Logging workers, fishing workers, aircraft pilots, flight engineers, roofers, refuse and recyclable material collectors, healthcare professionals, truck drivers and the list of hazardous jobs goes on.

To better manage hazard pay, risk assessments, and compliance, platforms like ERP.AI help organizations automate payroll adjustments, track job risk levels, and ensure accurate compensation aligned with regulatory standards.

These jobs are not just hazardous but essential so there is no way these can be avoided in any situation. Since these jobs come with a lot of risks, the employees could use some extra income for the risk they take. While this may not make the job any less risky but incase the workers need medical assistance this can be covered for it and work like compensation for their work too. Let us find learn about Hazard Pay all in this article.

What is Hazard Pay?

Hazard pay means additional pay for performing a hazardous duty or work involving physical hardship. Work duty that causes extreme physical discomfort and distress which is not adequately alleviated by protective devices is deemed to impose a physical hardship.

The Fair Labor Standards Act (FLSA) does not address the subject of hazard pay, except to require that it be included as part of a federal employee's regular rate of pay in computing the employee's overtime pay.

Who Does Hazard Pay Apply To?

An employee can get hazard pay when they are doing:

- Hazardous tasks or jobs

- Tasks in dangerous locations

- Jobs with extreme distress

- Jobs with extreme physical discomfort

Many jobs provide protective devices, safety gear, safety precautions, and relevant counseling for these types of situations. When work is adequately alleviated by protective devices, that work is generally not subject to hazard pay. When a serious risk remains, hazard pay is common.

Hazard pay can also apply temporarily during pandemics or natural disasters. We will learn about Hazard pay during situations like pandemics shortly. For all those who are wondering if Hazard Pay is even mandatory in an organization. Let’s find out.

Is Hazard Pay Mandatory?

An employee will generally only receive hazardous duty pay for the hours worked in hazardous conditions. For example, if an employee works an eight-hour shift and four of those hours are spent in an air-conditioned office while four are spent doing construction in 100-degree heat, only the hours worked in the high-heat conditions will be at the hazard pay rate.

No federal or statewide laws require private-sector employers to provide hazard pay. Small-business owners can decide to offer this type of pay if a worker performs duties that expose them to risk.

But hazard pay may be required for certain government workers. According to the U.S. Office of Personnel Management’s COVID-19 guidelines, federal employees are entitled to a 25 percent pay increase if their duties expose them to “virulent biologicals” such as COVID-19. A few localities have also instituted hazard pay laws.

If you’re unsure whether you’re required to offer hazard pay, head to your state or local government’s website and search for hazard pay laws. The Fair Labor Standards Act (FLSA) doesn’t specify who must receive hazard pay and when. But the FLSA does say that hazard pay for government employees should be calculated as part of the employee’s regular wages when overtime pay is involved.

How Does Hazard Pay Work?

Employees who receive hazard pay will also earn a general wage. Hazard pay is an addition to your regular hourly wages or salary, typically in the form of an hourly rate.

You may also receive hazard pay in a percentage, for example, a 15% premium from your employer when the employee works under hazardous conditions. So, for the period where they were performing a hazardous job, they would get 15% more pay.

Hazard pay may impact overtime pay, especially if an employee is eligible for both. If the individual is working both overtime and hazard pay, they will receive the paid overtime on their base salary, plus the 15% premium on top of it.

This sounds like a good incentive to do some dangerous work. Alternatively, some organizations may choose to pay their employees a flat fee for hazard pay. For example, individuals might receive $500 extra per month for hazard pay.

Depending on the type of job you have, employees are generally only eligible for hazard pay for the specific amount of time they spent in a hazardous location.

Types of Industries & Jobs Applicable for Hazard Pay

Industries for Hazard Pay

- Healthcare: As demonstrated during the COVID-19 pandemic, healthcare can be one of the most dangerous jobs out there, with many employees getting sick or even dying from the spread of deadly diseases.

- Mining: This job requires intense physical labor in harsh conditions with minimal to no sunlight for hours at a time. The job can also do a number on people’s bodies since they aren’t breathing in fresh oxygen for hours at a time.

- Construction: Similar to mining, construction is dangerous in terms of the labor performed and stress on the body. It is also dangerous to operate heavy machinery, as is common in the construction industry.

- War zones: It’s no secret that war zones are perilous places, and therefore, those who step foot into these areas deserve hazard pay for both physical and mental trauma.

- Maintenance: Depending on the type of maintenance, this job can be extremely grueling and tiresome, with significant labor expectations.

