When we discuss financial accounting, long-term assets have an estimated useful life. Organizations usually dispose of these physical assets such as machinery, furniture, vehicles once the asset exhausts its useful life. A portion of these resources/assets, notwithstanding, may have a leftover worth. The organizations would then be able to hope to sell the resource at this remaining worth called Scrap Value.

We shall see more of this in this article that also includes the following points:

- Calculation of scrap value

- Determining scrap percentages on depreciation

- Examples of scrap value

- Facts to check before scrapping your car

- Impact of scrap value in accounting

What is Scrap Value?

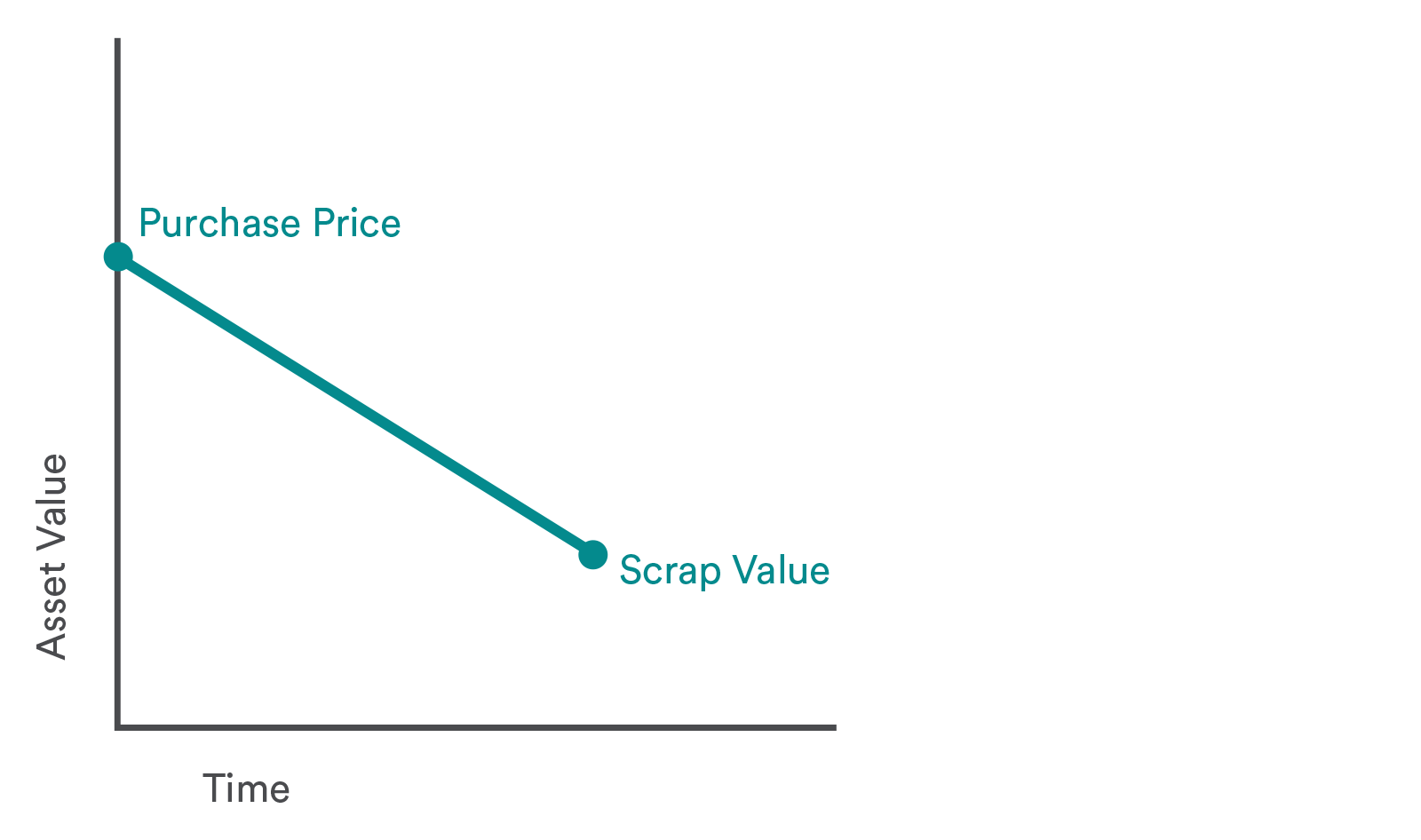

The value or worth of a long-term or physical asset after its useful life is called the scrap value of the asset. The assets may not be used as a comprehensive machine, but if broken down to individual components, the scrap may be used somehow. These scrap materials could then be processed to yield some scrap value before they can be reused. The value they generate at this stage is called scrap value or residual value.

