Ever wondered how MNCs and massive corporations create payslips informing the employees of their salary breakdown? At the appointment, HR delivers the appointment letter to a recruit in which the breakdown is specified. But there could be changes every month.

There could be incentives, overtime, or even penalties and deductions. So, when an employee receives his monthly salary, he may notice a deviation from the previous amounts.

How should he find out where the difference came from? HR cannot deal with thousands of requests based on salary breakdowns. So, shops, establishments, and organizations must issue payslips to each employee every month

According to the Tamil Nadu Shops & Commercial Establishments Act & Rules, the Form T – payslip should be submitted by the employer or the owner and should be passed on to the employees. The Form T - payroll contains details of an employee's salary breakdown and the number of working days for a month.

Table of Contents

- What are the elements of a Form T - payslip?

- About The TamilNadu Shops and Establishments Act, 1947 and Rules, 1948

- About the Law of Tamil Nadu Shop and Establishment Act

- Key definitions

- Applicability of the Tamilnadu Shops and Establishment Law

- Important Aspects of the Tamilnadu Shop and Establishment Act

- More about Form T – Payslips Issuance as regulated by the Tamilnadu shops and establishments Act

- Sample of Form T - Payslip template

- Inclusions of Form T - Payslip template

- Conclusion

- Key takeaways

What are the elements of a Form T - payslip?

A payslip usually shows different bases of your salary, such as base salary and allowances. Form T Payslips, as specified under the Tamilnadu shops and establishments Act, contains the following information:

- Employee name and department

- Employee identification number

- Employee PAN/Aadhaar number

- Employee's bank account number

About The TamilNadu Shops and Establishments Act, 1947 and Rules, 1948

This Act applies to all shops and businesses in areas notified by the Tamil Nadu government.

The law is intended to protect the rights of workers. The law provides rules for the payment of wages, working conditions, working hours, rest periods, overtime, opening and closing times, closing days, holidays, leave, maternity and benefits, working conditions, rules for employment of children, administrative support, etc.

The Tamil Nadu Shop and Establishment Act is state legislation that regulates the proper functioning and affairs of the state of Tamil Nadu. The State Department of Labor is the department where registration of the Shop and Establishment Act is obtained.

The registration of the Shop and Establishment Act in the case of Small Scale Industry (SSI) or Micro, Small, Medium Enterprise (MSME) in the unorganized sector serves as proof of the existence of a company.

About the Law of Tamil Nadu Shop and Establishment Act

Various state governments enact the Tamil Nadu Shop and Establishment Act to regulate the working conditions of employees in shops, commercial enterprises, restaurants, etc.

The stipulations of this law vary from state to state and should be passed as a procurement and institution law. This is intended to help regulate the conduct of businesses within their jurisdiction.

Key definitions

"Shop" means any premises where a business is conducted or services are provided to customers and includes offices, warehouses, goods, and warehouses, even on the same premises used in connection with that business, but not a restaurant.

Commercial enterprise means a facility that is not a retail store but which is:

- Advertising, commissioned, shipping, or commercial agency

- An administrative division of a factory or industrial enterprise

- Insurance company, limited liability company, bank, brokerage, or stock exchange

- All other establishments that the state government may declare through notice to be a business under this Act

Establishment means a store, business, restaurant, restaurant, residential hotel, theater, or any venue of public entertainment or entertainment and includes any facility that the state government may declare through notice to be a facility within the meaning of this law.

Applicability of the Tamilnadu Shops and Establishment Law

The Tamilnadu Shop and Establishment Act applies to all shops and businesses as defined above but does not cover the following people or types of businesses:

- People who work in a branch in a managerial position

- People who travel and people who work as investigators and guardians

- Branches under central and state government, local authorities, the Reserve Bank of India, and cantonal authorities

- Branches in mines and oil fields

- The establishments in the bazaars in the places where fairs or festivals are held temporarily for a maximum period of 15 days at a time

- Establishments that, not being factories under the Factories Act of 1948, are governed by a separate law provisionally enforceable in (state) law concerning matters governed by the Tamilnadu shops and establishments Act

In addition, store opening and closing hours and leave regulations do not apply to hospitals, hospitals, nursing homes, pharmacies, or drugstores as specified by the government from time to time of the state.

