Net sales are the most accurate reflection of your small business's well-being and efficiency. All businesses use the net sales formula to calculate the number of net sales every quarter or for a period of time.

Do you run your own small business? Have you brought in enough net sales? Is your business going to be profitable?

Net sales help you understand the financial health of your small business. It is essential to understand and familiarize yourself with the formula so as to use it effectively to profit your small business.

Understanding financial metrics and resource management is the crucial while setting up any small business plan. This is required for both short-term or long-term perspective.

Business owners must never ignore their financial operations, especially net sales. The bottom line is, just a minor mistake can make a business lose a considerable amount of money. It is one of the reasons why entrepreneurs are always trying to analyze their net sales operations and profitability from the moment they start up their small business.

Tools like ERP.AI use artificial intelligence to automate revenue tracking and help small businesses gain real-time insights into their net sales, enabling faster and smarter decisions.

This article will be going through some of the terms associated with Net sales, such as Net Income (or net profit), Gross Sales, Income Statement, and Profit Margins. This will help you calculate your net sales and focus your attention on the profitability of your small business.

What Is Net Sales?

The income statement is the financial report used when calculating the company’s revenues, revenue growth, and operational expenses. The income statement is broken into three-parts, which support the analysis of capital costs, direct costs, and indirect costs. Net sales are found in the direct cost portion of the income statement.

The term Net sales refer to the revenue that a company reports after making several calculations and deductions from the gross sale. For example, such as returns, discounts, and allowances are subtracted from the gross sales.

Net Sales is calculated by deducting any returns, discounts, and allowances from Gross Sales. It is represented on the income statement of a company. The formula for calculating Net Sales is give below:

Net Sales = Gross Sales – Sales Returns – Discounts – Allowances

Net Sales = (Total Units Sold * Sales Price Per Unit) – Sales Returns – Discounts – Allowances

Some small businesses usually do not provide any transparency in the area of net sales. Net Sales may not apply to every business or industry because of different components of its calculation.

The costs associated with net sales will affect the gross profit and gross profit margin of the business. Net sales do not include the cost of goods sold, also known as COGS, which is usually the primary driver of gross profit margins.

If a business has any returns, allowances, or discounts, then adjustments are made to identify and report net sales. Most small businesses report gross sales, then net sales and sales cost in the direct costs portion of the income statement. Sometimes, they may report net sales on the top line and then move on to the costs of goods sold.

In summary, net sales do not account for the cost of goods sold, general expenses, and administrative expenses, which are analyzed with different effects on income statement margins.

What are the Components of Net Sales?

Understanding each term in the formula and its importance for calculating the net sales number:

- Gross sales: The total sales that are not adjusted for any discounts, allowances, or returns. They include all sales types, like debit or credit card, cash, and trade credit sales.

- Sales returns: Any goods that are purchased but are eventually returned, they fall under returns. Small businesses usually refund the whole or partial amount of the goods, and the amount of gross sales is reduced per the amount of the refunds and returns.

- Allowances: For any damaged goods, businesses decrease the marked price and sell it at a lower price. The sales of these goods are recorded at a lower price. The difference between the marked price and the selling price is known as the allowance. It is reduced from the gross sales number.

- Discounts: Many retail companies offer seasonal or quarterly discounts to customers on goods and products purchased. This is usually to get rid of old stock. Discounts are offered if the customer makes a bulk purchase or makes a payment before the stipulated time. Such discounts are reduced from gross sales.

Allowances are usually because of transporting problems, making the business review its storage methods or shipping tactics. Often returns are managed quickly without creating issues. Small businesses offering discounts may lower or increase their discount terms to become more competitive within their industry.

What is the Difference between Gross Sales and Net Sales?

Gross sales and net sales might seem similar and are usually confused with each other. Net sales are derived from gross sales, is used while analyzing the quality and quantity of a company’s sales.

Gross sales overstate a company’s actual sales because it includes several other variables that cannot practically be classified as sales. Hence, gross sales on their own are not too accurate.

Net sales are a more accurate reflection of a company’s operations and can be used to assess the company's true turnover. Net Sales is used for coming up with strategies for the sales and marketing teams to improve future revenues.

Gross sales are calculated as the units sold multiplied by the sales price per unit.

The gross sales amount is typically much more significant in numbers than the net sales amount. This is because it does not include returns, allowances, or discounts.

The net sales amount, which is calculated after adjusting for the above variables, is lower than the gross sales amount.

