Do you add auto gratuity to the bill? That is a service charge, not a tip. We frequently give someone a few bucks as a sign of our appreciation if we appreciate their service, especially in restaurants. However, there is currently a debate about whether the tip should be replaced with a service charge or just a service.

The distinction between a service charge and a tip, as well as reporting procedures, is covered in this article. Prior to delving into the tax regulations for each, we'll first clarify the distinctions between service charges and tips. Following will be the topics covered:

- Service Charges

- Tips

- Difference between tips and service charges

- Tax on tip vs. service charge

- How to accept tips and service charges

- Key takeaways

Service Charges

The fee added to the bill as a mandatory or optional charge by the company for the service obtained. Service charges are sums an employer requires a client to pay. Even if the employer or employee refers to the payment as a tip or gratuity, it still counts as such. If it's a service charge, the cash you pay will belong to the company's owner.

Service charges are sums an employer requires a client to pay. Even if the employer or employee refers to the payment as a tip or gratuity, it still counts as such.

Service charges that are frequently included on a customer's check include:

- Bottle service charges by nightclubs and restaurants.

- Large dining party automatic gratuity (usually 18 percent or more)

- Hotel room service charge

- Banquet event fee

- Cruise trip package fee

Service fees are typically reported as non-tip compensation given to the employee. Some employers retain a percentage of the service charges. Only the sums given to the workers constitute their non-tip earnings.

When business owners falsely claim that a service price and a gratuity are equivalent, the clients may be duped. A statute prohibits any arrangement between an employer and a tipped employee in which a portion of the tip becomes the employer's property, according to divisionoflabor.com.

Despite the fact that certain places may use the phrases interchangeably, service charges and tips are separate.

However, a charge is regarded as a service charge if it is required, demands a certain sum, and must go to a specific party. It is irrelevant how a business self-classifies or refers to its fees or tips for tax reasons.

• Any charge that is automatically added to a bill without giving the customer the option of paying it or not.

• Sales tax must be collected - This is where the Department of Revenue and IRS audits cause a lot of restaurants to run into difficulty.

• The business may keep all or part of a service charge, but it must be recorded as revenue and treated similarly to regular payroll.

• A service charge payment made to an employee is not eligible for a tip credit.

What are they worth?

It can be challenging to determine how much of a service charge to add; if you ask for too much, you run the danger of turning away consumers, insulting them, or receiving numerous requests to have the charge removed. If you set your goal too low, you risk losing out on important extra money.

In the UK, eateries that use service fees demand somewhere between 10 and 20 percent of the tab. The top end of this can seem excessive to your guests if you own a high-end restaurant that already costs top cash for your meals.

Tips

Monetary compensation provided willingly to someone as reward for their service. Tips are optional (or extra) contributions made by clients to personnel that are at their discretion. The gratuity is the name for the tip. We are not required, in other words, to pay the employee a little sum of money. The gratuity will be regarded as the employee's property if the customer gives it to them.

According to the IRS, tips include:

- Directly received from clients, in the form of cash tips.

- Customer tips left as part of an electronic settlement or payment. A credit card, debit card, gift card, or any other kind of electronic payment method falls under this category.

- Tips received from other employees and distributed through tip pools, tip splitting, or other formal or informal tip sharing arrangements.

- The value of any non-cash tips, such as tickets or other valuable items.

We give tips to staff because we want to express our gratitude to them alone, not to everyone else. Some business owners attempt to use every one of those suggestions to boost their personal profits.

Generally, a payment qualifies as a tip if it meets the criteria listed below:

- The payment must be made free from compulsion

- The quantity must be determined by the customer without restriction;

- It should not be subject to discussion or be determined by employer policy; and

- The recipient of the payment should generally be chosen by the customer.

If these factors are absent, the payment is likely a service charge.

The money supplied by the clients will go directly into the coffers of the business owners after the tips are converted into service charges. Despite how it may sound, some business owners wish to use the service to enhance their location. The client service will also improve as a result, which is undoubtedly positive.

