Are you a small business owner looking for ways to reduce your tax burden? One of the most valuable tax breaks available to you might be the Qualified Business Income (QBI) deduction. Introduced as part of the Tax Cuts and Jobs Act (TCJA) of 2017, the QBI deduction allows eligible business owners to potentially deduct up to 20% of their business income on their taxes. This powerful tax benefit can lead to significant savings, but what exactly qualifies as QBI, and who can take advantage of this deduction?

In simple terms, Qualified Business Income refers to the net income earned from a qualified trade or business, excluding investment income like dividends and capital gains. This deduction is available to sole proprietors, partnerships, S corporations, and certain trusts, making it a crucial consideration for anyone running their own business. However, understanding the nuances of QBI, such as income thresholds and exclusions, is key to maximizing the benefits.

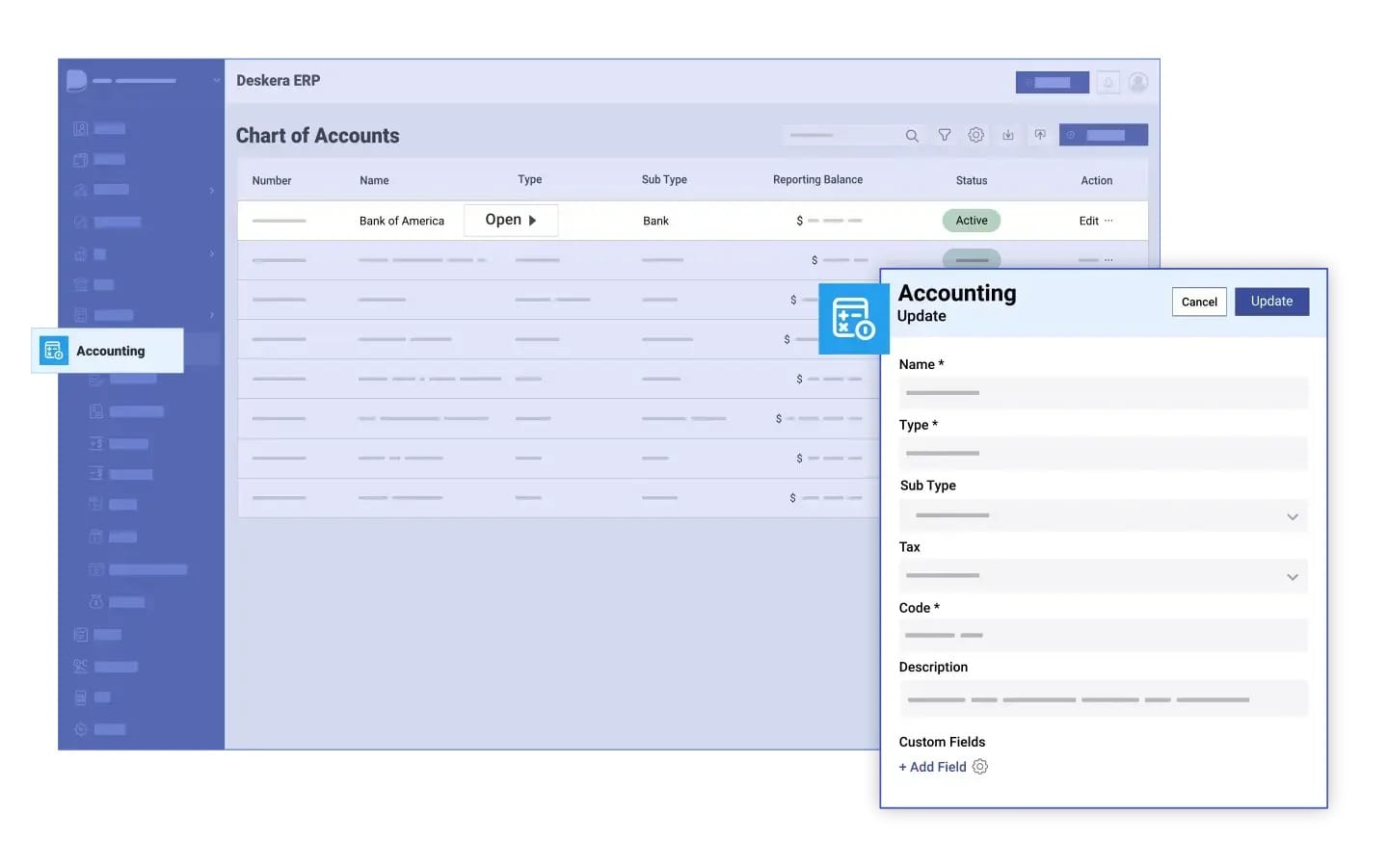

When it comes to managing your finances and staying on top of your business income, using the right accounting tools can make a big difference. Deskera ERP simplifies accounting by offering features like real-time financial reporting, automated invoicing, and expense tracking. With built-in tools for tax management and compliance, Deskera helps you keep accurate records, ensuring you're always prepared for tax season and ready to optimize your QBI deduction.

