The Ease of Compliance to Maintain Registers under Various Specified Labor Laws Rules 2017 was released by the India Ministry of Labor and Employment, Government of India (Ministry) (Ease of Compliance Rules). Under India's Ease of Compliance Rules, an employer can keep five different types of combined registers, one of which is the Wage Register.

This article focuses on Tamil Nadu Form R Wage Register and its components. Here’s what we will cover:

- Tamil Nadu Shops and Establishments Act, 1947

- Form R - Wage Register

- Form – R

- Exemptions from Registration for the Act

- Compliance for the Act

- Key takeaways

Tamil Nadu Shops and Establishments Act, 1947

All stores and commercial establishments in the regions declared by the Tamil Nadu Government are subject to the Tamil Nadu Shops and Establishments Act, 1947 and Rules, 1948.

The Act was passed in order to defend the rights of employees.

The Act regulates wages, terms of service, work hours, rest intervals, overtime work, opening and closing hours, closed days, holidays, leaves, maternity leave and benefits, working conditions, rules for child employment, and record-keeping, among other things.

"Shop" refers to any location where a trade or business is conducted or where customers are served, and includes offices, store rooms, godowns, and warehouses, whether on the same premises or elsewhere, that are used in connection with the business, but excludes a restaurant, eating-house, or commercial establishment.

"Commercial Establishment" means an establishment that is not a shop but engages in the business of advertising, commission, forwarding, or commercial agency, or a clerical department of a factory or industrial undertaking, or an insurance company, joint stock company, bank, broker's office, or exchange, as well as any other establishments that the State Government may declare to be a commercial establishment for the purposes of this Act by notification.

"Establishment" includes any shop, commercial establishment, restaurant, eating-house, residential hotel, theater, or other place of public amusement or entertainment that the State Government may declare to be an establishment for the purposes of this Act by notification.

Form R - Wage Register

Name of person employed, Gender, Designation or Nature of work, Wage Period - Weekly / Fortnight / Month, Total number of days worked throughout the Week / Fortnight / Month, Overtime and Wage Break-up

Fines

Anyone other than the employer who imposes a fine or orders a deduction for damage or loss must immediately notify the employer of all details so that the register required by sub-rule (4) can be properly filled.

(a) The employer of any establishment for which he has obtained approval under sub-section (1) of section 35 to a list of acts and omissions for which fines may be imposed shall keep a Register: Provided that the signature or thumb-impression of the person employed shall be obtained in [the Register prescribed under sub-rule (4)] immediately on the next working day following the last day of the month concerned.

(b) The approved purpose or purposes for which the fines realized are to be spent shall be entered and serially numbered at the beginning of the [Register established under sub-rule (4)].

(c) If any disbursements are made from the fines collected, the amount so spent must be deducted in the [Register stipulated under sub-rule (4)]. The vouchers or receipts for the sums so spent must be serially numbered and stored separately, with the serial number of each voucher or receipt and the amount to which it corresponds recorded in the register's notes column.

(d) If multiple purposes have been approved, the disbursements must be recorded with the purpose for which they were made. Every employer must keep a Form P record of fines, deductions for damages or losses, and advances:

Provided, however, that the signature or thumb impression of the person hired be obtained in [Form P] on the next working day following the month's last day.

In his establishment, every employer must keep a wage register in [Form R].

(e) Every month, a day prior to the disbursement of wages or at least on the date of disbursement or if the wages are paid daily, a Wages Slip in Form T shall be issued by every employer to every person employed, along with the wages, duly signed by him or any other authorized person and also the signature of the concerned person employed. The employer must keep copies of all wage slips issued and present them to the inspector upon request.

Advances

(a) Any loans, whether made before or after the Act's enactment, as well as all repayments of such advances, must be recorded in a register.[Form P prescribed under sub-rule (4) of rule 11]

Provided, however, that the person employed's signature or thumb impression be obtained in [the Register in Form P] on the next working day following the month's last day.

(b) Maintaining registers and records, as well as posting notices – [Every employer is required to keep a Form Q Employment Register.]