However, even with the best of intentions, it is still fraud or dishonesty if you don't let the customer know that the tip he leaves won't get to the employee who would receive it. On the other hand, there is nothing wrong with it if you clarify to the customer the distinction between a service charge and a tip.

According to federal law, the business owner is free to do anything he wants with the money if the client still chooses to pay for the service.

It's acceptable, though, provided you insist that the staff receive the tip. The gift or payment from you will be gratefully accepted by the employee. The offering and receiving of tips is prohibited in some other nations. Therefore, before leaving a tip, make sure you are aware of the local customs. The idea of tips being considered bribery in other nations can be offensive to them.

Forms of Tips

There are two types of tips: cash tips and non-cash tips.

Cash tips

Cash tips are sums of money given to a service provider by a client, whether it is in the form of actual cash or credit/debit charges. Cash tips also include any money given by other staff members as part of a tip-sharing arrangement. For instance, hostesses, bussers, and service bartenders frequently receive a part of the gratuities left by waiters and waitresses.

"Directly tipped employees" are workers who get tips straight from customers. "Indirectly tipped employees" are those who get gratuities from other workers, such the hostesses, bussers, and service bartenders in the example above.

Non-cash tips

Passes, tickets, and other products and commodities are examples of non-cash tips.

What are they worth?

There is no definitive answer on how much you could earn in tips because each customer will leave a different amount. There is a general consensus that 10% of the bill should be left as a tip (this is the minimum expected in the USA, for example), however tips can be anywhere from greater to lower than this.

Difference between tips and service charges

What distinguishes service fees from tips, first? On food bills, service fees are included as either a "discretionary" or "compulsory" price. This is how they diverge:

• Compulsory service charge: Must be disclosed to the consumer before placing an order. Only when the consumer receives subpar service can they refuse to pay.

• Discretionary service charge: This fee may be added to the bill receipt at the conclusion of the meal, but the client is always free to decline it.

A service charge is a type of tip for service that is added to a customer's bill as an optional or required additional expense. At the conclusion of the service, a discretionary service charge is added to the client's bill; however, the customer has the option to refuse to pay it for a variety of reasons, including dissatisfaction with the service or plain laziness.

A mandatory service charge is precisely that—mandatory—and as such, it must be disclosed up front before the start of the service. If the service was subpar, that is the only defense for not paying a required service charge.

Without a doubt, appropriate compensation should be matched with good service. It might be offered as a tip. But keep in mind that, unlike other service fees, leaving tips is not required. A tip is something you give out of the goodness of your heart to express your gratitude, whereas a service charge is more frequently started by the business owner.

In both situations, the business adds the charge to the bill rather than the client. The payment for the service also includes a gratuity, although it is more 'freestyle'. Customers that tip willingly give an additional amount of money to express their gratitude and satisfaction with their experience, which is a much more "freestyle" approach to gratuities.

Even though leaving tips is entirely up to the discretion of the client, there is a slight cultural expectation in the UK that some sort of tip will be given, especially in restaurants where there isn't a separate service charge. In restaurants where there is no added service charge, leaving a tip is customarily expected even when it is optional.

However, a gratuity is rarely anticipated if you are simply purchasing a coffee in a tiny café or a beer at the bar. Some claim that while tips are frequently paid in cash, gratuities are typically paid by card in addition to the bill amount (on top of the service charge). Some people view them as synonyms.

As an alternative, some companies charge a cover charge, which is a set sum that the client must pay.

Tax on gratuity vs. service charge

Taxes on tips and service charges are the same as those on regular wages. The IRS views them both as forms of income, so you are required to pay both federal income tax and FICA tax on these wages.

If any of the aforementioned scenarios apply to money or valuables received from customers, they must be considered as gratuities and taxed in accordance with IRS guidelines.

Additionally, tips must be freely offered (i.e., without compulsion) and the consumer must be permitted to choose who receives the cash. These salaries are not like meals that are tax deductible but cannot be deducted at the end of the year. It is the employee's responsibility to submit a monthly tip income report to their employer.

Employers may be eligible for the FICA tip credit if they operate service-based enterprises where tips are common. This credit only applies to tipped salaries, not service charges, albeit it has the potential to save companies hundreds or even thousands of dollars annually.

