesh. Understanding the various provisions of the Uttar Pradesh Shops and Establishments Act is imperative for every shop or commercial establishment owner operating in Uttar Pradesh.

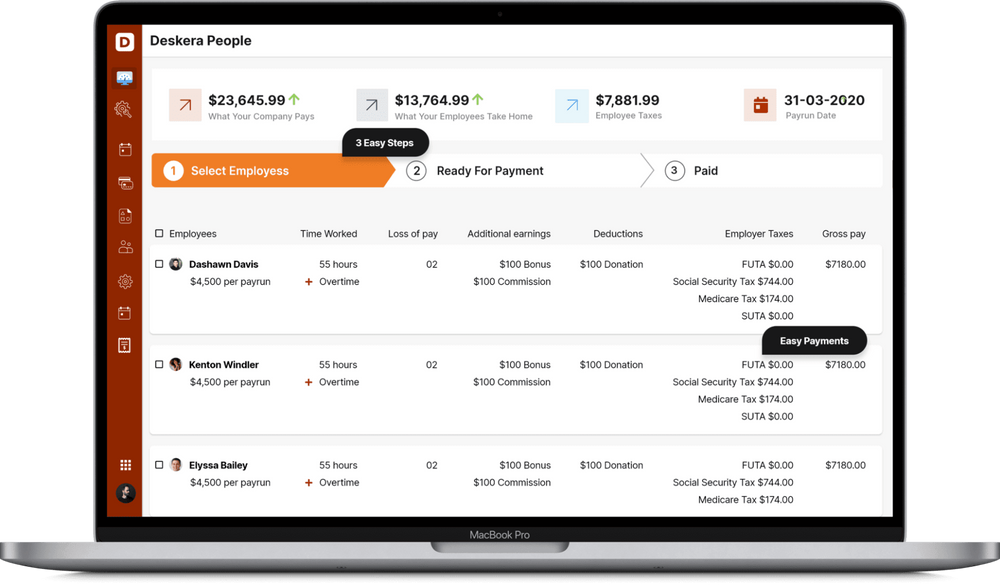

How Can Deskera Assist You?

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- The Uttar Pradesh Shops and Commercial Establishment Act, also referred to as The U.P Dookan Aur Vanijya Adhishthan Adhiniyam or Uttar Pradesh Shops and Establishments Act, is a key legislation covering all shops and commercial establishments in the Indian State of Uttar Pradesh

- The Uttar Pradesh Shops and Establishments Act was enacted on 26th December 1962

- It is mandatory for all shops and commercial establishments operating in the Indian State of Uttar Pradesh to follow the rules laid in the Uttar Pradesh Shops and Establishment Act 1962 and the Uttar Pradesh Shops and Establishment Rules 1963 (U. P. Dookan Aur Vanijya Adhishthan Niyamavali, 1963)

- The Uttar Pradesh Shops and Establishments Act has been enacted to protect the rights of the employees working in all commercial establishments and shops in Uttar Pradesh

Related Articles