Find accounting too much to handle?

If you are a law firm owner and wondering if you could lay your hands on a basic Accounting Guide to help you with the basics, then this post is for you.

Law firms are all about seasoned lawyers and expert legal counselors. Bookkeeping and accounting cycles are not the areas they spend the most of their time around.

Yet, accounting is integral to any legally registered business. If you are the owner of a small business or a small law firm, you must familiarize yourself with the accounting concepts to implement in your firm. Doing so will help you keep a tab on the updated rules and regulations pertaining to your state.

Having a law firm needs you to assess and organize your firm’s finances, draft an appropriate payment policy, handle your trust accounts (if any). Moreover, you may also want to minimize your tax expenses through accounting practices.

Intimidated already? Let me tell you the good news! For achieving all this, you certainly do not need to put aside your law firm books and learn accounting from scratch.

This guide will touch upon all the fundamentals of law firm accounting and some important legal terminologies that you must know of. Regardless of your firm’s expanse, you can get your law firm off the ground financially by following the steps discussed in the post.

Here is what the post aims to achieve:

- Law Firm Bookkeeping Vs. Accounting

- Why do Law Firms Need Accounting?

- Important Terms of Accounting

- Best Accounting Practices for Law Firms

- 4 Mistakes Law Firms Must Avoid

- Choosing the Right Accountant for Law Firm

- Your 2022 Guide For Succeeding at Law Firm Accounting

Law Firm Bookkeeping Vs. Accounting

Bookkeeping and accounting are often used interchangeably. However, they are distinct from each other and as a law firm owner, it becomes imperative for you to learn about it. There are different sets of people with diverse skill sets in each area- Bookkeeping and Accounting - that look after and present the financial health of your company for your analyses.

There are legal accountants and legal bookkeepers who collaborate to maintain the intactness of your company’s financial portfolio. Here’s what each department does:

Bookkeeping

Bookkeeping is the process of tracking financial transactions and balancing your company's accounts. Any law firm must perform legal bookkeeping before accounting can take place and it is a crucial business function. Accounting for your law firm is essential for tracking the financial transactions taking place. Having this issue can have serious consequences and impede the growth of your business. In addition to providing accurate financial data for attorneys, reliable bookkeeping can also help legal accountants.

Accounting

Bookkeepers record data that legal accountants use as a foundation to help your firm make more informed choices. The role of an accountant is to interpret, summarize, and analyze financial data. Among the tasks that legal accountants perform for law firms are preparing accounting reports, preparing financial forecasts, and tracking expenses.

Why do Law Firms Need Accounting?

It would be an understatement to say that effective legal accounting is crucial to law firms. Expert accountants and bookkeepers are necessary to keep you informed about the accurate and comprehensive financial statements.

Compliance

Furthermore, accurate accounting reports help you make the right move and help expand your business. So, it wouldn’t be wrong to mention that there are multiple and immensely important responsibilities handled by the accountants. Aside from this, they also assist in keeping you away from violating legal accounting rules, penalties or suspension of license.

Business Expansion

It's important to pay attention to legal accounting. The process allows you to track all kinds of financial transactions happening in your company, analyze it, and make data-driven decisions.

Wouldn't it be nice to know everything inside and out? How does the cash flow happen, what are your expenditures, and what do the prospects of revenue look like in the future? With all this information, you shall be better positioned to use it to turn more success towards your business.

Building Good Corporate Reputation

Law, as they say, is a business that works on reputation. It, therefore, becomes apparent that you must design your business operations that contribute to enriching the image and the reputation of your law firm. This also includes accounting wherein the things could take dire diversions if not done professionally.

It is in the best interests of your firm that these mistakes be avoided before they prove costly and result in loss of clients, referrals, growth prospects, apart from good reputation.

We shall now move on to getting a grip over some basic terms related to accounting, in the next section.

Important Terms of Accounting

As someone working in Law, you are not expected to know things in depth as a professional CPA. However, it is always advised to know a few basics to keep yourself in the loop with context to what’s going on in your firm.

Here are a few terms that are good to pick up at this stage:

Double Entry Accounting

Every entry in double-entry accounting is matched by an opposing entry in a different account. The debits and credits of a double entry system are therefore equal and corresponding. It results in a balance sheet which is a document that comprises information about the assets, liabilities, and equity. To give you a clear idea, here is a simple equation:

In double-entry accounting, financial transactions are categorized into asset, liability, or equity categories. Both categories should match when they are sorted. The practice of double entry accounting provides an extra level of protection against errors and is therefore, a trusted method.

