Are financial projections just educated guesses, or can they truly guide smarter business decisions? The answer lies in how well they are built. Financial projections are not about predicting the future with absolute certainty—they are about creating a structured, data-backed view of where your business is headed. When done right, they help businesses anticipate challenges, allocate resources wisely, and plan growth with confidence rather than assumptions.

For businesses of all sizes, financial projections play a critical role in strategic planning. They provide clarity on expected revenue, expenses, cash flow, and profitability, enabling leaders to make informed decisions before committing capital or pursuing expansion. Whether you’re preparing for investor discussions, applying for financing, or simply planning the next financial year, well-prepared projections act as a financial roadmap.

However, many businesses struggle with creating realistic financial projections. Overly optimistic assumptions, disconnected data, and manual spreadsheets often lead to projections that look good on paper but fail in practice. A practical approach—grounded in historical data, realistic assumptions, and regular updates—is essential to ensure projections remain accurate and actionable.

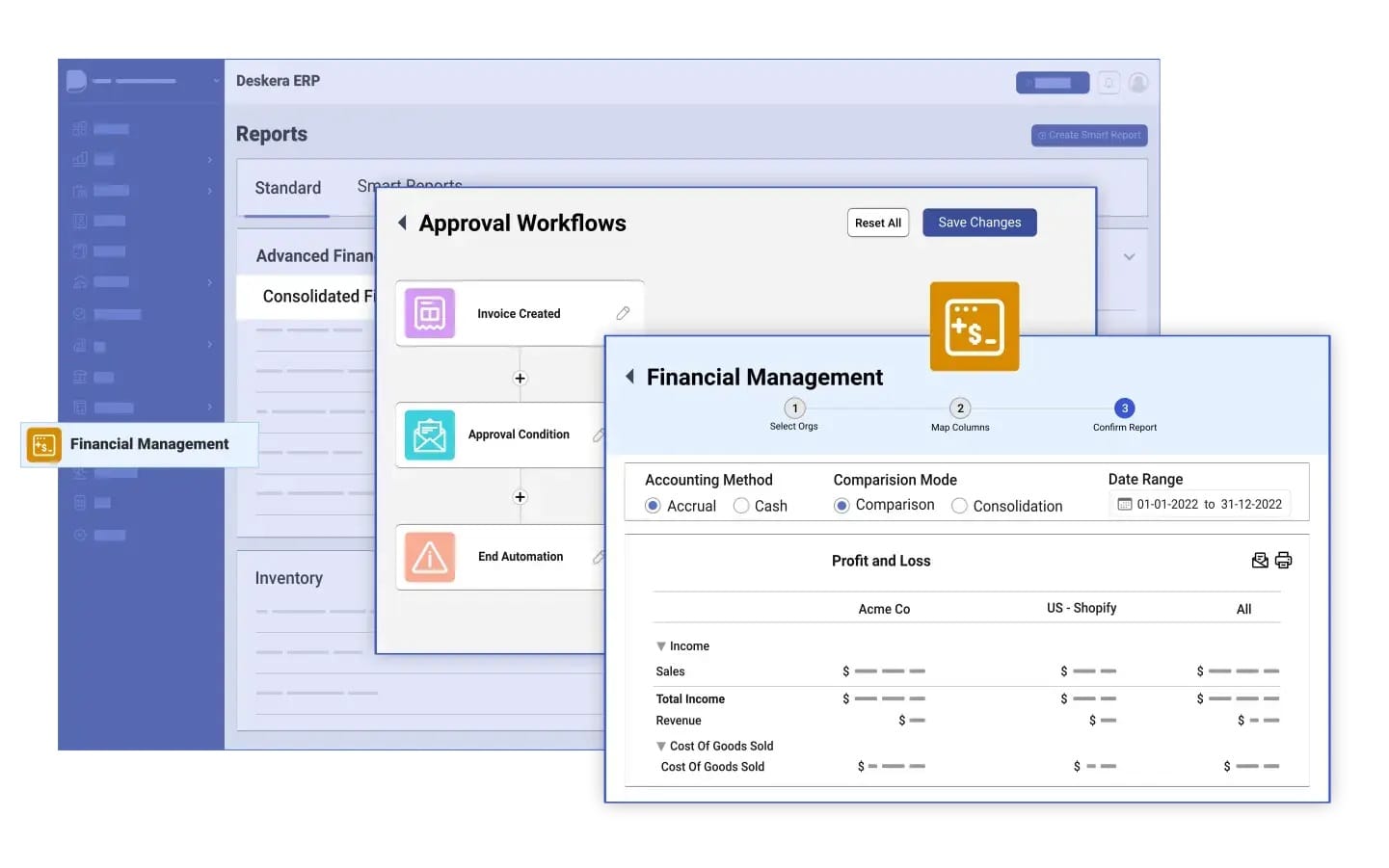

This is where tools like Deskera ERP can make a meaningful difference. Deskera ERP centralizes financial, sales, and operational data in one platform, making it easier to build reliable financial projections. With real-time reporting, automated accounting, and integrated cash flow visibility, businesses can create projections that are not only accurate but also easy to update as conditions change. By combining structured processes with the right technology, financial projections become a powerful decision-making tool rather than a static document.

What Are Financial Projections?

Financial projections are forward-looking financial statements that estimate how a business is expected to perform in the future based on available data, assumptions, and hypothetical scenarios. They are typically prepared using financial modeling techniques and are considered a type of pro forma financial statement, meaning they show what the financial results could look like if certain plans or strategies are executed. Common examples include projected income statements, balance sheets, and cash flow statements.

At their core, financial projections translate a company’s business goals and operational plans into numbers. They help answer critical stakeholder questions such as: If we invest or lend money to this business, how will it be used, and how will it be paid back? Because of this, projections are widely used by lenders, investors, and internal leadership teams to evaluate potential courses of action before committing resources.

Unlike historical financial statements, which focus on past performance, financial projections are future-oriented. They establish baseline expectations for strategic planning by showing where the business is heading under different assumptions. By modeling multiple scenarios—such as best-case, worst-case, and most likely outcomes—businesses can visualize their future financial position and identify potential risks or opportunities early.

