Borrowers may come across certain kinds of loans. Among those loans includes— secured and unsecured lines of credit. Both of them hold different aspects related to collateral, interest rates, consequences, and more. Nevertheless, it is important to understand both these types of loans before deciding which works the best for your long-term financial health.

In this detailed guide, we have discussed all the relevant subjects related to secured lines of credit and unsecured lines of credit. We’ll cover:

- What is a Secured Loan?

- What is an Unsecured Loan?

- Secured Loan Vs Unsecured Loan

- Pros and Cons of Secured Loan

- Pros and Cons of Unsecured Loan

- Type of debts you should prioritize paying off first

- Is Secured Loan right for your business?

- Is Unsecured Loan right for your business?

- What will happen if you don’t pay secured debts?

- What will happen if you don’t pay unsecured debts?

- Paying off secured debts Vs Unsecured debts

- Building credit with Secured Loan Vs Unsecured Loan

- Choosing between Secured Loan Vs Unsecured Loan

Let’s learn more in this article:

What is a Secured Loan?

Secured lines of credit are personal or business loans that are collateralized by valuable assets. Further, a lender will ask for collateral or title until you repay the full loan. In addition, car loans, home loans, bonds, stocks, or personal assets could be used as collateral.

Simply put, you are providing security to the lender that their loan will be repaid. However, in case you are not able to pay the loan on time, then the lender has the right to sell, foreclosure, or seize your collateral to recoup the outstanding loan amount.

Note that secured loans come with lower risk for lenders. Also, borrowers have the convenience of a lower rate of interest with secured loans. On the contrary, some secured lines of credit such as — short-term installment loans or bad credit personal loans often have higher rates of interest.

Secured Loans Features

Following is the list of features of secured loans. Check out:

- It provides flexible repayment options as compared to regular loans.

- You obtain faster approval for secured loans.

- Secured loans could be obtained against the deed or title of personal assets. It includes property, home, automobile, and more.

- You get options for variable rates and fixed rates.

- Even non-salaried individuals could obtain secured loans.

- No requirement for any guarantor in these loans.

- As compared to unsecured lines of credit, you get lower rates of interest.

- You get customizable loans for your needs.

- Lenders or banks can repossess personal assets on which a loan was obtained.

- When you repay a secured loan in full, then your CIBIL score improves.

What is an Unsecured Loan?

Unlike secured loans, an unsecured line of credit does not need any kind of collateral. The word ‘Unsecured’ clearly states that the lender or bank cannot foreclosure or seize the borrower's assets. Instead, lenders or banks approving unsecured loans completely relied on the borrower's creditworthiness.

Furthermore, if you want to protect your personal assets and want instant cash, then this loan works best for you. Examples of unsecured loans include credit cards, personal loans, student loans, and much more.

Unsecured Loans Features

Following is the list of features of unsecured lines of credit. Check out:

- Borrowers are free from providing any collateral. It makes borrowers at ease when it comes to the protection of personal assets.

- Unsecured loans possess a risk for lenders as they cannot seize or foreclose borrower's assets. Therefore, lenders charge a high rate of interest on unsecured lines of credit. Also, they have strict prerequisites for this type of loan.

- Lenders or banks could counteract borrowers' non-repayment by taking the concern to court and filing the case against the borrower.

- Unsecured loans do not offer any tax benefits.

- With an Unsecured line of credit, borrowers can obtain only a smaller loan value.

- For Unsecured loans, payment terms are lower and range from 3 months to 5 years. However, interest rates and payment terms may vary depending on the outstanding amount.

Secured Loan Vs Unsecured Loan

Check the mentioned table to understand the difference between a secured loan and an unsecured loan:

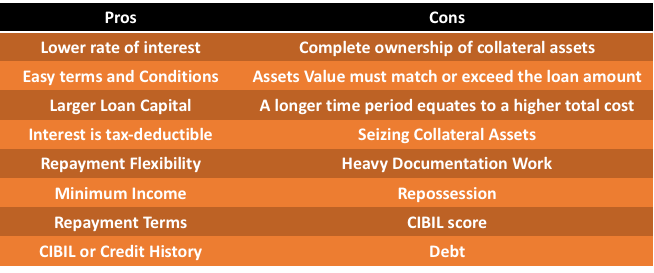

Pros and Cons of Secured Loan

Here we have listed the benefits and disadvantages of a secured line of credit. Let’s check:

Pros of Secured Loans

You will have certain benefits with a secured line of credit that you might miss with other kinds of loans. It includes:

- Lower rate of interest

As lenders or banks can keep your collateral, therefore, they will lend you a lower interest rate.