Trust Accounting

In trust accounting, the client funds are kept segregated and apart from law firm operating funds. The operating funds include billings, collections, court fees, and overhead or miscellaneous costs.

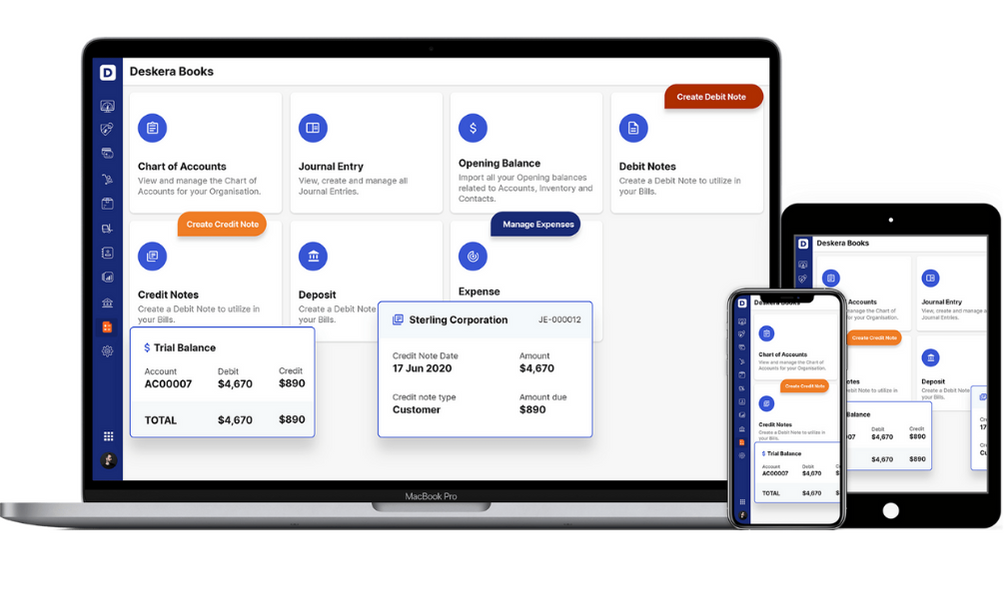

Chart of Accounts

The structure of the Chart of Accounts shows you where each transaction in your firm's finances should be recorded. In addition to five core categories, the chart of accounts typically includes several subcategories depending on your law firm's size, jurisdiction, and practice area. Assets, liabilities, owner’s equity, income, and expenditures make up these five categories.

A law firm's chart of accounts needs to include a trust account and an IOLTA account. This is done to offset and demonstrate that those funds are separate from the funds of the firm.

Interest on Lawyers Trust Accounts or IOLTA

The IOLTA account is a type of bank account the interest on which is directed to funds for social justice by the state. With that said, you must confirm with the jurisdiction of your state as the specifications for the IOLTA accounts are variable. The lawyers are prohibited from collecting interest on trust funds held for their clients.

IOLTA accounts work in a way that's different from the ways in which the operating or business accounts work, where interest accumulates. Also, lawyers are not allowed to deposit their own money into IOLTA accounts, unless it is to pay fees. However, you are advised to establish a separate account to cover fees. This way, you can eliminate the chances of involving the client's money even by mistake.

3-Way Reconciliation

Make sure that you check these three things frequently to confirm the integrity and validity of your financial data. You may carry out the 3-way reconciliation checks on your own or you may take help from software to do that.