In practice, financial projections are not static predictions but dynamic planning frameworks. They are regularly updated as actual results come in, allowing decision-makers to test scenarios like launching a new product, expanding the workforce, or scaling operations. Most projections cover monthly periods for the first year, quarterly for the second year, and annual estimates for the next three to five years. This ongoing, flexible approach turns abstract business ideas into measurable financial outcomes that can be tracked, refined, and improved over time.

Types of Financial Projections

Financial projections are not limited to a single statement or metric. Instead, businesses rely on multiple types of projections to gain a complete view of future performance, cash position, and financial stability.

Each type focuses on a specific aspect of the business and collectively supports informed decision-making around growth, investments, and risk management.

Revenue Projections

Revenue projections estimate future sales based on historical performance, market demand, industry trends, and planned sales and marketing strategies. These projections help businesses understand expected income levels, evaluate growth opportunities, and set realistic sales targets aligned with market conditions.

Expense Projections

Expense projections forecast future costs by analyzing fixed and variable expenses such as rent, salaries, utilities, production costs, and marketing spend. By estimating expenses in advance, businesses can plan budgets more effectively, control costs, and ensure that spending aligns with projected revenue and profitability goals.

Cash Flow Projections

Cash flow projections track expected cash inflows and outflows over a specific period, highlighting whether the business will have enough liquidity to meet its obligations. They are critical for understanding short-term financial health, managing working capital, and avoiding cash shortages even when the business appears profitable on paper.

Profit and Loss (P&L) Projections

Profit and loss projections, also known as income statement projections, estimate net income by subtracting projected expenses from projected revenues. These projections help businesses assess future profitability, evaluate pricing strategies, and determine whether planned initiatives are likely to generate sustainable profits.

Balance Sheet Projections

Balance sheet projections show the expected financial position of a business at a future point in time by estimating assets, liabilities, and equity. They help stakeholders understand how growth plans, investments, and financing decisions may impact the company’s overall financial stability and capital structure.

Break-Even Analysis

Break-even analysis identifies the point at which total revenues equal total expenses, indicating when the business will start generating profits. This type of projection is especially useful for evaluating new products, pricing strategies, or expansion plans, as it clarifies how much sales volume is required to cover costs and reduce financial risk.

Scenarios That Require Financial Projections

Financial projections are a core component of the financial planning and analysis (FP&A) process and are used across a wide range of business situations. They help organizations evaluate options, anticipate outcomes, and make informed decisions before committing time, capital, or resources. Below are some of the most common scenarios where financial projections are essential.

Creating a Business Plan or Go-To-Market Strategy

Financial projections are critical when developing a business plan or launching a new product or service. They translate strategic ideas into measurable financial outcomes, helping businesses estimate revenue potential, cost structures, and profitability before entering the market.

