The accounting cycle starts with recording financial transactions as journal entries.

And with every recorded journal entry, there’s a corresponding dual effect that affects two accounts, one of which is debited and the other is credited. In accounting, this process is known as double-entry bookkeeping.

Now, you probably have a ton of questions. Why does one transaction simultaneously affect two accounts? What even are debits and credits, exactly?

In this guide, we will answer all of your questions, along with everything else you need to know about double-entry bookkeeping for small business accounting.

Read on to learn about:

- What Is Double-Entry Bookkeeping?

- Why Is Double-Entry Bookkeeping Important?

- Basics of Double-Entry Bookkeeping

- Double-Entry Bookkeeping Examples

- Double-Entry Bookkeeping in Accounting Software

- Double-Entry Bookkeeping FAQ

What Is Double-Entry Bookkeeping?

The most commonly used and widespread bookkeeping method for recording financial transactions is double-entry bookkeeping.

In double-entry bookkeeping, every transaction is recorded as a journal entry that affects at least two accounts, where one is debited and the other credited.

To understand this concept, think of the last time you paid for groceries at the supermarket. Most probably, you paid using either cash or card, and then you received the product.

For the supermarket, this purchase causes two changes to happen. Their cash increases and their inventory (groceries) decreases. In double-entry bookkeeping, this is recorded as a journal entry where the Cash account is debited, and the Inventory account is credited.

In simple terms, debits and credits are words that track where cash flows from, and where it’s going. They must be always equal, in order to keep the accounts balanced.

First, these debit and credit entries are posted into the general ledger, which is basically your database of accounting information. The goal of the general ledger is to keep the primary financial records of your business.

Then, this information is transferred to the trial balance, which is a bookkeeping worksheet reflecting all of the ending balances of your ledger accounts. Unlike the general ledger, its purpose is to make sure that total debits equal total credits.

We’ll get into more details about the different types of accounts, and how debit and credit works as we go along.

But first, let’s explain who uses double-entry bookkeeping, and when it’s appropriate to use single-entry instead.

Who Uses Double-Entry Bookkeeping?

There are two main bookkeeping methods businesses can choose from: single-entry and double-entry. With single-entry bookkeeping, businesses follow the cash-basis of accounting. Whereas with double-entry, businesses have to follow the accrual basis of accounting.

So what businesses need to do double-entry bookkeeping?

According to the IRS, public companies and businesses with inventory are legally obligated to use the accrual basis of accounting, which requires double-entry bookkeeping.

Additionally, businesses that generate over $5 million in annual revenue, must also do accrual basis accounting.

As for other small businesses, they are free to choose between cash and accrual basis, as long as it shows a clear picture of their income and expenses.

With that being said, double-entry bookkeeping is still the most accurate way for a business to keep track of finances, no matter the size.

Double-Entry vs Single-Entry Bookkeeping

As the name suggests, single-entry bookkeeping records transactions with just one entry.

More specifically, a single entry contains the date, description, and positive or negative value of the transaction, along with the remaining cash balance of the business’ bank account.

If you don’t own inventory, you don’t sell products on credit, you only have a handful of employees, and you deal with all transactions in cash, then single-entry bookkeeping is the way to go. It’s quick and straightforward - but that just about sums up the advantages of single-entry.

Single-entry bookkeeping doesn’t record any of your assets or liabilities, and you can’t use it to create a balance sheet at the end of the fiscal year. At the same time, the method is prone to errors and doesn’t provide much information on the financial health of your business.

With double-entry bookkeeping, on the other hand, every change that happens to the accounts is immediately recorded, so that you always have a full picture of your financial state. This data allows you to create important financial statements that are necessary for taking out loans and attracting investors.

Why Is Double-Entry Bookkeeping Important?

Only freelancers and very small businesses with little to no inventory can satisfy their accounting needs with single-entry bookkeeping.

But if your business is any more complicated than that, we strongly recommend shifting to double-entry bookkeeping, for a handful of reasons:

1. Suitable for All Businesses

Unlike single-entry, double-entry is a fitting approach for all businesses, regardless of their size, industry, or purpose. This bookkeeping method is guided by GAAP (Generally Accepted Accounting Principles) and fully trusted by financial institutions and government authorities.

2. Provides a Full Financial Picture

Double-entry bookkeeping gives you a 360-degree view of the cash that’s flowing in and out of your small business. Everything gets recorded chronologically, through a systematic technique that tracks down every aspect of the transaction.

With this financial information, you can create all of the major financial statements such as the income statement, balance sheet, statement of cash flow, and statement of owner’s equity.

Then, from these reports, you get to keep track of any outstanding receivables or payables as well as easily identify the exact profit and loss generated at the end of the fiscal year.

3. Make Better Financial Decisions

Financial reports can be really helpful in easing financial decisions and achieving higher profits.