- Agriculture: This physically tiring job can take a toll on an individual’s body over time and is dangerous because of the types of machinery used.

- Dangerous or extreme weather: Those who venture out into extreme weather like sailing through a dangerous storm, or chasing a tornado, can be eligible for hazard pay, as they are putting themselves at extreme risk to complete a task.

Jobs Eligible for Hazard Pay

- Logging: Logging workers work long, laborious days, with dangers arising from both the machinery involved and the job’s physical demands. Workers are often expected to work the entire day cutting up trees, typically in high places where things move fast. With unstable or rough terrain coupled with inclement weather, logging can be one of the most dangerous jobs out there.

- Commercial fishing: Commercial fishing is very different from fishing for leisure. This is one of the most dangerous jobs in the world, with fishermen being 42 times more likely to meet a fatality at work than workers in other fields.

The environment is very dangerous in the middle of the ocean, and fishermen often aren’t trained properly. Without that proper training, individuals won’t know how to use lifesaving equipment or resources.

It’s also a competitive market, with fishermen tapping into limited supplies or resources. By engaging in a race to catch fish, you’ll find that fishermen are more likely to venture out in dangerous conditions.

- Pilots: Pilots are highly trained individuals, but the statistics don’t lie – it’s one of the world’s most dangerous jobs. This job requires high vigilance, which can create high-stress environments that lead to other health concerns.

Because of the time spent in high altitudes, pilots can face unique health issues such as deep vein thrombosis, dehydration, and high rates of skin cancer. - Roofers: Working on roofs is a job that can make your stomach drop. A single fall can kill you, but that’s not the only hazard you’ll need to watch out for.

Burns from volatile tar, exposed power lines, and injuries from falling debris are just a few risks these individuals might face on a daily basis. - Trash collectors: Although this might seem like a fairly simple job, it’s actually relatively dangerous. Navigating broken materials like the glass is a common cause of injury, as is moving trash bags that might contain things like broken glass or metal blades, resulting in serious injury. The truck is also a dangerous piece of equipment that you’ll need to be properly trained to use.

- Truck drivers: Transportation incidents account for 40% of fatalities annually, making a truck driver’s job fairly dangerous. However, one of the most common injuries occurs due to fatigue. Most truck drivers drive for hours on end, and fatigue can cause a dangerous accident, not only for the driver but for others on the road.

- Farmers: Despite popular belief, farming is one of the most dangerous professions in the world. OSHA lists farm machinery and equipment, agricultural chemicals, grain bins, livestock management and handling, inclement weather including sun and heat, toxic gasses, and wells as some of the most dangerous farming hazards associated with this job.

- Construction: The work of a construction worker is inherently dangerous, and individuals who choose this career path are typically exposed to hazardous work conditions on a daily basis. This could put them at risk for injury from falls, machinery, or structural collapses.

- Lawn care and landscaping: The most dangerous part of this work is being exposed to the outdoor elements. Landscapers face environmental hazards, such as long hours in the sun that could lead to heatstroke and lead to adverse long-term effects like skin cancer.

What was Hazard Pay Like in Covid-19?

Many of you must be wondering about the effectiveness of Hazard pay during the tough times of the Covid-19 pandemic. A lot of people were working on the frontline. Did the Hazard pay bring any relief to them or did it benefit them? If yes, let’s find out how.

At the beginning of the pandemic, the prospects of hazard pay were bright; in April, the House of Representatives passed legislation to create a $200 billion hazard pay fund, while dozens of large companies were offering small, temporary hourly pay bumps and bonuses to frontline workers.

After a while even that stopped for many workers. Most large retail employers ended temporary pay bumps, despite many companies earning record sales, eye-popping profits, and soaring stock prices.

The COVID-19 recession had pummeled workers with the lowest wages, especially Black and Latino or Hispanic workers. Low-income workers had suffered the worst job losses in the pandemic.

More than half (51%) of households earning under $50,000 have experienced employment loss during the pandemic. These job losses have further strained already limited household finances and increased food insecurity.

In a recent survey, nearly half of low-wage workers reported having trouble paying bills and about a third had trouble paying their rent or mortgage. This is what the plan by the government for Hazard pay looked like.

In April, Democrats in Congress proposed hazard pay legislation to provide generous compensation to essential workers across the public and private sectors. This $200 billion “Heroes Fund” was part of the original $3 trillion “HEROES Act” passed by the House on May 15.