Budgeting for a Quarter or Financial Year

Organizations use financial projections to create quarterly or annual budgets by estimating expected income and expenses. These projections provide a financial framework for controlling costs, allocating resources, and ensuring spending aligns with business goals.

Assessing Business Profitability

Financial projections help evaluate whether current or planned operations will be profitable. By projecting revenues and expenses, businesses can identify margin pressures, test pricing strategies, and determine whether operational changes are needed to improve financial performance.

Setting Sales Targets and Performance Goals

Sales targets are often derived from revenue and expense projections. Financial projections help leadership teams set realistic, data-driven goals that align with market conditions, capacity, and overall financial objectives.

Pitching to Investors or Raising Funds

When seeking investment, financial projections demonstrate how the business plans to generate returns. Investors rely on projected income statements, cash flows, and balance sheets to assess growth potential, risks, and the viability of the business model.

Applying for Loans or Credit Facilities

Lenders require financial projections to evaluate a company’s ability to repay debt. Cash flow and profitability projections help banks and financial institutions assess creditworthiness and repayment capacity before approving loans or credit lines.

Monitoring Progress Against Financial Goals

Financial projections serve as benchmarks for tracking actual performance over time. By comparing projected results with actual outcomes, businesses can identify gaps, adjust strategies, and stay aligned with financial targets.

Evaluating New Projects or Strategic Initiatives

Before committing to new projects—such as expanding operations, launching a new product line, or entering a new market—businesses use financial projections to assess feasibility, expected returns, and potential risks.

Analyzing Mergers and Acquisitions (M&A)

In M&A scenarios, financial projections help estimate the combined entity’s future performance. They are used to evaluate synergies, integration costs, and long-term financial impact, supporting informed deal-making decisions.

Scenario and Sensitivity Analysis

Financial projections form the foundation for advanced analyses such as scenario and sensitivity analysis. By modeling different market conditions or assumptions, businesses can assess potential risks, prepare for uncertainty, and build more resilient financial plans.

7 Steps for Building a Financial Projection for Your Business

Building financial projections is a structured process that combines market research, realistic assumptions, and interconnected financial statements. Rather than being a one-time exercise, projections should evolve as your business grows and new data becomes available.

Below are the key steps businesses typically follow to create reliable and actionable financial projections.

Step 1: Research Your Market and Revenue Drivers

Start by understanding the external factors that influence your business. This includes industry trends, target market size, customer segments, competitor performance, and broader economic conditions.

Market research helps you identify realistic revenue drivers such as pricing, demand, conversion rates, seasonality, and customer churn. These insights form the foundation for credible sales and growth assumptions.

Step 2: Create a Sales Forecast

Sales projections are the backbone of any financial model. Estimate how much you expect to sell over a given period—often monthly for the first year, quarterly for the next two years, and annually thereafter.

For product-based businesses, this includes units sold and price per unit. For service or subscription businesses, it may involve customer acquisition rates, average deal size, renewals, and churn. The goal is to link sales expectations to clear, measurable drivers rather than guesswork.

Step 3: Build an Expense Projection

Once revenue expectations are defined, estimate the costs required to achieve them. This includes direct costs such as cost of goods sold (COGS) or service delivery costs, as well as indirect operating expenses like salaries, rent, marketing, software, and administrative overheads. Expenses should reflect how costs scale with growth, and it’s often wise to include a buffer to account for unexpected increases.

Step 4: Create the Income Statement Projection

Using your revenue and expense assumptions, build a projected income statement. This statement shows expected revenue, gross profit, operating expenses, and net profit over time. It helps assess future profitability, margins by product or service line, and the financial impact of pricing or cost changes.

Step 5: Develop the Cash Flow Projection

Profitability does not always equal liquidity, which is why cash flow projections are critical. This step focuses on when cash actually moves in and out of the business.

Consider customer payment timelines, accounts receivable collections, accounts payable schedules, inventory purchases, payroll, taxes, and capital expenditures. Cash flow projections help identify potential shortfalls and ensure the business can remain solvent.

Step 6: Prepare the Balance Sheet Projection

The balance sheet projection shows your expected financial position at specific points in time by estimating assets, liabilities, and equity. It incorporates cash balances from the cash flow projection, along with items such as inventory, accounts receivable, accounts payable, debt, depreciation, and capital investments. This step provides a broader view of financial health and long-term sustainability.