You can get insights on what products are selling well, which segments are growing, and which ones might need further re-investments. At the same time, you can forecast budgets to keep expenses in line by analyzing income and sales.

4. Minimizes Accounting Errors

With double-entry bookkeeping, accounting errors that affect the trial balance are easily identifiable and can be fixed right on the spot. In fact, if you’re using accounting software the system will notify you when debits and credits are out of balance, so you don’t have to worry about tracking mistakes in the first place.

5. Preferred by Stakeholders and Other Third Parties

If you want your business to be taken seriously by your stakeholders you should use double-entry as a bookkeeping method.

Accurate and transparent financial reports add a layer of accountability to your business.

Customers will see you as more trustworthy, banks will be more willing to grant loans, and investors will be more open to funding.

Basics of Double-Entry Bookkeeping

The Accounting Equation

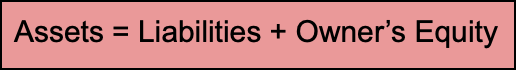

The accounting equation is the foundation formula for double-entry bookkeeping. It consists of three main elements of a business: assets, liabilities, and owner’s equity.

Assets represent all of the resources a business owns, liabilities are obligations owed to creditors, while the owner’s equity is the share the owner has over assets.

According to the accounting equation:

Now, every transaction has a dual effect on the accounting equation.

For example, say you pay back a liability, such as owed office rent. This causes a decrease in your cash, which is an asset account.

In double-entry bookkeeping, these changes on the liability and asset account are recorded as debit and credit entries.

Debits and Credits

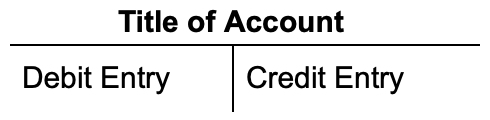

Debits and credits are equal but opposing entries you make in your accounts.

For instance, if you debit an account by $300, there will be a respective credit entry of $300 on another account.

Debits are always recorded on the right side of an entry, while credits on the left, as shown below:

Keep in mind: happiness for an accountant is when debits equal credits. If they are not equal in the end, double-check to see if you’ve made a mistake along the way.

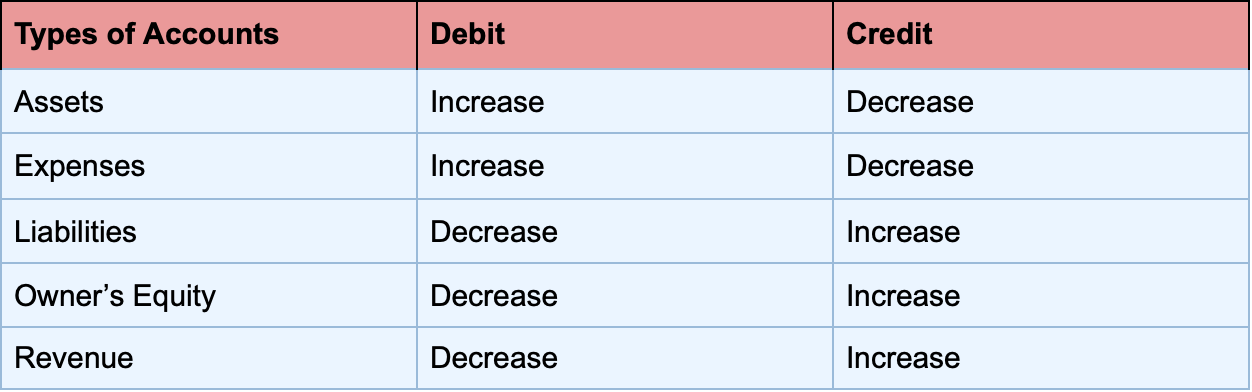

Now, what determines whether there will be a debit or credit entry, are the different types of accounts of the business.

Types of Accounts in Double-entry Bookkeeping

The 5 most common types of accounts include:

- Assets represent everything the business owes, such as equipment, cash, accounts receivable, and more.

- Expenses include the cash the business spends on rent, insurance, and other services.

- Liabilities are what a business owes, and include accounts payable, notes payable, wages payables, etc.

- Owner’s equity is the owner’s investment in the business.

- Revenue represents cash generated from sales.

Debits and credit affect each of these accounts differently.

A credit increases the owner’s equity, liabilities, and revenue when credited, and decreases them when debited. A debit, on the other hand, increases assets and expenses when debited, and decreases them when credited.

We know that memorizing which accounts get debited and credited can be a bit confusing at first. But, don’t worry!

Here’s a cheat sheet for you to easily remember:

Double-Entry Bookkeeping Examples

To put what we’ve learned into practice, let’s take a look at a few financial transactions and how they would be recorded using double-entry bookkeeping.

