According to the Small Business Association, small businesses make up 99.2 percent of all enterprises in California. No matter if you operate a small business or large workforce, there’s one thing that is common to all: Payroll Taxes.

Furthermore, payroll taxes are imposed on both state and federal levels. It is important for all business owners to understand all aspects of payroll taxes, how to compute the taxable income, what to withhold, what to pay, and how to file.

In today’s guide, we’ll focus on and learn all about California Payroll Taxes and their related concepts. Let’s check what we’ll cover ahead:

- Understanding Payroll Taxes

- Four State Payroll Taxes

- Computation of Payroll Taxes

- Understanding Employers California Payroll

- California Income Tax Withholding

- California Federal Payroll Taxes

- California Benefits

- How Deskera Can Assist You?

Let’s Start!

Understanding Payroll Taxes

Payroll taxes are based on a proportion of an employee's earnings. Some taxation is deducted from an employee's pay, while others are collected depending on the employee's earnings by you, the employer.

After paying more than $100 to one or more individuals in a calendar quarter, a company is normally subject to payroll taxes. This is true whether you manage a company, a nonprofit, or have recently hired a housekeeper or caregiver for your household.

The most important thing to know is that new employees must be reported to the California New Employee Registry within 20 days of their start date, according to California law.

This can be accomplished in one of four segments:

- Using the California Employment Development Department's (EDD) e-Services for the Business portal, file a Report of New Employee(s) (DE 34) digitally.

- DE 34: submitting a paper You may get a DE 34 fill-in form here.

- On the W-4 form, you must also enter the employee's first day of work, your Federal employer identification number (FEIN), and your California employer account number.

- You can also use the given information to build your own form and email it to the EDD.

Four State Payroll Taxes

Although most wages are generally subject to all four taxes, there are some occupations where payroll tax responsibility is limited or non-existent.

The California Employment Development Department (EDD) has prepared a complete list of job kinds and their tax and withholding obligations.

Payroll taxes are a complicated topic, partly because there are four different taxes to calculate. The first two, the Unemployment Insurance (UI) Tax and the Employment Training Tax (ETT), are paid by employers.

The employee pays the other two, the California Personal Income Tax (PIT) and the State Disability Insurance (SDI) Tax, but you must withhold these taxes for the state.

Each of these taxes has a separate rate of calculation:

Unemployment Insurance (UI) Tax

Unemployment insurance is designed to help persons who are unable to find work due to no fault of their own.

- This tax is determined as a percentage of the first $7000 in wages paid to each worker in a calendar year, and you, as the employer, are responsible for paying it.

- The current highest UI tax rate is 6.2 percent, which equates to a maximum tax of $434 per employee per year.

- The sum you pay is determined by the length of time you have worked as an employer. For the first two to three years, you'll pay 3.4 percent, but this rate is subject to fluctuation and will climb over time.

Employment Training Tax (ETT)

The Employment Training Tax (ETT) was created to help California's labor market expand. The funds collected by the ETT go towards providing training to people in specific industries.

- In your first year as an employer, Employment Training Tax (ETT) will automatically apply to you.

- On the first $7,000 in taxable earnings you pay each employee, the Employment Training Tax (ETT) rate is one-tenth of one percent. This translates to a maximum annual tax of $7 per employee.

- Most businesses will continue to pay the Employment Training Tax (ETT) if their UI reserve account balance is positive after the first year.

State Disability Insurance Tax (SDI)

Employees who are temporarily unable to work due to a non-job-related disability can receive support payments through the state's disability tax scheme.

Paid Family Leave (PFL) benefits are also funded by the SDI tax. PFL benefits are available to employees that are unable to work since they are required at home to care for a sick family member or bond with a new infant.

- SDI is taken out of your employee's pay.

- Over the duration of a calendar year, you are liable for withholding a portion of the first $118,371 in earnings paid to each employee.

- In 2019, the maximum tax is $1,183.71 per employee. Every year, the SDI tax rate is 1.0 percent of SDI taxable wages per employee.

- The California State Legislature sets the SDI rates each year, and they are subject to modification.

California Personal Income Tax (PIT)

California residents and non-residents who make money in the state are both subject to the personal income tax.

Income tax funds are used to fund local infrastructures such as schools, roads, parks, as well as health and human services.

The EDD is in charge of administering these taxes, as well as reporting, collecting, and enforcing them.

- PIT is taken out of your employee's pay.

- The rate is determined by your employee's Employee's Withholding Allowance Certificate (Form W-4 or DE 4) from the beginning of the year.

- In this category, there is no maximum tax amount.

Computation of Payroll Taxes

Because there are four distinct taxes to keep track of, determining your payroll tax liability and withholding rates can be complicated, especially for new employers.

You may find it easier to navigate the system if you divide the activity down into different steps:

Calculate your taxable income

This is the first and most crucial step since it will serve as the foundation for all subsequent calculations. The EDD has a very useful table that shows how to compute taxable wages for each employee.

