Have you always wanted to buy a business? Before making that decision, it is essential to know what questions to ask. There are a lot of questions to ask when buying a business if you want the business you're considering to succeed.

So here’s a list of questions you can ask. Following are the topics covered:

List of questions to be asked

Why Are You Selling?

This is an important question to put to a business owner. Why are you trying to sell your business? Are you interested in purchasing it because you like the sector? Do you have prior business ownership experience in the sector, and do you believe you can operate this business in the same manner? Is it only a wise financial decision?

It's a straightforward question that gets to the heart of what you need to know in a straightforward manner. Depending on the response, it can alter how you approach making improvements to the business (or whether you make any at all). Relocation, family obligations, or health issues are also legitimate justifications for selling a business. These causes will typically have little to do with the business itself.

Investigate carefully the response they provide. They can be starting a new business or simply want to retire. However, some people might not be prepared to invest the necessary time or money to advance. However, if they appear to be lying or avoiding a topic, it may be grounds for alarm.

By being aware of these elements, you can decide whether the business fits your lifestyle. You will occasionally need to trust your instincts in circumstances like this.

How is the financial health of the business?

You should look at a business's financial health in addition to its overall health, which may be determined in part by looking at the business value. Examine the financial statements for the previous three to five years with the help of an accountant or financial counselor. To ensure everything is financially solid, review tax returns, cash flow statements, balance sheets, contracts, payroll, and investments.

Research cash flow and other financial obligations, such as outstanding debt such as notes, accounts, interest, and accounts payable.

Assets of the current firm comprise both real (items like delivery vehicles, equipment) and intangible (goodwill created, social media profiles) assets. You need a thorough inventory of everything you'll be purchasing from the sale. The list of successful clientele is another crucial item that you should ask about.

The price that a buyer is willing to pay for a business over and above the value of its assets is known as the goodwill value. This could include things like a business's brand power, reputation, personnel know-how, customer databases, and any other features that make a business more valuable to a buyer.

The widespread belief is that you must have the following items, at the very least:

• The last two years’ worth of financial (profits, losses, and balance sheets).

• The current year's financial information.

• Statements of Business Activity from the previous four quarters.

• The most recent tax filing.

• A list of all the assets that would be sold.

Examine the financial records to make sure they are accurate. For instance, if you want to purchase an internet business, check the website traffic to verify if the stats are accurate.

The owner should make any outstanding obligations related to the business known right away. Additionally, you should research the equipment purchased on hire purchase (buy now, pay later), long-term contracts with current clients, and the mortgage rate for the business location. Before buying this business, you have the right to ask the present owner to settle any outstanding obligations.

Operating capital enables companies to pay bills while increasing revenue from sales. You can function with more freedom if you have some wiggle room in this area. Receiving responses from sellers is one thing. However, seeing the business's revenue statements and cash flow in person could offer you a more complete sense of its financial situation.

This frequently relates to the revenue issue. However, sales simply take into account the money a business makes by offering goods or services to customers, whereas revenue takes into account everything before expenses.

What’s the Annual Gross Revenue?

This will reveal how much revenue you can expect from the current business. But the following query is perhaps much more crucial.

How much money have you made in the past?

A trustworthy seller won't be reluctant to provide you with the precise data for the business's profit margin. You should find out how much money you may make from this venture as well as what the existing expenses are.

Take a hard look at these numbers. When gross revenues are significant but the profit margin is low, there are likely high overhead costs involved. It is undoubtedly a warning sign.

You should get these financials independently audited once you start to contemplate purchasing a business seriously. This person will meticulously go through the books to make sure that what the owner informed you is true.

And if he performs his duties properly, he will look everywhere.

Are You Willing To Finance the Transaction Yourself?

This will show whether or not he has faith in you and your small business. Seller finance often covers 10% to 25% of the cost of buying a business. You might use it to increase your down payment.