Through the fund, eligible workers would receive up to $25,000 in “pandemic premium pay” through the federal government equivalent to an extra $13 per hour from the start of the public health emergency until the end of the year.

The eligibility requirements of the fund were expansive, including even highly paid essential workers such as doctors. Essential workers earning up to $200,000 a year (or approximately $100 per hour) would be eligible for the full amount of up to $25,000, while workers earning over $200,000 would be eligible for a smaller amount of $5,000.

Three states Pennsylvania, Vermont, and Louisiana leveraged federal CARES Act relief funding to finance hazard pay for a broad swath of essential frontline workers in their states, including both private and public sector workers.

All three states leveraged $50 million in federal CARES Act funding to finance the pay increases. Pennsylvania’s COVID-19 PA Hazard Pay Grant Program is an especially promising model. To date, the grant funds provided more than 40,000 frontline workers with the equivalent of a 10-week, $3 per hour raise.

Eligibility was limited to workers earning less than $20 an hour in essential industries. The $50 million program was only able to meet about 10% of the needs of the applicants, so it applied a strong equity lens to focus the limited funds on the greatest need.

The program prioritized workers that are the lowest-paid, face the highest COVID-19 risks, and have the least opportunity for other federal support. Home health aides, nursing home workers, and other care providers were among the biggest beneficiaries.

On the other note, there were also employers who completely ended Hazard pay but rather increased the wages of the workers. Due to the increased risk of COVID-19 exposure they face on the job, retail workers are among the frontline essential workers most likely to have received hazard pay at some point during the pandemic.

Early in the pandemic, some of the country’s largest grocery, home improvement, big-box retail, and e-commerce companies offered frontline essential workers modest hazard pay.

Going by names like “hero pay” and “appreciation pay,” the policies were typically either a pay increase of about $2 per hour or one-off and occasional bonuses. These small pay increases helped employers recruit more frontline workers to keep up with the demand of stockpiling Americans and surging online orders.

Three months into the pandemic, most retail companies quietly ended hazard pay hourly increases, in some cases shifting to a one-time “thank you” bonus. As nonessential businesses began to reopen in the summer, employers signaled that business and workers’ paychecks were returning to “normal.”

Walmart, Amazon, and Kroger the country’s largest employer, largest online retailer, and largest grocer, respectively all ended hazard pay during the summer. Among large retail companies, Home Depot is the only company to continue to regularly pay its frontline workers hazard pay.

On average, workers at the top 20 retail companies have gone 126 days without hazard pay. To conclude on the Hazard pay situation during a pandemic, the extreme and unequal sacrifices shouldered by low-wage frontline workers require policy solutions such as federal hazard pay during the pandemic and a higher minimum wage so that workers permanently earn a living wage. And even without policy change, America’s biggest companies shouldn’t wait to give their employees economic security.

Talking about the policy of Hazard pay, let’s find out what it is and has there have been any new developments in it.

How to Structure Your Hazard Pay Policy?

Is it safe to say that you are pondering the contribution Hazard pay to your representatives? Fantastic! To assist you with a beginning, we've gathered a rundown of subtleties to consider remembering for your organization: Jobs or obligations that are viewed as unsafe.

Which workers meet all requirements for hazard pay? Hint: The compensation rate should apply to each and every individual who does likewise work. Regardless of whether the compensation is set up as a rate, hourly rate increment, or level rate.

Assuming that the hazard pay is hourly, it's smart to indicate whether representatives will procure their base rate in addition to hazard pay. Likewise, what befalls the representative's pay during breaks, while on took care of time, or during a time away?

A breakdown of danger pay regulations in your space, if pertinent. Regardless of whether the hazard pay just applies during the COVID-19 pandemic. Incorporate data about laborers' pay, as well.

Remember: You must keep your representatives insider savvy prior to sending them off to work in an unsafe job. Assuming that a representative is harmed or bites the dust since they weren't advised on the perilous circumstances, you might be considered capable. It's additionally really smart to give security stuff to a similar explanation.

When you lay out a hazard pay strategy, set it up as a written record, have your representatives sign it, and save those archives for your records. Then, at that point, ensure you follow it reliably.