- Bank account reconciliation: Compare what you think your balance should be with what the bank reports. Document any discrepancies you find

- Client trust ledger: Review and monitor your trust statement

- Trust reconciliation: Determine how much money is owed. In other words, you need to recognize and note the clients to whom the money is owed

Best Accounting Practices for Law Firms

‘Well begun is half done’. That is so true when you know the best practices of accounting. So, let your law firm implement the following set of actions to accomplish the best possible results:

Establish a budget

Setting a law firm budget is essential if you want your firm to be financially successful. Here are some benefits of establishing a budget in your firm:

- You can establish benchmarks for revenue

- You will be able to forecast and create cash flow projections

- Preparing a budget will allow you to segregate cash for bigger expenses lined up

When you're preparing your budget, ensure that you have a strategy in place. The following points can come in handy for you in the process:

- Write down a list of the mandatory costs and resources your company must incur

- Make a realistic forecast of your revenue

- Establish personal as well as business goals

- Keep your financial records organized with a reliable and well-equipped software such as Deskera that helps you track expenses, revenue, and all things pertaining to your accounts

Make sure your trust accounting is up to date

Accounts involving trusts and IOLTAs are among the most likely to contain errors in legal accounting. You and your staff can easily lose track of funds if you don't adhere strictly to best practices. When keeping track of trust funds, ensure that you cover the following:

- Record everything systematically. It depends on your jurisdiction how detailed records of client trust accounts must be kept in law firms

- Set up separate accounts. Lawyers are often required to maintain at least two bank accounts which are an operating bank account and a separate IOLTA account

Consistency is the Key

While firms do realize that the year-end law firm accounting is vital, they may not be consistent with preparing for it until it is time to file.

Therefore, our word of advice is that law firms need to be mindful of the consistency while collecting and working on their financial data. Timely recording and reporting will help them rule out a lot of struggle and erroneous filings, eventually.

Periodic reviewing of the financial statements every week or month will help your firm evaluate the real progress card of the firm’s financial health. So, do not procrastinate and keep working with your financial info throughout the year. Moreover, doing so will also offer an added advantage of recognizing multiple other growth opportunities.

4 Mistakes Law Firms Must Avoid

Law firm accounting could get messy, especially if you aren’t well-prepared for it and have been dilly dallying the process. If you are at the foothills of learning bookkeeping for your law firm, you must also know about the common mistakes that may happen at this stage. Avoid them before it's too late.

Chris Mova, a personal injury lawyer and founder of the Mova Law Group, says: "As attorneys, we must remember that every aspect of our practice reflects on our commitment to justice and ethical service. Avoiding common law firm accounting mistakes is essential to upholding the trust our clients place in us."

Not Seeking Professional Help

Lawyers are adept at understanding the significance of professional help, given the level of professional assistance they provide to their clients all the time. Similarly, when it comes to law firm accounting, it becomes just as important to seek professional help.

The assistance can be welcomed in any form; be it a software like Deskera or be it a legal accountant who understands the business. A software can help you automate multiple processes such as receiving and recording online payments or auto populating the accounting entries, and so on.

All your tasks will get done without any hassles, in a timely manner, and without having to worry about errors in reporting.

Data Entry Mistakes

Manual entries are like a huge canvas that is conducive for generating mistakes. Duplicate data or incorrect entries are a common occurrence while entering the numeric data manually. This could lead to mistakes at many levels. Right from mismatched records to compliance violations and from billing errors to double work, it is a recipe for disaster leading to wastage of time.

So, avoid making manual entries, and take help of a software that would not only collect data but will auto populate it for you.

Failing to Distinguish between Income and Revenue

If a client pays an invoice, you must first account for the incurred costs. Since the incurred costs are not income, you should record them separately. The records of a firm will not be accurate if it does not separate costs incurred from actual revenue.

Consequently, the firm will have inaccurate data in its financial statements, resulting in violation of the compliances.

Managing Trust Accounts incorrectly

A legal accounting error is most often made in trust accounts. There are plenty of directions in which mistakes can occur. You make mistakes in your accounts, incorrectly allocate funds, misuse funds, or make mistakes in reporting. Trust accounting errors are a serious concern in law firm accounting. Trust accounting mistakes can cost you your license.

Choosing the Right Accountant for Law Firm

Having been through the various concepts of law firm accounting, you may have now achieved a better clarity into the subject by now. Despite the guidelines, undermining the importance and effect of having an adroit accountant would be an incorrect thing to do.

Bringing in professionals is a common practice among law firms, and it can help ease your worries and be reassuring. You can manage your firm's revenue by using the abilities of a legal bookkeeper and an accountant. Ensure fair and accurate handling of your company's finances by utilizing the services of a learned and skilled accountancy professional.

When you have administrative tasks to be done such as capturing transactions, reconciling accounts, or generating invoices, you might want to hire a bookkeeper.

