Every business maintains three types of Financial Reports or statements that summarize the performance of the company. The income statement is one of the three critical financial reports of a business. The other two being the balance sheet and cash flow statement.

Modern tools like ERP.AI enhance the financial reporting process by automating data collection, improving accuracy, and providing real-time insights, helping businesses generate reliable income statements faster and make more informed decisions.

This article will detail out everything you need to know about the income statement - from the definition of what an income statement is, to the reasons why businesses need to prepare an income statement.

What Is an Income Statement?

In addition to the balance sheet and cash flow statement, the income statement is also part of the financial statements prepared by all organizations.

The purpose of an income statement is to provide financial information to investors, creditors, and readers, whether the company is profitable during the financial year.

In the context of corporate finance, the income statement is the record of the company's profit and loss over the financial year. The company's net profit is derived by deducting the total revenue from all the expenses incurred for operating and non-operating activities.

Investors, accountants, and business owners regularly review an income statement to see if they are on track for its expected target. An income statement is examined to identify a specific strategy's shortcomings and nudge it in the right direction.

There are various monikers associated with the income statement, such as:

- Profit and Loss Statement

- Statement of earnings

- Statement of income

- Revenue statement

- Statement of operations

All these income statement terms mean the same thing, and it's often used interchangeably. However, the Profit and Loss Statement is still the most popular term used by most financial professionals.

Do you wish to find out more about the income statement? Check it out here to find out how different industries in the market prepare their income statements.

Why Is the Income Statement Important?

In the corporate world, preparing an income statement is a monthly, quarterly, and even yearly affair.

Here are some great reasons why preparing an income statement is such a crucial task in every organization regardless size:

- Assist in better decision making - Reading the income statement enables the business owners to be aware of the current financial footing of the company. With the accurate figures presented on the income statement, business owners can make swift and wise decisions about the company's expenditure.

- Track the company's profitability - With an income statement, it provided the business owner, the shareholders, and stakeholders the knowledge of the company's financial standing.

- Essential report for compliance - Operating your business in a country means companies will have to bear the various forms of business taxes, following the tax regulations of that country. Paying business taxes is mandatory by law. To calculate your tax liability, the income statement, and other financial statements (balance sheet and cash flow statement) will help a lot in providing the necessary financial data you will need.

Uses of an Income Statement

There are several uses of an income statement though the primary purpose is to convey a business's profitability and activities. It provides micro insights if created for departments within a company.