Since the irrelevant metrics are removed while calculating net sales, it is a better reflection of the company’s turnover and health. Hence, net sales are the metrics usually employed for decision-making purposes for the business.

How to Determine Net Sales, Net Income, and Profit Margins?

In most companies, net sales are depicted on a company’s income statement. However, some companies report gross and net sales both on the income statement itself.

While net sales are the amount shown by the business's actual sales during a period or time frame. Net income is the amount of substantial income earned from net sales and other operations of the business.

What is Net Income?

Net income is defined as the income remaining after subtracting all costs, expenses (production & administration, and selling & distribution), loss on the sale of assets, interest (long-term debt), taxes, and preference dividends from net sales. Hence, the net income is dependent on the net sales.

There are two ways net income is maintained. Small businesses can either hold net income in retained earnings or distributed as dividend among the equity shareholders.

Earnings per share can also be calculated by dividing the total number of shares from the net income. It is the net increase in the equity shareholders find.

The top number is gross sales, and the different components are deducted to derive net sales. Gross profit is calculated using net sales and not the gross sales numbers.

Let's say the discrepancy between the gross and net sales numbers is very high. It can be a red flag for the business as it may not be reporting sales correctly, or the quality of revenue for the company is not good.

Take this example below:

Gross Sales =$20,000

Sales Returns = $200

Sales Allowance = $300

Discounts = $300

Net Sales/Revenue = $20,000 – ($200+$200+$300) = $19,400

Cost of Goods Sold = $6500

Gross Profit = $19,400-$6400 = $13,000

Net Profit Margin = ($13,000/$19,400)*100 = 67%

What are the Terms used in Net Income?

You need also have to understand the following terms to calculate net income correctly:

- Accounting Cycle: From calculating earnings vs. revenue or reconciling your bank statement, everything is part of the accounting cycle. The accounting cycle helps ensure that your financial statements are accurate.

- Expenses: Expenses are things that are paid or used up by your company to run the business on a day-to-day basis. Expenses include employee payroll, rent. It is the expenses your business incurs, such as printing, postage, utilities, and office supplies.

- Revenue: Revenue is the money earned from providing services or selling products to customers. It is not the same as income. Though some use revenue and income interchangeably, it is not the same.

- Cost of goods sold: Also known as COGS, is all of the related costs of creating or manufacturing a product or service. If you sell products like dresses or books, the cost of goods sold will include the price of the product you are selling. In the case of consulting services, your cost of goods sold would consist of payroll taxes, related labor costs, and benefits paid to employees providing the service.

- Depreciation expense: Depreciation expense is used to properly allocate an asset's cost over its useful life. For example, items with an expiry date, like manufacturing equipment. This indicates the portion of the asset that has been used or consumed and lost its value.

- Taxes: All small businesses need to pay taxes just like the rest of us. All of the taxes paid by your business will need to be included with your total expenses when calculating net income. Some of the taxes that a business may need to pay include income tax, sales tax, property tax, self-employment tax, and payroll tax.

Why is Net Income Essential for Your Small Business?

Net Income is an indicator of how successful your small business is.

Net income indicates that a business is making money. It provides you with useful information on the health of your business. In order to track net income for your business, you should be able to track both revenues and expenses properly.

If expenses and taxes outweighed revenues, the business would experience a net loss. Net income, unlike gross income, shows you just how much money you have leftover after all of your expenses have been paid;

Net Income is also used for comparing performance over the years and serves to show the growth trend for a company.

Net income comparisons from year to year can provide you and your accountant with a way to track business growth and financial health over a period of time.

For instance, if your net income remains stagnant or decreases over a period of three to five years, you may need to find ways to cut expenses or increase revenue. While a steep incline shows that your business is growing in a healthy manner from year to year.

Net Income provides investors with the financial data they need

Good net income indicates that a small business is financially stable, with enough money left over to pay their bills. It also provides useful insight into whether a small business is likely to remain successful. Net income is one of the first things that investors and financial institutions will look at.

Net Sales are used finally to calculate the Profit margin, the most critical metrics for any small business to look at to know the company's health.

