One of the most important responsibilities of the West Bengal Department of Labour's Commissionerate is to enforce the West Bengal Shops and Establishment Act, 1963.

States have implemented Shops and Establishment Acts to control workplace conditions and provide for statutory obligations of employers and employee rights in the unorganized employment sector.

Furthermore, it is an act that incorporates and amends the law governing the regulations of working and employment conditions in commercial establishments, shops, and other establishments.

In this article, we will discuss all aspects related to West Bengal Shops and Commercial Establishment Act, 1963 and Form B Application for Registration.

Let’s take a look on what we’ll cover further:

- Overview: West Bengal Shops and Commercial Establishment Act

- Register Elements: Shops and Establishment

- FORM B: Application for Registration

- Difference between Shop and Establishment

- Who is in charge of enforcing the shop and establishment act?

- Definitions & Non-Applicability

- Important Features: Hours of Work/Young Persons & Women/Wages/Leaves

- Registration and Appointment

- Exemptions

- Fees & Penalty

Let’s Start!

Overview: West Bengal Shops and Commercial Establishment Act

The West Bengal Shops and Establishments Act, 1963, was enacted on 2nd April 1963 and it became effective from 15th August 1964. It covers the entire state of West Bengal. It is enacted as social welfare legislation and aims to regulate certain conditions of service of the employees.

As stated previously, this Act was passed in order to preserve the rights of employees.

Moreover, the Act regulates certain aspects. It includes terms of service, wages, work hours, opening and closing hours, closed days, rest intervals, overtime labour, maternity leave and benefits, holidays, laws for child employment, leaves, working conditions, and record-keeping, among other things.

Register Elements: Shops and Establishment

The following are the four elements of the Shops and Establishments Register that must be kept:

Part I: Shops

Part II: Commercial Establishments

Part III: Restaurants, Residential Hotels, Cafes, and Eating House

Part IV: Cinemas, Theaters, and other places of public amusement or entertainment

FORM B: Application for Registration

Following we have provided the specimen of Form B, which is the application for registration:

Click and Download the Form B Application for Registration

Difference between Shop and Establishment

A shop, according to the Act, is a location where a consumer can buy goods or services. Examples include storerooms, offices, warehouses, and go downs.

On the other hand, Establishments include all residential hotels, restaurants, theaters, commercial facilities, and other public amusement activities.

Who is in charge of Enforcing the Shop and Establishment act?

The Shop and Establishment Act is enforced by the Labour Departments of various states. The Act applies to all retailers and commercial establishments in the state.

Moreover, individual states are responsible for issuing the registrations, which vary from one state to state.

Definitions & Non-Applicability

Definition-I:

We have discussed the following terms in detail:

Establishment

An establishment for people's amusement or entertainment includes theater, restaurants, hotels, cinema, and more.

It also encompasses any other categories or types of businesses or operations that the State Government shall designate to be for the purposes of this Act. The Government informs that by notice after evaluating the structure of their operations.

Note that it does not include any commercial establishments or shops.

Commercial Establishment

A commercial establishment is a facility where a trade, business, profession, or similar work is carried out.

It includes the industrial or commercial undertaking, joint-stock company, insurance company, clerical department of a factory, commission, advertising, or commercial agency, and more.

Moreover, it includes any other type or groups of enterprises or undertakings that the State Government, after considering the nature of their operation, may designate to be commercial establishments for the purposes of this Act by notification.

Remember: Commercial Establishment does not include shops or establishments for public amusement or entertainment.

Shop

Any facility that is operated entirely or partially for the selling of services to consumers or the retail and wholesale sale of products or items.

It includes any storerooms, go downs, offices, or warehouses utilized in conjunction with the sale or the warehousing of commodities or products for the objective of sale.

Moreover, it includes any other class or kinds of facilities that the State Government may designate to shop for the purposes of this Act by notification. They also do so after considering the type of job done there, however, this does not involve an establishment.

Shopkeeper

Any individual who owns, operates, or is in charge of a shop and includes an agent or manager

Young Person

Any individual who has completed his fourteenth year but not surpassed the eighteenth year.

