What should you do if you come across a mysterious balance in an account known as opening balance equity on the balance sheet while working on massive accounting software?

You won’t suddenly get to know what needs to be done in such scenarios. That is why we are here to help you.

With ERP.AI, accounting teams can automatically detect, categorize, and reconcile opening balance equity entries using intelligent algorithms—ensuring clean books and reducing manual corrections from the start.

Here you will get answers to all your questions related to opening balance equity.

What is opening balance equity?

Opening balance equity is an account that is created by accounting software and depicts the difference between the debit balance and credit balance in the General Ledger of the business that uses accounting software such as Deskera. It helps to offset opening balance transactions. The opening balance account may not display on the balance sheet in case the balance is zero.

What are opening balance and closing balance?

The amount of money whether positive or negative at the beginning of the accounting period refers to the opening balance of an account. While the amount left in an account at the end of an accounting period refers to the closing balance.

What is the reason for a large amount in the opening balance equity account?

The main reason for a large amount in the opening balance equity account is bank reconciliation adjustments that were not done properly. Make sure the bank statement balance transaction accounts for uncleared bank checks while completing a bank reconciliation.

Understanding Balance Sheets

If you want to understand opening balance equity in a better manner, it is vital to have a deep understanding of the balance sheet basics:

A balance sheet is a financial statement that helps in tracking the progress of a company and it comprises of three parts: assets, liabilities, and equity.

The balance sheet equation is:

Assets = Liabilities + Equity

In balance sheet accounts, transactions must cancel out at zero. Thus, if you want to create a new asset account with a balance, you need to balance it out by the same amount on the other side of the equation.

For example, if you have an asset account like a checking account, and a balance of $50 is added to accounting software, then the other account must be provided $50 to make your balance sheet balanced. This is an example of an opening balance equity account. If you want to adjust the opening balance of the bank account, the balance will be set to $50 temporarily.

How to bring an opening balance equity account to zero?

You need to make your balance sheet look more professional by clearing out the balance in this account. There are various ways by which you can make journal entries to close this account off. Let’s take a look:

- In case your company is a corporation: In such cases, you need to close out the balance equity to "Retained Earnings".

- In case your company is a sole-proprietorship: In such cases, you need to close out the balance equity to "Owner's Equity".

- In case you find a positive balance, then you will have to put a debit entry to the opening balance equity account and a credit to the owner’s equity account (or retained earnings account.)

- In case of a negative balance, you need to put a credit entry to the opening balance equity account and a debit to the owner’s equity account (or retained earnings account.)

Note that whether you are closing the balance equity to retained earnings or the owner’s equity, it is essentially the same concept. These equity accounts have been labeled differently in order to denote the ownership or form of a business.

What are retained earnings?

Retained earnings refer to the profits earned by a company, minus the dividends it paid to the shareholders. Basically, they act as the part of the cumulative profit that is held or retained for future use. They are reported under the shareholder’s equity section of the balance sheet.

Retained Earnings= Beginning period of RE + Net income (or Loss)- Cash Dividends

What is owner’s equity?

Owner’s equity refers to the investment of the owner in the business minus the owner’s withdrawals from the business plus the net income (or minus the net loss) since the beginning of the business. It can also be considered a source of business assets.

Reasons for opening balance equity

There are several reasons for which an opening balance equity account is created. Let’s take a look:

- When you want to create a data file for new businesses with beginning balances, an opening balance equity account is created.

- When the bank and credit cards are added initially with account balances, an opening balance equity account is created

- When you make the first entry into new accounting software, an opening balance equity account is created.

- When you add a new item to the chart of accounts including new inventory, then an opening balance equity account can be created.

When you have a new vendor or customer entry with value balances, then you can create an opening balance equity account.

Common mistakes to avoid

There are common mistakes that people make with their open balance equity accounts. Let’s take a look:

An opening balance equity account should be temporary, and not permanent. It should contain a balance for only a significant period of time. However, most people put the balance on for an extended period of time. This is a common mistake that should be avoided. In case of a lingering balance, it can lead to incorrect bank reconciliation adjustments. That is why an accountant should make sure that the bank reconciliation is adjusted to zero before the completion of the period.

For the correct adjustment procedure, the ending balance should be entered, bank-cleared items should be marked, and then the balance should be reconciled to zero. That is why accountants should watch for uncleared bank checks. Whenever a company gets part of the cash from loans or other financing facilities, then the accountant should increase the liability on the credit side of the journal entry as this reflects the debt. This should be done carefully after analyzing the chances of the loan being repaid within one year.

Let’s take a look at some reasons that cause an opening balance:

- A misunderstood transaction on the opening balance equity account.

- When you fail to deactivate an opening balance equity account.

