The term 'garnishing' essentially implies decorating food with a small amount of other food. Garnishing wages is not too different from this definition. Yet, the only difference is, garnished food looks appealing but the same cannot be said about the garnished wages. Let’s know why!

Broadly, when you deduct a part of your employees’ salary to pay off their debts, you are garnishing their wages. This is legally permitted and we shall learn more about garnishing wages in detail. Upon receiving the court’s order to garnish wages, the company's payroll department must initiate actions in the direction to garnish the wages of the employees.

Here is what we have aligned for you in this article:

- What is wage garnishment?

- Types of wage garnishment

- How does wage garnishment work?

- Termination of Wage Garnishment

- How to know if my employees’ wages must be garnished?

- What wages should I garnish?

- Is there a limit to the amount that can be garnished?

- As an employer, what is my responsibility?

- What does my employee need to do?

- FAQs

- How can Deskera help You?

- Key Takeaways

What is Wage Garnishment?

Mandated by the court, wage garnishment is a withholding of the employees’ salary or the paycheck for the purpose of paying off their debts. All the salaried employees are subject to wage garnishment. Salaries, bonuses, and even the retirement plan income can be garnished if the individual has a debt.

However, the federal regulations prescribe that the income in the form of tips is not subject to wage garnishment.

Employers are legally obligated to withhold wages from an employee and make direct payments to the designated agency or creditor when they are notified of a garnishment order.

Wage garnishment may be triggered by any of the following elements:

- Alimony

- Child support

- Default on a student loan

- Unpaid taxes

- Default on a credit card

A wage assignment chosen by the employee, such as medical insurance or pre-tax benefit programs, is not a wage garnishment. Upon receiving notification of a wage garnishment, it is important to remember that the garnishment must be processed within a reasonable timeframe. In the case where one fails to do so may result in penalties for the employer.

Types of Wage Garnishment

Wage garnishment may be done for the four different types of debts. They are arranged in order of ease of collection. Whenever the federal government collects debts, it always takes precedence over state law garnishments. Similarly, child support will be garnished before credit card payments if an employee owes both.

Here is a table that sheds more light on the types of wage garnishment:

How does Wage Garnishment work?

The wage garnishment procedure is an elaborate process comprising numerous steps. This section takes you to the depth of this process.

- Wage garnishment begins with a creditor filing a ‘Request for Garnishment on Wages’ which is the Form DC/CV65 with the court

- Following the filing of the request, a court clerk or judge signs the document, thereby establishing the Writ of Garnishment. As part of the Writ, the garnishee is required to hold any property of the debtor that the garnishee possesses at the time the Writ is filed

- For filing a Request for Garnishment on Wages, the creditor must pay court fees. The garnishee may also have to pay fees for serving the garnishment writ. The garnishee must be served with the Writ of Garnishment from the creditor via certified mail, restricted delivery, private process, or sheriff/constable

- In addition to interest, court costs and fees may also be added to most judgments that a debtor owes a creditor. Therefore, communication between the garnishee and the creditor is important to ensure that the right amount is paid to the creditor

- Garnishees must respond to the Writ within 30 days of being served.

- It is required that the garnishee disclose whether the debtor is employed, the amount of salary they receive, and any wage garnishment that has already occurred

- Garnishees who fail to respond to the Writ of Garnishment will likely be held in contempt of court

- Once the garnishee receives the Writ, they are required to calculate the amount of the debtor's garnishable wages per pay period. In such a case, wages must be withheld until either the judgment is satisfied or the garnishee is ordered to stop withholding. The garnishee must report to the creditor, or their attorney, the total wage garnished when the debtor's pay period ends

- Another garnishment must be handled in exactly the same way, but a subsequent garnishment should not be paid until the first one is paid in full. The next garnishment will begin once the first is fully paid. If there are multiple garnishments, then the first one must be satisfied in full before any later garnishments are paid

- The creditor receiving wage garnishments must apply for payments for the interest accrued on the judgment.

- Afterward, the debtor has assessed the attorney's fees and court costs, then the principal amount of the judgment.

- During each pay period, the garnishee must give the debtor a written description of the amount taken and the method used to determine it. This information can be obtained from paycheck

- When the creditor receives payment from the garnishee within 15 days of the end of the month, they must send them a statement detailing the payments received

- Creditors must retain copies of these statements for 90 days after the garnishment ends, but they are not required to file them with court

- These statements may be examined by the court or any party at any time they wish to see them

Termination of Wage Garnishment

A wage garnishment terminates 90 days after an employee's termination unless the garnishee hires the employee again during that time. It is the garnishee's duty to inform the court and all parties if the debtor is fired or ceases to work.