Before the persons employed therein begin work, the employer shall post in a conspicuous location a notice in [Form S] showing the names of the persons employed, daily periods of work, rest interval, and weekly holiday, and send a copy of the same to the Assistant Inspector of Laborers having jurisdiction over the area.

(c) No employer shall require or allow any person employed in his establishment to work in his establishment without displaying a notice in [Form S] in respect of him and sending a copy of it to the Assistant Inspector of Labor concerned, and shall not require or allow him to work other than according to the work periods and weekly holidays shown therein:

Provided, however, that employees may be forced to perform overtime in compliance with the Act if entries in the employment record detailing the periods of such overtime work are made before the work begins:

(d) In exceptional circumstances and due to unforeseen circumstances, when a notice of change could not be sent to the Assistant Inspector of Labor prior to allowing or requiring any person/persons employed to work otherwise than in accordance with the notice in [Form S], it will be deemed sufficient compliance with the rules if the notice of change has been exhibited simultaneously while allowing him to work subject to the payment of overtime wages, in accordance with the provisions of the Act and Rules, entries being made to the employment register.

(e) Every employer shall post in his workplace a notice including such portions of the Act and these Rules as the Government may require in English and the language of the majority of his employees.

(f) Any notice needed to be displayed under these rules must be displayed in a way that anybody who is affected by it can easily see and read it, and it must be reissued if it becomes defaced or otherwise ceases to be plainly legible.

(g) The entries for every day in any register or record that an employer is required to keep under these rules must be made on that day.

(h) Any calendar year's registers, records, and notices must be kept until the end of the following calendar year.

Except as indicated in sub-rule (5), all registers, records, and notices required to be kept, exhibited, or given under this rule must be kept, exhibited, or given in either English or the language of the majority of the establishment's employees.

(i) Every employer must keep a visit book in which any inspector visiting the firm may record his notes about any problems that may come to light during his inspection, and must produce it whenever any inspector with jurisdiction requests it.

The Act/Rules require that the registers be kept up to date.

a) Advance Paid Register, Deduction for Damages or Losses, and Fines in "Form P"

b) Employment Register in "Form Q"

b) Wage Register in "Form R"]

Amendments to the Rules

The Governor of Tamil Nadu made the following amendments to the Tamil Nadu Contract Labor (Regulation and Abolition) Rules in exercise of the powers conferred by Section 35 of the Contract Labor (Regulation and Abolition) Act, 1970 (Central Act 37 of 1970) and in supersession of the Labor and Employment Department Notification No. SRO A-2/2006, published at pages 2 to 6 of Part III—Section 1(a) of the Tamil Nadu Government Gazette, dated the 11th January 2006

(1) Section 35 of the aforementioned Act AMENDMENTS (1) The expression "or the Register of Wages-cum-Muster Roll, as the case may be" shall be omitted in rule 73;

(2) in rule 75, for the expression "register in Form XIII," the expression "register of Employment in Form XXVI" shall be substituted;

(3) rule 76 shall be omitted;

(4) in rule 78,

(a) for the marginal heading, the following marginal heading shall be substituted, namely: "Register of Wages"

(b) in sub-rule (1)

(i) In place of clause (a), the following clause shall be used: "(a) Every contractor shall keep a Register of Wages in Form XXVII for each project on which he engages contract labor";

(ii) in place of clause (b), the following clause shall be substituted: "(b) Every contractor shall issue wage slips in Form XXVIII to the workmen at least a day prior to the disbursement of wages, where the wage period is one week or more." The employer must keep copies of the wage slips supplied to the workers and produce them to the Inspector upon demand "

(iii) in the clause

(c), the expression "or Muster Roll-cum-Wages Register, as the case may be" shall be omitted; (iv) after clause (c), the following clause shall be added: "(c) Every contractor shall keep a Register of Advances, Deductions for Damage or Loss, and Fines in Form XXIX for each work on which he engages contract labor."