Calculate the UI and the ETT

Determine your liabilities based on your rates, as these are the taxes you will be paying as the employer. The EDD website has the most up-to-date UI rates; you'll need to check in to view your individual rate.

Determine the SDI

In 2019, the California State Legislature determined that the SDI rate should remain at 1.0 percent.

Calculate PIT

There are two methods for calculating withholding schedules in California:

Method A - Wage Bracket Table Method (PDF) - with Instructions

Method B – Exact Calculation Method (PDF) – with Instructions

California Laws (Wage & Hour)

Those with 26 or more employees must pay at least $14.00 per hour under California's minimum wage law, whereas employers with 25 or fewer employees must actually pay $13.00 per hour.

Except for those specifically exempted by wage order, all employees are covered; those exempted include

Outside salespeople; executive, administrative, or professional personnel; and doctors, lawyers, dentists, architects, engineers, optometrists, accountants, teachers, and other state-licensed or qualified professionals.

Employers California Payroll

Wage payment laws in California require employers to pay wages at least twice a month. The first half of the month's payment is due on the 26th, and the second half is due on the 10th of the following month.

California Unemployment:

California Income Tax Withholding

Employers must withhold state personal income tax (PIT) from their employee's wages and report the amounts withheld to the Employment Development Department, according to California law.

In most circumstances, individuals who work for themselves (independent contractors) are not considered employees and are therefore not subject to withholding.

Residents of Guam, Arizona, Indiana, Virginia, and Oregon can deduct taxes paid to their home states from their California income tax due, despite the fact that California has no reciprocal taxation arrangements with other states.

California State Payroll Taxes

Let's move on to California state taxes now that we've finished with federal income taxes. The state with the highest top marginal income tax rate in the country is California. It's a graduated income tax, meaning that the higher the income, the higher the tax.

The graph below depicts the various tax rates in effect for single filers.

What You Pay For:

The United States Department of Labor (USDOL) issues unemployment insurance (UI). Unemployment insurance (UI) pays persons who are unemployed for a limited period of time-based on their own ability.

Employers must pay up to 6.2 percent of each employee's first $7,000 in wages in a calendar year. For the first two to three years, new employers pay 3.4 percent. Your updated rate will be sent to you each December.

The Employment Training Tax (ETT) is sometimes known as training funding. You are accountable for paying 0.1 percent of each employee's first $7,000 in annual wages. This one is reasonably priced, with a maximum annual cost of $7 per employee.

What is withheld from employees:

The State Disability Tax offers temporary support for non-work-related disabilities, as well as paid family, leave for those caring for a sick family member or bonding with a newborn child. The rate is set at 1.1 percent of annual income up to $145,600 in 2022, which equates to a maximum of $1,601.60 per employee.

Personal Income Tax (PIT) is a tax levied on both California citizens and nonresidents who earn money in the state.

There is no maximum tax on the Personal Income Tax (PIT), which is calculated based on allowance submissions on each employee's W-4 or DE 4 form.

California Federal Payroll Taxes

You can use our California payroll calculator to calculate your employees' federal withholding as well as any additional taxes you, as the employer, are liable for paying.

Here's a fast rundown of everything you need to know about federal payroll taxes. Check out our step-by-step guide if you want to learn more about each computation.

Compute Gross Wages:

Multiply the hours worked by the pay rate for all of your hourly employees (and don't forget to pay the higher rate for any overtime hours worked).

Divide each employee's annual wage by the number of pay periods your company has for all salaried employees.

Compute any Pre-Tax Deductions:

Deduct the amount from your employee's gross salary before applying payroll taxes if they contribute to a 401(k), FSA, or any other pre-tax withholding account.

Deduct (and Match) FICA Taxes:

Employers must withhold 6.2 percent of each employee's taxable salary until they reach a total annual income of $147,000. As an employer, you must equal this tax dollar for dollar.

Withhold 1.45 percent of each employee's taxable wages until they attain a total annual income of $200,000 for the year. This tax will have to be matched by you, the employer.

Employees earning more than $200,000, however, must pay a 0.9 percent in addition to the 1.45 percent Medicare tax. The Additional Medicare Tax is solely the responsibility of the employee.

FUTA Unemployment Tax

For each employee, you must pay 6% of the first $7,000 in taxable income every year. You may be eligible for a tax credit of up to 5.4 percent if you pay state unemployment taxes, essentially lowering your FUTA tax rate to 0.6 percent.

The employer is solely responsible for the FUTA tax. This tax is not the responsibility of your employees.

Deduct Federal Income Tax:

The federal income tax rate ranges from 0% to 37%. The IRS Publication 15-T contains further withholding information.

Minus any post-tax deductions:

Your employees may be liable for post-tax deductions such as wage garnishments, child support, and so on. If that's the case, you'll have to subtract these amounts from their paychecks.

Once you've figured out your withholding, you'll need to complete a series of quarterly and annual payroll tax forms.