- If wages are garnished, a garnishee is not permitted to fire or dismiss the debtor

- Under federal law, a garnishment can only equal 25 percent of a debtor's disposable income. Disposable income is the amount of earnings present after legally required deductions

- Examples of these include federal or state taxes, unemployment, Social Security, medical insurance

When a debtor is earning close to minimum wage, they must be left with at least 30 times the federal minimum wage. For the collection of past-due child support, this rule is not necessarily applicable.

How to know if my employees’ wages must be garnished?

A wage garnishment letter will be sent to you. A court order which is also known as a writ is necessary for wage garnishment. Therefore, wage garnishment is a legal procedure. The court order or IRS levy will notify you if wages need to be garnished. Courts and government agencies will order you to withhold a portion of an employee's salary or wages until the debt is paid off.

The letter will lay out your responsibilities in detail. It also explains when and where you should send the funds and how much you need to withhold and when to begin and end withholding.

Typically, you must begin garnishing an employee's wages within seven days of receiving notice that orders are being obtained. A garnishment usually lasts until it is notified to stop. Therefore, you must garnish wages until you are notified to stop. In case you need further information, the letter will include a contact through which you can obtain more information or clarification.

What wages should I garnish?

According to Title III of the federal Consumer Credit Protection Act or the CCPA, garnishments of wages should be based on an employee's disposable earnings.

What is disposable income? Disposable income is the total compensation an employee receives minus mandatory deductions, including federal, state, and local taxes. Typically, it includes the wages, bonuses, and commissions as well as retirement income and pensions.

The legal deductions will comprise the following:

- Social Security tax

- State income tax

- Medicare tax and additional Medicare tax

- Federal income tax

- Local income tax

Is there a limit to the amount that can be garnished?

In most cases, the amount of garnished wages varies depending on garnishment. The range is usually between 15 percent of disposable to 65 percent of disposable earnings. (15% for student loans and 65% for child support).

Employers must comply with state laws requiring a lesser wage garnishment in states that have laws different from the federal wage garnishment laws. Regardless of debt levels, employees can rest assured that they shall always have enough amount of their paycheck to take care of their daily needs.

If the wages are not used to maintain an individual or family, the lesser of these two amounts is the cap:

- 25 percent of disposable income

- The amount after finding the difference between the disposable income and 30 times the minimum hourly wage

Under Title III, wage garnishments used for support of an individual or family can only be made for the following amount per pay period:

- The employee can receive 50% of his or her disposable income if he or she supports an unprotected spouse or child

- If the employee does not have any current dependents other than those listed in the court order, 60% of disposable income can be paid

Some garnishment orders, such as bankruptcy orders or tax debts, may not be affected by the restrictions.

Here is a table that depicts the employee’s financial standing and the corresponding wage garnishment that could be applied:

As an employer, what is my responsibility?

As the employer of the firm, upon receiving the court order, you will be required to take the following steps:

Step 1: Informing the employee

Once you receive the wage garnishment court order, the first thing you do is to immediately inform your employee of the matter in writing. The order will contain the details of the garnishment. It may also comprise a form based on the type of garnishment ordered by the court.

Step 2: Alert the HR department of the Payroll Team

At this point, the human resources departments should be notified so that the wage garnishment process can begin. There could be times when the employee may not be willing to comply with sending the payments to the creditors. This would be termed noncompliance with regulations of wage garnishment.

The payroll department must ensure that the due amount is sent to the creditors in such a situation. A business that complies with these steps will not face any legal consequences for failing to respond to the order.

Step 3: Drafting the wage garnishment letter

Additionally, an employer may also draft a letter describing the wage garnishment order. The letter also consists of information about the duration for which the wage garnishment will occur.

Step 4: Stopping the garnishment procedure

Once the employee's debt is cleared, it is now time for the procedure for stopping the garnishment. However, this depends on the type of garnishment.

Employers are sent forms 668-D for federal levies. In the case of child support, they may receive correspondence from the state. State officials will send the employer a notice or letter, and creditors will send employers a "Notice of Termination/Release of Wage Garnishment Order".

What does my Employee need to do?

When the employees receive a wage garnishment order, they can choose to challenge the garnishments or discuss/ negotiate them with their creditors. Furthermore, if your employee needs more information about the Social Security garnishment rules that apply to them, they must communicate with their creditors.

Apart from these, if they have concerns about issues such as the following, they must be discussed between the employee and the creditor:

- Work out a different plan

- Check the garnishment balance

- Any other relevant query

Despite this, if there are any other doubts that you as an employer want to know about, then you may get in touch with the local wage and hour division office in your locality.

