Form W-9 is an IRS form that is used to confirm a person’s name, address, and taxpayer identification number (TIN) for the purpose of employment or other modes of income generation. In case you have your own business or work as an independent contractor or a freelancer, then you are required to fill out and submit a W-9 form.

This information will then be used to prepare the 1099-NEC form which is further required for income tax filing purposes.

Form W-9 is different from Form W-4. The difference between the two is that Form W-9 is for independent contractors, freelancers or vendors, while Form W-4 is for employees.

Who has to file Form W-9?

There are certain situations in which you are required to file Form W-9:

- If you are a contractor, consultant, or freelancer, and you want to get paid more than $600 by one particular client in a tax year, then you are required to file Form W-9 so that you can get a Form 1099-MISC. This form is required to report your income to the IRS.

- In some situations, Form W-9 is required when you open a new account in a bank.

- In case, someone cancels or forgives the debt you owe them, then you are required to file Form 1099-C with the IRS. You will have to complete W-9 to finish the process.

What is backup withholding?

In certain situations, the payer has to withhold taxes at the rate of 24 percent and remit it to the IRS. This is known as backup withholding.

You may be subject to backup withholding if:

- You do not provide a TIN or provide an incorrect TIN

- In case you have a history of under reporting your income on your tax return, then the chances of tax withholding are high.

- You are not able to certify that you aren’t liable for backup withholding

If you want to prevent backup withholding, then you need to provide the correct information and pay the relevant amount of taxes each year. In case you get a 1099 form stating that you’ve withheld the taxes through backup withholding, then you have to report this as federal income tax withheld on your income tax return.

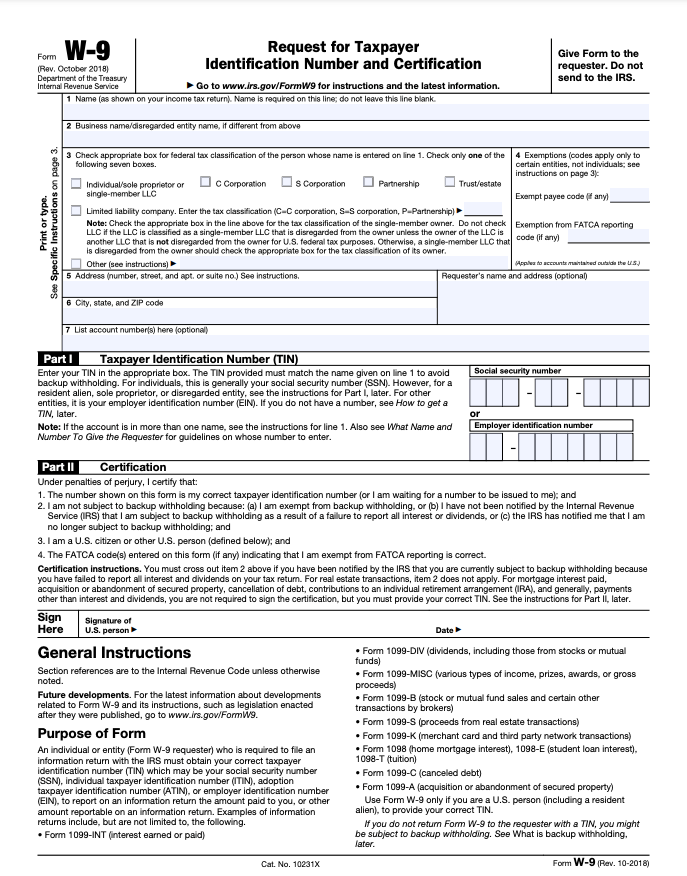

How to fill out Form W-9?

Let’s walk through the steps to fill out Form W-9:

Step 1-Enter Name

Firstly, you need to enter your name as displayed on your tax return.

Step 2-Business Name

Then, you are required to enter your business name or "disregarded entity" name, in case it is different from the name you entered previously. For example, you might be a sole trader, but for some reason or the other, you are not using your personal name as your business name; instead, some other name is being used. That name is to be entered here.