Accurate calculation and categorization of additional money provided to employees are crucial to maximizing this credit. Falsely classifying service charges as tipped earnings in an effort to boost the credit could end up costing the business considerably more in fees and penalties.

Employers must withhold payroll taxes before distributing service charges to employees because they are considered normal salaries for tax calculation purposes.

On the other hand, when disbursing tipped earnings, prior withholding is not necessary. Since service fees are frequently more uniform than cash gratuities, employers can keep track of them. Any percentage of service charges paid to employees is considered regular compensation.

Payroll taxes may get complicated by tip and service charges. To ensure that your company benefits the most from tax credits and prevent unwarranted fines or penalties due to incorrectly calculating gratuities or service charges, choose a trusted payroll provider.

Tip Reporting

Employees

Employees must include all tips in their total income for tax purposes. Along with any cash tips, this also includes the worth of any non-cash tips. Employees must also report monetary tips to their employers, with the exception of tips that are less than $20 in any given month.

Cash tips include tips from customers, tips that are paid to an employee by their company (such as credit and debit card charges), and tips that are gathered from other employees as part of any tip-sharing program. Tips that an employee receives from customers in a form other than cash, such as passes, tickets, or other goods or commodities, are referred to as non-cash tips.

These tips are not reported to the employer. Both cash and non-cash tips are taxable as part of an employee's total income and must be reported to the IRS.

Non-cash tips are not covered by the employee reporting requirement, though. A waitress, for instance, is not obligated to report a tip to her employer if a customer tips her with an expensive piece of jewellery, but she must include the tip in her gross income.

Tipped workers, both directly and indirectly. Employees who are tipped both directly and indirectly must inform their employer of the gratuities received. Any employee that receives tips directly from customers, including contributions that are contributed to a tip pool, is referred to as a "directly tipped employee." Servers, bartenders, and hairdressers are a few examples.

An employee who typically does not receive tips directly is referred to as a "indirectly tipped employee." Bussers, cooks, and salon shampooers are a few examples.

Employers

Employers must maintain employee "tip records" in order to deduct income taxes, Social Security taxes, and Medicare taxes from employee earnings based on reported tips. Additionally, based on the total wages provided to tipped employees as well as the reported tipped revenue, businesses are required to pay their proportionate part of Social Security and Medicare taxes.

The Form W-2 must contain tips reported to the employer by the employee in Box 1 (Wages, Tips, and Other Compensation), Box 5 (Medicare Wages and Tips), and Box 7. (Social Security tips). Employers must fill out Box 12 on Form W-2 with the total of any unpaid Social Security and Medicare taxes.

If an employee receives tips that total more than $20 in a given month, they are required to pay Federal Unemployment Tax Act (FUTA) taxes. They must additionally deduct from the tipped wages of their employees federal income tax, Social Security tax, and Medicare tax. If relevant, you as a small business owner can record gratuities together with paid and unpaid payroll taxes on Form 941.

Tip Credit

When a consumer leaves a tip for an employee, the tip remains in the employee's pocket and never belongs to the company. The difference between the required cash wage ($2.13) and the federal minimum wage ($7.25), or $5.12, is what's known as a "tip credit" and is permitted by the FLSA (the maximum tip credit an employer can claim). Any tip credit claimed by an employer is limited to the actual tips that the employee actually received. Additionally, unless the employee is informed that the employer is taking a tip credit, the tip credit cannot be applied.

Service charges Reporting

Service fees should be treated equally to normal earnings by employers for the purpose of tax filing and withholding. According to the updated fact sheet, distribution service costs must be reported on Form W-2 in Boxes 1, 3 (Social Security earnings), and 5.

In 2012, the IRS published a revenue ruling on this subject (see Rev Rul 2012-18, 2012-26 IRB 1032). The revenue judgement includes examples to illustrate the ideas.

How to accept tips and service charges

Cash is on its way out, and COVID-19 is making it particularly unpopular right now. Despite this, you don't have to say goodbye to your hard-earned tips. When entering the price into your card reader or other electronic point of sale, you simply need to add the service charge to the final total.

