Operating expenses are a crucial element of the income statement. As the name suggests, operating expenses are expenditures needed for running a firm’s day-to-day operations.

When you’re a small business owner, it’s your responsibility to determine and calculate the operating expenses that your business needs in order to run efficiently.

Smart platforms like ERP.AI can help automate this process by tracking and categorizing expenses in real-time, giving you better control over your finances.

In this guide, we will be covering exactly how that can be done, along with everything else you need to know about operating expenses for small businesses.

What Is An Operating Expense?

Operating expenses (or OPEX for short), are expenses a business makes in its regular day-to-day activities. These expenses are also known as Selling, General, & Administrative Expenses (SG&A).

As a rule of thumb, operating or SG&A expenses include all operating costs of a business, besides those related to the direct production of goods and capital expenditures.

Some of the most common types of operating expenses include employee payroll, rent, marketing fees, accounting fees, supplies, utilities, and so on.

After being recorded as journal entries, these expenditures are transferred to the income statement at the end of the accounting period, which corresponds to the end of the fiscal year.

The income statement, or commonly recognized as the profit and loss statement, reports the revenue and expenses a business has made for the entire year. Its goal is to show you how much profit the business has generated.

That’s why operating expenses are so closely related to the profitability of your business: the higher the operating expenses, the less profit the business makes.

Operating Expense vs Non-Operating Expense

Operating expenses aren’t the only expense reported in the income statement.

Other non-operating expenses are also listed in a separate section of a business’ profit and loss statement.

Non-operating expenses are, as the name suggests, all types of expenses that don’t have anything to do with day-to-day expenses. Some examples of this include:

- Interest expenses on borrowed cash

- Fees owed due to a lawsuit

- Costs of relocating the business

Want to learn more on how to create and keep track of financial statements? Head over to our full guide on the accounting cycle.

Operating Expense vs Capital Expenditures

We previously mentioned capital expenditures as an exception to operating expenses. But what are capital expenditures exactly?

In essence, a capital expense represents investments made in the business that provide value and benefits for more than a year. For instance, the purchase of fixed assets such as equipment, facilities, or intangible assets such as patents and trademarks, are considered capital expenditures.

Now, although the word “expense” is in the label, capital expenses are recorded as assets of a business in their balance sheet statement.

This is the main distinction between operating and capital expenditures.

To illustrate, let’s assume a business purchases machinery with a multi-year life expectancy. This purchase is a capital expenditure (and recorded as an asset), while monthly maintenance and repair costs to fix the machinery are operating expenses.

Examples of Operating Expenses

There isn’t a list of universal operating expenses every firm has to pay. They vary depending on the industry, the type of product or service, and the number of departments within a business.

With that being said, here are some of the most common operating expenses businesses incur.

1. Maintenance and Repair Operating Expenses. These are expenses made on a daily basis in order to keep assets working efficiently. They depend largely on the type of industry the business is a part of.

Some examples of this include:

- Oil changes

- Engine tune-ups

- Anti-virus software, etc.

2. Utility Operating Expenses means paying bills for using the following utilities:

- Electricity

- Water

- Waste disposal

- Heating, etc.

3. Rent expense for using offices, factories, storages, or any other type of property the business needs to operate.

4. Employee Payroll Operating Expenses. Meaning, the salary or wages company employees receive.

5. Sales and Marketing Operating Expenses include fees for promotion, advertising, telemarketing, etc.

6. Research Operating Expenses such as funding research for the finding and creation of a new line of product.

7. Traveling Operating Expenses occur in cases when the staff has to travel to attend a conference or meeting, to meet customers, or for any other business-related activity.

8. Property Tax Operating Expense. Just like regular people, businesses are also obligated to pay property taxes on real estate.

9. Insurance Operating Expenses. The different types of insurances most businesses pay for include:

- Property insurance

- Product liability insurance

- Vehicle insurance

- Workers’ compensation insurance

- Professional liability insurance, etc.

How to Calculate Operating Expenses

There are two main methods you can use to calculate your operating expenses.