It may be a sign of the seller's faith in the future of the small business if you can persuade them to finance the sale and put some money on the line. They are more knowledgeable about the industry than you are, so why should you take a chance on its success if they aren't?

Are you willing to assume a position of standby?

The majority of small business loan providers require sellers to assume a standby position for roughly two years. This implies that no payments will be made to the vendor during that time. Find out whether your seller would be willing to take a standby position so that the remainder of the deal can be funded if he won't finance the complete transaction.

Why do I want to purchase this business as opposed to simply creating my own?

Maybe you feel that since the business is already established, you'd prefer to carry on the previous owner's legacy. Or you're confident you have what it takes to enter this industry and improve it. It might make a fantastic addition to a business you already run. Or perhaps starting again and building your own business would be better for you. Maybe it would be best to start over from scratch. By doing so, you can develop your own vision independently of others' aspirations.

How Did You Arrive At Your Valuation?

It might be challenging to value a business. It's possible that the asking price the existing owner has set for their business is exactly what they need to move on to the next phase of their lives.

On the plus side, this can result in a really good purchase. However, it might also cause you to overpay.

There are numerous ways to value a business, but the top four are as follows:

- Asset Valuation

- Profit Multiplier

- Discounted Cash Flow Method

- Comparables

In general, there are no set formulae or guidelines that apply to determining the value of your firm. The price you are willing to sell it for and the price a potential buyer is willing to pay will always determine its value. There are no two businesses that are alike, unlike real estate where property values may be determined by comparing similar property types within a specific market. Comparable sales are therefore not a realistic alternative.

As a result, you should do your homework given that a business's worth is fairly adjustable. How has its valuation historically been determined? Is the price you've been provided the same as the business's current market value?

Extenuating circumstances like the management team, industry trends, and client loyalty may outweigh the facts you receive. In any case, it's useful knowledge to have.

You can determine whether they have set a reasonable price by asking them how they arrived at their estimation. You have the opportunity to bargain if you discover that they are overcharging you or if they chose a number at random.

How Much Are You Asking?

In order to determine whether you can pay the asking price and whether the business is a good value, you must know it. Ask the seller why they believe the business is worth that amount, even if the asking price is within your means.

Ask questions that will enable you to make a more accurate assessment of the small business's value. This knowledge will enable you to purchase the business at a fair price without being taken advantage of. If you overspend, you can find yourself in a terrible financial situation, which might ultimately cause your firm to fail.

Get at least a rough idea of the owner's desired price. This will indicate whether moving on to the negotiation stage is worthwhile. No more than three times the annual earnings should be charged as the price.

The purchase price was calculated in what manner?

Once more, an inquiry like this will allow you to acquire a little insight into the owner's thoughts. Consider his responses carefully before deciding whether you believe them to be reliable.

The easiest way to determine how much you should pay is to get an impartial appraisal. Therefore, before you buy it, you should consider having one done if one hasn't already been. In this approach, you'll be able to determine the worth of the business you're considering buying.

Make sure that you or a member of your financial team has access to the business's financial statements for the previous three to five years. Tax returns, income statements, balance sheets, cash flow statements, and any active leases or contracts fall under this category. Make sure to work with a trustworthy independent auditor if you plan to have them reviewed.

Despite the fact that it would be wonderful to believe a business's own financial analysis, it is best to make sure the statements have been reviewed by accountants. If the owner declines, he might be concealing something. It would be best to simply back out of the contract in that situation.

Can you genuinely afford to buy it?

Avoid overextending yourself to avoid future issues. You'll require operating capital in addition to the money for the business purchase to pay for payroll, rent, utilities, inventory, and many other expenses.

Analyze your existing cash flow to determine how much you can invest in the business. Usually between 10 and 20 percent of the buying price is required as a down payment, so make sure you have adequate cash on hand. Next, establish a price and adhere to it.

It's feasible that the present owner will commission both his own appraisal and a review from a third party auditor. If these numbers differ dramatically, it can be a clue that more is going on than meets the eye.

