Are you aware of what your employer deducts from your compensation and sends to the IRS? Payroll taxes, including FICA tax or withholding tax. In this article, we will talk about why your tax withholding is critical to monitor in US.

We shall cover the following topics:

- What is FICA?

- Payroll tax

- Why pay FICA tax?

- Overpaying FICA Taxes

- FICA Tax Exemptions

What is FICA?

Assuming that you earn a salary or compensation, you're probably dependent upon Federal Insurance Contributions Act charges. FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay.

The law that made the FICA charge was passed in 1935. The funds are utilized to give retirement savings funds and insurance programs for working Americans. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits. Notwithstanding Social Security, FICA taxes are piped into the Medicare program.

FICA tax incorporates two taxes: Medicare expense and Social Security charge. This regulation blueprints that taxes ought to be kept from checks and used to support the Social Security and Medicare programs. The two, workers and employers are affected by the FICA tax.

This tax upholds the Medicare program, which gives government health care coverage to Americans who are 65 and older. The two businesses and workers should make good on the Medicare tax. (Self-employed people pay both the business and workers bits of the Medicare tax as a component of the self-employment tax.)

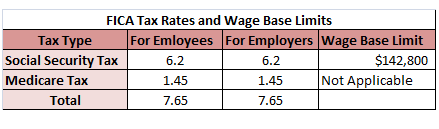

FICA Tax rate

Both SECA and FICA tax rates have expanded since they were presented. Government-managed retirement tax rates stayed under 3% for workers and businesses until the finish of 1959. Federal Medicare tax rates increased from 0.35% in 1966 (when they were first executed) to 1.35% in 1985.

The two workers and employers pay FICA taxes at a similar rate. The Social Security tax rate is 6.2% of wages, and the Medicare tax rate is 1.45% of wages. Together, these make up a tax rate of 7.65% for FICA taxes. In the event that you're independently employed, you'll have to pay for both the worker's and the business' part of FICA taxes, which is 15.3% of income.

For the recent many years, in any case, FICA tax rates have stayed steady. Businesses and workers split the expense. Independently employed workers get stuck paying the whole FICA tax all alone. For these people, there's a 12.4% Social Security tax, in addition to a 2.9% Medicare tax. You can pay this tax when you pay assessed taxes on a quarterly premise. To sort out the amount you owe, you can utilize the worksheet and guidelines given by the IRS to Form 1040-ES.

The independent work tax derivation is an over-the-line allowance that you can use to bring down your personal tax bill. So you can claim it whether or not you're organizing your derivations or taking the standard deduction. Withholding and filing requirements can be interesting, so it's ideal to work with a CPA or finance supplier to assist with claiming that your payroll taxes are taken care of accurately.

Withholding tax

A withholding tax is an income tax that a payer (usually a business) remits for a payee's sake (usually a worker). The payer deducts or keeps, the tax from the payee's compensation. Here is a breakdown of the tax that could emerge from your paycheck.

Medicare tax withholding rates: The rate for the Medicare tax is set at 1.45% of a worker's gross profit, and the business segment matches that 1.45%. The worker's part is deducted from their wages while the business pays their portion straightforwardly.

A few workers may likewise need to pay an Additional Medicare Tax. This 0.9% tax applies to people who make in excess of a set threshold amount each scheduled year. The thresholds are:

- $125,000 for the individuals who are Married Filing Separate

- $200,000 for the individuals who file their taxes as Single or Head of Household

- $250,000 for the individuals who are Married Filing Jointly

Social Security tax withholding rates: The Social Security tax pays for government retirement and disability benefits that help a great many Americans every year. Very much like Medicare, the two businesses and workers should pay the Social Security tax. Also, very much like Medicare, independently employed people both shares business and workers as a component of the self-employment tax.

The rate for the Social Security tax is 6.2% of a worker's gross earnings up to $132,900, with a matching 6.2% from the business. The worker's part is deducted from their wages while the business pays its portion straightforwardly.