- Easy terms and Conditions

You will get simplified, easy, and inexpensive processing, better terms & conditions, and faster documentation.

- Larger Loan Capital

As banks or lenders know that their investment is protected so they may approve your larger loan amount. It can get close to your collateral assets.

- Interest is tax-deductible

It means you'll save even more money that might otherwise be lost to taxes.

- Repayment Flexibility

Repayment terms are flexible and can be tailored to your financial situation. Further, you can return your loan faster by paying larger EMIs over a shorter period of time. Also, you can pay lower sums over a longer period of time. For as long as your collateral asset is yours, you have the option.

- Minimum Income

The needed minimum income is significantly lower than for the unsecured line of credit. Further, this factor helps to determine your ability to repay. Also, your ability to repay becomes irrelevant because you have already paid them in full by putting an asset as collateral.

- Repayment Terms

Flexible repayment terms eliminate the need to worry about certain aspects. It includes fines and charges on settlement payments, pre-closing your loan, making one large payment that drastically reduces your capital, or if you want to close your loan early or even extend your loan tenure.

- CIBIL or Credit History

A secured line of credit can be obtained by those with a poor credit history or a low CIBIL score. Further, both these are indicative of your ability to repay your loan. In addition, when you include a collateral item in the calculation, the bank no longer needs to know if you can or cannot repay your loan. However, they require CIBIL and credit history information in order to estimate their own risk.

Cons of Secured Loans

You will face some disadvantages with secured loans. It includes:

- Complete ownership of collateral assets

If you want to pledge an asset as collateral for a loan, you must own it outright. Also, the asset must be free of any EMIs and partnership agreements, and it must be owned entirely by the person requesting the loan.

- CIBIL score

If you default on a secured line of credit, your CIBIL score will suffer significantly. Further, if the bank has to seize your home and other assets, then your credit score and rating may plummet. And, you will face difficulties to recover your credit score ahead of.

- Debt

If you are unable to repay the loan after the bank has confiscated your possessions. Then, you will be sentenced to a life in which all of your earnings will go to the bank. The majority of the time, you'll be paying off interest and penalty costs while keeping the principal amount the same.

- Repossession

If you buy a car with a secured loan, for example, you're putting the car up as collateral against the potential of defaulting on the debt. However, if you fail or skip a payment or default in any way. Then, the bank will repossess your new vehicle and deem all of your EMI payments to be void.

- Assets Value must match or exceed the loan amount

The loan you want must be repayable through the sale of the asset you're pledging. However, if the bank is unable to recoup its losses through the sale of the collateral. Then, it will pursue you with a deficiency judgment, which will bind you to fulfill your obligations.

- A longer time period equates to a higher total cost

A longer repayment period allows for more potential snags in your overall rate of income. However, if you miss an EMI payment, the bank will impose steep fines and penalties. It will further compound over time and lead to the loss of your asset. In addition, a longer repayment schedule also entails a higher chance of default.

- Seizing Collateral Assets

While the bank may authorize a larger loan amount and a lower interest rate. Then, it will not hesitate to confiscate all of the assets you have pledged as security. Therefore, you must be just as willing to relinquish the pledged asset as you are to accept the loan. You may lose your home, your car, and other assets if you fail to repay the loan.

- Heavy Documentation Work

This type of loan necessitates a heavy amount of documentation. You will be asked to produce the standard documentation such as identification, age, and address evidence. Also, it will include documents pertaining to the ownership of your asset.

Furthermore, you'll also have to attach a metric tonne of specimen signatures to a series of documents. However, if any of them doesn’t match, then you'll have to repeat the entire tedious process.

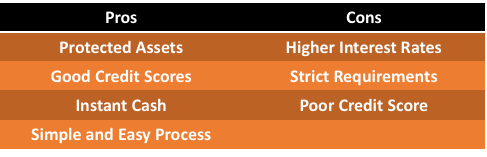

Pros and cons of Unsecured Loan

Here we have listed the benefits and disadvantages of unsecured loans. Let’s check:

Pros of Unsecured Loans

You will have certain benefits with an unsecured line of credit. It includes:

- Protected Assets: In unsecured loans, you do not have to deal with your personal assets including — car, home, property, and more. All you have to focus on is to showcase your creditworthiness to get qualified for an unsecured line of credit.