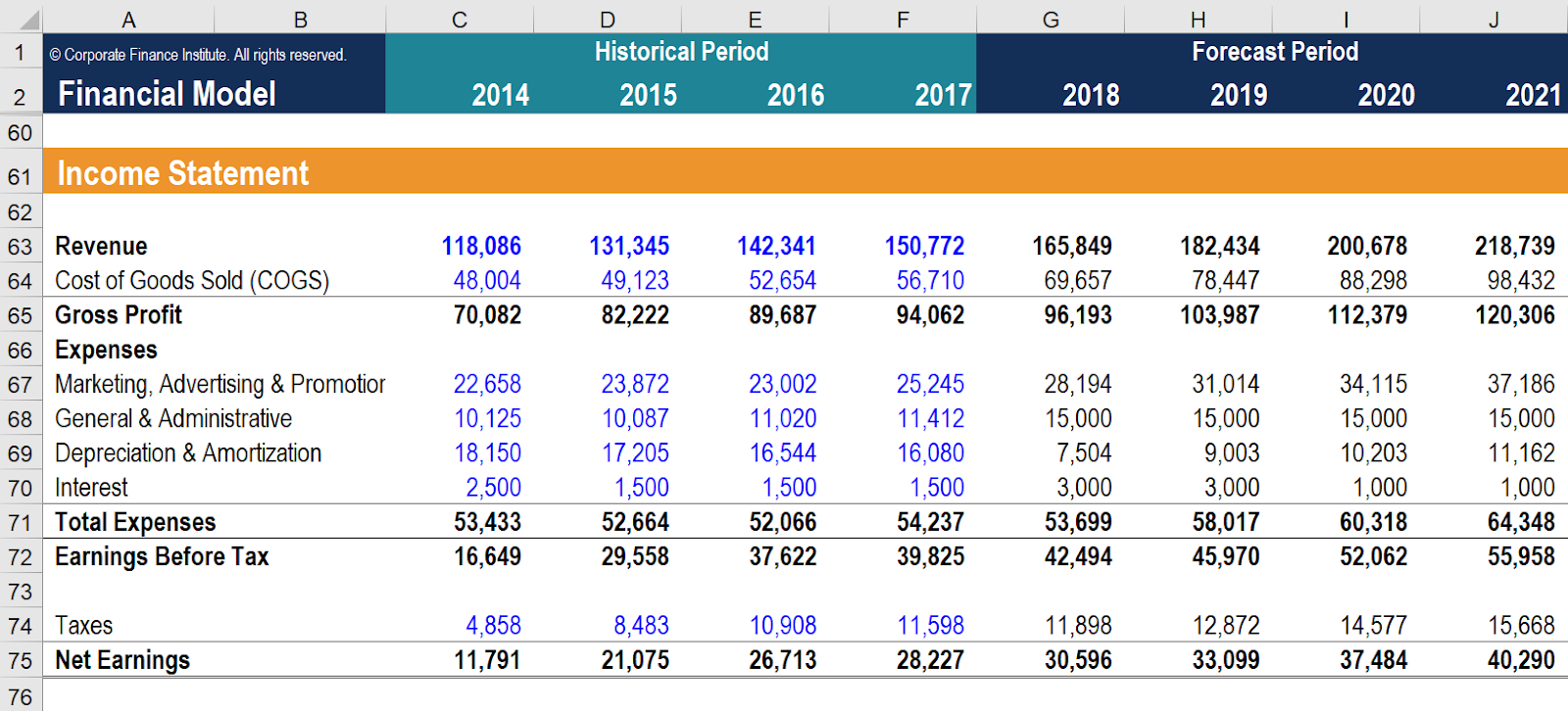

Based on the income statement, management and investors can decide on the strategy of a particular product or department or the entire company. While a yearly income statement gives an idea of the annual plan to be placed for the next year, monthly and quarterly reports can make it easier for a short term change in strategy.

Based on an income statement, key decisions such as increasing production capacity, pushing sales, targeting a new audience, or shutting down and opening a new department can be taken.

Research analysts use an income statement to compare the quarter-on-quarter and year-on-year performance of a company. Investors can also know if the management has been able to keep a tab on overhead operating expenses without compromising productivity.

Understanding the Income Statement

When it comes to a company's financial health, an income statement is one of the most important documents. The three main components of an income statement are-

- Revenue

- Expenses

- Profit

There are two ways in which businesses can prepare their income statements

Types of an Income Statement

Single-step income statement

It is a basic report of a company's profit prepared using a single equation to calculate net income.

Net Income = (Revenues + Gains) – (Expenses + Losses)

Multi-step income statement

It calculates the net income using a three-step process.It separates operational revenues and expenses from non-operational ones

Gross Profit= Net Sales - Cost of Goods Sold

Operating income = Gross Profit - Operating Expense

Net Income = Operating Income + Non Operating Items

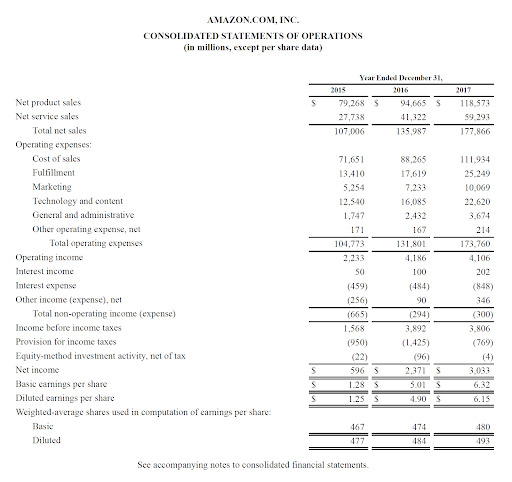

Here is a real example of Amazon’s income statement, for the years ended December 31, 2015 – 2017.

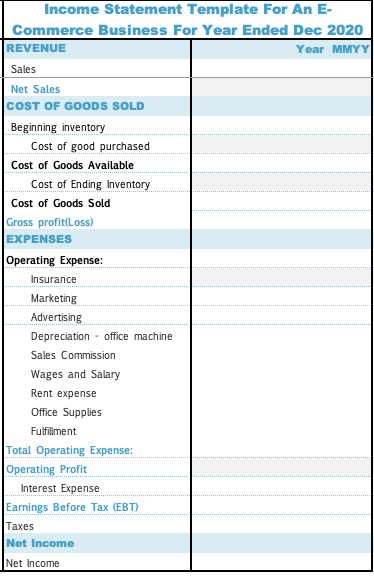

Any income statement template will consist of the below items:

-

Revenue:An organization's income or the money that your business brought in within a specific period of time

-

Expenses: An organization's outflow of cash. Expenses are broadly divided into two parts cost of sales/ COGS and SG&A

- Costs of Goods Sold (COGS): The direct costs of producing goods that the company sells

- SG&A- The selling, general, and administrative expenses that your business incurs

-

Gross profit: The profit a company makes after deducting the COGS with the revenue

-

Operating income: The income of the company after subtracting gross profit from operating expenses (including COGS, wages, and depreciation).

-

Income before taxes: Income before taxes are calculated

-

Net income: Income left after deducting all costs, expenses, and taxes

-

Earnings Per Share (EPS): Division of net income by the number of outstanding share

-

Depreciation: The decreased value of an asset within a defined period

-

EBITDA: Earnings before interest, depreciation, taxes, and amortization

The above items can further be divided into different categories. For example, expenses can be broken down to wages, interest paid on debt, procurements costs, and wages. The chart below shows a detailed breakdown of Income statement.

You can download free Income statement templates of businesses like manufacturing, merchandising etc from the Deskera page.

How to Make an Income Statement

Let's take a look at how to create an income statement.

Follow the steps given below and add them to a sheet to create a basic template.

1. Reporting period

To prepare an income statement, we begin by determining a specific period for the income statement. The period can be in the form of a monthly, quarterly, or annual basis. Public traded companies usually have a yearly income statement, while smaller ones tend to create a monthly or quarterly report.

2.Trial balance report

Once you identify the reporting period for your income statement, you will need a trial balance report. That report will give you the end balance of each account and the figures required to prepare an income statement.

3.Revenue

After you have the balance report, you will now need to calculate your total sales revenue. The total revenue will include all of your business's income, even the payments which haven't been received yet. Add everything, and you will get your revenue.

4. COGS

The Cost of Goods Sold is determined by adding up direct labor, overhead expenses, and materials. Add the total cost of goods sold to your sheet

5.Gross Profit

Subtract the COGS from your revenue, and you will have a gross profit figure.

6. Operating expense

Add up all your operating expense costs mentioned in the balance report and enter it in your sheet.

7.Income before taxes

Subtract your selling and administrative expenses from gross profit to determine your income before taxes.

8. Net income

Subtract your gross profit with all expenses, including wages, taxes, and COGS. Net income is obtained after that.

Congratulations! Your basic income statement is ready. You can read income statement for small businesses on the Deskera blog to get a deeper understanding on this subject.

How AI Enhances Financial Reporting

AI automates this process by pulling real-time data from sales, expenses, and inventory to produce accurate income statements instantly. It can detect anomalies, flag unusual spending patterns, and provide insights to boost profitability.

With built-in predictive analytics, AI also helps forecast future revenue and expenses, enabling smarter strategic planning. By simplifying financial reporting and ensuring precision, AI empowers businesses to make faster, more confident decisions based on reliable, data-backed income statements.

The Bottom Line

A balance sheet, cash flow statement, and annual report with income statements help an individual determine the future financial trajectory of a business and its value and efficiency.

Analysis of an income statement can reveal if the sales are improving, the cost of goods sold is falling or if the return on equity is rising. If you are planning to invest in a company, an income statement will be one of the most critical documents you need to evaluate.

Learning to read, understand, and knowing how to create an income statement enables you to make informed decisions about a company or business. To make things easier, it is good to invest in cloud accounting software like Deskera to automate your business processes. With a solution like Deskera, all the income statement accounts will be auto-populated based on the system's business activities, making the process error-free and more uncomplicated.

Visit Deskera's website today to find out more about Deskera's accounting products. You can even sign-up for a 30-day free trial.

Related Articles