Step 7: Review, Test, and Monitor Projections

Financial projections should be tested through scenario and sensitivity analysis. Create best-case, worst-case, and most-likely scenarios to understand how changes in assumptions affect outcomes.

Once finalized, compare projections against actual results regularly. Monitoring performance allows you to adjust assumptions, refine strategies, and use projections as an ongoing planning and decision-making tool rather than a static document.

Benefits of Financial Projections

Financial projections provide businesses with a forward-looking view of their financial performance, helping leaders move from reactive decision-making to strategic planning. When built on realistic assumptions and updated regularly, financial projections deliver several tangible benefits across planning, operations, and growth.

Improves Strategic Planning and Decision-Making

Financial projections translate business goals into measurable financial outcomes. By forecasting revenue, expenses, and cash flow, decision-makers can evaluate different strategies, compare alternatives, and choose actions that align with long-term objectives.

Enhances Cash Flow Visibility and Control

One of the biggest advantages of financial projections is improved cash flow management. Projections highlight when cash will come in and go out, helping businesses anticipate shortfalls, manage working capital, and maintain liquidity even during periods of growth or uncertainty.

Supports Investor and Lender Confidence

Investors and lenders rely on financial projections to assess risk and return. Well-prepared projections demonstrate financial discipline, clarify how funds will be used, and show a credible path to profitability and repayment, increasing the chances of securing funding.

Enables Better Budgeting and Resource Allocation

By estimating future income and expenses, financial projections help businesses allocate resources more effectively. Teams can prioritize spending, control costs, and ensure capital is directed toward initiatives that deliver the highest impact.

Identifies Risks and Potential Challenges Early

Financial projections act as an early warning system. Scenario and sensitivity analysis reveal how changes in market conditions, pricing, or costs could affect performance, allowing businesses to mitigate risks before they become serious problems.

Measures Performance Against Goals

Projections provide benchmarks for tracking actual performance. Comparing projected results with real outcomes helps businesses identify gaps, understand variances, and adjust strategies to stay on track toward financial targets.

Guides Growth and Expansion Planning

Whether launching a new product, entering a new market, or scaling operations, financial projections help assess feasibility and expected returns. They clarify when growth is sustainable and when additional funding or operational changes may be required.

Improves Financial Communication and Alignment

Financial projections create a common financial language across leadership, finance, and operational teams. By aligning everyone around shared assumptions and goals, projections improve coordination and accountability across the organization.

Challenges in Financial Projections

While financial projections are essential for planning and decision-making, creating accurate and reliable projections is often challenging. Uncertainty, data limitations, and changing business conditions can all impact the quality of projections.

Understanding these challenges helps businesses build more realistic models and avoid common pitfalls.

Uncertainty in Assumptions

Financial projections rely heavily on assumptions about future market conditions, customer behavior, pricing, and costs. Small changes in these assumptions can significantly alter outcomes, making it difficult to predict results with precision—especially in volatile or fast-changing markets.

Limited or Inaccurate Historical Data

For startups or businesses entering new markets, the lack of reliable historical data makes projections more difficult. Even established businesses may struggle if past data is incomplete, inconsistent, or does not reflect future operating conditions.

Overly Optimistic Revenue Estimates

A common challenge in financial projections is overestimating revenue growth. Businesses may assume rapid customer acquisition or market expansion without fully accounting for competition, pricing pressure, or longer sales cycles, leading to unrealistic expectations.

Underestimating Costs and Cash Requirements

Expenses such as operational overheads, staffing, marketing, and compliance costs are often underestimated. Additionally, businesses may overlook timing differences between revenue recognition and actual cash receipts, resulting in unexpected cash flow gaps.

Difficulty in Forecasting Cash Flow

Cash flow projections are more complex than profit projections because they depend on payment terms, inventory cycles, and working capital management. Even profitable businesses can face liquidity issues if cash inflows and outflows are not accurately projected.

Managing Multiple Scenarios and Variables

As businesses grow, projections must account for multiple product lines, markets, and cost structures. Managing these variables and running scenario or sensitivity analyses can become complex and time-consuming without the right tools or expertise.

Keeping Projections Updated

Financial projections can quickly become outdated if they are not revised regularly. Changes in market conditions, customer demand, or internal operations require continuous updates, which many businesses struggle to maintain.

Dependence on Manual Processes

Many organizations still rely on spreadsheets for financial projections. Manual data entry and disconnected systems increase the risk of errors, inconsistencies, and version control issues, reducing the reliability of projections.