You can either trust the audit that their auditor has conducted or you can have someone else do it. In any case, the most trustworthy estimate to utilize when starting conversations about the value of the firm will be the auditor's fee. Additionally, thoroughly examine the prices at which firms similar to yours have recently sold.

What Does The Competition Look Like?

Understand the competition. One of the first business principles is that. Many of the choices you make will depend on your understanding of who they are and how they operate.

After all, a business's ability to succeed depends on a variety of variables. Knowing how it works is not sufficient; you also need to be aware of your opponents. You can start getting ready that way.

Many companies fall short because they don't carefully research their rivals. After purchasing a business, you must thoroughly understand your rivals in order to compete against them.

Perform research on nearby firms and conceivable internet rivals. Make sure you find out who is competing with your acquisition target before you sign any documents because every business has at least one rival.

You may address them by knowing who the big players are in your market. You can get a snapshot of the industry overall from this. Imagine going through the entire due diligence process for a chocolate business only to learn that Bill Gates has backed your main rival. Knowing that kind of knowledge beforehand is preferable.

What permits and licenses will you have to renew?

The majority of enterprises are subject to industry-specific licensing requirements. If you ask the existing owner about this, you'll save yourself a lot of time and even legal trouble if you don't follow the proper permits and licensing regulations.

Make careful to request copies of any necessary licenses and permissions. For instance, a restaurant's liquor license or a home services business's safety accreditation.

Verify the permits are valid and that there won't be any problems transferring them upon the sale of the business by speaking with the local regulatory agencies directly.

Are There Any Pending Lawsuits?

If the business is dealing with legal issues, this is unquestionably a warning sign. Such problems might swiftly deplete your financial resources. It can be challenging to recover financially from inheriting a business with a terrible reputation or recognized unethical practices, which could have an impact on your future business endeavors.

What Are the Business’s Biggest Challenges?

You must be aware of every obstacle a business is encountering before you take it on. Is it a business operating in a crowded industry? Is the product subpar compared to its rivals in terms of quality? Is it merely a matter of poor management?

Understanding the difficulties can help you find the solution or the best way to make this a prosperous business venture.

What Challenge Did You Face the Most Recently?

Ask specifically about current difficulties. Find out if they were able to overcome it or if they believe it will persist.

What Actions Does Your Team Take When a Challenge Arises?

These circumstances could be less challenging if the team responds swiftly. Are there procedures in place to handle things like problems with customer service?

What Obstacles Do You Currently Face?

These could have an effect on your new business's early stages. To start off strong, find out ahead.

What Future Challenges Have You Identified?

The current owner may be aware of trends or problems that could affect the future of the business if they are familiar with the industry.

How Involved Are You in Managing the Business?

This will depend on how big the business is, but if it's big enough, you'll probably have to collaborate with a management team. Consider the team's capabilities and whether your management style is compatible with theirs. The management group will work with you to expand your firm, nurture internal talent, and carry out your vision.

You must make sure they are competent and a suitable fit for you. The present owner might play a significant role in the management group. This might affect the way you manage yourself. Or, if you intend to adopt a relaxed attitude, it can imply that you need to appoint a new boss.

A business's management team has a significant influence on its performance. You may get a sense of the team and culture by using these questions.

What Is the Organizational Structure?

Is the business divided up into departments? Exists a rigid hierarchy in place? Learn about these systems before you buy.

Will the Management Team Remain in Position?

Some teams remain after a business is sold. Some people may not. Find out the team's plans if this is a key component of your business purchase.

How Does Your Team Address Management Issues?

Each and every firm includes them. Find out the team's typical problem-solving methods if they remain.

What Changes Would You Make to the Management Structure?

You might simply learn more about the circumstance by answering this question. Maybe the owner would be less involved and depend more on their managers. Or they might alter the organization of the departments.