By staying informed about the specifics of QBI and utilizing robust accounting solutions like Deskera, small business owners can streamline their operations, stay compliant, and make the most of available tax benefits. Let's explore QBI in more detail and discover how you can leverage this deduction to reduce your taxable income.

What is Qualified Business Income (QBI)?

Qualified Business Income (QBI) is a tax term that refers to the net income earned from a qualified trade or business, excluding certain types of income like capital gains, dividends, and interest. Introduced under the Tax Cuts and Jobs Act (TCJA) of 2017, the QBI deduction allows eligible individuals and small business owners to deduct up to 20% of their qualified business income on their federal taxes.

QBI applies to sole proprietors, partnerships, S corporations, and some trusts and estates. The deduction is intended to reduce the overall tax burden on small and medium-sized businesses, helping them retain more of their profits. However, not all income qualifies—investment income, wages, and other specified types of income are excluded from the calculation.

There are also income thresholds and limitations based on the type of business, such as Specified Service Trades or Businesses (SSTBs), which include professions like law, healthcare, and consulting. For those earning above the threshold, additional factors like wages paid and the value of business property can affect the amount of the QBI deduction.

Qualified Business Income vs. Ordinary Business Income

Qualified Business Income (QBI) and Ordinary Business Income are both forms of income derived from business activities, but they differ in how they are defined, taxed, and reported. Understanding the distinctions between these two types of income is essential for maximizing tax benefits and compliance.

Below is a comparison of the two:

1. Definition

- Qualified Business Income (QBI) refers to the net income earned from a qualified trade or business that is eligible for the QBI deduction under Section 199A of the U.S. tax code. QBI applies only to pass-through entities, such as sole proprietorships, partnerships, S corporations, and certain trusts and estates. This income includes profits from active business operations but excludes certain types of income like capital gains, interest income, and dividends.

- Ordinary Business Income represents the total income generated from regular business operations before considering any special deductions like QBI. It includes gross receipts minus business expenses, such as operating costs, wages, and depreciation. Ordinary business income applies to all types of businesses, including C corporations, S corporations, and partnerships. It also includes income that may not qualify for the QBI deduction, such as investment income and certain service-based income above income thresholds.

2. Tax Treatment

- QBI: The QBI deduction allows eligible taxpayers to deduct up to 20% of their qualified business income. This deduction reduces the amount of income subject to taxation but is not a direct deduction against business income itself. It is a separate deduction applied to the taxpayer’s taxable income after business income is calculated. Additionally, the deduction is subject to income thresholds and wage/property limitations for higher-income earners.

- Ordinary Business Income: Ordinary business income is taxed according to the standard tax rates applicable to the taxpayer’s business structure. For pass-through entities, the income flows through to the individual owner’s tax return and is taxed at their personal income tax rate. C corporations, however, are taxed at the corporate rate, which is currently 21%. There is no additional special deduction like QBI available for ordinary business income.

3. Inclusions and Exclusions

- QBI: Not all income qualifies as QBI. Specifically, the following types of income are excluded:

- Capital gains or losses

- Dividends

- Interest income (unless from business activity such as lending)

- Income earned as an employee

- Certain foreign income

- Certain Specified Service Trades or Businesses (SSTBs) with income above the threshold

- Ordinary Business Income: Includes all income and losses from regular business operations, including income from the sale of goods, services rendered, and even rental income if considered part of the business’s regular activity. However, it also includes items that do not qualify as QBI, such as investment income and interest from savings.

4. Eligibility

- QBI: Only business owners of pass-through entities such as sole proprietorships, partnerships, S corporations, and trusts/estates are eligible to claim the QBI deduction. C corporations are not eligible for the QBI deduction.

- Ordinary Business Income: All business entities—whether pass-through entities, C corporations, or other structures—report ordinary business income. This income is subject to regular taxation based on the structure of the business.

5. Income Thresholds

- QBI: The QBI deduction is subject to income thresholds. For tax year 2024, single filers with taxable income above $191,950 and married couples filing jointly with taxable income above $383,900 may see their deduction phased out, particularly if their business falls under the Specified Service Trade or Business (SSTB) category (e.g., law, health, consulting). Additionally, for high-income earners, the deduction is limited by factors such as wages paid or qualified property owned by the business.

- Ordinary Business Income: There are no specific income thresholds that affect the taxation of ordinary business income. It is simply taxed at the applicable rates based on the business entity type or the individual owner’s tax bracket.

6. Reporting and Compliance

- QBI: When claiming the QBI deduction, business owners must report their qualified business income on IRS forms such as Form 8995 or Form 8995-A. They must also calculate any wage and property limitations if their income exceeds the threshold.

- Ordinary Business Income: All businesses must report ordinary business income on their respective tax returns:

- Sole proprietorships: Schedule C of Form 1040

- Partnerships: Form 1065

- S corporations: Form 1120S

- C corporations: Form 1120

- No special form is required for ordinary business income, but it is subject to regular reporting rules for each business type.

7. Examples

- QBI: A small business owner who operates a bakery as a sole proprietorship earns $100,000 in net income from the business. After deducting business expenses, they are eligible to claim a QBI deduction on this income, reducing their taxable income by up to 20%.