Often, the demand and supply of the scrap materials determine the scrap value. It is the assessed cost at which a fixed asset can be sold after considering its full depreciation. The asset is usually is disintegrated into its components with each component valued and sold separately.

Scrap value in Insurance Industry

Scrap value in the property insurance industry refers to the value recovered for an abandoned or damaged property.

Scrap value in the auto insurance is deducted from loss settlement in case the insured keeps the asset.

Assuming a person with an auto insurance policy that has a $1,500 deductible. In the case of an accident of the insured, the loss suffered is $8,000. The estimated scrap value is $3,500.

In this case, if the insured decides to keep the vehicle, then he shall receive a settlement check from the insurer that has the following calculations:

$8,000 - $1,500 - $3,500 = $3,000

$3,000 is the amount the insured receives from the insurer.

Concept of Negative Scrap Value

An asset’s scrap value tends to become negative if the cost of disposing of results in cash outflow.

Let’s consider this scenario for a better understanding:

A company owns property or land that has barely appreciated by the end of its useful life. If there is any construction or establishment on this land which needs to be demolished, then there will be some expenses or cost attached to it. If this cost of demolishing the construction is more than the scrap value of the land then the land is said to create negative scrap value.

How is Scrap Value Calculated?

The scrap value can be calculated through the given formula:

Scrap Value = Cost of Asset - ( Useful life in years * Depreciation)

With an enormous number of manufacturing organizations depending on their machinery for supporting efficiency, they consistently assess the gear they own. Steady use and different variables cause a constant disintegration. The general costs additionally influence the overall efficacy of the organization. Inferable from these components, the organizations need to make the resource cost-productive.

Furthermore, the organizations likewise need to guarantee that the merchandise created is practical from the client's viewpoint also. In general, organizations need to compute the productivity of the machine to keep up their significance.

How to Calculate Scrap Value of a Leased Vehicle?

Leasing a car is similar to renting it for a set measure of time. The issue with the lease is that a lot of your monthly installment is used up for the expense of car depreciation.

Your vehicle's worth toward the end of the lease is called scrap value.

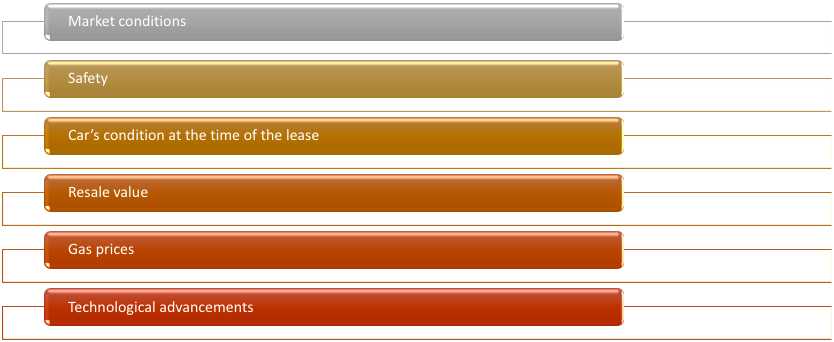

So, how is the scrap value of a leased car decided?

While it’s the leasing firm that determines the scrap value, there are multiple factors that contribute to it such as:

- Market conditions

- Safety

- Car’s condition at the time of the lease

- Resale value

- Gas prices

- Technological advancements

You may expect a percentage of the initial value of the car to be its scrap value.

For example, if

Initial price = $25,000

Estimated percentage of scrap value = 60%

Then, the scrap value = $15,000

Example of Scrap Value Calculation for a Car belonging to a business

In this section, we take an example of how businesses carry out the scrap value calculation for a car/vehicle owned by them.

Let us take an example of a company that owns a van or car. We shall look through the scrape value calculations for the car. Here are the assumptions:

Initial cost of car = $30,000

Useful Life in years = 6

Depreciation = 10% per year

So, after 6 years if the company sells the car, 60% depreciation is reported over 6 years and scrap value is 40% of the initial cost of the car.

Scrap value of 40% = $12,000

So, this is the value the business can expect before the tax deductions.