Determine which employees will be the business's most valuable assets, and then strive to persuade them to stay. Once it appears that the transaction will go through, it is also a good idea to meet with the staff. Then, respond to any inquiries they may have about your future goals for the business.

High staff turnover may be a sign of dissatisfied employees. It can also be a sign that something is wrong with the management group.

This may imply that in order to retain talented individuals, you must provide new hire incentives. A business can gain a tremendous amount of value by having good staff. You shouldn't undervalue the expertise and comprehension of existing employees if you intend to replace some of them because they probably have more experience working there than you do.

How Well-Known Is Your Business's Brand in the Market?

Simply put, brand recognition indicates that your target audience is aware of you. You might not have to work as hard to spread the word about your business if the current owner has made any marketing investments.

What Share of the Market Does Your Business Hold in the Sector?

A little more detailed is market share. Find out how your business compares to its competitors in terms of sales and performance.

What Differentiates Your Brand?

The positioning of a brand matters a lot. Find out what marketing advantages a business has over its competitors. Inquire about the owner's prior marketing efforts. And what did and did not work. In this method, you'll get insightful feedback on the marketing that will yield the highest return on your investment.

For many people interested in purchasing an existing business, having a reputation in a given market is a crucial consideration. To learn how the business may already be formed in the thoughts of clients, ask these questions. Knowing your business's financial standing is great, but if it operates in a declining industry, investing in it is probably not a wise idea.

Investigate the marketplace. It's important to be aware of any impending new products that will render the services this firm offers unworkable before you make a purchase.

How is the day-to-day management of the business doing?

Create a list of thoughtfully crafted questions to ask to learn more about the small business's daily operations and revenue generation. The more you comprehend everything, the more assuredly you can run your new business. The best bets are companies with a reliable stream of revenue.

Ask questions like:

How many hours a week do you work?

This gives you an idea of how much time your business will require from you. Even the most dedicated business owners occasionally desire to travel. Therefore, learn how frequently the existing owner was allowed to leave. You should be aware of the situation you are entering.

How Much of the business's success may be attributed to the owner's personality?

If "a lot" was the response, you might want to reconsider purchasing this business. That's because it will be challenging to duplicate this, even with a lot of effort.

Has the business compiled a list of profitable customers?

Ask to look at it if the small firm you're considering buying has one. This list can out to be a goldmine for you and provide you yet another excuse to buy the little business.

How quickly does the business receive payment for its goods and services?

A supply chain issue may exist if there is a lag between the delivery of goods and payment. Before deciding to purchase the business, you might want to look into that more thoroughly.

Would You Have Any Advice for Me on How to Make the Business the Most Successful?

This query will assist the business owner in clearly articulating in his thoughts what he has done over the years to make his business successful. You might learn useful information from this that you can use to imitate and become successful yourself.

How Does the Business Make Money?

You'll want to be aware of the payment method—whether it's a one-time fee, a monthly subscription, or another option. Some companies have distinctive revenue-generating strategies that you might not be familiar with.

Will you be able to stay for a brief while to ensure a smooth transition?

An existing small business buy is different from previous significant transactions. No matter how much you already know about the product you'll be selling, there will undoubtedly be some learning curve. In order to assist you in getting the hang of things, it would be ideal if the owner could stay on for 6–12 months.

Are You Paying Yourself Right Now?

A warning sign is if the owner isn't getting paid. You want your business to be profitable enough for you to be paid a wage.

How Do The Business's Relationships With Its Customers Stand?

Building a business's reputation is a major undertaking. A major warning sign is if a business's current clients don't think highly of it. It might make it tough to expand the business, which would make revenues difficult to increase.

Programs like loyalty programs can address these problems, but it's up to you to decide whether the investment is worthwhile given the time and resources needed to change how the public perceives your business. A business with a good reputation, however, must be doing something right.

