What’s the quickest way for a profitable business to run into trouble? Poor budgeting. Even with a steady stream of customers and a great product or service, a business can stumble without a clear financial roadmap. Budgeting isn’t just about controlling costs—it’s about aligning spending with strategy, anticipating challenges, and preparing for growth.

Many business owners, especially those juggling multiple responsibilities, fall into budgeting traps without even realizing it. From underestimating costs to overestimating revenues, these mistakes can quietly erode profit margins, disrupt operations, and stall decision-making. The good news? Most budgeting mistakes are avoidable with a little foresight and the right tools.

A well-structured budget helps you prioritize spending, allocate resources efficiently, and maintain healthy cash flow. But to truly gain control over your finances, it’s essential to go beyond spreadsheets and manual planning. That’s where smart, integrated solutions come into play.

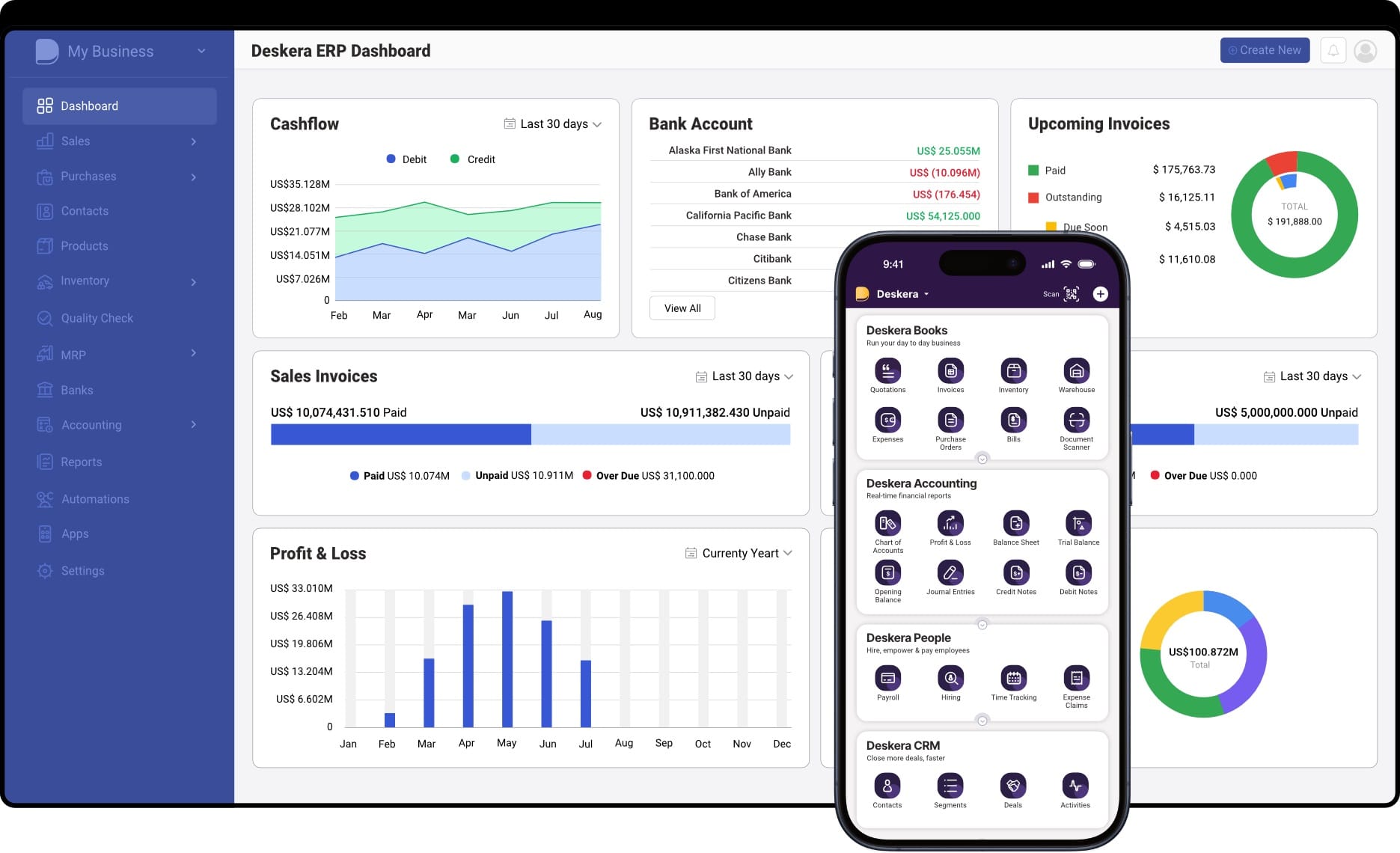

Deskera ERP is one such tool designed to help businesses streamline budgeting, accounting, inventory, and payroll in one platform. With real-time data visibility, automated financial tracking, and customizable reporting, Deskera empowers business owners to make confident, data-driven decisions—while avoiding common budgeting missteps.