When it comes to using plastic to make payments, tips have always been the most difficult part. However, owing to technology, this is no longer the case.

Card machines

High-end card machines include tipping capability as standard, allowing your customers to pay as they like while still leaving a tip.

Let's take a brief look at each of our four card readers to see if you can collect tips.

Counter-top

Our compact, clever, and stylish counter-top device is installed at your point of sale, connected to your phone or broadband, and it takes all of the most recent payment methods, including contactless and mobile wallets.

Portable

Our mobile card reader's Bluetooth technology and outstanding 50-meter range enable you to accept card payments from wherever in your establishment, making it a favorite among service-based companies looking to provide top-notch customer care.

Mobile

The mobile device is identical to the previous ones in terms of functionality, but thanks to an integrated SIM card, it can accept payments from anywhere in the nation, making it ideal for takeaways and deliveries.

Order and pay at the table

Our order & pay at table solution, created exclusively for hospitality enterprises, is last but certainly not least. Diners can scan, order, and pay using an app without getting up from their seat, and tipping is automatically included in the solution as well. This is how it goes:

• They'll give you a unique QR code that you may post around your business.

• Customers are directed directly to your menu after scanning the code with their smartphone.

• They take their time looking around and place orders from their table when they're ready.

• After the service is over, they pay via the app, including tips.

Which should I accept?

Although it's truly up to you which method you prefer—the service charge or tipping—you should follow the HMRC-established tax and National Insurance regulations. Because the appropriate tip is already determined for them, some consumers find it simpler to deal with service fees. Others would prefer not to be pressured into paying a certain amount, in which case a tipping system would be preferable.

The system preferred for the point of sale, accounting, and employee wages affects the business' decision between tipping and service charges.

For instance, you may decide to merely pay minimum wage to your personnel and leave tips in their pockets, or you could accept mandatory service charges, which could result in greater hourly wages that are consistent for everyone.

Sadly, we don't have an algorithm that informs us which establishments should accept which type of tip, but we do have a few top suggestions that may help you choose whether tips or service charges are more appropriate for your company.

Customer preference

Some clients like a service charge because it saves them the trouble of determining how much is appropriate. The expectation may offend some people. It's a conundrum, but you can solve it by asking.

Why not conduct a poll or create a brief questionnaire before making a decision and ask your clients for their preferences as well as what percentage they believe is appropriate? (if you did opt for a service charge). To spread this, use your online presence and subscriber list. Your followers and subscribers will be current clients, and their opinions matter.

Staff preference

Not just your customers' opinions, but also those of your staff, are important. While tips can provide waiters and waitresses with significant additional cash, they can occasionally make the kitchen workers feel disrespected.

If you decide to implement tipping, it's crucial to communicate with your team about how monetary tips will be handled and divided among all staff members.

It could be simpler to divide evenly service fees that have been added to the bill.

Payment methods

Since tips are typically provided in cash, it may be difficult for consumers to pay for additional service if your payment systems aren't set up to handle tips in today's cashless society.

If you add service charges to the bill, you can avoid using cash completely, which may make them a simpler choice—unless your payment systems include tipping, which, spoiler alert, all of ours do!

Another important factor to think about is the service charge's %. For some who already feel they are overpaying on a fancy meal out, adding 20% to the bill may seem a bit excessive in cities where food is already pricey. While a greater cost is preferable for establishments where patrons come for the experience or quality of service rather than the food or drink, a fee of about 10 percent to 15 percent is arguably less burdensome for patrons.

Any organised establishment should have clear rules for how the money is dispersed among the personnel, regardless of how you are compensated for providing customer care.

What if you accept both?

Can you still collect tips if you accept service charges? Yes, in fact, this is typical, is the quick response. If a consumer feels that the service went above and above, they could add money on top of the service price; in this situation, the extra cash is treated as a distinct voluntary tip from the service charge.

You could decide to add a smaller-than-average service charge of, say, 10% to maximize the overall amount supplied for the service. Customers could be more likely to leave a little tip in cash or by credit card when there is such a "base" price.