- Ordinary Business Income: A C corporation earns $200,000 in revenue from sales of products, pays $50,000 in business expenses, and has $150,000 in ordinary business income. This income is taxed at the corporate tax rate of 21%, resulting in a tax bill of $31,500, with no QBI deduction applicable.

How Does the QBI Deduction Work?

The Qualified Business Income (QBI) deduction allows eligible business owners to potentially deduct up to 20% of their QBI from their taxable income. However, how the deduction works depends on a variety of factors, including the business structure, income levels, and the type of business activity.

Eligibility for the QBI Deduction

- Eligible Businesses: The QBI deduction is available to owners of sole proprietorships, partnerships, S corporations, and certain trusts and estates. Employees are not eligible to claim this deduction on wages they earn.

- Income Thresholds: For tax year 2024, if your taxable income is below $191,950 for single filers or $383,900 for joint filers, you can generally claim the full 20% deduction. If your income exceeds these thresholds, the deduction may be limited, especially if you are in a Specified Service Trade or Business (SSTB) like health, law, or consulting.

Limitations on the Deduction

For those whose income exceeds the thresholds, the QBI deduction is subject to two main limitations:

- Wage and Property Limitation: If your income exceeds the threshold, the deduction may be limited to the lesser of 20% of your QBI or 50% of wages paid to employees (or 25% of wages plus 2.5% of the cost of qualified property owned by the business).

- Specified Service Trades or Businesses (SSTBs): High-income earners in SSTBs face a phased reduction in their deduction. Once the income is above a certain point, they may lose the deduction entirely.

Exclusions from QBI

Not all income qualifies for the deduction. Income like capital gains, dividends, interest, and foreign income are excluded. Additionally, income earned as an employee or any income derived from investments, such as stocks or bonds, doesn't qualify as QBI.

Understanding these rules can help eligible business owners maximize their tax savings. However, it’s important to stay aware of how these limitations affect your specific situation and consult with a tax professional for personalized advice.

Who Qualifies for the QBI Deduction?

The Qualified Business Income (QBI) deduction is available to a wide range of business owners, but eligibility depends on certain criteria, such as the type of business and the taxpayer's income level.

Here's a breakdown of who qualifies for the QBI deduction:

1. Eligible Business Entities

The QBI deduction is primarily available to owners of pass-through entities, meaning the business income "passes through" to the owner's personal tax return. The following types of businesses can qualify:

- Sole Proprietorships: Individuals who report their business income on Schedule C of their tax returns.

- Partnerships: Partners who receive their share of the partnership’s income.

- S Corporations: Shareholders who report their portion of the S corporation's earnings.

- Certain Trusts and Estates: Some trusts and estates may qualify based on their business income.

It's important to note that C corporations do not qualify for the QBI deduction since they pay corporate taxes rather than passing income through to the owners.

2. Income Thresholds

Taxpayers must meet specific income thresholds to qualify for the full QBI deduction. For the 2024 tax year, the limits are:

- Single filers: Taxable income must be below $191,950 to claim the full 20% deduction.

- Married filing jointly: Taxable income must be below $383,900 to claim the full deduction.

For taxpayers whose income exceeds these thresholds, the deduction is subject to additional rules and limitations, particularly for Specified Service Trades or Businesses (SSTBs).

3. Specified Service Trades or Businesses (SSTBs)

Certain high-income professionals in fields like health, law, accounting, consulting, and other SSTBs may face restrictions on claiming the QBI deduction. If your income exceeds the threshold, the deduction phases out gradually for SSTBs, and it may disappear entirely above certain income levels.

4. Non-Specified Service Businesses

Businesses that do not fall under SSTBs generally have fewer limitations on claiming the QBI deduction, even if their income exceeds the threshold. However, the deduction might still be capped by wage and property-related limitations for high-income earners.

5. Exclusions from the QBI Deduction

- Wage Earners: Employees cannot claim the QBI deduction on their wages or salaries.

- Investment Income: Certain types of income, like capital gains, interest, dividends, and foreign income, are not eligible for the deduction.

By meeting these requirements, a wide range of small business owners can qualify for this valuable tax deduction, potentially reducing their taxable income significantly.