Federal income tax: This is income tax your employer keeps from your compensation and ships off the IRS for your benefit. The amount to a great extent relies upon what you set on your W-4.

State tax: This is state income tax kept from your compensation and shipped off the state by your employer for your benefit. The amount relies upon where you work, where you live and different elements, for example, your W-4 (and a few states don't have an income tax).

Local income or wage tax: Your city or area may likewise have an income tax. This money could go toward such costs as the transport framework or crisis services.

Calculating FICA Tax

At the point when you start a new position, you'll normally finish up a W-4 structure. The amount of tax your manager keeps from your check generally relies upon what you set on your Form W-4, which you likely finished up when you began your job.

The form relates data, for example, your marital status and number of wards, which at last decides the sum that will be taken out for charges. At the point when more allowances are claimed, less tax is deducted. To edit it, you can download the W-4 from the IRS site and submit it again to your organization's payroll division.

You can compute the amount you'll pay for FICA taxes by increasing your compensation by 7.65%, considering any special cases or limits that could apply to your circumstance. For instance, Assuming you earn $50,000, you will pay $3,825 as a FICA commitment. This is found by multiplying the 7.65% rate by $50,000.

FICA Tax Wage Base Limits

A compensation base limit applies to workers who make good on Social Security taxes. This implies that gross pay over a specific threshold is absolved from this tax. As far as possible changes are pretty much consistently founded on expansion. In 2021, it was $142,800. Your wages over that cutoff won't be taxed for Social Security.

By 2022, the limit rose to $147,000. This income ceiling is likewise the greatest measure of money that is viewed while computing the size of Social Security benefits.

Federal Medicare tax doesn't have an income limit, so you'll be relied upon to pay the 1.45% tax on the entirety of your profit. On the off chance that you file tax as a single person and earn more than $200,000 per year, you need to pay an extra Medicare charge. This duty is determined at 0.9% of your wages over the $200,000 mark. Assuming you are married and file jointly together, that extra tax will apply to profit above $250,000.

The Additional Medicare Tax rate is 0.90% and it applies to worker's (and independently employed worker's) wages, pay rates, and tips. So any piece of your pay that surpasses a specific amount gets taxed for Medicare at a complete rate of 2.35% (1.45% + 0.90%).

That income ceiling for 2021 and 2022 is $200,000 for single filers, qualifying widows, and anybody with the head of family filing status; $250,000 for wedded couples filing joint tax forms and $125,000 for couples filing separate government forms. You can compute the amount you owe utilizing Form 8959.

While the FICA tax is paid by most specialists, the tax doesn't make a difference to all checks. Payments that are not subject to FICA taxes include:

- Kids under age 18 who are employed by their guardians.

- Qualified retirement plan contribution from businesses.

- Service performed by students is utilized by a school, university, or college.

- A few churches and qualified church-controlled association wages.

- A few state and local government pay rates.

State and local government workers in certain states who are qualified for benefits may simply be expected to pay the Medicare part of FICA taxes. Assuming you are a religious worker, your association could decide to claim an exception from the FICA tax. Workers who are absolved from FICA "will not need to pay Social Security or Medicare tax, however, you will not get the benefits of the FICA framework, either.

Payroll Tax

FICA is regularly alluded to as payroll tax in light of the fact that ordinarily, businesses deduct FICA tax from workers' checks and dispatch the money to the IRS for the benefit of the worker.

Why pay FICA tax?

Employers need to keep taxes from workers' checks since taxes are a pay-more only as costs arise game plan in the United States. At the point when you bring in money, the IRS needs its cut at the earliest opportunity.

Certain individuals are "excluded workers," and that implies they choose not to have government income tax withheld from their checks. However, government-managed retirement and Medicare taxes will in any case emerge from their checks.

Regularly, you become excluded from keeping provided that two things are valid:

· You got a refund of all your government income tax withheld last year since you had no tax responsibility.

· You anticipate that exactly the same thing should happen this year.