Definition-II:

Employed Person: It defines an individual who is employed but does not include the owner or relatives of the owner

Wages: It means salary or wages as defined in the Payment of Wages Act 1936

Non-Applicability

It shall not apply to Offices of Central or State Government:

It includes any airways service, railway service, tramways, or motor service, postal, telegraph or telephone services, any industry, water transport service, any system of public conservancy or sanitation, business or undertaking which supplies power, light, or water to the public and those are operated by or under the authority of Central or State Government or Public Sector Undertakings.

Important Features: Hours of Work/Young Persons & Women/Wages/Leaves

Following we have listed some crucial features of the West Bengal Shops and Establishments Act. Check below:

Hours of Work

Check the following working hours and related information for both shop and establishment:

Work Hours at the Shop:

- The shop must open after 8 a.m. and close before 10 p.m.

- No individual may work for more than five and a half hours in a day without taking at least one hour of rest.

- No one recruited shall work more than eight and a half hours per day, forty-eight hours per week. Also, they should not work after shops' closing hours.

- Working hours and relaxation periods should not exceed ten and a half hours in a single day.

Hours of Work in-Establishment:

- Close before or up to 11 p.m. in any hotel or restaurant.

- No individual may work for more than five and a half hours in a day without taking at least one hour of rest.

- No one recruited shall work more than eight and a half hours per day, forty-eight hours per week, or after the shop's closing time.

- Working hours and relaxation periods should not be separated by more than ten and a half hours in a day.

Young Persons & Women And Leaves Applicable

Young Persons Special Provisions:

- It is not allowed for any young person to work above seven hours per day or forty hours per week.

- Will obtain advantage as available in other acts They shall not work above four hours in a day without rest of at least an hour.

- Will obtain advantage as available in other acts

- Any children above the age of 14 years are not allowed to work.

Women Workers

Other than a cinema or theater, no woman worker shall work after 6 p.m. in any facility for public amusement or entertainment. And after 8 p.m. at shops or establishments.

- For every year of length of service completed, a fourteen-day privilege leave with full pay is granted. The maximum accumulation is 28 days.

- Paid sick for fourteen days at half pay with a medical certificate The maximum accumulation to 56 days.

- Maternity benefits are available to women.

- For ten days, you can take a casual leave with full compensation (no accumulation allowed)

Wages

- Overtime payments are calculated at double the regular rate of pay.

- Salaries must be paid and retrieved by the tenth day of the next month after the month in which they are due.

- Overtime includes any work performed on a day that has been proclaimed a national holiday by notification.

- In the event of non-payment within the specified time frame or improper deductions, such a person has six months to file a complaint with the competent authority.

- After considering both parties and conducting further investigation, the authority known as the referee can initiate a direction to pay back wages in the event of non-payment, as well as remuneration not exceeding ten times the amount asserted in the case of deductions and not surpassing ten rupees in the case of non-payment.

- The applicable amount may be reclaimed by a magistrate in the event of non-compliance with the order.

- An aggrieved party has thirty days from the date of the order to file a petition with the appellate body.

Registration, Records, and Appointment

Following we have discussed registration and appointment associated with application:

Registration

Every employer and retailer must complete an application:

- during the time period designated by the State Government by notification in the event of shops or premises in operation on the date this Act takes effect;

- complete the registration form and send it to the registrar's office if this Act refers to new establishments or shops as may be prescribed within such period as may be stipulated with applied charges.

Every such application must include the following information:

- the shop's or establishment's mailing or postal address;

- shopkeeper's or employer's name;

- the store's or establishment's title or name;

- declaration of weekly closing days in the event of a shop;

- and any other information that may be necessary.

Note the following points:

- Every shopkeeper and employer must apply to the enrolling authorities in the approved form within six months of the start date and pay the necessary charge.

- The registration must be shown by every shopkeeper and employer.

- For an extension of the certificate of registration, a shopkeeper or employer must fill out the relevant form and pay the required fee to the registering authority. It must be completed within thirty days of the certificate's expiration date, which is three years from the date of issue.

- In the event of a liquidation, the shopkeeper and employer must notify the registering authorities in the specified format within fifteen days.

Keeping Records:

Every shopkeeper and employer is required to establish and maintain employee registrations in the specified format.

