Liquid fund is an asset that can easily be converted into cash in a small amount of time. Liquid assets or funds include things like money market instruments, cash, and marketable securities. Liquid funds are debts that invest in securities with a residual maturity of up to 91 days.

Both businesses and individuals are usually concerned with tracking liquid assets as a portion of their net worth. Usually, in financial accounting, a company's liquid assets are reported on its balance sheet as current assets.

Liquid funds invest in money market instruments and debt such as Certificate of Deposit(CD), Treasury Bills(T-bills), Commercial Paper (CP), etc., with residual maturity of 91 days only. The liquid funds aim at providing a high degree of liquidity to investors. Liquid funds are considered one of the safest funds among the mutual fund categories.

Several factors need to exist for liquid assets to be considered liquid. The liquid assets needs to be in an established liquid market with a large number of easily available buyers. Ownership transfer should also be secure and easily facilitated.

The most liquid assets are securities and cash that can be immediately or quickly be transacted for cash. Businesses can also look to assets with a cash conversion expectation of one year or less as a liquid. Collectively, these assets are known as the company's current assets. This broadens the scope of liquid assets to include inventory and accounts receivable.

Overall, liquid assets are very important for businesses and individuals because they are the first source of cash used in meeting payment obligations.

Examples of Liquid Assets

Examples of liquid assets held by both businesses and individuals include:

- Money market assets

- Marketable equity securities (stocks)

- Cash

- Marketable debt securities (bonds)

- Mutual funds

- Exchange-traded funds (ETFs)

- Accounts receivable

- Inventory

- U.S. Treasuries actively traded in the secondary market

- U.S. Treasuries maturing within one year

Why Invest In Liquid Funds?

Let us find out why you should invest in a liquid fund below:

Professional Management

- All investments are vulnerable to risk and hence should be managed carefully. Professional funds are not risk-free.

- Professional fund managers are needed to mitigate such risks and generate positive returns

- These managers understand the larger picture of the economy well. They realign your debt portfolio according to the changes in the macro-environment and the dynamic interest rates

- The managers make timely calls if they see any interest rate risk on their holdings, which could otherwise be difficult for just an individual investor

Better Post Tax Returns

- Short-term capital gains from liquid mutual funds and debts are taxable as per your tax slab.

- Debt mutual funds have some favorable tax treatment which can, in turn, help you increase your overall net returns.

Accessibility of Unavailable Debt Securities

- Certain securities like Government securities have a very high ticket size

- Usually the minimum investment requirement is very high and hence out of the reach of an individual retail investor

- Liquid mutual funds can widen your choice of investment as it can pass on the benefit to you by investing in multiple securities

- The benefits of investing in liquid funds are huge, hence choose wisely to park your short-term surpluses.

Why Invest in Liquid Funds?

Let us look at the reason for you to invest in liquid funds:

- Liquid funds are a potential for better returns. Liquid funds have a greater potential to generate better returns than the usual savings account.

- Liquid funds have high liquidity with no lock-in period. The benefit of liquid funds are that investors can choose to redeem their investments whenever they want and do not need to wait for a lock period.

- Liquid funds are low-risk. Due to the short term nature of the underlying securities, liquid funds have one of the lowest interest rate risk in comparison to other debt funds

- Liquid mutual funds are easy redemption. The usual redemption requests are usually processed within a working day. Liquid funds offer an instant redemption access facility on withdrawals of a certain amount per day per scheme per investor.

How are Liquid Funds Taxed?

Like any other debt fund, liquid funds are also taxed. In case, liquid funds are held for less than 3 years, then the gains will be calculated as STCG or Short Term Capital Gains. They will be taxed according to the investor's income slab. Whereas in case they are held for more than 3 years, it will be calculated as LTCG or Long Term Capital Gains and taxed at 20% along with the benefit of indexation.

Liquid Funds Vs. Bank Fixed Deposits

Bank Fixed Deposits or FDs are a staple instrument to place one's savings for very long. However, this behavior is changing slowly. Investors are exploring various investment avenues looking for better returns. Let us look at a comparison between bank FDs vs. mutual funds.

|

Parameters |

Liquid Mutual Funds |

Fixed Deposits |

|

Rate of Returns |

No Assured Returns |

Fixed Returns |

|

Inflation Adjusted

Returns |

Potential for High

Inflation-adjusted Returns |

Usually Low

Inflation-adjusted Returns |

|

Risk |

Medium to High Risk |

Low Risk |

|

Liquidity |

High liquidity |

Medium to Low Liquidity |

|

Premature Withdrawal |

Allowed with Exit Load |

Allowed with Penalty |

|

Cost of Investment |

Management Cost |

No Cost |

|

Tax Status# |

Favourable Tax Status |

As Per Tax Slab |

How can Deskera help you in your business?