Keep in mind, one of the integral reasons you file a tax return is to compute the income tax on all of your available pay for the year and perceive the amount of that tax you've as of now made good on through keeping the tax. On the off chance that it turns out you've overpaid, you'll likely get a tax refund. Assuming it turns out you've underpaid, you'll have a tax bill to pay.

Overpaying FICA Taxes

A few workers pay more Social Security tax than they need to. This could occur in the event that you switch occupations at least a few times and all of your income is taxed (regardless of whether your consolidated pay surpasses the Social Security wage base breaking point). Luckily, you might have the option to get a refund when you document your duties.

Assuming you have numerous positions, you can claim the Social Security over payment on Form 1040. In the event that you owe any taxes, the IRS will utilize part of your refund to take care of them. Then, at that point, you'll get anything that remains over. Assuming that you overpaid Social Security taxes and you just have one job, you'll have to ask your employer for a refund. Excess Medicare tax repayments are nonrefundable since there's no compensation base limit.

Assuming you have more than one job, you might come up short on how much FICA taxes you owe. Assuming that occurs, you'll need to make separate estimated tax payments (except if you requested an extra portion on your W-4 form).

Assuming you wound up with a tremendous tax bill this year and don't need another, you can utilize Form W-4 to expand your tax hold back. That will assist you with owing less (or nothing) one year from now.

Assuming you got a tremendous tax refund, consider utilizing Form W-4 to decrease your tax withholding. You're giving the public authority a free loan and - far more detestable - you may unnecessarily live on less of your paycheck throughout the year. It might feel incredible to get a tax refund from the IRS, yet consider how life might've been last year assuming you'd had that additional money when you wanted it for food, late bills, sorting the vehicle out, taking care of a Master card or contributing.

FICA Tax Exemptions

Pretty much everybody settles FICA taxes, including resident aliens and nonresident aliens. It doesn't make any difference whether you work part-time or full-time. Be that as it may, there are a few exemptions.

For instance, students are excluded from paying FICA taxes on the wages they acquire from on-campus work. Exceptions additionally apply to a few alien nonresidents, including unfamiliar government workers and instructors. Certain religious groups may apply for an exception from FICA taxes by recording IRS Form 4029. However, by not covering these payroll taxes, they forgo the option to get Medicare and Social Security benefits.