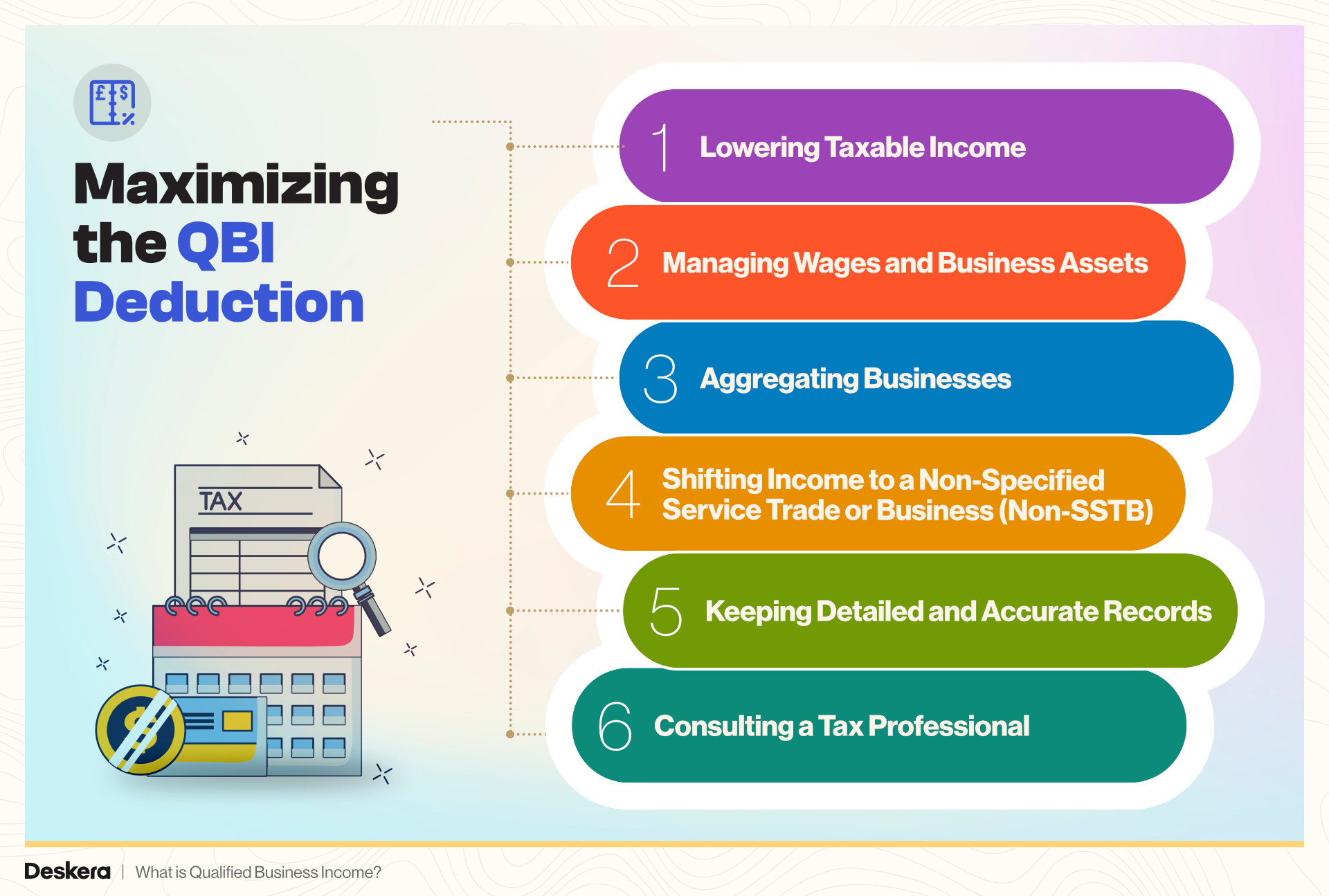

Maximizing the QBI Deduction

Maximizing the Qualified Business Income (QBI) deduction requires a strategic approach, especially for those with higher income or businesses that may face limitations. By understanding how the deduction works and taking proactive steps, business owners can optimize their tax savings.

Here are several strategies to maximize the QBI deduction:

1. Lowering Taxable Income

Since the QBI deduction is influenced by taxable income thresholds, one of the simplest ways to maximize the deduction is to lower your taxable income below the threshold limits:

- Single filers earning below $191,950 and married filers earning below $383,900 are eligible for the full deduction.

- Consider making contributions to retirement accounts (e.g., IRAs, 401(k)s) or health savings accounts (HSAs) to reduce taxable income and increase your QBI deduction.

2. Managing Wages and Business Assets

For businesses that exceed the income threshold, the deduction is limited by either 50% of wages paid to employees or 25% of wages plus 2.5% of the cost of business property. You can maximize your deduction by:

- Increasing wages: If you’re operating a business with few employees, paying reasonable wages to yourself or staff can increase your potential deduction.

- Investing in property: Purchasing qualified business assets such as equipment or buildings can also boost your deduction, as these assets count towards the 2.5% threshold.

3. Aggregating Businesses

If you own multiple businesses, aggregating them may help maximize the deduction. When businesses are aggregated, their income, wages, and assets can be combined to meet the wage and property limitations. This strategy is beneficial for high-income earners, especially when one business generates substantial income while another employs more staff or owns significant assets.

4. Shifting Income to a Non-Specified Service Trade or Business (Non-SSTB)

For high-income professionals in Specified Service Trades or Businesses (SSTBs) like health, law, or consulting, the QBI deduction may phase out as income rises above the threshold. In some cases, shifting certain parts of your business to a non-SSTB (e.g., an equipment rental business) could preserve the deduction by creating QBI from a different qualified source.

5. Keeping Detailed and Accurate Records

Maintaining accurate records is crucial for calculating and maximizing the QBI deduction. Ensure that you:

- Track wages paid: Document employee wages, as this is a key factor in calculating the deduction for high-income earners.

- Classify income correctly: Exclude non-qualifying income such as capital gains, dividends, and investment income from your QBI calculation.