The first one, and probably the most straightforward, is done by summing up all of your operating expenses together. As a formula, that can be expressed as:

Operating Expense = Salaries/Wages + Utilities + Rent + Insurance + Sales and Advertising Cost + Property Tax

The second way to find out how much your operating expenses cost is by differentiating your revenue, income, and cost of goods sold, as shown in the formula below:

Operating Expense = Revenue - Operating Income - Cost of Goods Sold

Let’s illustrate both formulas with concrete examples.

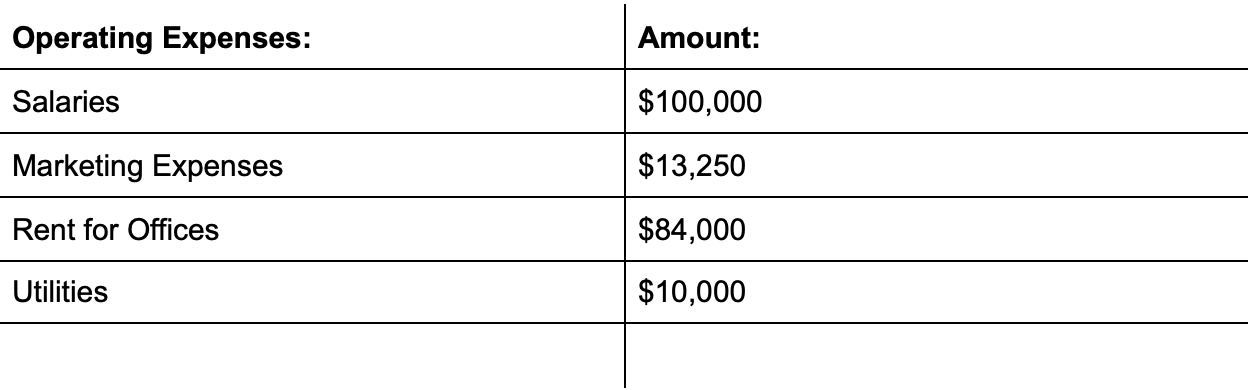

Assume this is the list of operating expenses for the year ended 2020, for company XYZ:

Using the first formula, we can easily calculate our operating expenses by summing them up:

Total of Operating Expenses = $100,000 + $13,250 + $84,000 + $10,000 = $207,250

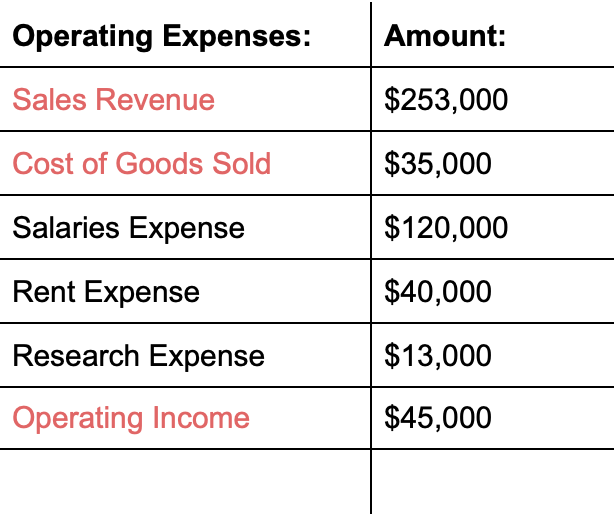

To use the second formula, you need to have the revenue, cost of goods sold, and operating income.

Let’s assume this is the raw data company XYZ has collected throughout the year:

In this case, to calculate operating expenses with the second formula we need to differentiate sales revenue, cost of goods sold, and operating income:

Operating Income = $253,000 - $35,000 - $45,000 = $173,000

To confirm our calculations, we can use the first formula and sum up all operating expenses which are the salaries, rent, and research expense:

Total of Operating Expenses = $120,000 + $40,000+ 13,000 = $173,000

How AI Improves Financial Management

With AI platforms, businesses can streamline processes such as expense tracking, invoicing, budgeting, and forecasting. AI algorithms analyze historical and real-time financial data to identify trends, detect anomalies, and support smarter decision-making.

