Small businesses can be a great way to get on the road to wealth and success. However, they're not without their challenges, and constantly paying taxes can be one of them.

One of the most challenging aspects of small business ownership is paying taxes. How much do small businesses pay in taxes? Your tax burden will vary depending on your industry, location, type of entity, and other factors. Let's see how much you pay in taxes as a small business owner.

Here are the key pointers to focus upon in the article:

- Know your businesses tax structure

- How much do small businesses earn in profits?

- How much tax should small businesses pay?

- Types of taxes paid by small businesses

- What small businesses can do to save money on their taxes

- Calculating small businesses tax rates

- Exemptions and deductions for small businesses

Know your small businesses tax structure

There are many different types of business structures. Your business tax structure has a significant impact on the taxes you owe. Even though you may have heard that corporate taxes are higher than taxes for small businesses, the facts are not that simple.

Many small to mid-sized businesses benefit from being taxed as a corporation. Many small businesses incorporate to get the tax advantages of being a corporation, such as deducting pay for owners from taxable income. Other small companies choose to be taxed differently to avoid double taxation.

Taxes come in many shapes and sizes, depending on what kind of business you run. The federal government collects excise taxes on items like gas, cigarettes and alcohol. Businesses pay sales taxes at the state level, while local governments collect property taxes, often based on the value of real estate owned by a company.

Other obligations could trip up an unwary small business owner. For example, if you have employees, you'll have to pay into Social Security and Medicare. You'll also have to pay unemployment taxes, set at a state level but handled by the federal government.

Small businesses can choose from two types of tax structures: a pass-through entity or a corporation.

The main difference between the two is how they are taxed. A corporation is subject to double taxation, paying income taxes on profits and then dividends to shareholders. In contrast, a pass-through entity pays no income taxes itself. Instead, its earnings "pass-through" to its owners and are taxed at their tax rates.

Corporations also have the option of converting into an S corporation, which provides most of the same benefits as a C corporation but with fewer restrictions on who can own one.

How much do small businesses earn in profits?

According to the Small Business Administration, there are 31.7 million small businesses in the United States.

It is estimated that small businesses generate over half of the private sector income in the United States. Small companies are also responsible for employing over half of the American workforce, so it's safe to say that their contribution to the American economy is significant.

However, not all small businesses are profitable, so how much do they earn in profits?

The IRS provides statistics on this question. According to its data, about 75 percent of small business owners report business profits. This means that 25 percent of small businesses are operating at a loss or break-even, which is still an accomplishment considering that they aren't relying solely on an outside income.

Being a small business owner or manager can be a profitable experience, but it also comes with a few extra responsibilities that the average individual doesn't have to take on. One of these responsibilities is paying taxes.

Your gross receipts are the amount of money your business brings in from selling goods or services before any expenses are deducted. You report this number on Schedule C, Profit or Loss from Business, which is one of the forms required for filing your federal income tax return.

If you sell products online, you may have to pay taxes on each sale, depending on where your customers live. This is called a remote sellers tax. It's sometimes called an Internet sales tax, but it doesn't have anything to do with whether your customers use the Internet or not.

How much tax should small businesses pay?

You have two main tax types to consider when it comes to business taxes: your corporate income tax and your employees' taxes. Corporate income taxes are based on the amount of money that your business earns before expenses. Employees' taxes are based on their wages.

The tax code is designed to be progressive — meaning that higher-income earners generally pay more than lower-income earners — and small business owners aren't immune from these rules.

The amount of tax you pay depends on the type of business you're operating, how much money it makes, and where it's located. Income earned in foreign countries is also taxed.

When you start a business, you first set up a legal structure for it. You can choose from a sole proprietorship, partnership, corporation, or LLC (limited liability company). Your choice will determine how much tax you'll pay on your business income.

For example, if you operate as a sole proprietor, then all profits belong to you personally. You're responsible for paying both corporate income tax and employees' taxes. Suppose you're operating as an S corporation or limited liability corporation (LLC). In that case, most of its profits are taxed at the corporate level, but they're still considered personal income when distributed to shareholders or members.