Every shopkeeper and employer must provide a letter of appointment in the form provided to each person engaged.

The shop or establishment is registered in accordance with the rules and regulations of the registering body. Once the registering auditor concludes that the particulars are accurate. Then, the employer or shopkeeper is then provided a registration certificate in the specified format.

Furthermore, it is important for registering authorities to maintain a proper format for the Shops and Establishments Register.

Every shopkeeper or employer must present the certificate of registration in a prominent area in the shop or establishment.

Any modification in any of the application's specifics must be submitted to the registration authority in the suitable format within seven days of the alteration arising.

It's worth noting that a shop's statement of weekly closure days can only be modified once a year.

The registering commission shall, if fulfilled with the accuracy of the information, make improvements in the Register of Shops and Establishments. Also, they can change or issue a new certificate of registration, if necessary. However, it will be done upon receipt of such data/information and payment of such fee as may be instructed.

The registering administration must be notified in writing format by the shopkeeper or employer. It further needs to be informed within fifteen days after the termination of his business.

As a result, the shop's or establishment's name has been removed from the Register of Shops and Establishments. Moreover, the certificate of registration is canceled, once the registering law confirms that the details are correct.

Furthermore, a shopkeeper or employer must submit a renewal request to the registering body. It must be completed in the form and with the payment within thirty days of the completion of three years from the date of issue or renewal, as the case may be.

Appointment

Appointment of Inspectors:

Section 19(1): The state government may designate inspectors for the purposes of this Section by issuing a notification.

Sec 19(2): All inspectors employed must be considered public servants for the purposes of Sec 21 of the Indian Penal Code 1860.

Cooperation with the Inspectors:

It is important for shopkeepers and employers to preserve the certification, documents, letters, reports issued by inspectors. It needs to keep safe for a period of 12 months and shall be made available for examination by the inspector

Inspectors:

- Inspectors may be appointed by the State Government for the objective of this act.

- Inspectors have the authority to enter and inspect any premise or location in order to investigate the provisions of this act.

- Inspectors are all considered public servants.

- Examine anyone who works in the store or establishment.

- Obtain copies of registers, records, documents, or notices or seize them.

Exemptions

Following we have listed sectors or offices that do not come under West Bengal Shops and Commercial Establishment Act, 1963. Take a look:

- Institutions for the care and treatment of the infirm, sick, poor, and mentally ill;

- the Reserve Bank of India, any railway administration, or any local authority, offices of or under the Central or State Governments;

- any railway, airline, water transport, tramway, or automobile service, postal, telegraph, or telephone service, and public sanitation or conservation system, or any industry, business, or activity that provides electricity, light, or water to the public;

- refreshment rooms and stalls at airports, railway stations, docks, wharves, and airports;

- stalls or shops at any public bazaar(market) or fair held for a charity purpose.

Fees & Penalty

For the first offense, a penalty of up to two thousand rupees may be imposed, but it must not be below Rs. 150/-. If the violation is committed again (within two years of the first violation), the penalty is either six months in jail and a fine of up to five thousand rupees, or both.

Prison sentence for up to six months or a penalty of up to five thousand rupees, or both, for failing to maintain records, registers, and display notifications.

Conclusion

West Bengal Shop and Establishment Act was enacted to preserve the rights of employees and for social welfare. Furthermore, the Act’s rules and regulations are issued under the notified zones of the State of West Bengal.

It includes such as commercial establishments, shops, residential hotels, restaurants, theaters, eating houses, and other establishments in their jurisdiction.

Applicability:

It pertains to everyone who works for wages or no pay in a firm. It does not include members of the employer's family.

Features:

Following we have listed some major features. Check below:

1) It requires mandatory registration as well as the closing of shops and establishments.

2) Establishes work hours per day and week, as well as rules for rest periods, opening and closing periods, closed days, religious and national holidays, and additional or overtime work.

3) It also specifies employment standards for children, young people, and women, as well as annual privilege break, sick leave, informal leave, maternity leave, and appointment and dismissal of service.

4) Allows the upkeep of statutory, registers, and records, as well as the posting of notices. Furthermore, both employers and employees have responsibilities.