As the creditors generated the order and therefore, it does not involve you in any way. Consequently, all the discussions and negotiations must happen between the employee and the creditor.

FAQs

Here are some of the most commonly asked questions:

Q. Are there any penalties for Non-compliance?

A: Like any other regulation that has non-compliance penalties so does the wage garnishment. There could be violations from either the garnishee or the creditors.

- A garnishee who violates the law may be cited for contempt of court and assessed attorney's fees and court costs

- Creditors who fail to comply with the law may have their garnishments dismissed and charged attorney's fees

Q: Are there any state laws I should follow?

A: Yes. The laws governing wage garnishment vary from state to state. Certain states have restrictions and protections and some do not. Because of this, it is crucial that you hire a CPA who is familiar with the wage garnishment guidelines in your state.

Q: Is it possible to fire an employee whose wages are garnished?

A: Wage garnishment cannot be a reason to fire an employee. In contrast, the CCPA doesn't cover or protect employees who have more than two wage garnishment orders. Special instances can be consulted and discussed with a lawyer before proceeding.

Q4: Is an employer required to honor a garnishment?

A: Wage garnishments are court orders, so employers must obey them. Employers have seven days from receiving a writ of garnishment to acknowledge and respond.

However, a garnishment does not have to be complied with in all cases. You may contest a garnishment writ if you receive it for a former employee using the statutory response form included with it.

How can Deskera help You?

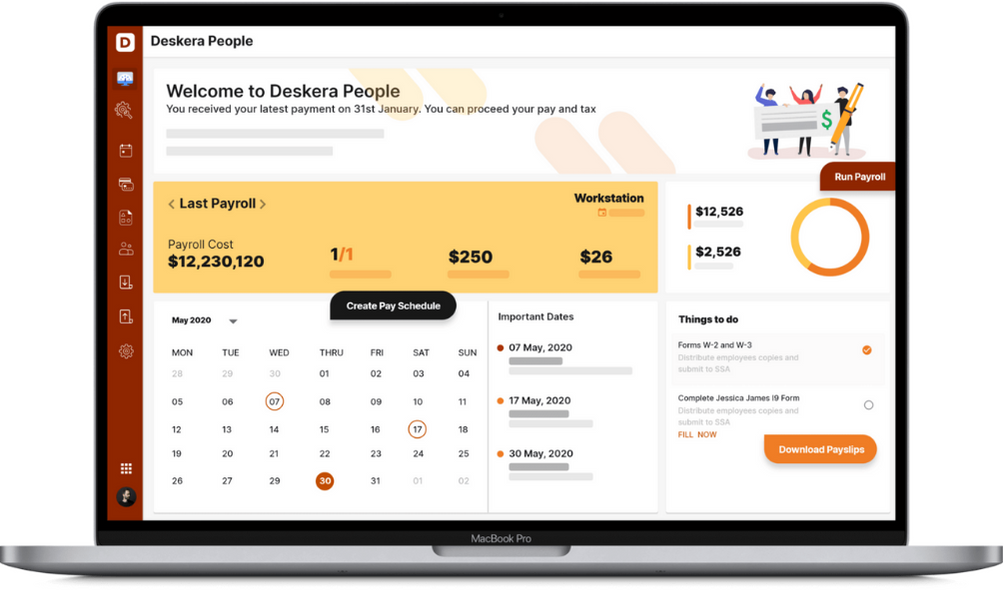

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Broadly, when you deduct a part of your employees’ salary to pay off their debts, you are garnishing their wages. This is legally permitted and we shall learn more about garnishing wages in detail

- Mandated by the court, wage garnishment is a withholding of the employees’ salary or the paycheck for the purpose of paying off their debts

- All the salaried employees are subject to wage garnishment. Salaries, bonuses, and even the retirement plan income can be garnished if the individual has a debt

- Income in the form of tips is not subject to wage garnishment

- Alimony, Child support, Default on a student loan are some of the elements that can trigger wage garnishment

- There are four types of debt for which wages can be garnished. They are arranged in order of ease of collection: Child Support, Federal debt, State debt, credit card debt

- The range for wage garnishment is usually between 15 percent of disposable to 65 percent of disposable earnings. (15% for student loans and 65% for child support)

- A garnishee who violates the law may be cited for contempt of court and assessed attorney's fees and court costs

- Creditors who fail to comply with the law may have their garnishments dismissed and charged attorney's fees

- The laws governing wage garnishment vary from state to state; therefore, it is recommended to check with a CPA about the updated list of regulations and garnishment guidelines

- Wage garnishment cannot be a reason to fire an employee

- Wage garnishments are court orders, so employers must obey them. Employers have seven days from receiving a writ of garnishment to acknowledge and respond

Related Articles