Important Aspects of the Tamilnadu Shop and Establishment Act

Child Labor Prevention

According to the Tamilnadu Shop and Establishment Act, no children are allowed to work in any establishment. A "child" means a person who has not turned fourteen. Furthermore, no young people can work in an institution before 6:00 and after 19:00. A young person can only work 7 hours a day and 42 hours a week.

By "young," we mean a person who is not a child and has not yet turned seventeen.

Opening and Closing of Shops and Commercial Establishments

According to the Tamilnadu Shop and Establishment Act, no person who works in a shop or business can work more than 8 hours a day and 48 hours a week without paying overtime.

Also, every person who works in a shop or business should have one day off every week

Health & Safety

According to the Tamilnadu Shop and Establishment Act, the following health and safety aspects must be maintained in all shops and businesses:

- Cleanliness: The premises of each establishment must be kept clean. It must be free of effluent from sewers, toilets, or other nuisances and should be cleaned and disinfected at regular intervals.

- Ventilation: The premises of each establishment must be well ventilated.

- Lighting: The premises of each company must be sufficiently lit during working hours.

- Fire protection measures: Fire protection measures must be taken in every company.

Public holidays

A person employed in a shop or establishment is entitled to paid leave for 12 days within the next 12 months after 12 months of uninterrupted employment in the establishment.

Payment of Wages

Employers are responsible for paying wages to employees. All employers are required to set a period for which wages must be paid as specified in the Tamilnadu shops and establishments Act. Pay periods cannot exceed one month.

Form T for payslips or Form T payroll must be provided to each employee, suggesting a breakdown of the salary paid out to him/her for each month.

More about Form T – Payslips Issuance as regulated by the Tamilnadu shops and establishments Act

Payslips are required by law to be issued regularly by the employer as proof of the salary paid to an employee. Only salaried employees have access to a pay slip, and your employer is required to provide you with a copy of the pay slip every month.

All employees must receive monthly payslips as this is proof of their employment in an organization and is required to file various formalities such as tax returns and PF returns.

- Determination of salary periods - Any person responsible for the payment of wages under Article 3 will determine the periods during which such wages are due

- No pay period can exceed one month

- You can complain to your top management about HR staff who don't provide details of your monthly payslip

- Under the Payslip Act, your employer must issue your payslip by payday; paydays vary by company and by travel, so some paydays are the same day every month, while others are weekly; if you get paid every four weeks, your payday will change every month

- The Payment of Wages Act 1991 regulates the payment of wages to employees and grants employees several rights, including the right to receive a payslip

- All employers must keep in their company a pay slip type 6 - form R and Payslips and Type T Payroll to be kept with each employer to each employee each month one day before the payment of wages, or at least the day on which wages are paid, or if wages are paid daily, together with wages, duly signed by him or another authorized person and signed by the employee concerned

- Copies of issued payslips must be kept by the employer and presented to the inspector on request as per the Tamilnadu shops and establishments Act

- No deduction may be made from an employee's wages for breach of contract unless

- There is a written provision forming part of the term of the employment contract

Sample of Form T - Payslip template

Inclusions of Form T - Payslip template

FORM – T Payroll under sub-rule (6) of Rule 11], the Tamilnadu shops and establishments Act provides that the payslip must contain the following information:

- Name and address of the establishment

- Name of the person employed

- Father/Husband's Name

- Designation

- Date of entry into service

- Wage period From: …….To: ……….