6. Consulting a Tax Professional

Given the complexities of the QBI deduction, working with a tax professional or accountant is one of the best ways to ensure you’re taking full advantage of the deduction. A tax expert can help you navigate the income thresholds, wage limitations, and exclusions to develop the most effective tax strategy for your business.

By implementing these strategies, business owners can make the most of the QBI deduction and reduce their tax burden significantly, improving profitability and cash flow.

Common QBI Deduction Mistakes to Avoid

Claiming the Qualified Business Income (QBI) deduction can be highly beneficial for eligible business owners, but it’s also easy to make mistakes that could reduce the deduction or even result in IRS penalties.

Below are some common mistakes to avoid when claiming the QBI deduction:

1. Misclassifying Business Income

Not all income qualifies for the QBI deduction, and misclassifying income is one of the most frequent mistakes. The following types of income are excluded from QBI:

- Capital gains or losses

- Dividends

- Interest income (unless from a business activity like lending)

- Income earned as an employee

Ensure that you are only including qualified business income from eligible trades or businesses when calculating your deduction.

2. Incorrectly Calculating the Deduction

The QBI deduction can be complicated to calculate, especially for those above the taxable income thresholds. Errors often occur when calculating:

- The 50% wage limitation (or the alternative 25% of wages plus 2.5% of the unadjusted basis of qualified property).

- Phase-outs for taxpayers in Specified Service Trades or Businesses (SSTBs) who exceed the income thresholds. For those with more complex income streams, it’s important to use detailed formulas or consult with a tax professional to avoid costly miscalculations.

3. Not Meeting Wage and Property Requirements

For taxpayers whose income exceeds the QBI deduction threshold, their deduction may be limited based on wages paid or property owned by the business. Common errors include:

- Underreporting wages: Failing to pay reasonable compensation to yourself or employees can reduce the allowable deduction.

- Overlooking qualified property: Failing to account for the 2.5% of unadjusted property basis could lead to a smaller deduction than you’re entitled to.

4. Overlooking Aggregation Rules

If you own multiple businesses, you might be able to aggregate them for the purposes of the QBI deduction. This allows you to combine the income, wages, and property across businesses to maximize your deduction. Many business owners overlook this opportunity, which can result in a lower deduction than what they might be eligible for.

5. Claiming the Deduction for Non-Pass-Through Entities

Only pass-through entities (sole proprietorships, partnerships, S corporations, and certain trusts and estates) are eligible for the QBI deduction. C corporations do not qualify, but some business owners mistakenly try to claim the deduction for income earned from these entities. Make sure your business entity is eligible before attempting to claim the deduction.

6. Failing to Adjust for Income Thresholds

The QBI deduction is subject to income limits that can phase out or eliminate the deduction for high earners. For tax year 2024, the thresholds are:

- $191,950 for single filers

- $383,900 for married couples filing jointly Failing to adjust the deduction for income levels above these thresholds, especially in Specified Service Trades or Businesses (SSTBs), can result in IRS scrutiny.

7. Ignoring Non-Qualified Business Income

It's critical to distinguish between qualified business income and other forms of income. If you're in a SSTB and exceed the income threshold, trying to claim the QBI deduction on non-qualified business income can lead to disqualification.

8. Not Keeping Adequate Records

Failing to maintain accurate and thorough records can lead to mistakes when calculating the QBI deduction. Proper documentation of wages, property, and income is essential to claiming the correct amount. Without these records, you may struggle to substantiate your claims if audited by the IRS.

9. Overlooking Changes in Tax Law

The QBI deduction was introduced in 2017 and may be subject to future changes. Many taxpayers fail to stay up-to-date on revisions to the tax code, which could affect their eligibility or the amount of the deduction they can claim. It’s important to check each tax year for any updates or consult with a tax professional.

10. Not Seeking Professional Advice

Because the QBI deduction involves complex calculations, wage limitations, and exclusions, failing to consult with a tax professional is a common mistake. A professional can ensure that you're not overestimating or underestimating your deduction and can help you avoid potential penalties.

By steering clear of these common mistakes, business owners can take full advantage of the QBI deduction and ensure compliance with IRS rules, potentially saving thousands in taxes each year.

What are the Benefits of Claiming Qualified Business Income?

Claiming the Qualified Business Income (QBI) deduction offers several significant advantages for eligible business owners. This tax break, introduced under the Tax Cuts and Jobs Act (TCJA) of 2017, is designed to reduce the tax burden on small businesses and stimulate economic growth.

Below are the key benefits of claiming the QBI deduction:

1. Reduces Taxable Income

The primary benefit of the QBI deduction is that it allows qualifying taxpayers to deduct up to 20% of their qualified business income from their taxable income. This can lead to substantial tax savings, reducing your overall tax liability. By lowering taxable income, the deduction helps business owners keep more of their profits, which can be reinvested into the business or used for personal financial goals.

For example, if you have $100,000 in QBI, you could deduct $20,000 from your taxable income, meaning you'd only be taxed on $80,000 instead of the full amount.

2. Encourages Growth of Pass-Through Entities

The QBI deduction primarily benefits pass-through entities, such as sole proprietorships, partnerships, S corporations, and certain trusts and estates. These entities "pass" their income directly to the owners, who report it on their personal tax returns.