Example 1

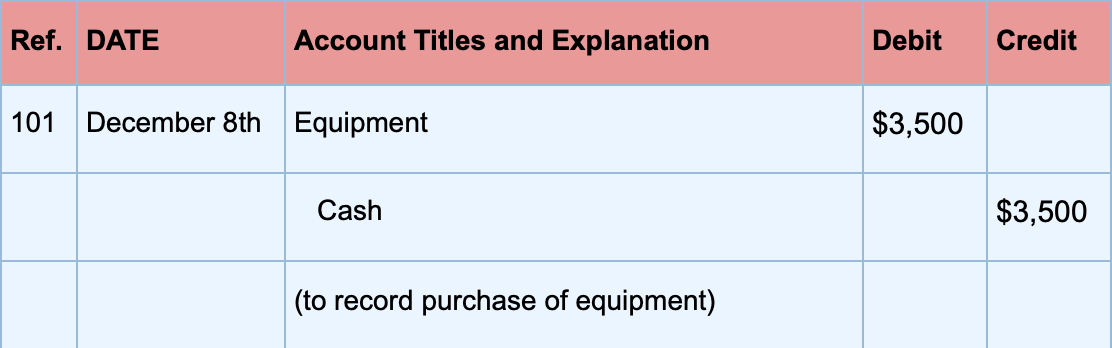

Say company XYZ purchases equipment for $3,500. This would result in an increase in equipment since the company gained an asset and a decrease in cash since the company paid.

Since both equipment and cash are assets, based on the table above, equipment is debited for $3,500, while cash is credited for $3,500. You would record the journal entry like this:

Example 2

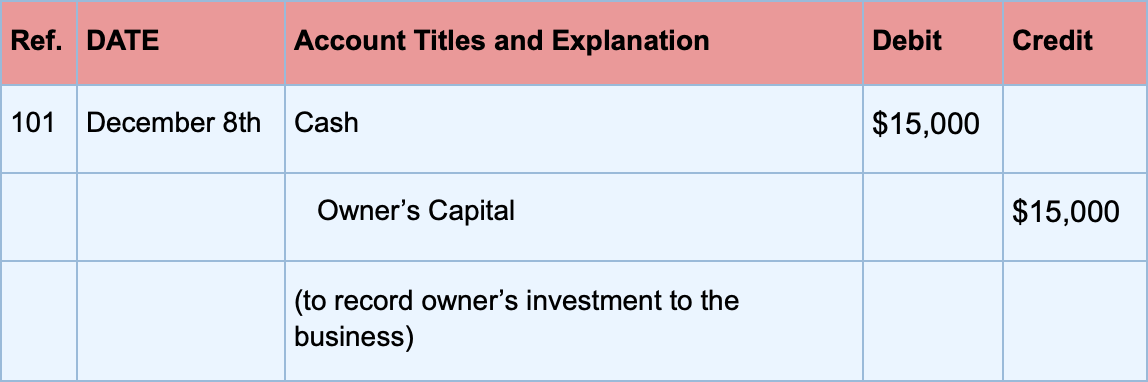

Assume an owner invests $15,000 in cash in their company.

Since the owner is making an investment, both the Owner’s Equity account and Cash account will increase by $15,000.

Cash is debited for $15,000, and the Owner’s Capital is credited for $15,000. The journal entry would look like this:

Example 3

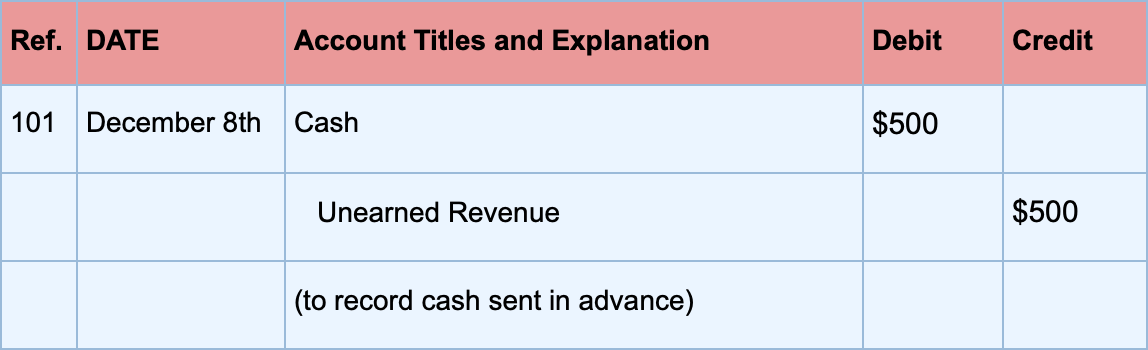

Company XYZ receives $500 cash in advance for advertising services that haven’t been provided yet. This financial transaction causes an increase in the Cash asset and an increase in liabilities, specifically Unearned Revenue.

In this case, Cash is debited for $500, while Unearned Revenue credited for $500. This is how that entry would look like the ledger:

Example 4

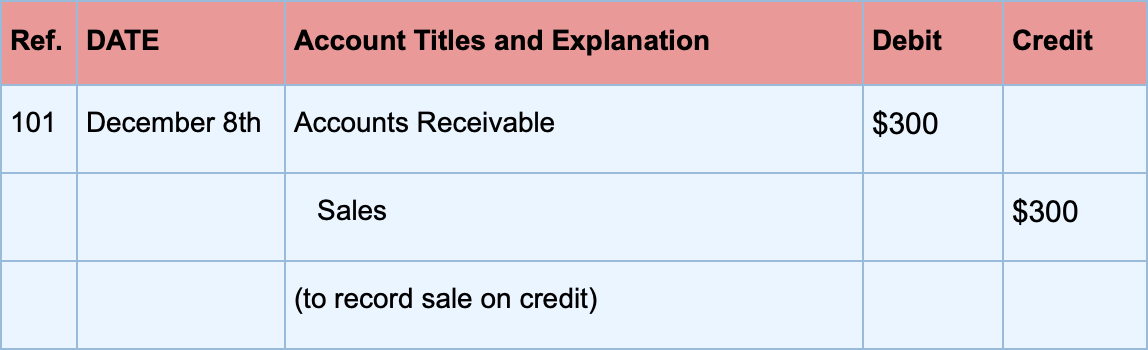

Say company XYZ issues a sales invoice for $300 worth of product, with a payment term of 15 days. This transaction results in an increase in both the Accounts Receivable asset account, and Sales revenue account.

So, Accounts Receivable will be debited for $300, while Sales credit for $300.

Double-Entry Bookkeeping Using Accounting Software

Running your own business can be overwhelming. As an owner, you probably don’t have the time to worry about doing double-entry bookkeeping and balancing your books.

That’s why most businesses use accounting software to make accounting much easier.

Now, you may be thinking: don’t you need technical knowledge to use accounting software?

Usually, yes, but we at Deskera place small business owners at the center of our business. Deskera is an intuitive, super easy-to-use cloud-based application you can access from any device with an internet connection.

The software allows you to automate your entire double-entry bookkeeping in just a few clicks.

For example, when your business creates an invoice, the corresponding journal entry is automatically added by the system in the respective ledger for Accounts Receivable, Sales, Sales Tax, and so on.

The same process applies to making expenses or processing payments. Cash, accounts receivable, and every other type of account is adjusted automatically by the accounting software.

The best part? Generating financial reports with Deskera is just as easy!

Still not sure the software is the right decision for your business’ double-entry bookkeeping? Give it a try out yourself, with our completely free trial.

Double-Entry Bookkeeping FAQ

Is Double-Entry Bookkeeping Hard?

Manually learning how to do double-entry bookkeeping is a complex process to understand and implement.

Thankfully, though, we’re in a modern-day bookkeeping era, where there is accounting software that automates the entire process for you. All you have to do is enter the transaction details and the right debit and credit entries will get automatically posted into the ledger.

What Are the Disadvantages of Double-Entry Bookkeeping?

Double-entry bookkeeping can be complex to understand, and requires a lot of time and effort to manually maintain. And unless you’re using accounting software, you’ll need expert knowledge to apply it as your bookkeeping method.

What is the Difference Between Accounting and Bookkeeping?

Bookkeeping deals with identifying and recording financial transactions, while accounting summarizes and analyzes the data provided by bookkeeping.

So in simple terms, bookkeeping is the recording part of the accounting cycle.

Key Takeaways

And that’s a wrap! Hope you enjoyed our double-entry bookkeeping guide for small business accounting.

For a quick recap, here are some of the main points we’ve covered:

- Double-entry bookkeeping is the accounting system in which every financial transaction gets recorded in at least two accounts. One account is debited, while the other is credited.

- Only public companies and businesses with inventory are legally required to use double-entry.

- Double-entry is beneficial for every type of business because it provides a complete picture of your finances, helps you make more educated financial decisions, minimizes error, and opens your business up to investment opportunities.

- Double-entry bookkeeping keeps the accounting equation balanced, with debit and credit entries. A debit is on the right side of the account, while a credit on the left.

- The golden rule of double-entry bookkeeping is that debits should always equal credits. If they don’t, you’ve made a mistake along the way.

- The 5 main types of accounts in double-entry are:

- Assets

- Expenses

- Liabilities

- Owner’s equity

- Revenue

- A credit increases the owner’s equity, liabilities, and revenue when credited, and decreases them when debited. While a debit increases assets and expenses when debited, and decreases them when credited.

Related Articles