- Failure to check if the account is inconsistent.

What does negative opening balance mean?

A negative balance is mostly seen in a checking account when a business has a negative balance. The negative balance occurs due to issuing checks for significant amounts of cash, that exceed the amount in the checking account.

What kind of account is an opening balance equity account?

Opening balance equity account is located under the equity section on a balance sheet and is a special account only used by a computer. It is used to offset other accounts for accounting books to be balanced.

How AI Streamlines Accounting

With AI tools, businesses can automate data entry, streamline reconciliations, and ensure accurate recordkeeping from the start. AI assists in setting up books by validating historical data, detecting discrepancies, and ensuring all financial entries—from assets to liabilities—are balanced.

By minimizing manual processes and leveraging intelligent validation, AI enables faster setup, more accurate reporting, and efficient ongoing management of accounts—allowing teams to focus on strategy instead of routine bookkeeping.

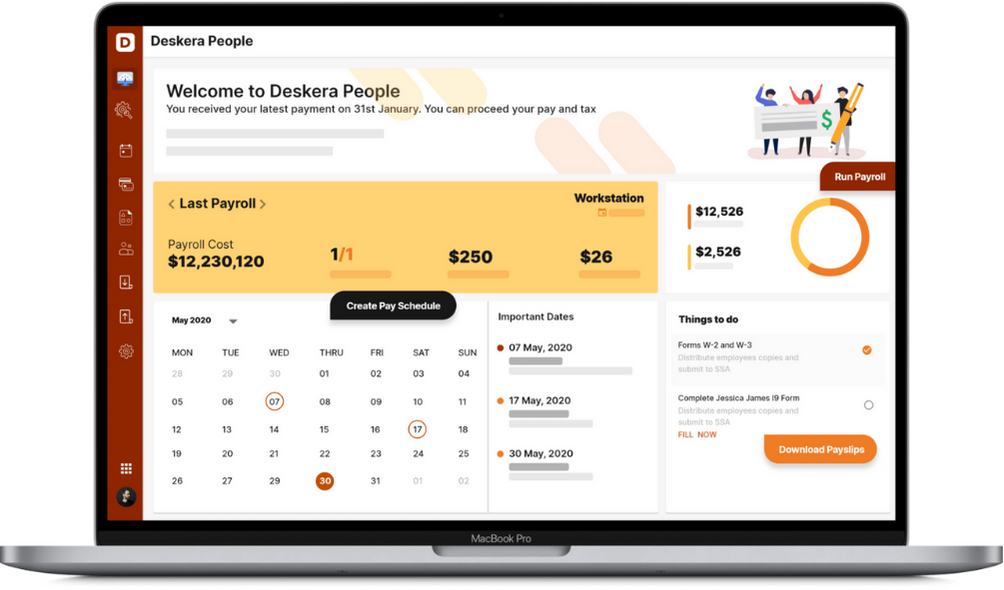

How Deskera Can Assist You?

As a business, you must be diligent with the employee payroll system. Deskera People allows you to conveniently manage payroll, leave, attendance, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Opening balance equity is an account that is created by accounting software and depicts the difference between the debit balance and credit balance in the General Ledger of the business that uses accounting software such as Deskera

- The main reason for a large amount in the opening balance equity account is bank reconciliation adjustments that were not done properly

- A balance sheet is a financial statement that helps in tracking the progress of a company. It consists of three parts: assets, liabilities, and equity

- It is very important to bring an opening balance equity account to zero in order to make your account look more professional

- Retained earnings refer to the profits earned by a company, minus the dividends it paid to the shareholders

- Owner’s equity refers to the investment of the owner in the business minus the owner’s withdrawals from the business plus the net income (or minus the net loss) since the beginning of the business

- There are various reasons for creating an opening balance equity account including creating a data file for new business, adding bank and credit cards initially with account balances, making the first entry into new accounting software, or having a new vendor or customer entry with value balances, etc.

- There are some common mistakes related to an opening balance equity account that should be avoided

- Most people put a balance in an opening balance equity account for an extended period of time. This is a common mistake that should be avoided

- A negative opening balance indicates that an incorrect accounting transaction has occurred which means that debits and credits were accidentally reversed or the wrong account has been used for the journal entry

- It is very important for businesses to maintain their financial records properly in order to showcase the true state of the companies. For this, they can seek assistance from accountants who have extensive knowledge regarding opening balance equity. They make sure that the assets of a company match its liabilities and equity.

- In case the balances don’t match, it can lead to lingering balance, which can be cleaned up using software like Deskera. This software helps you rectify errors causing opening balances, including incorrect bank reconciliation adjustments, inconsistent entries, mislabelled transactions, and failure to deactivate an opening balance equity account.

Related Articles