A partnership is similar to an S corporation in that profits are passed through directly to partners who report them on their tax returns.

Types of taxes paid by small businesses

Here is a list of business taxes that you may have to pay:

- Corporate tax – All incorporated businesses, such as LLCs and corporations, must file an annual income tax return. The corporate tax rate is 15 percent

- Business tax – In most jurisdictions, businesses are taxed on the net income earned from their business operations. The business tax rate varies from jurisdiction to jurisdiction

- Income tax – Self-employed individuals who work as independent contractors or sole proprietors pay taxes on their individual income tax returns based on the net profits of their business. They also must pay self-employment taxes if they have more than $400 in net earnings from self-employment during the year

Sole proprietors have to file both a Schedule C Profit or Loss from the Business form with their personal 1040 federal income tax return as well as a Schedule SE Supplemental Income and Self-Employment Tax form with their 1040 federal income tax return if they had more than $400 in net earnings from self-employment during the year.

In addition, some states allow businesses to deduct certain operating expenses from their gross receipts before calculating corporate and business taxes due.

Self-employment tax. If you work for yourself, you'll probably have to pay self-employment tax (also known as SECA tax), which consists of Social Security and Medicare taxes. Your employer usually takes these out of your paychecks, but you must pay the full amount yourself if you're self-employed. The combined rate is 15.3 percent for both Social Security and Medicare taxes, so there's no advantage to being paid in the form of dividends rather than salary.

Taxes on profits. This is the tax rate business owners pay on their earnings at their companies, which are called pass-through entities because they pass payments through to the owner.

For example, someone who owns a partnership passes profits through to his individual income tax return. Gains are taxed at marginal income rates up to 39.6 percent, plus 10 percent for the extra Medicare surtax on high earners. This gives many business owners an incentive to keep their taxable income low by taking money out of their businesses in the form of dividends or by using deductions and other write-offs that reduce what they owe. State income taxes apply in most states where this income is earned, too.

What can small businesses do to save money on their taxes?

The complexity and constant changes of the U.S. tax code make it difficult for small businesses to stay up to date on all the laws and regulations affecting them.

The primary difficulty for small business owners is that they can't take advantage of the same tax deductions as more giant corporations. While a business owner may take a $20,000 deduction, for example, it's not possible to take $20,000 out of the business and pocket it as personal income without paying taxes on that amount.

Here are some ways small businesses can save money on their taxes:

- Simplify your accounting – There's no reason to overcomplicate your tax preparation. You don't need to hire an accountant or use complicated software to handle your taxes as a small business owner. Keeping things simple will help you save money on taxes because you won't have to pay anyone to do your taxes for you

- Incorporate – Incorporating as a limited liability company (LLC) or corporation allows you to separate your finances from your business and protect yourself from potential lawsuits or other financial setbacks that could threaten your business and personal finances. The more complex your business gets, the more critical this feature becomes

Small businesses get some breaks on their taxes. You can deduct some of the costs of doing business from your gross income for tax purposes. This includes office supplies, advertising, maintenance, and repairs on equipment used for the business, and even part of your rent or mortgage payment if you use part of your home exclusively for business purposes.

You do get hit with an employer's share of social security and Medicare taxes on employee paychecks, though. These are both paid by the employee, but it's up to you to withhold them from wages before they're paid out. Your employees can ask you to submit these payments in advance, so they don't have to wait until next year's refund.

Calculating small businesses tax rates

Calculating small business tax rates is not an exact science because it depends on many factors, including what state you live in, how much money your business makes, and how much your income is. However, there are some essential guidelines to follow when figuring out your tax rate for your small business.

Once you have figured out the type of entity you want to be for your business (if it is not an LLC or S Corp), you need to determine how much money will be allocated to the business and how much will be allocated to yourself personally. To do this, you will need to know what percentage of the company you own and what percentage of the profits go towards yourself. For example, if your company makes $300,000 and you own 30% of the company and take home $100,000.

The tax rate for a small business is slightly different from that of a corporation. If you do not plan to hire any employees in the near future, you can use Schedule C to calculate your taxes.