- Wage Earned Deductions:

(a) Basic:

(i) Employees Provident Fund

(b) Dearness Allowance

(ii) Employee State Insurance

(c) House Rent Allowance

(iii) Other Deductions

(d) Overtime Wages

(e) Leave Wages

(f) Other Allowances

(g) Gross Wages Net Amount

- Paid Leave Availed during the month CL/SL/EL M

- Leave at Credit CL SL EL M

- Signature of the Employer/Manager/ or any other Authorised Person

- Signature/Thumb Impression of the Employee

Conclusion

By law, as stated under the Tamilnadu shops and establishments Act, you must provide your employees with a Form T - payslip. Thanks to technology, it has now become a very simple process. You don't have to create manual hand-made payslips, or sit with employees for hours and explain to them factors like incentives, deductions, etc. You get software that generates automated payslips which reach the employees conveniently.

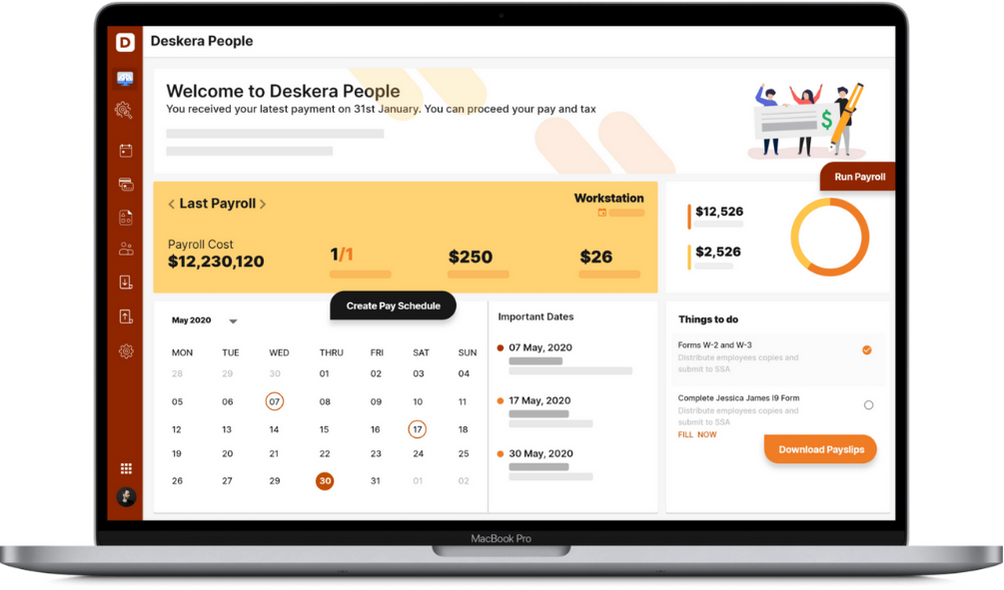

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key takeaways

- The Tamilnadu shops and establishments Act gives out certain rules and regulations that protect the rights of employees and workers of institutions in

- The pay slip must contain the wage amount of salary, the date of receipt of the salary, the payment period, any indemnity, bonus, or indemnity, deductions, social security contributions, the name of the employer, and the employee's name

- Form T payroll displays the employee's hourly rate and the hours that he has worked at that rate.

- Deductions like advance payments, tax deductions, etc should only be subtracted from wages if the employee gives his written consent

- The contemporary software and technological systems offer you templates of payrolls or payslips and some of them have even included the leave balance.

- All employees must receive payslips, in electronic or paper format, within one business day of receiving their salary; if you pay your employees electronically, you must send it by email or to a personal account

- In addition, the employer must provide the pay slip in such a way that the employee can access it easily

- Form T payroll is an essential legal proof of employment, and the payroll determines how much tax you have to pay; it also tells you how much tax return you need to file with the government

- You need a payroll to get a loan, bank credit, or mortgage because you can use it to prove that you will pay the loan amount; payslips show your creditworthiness and repayment ability

- Form T Payroll also serves as proof of using various free subsidies or services from the government, such as medical care, cheap cereal, and such

Related Articles