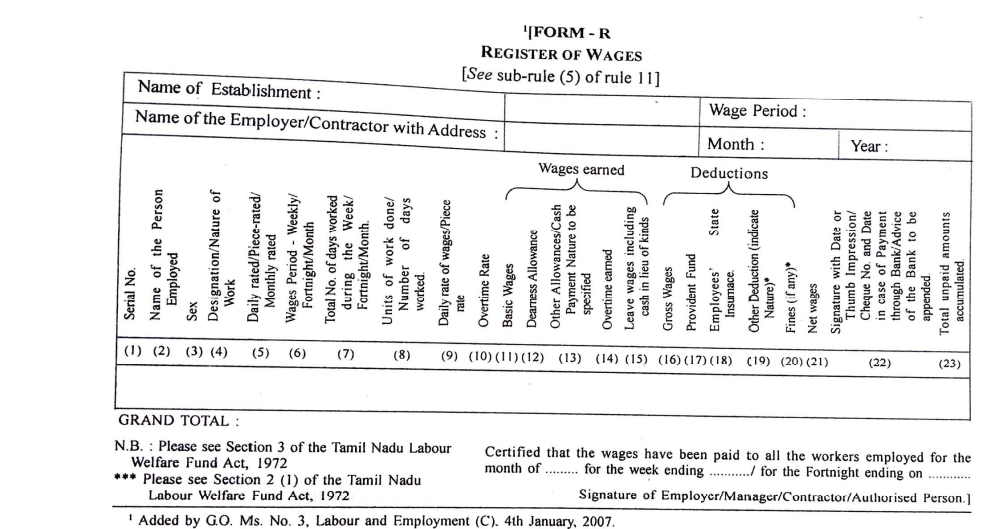

Form - R

Register of Wages consists of the following components:

Name and Address of the Establishment

Name and Address of the Employer

(1)Name of the Person Employed

(2)Sex

(3)Designation

(4)Daily Rated/Piece Rated/Monthly Rated

(5)Weekly/Fort Night/Month

(6)Total No of days worked during the week/FN/Month

(7)Units of work done/No of days worked

(8)Daily rate of wages/Piece rate

(9)Wages Earned Deductions

(10)Basic Wages

(11)DA

(12)Other Allowances/Cash Payment/Nature to be specified

(13)OT Earned

(14)Leave wages including cash in lieu of kinds

(15)Gross Wages

(16)Provident Fund

(17)ESI

(18)Other Deductions (indicate nature)*

(19)Fines (if any)*

(20)Employee Name

(21)Signature with Date or Thumb Impression / Cheque No and Date in case of Payment through Bank / Advice of the Bank to be appended

(22)Total unpaid Amounts accumulated

(23)OT rate

Exemptions from Registration for the Act

The following organizations are exempt from registering under this Act:

• Persons employed in a supervisory position in any firm;

• Persons whose employment requires travel: and those who work as canvassers and caregivers;

• establishments under the Central and State governments, local governments, the Reserve Bank of India, a railway administration operating any railway as defined in clause (20) of Article 366 of the Constitution, and cantonment authorities;

• Establishments in mines and oil fields;

• establishments in bazaars in places where fairs or festivals are held temporarily for a period not exceeding fifteen days at a time;

• establishments that are governed by a different legislation for the time being in force in the State in respect of subjects dealt with in this Act, but are not factories within the terms of the Factories Act, 1948.