Now lets say the company has to pay a tax of 10% on this amount,

10% on $12,000 = $1,200.

So $12,000 - $1,200 = $10,800

$10,800 is the salvage value after the company has paid the tax on the residual value..

These observations make it clear that the businesses consider before tax and after-tax calculations while estimating the scrap value of the car.

Facts You Should Know Before Scrapping Your Car

In the case of you getting multiple quotes from scrap yards for your car, you may contemplate whether you're getting the best conceivable scrap value. While scrapping, the companies may need to consider a wide range of factors such as the model and make of the car, the year of manufacturing.

In light of that, here's a straightforward rundown of interesting points in case you're puzzling over whether you're being offered a reasonable cost for your car.

Monitor Current Scrap Prices

In case you will sell your scrap vehicle for cash, it's best to know a few essentials about current salvaged material costs. By monitoring the most current rates, you can decide when you'll get the most when exchanging scrap vehicles for cash. There is a lot of information you can use to follow along.

Ensure You Get More If Your Car Is Drivable

To a scrap yard, a vehicle in running condition is consistently worth more than one that isn't. Drivable cars wouldn’t need towing. Also, if it is drivable it may be auctioned. This could certainly imply a higher scrap price from the scrap yard.

Ensure You Get More If Your Car Has Salvageable Parts

Remember that the straight salvaged material cost for a vehicle doesn't consider any important parts still on the vehicle. Your car may still have re-usable parts like a starter, wheels, new tires. All these can be disintegrated and sold off separately. All these should help you get a better price than the one already estimated.

Avoid Waiting for too Long

The more you hold on to send your vehicle to the rescue yard, the less it will be worth. In the case there are parts that disintegrate rapidly, these parts would be the top reasons why your car generated less scrap value. Therefore, it is best to avoid any delay.

After acquiring all this information, it is still recommended to ask for an itemized break-up of the car’s condition. Once you have a quote, carry out the proceedings firmly without letting the scrap yard dodge its word.

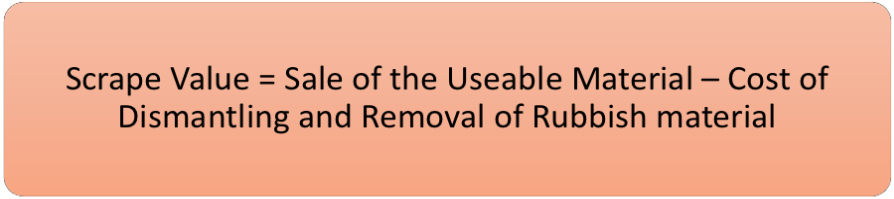

Scrap Value vs Salvage Value

Salvage value is defined as the value of a fixed or physical asset at the end of its useful life. Scrape value is the value of the dismantled material. That means after dismantle, we will get the steel, timber, metal etc. In case of machines the scrape value is metal or dismantled parts. In general the scrape value is about 10% of the total cost of construction.

Scrape Value = Sale of the Useable Material – Cost of Dismantling and removal of rubbish material

Whereas, Salvage value is the value of the utility period without being dismantled. We can sale it as second hand.

From the definition of the scrap value in the previous sections, we may conclude that the terms are synonyms for each other and can be used interchangeably.

How is Scrap Value used in Depreciation Calculations?

Scrap value can help in the depreciation calculations. We look at an example to understand how.

The scrap value of an asset differs based on the method of depreciation a company adopts.

Straight-Line Depreciation:

A company purchases equipment for $ 80,000 that has an expected useful life of 8 years. The company also expects a depreciation rate of 10%. So the depreciation will be calculated as:

Using the straight-line depreciation method,

Percentage depreciation * Cost of asset

10% * $80,000 = $8,000

The scrap value of the equipment after 8 years is:

Scrap value = $80,000 - (8,000 * 8)

= $16,000

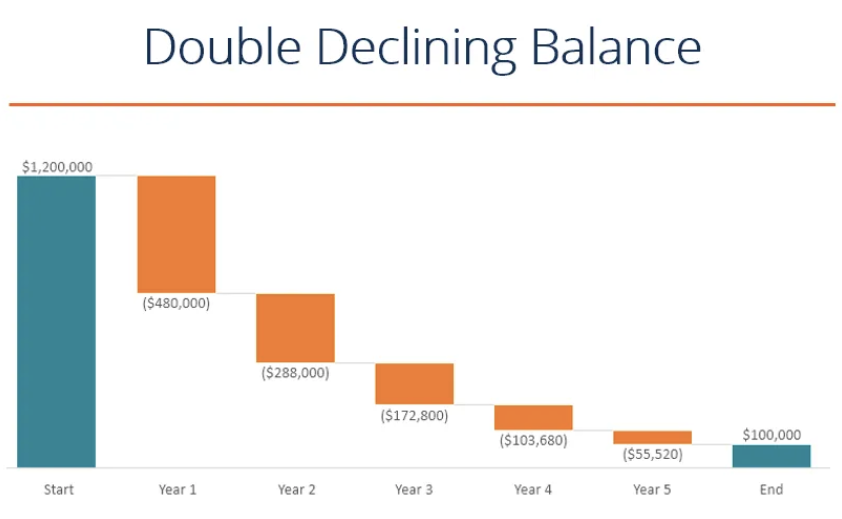

Declining-Balance Method

Let’s check if there is any difference in the scrap value if the company adopts the declining-balance method:

Total Depreciation = $45,562

Scrap Value = $80,000 - $ 45,562

= $34,438

So, we see the difference in the scrap value in both methods of depreciation.

Calculating Depreciation Expense

Considering the example above, we can get the depreciation per year as follows:

Estimated scrap value = $16,000

Useful life = 8 years

So, Depreciation expense per year = ($80,000 - $16,000) / 8

= $8,000

Gauging scrap value holds significance for a company as it helps it to sort its yearly depreciation cost. It is a significant measure since it influences the level of an organization's overall income.

What is the Impact of Scrap Value on Accounting?

When a good or an asset is disposed of or scrapped, there’s a journal entry posted for it when the companies process the scrapping in Disposal Processing under Asset Management.

The journal entries record the following:

- Any loss or profit, if the asset is not completely depreciated after disposal.

- Reversal of accumulated depreciation and depreciation basis.

How can Deskera help your Accounting and Business?

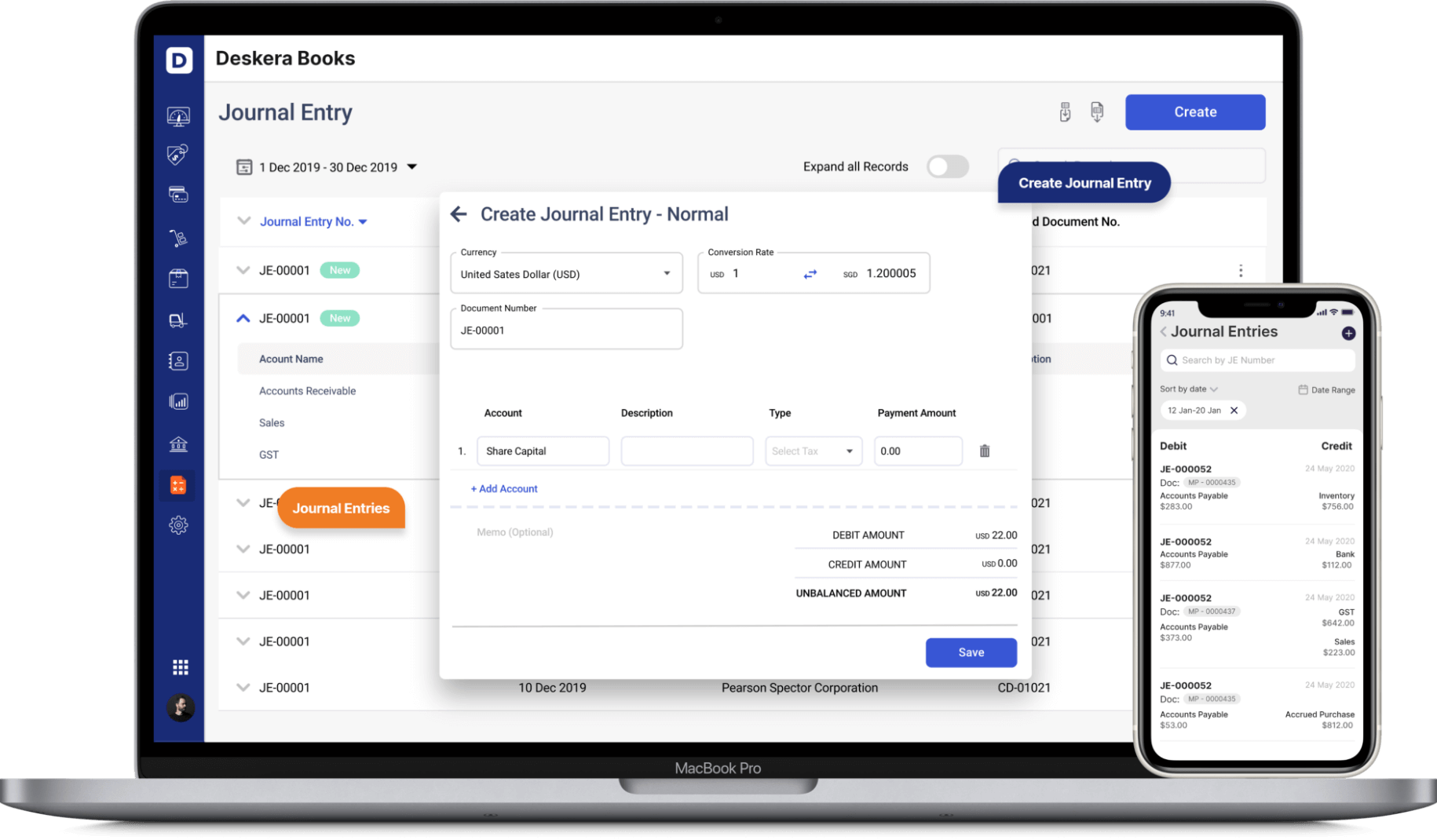

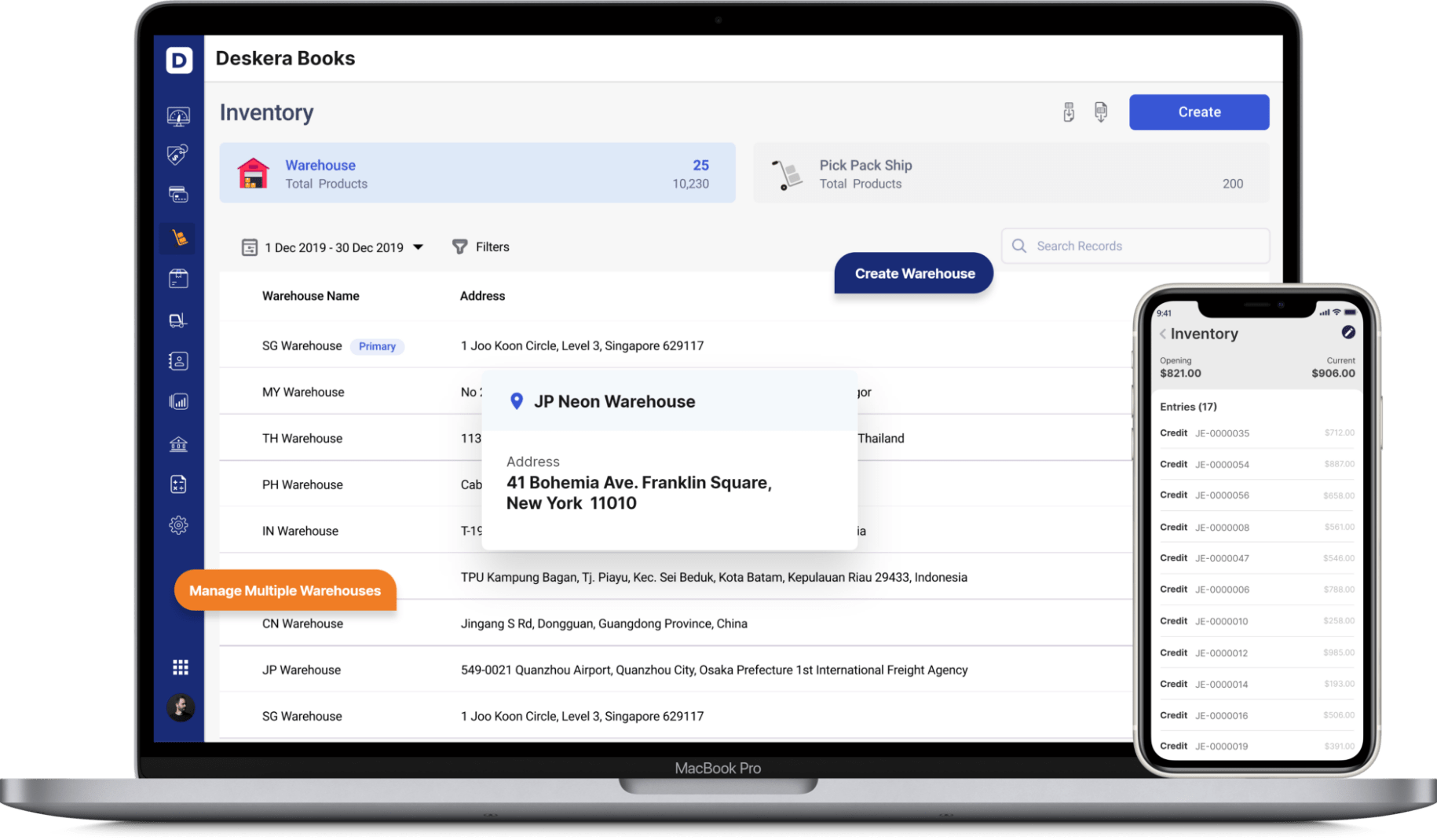

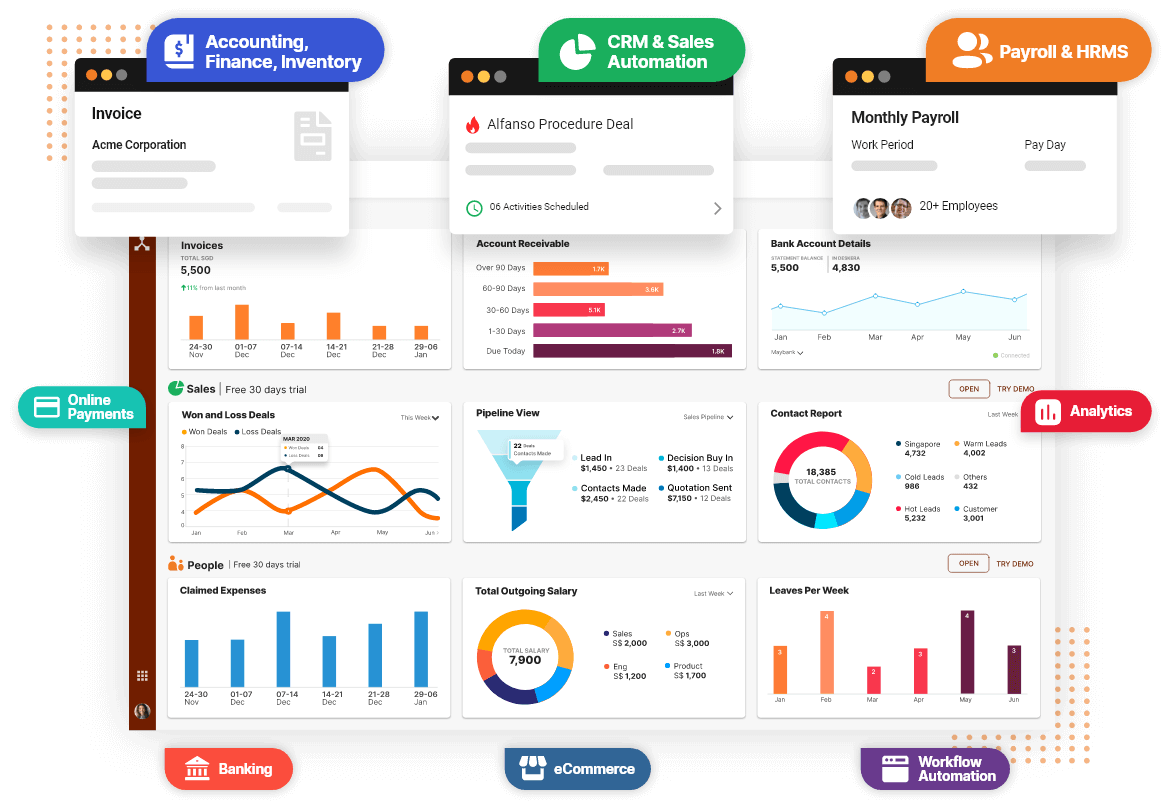

As a business owner, you can invest in accounting softwares that can help you keep track of your scrape value, residual value, salvage value, journal entries, balance sheet, inventory and production costs. A successful business needs an efficient financing process that meets its specific needs.