In a similar vein, conversing with customers may help you gain insight into how the business runs. The seller might be trying to conceal certain information if they won't put you in touch with customers. You shouldn't simply rely on the owner; you should also consult secondary sources. You may make sure it's as factual and sincere as possible in this way.

What Is The Handover period?

Certain legal requirements must be met by someone selling a business as part of the transaction. These requirements necessitate careful planning of the handover procedure, which often requires several weeks to several months. However, the buyer and seller have agreed upon this time frame, and it should benefit both parties.

The handover procedure may involve introducing staff members, providing management with training, introducing clients and suppliers, and notifying any banks, insurers, or utility providers.

What is the exit plan?

You should be asking yourself this query.

The majority of businesses are purchased with the intention of later selling them for a profit. Therefore, you will need an exit strategy unless you are managing a family firm that you will pass down through the generations.

Consequently, you ought to have a thorough business plan. The steps you will take to ensure the success of the business should be described in this business plan. Hopefully, this will enable you to eventually sell your business for a profit. You'll want to grow your business to a profitable or marketable stage, ideally both.

How Deskera Can help You?

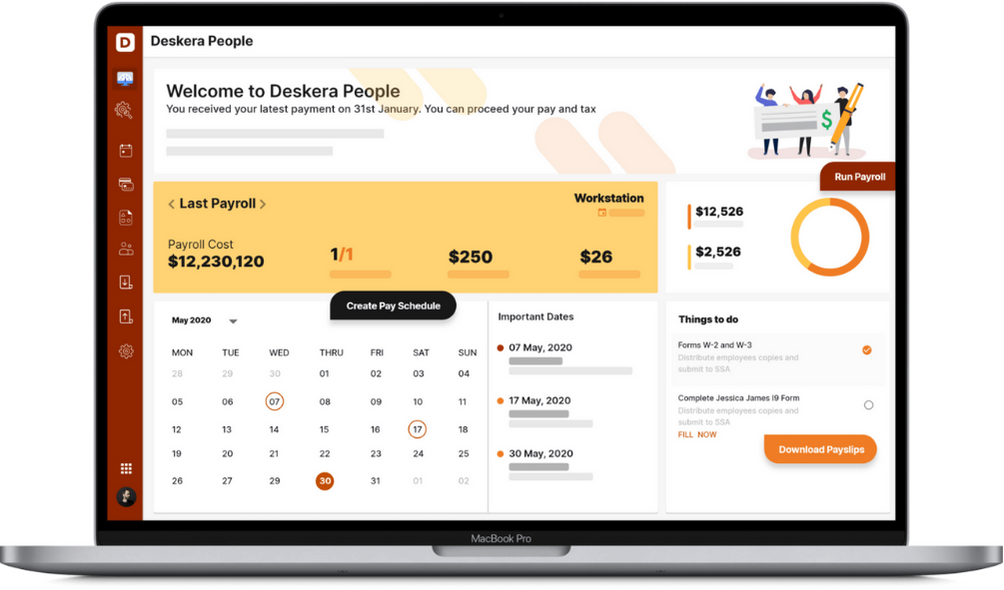

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

- It can be a terrific business chance to purchase a business that is for sale. It enables you to expand upon an existing firm that is doing well or turn around the fortunes of a failing business. When purchasing a firm, you want to take every precaution to ensure that you are not purchasing a failing money hole but rather a prospective cash cow.

- One of the finest reasons to ask the proper questions is to ensure that you pay the correct price and nothing extra for your new business venture. Having smart questions to ask might also help you reduce your risks. That's because you'll learn just how to manage your business to guarantee that you always have a consistent flow of income.

- With the appropriate guiding hand, the fortunes of many under performing companies can be altered. You can therefore discover the gem in the rough by exercising due investigation and asking the correct questions.

- If the current owner has owned it for a considerable amount of time, you may assume that you will as well. A successful history is a great predictor of future success. So, if the owner has been in business for three decades, you will likely inherit a lucrative asset that will serve as your own personal reward.

Related articles