When a business wants to get paid for providing a product or service they issue an invoice.

A business invoice is a document that contains all of the purchase details, such as product description, the total amount owed, due date, and more.

Invoices are essential for businesses of any size because they make it possible for you to receive payment for your products or services.

Additionally, on the client’s side, invoices act as legal proof that an expense took place, which is necessary for maintaining accurate accounting records.

In this guide we’ll explain everything you need to know about invoicing and more. Here’s what we’ll cover:

- What Is An Invoice & What’s Invoicing?

- What Is An Invoice Used for?

- What Elements Does An Invoice Include?

- Different Types Of Invoices

- Automate Invoicing Using Online Invoicing Software

- 6 Essential Tips For Invoicing

What Is An Invoice & What’s Invoicing?

An invoice is a bill that allows your business to get paid for the goods and services you provide. Specifically, an invoice includes the name of the product a buyer purchases, along with its cost and payment terms.

A payment term generally refers to the maximum time a buyer has to send the cash they owe. If the goods and services are purchased on credit, for instance, invoicing payment terms provide details on how far along in the future that credit applies.

Now, since an invoice means that a buyer owes cash to a seller, there are two invoice points of view. From the business’ or sellers’ point of view, the invoice is considered a sales invoice. While, from the clients’ or buyers’ perspective, the bill is called a purchase invoice.

The start of invoices began as early as 5000BC in Mesopotamia where people would carve transactions in stones. Later on, came hand-written invoices in parchment and paper. Then with the invention of computers, electronic bills revolutionized invoicing by being cheaper, easier, and faster.

Creating an invoice for your business used to be a time-consuming process. Nowadays, it has become easier than ever. The modern world has developed the most secure, convenient, and green way of invoicing, done online through accounting and invoicing software.

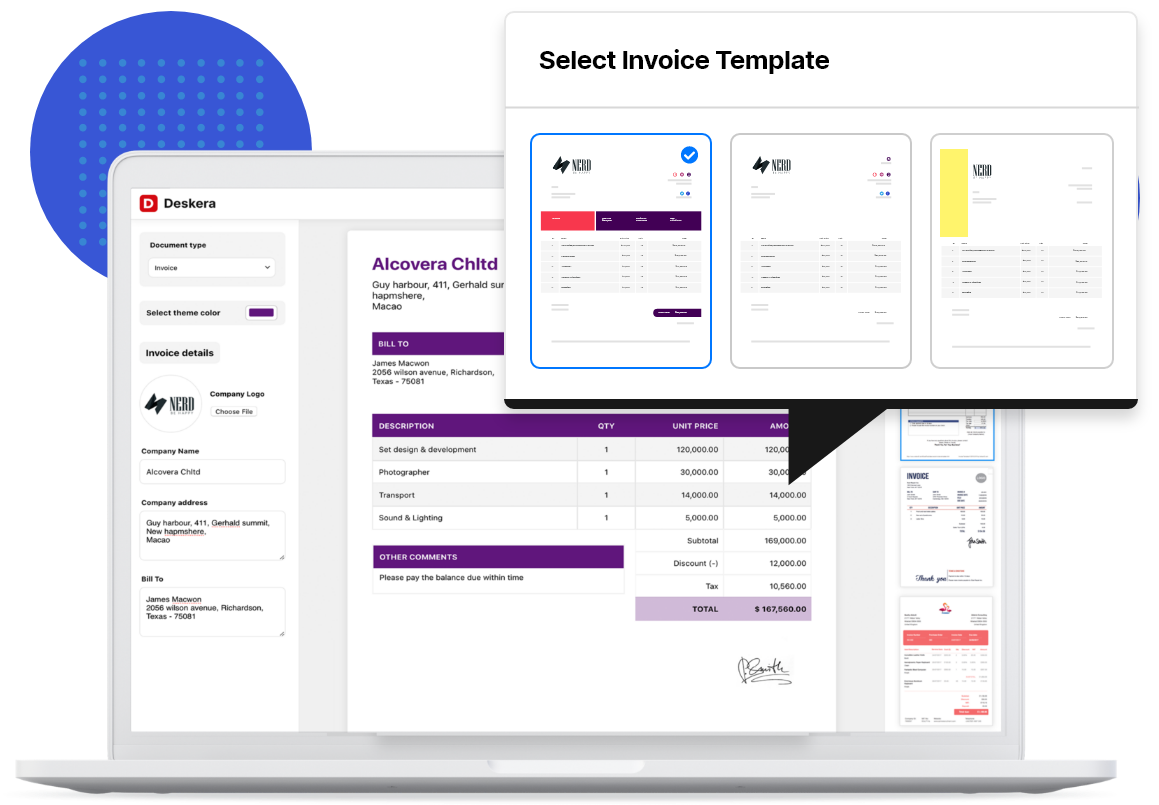

You can use invoicing software like Deskera to pick an invoice template, customize it with the necessary information, send it and get paid in minutes.

We’ll talk more about how to automate invoicing with accounting software, as we go along. But first, let’s learn more about the main uses of an invoice.

What Is An Invoice Used for?

The most basic use of an invoice is to serve as a record of a sale. However, there are other purposes and benefits of invoicing, such as:

- To track inventory. Sale invoices allow businesses to track how much inventory they have, along with how much they will need in the future.

- Bookkeeping. Invoices record when a good or service was sold, to who, and for how much. This helps both buyers and sellers track payments.

- Legal evidence. Invoices serve as legal proof of the details of an agreement between two parties. They protect the business from any potential false lawsuits.

- Tax filings. Keeping proper track of your invoices helps the business record its income, and file for the right amount of taxes.

- Business analytics. Through analyzing invoices you can find out the most in-demand goods and services, peak buying time periods, customer buying patterns, and so much more. In the long-run, this helps you develop effective marketing strategies for your business.

What Elements Does An Invoice Include?

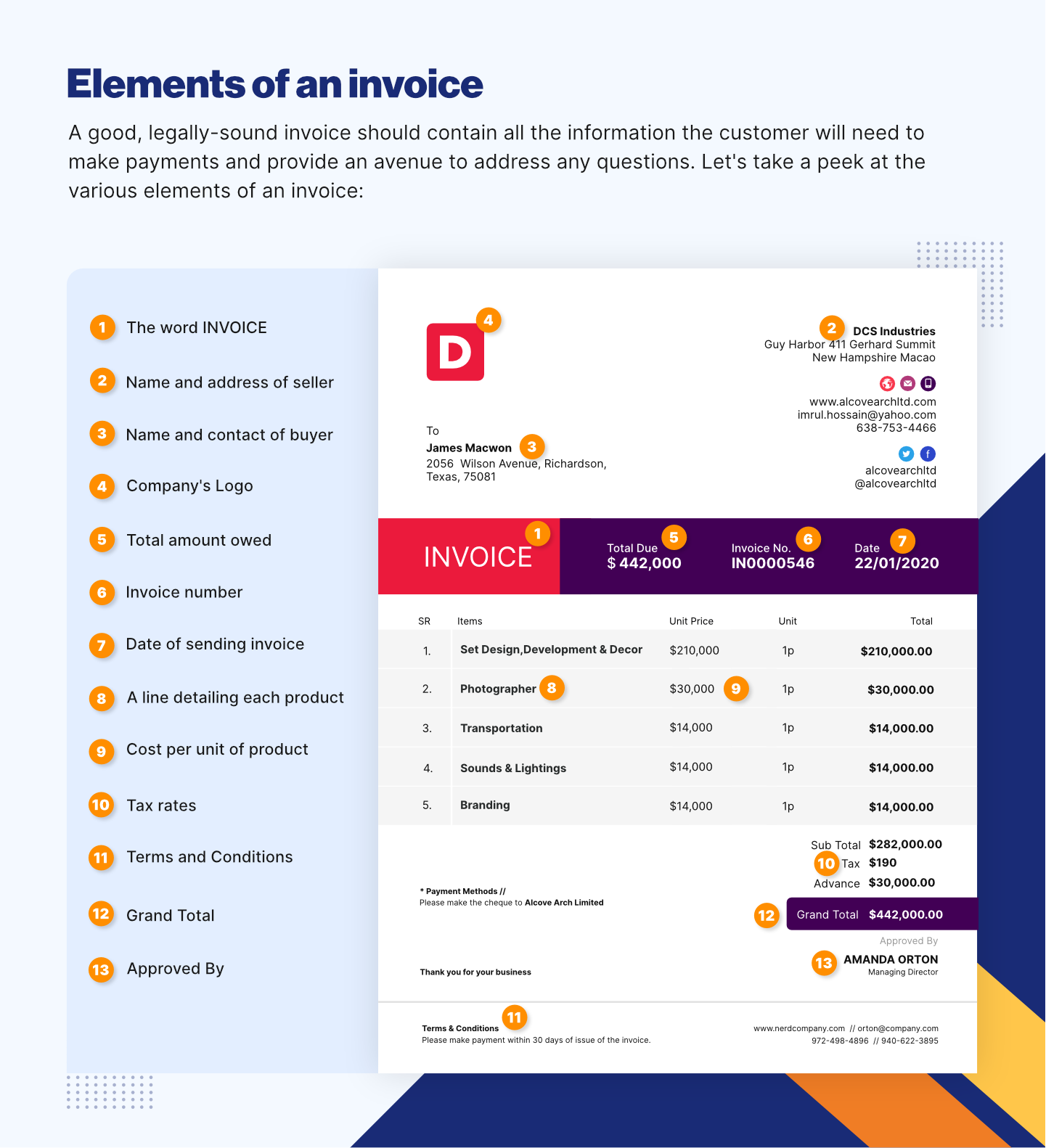

A professional invoice has to be a comprehensive and easy to read document that contains all of the appropriate details on services and payments. These details also determine whether an invoice is considered legal or not. The main elements of an invoice are:

- A header with the word INVOICE in clear, professional text.

- Business contact information. Includes the business name, billing address, and phone or fax number.

- Customer contact information. Include the customers’ name and billing address.

- Invoice ID or number. Also known as the reference number, this element is a unique code inserted at the top of every invoice, in order to distinguish different invoices from one another.

- Name and description of product or service. This is a line describing the name and type of product being sold.

- The cost per unit represents how much one unit of product costs.

- The billing date represents the date when the invoice is issued.

- The due date represents the date by when an invoice should be paid.

- The total amount owed.

- The terms of payment explain the time span the seller has to pay, late payment fees, and any other additional payment discounts or charges.

The template below showcases all of the previously mentioned elements an invoice should include:

How to Assign an Invoice ID?

To assign an invoice ID, you need to choose a practical and easy to remember numbering system. This step is very important because it prevents errors or duplications of invoice IDs, which can cause your business to waste a lot of time, money, and potentially even get caught up in legal issues.

The most commonly used invoice numbering method businesses use is sequential, where you just count up by one with every new transaction that happens.

For instance, if the first transaction is recorded as Invoice no: 0000000001 then the following one would be Invoice no: 0000000002, and then Invoice no: 0000000003 and so on.

Another popular system applied to assign invoice numbers is chronologically by date. If the date is October 25th, 2020, then the first transaction of the day would be recorded as 20201025-0001, 25102020-01, or any other preferred variation.

Other variations of invoice numbering systems include beginning with the client number, project number, or simply using accounting software to automate the job for you.

If you want to learn more about generating these invoice IDs, check out our guide on what is an invoice number and how to generate it.

Different Types Of Invoices

Depending on the different customers and projects, there are several types of invoices you will have to prepare. Keep in mind though, that while there may be variations of invoices, the elements we previously mentioned are consistent in every invoice model.

Without further ado, let’s get into the nits and grits of each different type of invoice. The most commonly used invoices in business are:

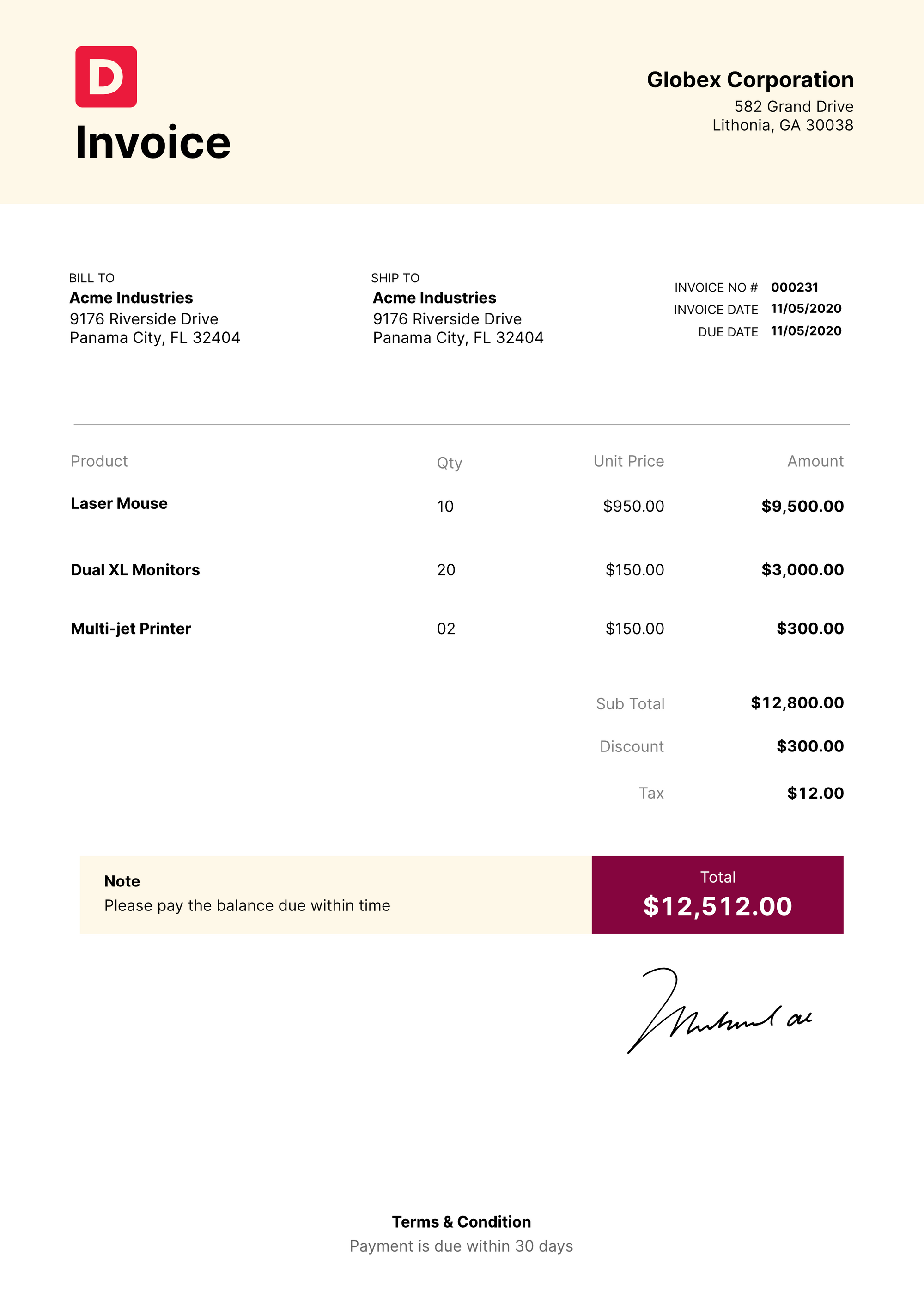

1. Standard Invoice. Just like the name suggests, the standard invoice is the most basic, as well as, the most common type of invoice used in business. It includes all of the essential elements of an invoice and finds a place in almost every industry and billing cycle.

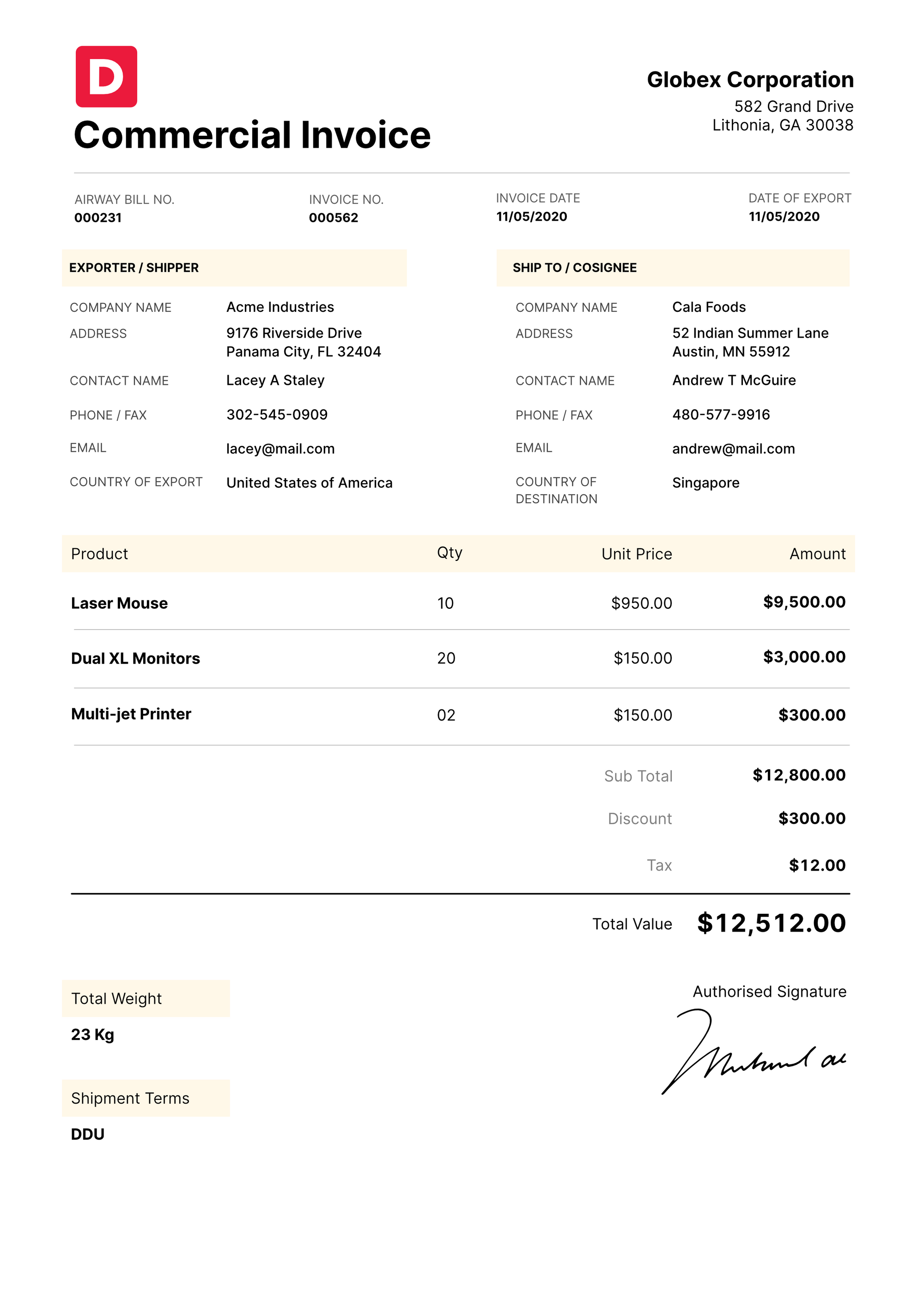

2. Commercial Invoice. When your business sells a product internationally, it needs to send a commercial invoice. This bill includes extra details needed for crossing the border such as country of origin, date shipment, the weight of the product, and more.

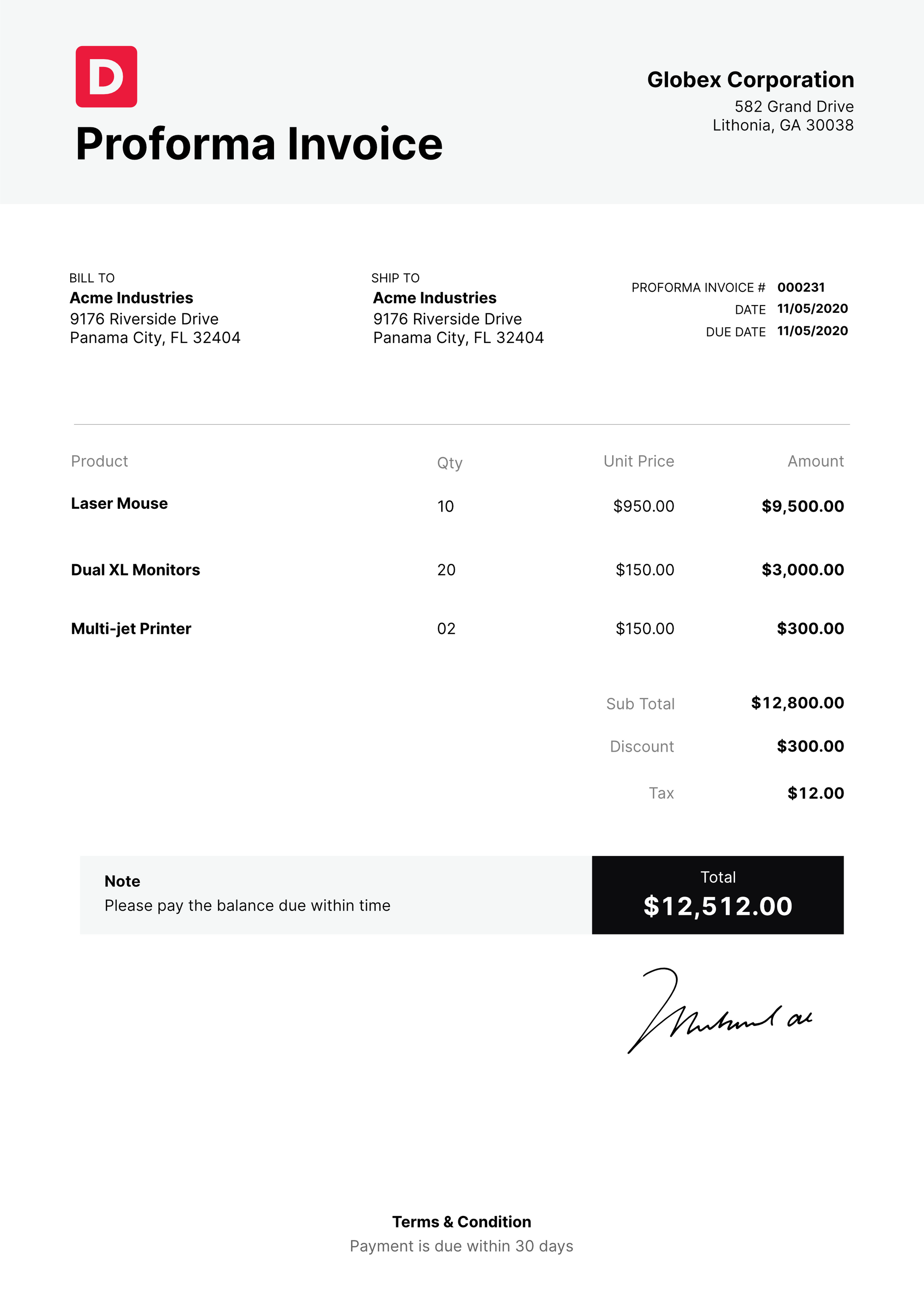

3. Pro-forma Invoice. This type of invoice is sent before a project is completed, but not as a demand for money. It’s an estimate of how much the project will cost once it’s finished. It prepares the buyer for the amount they have to pay in the future. The pro-forma invoice does not represent the definitive charge and it may change once the project is done.

4. Recurring invoices are used by businesses that charge customers the same amount for ongoing services, such as memberships or subscriptions. It’s especially relevant for all SaaS.

5. Past due invoice. When your clients don’t send the owed cash on time, you can remind them by sending out a past due invoice. A past due invoice includes all the information that a normal invoice has, plus any extra late fee charges.

6. The final invoice lets the client know when a project is done and includes a detailed description of the services provided and total cost.

Automate Invoicing Using Online Invoicing Software

Creating invoices in Excel or using Word templates to manage invoices has grown old for a reason. From remembering what reference number comes next, to figuring out whether an invoice has been paid, the whole manual process can be quite the chore.

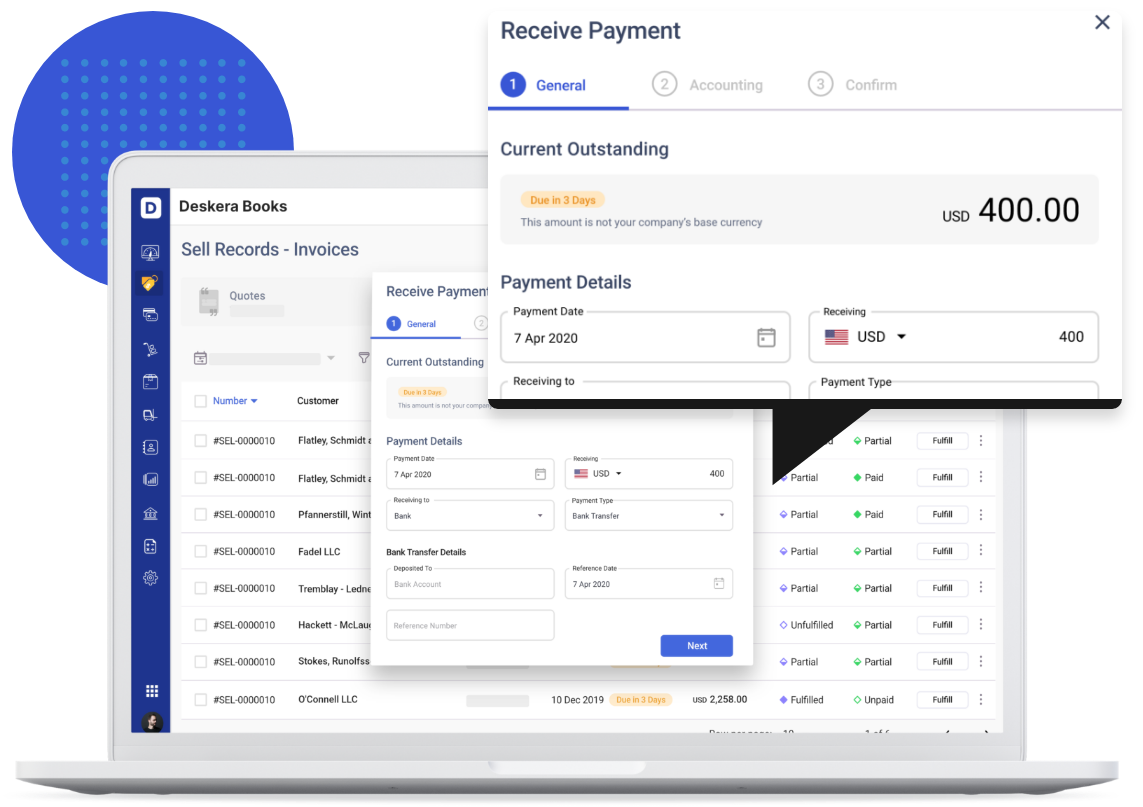

Cloud-based accounting and invoicing software like Deskera puts an end to all of these frustrations.

Deskera offers premade professional invoice templates you can customize with your preferred colors, fonts, images, and business logo. After creating a professional branded invoice template once, you can re-use it for all your invoices, with only a click.

Sending these invoices to your customers is just as ridiculously simple. All you have to do is select the customer, product, quantity, and any discounts that apply. Then press the send invoice button, and you’re done in a matter of seconds!

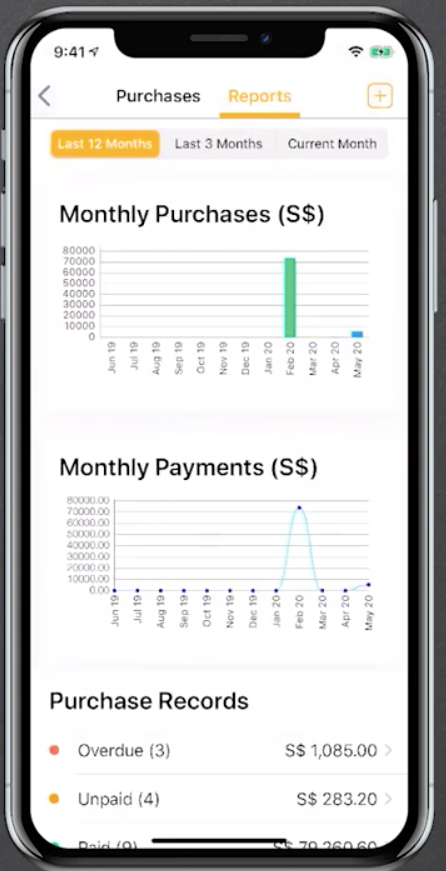

If you want to get an overview of how sales are going, Deskera automatically creates yearly and monthly reports for you. These reports also constantly notify you of any overdue or unpaid invoices.

The best part? You can access the software anytime, anywhere, by simply downloading the Deskera app on your mobile, tablet, or computer.

Still not convinced Deskera is the right choice for your business? Try the software out yourself, with our completely free trial!

6 Essential Tips For Invoicing

- Choose an invoice management system. It’s best for your business to ditch spreadsheets and paper and go for cloud-based invoicing software instead.

- Input all of the client information (name, email, billing and mailing addresses, and payment method) on the software. This way, you don’t have to input the clients’ contact details every time you’re sending invoices.

- Keep your invoices professional and polite. Always use “please” and “thank you” when requesting payments.

- Send out your invoices as soon as a project is done, or a service provided.

- If a client refuses to pay you on time, hold or stop the work until they do.

- Consider early payment discounts, and late payment fees to encourage clients to pay you on time.

Key Takeaways

And that’s a wrap to our invoice guide! Here are the key points we covered:

- An invoice is a document issued by a seller to a buyer, to specify the payment details of a good or service.

- Invoices are useful because they serve as a record of sale as well as legal proof of an agreement. They also track inventory and help with proper tax filings and business analytics. The essential elements an invoice includes are:

- A header with the word Invoice.

- Business contact information.Customer contact information.

- Invoice ID or number.

- Name and description of product or service.

- Cost per unit.

- The billing date.

- The due date.

- The total amount owed.

- The terms of payment.

- Use cloud-based invoicing software like Deskera to manage your business’ invoices.

Related Articles