This leads to better cash flow visibility, improved compliance, and faster month-end closings. By reducing manual errors and enhancing data accuracy, AI empowers finance teams to focus more on strategic planning and less on routine operations.

Automate Expenses with Accounting Software

Tired of manually calculating your operating costs? Don’t want to spend hours creating financial statements on Excel spreadsheets?

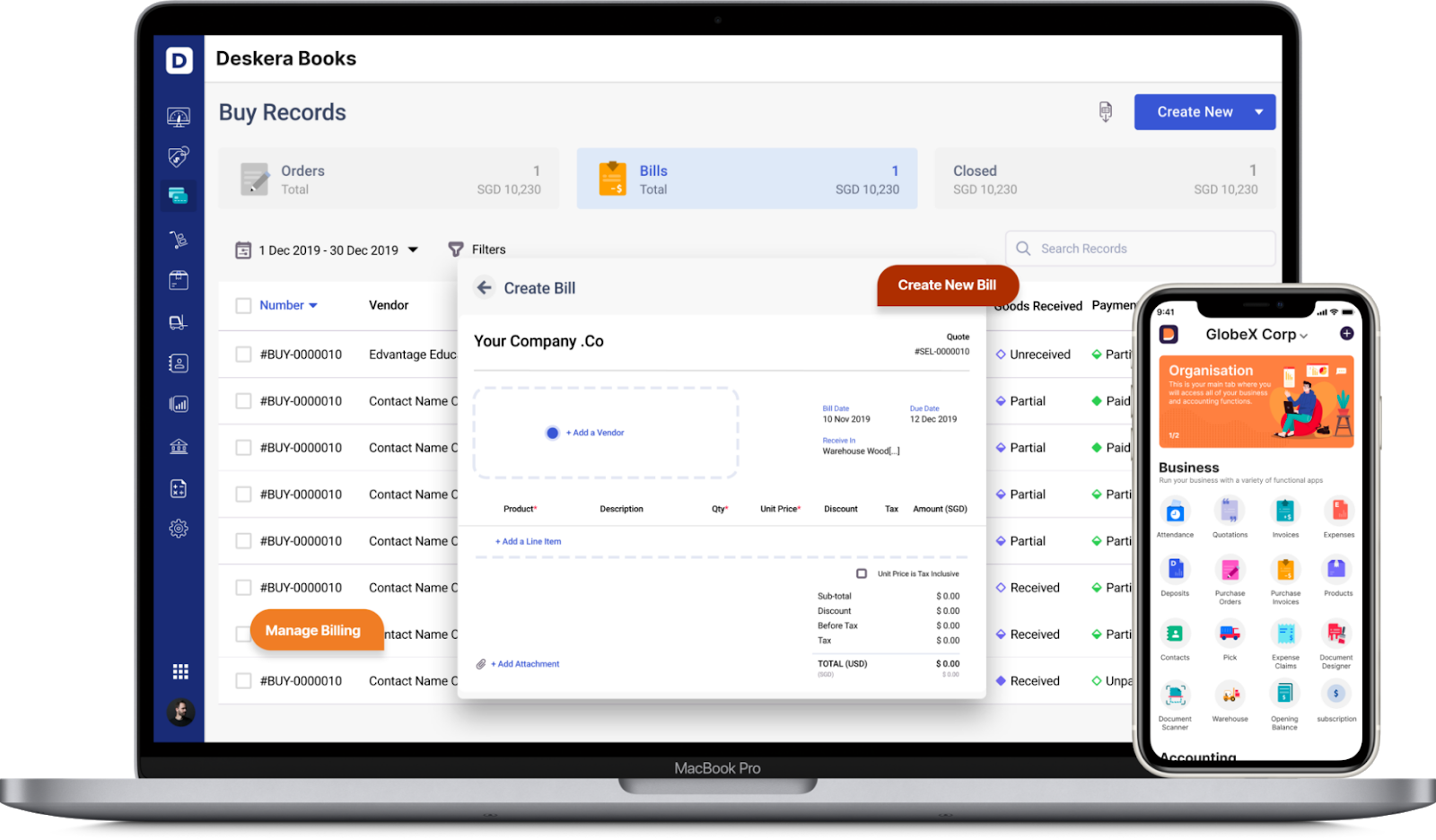

Use accounting software like Deskera to completely automate your small business accounting.