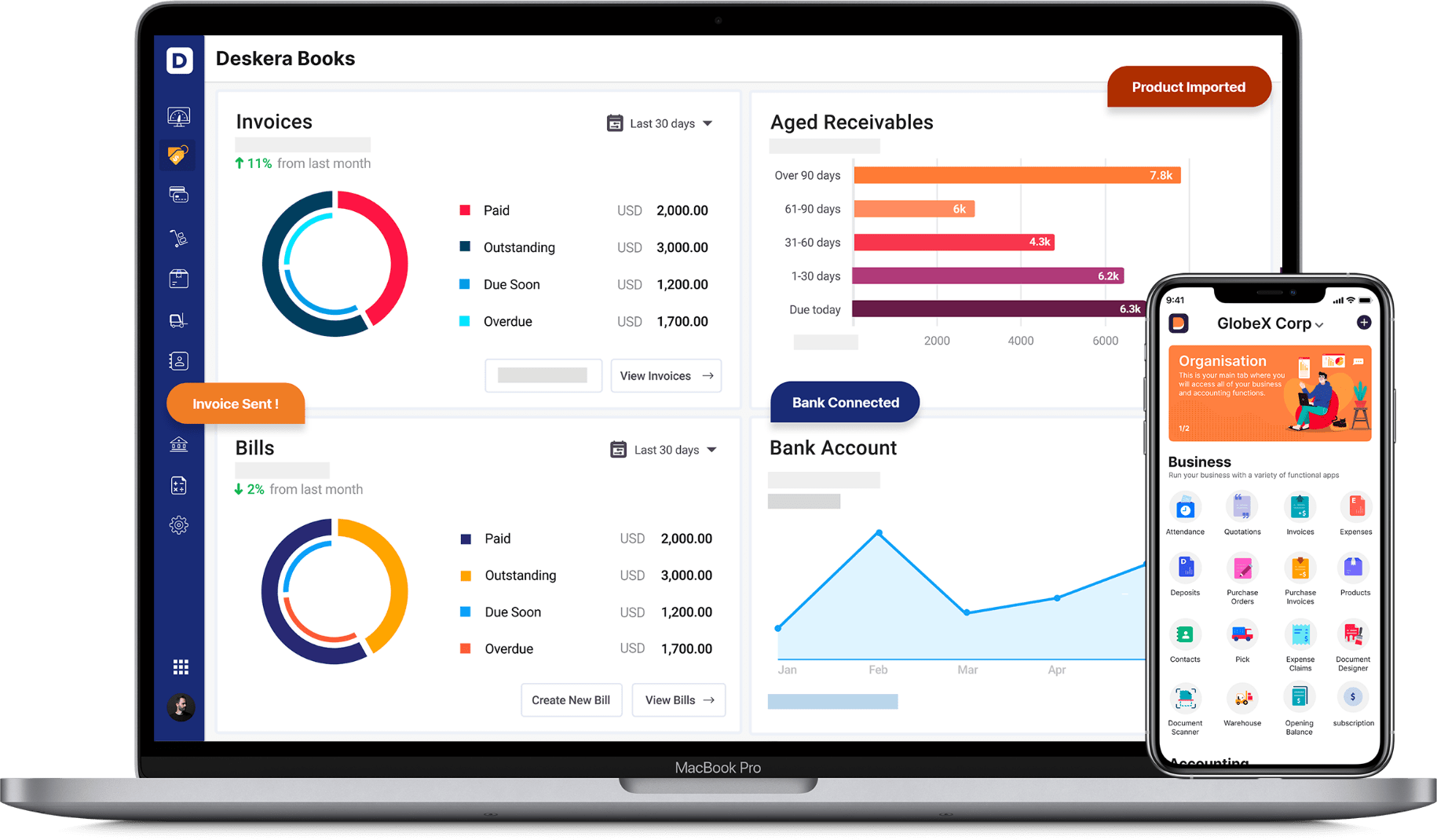

Want to manage your finances, assets and budgets? Look no further than Deskera. Whether it is invoicing, inventory, CRM, accounting, or HR & payroll, as a business owner you need to manage thousands of things. This is where Deskera Books can help you.

Deskera works on a cloud-based business model to make business functioning a smooth process. It reduces the admin time while enhancing efficiency.

Deskera helps you manage tangible and intangible assets and keep your books in order with ease. Your company can benefit from accounting software that tracks journal entries, balance sheets, inventories, and production costs. An efficient financing system that meets the business's unique needs is crucial to its success.

Deskera offers Deskera Books for your accounting needs. With Deskera accounting software, you can keep track of your depreciating assets, scrape value, residual value, salvage value, journal entries, balance sheet, inventory and production costs.

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

With Deskera Books, you can automate journal entry creation so that you can save time. For each sale and purchase transaction, a double-entry record will be automatically generated in terms of debits and credits. As part of the Deskera system, the ledger accounts consolidate all transaction data. The corresponding financial reports will be generated based on their values.

You can get ready-made financial reports in just a few minutes with Deskera, including Profit and Loss Statements, Balance Sheets, and more. With Deskera, you can benefit from an all-in-one tool for generating leads for your business, managing customers, and generating revenue.

Deskera also develops extensive reports on your payroll, taxations, and all you need to know about your company. As a result, you are always prepared for any inspections taking place or if you have to go through any specific information.

Key Takeaways

- A liquid asset is an asset that can easily be converted into cash within a short amount of time.

- Liquid assets generally tend to have liquid markets with high levels of demand and security.

- Businesses record liquid assets in the portion of the current assets of their balance sheet.

- Business assets are usually broken out through the quick and current ratio methods to analyze liquidity types and solvency