What is Business Budgeting?

Business budgeting is the process of creating a detailed financial plan that outlines a company’s expected income and expenditures over a specific time period—typically monthly, quarterly, or annually. It serves as a strategic roadmap that helps businesses manage their finances, set priorities, and make informed decisions.

At its core, budgeting is more than just numbers—it’s a structured approach to ensure financial stability and support long-term growth. A well-prepared budget allows a business to anticipate future financial needs, manage cash flow effectively, and remain prepared for both opportunities and challenges.

Here are the key aspects of business budgeting every business owner should understand:

- Financial Planning: Budgeting involves estimating future revenue and expenses to create a clear financial roadmap for the company.

- Goal Setting: Budgets help define and support financial goals—such as increasing profitability, reducing costs, expanding into new markets, or managing debt efficiently.

- Resource Allocation: A solid budget ensures funds are allocated wisely across departments and initiatives, helping the business meet both short-term obligations and long-term investments.

- Performance Tracking: Regularly comparing actual performance against the budget allows businesses to track progress, identify variances, and make timely adjustments.

- Decision-Making: Budgets provide a financial framework that supports sound decision-making, whether it's about hiring, marketing, scaling operations, or capital investments.

In short, business budgeting is not just a financial exercise—it’s a critical tool for strategic planning, operational control, and sustainable growth.

7 Types of Budgeting in Businesses

Many businesses use a combination of budgets to manage different aspects of their operations. Each budget type serves a unique purpose—whether it's planning day-to-day operations, forecasting long-term growth, or managing resources efficiently.

Here are the seven most common types of business budgets:

1. Operating Budget

An operating budget outlines a company’s projected income and expenses over a set period, usually monthly, quarterly, or annually. It includes both fixed and variable costs such as rent, utilities, payroll, and supplies. This budget helps assess whether daily business operations are financially sustainable and aligned with strategic goals.

2. Master Budget

The master budget serves as the central financial plan, consolidating all individual departmental budgets—such as sales, operations, and marketing—into one comprehensive document. It provides an overview of the company’s financial health, cash flow forecasts, and long-term strategy. Finance leaders use it to coordinate interdepartmental goals and ensure the business stays on track.

3. Static Budget

A static budget remains unchanged regardless of fluctuations in sales or production levels. This fixed approach is often used by nonprofit organizations, government agencies, and educational institutions with pre-set funding. While less flexible, it serves as a strong benchmark to measure performance against original projections.

4. Cash Budget

This type of budget focuses solely on cash inflows and outflows over a period. It helps businesses monitor liquidity, avoid cash shortages, and make timely payments. A cash budget is crucial for ensuring that the company can cover operational costs, payroll, and unexpected expenses while maintaining financial stability.

5. Financial Budget

The financial budget provides a long-term perspective on a company’s capital structure. It includes projections for assets, liabilities, equity, and capital expenditures. This budget is essential for understanding the company’s financial position and planning major investments or financing decisions.

6. Labor Budget

A labor budget estimates the cost of employee wages, benefits, and other staffing-related expenses. It’s particularly useful for workforce planning, especially when hiring for new roles, managing seasonal labor, or adjusting to business growth. This budget helps align HR planning with financial goals.

7. Production Budget

Used primarily by manufacturing and product-based businesses, the production budget estimates how many units need to be produced to meet anticipated sales. It also factors in inventory levels, raw material needs, and machine capacity, helping managers streamline production scheduling and reduce waste.

The Importance of Business Budgeting

Budgeting is more than just a financial planning exercise—it’s a foundational component of strategic business management. Whether you’re a startup aiming to scale or an established organization looking to optimize operations, having a structured budget in place equips you to make informed decisions, manage resources effectively, and stay resilient in a constantly evolving business landscape.

Here are the key reasons why budgeting is vital to business success:

1. Ensures Availability of Resources

At its core, a budget ensures that a business has the financial resources necessary to meet its objectives. Through proactive planning, companies can allocate sufficient funds to high-priority teams and initiatives while identifying areas to cut back. For example, budgeting can support hiring plans, expansion projects, or new product development without jeopardizing other critical functions.