Compliance for the Act

- Form B - Register of Fines

- Form C - Register of Deductions

- Form D - Register of Advances made to Employees

- Form H - Record of Hours of Work of Persons

- Form P - Register of Advances paid, Deductions for damages or losses and fines

- Form Q - Attendance Register with Leave Credits

- Form R - Wage Register

- Form S - Register of Employees with Hours of Work

- Form T - Wage Slip

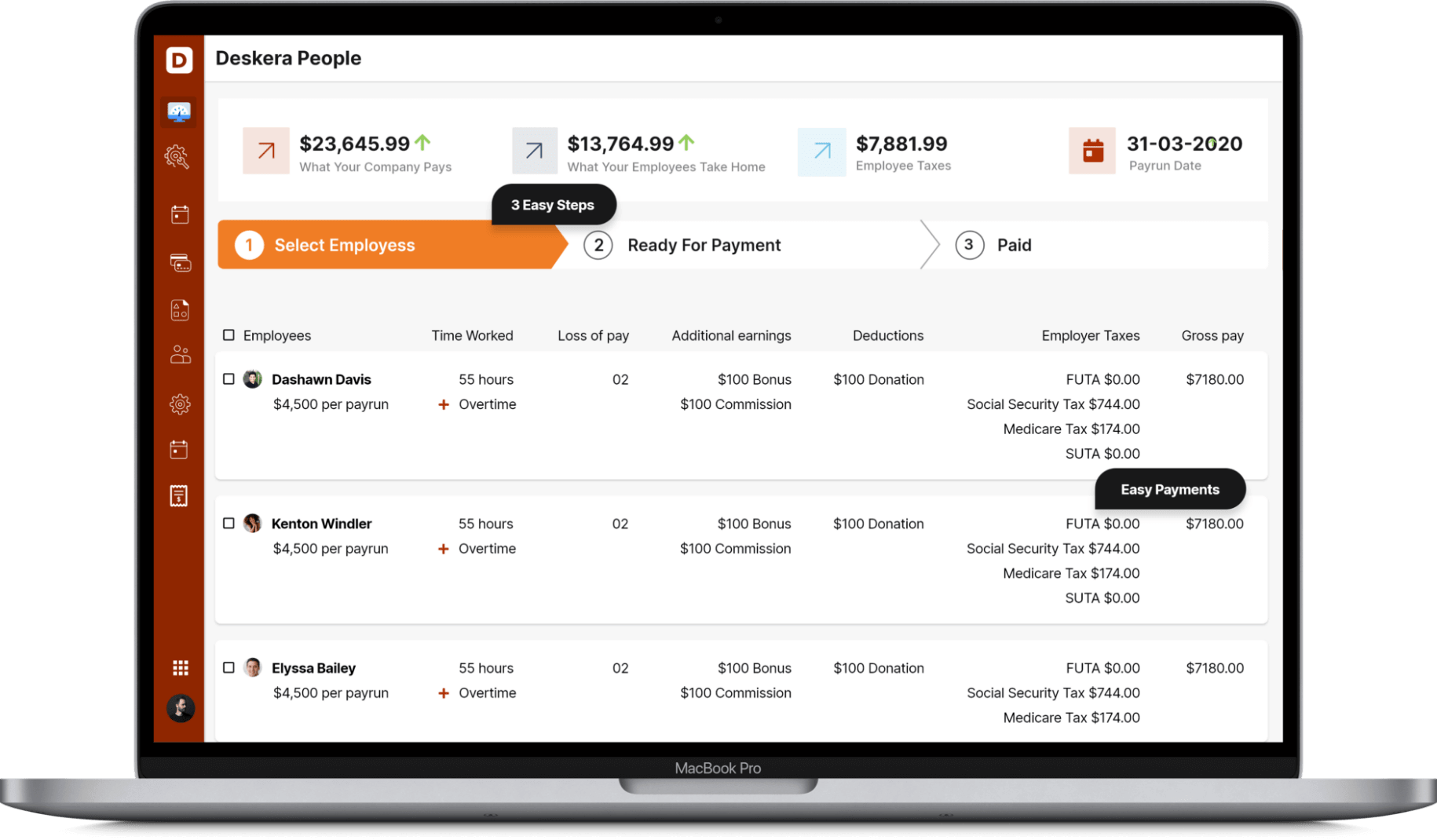

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

- Employee information, wage rate, basic wage, dearness allowance, overtime wage, other cash payments, total earnings and deductions, net amount, and time/date/place of payment are all included in the Wage Register. For a salary period, the employer must keep a register in the format provided.

- An Act to regulate working conditions in stores, commercial establishments, restaurants, theaters, and other businesses, as well as for other purposes.

- The Shops and Establishments Act (SEA) governs most Indian enterprises and their employees. Wages, working hours, holidays, earned leaves, child labor, women's rights, and other areas of work are all governed by this legislation.

- If the business is located inside municipal limits, the Shop Act is a legal necessity. It's applicable even if you're running a business out of your house or apartment. You must apply for either Shop Act Intimation or Shop Act Registration online, depending on the number of employees.

Related Articles