- Good Credit Scores: Having good credit scores get you qualified for unsecured loans. Suppose, if you have a good credit score, then you may not need to supply as many documents when applying for a cash loan. If your records are in good shape, getting approved is simple.

- Instant Cash: An unsecured line of credit is also available to those who require fast funds. Moreover, if you are qualified, you won't need to hunt for collateral. All you need to focus on is preparing your documentation, showing your credit ratings to your prospective lender, and having your loan accepted as soon as possible. In addition, unsecured lines of credit are perfect for consumers looking for short-term financing.

- Simple and Easy Process: You don't have to go through the appraisal process or wait for the lender to determine the fair market value of your property. It is because the unsecured lines of credit don’t require security. Furthermore, this means a simpler application process for borrowers. Ultimately, all you have to do now is submit your paperwork and wait for them to be approved.

Cons of Unsecured Loans

Here is the list of disadvantages associated with the Unsecured line of credit. It includes:

- Higher Interest Rates: Because the loan is unsecured, banks and lending organizations impose steep fines and taxes on those who break the terms. Further, while you can acquire a loan right away, you will have to pay exorbitant interest rates in the long run. Nevertheless, some borrowers may live with this disadvantage, but it comes at a high price.

- Strict Requirements: When it comes to applications, banks, and other lenders are quite strict with their processes. Moreover, your application might get rejected even if you fail to meet one or two of the prerequisites. Therefore, make sure to submit all of your documentation on time. Although the bank will follow up for missing facts in an incomplete document, your application may be queued for further review.

- Poor Credit Score: If you don't pay on time or default, the lender will have to report it to the credit bureaus. It would further affect your credit score. Moreover, a poor credit history will have an impact on future loan applications. In addition, if you want to avoid this, make sure to wisely arrange your payments ahead of time.

Type of debt you should prioritize paying off first

Everyone has different financial situations. Therefore, paying off debt may vary from person to person. However, you may still learn basic aspects of how you should prioritize paying off your debts. Let’s learn:

By Collateral

Secured debt includes collateral, whereas unsecured debt does not require collateral. If you fail to repay your secured loans, then your collateral— car loans, mortgages, or more would be seized or repossessed by the lender.

On the contrary, your assets would be protected in unsecured debts. However, you may face legal issues in extreme cases. Comparing both secured and unsecured lines of credit, you should prioritize paying off secured lines of credit to safeguard your collateral.

Nevertheless, make sure to repay on time to avoid affecting your payment, history, credit score, and other relevant financial elements.

By Interest

If your main focus to repay your loans is through interest, then you should consider paying unsecured debts. The reason behind it is that unsecured lines of credit have higher interest rates as compared to secured loans. In addition, you may face extra interest or fees if you fail to repay your debts. Make sure to pay off your smaller bills first to gain momentum.

By Balances and Terms

Instead of focusing on interest rates, you prioritize paying off your lowest loan first. It can be done while making minimum payments on your other debts. Furthermore, after you've paid off the smallest loan, put that money toward the next smallest debt. Continue until you've paid off all of your debts.

Is a Secured loan right for your business?

A secured line of credit can is generally used for multiple purposes. It includes purchasing property, cars, homes, renovations, and other expensive financial things.

Further, secured loans are a perfect fit for putting up security for either you or your shareholders. In addition, you may have to repay the loan over a longer period of time. However, you may be offered a lower interest rate, lowering your monthly payments and overall borrowing costs.

Is an Unsecured loan right for your business?

Unsecured debts work best for short-term borrowers and smaller capital loans. It is a perfect fit for those companies that are facing low sales situations and want instant cash flow to balance the situation. Furthermore, some lenders offer a revenue-based repayment option that provides access to businesses to repay loans at their own ease and pace.

Furthermore, an unsecured line of credit may have higher interest rates. However, many lenders will allow you to repay your loan early at no extra penalty and will not impose any upfront costs. In addition, they'll also provide repayment flexibility, with the extra benefits of top-ups and repayment holidays that won't affect any future lending.

What happens when you don’t pay secured debts?

Secured debt possesses lower risk for banks or lenders. However, borrowers, have to provide collateral to obtain secured loans. Further, if borrowers fail to pay secured debts, then lenders or banks may seize, foreclosure, or repossess borrower’s assets.

In addition, lenders may report negative information to credit agencies that may affect your credit score. It may further take a longer period to recover from a poor credit score.