The job of an accountant is a step ahead of this. They utilize the data generated in the previous step to prepare financial documents such as the Profit and Loss statement, the balance sheet. So, seeking the services of an accountant who specializes in accounting for law firms would be exceptionally beneficial. In most cases, hiring both a legal bookkeeper and a legal accountant is the best plan.

Here’s an explanation of the responsibilities both handle:

Responsibilities of a Legal Bookkeeper

Keeping financial records at your law firm is the responsibility of your bookkeeper. Among their responsibilities are:

- Keeping track of financial transactions

- Maintaining financial balances

- Maintaining bank reconciliations

- Payroll administration

- Invoicing

How to choose a Legal Bookkeeper

It is important that you don't rush into choosing the legal bookkeeper; it could make or break your firm's success. Take into account the following:

- Experience with law firms: You are likely to find bookkeepers with a diligent approach to work, but make sure they have experience working for law firms

- Ask for referrals: Be open to recommendations or you may even go around asking for references to an expert bookkeeper. Your search for a bookkeeper can be guided by the experience of other legal professionals

- Knowledge of your software: Verify if the bookkeeper is aware of the software you use. Having a familiarity with the same software may be an added advantage to you as you may not have to provide training to such a candidate

Now, let’s get a glimpse of the responsibilities handled by a legal accountant.

Responsibilities of a Legal Accountant

A legal accountant’s major responsibilities require them to record, interpret and utilize the generated financial information to prepare various financial statements. Besides, they are also in charge of keeping the firm compliant with the various laws and regulations of the state. Most of them are also experienced in working with law firms.

Let’s learn about their major tasks:

- Preparation of financial statements and data management

- Client trust accounting

- Case cost management

- Accounting for payroll

- Expense tracking

- Tax filing

- Distinguishing and accounting for revenue from income

How to choose a Legal Accountant

It is recommended that you hire a candidate who fits the bill and meets your expectations and requirements. There could be certain requirements that need you to look for peculiar abilities in the candidate. In order to find the right accountant, ask questions that answer your obvious requirement solutions.

- Do they have an understanding of the specific rules of your jurisdiction?

- Is there any suggestion or advice they could provide to help your business grow?

- Does their accounting process use any specific technology?

- Do they require you to do any bookkeeping?

- How urgent is the need for their services?

- Can they handle accounting for a firm your size?

- Evaluate if your firm requires an employee or a contractor?

Your 2022 Guide For Succeeding at Law Firm Accounting

Law firm accounting may look like an uphill task, and of course, it is to a great extent; yet it lets you have immense peace of mind when you have all your accounting records accurate. These are some of the most crucial factors that contribute to the growth and expansion of your law firm.

In this section, we bring to you an easy guide you could follow to ensure that you have all the ingredients on your table to cook up a great accounting year ahead.

Create an Organized Bookkeeping System

You may want to hire a professional bookkeeper with experience working with law firms or take on bookkeeping tasks in-house. After all, Keeping accurate and detailed bookkeeping records for your law firm is essential for compliance, financial success, and growth.

No matter whether you do your own accounting and bookkeeping or hire someone to do it for you, you must maintain a schedule for carrying out the bookkeeping tasks. Based on your requirements, you could schedule them weekly, daily, or monthly.

Maintaining Clear and Strict Records

All law firms need robust accounting measures to ensure positive outcomes. To accomplish this, the firms must ensure that they keep all the financials organized. Although not an exhaustive list, the following are some of the documents that the firms can cover:

- A receipt or proof of payment

- invoices or bills

- Bank statements and credit card statements

- All canceled checks

- Previously filed tax returns

- Timesheets and billing information

Set up the correct bank accounts

You should open a business bank account for your law firm if you don't already have one. The average business needs at least three business bank accounts - a checking account, a savings account, and an IOLTA account. Having the wrong business accounts can lead to errors in bookkeeping, disorganized records, and a breach of trust account regulations.

Calculate your tax deductions

Taxes are a part and parcel of all businesses and so, law firms are no exceptions; yet, not all law firms are unaware of tax deductions. There may be times when they fail to take advantage of legitimate tax deductions.

While calculating your tax deduction, ensure to educate yourself well. Learn about the deductions that apply to you. Do not wait for the last moment to gather data; do it throughout the year. This will help you save a lot of time and effort when you are actually filing your taxes.

Determine which accounting method to use

While there are different methods you can adopt, choose the one that best suits your business. The only requirement is that you will have to follow the method once adopted. Therefore, it is important to check and confirm before you implement a method of accounting.

Firms in the US will demonstrate the use of one of the methods described in the following:

Cash Method Accounting

According to cash method accounting, revenue is recognized when funds are received and expenses when they're paid out. Your firm will also be able to pay tax on income once it has been received and deposited in the bank using this method.

Make sure you weigh the pros and cons of both methods for your firm, and then, moving forward, make sure your records are clear and easy to read.

Accrual Method Accounting

With the accrual method, revenues are recorded as they're earned and expenses as they're incurred, regardless of whether they're immediately paid. By doing so, the costs earned in a given month or year are more closely matched to the revenues earned. As a result, financial management becomes more effective.

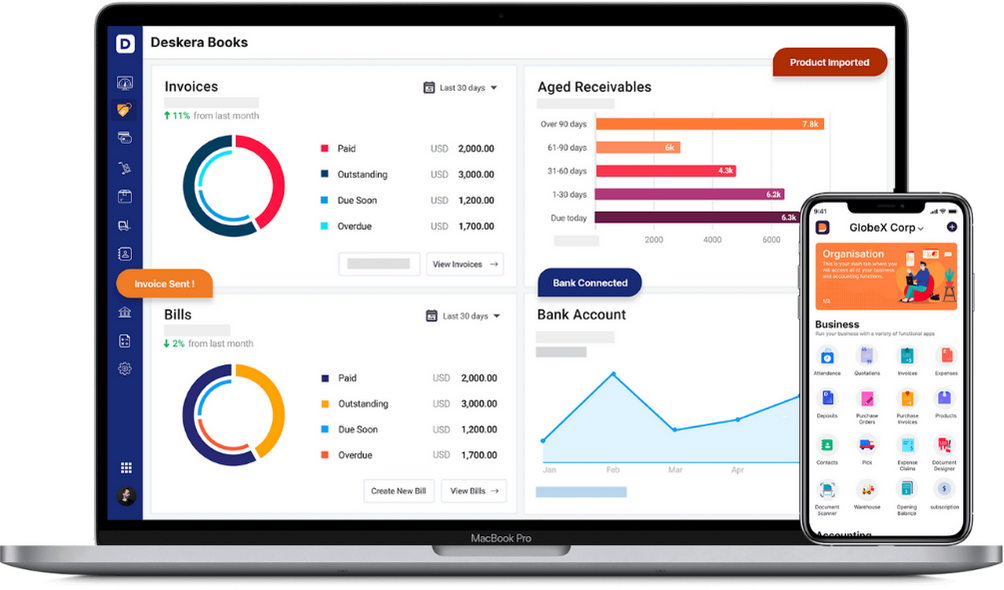

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs from creating invoices, tracking expenses to viewing all your financial documents whenever you need them.

The platform works exceptionally well for small businesses that need to figure out a lot of things when they are setting out. This delightful software allows them to keep up with the client’s expectations by assisting them in overseeing a timely delivery.

With the well-thought and well-designed templates, you can now anticipate your work to become simpler. These templates can be used for transactions like invoices, quotations, orders, bills, and payment receipts.

Deskera People is another platform that enables you to expedite and simplify the processes. Through its automated processes like hiring, payroll, leave, attendance, expenses, and more, you can now unburden yourself and focus on the major business activities. It also assists with driving growth for your business by integrated Accounting, CRM & HR Software.

Key Takeaways

This article discussed in detail the differences between bookkeeping and accounting. Once understood well, it will help you move swiftly towards your goals.

Here are the key highlights of Law firm accounting:

- Law firm accounting may sound intriguing and intimidating; however, much of it depends on how well-aware you are with its concepts

- Bookkeeping is the process of tracking financial transactions and balancing your company's accounts

- The role of an accountant is to interpret, summarize, and analyze financial data.

- Compliance, business growth, and building reputation are some of the reasons why law firms need accounting

- Establishing a budget, having an updated trust accounts, and maintaining consistency are ways to implement best practices in the law firm

- Not seeking professional help, data entry errors, not distinguishing between revenue and income, and incorrect management of trust accounts are some of the mistakes the law firms must avoid in order to gain better results

Related Articles