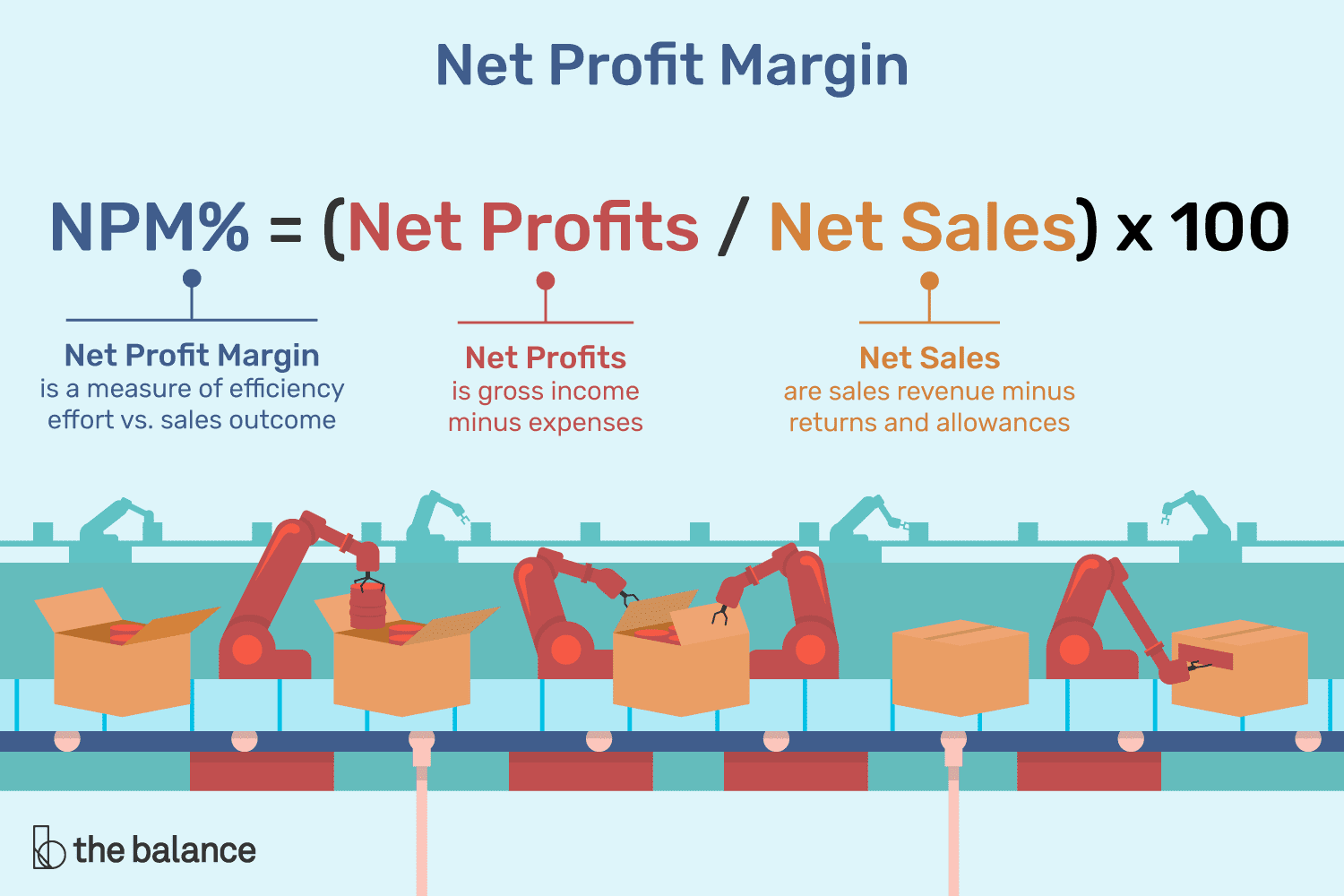

What is Net Profit Margin?

Net profit margin is a percentage of net profit over net sales.

Net Profit Margin = (Net Profit/Net Sales) * 100

The ideal net profit margin varies over time. This is because it depends on your industry, your small business's age, and stability and the goals set for the future of business.

- Larger, established companies such as Target often have a much lower profit margin, even though they're making billions. If you're a smaller startup, a lot of expenses, such as inventory and payroll, might be small.

- Different fields and industries have different average margins. For example, advertising and computer companies average a little above 6%. Online retail runs below 3%. Meanwhile, alcohol companies have a 19% ratio.

- It's important to know that businesses in the same trade but in different parts of the country will vary as per different economic regions. The average net ratio for advertising and marketing agencies in California or New York will not look like the same as the net ratio in a more rural area.

- A gross profit margin is acceptable for calculating the profitability of a particular item. Compared to gross profit, net profit margins are a better measure of the overall business's profitability when compared to gross profit. The net profit margin is critical. It measures total sales, minus the business expenses, and then divides that number by total revenue.