Therefore, make sure to read and analyze all the terms and conditions before taking up a secured line of credit. So that you don’t end up getting into any financial hassle.

What happens when you don’t pay unsecured debts?

Unsecured debts do not possess any risk for your personal assets. However, it does not mean that these types of loans are free from any potential risks.

Note that every scenario varies in unsecured debt. If your payments are delayed or missed, then you will get charged for late fees. Also, you may get charged extra interest rate charges.

Further, if your outstanding payments are lagging for a longer time, then your account could be transferred to collections. In addition, lenders may report your delayed payments to reputable credit agencies and it may affect your credit score.

Note that a poor negative score may remain on your account for seven years, and it may be difficult to recover ahead.

However, in extreme cases, if you fail to repay your loan amount, then the lender or banks may file a case against you and drag you to court.

Paying off Secured Vs Unsecured debts

It is crucial to make a plan to pay off your debts on time. Make sure to pay at least a minimum amount on all your debts. It will further help you to ensure that you are not lagging behind and won’t pose any risk to lose your collateral. Your collateral may include your automobile, home, personal assets, and much more.

For Unsecured loans, you will get charged with a higher rate of interest. Therefore, logically speaking, you should prioritize your unsecured debts to avoid paying higher charges.

Here we have listed two ways suggested by the Consumer Financial Protection Bureau (CFPB) that you should consider. It includes:

Snowball Method

According to the Snowball Method, you should focus on paying off your smallest debts. First and foremost, you need to create a list of your debts and then categorize them (from lowest to highest) depending on the owned loan.

Furthermore, make the minimum payment on all debts except the smallest. Then, in your budget, allocate more funds to the lesser debt. Apply the snowball strategy to the next smallest debt after you've settled it.

Avalanche Method

According to the CFPB, the avalanche method is the ‘highest interest rate method.’ It states to strategize and focus on targeting the high-interest rate loans.

Firstly, you need to make a list of your loans and categorize them (from lowest to highest) depending upon the interest rate.

Furthermore, except for the one at the top, pay the bare minimum on each debt. Then, similar to the snowball method, apply the leftover funds to the loan with the greatest interest rate. Nevertheless, apply the avalanche strategy to the debt with the next highest interest rate after you've paid it off.

Another alternative is to refinance your debt or use a balance transfer to combine or streamline your payments. However, make sure to look at the total cost of transferring debt, as well as interest rates. Consolidation may be more expensive due to factors such as transfer fees.

Before you do anything, speak with a financial professional. They may be able to assist you in making the best option.

Building credit with Secured Vs Unsecured debts

Rebuilding or establishing your credit works similar to these two kinds of credit cards. However, your card’s activity is being reported that includes account history, payment information, card balance, and other financial aspects. It is further reported to credit agencies. They analyze the above-mentioned categories and generate your credit score.

Although, your report may vary as not every card issuer reports the status of secured cards. However, if you want to increase your credit score, then you should focus on a card issuer who reports to leading credit bureaus.

Note that your credit score may get affected due to certain elements. It includes delayed or missing repayment, opening multiple accounts, maxing out your card, and much more.

The Consumer Financial Protection Bureau (CFPB) also offers credit-building advice. You need to make it a point to pay your credit card account on time every month. Further, focus on paying your balance in full each month, or at the very least keep it low. Ultimately, avoid using more than 30% of your credit limit.

Choosing between Secured Vs Unsecured loans

The answer to this question could vary from person to person. Because every individual has a different financial situation and purpose.

Considering secured loans, then it works perfectly for those who are long-term borrowers who want a large capital loan. Furthermore, you can obtain this loan for purchasing property, renovating houses, tuition, and other expensive things.

Note that you will get a low-interest rate on secured loans as compared to unsecured loans. In addition, you don’t have to pay higher interest even if your payment scheme goes beyond a year or so.

Next, considering Unsecured loans, it works best for short-term borrowers who want small capital loans. Furthermore, you can obtain these loans for medical bills, monthly expenses, short-term expenditures, and much more.

Note that unsecured lines of credit have higher interest rates. In case, you do not have any collateral or even if you want to protect your assets, then go for unsecured loans.