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

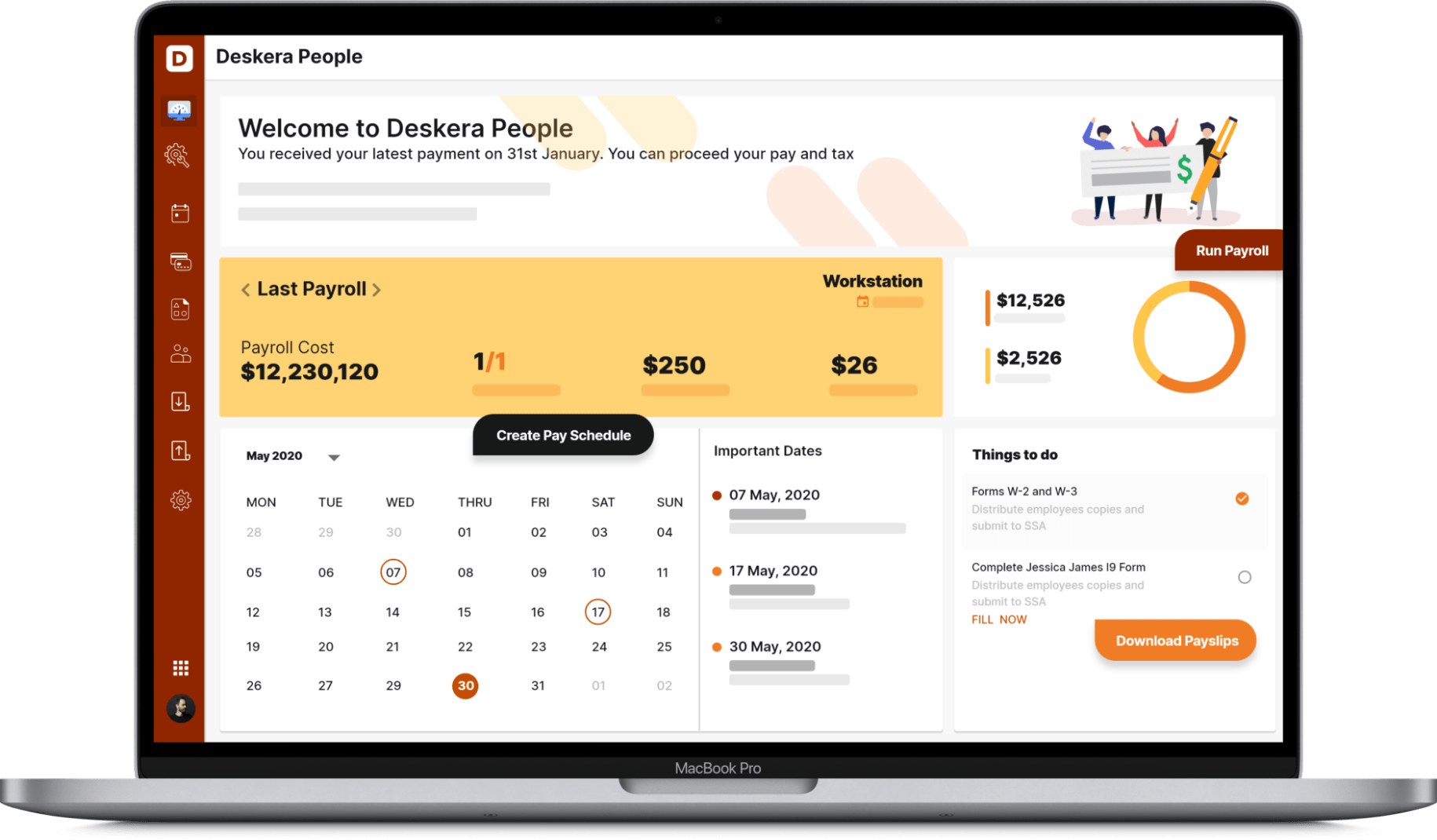

Deskera can also help with your inventory management, customer relationship management, HR, attendance and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