Aligning Projections Across Teams

Financial projections often require inputs from sales, operations, and finance teams. Misalignment between departments or inconsistent assumptions can lead to projections that do not accurately reflect the overall business reality.

By recognizing these challenges, businesses can adopt more disciplined assumptions, improve data quality, and leverage technology to make financial projections more accurate, flexible, and actionable.

Best Practices for Making Financial Projections

Creating accurate financial projections is both a science and an art. While financial models and formulas provide structure, experience, judgment, and context are equally important.

Following proven best practices helps businesses build projections that are realistic, credible, and useful for decision-making rather than overly optimistic or static estimates.

Base Projections on High-Quality Data

Accurate financial projections start with reliable data. Use clean historical financials, current performance metrics, and validated market research. Strong data collection and validation processes reduce errors and ensure projections reflect real business conditions rather than assumptions built on weak inputs.

Conduct Internal and External Research

Look beyond internal financial data. Analyze industry trends, competitor performance, customer demand shifts, and economic indicators such as inflation, interest rates, and regulatory changes. Combining internal insights with external research leads to more objective and well-rounded projections.

Use Realistic and Defensible Assumptions

Avoid wishful thinking or overly aggressive growth expectations. Every assumption—whether related to revenue growth, pricing, costs, or customer acquisition—should have a clear “why” behind it. Conservative but realistic assumptions improve credibility with investors and reduce the risk of missed targets.

Apply a Bottom-Up Forecasting Approach

Build projections from the ground up using detailed operational drivers such as units sold, conversion rates, average order value, and headcount costs. Bottom-up models tend to be more accurate than top-down estimates because they reflect how the business actually operates.

Create Multiple Financial Scenarios

Develop at least three scenarios: a base case, an upside case, and a downside case. Scenario planning prepares businesses for uncertainty, helps assess risk, and demonstrates financial readiness to investors and lenders. It also supports better contingency planning.

Use Driver-Based Financial Models

Driver-based forecasting focuses on the variables that most influence financial outcomes, such as sales volume, customer acquisition cost, or inventory turnover. This approach makes projections easier to adjust and more actionable when business conditions change.

Involve Cross-Functional Stakeholders

Collaborate with sales, marketing, operations, finance, and senior leadership teams when building projections. Input from multiple departments improves assumption accuracy, aligns expectations, and increases confidence in the final projections.

Consider Rolling Forecasts

Instead of relying solely on annual forecasts, use rolling forecasts that continuously project the next 12 months. Rolling forecasts provide a more dynamic and forward-looking view of the business and adapt more easily to changing conditions.

Review and Update Projections Regularly

Financial projections should be living documents. Regularly compare projected results with actual performance, identify variances, and update assumptions as needed. This ongoing review process improves accuracy and strengthens future projections.

Communicate Projections Clearly

Present financial projections in a clear and simple format, supported by summaries or executive dashboards. Clearly explain assumptions, limitations, and key risks so stakeholders can interpret the projections correctly and make informed decisions.

Don’t Aim for Perfection—Aim for Usefulness

No financial projection will ever be 100% accurate. Unexpected changes in sales performance, market conditions, or the economy can always occur. The goal is not perfection, but creating projections that guide planning, highlight risks, and support better decision-making over time.

Leverage Automation and Forecasting Tools

Manual spreadsheets increase the risk of errors and version control issues. Using automated forecasting or ERP tools improves accuracy, enables real-time updates, and makes scenario analysis faster and more reliable.

By following these best practices, businesses can create financial projections that are credible, adaptable, and valuable for strategic planning, investment decisions, and long-term growth.

When and How Often Should Businesses Update Financial Projections?

Financial projections are most effective when they are treated as living documents, not one-time exercises. Because market conditions, customer behavior, and internal operations constantly evolve, businesses need to update their projections regularly to ensure they remain accurate and relevant for decision-making.

How Often Should Financial Projections Be Updated?

There is no single update frequency that fits every business, but common best practices include:

- Monthly updates: Ideal for startups and fast-growing businesses. Monthly reviews help track cash flow closely, identify variances early, and adjust assumptions based on real performance.

- Quarterly updates: Suitable for most established businesses. Quarterly updates align well with financial reporting cycles and allow leadership teams to reassess revenue trends, expenses, and strategic priorities.

- Annual updates: Typically used for long-term planning and budgeting. Annual projections set high-level goals but should be supported by more frequent reviews to stay relevant.

Many businesses adopt a rolling forecast approach, where projections are continuously extended to cover the next 12 months rather than being tied strictly to a calendar year.