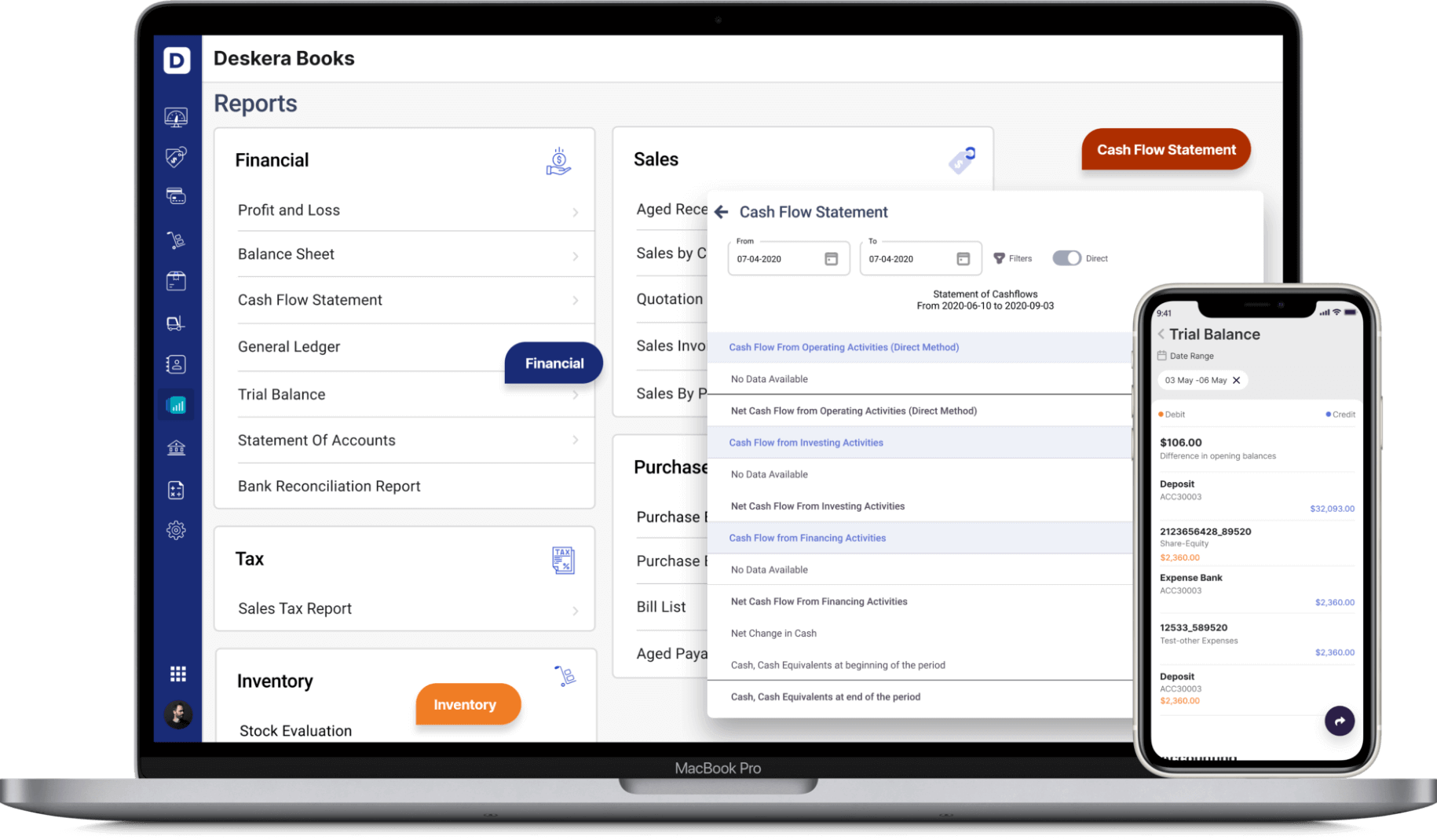

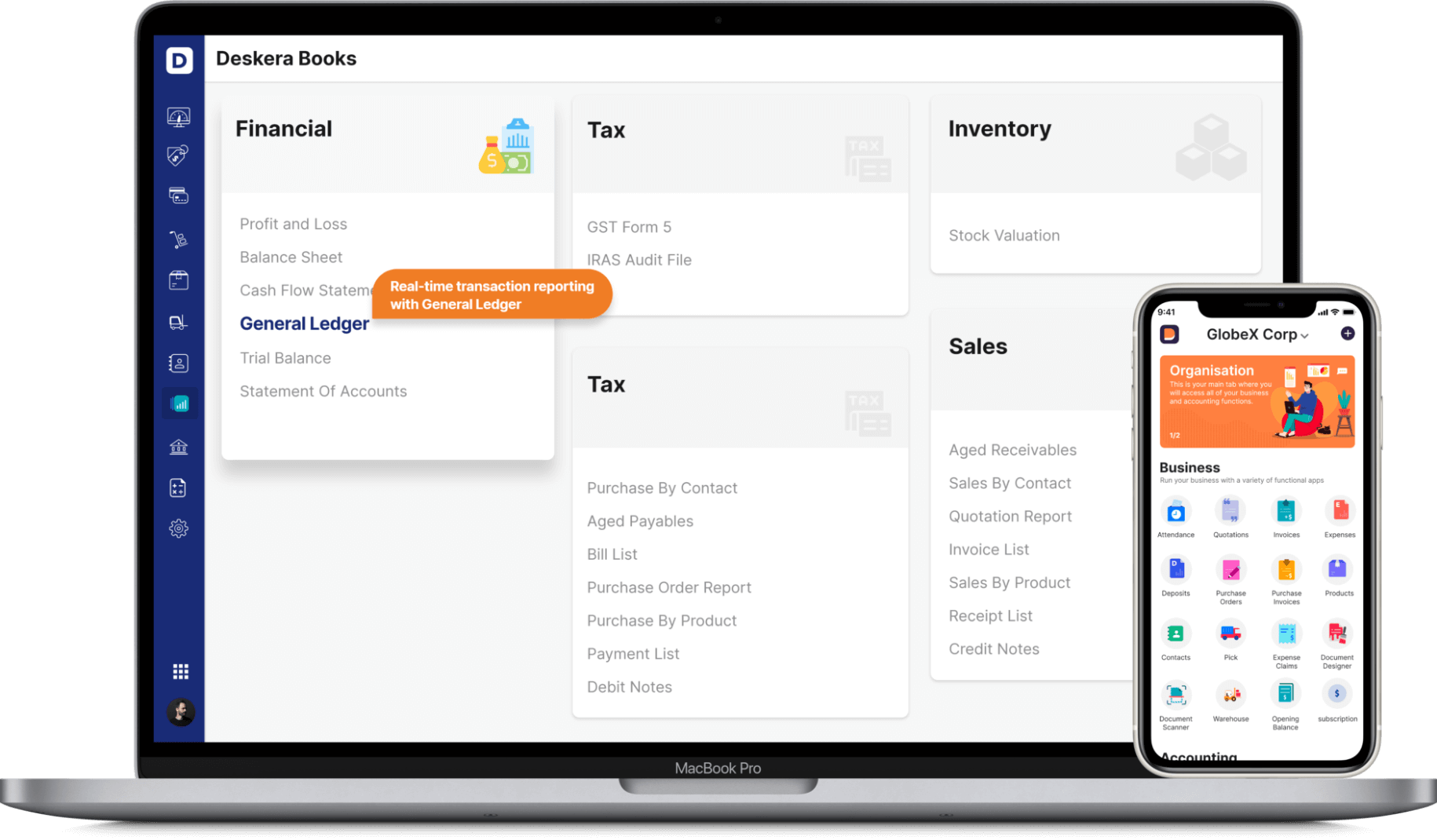

How can Deskera Books Help Your Business

Take your business to the next level with Deskera All-in-One. It is a platform that offers Invoicing, Accounting, Inventory, CRM, HR & Payroll all under one roof. With Deskera books, you can keep track of your business cash flow and revenue using its financial reports. Accounting can be easily managed Deskera Books and can help you keep track of your balance sheet, profit and loss statement and journal ledger. All this simplifies your accounting and tracking of your financial records, making it easy for your business to get business credit and to secure loans.

With Deskera Books, you can avail of online invoicing, accounting & inventory software to boost your business. It covers all the significant aspects of business such as billing, payments, warehouse management, Credit & Debit Notes, financial reports, an elaborate business dashboard apart from many other features.

Key Takeaways

Finally, we have reached the end of this comprehensive guide. We have summarised all the important points for your reference below:

- Secured loans are personal or business loans that are collateralized by valuable assets.

- Unsecured does not need any kind of collateral.

- Types of debts that you should pay off first based on certain factors. It includes— collateral, interest rates, and balances and terms.

- Secured loans work best for long-term borrowers and larger capital loans.

- Unsecured debts work best for short-term borrowers and smaller capital loans.

- Secured debt possesses lower risk for banks or lenders.

- Unsecured debts do not possess any risk for your personal assets.

- Credit score may get affected due to — delayed or missing repayment, opening multiple accounts, maxing out your card, and much more.