Statutory Forms

Form A: Register of Shops and Establishment ⇩

Form C: Notice of Change ⇩

Form D: Application for Renewal of Registration ⇩

Form E: Notice of Winding up of Business ⇩

Form F: Notice of Loss of Registration Certificate ⇩

Form G: Notice of Weekly Closure ⇩

Form H: Notice of Weekly Holidays ⇩

Form I: Register of daily hours of work and rest intervals of persons employed ⇩

Form J: Register of Leave ⇩

Form K: Notice of claim for maternity benefit ⇩

Form L: Delivery Certificate ⇩

Form M: Pay Register ⇩

Form T: Notice of Overtime ⇩

Form U: Register of Overtime Work ⇩

Form V: Diary of Inspector for the month endings ⇩

Form W: Register of Employees ⇩

Form X: Letter of Appointment ⇩

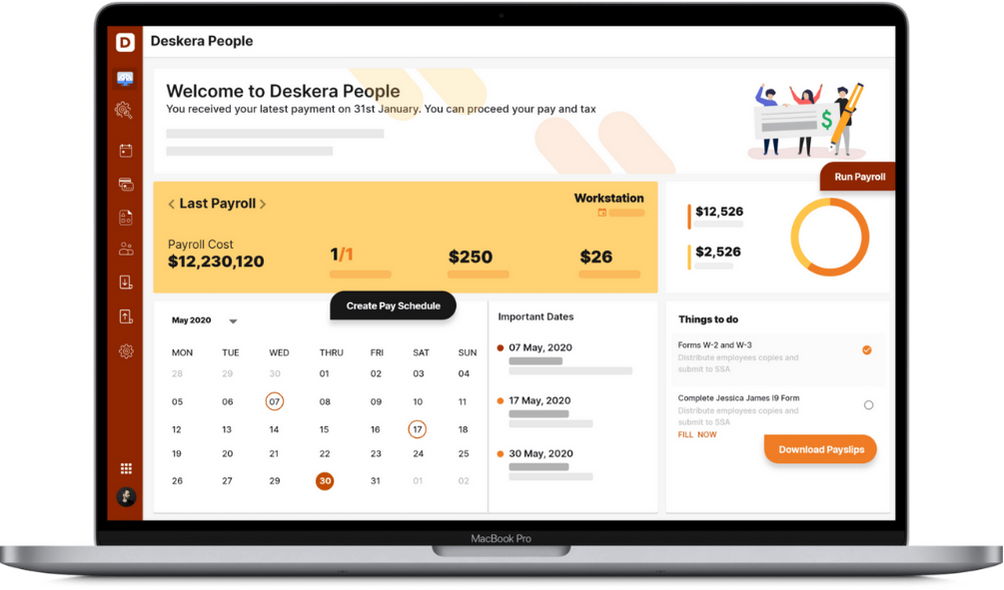

How can Deskera Payroll Help

Payroll management and employee management are integral to any organization. If you are looking for a holistic and automated tool to manage payroll, employees, expenses, contractor management, Deskera People could be the apt solution.

Process your payroll now with Deskera People:

Final Takeaways

We have reached the final section of this guide. Let’s take a look at some crucial points that you need to keep in mind:

- West Bengal Shop and Establishment Act was enacted to preserve the rights of employees and for social welfare

- It is an act that incorporates and amends the law governing the regulations of working and employment conditions in commercial establishments, shops, and other establishments

- A shop, according to the Act, is a location where a consumer can buy goods or services

- An establishment for people's amusement or entertainment includes theater, restaurants, hotels, cinema, and more

- A commercial establishment is a facility where a trade, business, profession, or similar work is carried out

- Every shopkeeper and employer is required to establish and maintain employee registrations in the specified format

- Once the registering auditor concludes that the particulars are accurate. Then, the employer or shopkeeper is then provided a registration certificate in the specified format

- It's worth noting that a shop's statement of weekly closure days can only be modified once a year

- It is important for shopkeepers and employers to preserve the certification, documents, letters, reports issued by inspectors. It needs to keep safe for a period of 12 months

- For the first offense, a penalty of up to two thousand rupees may be imposed, but it must not be below Rs. 150/-

- It pertains to everyone who works for wages or no pay in a firm. It does not include members of the employer's family

Related Articles