2. Supports Strategic Goal-Setting

Budgeting is integral to defining internal financial goals. It allows businesses to quantify what success looks like—whether that’s increasing revenue, reducing costs, or expanding market share. These financial goals inform budget allocations and vice versa, creating a feedback loop where performance metrics guide future planning and resource distribution.

3. Optimizes Resource Allocation

A budget acts as a framework for allocating financial resources systematically. By analyzing past performance and forecasting future needs, organizations can prioritize projects with the highest ROI or those most aligned with long-term strategic goals. This ensures that every dollar spent adds value and contributes to desired business outcomes.

4. Improves Cash Flow Management

Effective budgeting provides visibility into cash inflows and outflows, helping companies anticipate and manage surplus or deficit periods. This insight enables businesses to take proactive steps—such as securing a line of credit, postponing discretionary spending, or renegotiating terms with suppliers—to maintain operational continuity.

5. Controls Overspending

Budgets establish spending limits across departments and activities, helping to prevent financial mismanagement and unnecessary expenses. By monitoring budget adherence, companies can take corrective actions before small overruns become larger financial issues.

6. Facilitates Better Debt Management

A budget helps businesses prioritize debt repayments and avoid accumulating more liabilities. It enables financial teams to reserve funds specifically for servicing debts and identify opportunities to reallocate surplus cash toward reducing obligations.

7. Drives Long-Term Growth Planning

By linking expenses with long-term goals, budgeting provides a roadmap for sustainable growth. Businesses can set realistic revenue targets, monitor progress, and adjust strategies as needed. This forward-thinking approach ensures companies stay aligned with their vision and growth trajectory.

8. Builds Emergency Preparedness

A robust budget accounts for contingencies by allocating funds to emergency reserves. This preparedness allows companies to weather unexpected challenges such as economic downturns, market volatility, or unforeseen operational disruptions.

9. Uncovers Spending Patterns

Budgeting involves tracking and reviewing financial data over time, revealing trends in spending behavior. These insights help identify waste, improve forecasting accuracy, and enhance financial accountability across departments.

10. Enables Performance Measurement

Comparing budgeted figures with actual results provides valuable insights into organizational efficiency. This performance evaluation can be done at both departmental and company-wide levels, supporting continuous improvement and informed decision-making.

11. Enhances Decision-Making

Budgeting equips leadership with the financial data necessary to make smart decisions—whether it's investing in new technologies, scaling operations, entering new markets, or renegotiating contracts. It becomes a reference point for every significant financial action.

12. Attracts Investors and Stakeholders

Well-structured budgets signal fiscal responsibility and strategic foresight—key factors for gaining investor trust. Startups, in particular, benefit from strong budgeting practices that demonstrate their ability to manage funds and forecast future performance accurately.

13. Helps Meet Tax Obligations

Accurate budgeting enables businesses to plan for tax liabilities, avoid penalties, and maintain compliance with regulatory requirements. It also allows for strategic planning around deductions and credits, further optimizing financial health.

14. Supports Employee Benefits and Business Reinvestment

Sound financial planning can free up resources to reinvest in employee programs, equipment upgrades, or infrastructure improvements. These reinvestments not only boost morale and productivity but also enhance the company's competitive edge.

15. Aids in Risk Identification and Mitigation

Through scenario planning and financial modeling, budgeting enables businesses to identify vulnerabilities and develop contingency strategies. This proactive approach to risk management ensures resilience even in uncertain times.

Budgeting isn’t just a financial exercise—it’s a strategic necessity. From enabling smarter decisions to enhancing investor confidence, budgeting equips businesses with the structure, foresight, and agility they need to thrive. No matter the size or stage of a business, budgeting lays the groundwork for sustainable success.

12 Budgeting Mistakes Businesses Should Avoid

Creating a budget is essential for financial health and strategic growth. But even well-intentioned plans can go off track due to common budgeting errors.

Here are 12 budgeting mistakes businesses should avoid—and how to fix them.

Overestimating Sales Projections

One of the most common mistakes is basing sales targets solely on past performance, with an added “reasonable” growth percentage. This method ignores important variables like market size, competition, or the potential impact of entering new regions or launching new products.

An accurate sales target should be based on factors such as market dynamics, competitor activity, and macroeconomic conditions. Setting sales projections too high can result in overstretched resources, missed targets, and ultimately a budget imbalance.