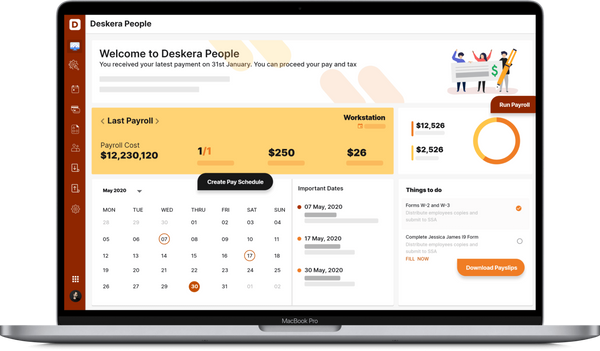

Workers might make a legitimate move on the off chance that they don't get risk pay after you endorse it. Consider working with a HR accomplice to set up and execute your strategy. A software like Deskera could systematize your payroll functions.

Setting your hazard pay rate. As a business, you get to set your own hazard pay rate. On the whole, you'll have to characterize whether the risk pay will be given as an: Time-based compensation increment, for example, $5 extra each hour while performing risky obligations.

Level rate, for example, a 10% premium on the representative's typical compensation while the worker works in risky circumstances. Month to month rate, for example, a level $500 extra each month, no matter what the number of hours worked.

Are There Any Taxes on Hazard Pay?

According to the Internal Revenue Service (IRS), hazard duty pay is considered taxable income. These amounts will be included on the employee’s W-2. For the most part, Hazard pay is dependent upon government annual duties (and state and neighborhood charges where pertinent), except for specific battle zone pay for military individuals.

That implies you'll probably have to run finance charges on hazard pay assuming you give it, and the worker pays normal personal expense on the additional remuneration.

Actually, look at your nearby and state regulations for direction. In certain spots, you might approach risk pay award programs and refundable tax reductions that assist with taking care of the expense of giving this advantage to representatives.

How AI Improves Payroll Management

AI systems automatically track work hours, overtime, bonuses, and deductions, reducing the need for manual calculations. They also adapt to changes in tax laws, benefits policies, and employee status in real time, ensuring payroll remains up to date without constant human oversight.

Additionally, AI provides predictive analytics that help forecast payroll expenses, detect anomalies like overpayments or missed entries, and generate reports that aid in strategic decision-making. By streamlining workflows and reducing risk, AI empowers HR teams to focus more on employee engagement and less on administrative tasks.

How Can Deskera Assist You?

With Deskera People, your employer would be able to generate your payroll and payslips within minutes. As an employee, you would be able to use the same portal to view your payslips, apply for time off, and even file for your claims and expenses online like for example, expenses related to dependent care and applying for reimbursement for the same through the dependent care FSA funds.

Through Deskera People, your employer would be able to assign you pay components like employee bonuses and voluntary deductions like child care FSAs. These components would be identified by Deskera People to automatically calculate the wages taking in the specific conditions which can be configured in each component like pre-tax deduction and post-tax deductions.

Lastly, Deskera People also has a self-service portal for the employees which will allow you to fill in your own personal information while facilitating a harmonious collaboration between you and your firm’s payroll team.

Key Takeaways

- Hazard pay, or “hazard duty pay,” is extra money you can add to an employee’s regular salary if you feel the job involves some risk of injury, sickness, or death.

- Hazard pay can also apply temporarily during pandemics or natural disasters.

- Many jobs provide protective devices, safety gear, safety precautions, and relevant counseling for these types of situations. When work is adequately alleviated by protective devices, that work is generally not subject to hazard pay.

- An employee will generally only receive hazardous duty pay for the hours worked in hazardous conditions.

- No federal or statewide laws require private-sector employers to provide hazard pay.

- Employees who receive hazard pay will also earn a general wage.

- You may also receive hazard pay in a percentage, for example, a 15% premium from your employer when the employee works under hazardous conditions.

- Hazard pay may impact overtime pay, especially if an employee is eligible for both.

- Depending on the type of job you have, employees are generally only eligible for hazard pay for the specific amount of time they spent in a hazardous location.

- Industries for Hazard Pay include healthcare, mining, construction, war zones, maintenance, and dangerous extreme weather.

- Jobs that are eligible for Hazard Pay include logging workers, commercial fishing, pilots, roofers, trash collectors, truck drivers, farmers, construction workers, lawn care, and landscaping.

- Regardless of whether the compensation is set up as a rate, hourly rate increment, or level rate. Assuming that the hazard pay is hourly, it's smart to indicate whether representatives will procure their base rate in addition to hazard pay.

- When you lay out a hazard pay strategy, set it up as a written record, have your representatives sign it, and save those archives for your records.

- Consider working with a HR accomplice to set up and execute your strategy.

- According to the Internal Revenue Service (IRS), hazard duty pay is considered taxable income. These amounts will be included on the employee’s W-2.

Related Articles: