Texas has the tenth most reliance on sales taxes in the US, according to the Tax Foundation, but the fifth least burdensome state-local tax burden. In one way or another, Texans pay state and local taxes.

Given that Texans want wealth and freedom, the best tax system is one that imposes the least amount of hardship on economic activity while funding limited government spending. You've come to the right place if you're still struggling to figure out how to withhold and pay taxes when reporting payroll in Texas. Following are the topics covered:

- What are employment taxes?

- Texas Payroll Taxes and laws

- How to Do Payroll in Texas?

- Texas Tax Exemptions and Exclusions

- Texas Unemployment Insurance Components

- Key takeaways

What are employment taxes?

Employment taxes are federal and state taxes levied on taxable wages paid to employees. Income tax withholding based on information submitted on Form W-4 by employees. Employees are the only ones who pay this tax.

Employers and employees both pay a portion of this, which is made up of Social Security and Medicare taxes. The Social Security element is known as Old Age, Survivors, and Disability Insurance, or OASDI, and it pays benefits to retirees, spouses, and former spouses, as well as dependent children in some situations and disabled people under the age of retirement.

The Medicare part entitles those 65 and older (as well as some other individuals) access free Part A Medicare coverage, as well as coverage through Parts B, C, and D for a additional fee.

Federal unemployment tax (FUTA), which is paid entirely by employers; state unemployment tax, which is paid entirely by employers, with the exception of a few states that require some employee contributions.

Texas Payroll Taxes and laws

In Texas, owning a small business means taking advantage of significant tax breaks and a manageable payroll tax burden. The following are the most important terms to understand while filing payroll taxes in Texas:

Federal Income Tax

Employees' paychecks have income tax withheld to offset what they will owe in federal income tax for the year. Employees' income taxes, as well as Social Security and Medicare taxes, are included. It also contains an extra Medicare tax for certain employees.

Federal income taxes are the first of two federal payroll taxes that Texas employees must pay. Depending on their withholding choices on IRS Form W-4, your employees must withhold a certain amount for income tax. Income taxes on the federal level might range from 0% to 37% by 2021.

Employers must withhold state income tax from employees' paychecks in all states except Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming, which have no income tax and New Hampshire and Tennessee (until 2020), which do not tax wages. Income taxes are also levied in some places, such as New York City and Philadelphia, resulting in additional wage withholding.

Other withholding is necessary in a few regions to cover

- Unemployment benefits

- Paid family leave

- Short-term disability

Additional Medicare Tax

Depending on an employee's filing status, an additional Medicare tax must be paid. When an employee's pay surpasses $200,000, the employer is required to deduct an additional amount to cover the increased Medicare tax. This tax is 0.9 percent of earned income above a certain level ($250,000 for joint filers, $200,000 for single filers, and $125,000 for married taxpayers filing separately).

The employee is completely responsible for paying this tax; the employer's role is limited to withholding it. Employees are responsible for paying the Additional Medicare tax, which is the second federal-level tax.

In Texas, employers must withhold the 0.9 percent Additional Medicare Tax from employees who meet specific filing requirements, as well as from wages over $200,000 per year.

State Unemployment Tax

States are responsible for paying unemployment compensation to workers who are laid off involuntarily (those laid off other than for gross misconduct or who are furloughed).

Employers pay an unemployment tax to help pay for this liability. Because the rate that firms pay is based on their claims experience, the tax is calculated more like insurance. The greater the tax rate on such employers, the more claims filed by former employees. Every year, the state notifies an employer of its tax rate, which must never go below a certain threshold.

Unemployment Insurance (UI) Tax

While Texas does not have a state income tax, there are a number of additional taxes you should be aware of. Employers must pay unemployment insurance tax on the first $9,000 of their employees' annual wages. The exact rate at which UI taxes are levied varies from year to year and is determined by five factors:

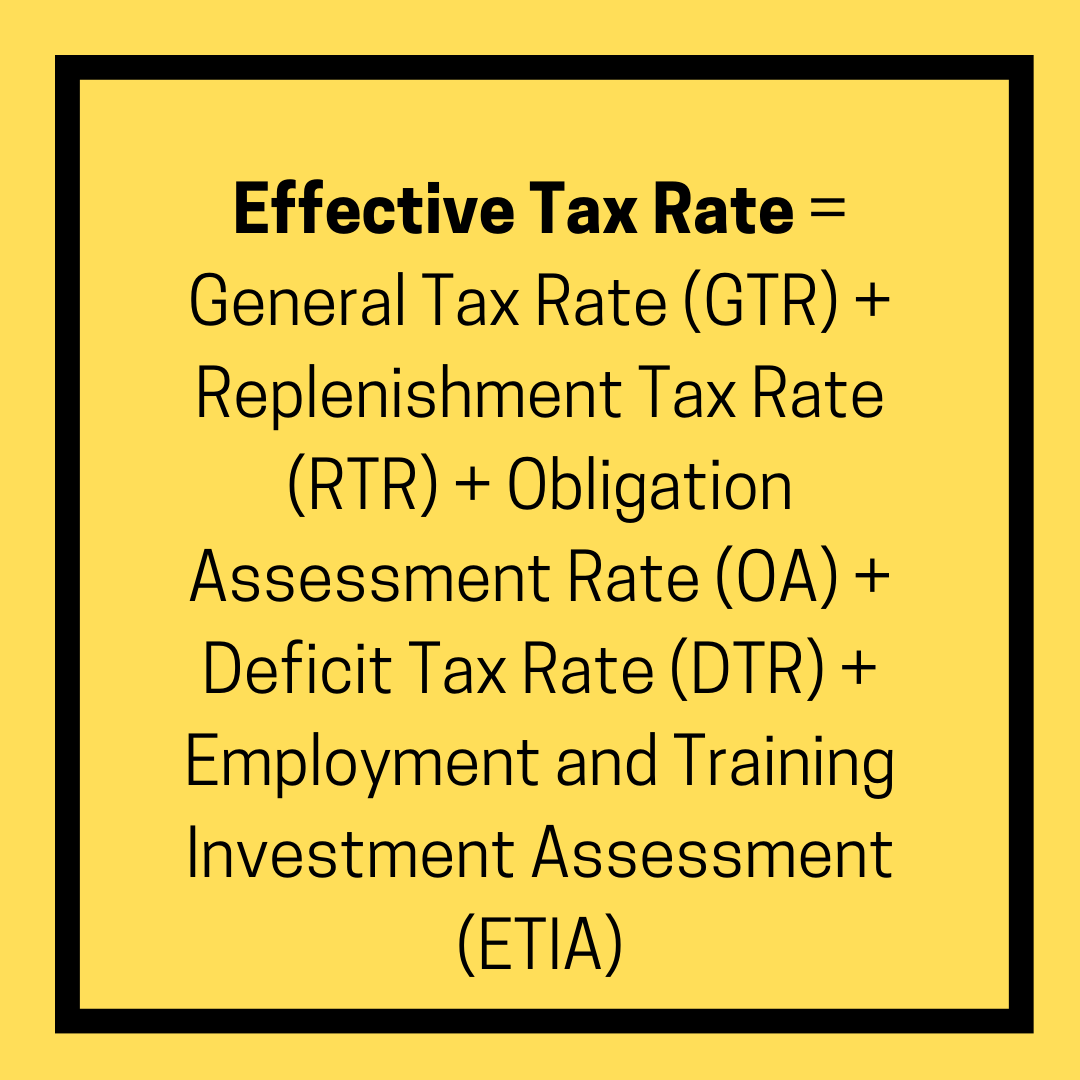

General Tax Rate (GTR), Replenishment Tax Rate (RTR), Obligation Assessment Rate (OA), Deficit Tax Rate (DTR), and Employment Training Investment Assessment (ETIA). The taxable pay base of your employees' first $9,000 in compensation is used to calculate UI rates, which normally range from 0.31 percent to 6.31 percent.

Property Tax

The comptroller's office in Texas does not collect property taxes or determine property tax rates at the state level. Property tax money can be used to support schools, towns, and local policing and firefighting in Texas local units that are set up to collect property taxes.

Federal Insurance Contributions Act (FICA) Tax

Employees and employers are affected by the Federal Insurance Contributions Act (FICA) tax, which includes the Social Security and Medicare taxes. The Federal Insurance Contributions Act (FICA), which funds Social Security and Medicare levies, requires both small business owners and their employees to pay taxes.

In Texas, employers and employees pay 6.2 percent of all earnings up to $132,900 in Social Security taxes; Medicare taxes are 1.45 percent of both an employer's and employee's total earnings in a year. Rates change annually as a result of IRS directives, and it's important to keep track of them even as you gain more comfortable submitting Texas payroll taxes.

Estate Tax

Texas is one of 38 states in the United States that does not levy an estate or inheritance tax on its citizens. In Texas, neither the state nor the municipal governments share in the proceeds of willed or inherited property.

Sales and Use Taxes

No small business owner can begin managing their payroll taxes without first learning about their state's sales and use tax rates. Texas's state sales use tax rate is now 6.25 percent, but cities, counties, districts, and other local taxing entities can apply an extra 2% rate, bringing the total sales use tax rate to 8.25 percent. Businesses in Texas are required to collect sales and use taxes at both the state and municipal levels, and should consult their local sales and use tax rates for more information.

Federal Unemployment Insurance Act (FUTA)

The federal government does not pay unemployment benefits, but it does assist states in providing them to employees who have been fired involuntarily.

The Federal Unemployment Tax Act (FUTA) is a tax that was intended to fund this assistance to the states. Each employee's first $7,000 in wages is exempt from the tax. Employers are required to donate 6% of their employees' first $7,000 in annual earnings to the federal unemployment tax (FUTA). FUTA encourages business owners to check to see whether they are eligible for a federal tax credit to help fund the program.

If a state borrows from the federal government to satisfy its unemployment benefits liability and does not repay the funds, the credit is reduced. The state is then referred to as a "credit reduction state," and the credit reduction (shown on Schedule A of Form 940) indicates the employer is required to pay more FUTA than usual.

When applicable, business owners should also consider court-ordered salary garnishments, child support payments, and employee contributions to accounts. Employers in Texas are required to deduct the necessary sums from their employees' paychecks and submit them on time to the appropriate authorities.

New Hire Reporting

Business owners must report new hires to the Texas Office of the Attorney General's Employer New Hire Reporting Operations Center, which is governed by both federal and state law.

Employers are mandated by law under the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 to disclose information on their new hires to the Center within 20 calendar days of the hire date.

If you're not familiar with reporting any new hire information in Texas or any other U.S. state, keep in mind that if an employee is required to file a W-4 form, you most certainly need to record their new hire information. Employers who fail to comply with their new hire reporting obligations will be fined $25 for each instance in which they fail to do so.

Employers who conspire with employees to purposely file a fraudulent or incomplete new hire report might face penalties of up to $500.

Texas New Hire Reporting

- ENHR Operations Center

P.O. Box 149224

Austin, TX 78714-9224 - Phone: 800-850-6442

- Fax: 800-732-5015

Texas Minimum Wage

Texas employs the federal minimum wage rate of $7.25, which it accepted in 2009, and there are no signs of a minimum wage hike in the near future. Employers should pay tipped employees a minimum wage of $2.13 and a maximum tip credit of $5.12. Employers can count tips, as well as the cost of food and housing, toward their minimum wage at their discretion and subject to certain conditions.

Anyone who operates a business in Texas is required to display a poster that contains information on the Worker's Compensation Program, the Uniformed Services Employment and Reemployment Rights Act, the Fair Labor Standards Act, the Employee Polygraph Protection Act, and the Occupational Safety and Health Act to educate employees on labor law topics such as the minimum wage.

In addition to their state posters, businesses in Texas are required to print and post the Department of Labor's mandated posters.

Reemployment Tax

The Texas unemployment insurance tax, often known as the reemployment tax, ensures that benefit payments are made on time and that the Unemployment Compensation Trust Fund remains sustainable. The minimum reemployment tax rate in Texas is 0.31 percent, with a maximum rate of 6.31 percent.

Employers must pay the Texas unemployment insurance tax on the first $9,000 each of their employees earns in a calendar year.

Employers must also contribute to the FUTA scheme to pay reemployment tax at the federal level. Texas employers pay federal reemployment taxes, with the possibility of receiving tax reductions of up to 5.4 percent in the form of a federal tax credit.

Labor Laws in Texas

Employment discrimination, child labor, overtime, minimum wage, and other issues are all covered under Texas labor laws. Employers must be aware of the Texas Child Labor Law, Texas Payday Law, as well as the state's minimum wage and overtime rules.

Texas does not have any labor regulations governing overtime pay. However, federal overtime requirements apply in Texas, and extra compensation is set at 1.5 times an employee's usual pay rate. Employers in Texas are required by the Fair Labor Standards Act (FLSA) to pay overtime to employees who work more than 40 hours per week.

Texas has no labor regulations requiring the state to provide meals, breaks, or severance compensation, and the federal government does not oblige the state to do so. Employers who provide breaks in Texas must still pay employees if the breaks are less than 20 minutes long, and employers who provide severance compensation must follow the rules of their company policy or the applicable employment contract.

Texas employs child labor laws to limit kids' work opportunities. Child labor laws in Texas require that workers under the age of 16 be subjected to work hour restrictions and that minors work fewer hours while school is in session.

Child Labor Laws In Texas

In Texas, child labor rules apply to any person under the age of 18, and it is prohibited to hire anyone under the age of 14 unless special circumstances exist.

For minors working in non-hazardous casual employment, the Texas Child Labor Law provides general exemptions to hours worked: 11 years or older distributing newspapers; 16 years or older selling newspapers in public; participating in school-supervised work-study programs; working in a county-supervised rehabilitation program; or working in agriculture during the school year.

The hours of lawful employment for children vary depending on their age. Children between the ages of 16 and 17 do not face restrictions on the number of hours or times of day they can work. Children aged 14 to 15 years old, on the other hand, are limited to working for no more than 8 hours per day and no more than 48 hours per week.

Employees aged 14 and 15 may not work during school hours and may only work up to 18 hours per week while school is in session, according to the federal Fair Labor Standards Act.

PTO Policy in Texas

Employers in Texas are able to create policies or contracts that set aside a certain amount of vacation time for their employees. Employers aren't obligated by law to provide company-wide PTO plans, and any vacation or PTO policies they do adopt must comply with the Texas Labor Code.

To both simplify PTO tracking in payroll management software and cap time-off accruals to discourage rollovers that may exceed an accrual cap, business owners may rely on a "use it or lose it" basis.

It's not uncommon for companies, particularly small business owners with only one or two employees, to provide PTO for a variety of "unofficial" reasons, such as holiday time and jury service, as well as voting and bereavement leave. Employers are not required to provide PTO for these reasons, but it is common practice for firms to decide at least certain scenarios in which their employees may be compensated for hours not worked.

Insurance for Workers' Compensation

Workers' compensation insurance is not needed for employers in Texas. Although Texas does not require companies to provide state-regulated workers' compensation insurance, it is customary for private employers to provide coverage to deal with work-related injuries or illnesses.

You risk having to pay for any costs associated with personal injury lawsuits or missing or partial employee salaries if you don't have workers' compensation insurance.

Employees have up to 30 days to notify their employer if they've been hurt or become unwell at work, according to Texas workers' compensation legislation. Employees then have up to a year to file their formal workers' compensation claim paperwork. Employers have only eight days to notify their employee's insurer about their claim. Employees may need to see a doctor to be eligible for workers' compensation payments, depending on the situation.

Disability Insurance

FICA withholding for Social Security and Medicare benefits applies to disability insurance. Employers in Texas are required to deduct a set amount from their employees' salaries at the end of each pay period.

Employers and employees in Texas are required to contribute 6.2 percent of any earnings up to $132,900 under the Social Security tax component of FICA tax regulations. Employers must match an employee's contribution and donate the cash to the Social Security Trust Fund to support disability insurance, Medicare benefits, and retirement income, according to FICA standards.

Payment Obligations

The Texas Payday Law, formerly known as the Texas Payment of Wages Act, outlines the payment requirements that firms must follow when paying employees throughout the year.

The law only applies to public employers, not private or independent contractors, and it specifies how those public companies can pay their employees. Payments for PTO or sick leave, as well as severance and even parental leave pay, are all considered wages under the Texas Payday Law.

Employers must pay any employee who is classified as an executive, administrative, or professional employee under the FLSA at least once a month in Texas. All other sorts of employees must be paid twice monthly by law, with paydays falling on the first and fifteenth days of each month unless an employer specifies otherwise.

Employers can only pay their employees on paydays through electronic transfers, checks, or cash, unless an employee agrees in writing to an other method of payment.

Employers in Texas are liable for paying garnishments on behalf of their employees, in addition to paying employees in accordance with the Texas Payday Law. Garnishments are court orders or IRS levies that direct employers to deduct a set amount from an employee's paycheck in order to pay off debts.

How to Do Payroll in Texas?

You now have a firm grasp on the tax words you must remember when processing payroll, as well as the legalities and computations that go into reporting appropriate payroll taxes.

Now that you have a better understanding of what you'll need to set up and run your own payroll system, it's time to consider what makes payroll processing tools and features stand out from the crowd.

Let's look at some of the payroll tools and services accessible to business owners who want to make administering their own payroll easier:

Step 1: Double-check that you're adhering to the Texas Payroll Laws.

For current Texas payroll legislation, we recommend reading the first section of this article. To recap, Texas has a simple set of payroll tax regulations that are reasonably simple to follow when it comes to filing payroll taxes.

Business owners must do their homework and follow all of Texas' payroll requirements to the letter, especially because they are exempt from state income taxes.

Texas is a large state, but it has a small number of payroll taxes. The only state-level payroll tax in Texas is for unemployment insurance, which is paid by the employer in addition to federal unemployment and income taxes, as well as the Additional Medicare tax.

Step two: Collect documentation from employees

Employee paperwork is essential for correctly entering data in the appropriate columns on an employee's slot in your payroll administration system. After researching Texas payroll tax rules, you'll need the right employee documentation, such as your W-4 form, W-2 form, and I-9 form.

- The Form W-4 gives business owners the information they need to figure out how much to withhold from employee wages for federal income tax contributions in Texas. Remind your staff that they need to amend their W-4 tax forms to reflect recent life changes.

- Employers must use Form I-9 to verify that their employees are legally able to work in the United States. I-9s must be completed on the first day of employment, and employers must complete their component of the I-9 within three business days following that.

- The IRS requires companies to deliver Form W-2 salary and tax statements to their employees at the end of each year. Employers must provide a W-2 for each employee who receives a salary or wage under the terms of employment.

Step 3: Work Out Your Employee's Salary

These days, sophisticated payroll software may make calculating an employee's compensation one of the most straightforward aspects of filing payroll taxes. With features like time sheets, attendance systems, and digital times that allow you to track the working hours of various employees, payroll software can make things easier.

In general, determining employee compensation on your own is most practical if your company has a small number of hourly or salaried employees.

If this is the case, remember to account for any gratuities received by your employees, as well as their commission, PTO/sick leave, and overtime compensation, in addition to their regular salaries and hourly rates.

Step 4: Payroll Taxes are deducted.

It's time to figure out how much federal and state taxes each of your employees owes and subtract them from their pay. The following are the most essential taxes that Texas employers must deduct:

Taxes on Federal Income: Calculate your employee's total federal income tax withholding using their Form W-4 and withholding choices. The amount of withholding is determined by a variety of factors, including an employee's earnings and filing status.

- Texas Unemployment Insurance: Unemployment insurance is paid on the first $9,000 of an employee's earnings each year and is covered by Texas' only state-level payroll tax. UI rates normally range from 0.31 percent to 6.31 percent, depending on the year, and are calculated using the taxable salary base of an employee's first $9,000 in earnings.

- FICA: The Social Security and Medicare taxes have an impact on employee and employer earnings. Social Security contributions are 6.2 percent of wages up to $132,900. Employees and employers both pay a 1.45 percent Medicare tax on all earnings.

- Additional Medicare Tax: Depending on an employee's filing status, an additional Medicare tax must be paid. Every year, the 0.9 percent Additional Medicare tax is deducted from employee wages of more than $200,000.

- Contributions to a savings account: Employers are responsible for sending their employees' contributions to social welfare programs like as health and life insurance, as well as retirement plans and 401(k)s.

Step 5: Payroll Processing

You're almost ready to give your staff their paychecks. You can either handle your paychecks manually or use the considerably speedier technique of direct deposits once you've determined your tax withholding and net pay for your employees. For each employee you'll be paying, you'll need to complete a one-time setup for your direct deposit system.

Although you can outsource your paycheck distribution to a third party, it's also a smart idea to use your payroll software system to automate the process yourself, especially if your company only has a few employees.

Step 6: Remember to Keep Records

It's well worth your time to set up a system for storing pertinent personnel information and documents. For example, if an employee quits or is dismissed, you'll probably want to keep their earnings information on hand. Details like these should be included in your payroll records:

- Employee's full name and Social Security number

- Address and ZIP code

- Employee's schedule

- Total hours worked each day by employee

- Type of pay

- Paycheck deductions

- Overtime and other forms of compensation

- Payment schedules and dates

Texas Tax Exemptions and Exclusions

You may be able to claim tax savings on Texas properties if you are legally entitled to them. School districts are obligated by Texas law to provide a $25,000 exemption on all residence homesteads, with counties having the option to provide their own exemption of up to 20% of the homestead's appraised value.

Texas provides comprehensive exemptions for veterans and their families. Depending on their age and the severity of their disability, disabled veterans may be eligible for a $12,000 exemption, while their surviving spouses may be eligible for the same exemption as the veteran at the time of his or her death.

In Texas, senior and disabled residents may be eligible for tax advantages, including a $10,000 exemption from school taxes. In some taxing districts, citizens who are disabled or over the age of 65 may be eligible for a bigger exemption from school taxes.

Payroll Calculator for Texas

When it comes to computing federal payroll taxes, here's what you need to know. Check out our step-by-step guide for a more in-depth look at each of the federal payroll tax components.

- Gross Earnings:

-Multiply all of your hourly employees' hours worked by their pay rate. Don't forget to include any hours worked overtime!

-Divide each employee's annual wage by the number of pay periods per year for all salaried employees.

- If your employees contribute to 401(k), FSA, or other pre-tax withholding, deduct them. Simply deduct their contributions from their gross earnings before paying payroll taxes.

- Subtract the federal income tax, which ranges from 0% to 37%. On the IRS website, you may find detailed withholding information.

- Deduct (and match) FICA taxes:

-Withhold 6.2 percent of each employee's taxable salary for Social Security tax purposes until they have earned a total of $147,000 for the year. You, as an employer, must also pay this tax.

-Withhold 1.45 percent of each employee's taxable pay for Medicare tax purposes until they earn a total of $200,000 for the year. This tax will be paid by you as well. Withhold a 0.9 percent Additional Medicare Tax from employees earning more than $200,000 per year. The Additional Medicare Tax is solely the responsibility of the employee.

- Pay the FUTA Unemployment Tax of 6% of your first $7,000 in taxable income. You may be entitled for a tax credit of up to 5.4 percent if you pay state unemployment taxes on time and in full. Employers are the only ones that have to pay FUTA taxes.

- Subtract any post-tax deductions, such as child support, wage garnishments, and so on. If relevant, the court will send you a letter detailing the amount of the deduction.

Texas Unemployment Insurance Components

The aggregate of five components determines your effective Unemployment Insurance (UI) tax rate.

The amount of tax you pay is determined by multiplying your effective tax rate by your taxable wages. Your taxable wages are the total of all wages paid to employees up to $9,000 per year.

The first four tax rate components contribute to the Unemployment Compensation Trust Fund's continued liquidity and proper funding of benefit payments.

General Tax Rates

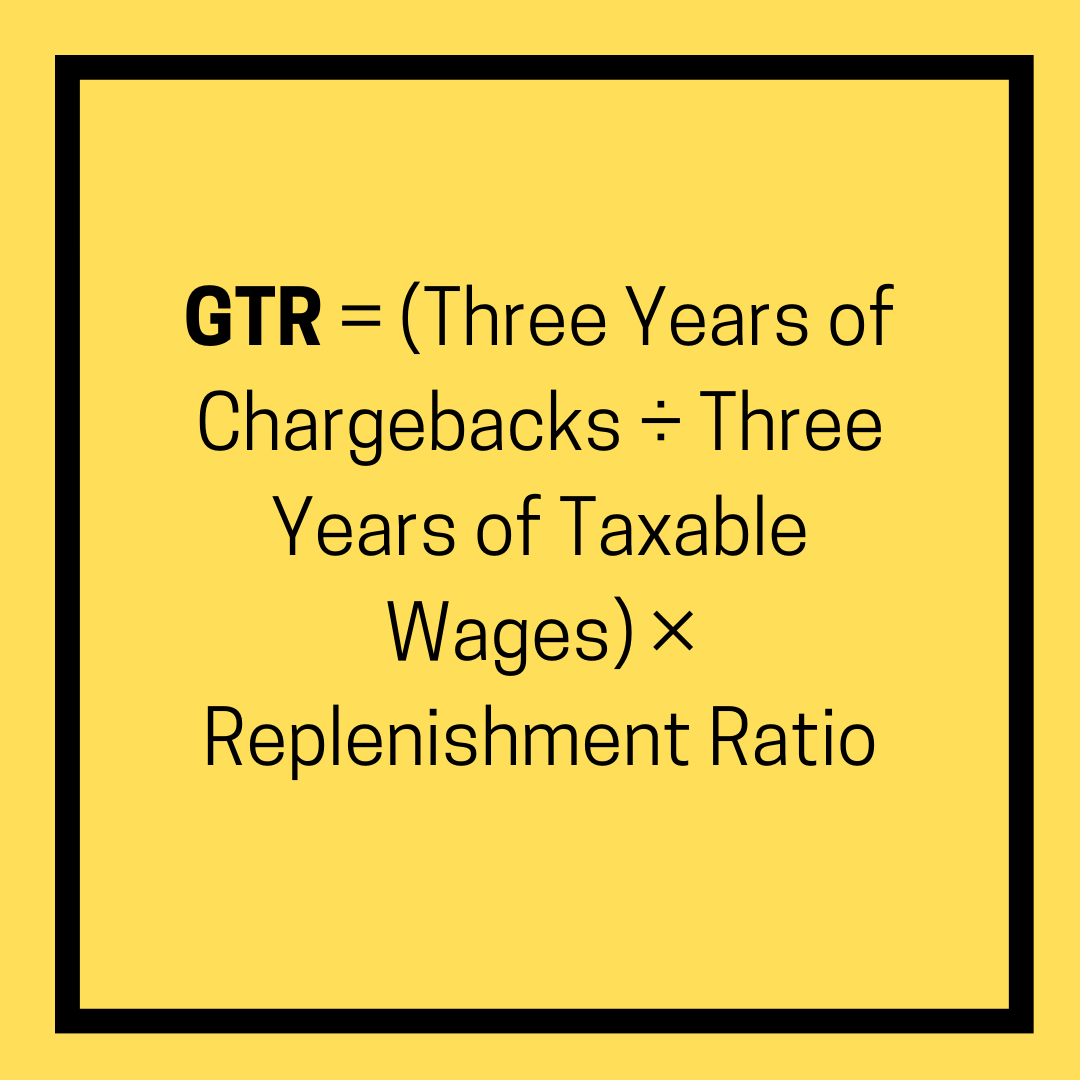

The General Tax Rate (GTR) is the first component of your effective UI tax rate; it is a tax that reflects your company's individual responsibility for repaying benefits paid to former employees. The GTR is the portion of your tax that is based on your experience.

It's called experience-rated since it's based on charge backs, or benefits paid to former employees of your company and debited to your account.

Your GTR is computed by multiplying your benefit ratio by 1.38 percent, which is the replenishment ratio for 2022. The replenishment ratio's goal is to reclaim half of the benefits paid to qualified workers that were not invoiced to a specific employer. The outcome of dividing the last three years of charge backs to your account by the last three years of taxable earnings provided to your employees is your benefit ratio.

The tax rate for 2022 was calculated over a three-year period, from the fourth quarter of 2018 to the third quarter of 2021.

Your general tax rate is zero if you have had no charge backs in the last three years and have reported and paid taxable earnings during that time (0.00 percent). TWC calculates the GTR each year using the following formula:

Be warned that failing to report and pay UI taxes on time might have a negative impact on your GTR.

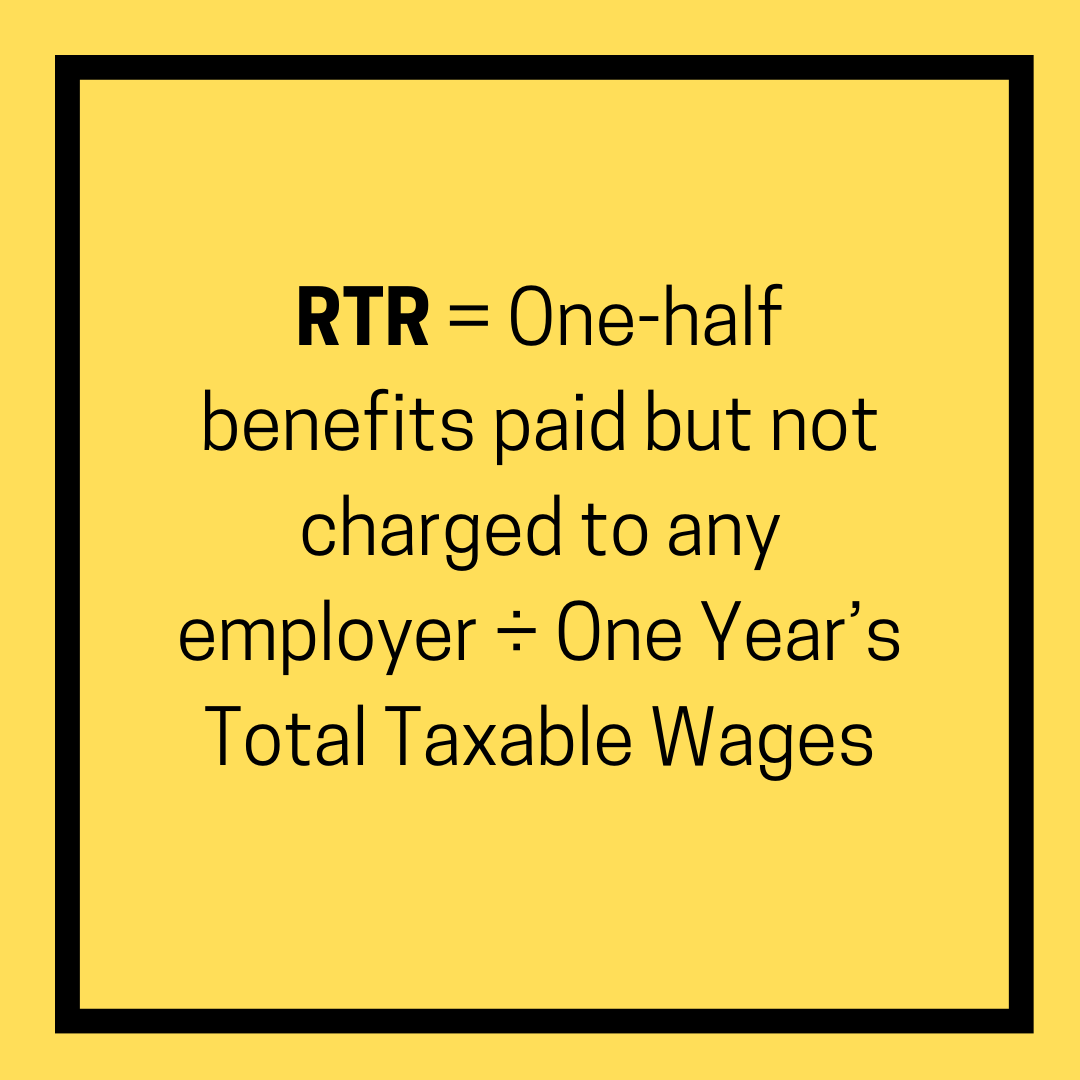

Replenishment Tax Rate

The Replenishment Tax Rate (RTR), a flat tax paid by all employers, is the second component of your UI tax rate. Its goal is to refill the Unemployment Compensation Trust Fund to cover the other half of the benefits awarded to eligible workers that were not billed to a specific employer.

Because no single company may be held accountable for these benefits, the Legislature decided to divide the expense among all companies with experience ratings. TWC determines the RTR each year using the following formula:

For 2022, the RTR is 0.20 percent. This RTR was lowered by.10 percent to account for the Employment and Training Investment Assessment (ETIA) component, which is discussed further below.

Unemployment Obligation Assessment Rate

The Unemployment Obligation Assessment is the third component of your tax rate (OA). The OA's goal is to collect funds to settle bond obligations as well as interest on federal loans to Texas that were used to pay unemployment benefits.

The Bond Obligation Assessment Rate and the Interest Tax Rate are added together to form the OA.

Bond Obligation Assessment Rate

This formula determines the Bond Obligation Assessment Rate:

(Prior Year Rate x Obligation Assessment Ratio) x Yield Margin percentage, rounded to the nearest hundredth. The sum of your 2021 General Tax, Replenishment Tax, and Deficit Tax is your prior year rate.

The Commission determines the Yield Margin and the Obligation Assessment Ratio (percentage). Those two variables are the same for all OA-eligible firms.

The Obligation Assessment Ratio (OA Ratio) for 2022 is 0.00%.

The OA Ratio is determined using the following formula:

OA Ratio = Principle, interest and administrative expenses due in 2022 on outstanding bonds ÷ Tax due from the General and Replenishment tax rates for the four quarters ending June 30th of the previous year

The result is rounded to the hundredth decimal place.

The Yield Margin for 2022 is 0.00 percent. The Yield Margin is decided by the Commission.

For 2022, there is no Bond Obligation Assessment Rate.

Interest Tax Rate

If interest on federal loans to Texas is payable, the Interest Tax Rate is utilised to pay unemployment benefits. In any given year, this percentage will be the same for all employers. The Commission Rule is used to determine the interest tax.

In 2022, the interest tax rate will be 0.01 percent.

Deficit Tax Rate

The Deficit Tax Rate is the fourth component of your tax rate (DTR).

A DTR is applied for the next calendar year for each experience-rated employer if the amount of money in the Unemployment Compensation Trust Fund on a tax rate computation date is less than a predetermined minimum level.

This formula determines the Deficit Tax Rate:

Prior Year Rate x Deficit Ratio, rounded to the nearest hundredth (limited to 2%)

The Deficit Tax Ratio in 2022 is 0.00%.

For 2022, there is no Deficit Tax Rate.

Employment & Training Investment Assessment

The Employment and Training Investment Assessment is the sixth component of your tax rate (ETIA). As a separate assessment of 0.10 percent of wages received, the assessment is imposed on each company paying contributions under the Texas Unemployment Compensation Act.

The proceeds of the assessment are put in the employment and training investment holding fund's account. The Replenishment Tax Rate is decreased by the same amount by law, therefore your tax rate will not increase as a result of this assessment.

Effective Tax Rate

In 2022, the minimum tax rate will be 0.31 percent.

In 2022, the maximum tax rate will be 6.31 percent.

The first $9,000 earned by each employee during the calendar year is subject to unemployment tax. Your taxable wages are the total of all wages paid to employees up to $9,000 per year.

How Deskera Can help You?

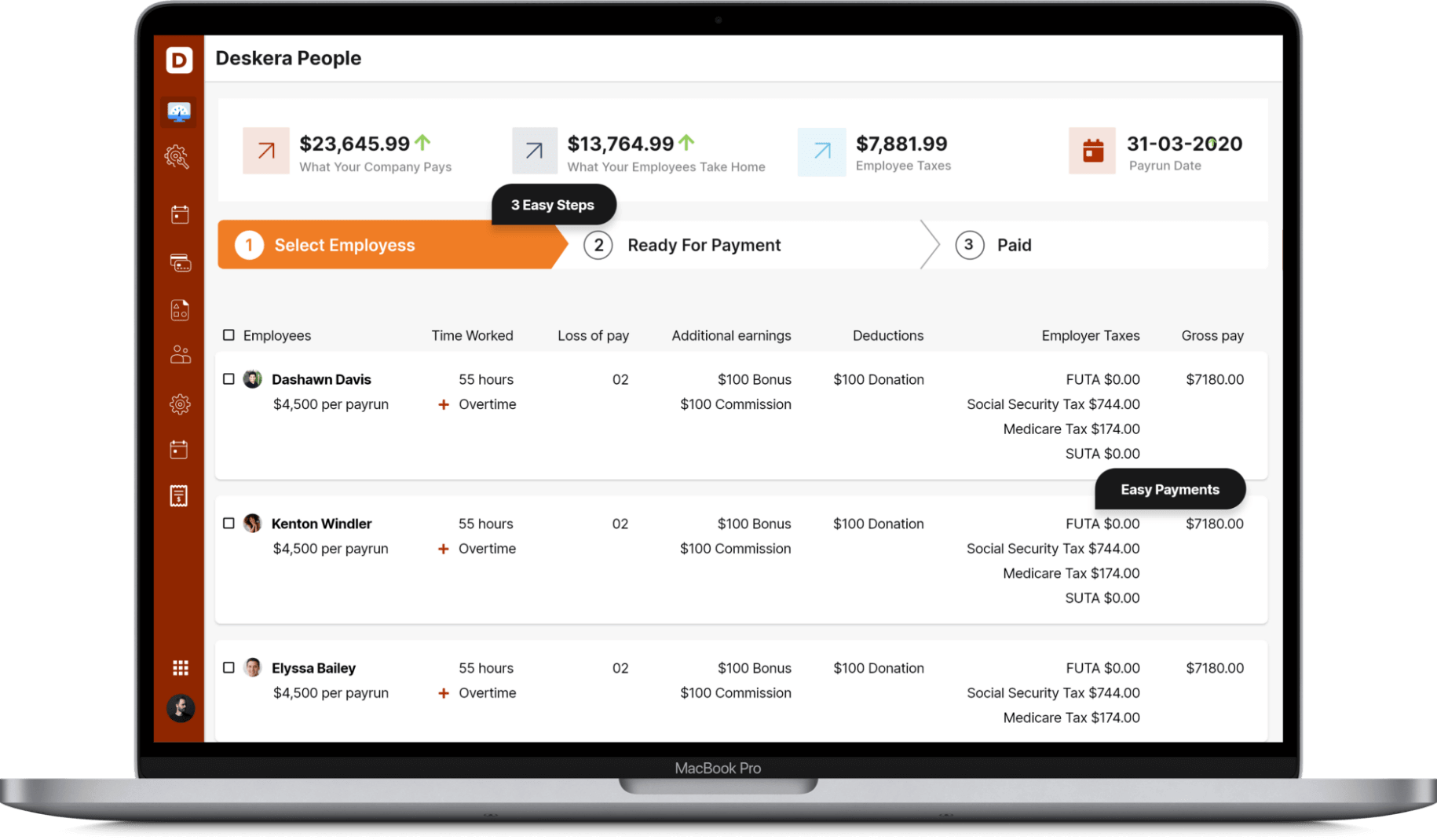

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key takeaways

- Texas payroll tax regulations are unique in that they only require one state-level tax from employers: unemployment insurance (UI). Employers, even small business owners, are exempt from reporting state income taxes on behalf of their employees, as well as submitting employee income taxes at the local level.

- You now understand the most crucial aspects of implementing and managing a payroll system that is easy to use. It's understandable that you'll need some time to get started on tax reporting more rapidly, but it'll only be a matter of time before you feel secure and in command.

- In most circumstances, employers are required to deposit and report employment taxes on a quarterly basis. Employees' paychecks are withheld to satisfy income taxes (federal, state, and local, if appropriate), as well as the employees' part of Social Security and Medicare taxes (FICA).

Related articles