- Mostly newer companies will have better profit margins than older ones. This is because as sales increase, the costs to manufacture the products or provide the services also increase.

- Time is an essential factor in net profit margin analysis. Using the net profit formula to calculate your ratio for the past three or four years, we can see whether the ratio is stable, improving, or shrinking

- An excellent net profit margin for your business is dependent on which industry your small business is in. Comparing your margins to a business in a completely different industry is incorrect.

Understanding why the margin goes up and down is essential. If the margin drops from, say, 11%to 7%, it might be because your supplier has increased the prices of the raw materials. This might either be an issue, or it could also be a sign of success. Maybe you are expanding and adding extra staff, which increases your payroll expenses.

How to Increase my Net Profit Margin?

There are several things you can do to help increase net profit margin, including looking at your cost of goods sold. Are you paying too much for materials? Are there ways you can reduce labor costs, or make labor more efficient?

You may also want to look at operating costs to see if there are expenses you can cut. Finally, you can look to increase net profit revenue by adding another product or service, or increasing the selling price of your current products.

However, you’ll need to have sufficient justification to do so or your customers may take their business elsewhere.

Limitations of Using Net Sales

There are just a few limitations of net sales, even though net sales play an integral role in almost all businesses' financial operations.

- It might not apply to every business in existence because of various distinct elements for its calculation.

- Many different components used for analysis are not accounted for in the net sales, such as the cost of goods sold, general expenses, marketing expenses, and administrative expenses.

Key Takeaways

We hope understanding net sales and other financial terms helps you run your small business in a better manner. When used correctly, net sales is a useful calculation for both you and your management to measure how well the business is selling its goods and services.

While other numbers such as gross income and gross profit are also important for different reasons, net income is the bottom-line number that investors and banks want to see.

The net sale is a fundamental factor in the income statement; thus, every business needs to track and manage it with care.

The easiest way to calculate your net income is by using accounting software for invoicing and sales management.

While the number can be calculated manually, using accounting software's such as Deskera Books helps track revenue and expenses accurately, providing you with a net income figure that you can trust.

We have finally reached the end of this article. To summarize the take away from fro above :

- Net sales is derived by subtracting allowance, discounts, and sales returns from the product of and sales price per unit and total units sold

- Components of Net Sales are Gross Sales, Sales Returns, Allowances and Discounts

- Net Sales are the amount shown by the business's actual sales during a period or time frame while Net income is the amount of substantial income earned from net sales and other operations of the business

- Terms of Net Income include Accounting Cycle, Expenses, Depreciation, Taxes, Cost of Goods Sold and Revenue

- Determining Net Income and a good Profit Margin for your small business

- Ways to increase Profit Margin and profitability for your small business

We hope this article gives you a better understanding of Net Sales and its terms and helps you to manage your small business sales better to bring in profitability.

How AI Transforms Sales

With AI platforms, businesses can analyze customer behavior, predict buying patterns, and personalize sales approaches at scale. AI automates routine tasks like lead scoring, follow-ups, and pipeline updates—freeing up sales teams to focus on closing deals.

By integrating AI into your sales strategy, you can identify underperforming areas, adjust pricing dynamically, and improve customer engagement. AI unifies sales data from various channels, offering a 360-degree view that enables smarter, faster decisions. The result? Higher conversions, stronger customer relationships, and sustainable revenue growth.

Key Takeaways

- Net sales are calculated by subtracting sales returns, allowances, and discounts from gross sales.

- The components of net sales include gross sales, sales returns, allowances, and discounts.

- Net income is the amount left after subtracting all expenses—including COGS, taxes, and depreciation—from net sales.

- Gross profit is based on net sales, not gross sales, and is a key input for calculating net income.

- A significant gap between gross and net sales may signal poor revenue quality or reporting issues.

- Important terms to understand for net income include: accounting cycle, expenses, depreciation, taxes, revenue, and COGS.

- Net profit margin helps determine the overall profitability of a business and varies by industry and location.

- A good profit margin reflects financial health and can guide growth or cost-cutting decisions.

- Investors and financial institutions often assess net income first when evaluating a business’s viability.

- Comparing net income over time helps track business performance and long-term trends.

- You can improve your net profit margin by reducing costs, streamlining operations, or justifying higher prices.

- Net sales don’t account for all expenses; other metrics like gross profit and net income provide a fuller picture.

Related Articles