By reducing the tax burden on these entities, the QBI deduction encourages small business growth and entrepreneurship. It also helps level the playing field for small businesses compared to larger corporations that benefit from lower corporate tax rates.

3. Boosts Business Cash Flow

By lowering the tax burden, the QBI deduction helps businesses improve their cash flow, leaving more funds available for operational expenses, hiring, and expansion. For business owners, having more cash on hand can mean the ability to:

- Invest in new equipment or technology

- Expand into new markets

- Increase employee wages

- Enhance marketing efforts

This extra cash can ultimately contribute to the growth and success of the business.

4. Helps High-Income Earners Maximize Savings

Even though there are income thresholds and limitations for high-income earners, the QBI deduction can still be valuable. For those above the threshold, the deduction is limited to a formula based on wages paid to employees or the cost of qualified business property. By carefully managing wages and property ownership, high-income business owners can still maximize their deduction and enjoy significant tax savings.

5. Rewards Specified Service Businesses (SSTBs) Below Income Threshold

Professionals in Specified Service Trades or Businesses (SSTBs)—such as doctors, lawyers, consultants, and accountants—may face restrictions on the QBI deduction if their taxable income exceeds certain thresholds.

However, if these professionals keep their income below the $191,950 threshold for single filers (or $383,900 for married filers), they can claim the full deduction, resulting in major tax savings.

6. Stimulates Job Creation

Since the QBI deduction is partially tied to wages paid, it encourages businesses to hire more employees or pay higher wages. This creates a tax incentive for businesses to expand their workforce, potentially leading to job creation and supporting economic growth at both the local and national levels.

7. Simplifies Tax Filing for Small Business Owners

Compared to complex deductions that require extensive documentation and restrictions, the QBI deduction is relatively straightforward for many small business owners.

It’s based on a percentage of qualified business income and can be claimed directly on personal tax returns using Form 8995 or Form 8995-A, making it easier for business owners to benefit from the deduction.

8. Supports Long-Term Profitability

By helping business owners reduce their tax liability, the QBI deduction directly contributes to improved profitability. Over time, this tax savings can strengthen a business's financial position, making it more competitive and better equipped to survive economic challenges. Long-term profitability can also make the business more attractive to potential investors or buyers.

In summary, the QBI deduction offers a range of benefits, from reducing taxable income and improving cash flow to incentivizing job creation and stimulating business growth. For small business owners and entrepreneurs, it is a powerful tool to lower taxes and reinvest in their businesses.

What are the Examples of Qualified Business Income?

Qualified Business Income (QBI) refers to the income earned from a qualified trade or business that is eligible for the QBI deduction. This income typically comes from pass-through entities such as sole proprietorships, partnerships, S corporations, and certain trusts and estates. While not all income qualifies, many business types and professions generate QBI that can benefit from the deduction.

Below are examples of qualified business income:

1. Income from Sole Proprietorships

If you operate a business as a sole proprietor, the net income you earn from business activities may qualify as QBI. For instance:

- A freelance graphic designer earning $70,000 from client work after business expenses.

- A landscaper generating $50,000 in profits from landscaping services offered to residential and commercial clients.

The income from these activities is eligible for the QBI deduction, reducing the taxable amount by up to 20%.

2. Income from Partnerships

In a partnership, each partner reports their share of the business’s income on their individual tax return. This share of net business income is generally considered QBI. Examples include:

- A law firm partnership where each partner earns $120,000 after expenses from the firm's profits.

- A restaurant co-owned by two partners, where each owner reports $100,000 in net business income.

Both partners in the restaurant or law firm are eligible to claim the QBI deduction on their share of the income.

3. Income from S Corporations

If you operate your business as an S corporation, the income that passes through to you from the business’s profits is generally QBI. For instance:

- A consulting firm structured as an S corporation, where the owner takes home $150,000 in net income after paying themselves a reasonable salary.

The income passed through to the owner from the S corporation’s operations qualifies for the QBI deduction.

4. Income from Rental Properties

Under certain circumstances, rental income from real estate businesses may qualify as QBI. For rental activities to qualify, the property owner must treat their rental activities as a trade or business, regularly and continuously involved in managing the property. Examples include:

- A landlord who earns $80,000 in net rental income from multiple residential properties.

- An individual who owns a commercial building and earns $200,000 in rental income after expenses.

If these rental activities are deemed part of a trade or business, the rental income can be considered QBI, provided it meets specific IRS criteria.

5. Income from Farming

Farmers and ranchers earning income from their agricultural activities can also qualify for the QBI deduction. Examples include:

- A dairy farmer who earns $90,000 in net income after expenses from milk sales.

- A crop farmer who earns $120,000 in profits from selling corn, wheat, or vegetables.

Income from these farming activities typically qualifies as QBI, giving farmers a valuable tax break on their earnings.

6. Income from Self-Employed Professionals

Self-employed professionals in a variety of industries can claim the QBI deduction on their business income. For example:

- A self-employed web developer who earns $85,000 after expenses from coding and designing websites.