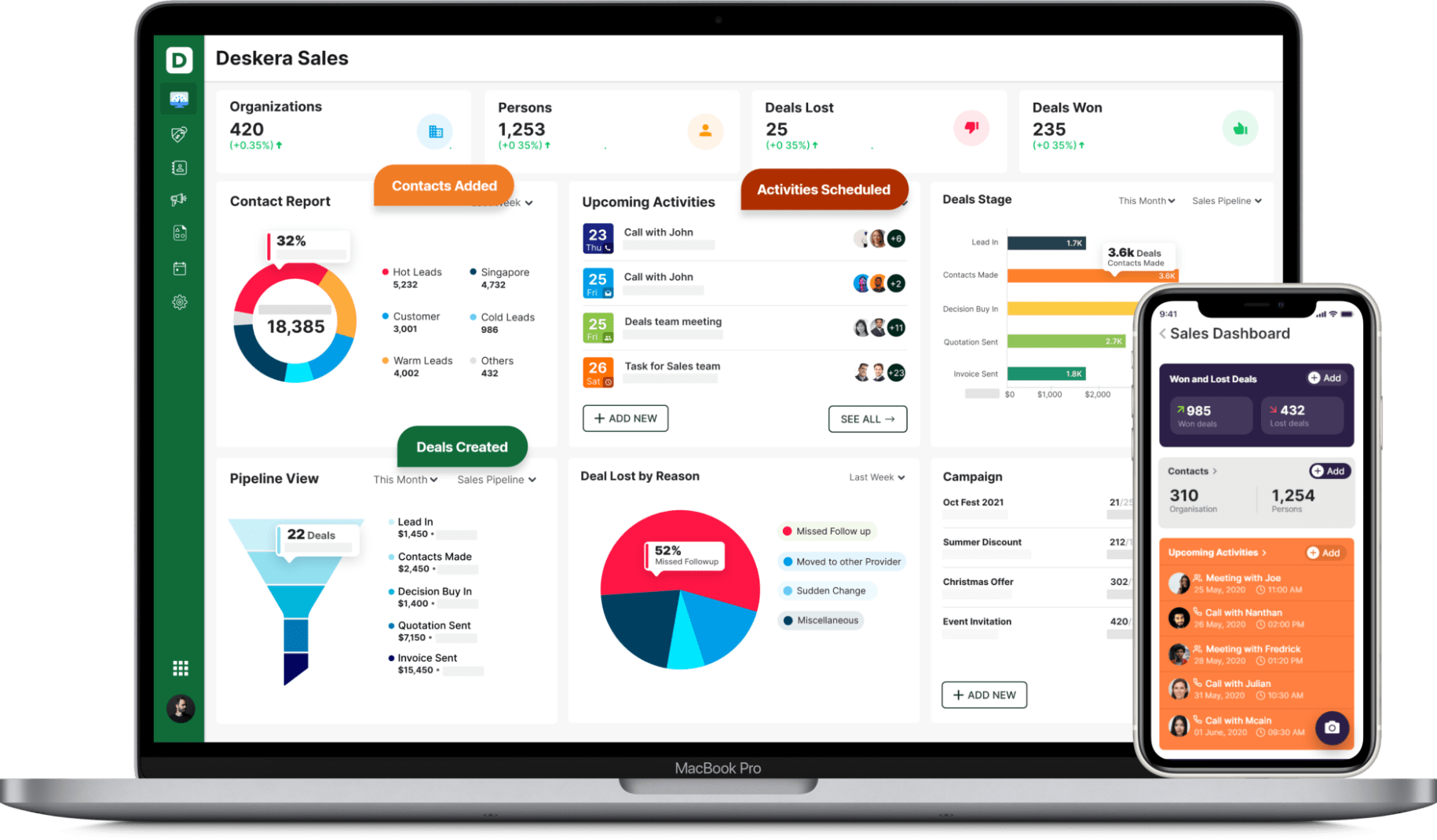

With Deksera CRM you can manage contact and deal management, sales pipelines, email campaigns, customer support, etc. You can manage both sales and support from one single platform. You can generate leads for your business by creating email campaigns and view performance with detailed analytics on open rates and click-through rates (CTR).

Deskera is an all-in-one software that can overall help with your business to bring in more leads, manage customers and generate more revenue.

Key Takeaways

At the end of the article, we take home the following key points:

- When an asset or its components are sold off at the end of its useful life, the value generated by it is called scrap value.

- The scrap value often depends on the demand and supply of the scrap materials created from disintegrating the asset.

- When the cost of disposing of an asset is more than its scrap value, then the asset is said to generate negative scrap value.

- Scrap value, residual value, and salvage value are technically the same.

Related Articles