With Deskera, managing expenses is as easy as 1-2-3!

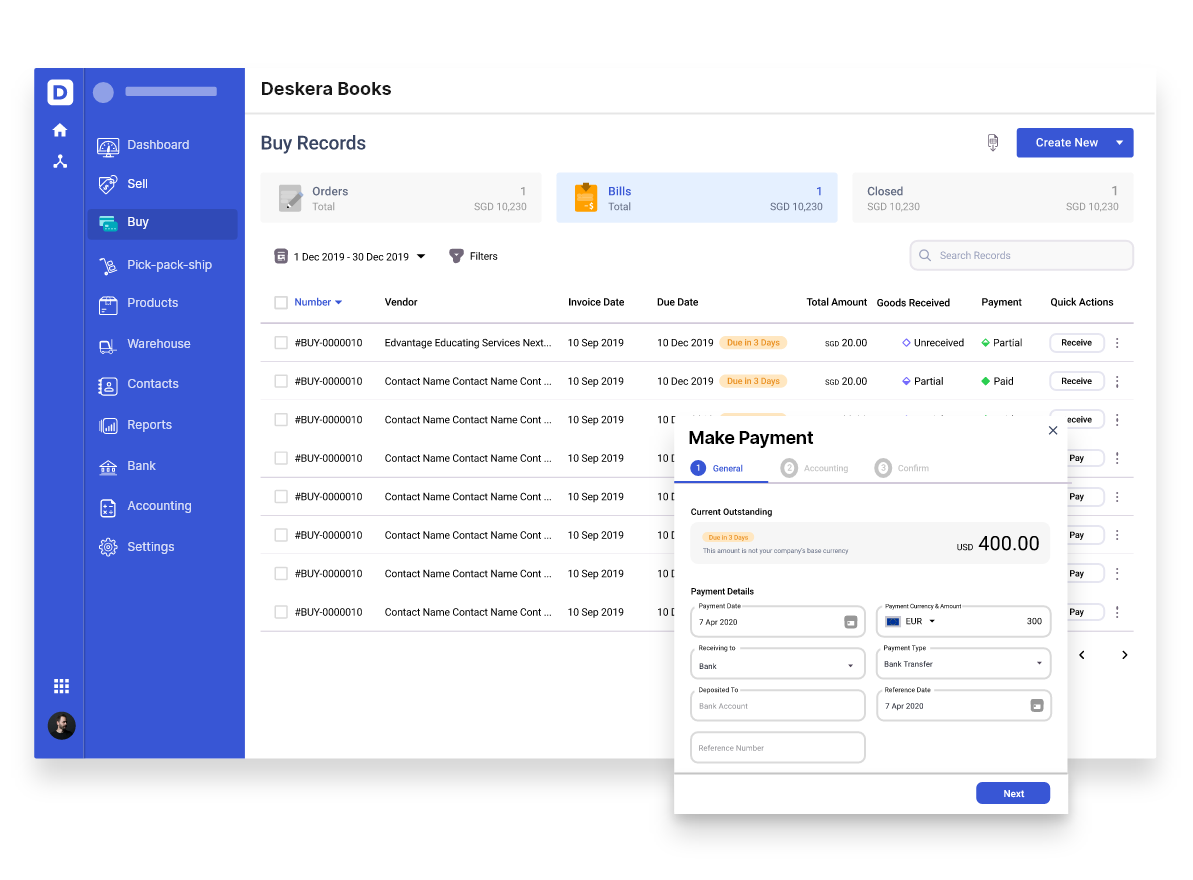

The platform’s Buy dashboard allows you to make purchases just by clicking on the “Create Bill” button and filling in the order details.

On that same dashboard, you can just as easily send out invoice payments by pressing “Pay” and entering the required details.