- A private tutor who generates $45,000 in income from one-on-one teaching sessions.

As long as these professionals are self-employed and operating in a qualified trade or business, their income qualifies for the QBI deduction.

7. Income from Specified Service Trades or Businesses (SSTBs) Below Income Threshold

Certain Specified Service Trades or Businesses (SSTBs)—such as law, health, consulting, and accounting—are subject to limitations if their income exceeds certain thresholds.

However, if their income is below the set threshold (for 2024, $191,950 for single filers and $383,900 for joint filers), their income qualifies for the QBI deduction.

Examples include:

- A dentist earning $150,000 in net income from their private practice.

- A consultant making $175,000 from providing business advisory services.

If these professionals remain under the income threshold, they can claim the full 20% QBI deduction on their income.

8. Income from Qualified REIT Dividends and Publicly Traded Partnerships

In addition to regular business income, qualified REIT (Real Estate Investment Trust) dividends and income from publicly traded partnerships (PTPs) can also qualify for the QBI deduction.

Examples include:

- An investor receiving $10,000 in REIT dividends from a publicly traded real estate investment trust.

- A partner receiving $25,000 in distributions from their investment in a publicly traded energy partnership.

This type of income qualifies for the QBI deduction, offering additional tax-saving opportunities for investors.

How to Calculate Qualified Business Income?

Calculating Qualified Business Income (QBI) is essential for eligible taxpayers who wish to claim the QBI deduction under Section 199A of the U.S. tax code.

This calculation involves determining the net income generated from your qualified trade or business activities and applying specific rules to ensure you meet the requirements for the deduction.

Here’s a step-by-step guide on how to calculate QBI:

Step 1: Determine Your Net Income from Qualified Business Activities

- Identify Qualified Business Income:

- Start by identifying the income generated from your qualified trade or business. This includes income from sole proprietorships, partnerships, S corporations, and certain trusts.

- Qualified income may include earnings from sales of goods or services, rental income from qualified properties, and profits from farming activities.

- Calculate Gross Income:

- Gather all revenue sources from your business, including sales, services rendered, and any other income streams related to your business operations.

- Subtract Business Expenses:

- Deduct all ordinary and necessary business expenses from your gross income to determine your net business income. These expenses may include:

- Operating costs (rent, utilities, supplies)

- Employee wages and benefits

- Depreciation

- Marketing and advertising costs

- The formula is: Net Business Income=Gross Income−Business Expenses

- Deduct all ordinary and necessary business expenses from your gross income to determine your net business income. These expenses may include:

Step 2: Exclude Non-Qualifying Income

- Identify Excluded Income:

- Certain types of income do not qualify as QBI and must be excluded from the calculation. This includes:

- Capital gains and losses

- Interest income not derived from the business

- Dividends

- Income from certain Specified Service Trades or Businesses (SSTBs) if the taxpayer’s income exceeds the threshold.

- Certain types of income do not qualify as QBI and must be excluded from the calculation. This includes:

- Adjust Net Business Income:

- Ensure that the income you report for QBI does not include any of the excluded sources mentioned above.

Step 3: Consider Limitations Based on Income

- Income Thresholds:

- For tax year 2024, single filers with taxable income above $191,950 and married couples filing jointly with taxable income above $383,900 may face limitations on their QBI deduction, especially if their business is classified as an SSTB.

- Apply Limitations if Necessary:

- If your taxable income exceeds these thresholds, the QBI deduction may be subject to limitations based on wages paid or the amount of qualified property owned by the business.

Step 4: Calculate the QBI Deduction

- Determine the QBI Deduction:

- Once you have calculated your QBI, the basic deduction allows you to deduct up to 20% of your QBI. The formula is: QBI Deduction = QBI x 20%

- Apply Any Limitations:

- If your taxable income is above the threshold, you must calculate any limitations based on the W-2 wages paid by the business or the unadjusted basis of qualified property. The deduction may be limited to the lesser of:

- 20% of QBI, or

- The greater of:

- 50% of W-2 wages paid by the business or

- 25% of W-2 wages plus 2.5% of the unadjusted basis of qualified property.

- If your taxable income is above the threshold, you must calculate any limitations based on the W-2 wages paid by the business or the unadjusted basis of qualified property. The deduction may be limited to the lesser of:

Step 5: Report Your QBI on Your Tax Return

- Use Appropriate Forms:

- Eligible taxpayers must report their QBI and claim the deduction using the appropriate IRS forms. Common forms include:

- Form 1040 (individual income tax return)

- Schedule C (for sole proprietors)

- Form 1065 (for partnerships)

- Form 1120S (for S corporations)

- Form 8995 or Form 8995-A (to calculate the QBI deduction).

- Eligible taxpayers must report their QBI and claim the deduction using the appropriate IRS forms. Common forms include:

Example Calculation

Let’s assume a sole proprietor has the following income and expenses:

- Gross Income: $100,000

- Business Expenses: $40,000

- Capital Gains: $10,000 (excluded from QBI)

Step 1: Calculate Net Business Income:

Net Business Income = $100,000 - $40,000 = $60,000

Step 2: Exclude Non-Qualifying Income:

- Since the $10,000 capital gains do not qualify, they are not included.