Basing the Budget on Gut Feelings, Not Data

Budgets based on instincts or historical data alone are inaccurate. Data-driven budgeting is crucial. This means reviewing previous budgets, examining current business environments, and analyzing market trends to identify potential revenue and expense fluctuations.

A robust budget should integrate both top-down (sales-driven) and bottom-up (cost-driven) approaches to provide a balanced view of expected financial outcomes.

Not Tracking Revenue and Expenses Regularly

Budgeting is not a one-time activity; it requires constant tracking and adjustments. Failing to regularly monitor actual revenue and expenses against the budget can lead to significant discrepancies.

Without tracking, unexpected shortfalls or overages go unnoticed, which can lead to missed opportunities for corrective action. Regularly reviewing and adjusting the budget ensures you stay on course and can make informed decisions in real-time.

Neglecting to Account for Unexpected Expenses

Many businesses fail to anticipate unplanned expenses that can disrupt financial stability, such as sudden increases in raw material costs, price hikes from vendors, or unforeseen repairs.

Without a contingency fund, these unexpected costs can lead to cash flow problems or force a business to resort to debt. Setting aside an emergency fund (typically 5% of the budget) ensures that your business can weather unexpected challenges without jeopardizing its financial health.

Setting Unrealistic Sales and Growth Targets

Setting goals without considering realistic market conditions or operational capacity is a dangerous practice. For example, budgeting for 25% year-over-year growth in a market growing at only 5% is overly optimistic and bound to lead to frustration and failure.

Unrealistic targets can lead to overextending resources, unachievable sales goals, and financial strain. Always ensure that your sales targets are S.M.A.R.T. (Specific, Measurable, Achievable, Realistic, Time-bound) and aligned with market trends and internal capabilities.

Failing to Update the Budget as Conditions Change

A fixed budget based on initial assumptions often fails to account for market fluctuations, shifting customer preferences, or unexpected economic changes.

Without periodic budget updates, a business might continue to operate on outdated figures that no longer reflect current realities.

Regularly reviewing and adjusting your budget based on performance and external changes keeps your finances aligned with the evolving business environment.

Underestimating Operational Costs

While fixed costs like rent and salaries are relatively predictable, variable expenses such as marketing, utility bills, or the cost of goods sold can fluctuate significantly.

Many businesses make the mistake of underestimating these variable expenses, which can lead to cash flow problems. It’s essential to accurately forecast both fixed and variable expenses, considering factors like seasonal demand fluctuations and market volatility.

Ignoring Cash Flow Projections

Cash flow is a critical component of any budget. Businesses that ignore cash flow projections often find themselves in trouble when payments are due, but funds are not available.

It's essential to project cash inflows and outflows, accounting for customer payments, vendor bills, and other operational costs. This ensures that you have enough liquidity to meet financial obligations and avoid delays in business operations.

Not Incorporating All Stakeholders in the Budgeting Process

A budget that is not shared with key stakeholders, such as department heads or project leads, can result in misalignment and confusion. Without their input, departments may operate outside of the agreed-upon financial constraints, leading to overspending. It’s essential to share the finalized budget with all relevant parties to ensure everyone is aware of their financial limits and objectives.

Setting Fixed Budgets Without Room for Flexibility

Strict, fixed budgets leave no room for flexibility, making it difficult to respond to unexpected opportunities or challenges. A rigid approach to budgeting can stifle growth and innovation because it doesn’t accommodate new, potentially lucrative projects or adjustments that might be necessary for survival. Instead, consider using rolling forecasts that can be updated regularly to reflect new information and market dynamics.

Failure to Prioritize Expenses Effectively

Not all expenses are equally important. Many businesses make the mistake of allocating funds without considering their return on investment (ROI) or long-term value. Whether it's marketing spend, operational costs, or capital expenditures, it’s crucial to prioritize spending on areas that directly contribute to the business’s core objectives. This ensures that every dollar spent contributes to business growth and stability.

Not Reviewing and Adjusting for Inflation or Market Changes

Ignoring the impact of inflation or broader market changes can result in underestimating future expenses. For instance, if raw materials increase in price, but these increases aren't accounted for in the budget, you risk overspending or experiencing cost shortages. Reviewing pricing trends, inflation rates, and market conditions can help you adjust your budget to reflect these anticipated changes, ensuring you're not caught off guard by rising costs.

By addressing these 12 common budgeting mistakes, businesses can ensure that their financial plans are more accurate, adaptable, and sustainable, leading to greater profitability and operational efficiency.