A corporation has to pay income tax and self-employment tax, equivalent to Social Security and Medicare taxes. The corporation itself does not pay these taxes; instead, they are withheld from the employee's paycheck and passed on to the government.

However, in certain instances, such as if you have significant medical expenses, the corporation may deduct these expenses from its taxable income.

Exemptions and Deductions for small businesses

It's time to revisit your small business tax strategy. As the fiscal year comes to a close, it's time to consider your small business tax exemptions and deductions for the coming year.

Exemptions reduce your taxable income; in other words, they reduce the number of profits you must report to the IRS. Deductions are expenses that you can subtract from your gross income to arrive at your adjusted gross income (AGI). Both exemptions and deductions help lower the amount of tax you owe.

And while most taxpayers are familiar with their tax exemptions and deductions, many small business owners aren't aware of what they can claim on their business taxes. The good news is that certain small-business tax exemptions and deductions are available, including:

Business use of home deduction: You may be able to deduct expenses related to using part of your home exclusively and regularly for business purposes.

Deduction for safety equipment: You can deduct the cost of safety equipment required by law, such as certain types of fire extinguishers or smoke alarms.

Employee use of a car: You can deduct expenses related to using your vehicle for business purposes, including mileage, parking fees, tolls, or repairs. Be aware that there are strict rules about who qualifies for it.

Depending on the type of business and how much it earns, a small business owner might be able to deduct a portion of their business expenses from taxable income.

The two types of tax deductions that apply to the vast majority of small businesses are:

- Business expenses that reduce taxable income, and

- Depreciation deductions

Wrapping Up

Overall, the main point to take away here is that while taxes for small businesses are likely lower than you might expect, they're not relatively as low as they should be; overall, tax rates for small businesses could be cut significantly.

And while there are some other interesting findings, the basic conclusion must be agreed upon: small business owners pay enough in taxes not to be broken down by it, but perhaps not enough to feel good about it.

At Deskera, we provide the freedom in how they structure their small businesses. They can choose whether they want to incorporate their business using an LLC or corporation, the latter being more complicated for most small businesses.