Step 3-Federal Tax Classification

You need to determine the type of business entity you are for federal tax classification. Whether you fall under sole proprietorship, partnership, C corporation, S corporation, trust/estate, limited liability company, or "other”, you need to check the relevant box.

Step 4- Exemptions

You need to leave this option blank unless you fall in these categories:

- If you have been exempted from backup withholding, then you will have to enter a code in the "Exempt payee code" box. There are instructions given on the Form W-9 regarding the exempt payees and their codes and the types of payments for which these codes have to be used.

- You will have to enter the code in the "Exemption from FATCA reporting code" box if you are exempted from reporting under the Foreign Account Tax Compliance Act (FATCA). These boxes will not be applicable to the independent contractor or freelancer.

Step 5-Address

Here you need to enter your street address, city, state, and zip code. Sometimes, the home address differs from the business address, in such cases, you will have to mention the address that is displayed on your tax return.

Step 6-Account Information

This step is optional and can be skipped. Here, you have to provide the requester's account details. This box can be filled in order to keep a record of to whom you have given your tax identification number.

Step 7-Part 1

This is Part 1 of the Form W-9. You have to provide your business's tax identification number. The tax identification number can be your own Social Security Number in case you are a sole trader, or your employer identification number (EIN) if you have any other type of business. However, there are some sole proprietorships that have EINs, but the preference is to use SSNs on Form W-9 if you are a sole proprietor. When you do this, it will make it easy for you to match any 1099s that you will receive with your tax return.

If your business is new and you don’t have an EIN, then you will have to apply for that number and mention ‘applied for’ in the space given for TIN. Try to get this number as soon as possible because otherwise, you will be liable for backup withholding. EIN can be applied on the IRS website.

Step 8-Part 2

In Part II, you have to declare that the information you are providing is completely correct by signing Form W-9. In case, the information you provided is incorrect, you will have to pay a fine or go to jail. Before signing form W-9, you need to certify that these statements are true:

1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me).

Make sure you use legit tax ID numbers. If you use an incorrect number, you will have to bear serious consequences.

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding.

Mostly all the taxpayers are exempted from backup withholding. However, if that’s not the case, your income tax will be withheld from your pay at a flat rate of 24%.

3. I am a U.S. citizen or other U.S. person.

In case you are a resident alien, then you fall under this category. Whether you are indulged in a partnership, corporation, company, a domestic estate, a domestic trust, or association created under the laws of the United States, then you will be considered a U.S. person. In case your business is indulged in a partnership with a foreign partner, then special rules apply as mentioned in Form W-9. If you are not a U.S. citizen, then you will have to fill out Form W-8 or Form 8233

4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct.

This is related to Foreign Account Tax Compliance Act.

Special Considerations When Filing Form W-9

Returning Form W-9

You will have to return your completed Form W-9 to the business that requested you to fill it out. Mail is considered a secure method to return Form W-9. Remember while emailing, you need to encrypt both the document and your email message and double-check that you have entered the correct email address of the recipient before sending it.

Key Takeaways

- Form W-9 is an IRS form that is used to confirm a person’s name, address, and taxpayer identification number (TIN) for the purpose of employment or other modes of income generation

- If you have your own business or work as an independent contractor or a freelancer, then you are required to fill out and submit a W-9 form

- In certain situations, the payer has to withhold taxes at the rate of 24 percent and remit it to the IRS. This is known as backup withholding

- There are certain steps that can help you file Form W-9

- The initial step requires you to fill in your name as mentioned in the tax return

- Then, you are required to enter your business name or "disregarded entity" name, in case it is different from the name you entered previously

- This step involves federal tax classification. You need to determine the type of business entity you are

- The next step is related to the exemptions

- In the next step, you need to enter your street address, city, state, and zip code

- You have to provide the requester's account details in this step. However, this step is optional

- Part 1 requires you to provide your business's tax identification number

- In Part II, you have to declare that the information you are providing is completely correct by signing Form W-9

- Lastly, you will have to return your completed Form W-9 to the business that requested you to fill it out

Related Articles