How Deskera ERP Can Help Streamline Your Business Operations

Deskera ERP is a comprehensive cloud-based solution designed to automate and optimize various business processes, from accounting and inventory management to human resources and customer relationship management.

Here's how Deskera ERP can help your business:

Centralized Business Operations

Deskera ERP provides a centralized platform for all business functions, ensuring seamless integration between departments. Whether it's finance, sales, HR, or inventory, Deskera ERP allows all teams to work on a single platform, reducing silos and improving collaboration.

Efficient Inventory Management

Deskera’s inventory management features help businesses track stock levels, streamline ordering processes, and reduce the risk of overstocking or stockouts. Real-time inventory tracking ensures that you can always maintain optimal inventory levels, leading to better cash flow management and reduced waste.

Automated Financial Management

Deskera ERP’s accounting tools automate financial reporting, invoicing, and reconciliation. It simplifies the process of generating financial statements, making it easier to track profits, manage cash flow, and comply with regulatory requirements. This leads to more accurate financial data and quicker decision-making.

Customer Relationship Management (CRM)

Deskera ERP comes with built-in CRM capabilities that help manage customer relationships, sales pipelines, and marketing campaigns. You can track customer interactions, automate follow-ups, and personalize communication to increase customer satisfaction and drive repeat business.

Enhanced Reporting and Analytics

Deskera ERP offers advanced reporting tools that provide real-time insights into key business metrics. With customizable dashboards, businesses can access detailed reports on financial performance, sales trends, inventory levels, and more. This data-driven approach helps in making informed, strategic decisions.

Improved Supply Chain Visibility

Deskera ERP helps businesses streamline their supply chain by providing visibility into supplier performance, order tracking, and shipment statuses. It enables better communication with suppliers and helps forecast demand, reducing delays and optimizing the supply chain for efficiency.

Customization for Business Needs

Deskera ERP is highly customizable, allowing businesses to tailor the software according to their specific needs and industry requirements. Whether you are in manufacturing, retail, or service industries, Deskera can adapt its functionalities to help streamline processes.

Mobile Accessibility

Deskera ERP offers mobile access, enabling business owners and employees to manage operations from anywhere. This flexibility ensures that you can stay connected to your business while on the go, improving productivity and responsiveness.

Scalability and Growth Support

As your business grows, Deskera ERP scales with you. Whether you are adding more employees, opening new locations, or expanding your product lines, Deskera can handle increased complexity without compromising performance, allowing you to focus on growth.

By leveraging Deskera ERP, businesses can achieve greater efficiency, reduce manual tasks, improve decision-making, and enhance customer satisfaction—all while streamlining operations and positioning the company for future growth.

Key Takeaways

- Setting sales targets based solely on past performance can lead to unrealistic expectations. Instead, consider market dynamics, competition, and future business plans to establish a more accurate and achievable sales forecast.

- Budgets should be grounded in solid data, not guesses. Look at past performance, market trends, and future forecasts to build a more realistic and effective budget.

- Failing to regularly monitor your budget against actual performance can result in unpleasant surprises. Consistent tracking helps identify issues early, allowing for corrective actions before they impact your financial health.

- Always account for unexpected expenses by setting aside an emergency fund in your budget. This ensures that you have financial flexibility to deal with unforeseen costs without derailing your operations.

- It's crucial to set realistic, achievable goals using the S.M.A.R.T. framework. Overestimating sales growth or underestimating expenses can create unnecessary financial stress. Aim for a balance between optimism and prudence.

- Your budget should be a living document that evolves as your business conditions change. Regularly update your budget based on performance, new market realities, and shifting expenses to keep it aligned with actual business needs.

- Transparency is key to successful budgeting. Ensure that all relevant team members are aware of the budget, their individual responsibilities, and how their actions impact the business's financial health.

- Often, businesses overlook variable costs, which can fluctuate throughout the year. Make sure to review and adjust your budget for these unpredictable expenses, especially in areas like raw materials or marketing efforts.

- Businesses often fail to account for seasonal fluctuations in sales and expenses. Be sure to factor in seasonality when setting your budget to avoid cash flow shortages during slower periods.

- Making budget decisions based on intuition alone can be risky. Rely on data, historical performance, and analysis rather than assumptions to make more informed financial decisions.

- Growing your business often comes with hidden costs. Factor in not just immediate expansion expenses but also longer-term operational costs to avoid overestimating profitability during periods of growth.

- A set-and-forget approach to budgeting can leave you blind to critical financial shifts. Make it a practice to review your budget regularly to stay on top of any necessary adjustments, ensuring it always reflects your current business situation.

Related Articles