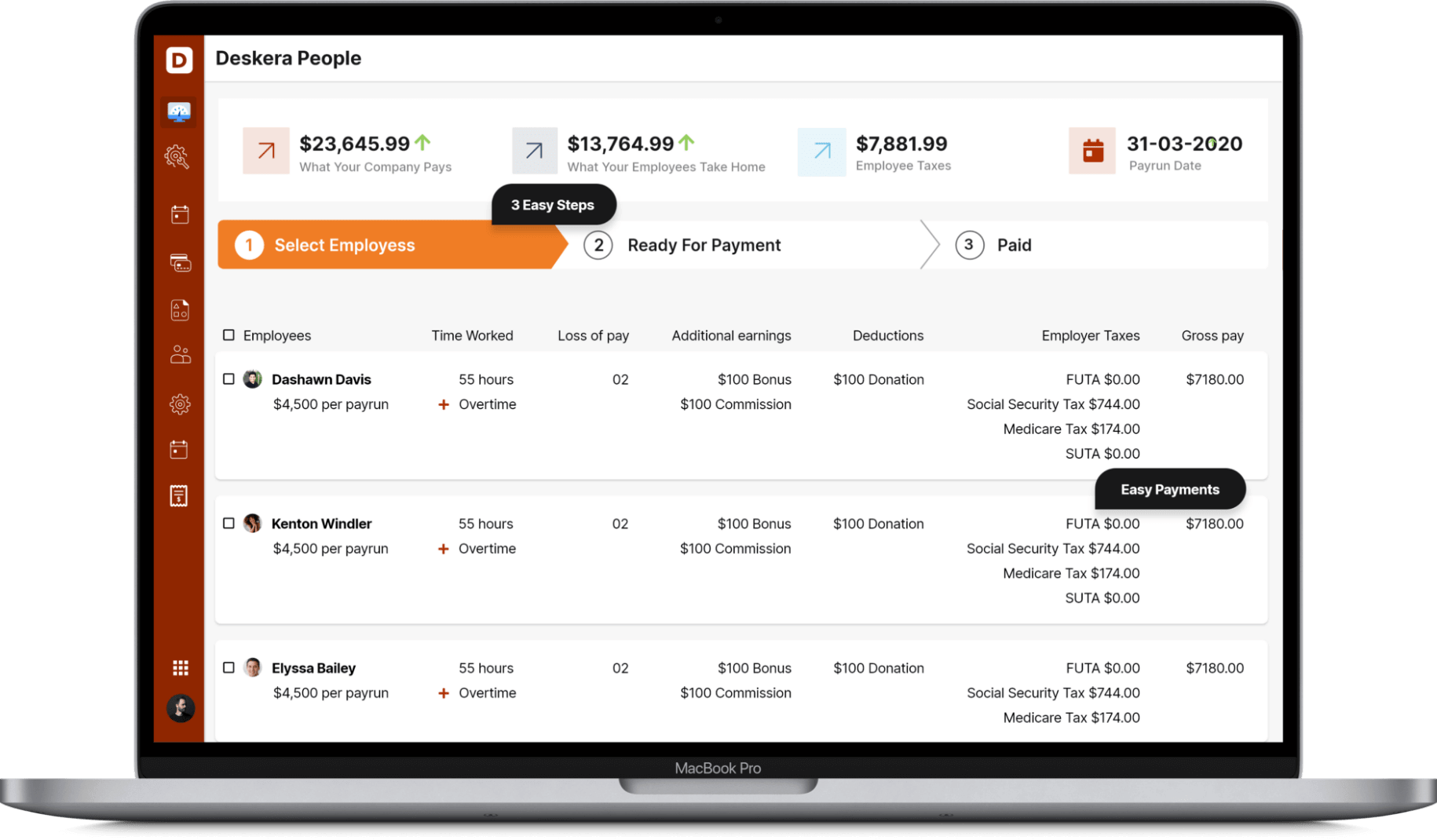

How Deskera Can help You?

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more.

Deskera People is a cloud-based software which will help to create and assign custom pay components to an employee in light of your requirements. Deskera People will distinguish those components assigned to the employee and naturally compute the wages taking in the specific conditions which can be designed in each component like pre and post-tax deductions.

Conclusion

FICA tax is intended to offer help for retired folks who meet all requirements for benefits. FICA taxes deposit the Social Security and Medicare programs. Otherwise called payroll taxes, FICA taxes are consequently deducted from your paycheck. Your organization sends the money, alongside its match (an extra 7.65% of your compensation), to the public authority. In this article, we talked about what FICA taxes are, the way they're applied, and who's liable for paying them.

Assuming that you own a business, you're liable for paying Social Security and Medicare taxes, as well. For independently employed workers, they're alluded to as SECA taxes (or self-employment taxes) in light of guidelines remembered for the Self-Employed Contributions Act.

Key Takeaways

- Each payday, a piece of your paycheck is kept by your employer. That money goes to the public authority as payroll taxes. There are a few distinct kinds of payroll taxes, including unemployment taxes, income taxes, and FICA taxes. Two sorts of charges fall under the classification of FICA taxes: Medicare taxes and Social Security taxes.

- Like federal income tax, FICA taxes are required - and much of the time, you can't get around them. In any case, since they pay for Medicare and Social Security, you will in a sense get the money back, to some degree by implication, when you retire.

- Paying FICA taxes is required for most workers and managers under the Federal Insurance Contributions Act. The funds are utilized to pay for both Social Security and Medicare.

- While FICA taxes are naturally removed from your paycheck, you'll have to give close consideration in the event that you change occupations or have multiple. You need to be certain you're not paying more than you're expected to. Also assuming you're self-employed you'll have to utilize the IRS worksheets to guarantee you're paying the right sums.

Related Articles