When Should Financial Projections Be Updated?

Beyond scheduled reviews, projections should be updated whenever significant changes occur, such as:

- Major shifts in revenue or demand, including unexpected growth or decline

- Changes in pricing, costs, or margins, such as supplier price increases or wage adjustments

- New product launches or market expansions

- Funding events, including new investments, loans, or changes in capital structure

- Economic or regulatory changes that impact operations or customer behavior

- Operational changes, such as hiring plans, restructuring, or supply chain disruptions

Updating projections in response to these events helps businesses stay proactive rather than reactive.

Why Regular Updates Matter

Regularly updating financial projections allows businesses to:

- Compare actual performance against expectations

- Identify risks and opportunities early

- Improve cash flow management and liquidity planning

- Make timely, data-driven strategic decisions

In practice, the most effective approach is to review projections monthly, update them quarterly, and revisit long-term assumptions annually—while making immediate adjustments whenever material changes occur. This ensures financial projections remain accurate, actionable, and aligned with the realities of the business.

How Deskera ERP Helps Simplify Financial Projections

Deskera ERP provides a unified, automated platform that makes financial projections faster, more accurate, and far easier to manage—especially compared to manual spreadsheets or disconnected systems. Here’s how it supports businesses with better financial planning and forecasting:

Centralized Real-Time Financial Data

Deskera ERP brings together financial information from accounting, sales, inventory, expenses, and bank accounts into one centralized system. This real-time visibility ensures that financial projections are built on current, accurate data rather than fragmented or outdated spreadsheets, reducing the risk of errors.

Automated Budgeting and Forecasting

With built-in budgeting and forecasting tools, Deskera enables finance teams to create detailed financial projections—including revenue, expenses, cash flow, and profit forecasts—without manual data entry. These features automate repetitive tasks, improve consistency, and free up time for strategic analysis.

Scenario Planning and “What-If” Analysis

Deskera allows businesses to model multiple financial scenarios—such as best-case, worst-case, and most likely outcomes—by adjusting assumptions and key variables. This helps teams understand potential risks and opportunities, making projections more robust and informative.

Cash Flow Forecasting

Cash flow projections are a vital part of financial planning, and Deskera simplifies this by automatically tracking inflows and outflows—from sales receipts to expenses and payroll. Integrated cash flow tools help businesses anticipate liquidity needs and maintain financial stability.

Custom Reports and Dashboards

Deskera ERP generates customizable financial reports, including projected income statements, balance sheets, and cash flow summaries. Visual dashboards make it easy to interpret projection results, share insights with stakeholders, and align teams around financial goals.

Reduced Manual Errors and Improved Efficiency

By automating core financial tasks—such as data entry, bank reconciliation, and journal posting—Deskera minimizes human errors that can distort financial projections. This improves accuracy and saves time compared with manual models.

Cross-Department Integration

Because Deskera connects finance with sales, operations, inventory, and procurement, it captures a holistic view of business performance. This integrated data flow strengthens projections by incorporating insights from multiple functions rather than relying solely on finance data in isolation.

By combining real-time data, automation, scenario planning, and intuitive reporting, Deskera ERP turns the traditionally complex task of financial projection into a streamlined, reliable, and strategic process that supports smarter decision-making across the business.

Key Takeaways

- Financial projections are forward-looking, data-driven estimates that translate business plans and assumptions into measurable financial outcomes, helping stakeholders understand where the business is headed.

- Using multiple projection types—revenue, expenses, cash flow, P&L, balance sheet, and break-even—provides a complete and realistic view of future financial performance.

- Financial projections are essential across planning, budgeting, fundraising, expansion, and risk analysis, making them a core component of effective FP&A processes.

- Accurate financial projections follow a structured process—from market research and sales forecasting to cash flow, balance sheet modeling, and ongoing monitoring.

- Well-prepared financial projections improve strategic decision-making, cash flow control, investor confidence, and long-term business planning.

- Uncertain assumptions, data limitations, cash flow complexity, and manual processes make financial projections difficult—but manageable with disciplined modeling and regular updates.

- Using realistic assumptions, bottom-up models, multiple scenarios, cross-functional input, and frequent reviews leads to more credible and actionable projections.

- Financial projections should be updated regularly—monthly or quarterly—and immediately when significant business or market changes occur to remain relevant.

- Deskera ERP simplifies financial projections by centralizing real-time data, automating reporting, improving accuracy, and enabling faster scenario analysis and decision-making.

Related Articles