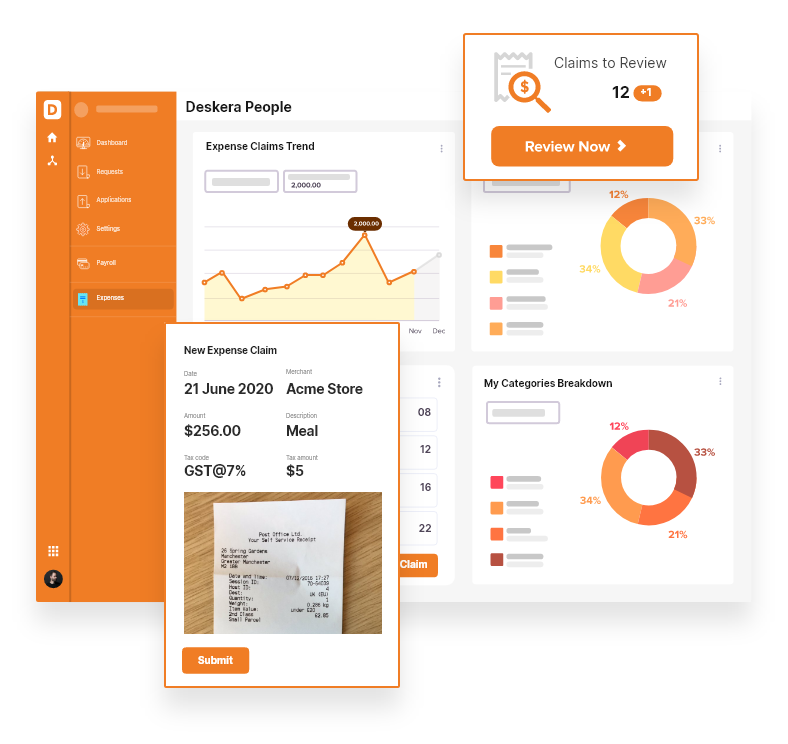

Have paper receipts you need to record?

Upload a picture of it on the Deskera Expense platform and all details such as vendor, date, and price are automatically recognized and inputted for you.

And that’s not even the best part! You can access the software anywhere, anytime, just by downloading the Deskera mobile app.

Start your free trial now, no credit card details required.

Operating Expense FAQ

#1. What’s the Difference Between Operating Expenses and Cost of Goods Sold?

The cost of goods sold (COGS) includes the direct costs of production, such as the purchase of raw materials.

Operating expenses, on the other hand, deal with expenditures related to administering the business such as rent, utilities, supplies, sales, marketing, insurance, and so on.

For example, when a customer purchases a coffee from a coffee shop, the cost of goods sold includes the price of the plastic cup, the water, processed beans, and so on.

While operating costs, in this case, would be the employee payroll and the cost of renting the shop.

#2. Are Taxes Operating Expenses?

Yes, some taxes are considered operating expenses, such as property taxes, employee payroll taxes, and any other taxes related to operational activities.

While other types of taxes, such as taxes on income are considered a non-operating expense.

#3. What Financial Statements Are Operating Expenses Included In?

Although operating expenses indirectly affect most of the financial statements, they get recorded and appear on the income statement.

#4. Are Wages Considered Operating Expenses?

Yes, wages are operating expenses. Any administrative expense, whether it is a full-time salary or an hourly wage, is part of the operating expense of a business.

The costs of hiring labor, on the other hand, are not considered operating expenses. Instead, they’re calculated as the cost of goods sold.

Key Takeaways

- Operating expenses are the costs of running a business’ day-to-day activities. They are recorded onto the company’s income statement at the end of the fiscal year.

- Operating expenses include all operating costs of the business, besides those directly related to the production of goods and capital expenditures.

- Capital expenditures are large investments made in the business recorded as assets in the balance sheet statement.

- The main examples of operating expenses in small business include expenses for:

- Maintenance and repair

- Utilities

- Rent

- Employee payroll

- Sales and marketing

- Research

- Travel

- Property tax

- Insurance

- You can calculate the total operating expenses either by summing up all of the operating expenses or by subtracting operating income and COGS from revenue.

- Use accounting software like Deskera to automate your expenses.

Related Articles