Step 3: Determine QBI:

- The QBI is $60,000.

Step 4: Calculate QBI Deduction:

QBI Deduction = $60,000 x 20% = $12,000

The taxpayer can claim a $12,000 deduction on their tax return.

How Deskera ERP's Accounting Features Support Qualified Business Income (QBI) Deductions

Deskera ERP’s accounting module provides businesses with essential tools to manage financial transactions and reporting efficiently, which can be particularly useful when calculating and maximizing Qualified Business Income (QBI) deductions.

- Accurate Tracking of Income and Expenses: Deskera ERP helps ensure that business income and related expenses are accurately tracked. This is crucial when calculating QBI because deductions must account for self-employment taxes, retirement contributions, and health insurance premiums. Deskera’s automated system reduces manual errors, making your QBI calculations more reliable.

- Comprehensive Payroll Management: Deskera’s payroll module tracks W-2 wages, which are key components in determining QBI deductions. By efficiently managing employee salaries and wages, Deskera helps pass-through entities calculate their allowable QBI deductions, especially for businesses that may be subject to W-2 wage limitations.

- Seamless Depreciation Management: Deskera ERP supports managing the depreciation of qualified property, a factor that can increase QBI deductions for capital-intensive businesses. It tracks the unadjusted basis of depreciable assets, enabling you to claim deductions for the QBI deduction limitations tied to the Unadjusted Basis Immediately After Acquisition (UBIA).

- Tax-Ready Financial Statements: With Deskera, generating financial statements for tax preparation is quick and easy. These statements are essential when preparing your tax return and calculating your QBI, especially for higher-income individuals or businesses facing phase-out limitations.

- Integrated Retirement and Self-Employment Contribution Management: Deskera makes it easier to track deductible contributions to retirement plans, self-employed health insurance, and self-employment taxes. These deductions reduce QBI, and Deskera's accounting solution ensures they are factored correctly, providing a clear view of how much can be deducted.

By leveraging Deskera ERP’s powerful accounting tools, business owners can streamline the process of calculating and reporting QBI deductions, ensuring they fully capitalize on tax savings while maintaining compliance.

Key Takeaways

- What is Qualified Business Income? Qualified Business Income (QBI) refers to the net amount of income, gains, deductions, and losses from a qualified trade or business. For 2024, individuals can claim a deduction of up to 20% on QBI earned from eligible pass-through entities, reducing their taxable income.

- Who Qualifies for the QBI Deduction? Most self-employed individuals and owners of pass-through businesses, such as sole proprietorships, partnerships, S corporations, and certain LLCs, are eligible for the QBI deduction in 2024. However, income limits and other restrictions apply, especially for specified service trades or businesses (SSTBs).

- How Does the QBI Deduction Work? In 2024, the QBI deduction can be up to 20% of qualified income from a pass-through entity. The deduction is claimed at the individual level and does not reduce adjusted gross income (AGI) but still significantly lowers taxable income.

- Maximizing the QBI Deduction: Strategies for maximizing the QBI deduction in 2024 include aggregating businesses to meet W-2 wage requirements, optimizing retirement contributions, and managing depreciation. Careful tax planning is essential to make the most of the available deduction.

- Common QBI Deduction Mistakes to Avoid: In 2024, common mistakes when claiming the QBI deduction include misclassifying wages, not properly calculating QBI deductions from SSTBs, and failing to account for business property depreciation. Ensuring accurate record-keeping can help avoid these pitfalls.

- What are the Benefits of Claiming Qualified Business Income? The QBI deduction can reduce taxable income by up to 20% for eligible businesses in 2024, potentially leading to significant tax savings for business owners and allowing them to reinvest in their businesses.

- Qualified Business Income vs. Ordinary Business Income: Unlike ordinary business income, which is fully taxable, QBI allows eligible taxpayers to claim a deduction of up to 20% in 2024, offering a valuable tax break for owners of pass-through entities compared to traditional income streams.

- What are the Examples of Qualified Business Income? In 2024, examples of QBI include income from sole proprietorships, S corporations, partnerships, and certain LLCs. However, income from being an employee, capital gains, dividends, and interest does not count as QBI.

- How to Calculate Qualified Business Income? Calculating QBI in 2024 involves deducting business expenses such as retirement plan contributions, self-employment taxes, and health insurance premiums from business income. Taxpayers must also account for phase-out thresholds based on income levels.

- Considerations While Calculating Qualified Business Income: In 2024, individuals earning above the income threshold must consider additional factors, such as the wages paid to employees and the value of business property, to accurately calculate their QBI deduction, ensuring they comply with tax regulations.

- Tax Implications of Qualified Business Income: Although the QBI deduction can lower your taxable income in 2024, it does not reduce your self-employment tax or affect net investment income tax. Careful tax planning is required to understand the full implications of the QBI deduction.

- Future of the QBI Deduction: The QBI deduction is available through 2025, meaning 2024 is a critical year to take advantage of the write-off. Without congressional action to extend it, this valuable deduction may disappear after 2025.

Related Articles