California Benefits

Employers in California are required to provide employees with enough time off to vote. The quantity of leave time that must be granted is not specified in the law.

Employers can award time off at the start or end of a typical work shift, whichever provides employees the most period for voting and the least time away from work unless they have a specific agreement with employees.

California Voting Rights:

How Deskera Can Assist You?

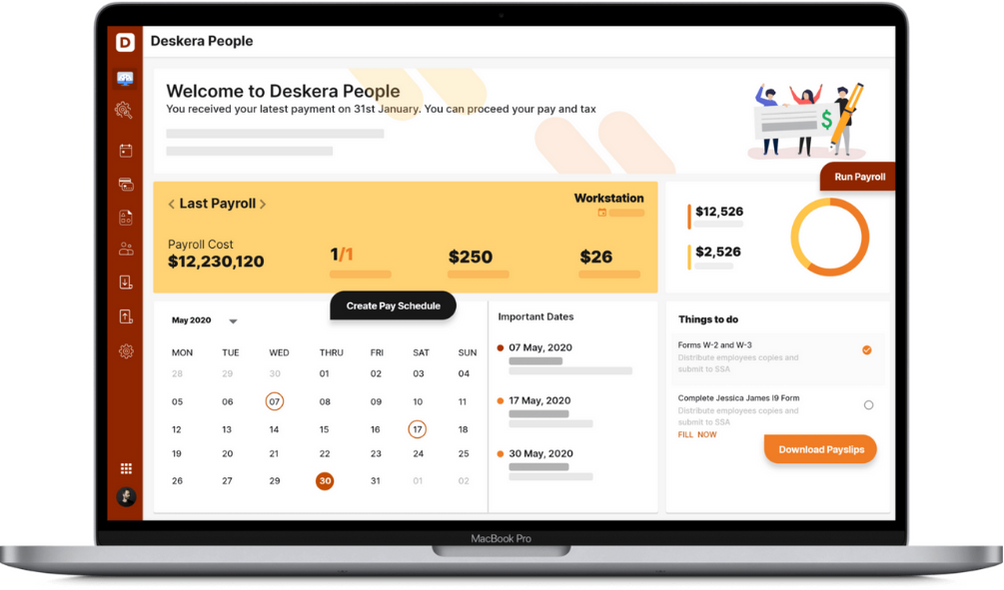

As a business, you must be diligent with the employee payroll system. Deskera People allows you to conveniently manage payroll, leave, attendance, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Final Takeaways

Now that we've reached the end of this extensive guide, we've compiled a summary of crucial sections for your future reference. Let's get started:

Payroll taxes are imposed on both state and federal levels.

- Payroll taxes are based on a proportion of an employee's earnings. Some taxation is deducted from an employee's pay, while others are collected depending on the employee's earnings by you, the employer.

- The most important thing to know is that new employees must be reported to the California New Employee Registry within 20 days of their start date, according to California law.

- Payroll taxes are a complicated topic, partly because there are four different taxes to calculate. The first two, the Unemployment Insurance (UI) Tax and the Employment Training Tax, are paid by employers (ETT).

- The Employment Training Tax was created to help California's labor market expand. The funds collected by the ETT go towards providing training to people in specific industries.

- Paid Family Leave (PFL) benefits are also funded by the SDI tax. PFL benefits are available to employees that are unable to work since they are required at home to care for a sick family member or bond with a new infant.

- Determine your liabilities based on your rates, as these are the taxes you will be paying as the employer. The EDD website has the most up-to-date UI rates; you'll need to check in to view your individual rate.

- Those with 26 or more employees must pay at least $14.00 per hour under California's minimum wage law, whereas employers with 25 or fewer employees must actually pay $13.00 per hour.

- Wage payment laws in California require employers to pay wages at least twice a month. The first half of the month's payment is due on the 26th, and the second half is due on the 10th of the following month.

- In most circumstances, individuals who work for themselves (independent contractors) are not considered employees and are therefore not subject to withholding.

- Employers in California are required to provide employees with enough time off to vote. The quantity of leave time that must be granted is not specified in the law.

- The United States Department of Labor (USDOL) issues unemployment insurance (UI). Unemployment insurance (UI) pays persons who are unemployed for a limited period of time-based on their own ability.

- You can use our California payroll calculator to calculate your employees' federal withholding as well as any additional taxes you, as the employer, are liable for paying.

- Residents of Guam, Arizona, Indiana, Virginia, and Oregon can deduct taxes paid to their home states from their California income tax due, despite the fact that California has no reciprocal taxation arrangements with other states.

- Employees earning more than $200,000, however, must pay a 0.9 percent in addition to the 1.45 percent Medicare tax. The Additional Medicare Tax is solely the responsibility of the employee.

- Your employees may be liable for post-tax deductions such as wage garnishments, child support, and so on. If that's the case, you'll have to subtract these amounts from their paychecks.

Related Articles