The sum of the two is probably greater than if the client had only left a voluntary gratuity.

You still need a clear policy in place at work even if you don't encourage tipping with a service charge in case staff receive gratuities independently. It is the employer's duty to handle any voluntary additions to card payments in accordance with internal and HMRC policies.

Who pays taxes on service fees and tips?

When it comes to taxes, tips and service fees are taxed the same as regular pay. This indicates that payroll taxes continue to be levied on various forms of income. Therefore, tip and service charge taxes must be paid by both employers and employees.

Employers in the tipping sector deduct income taxes from employee pay, just like in other sectors. Employers must account for tips and service charges when determining withholdings for employees who are tipped. Employers will immediately deduct the appropriate payroll taxes from an employee's paycheck upon the reporting of tipped wages.

The total amount of employer payroll taxes due might also be impacted by tips and service fees. Employers are liable for contributing to state and federal unemployment taxes, as well as Social Security and Medicare taxes. More gratuities and service charges result in larger gross pay, which in turn raise the employer’s tax liability.

How Deskera Can help You?

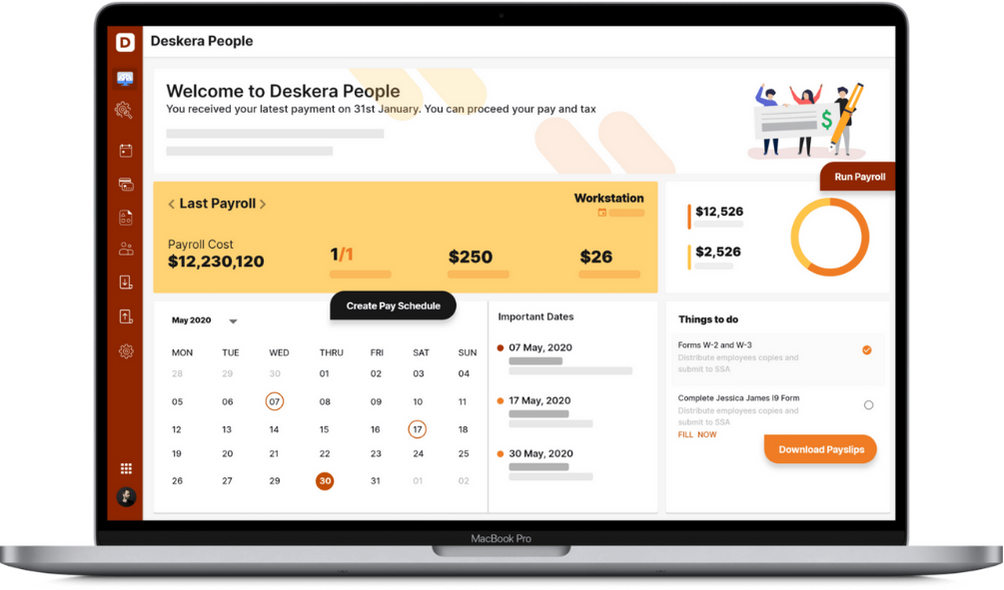

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key takeaways

- A service charge is any non-discretionary charge that is applied to a customer's bill, regardless of its name. This includes auto gratuities, back-of-house service fees, health and wellness fees, and any other expenses that a consumer cannot opt out of.

- Both cash and non-cash tips are often regarded as taxable income. An employee is required to declare any financial tips they get to their employer each month. However, tips do not have to be disclosed if the total amount collected in that month is less than $20.

- The IRS classifies service fees as non-tip income. This implies that businesses that charge service fees should consider these payments to be regular sources of income. Make a note in your payroll system if employees receive a portion of service charges.

- When an employer distributes all or a portion of a service charge to its employees, the distribution may be at the employer's discretion, and the service charge, which would be in the nature of a bonus, would be included in the regular rate of pay when calculating overtime compensation.

- Tips are voluntary presents that customers offer to employees. Sales tax is not gathered on them since they are not regarded as business revenue. Tips may be combined, and you may give all regularly tipped staff a tip credit, depending on your business model. Tips cannot be distributed by a firm very freely because they belong to the employee.

Related articles