How Can Deskera Help SMBs

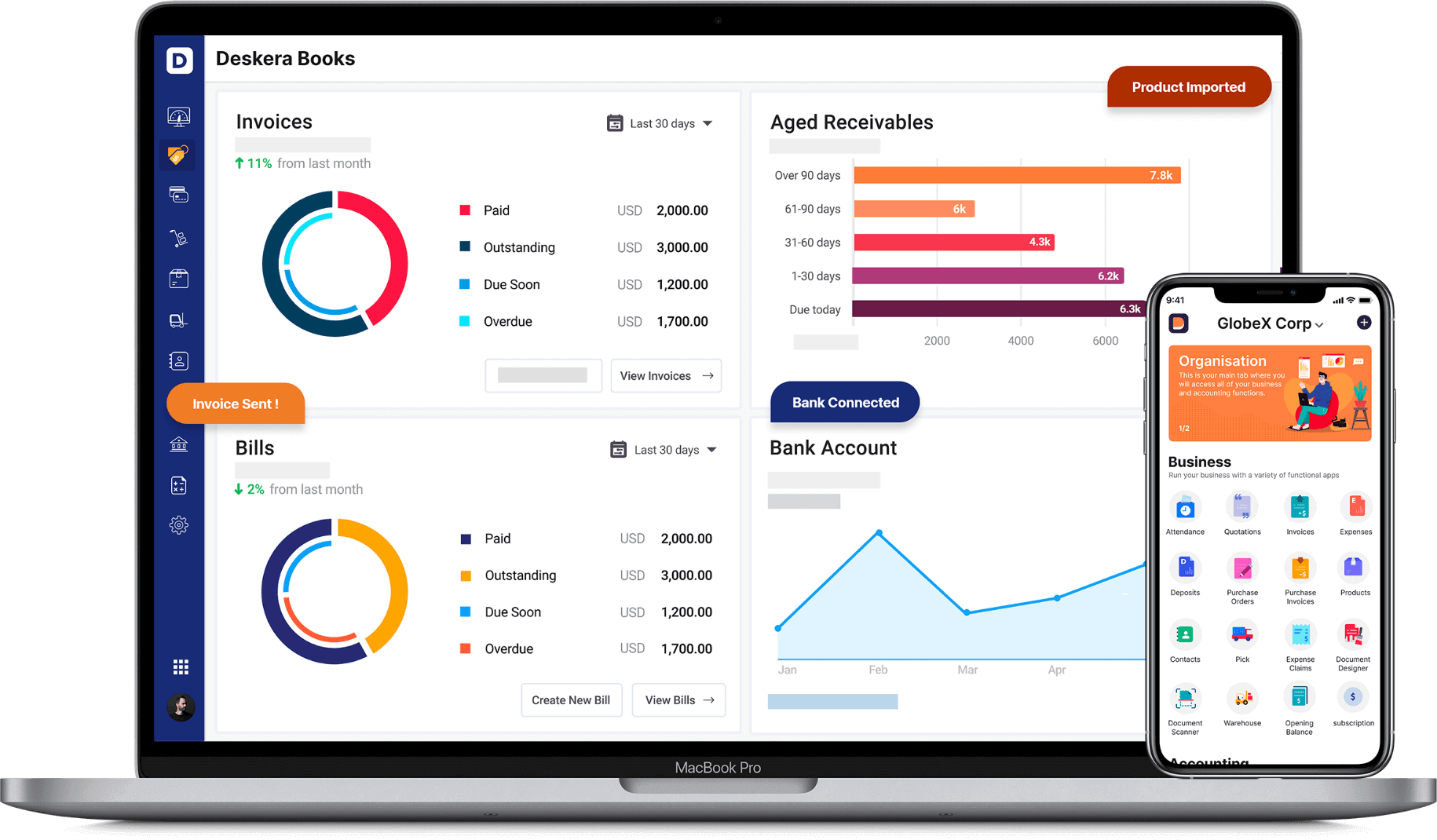

Deskera is a software that specializes in meeting all of your needs. Deskera Books is one that is devoted to making life easier for small businesses and focused on meeting all their financial needs

Through Deskera Books, your accounting would be handled by it, with all that you would need to do is update your invoices, your account receivables, and accounts payable, and the operating expenses incurred as well as operating income earned on the software. In fact, you can even delete or edit the existing debit notes and credit notes, as is applicable.

Following the US accounting rules, it will process all these financial transactions and make financial statements like balance sheets, profit and loss statements, cash flow statements, income statements, and so on.

It would be all of this data, updated in real-time, which will facilitate Deskera Books to complete filing for your income tax returns. Deskera Books has one more benefit that it also allows you to transfer your data from your previous accounting software by updating the details in the spreadsheet available on Deskera Books.

Additionally, the entire setting up process on Deskera Books is super easy, with you having to only sign-up using your email address or social authentication, and half of your work would be done. Once you have registered on Deskera Books, you would get pre-configured accounting rules, invoice templates, tax codes, and a chart of accounts, to mention a few vital features. Lastly, your accountants can be added to your Deskera Books account for free by just inviting them to use the system.

With so many features at your disposal, making your accounting, reporting, and compliance easier, what are you waiting for?

Key Takeaways

- The United States has a progressive income tax system - the more you earn, the higher your tax bracket is. Corporate taxes are also developed, meaning that the higher the corporation's income is, the higher its tax bracket

- The effective corporate tax rate varies by company and industry; however, surveys show that small businesses pay an average effective rate of 27.1%

- Small Businesses taxes and tax planning is a complex and confusing subject. There are various taxes to consider for a small business, such as payroll taxes, sales taxes, property taxes, and even taxes on gas and other items that may be regarded as "non-business" expenses

- It is important to note that each type of business (LLC, S-Corp, C-Corp) will likely have different tax requirements

- Small businesses pay every form of taxes that corporations do, including corporate income taxes and payroll taxes. However, because small businesses generally have less capitalization, they are taxed at different rates than more giant corporations

Related Articles