Employers maintain several types of registers and records to keep track of different information related to the company and its employees. This is an important task because it helps the whole system run smoothly without creating any confusion. A muster roll is also a record book that employers use to keep track of employee attendance. This record also holds other crucial information on a particular workplace, a company, or a contractor.

The muster roll is maintained by a company mainly to keep a record of the attendance of employees over a specified period of time. The muster roll has a wage register format. So, it also serves as a receipt and as evidence when requesting money from an employer to pay salaries and wages.

If you are an employer belonging to Maharastra or if you are going to start your business in Maharastra, you have to adhere to regional and central government-aided business rules to run your business legally there.

You are entitled to maintain a Maharashtra form II muster roll cum wage register to keep track of your employees' and attendance information.

If you want to learn more about muster roll and its wage register format, this article is going to help you in many ways. For better understanding, we are going to discuss it and its origin in detail. We will talk about the following topics:

- An Introduction - Maharashtra Form II Muster Roll cum Wage Register

- With Regards to Maharashtra Form II Muster Roll cum Wage Register, What is the Maharashtra Shops and Establishments Act?

- What are the Definitions of “Shop” and “Establishment” Mentioned in the Maharashtra Shops and Establishments Act?

- Enrollment Process Under the Maharashtra Shops and Establishments Act

- With Regards to Maharashtra Form II Muster Roll cum Wage Register, what are the Advantages of Registering Under the Maharashtra Shops and Establishments Act?

- The Compliances Under The Maharashtra Shops And Establishments Act

- What Information Should be Included in the Maharashtra Form II Muster Roll cum Wage Register?

- Conclusion

- How Can Deskera Assist You?

- Key Takeaways

An Introduction - Maharashtra Form II Muster Roll cum Wage Register

If you run a company in Maharastra, or if you are planning to start a venture, Maharashtra form II that has a muster roll and wage register format is very crucial to maintain. A company generally has to maintain several kinds of muster rolls to keep track of different kinds of information. Due to dealing with several contractors, programs, or time periods, a worksite typically has many muster rolls.

A Maharastra form II muster roll is considered a register that provides all the information regarding an employee and their working hours. This muster roll has a wage register format that helps to decide the payment for a project or piece of work that has been finished.

If some employee has worked overtime, the record is kept in the wage register to pay his or her wage. If someone has been punished with a fine, the record is also kept in the wage register to deduct his or her wage.

As an employer, you are entitled to fill out and submit Maharastra form II muster roll that has a wage register format. This is crucial because Maharashtra form II is a part of the Maharashtra Shops and Establishment Act.

With Regards to Maharashtra Form II Muster Roll cum Wage Register, What is the Maharashtra Shops and Establishments Act?

All stores and other commercial businesses in the entire state of Maharashtra are subject to the Maharashtra Shops and Establishments (Regulation of Employment and Conditions of Service) Act, 2017 & Rules, 2018 ("S & E Laws"). The Act was passed in order to safeguard employees' rights.

The Act sets forth rules for the right payment of wages salaries, terms and conditions of services, working hours, breaks, overtime and bonus pay, closed days and vacation days, leaves, parental leave and benefits, working conditions, and guidelines for hiring children, record-keeping, etc.

So, it can be evident that the law or act almost covers every aspect of business laws that are crucial to maintaining to achieving a lawful commercial environment. It also ensures that employees are not deprived by the company by any means.

The Maharastra form II muster roll that has a wage register format is an inclusive part of this act that ensures that the employees' identification and their record of workdays are rightly kept. It helps the employees to get the right payment without creating any confusion.

What are the Definitions of “Shop” and “Establishment” Mentioned in the Maharashtra Shops and Establishments Act?

As per the law enforced by the Maharashtra Shops and Establishments Act, "shop" refers to any place where products are offered for sale. Shops can be of different types, including wholesale, retail, etc. Despite the size of businesses, a shop is a place where customers can buy products and receive useful services. It also includes any workspace, be it a storage room, distribution center, warehouse, or other workspaces.

So, in a nutshell, shops can be described as premises that are used to carry on any trade or business. However, it does not include any factories. Since shops or businesses deal with trade, they always require a muster roll register to keep track of their trading records. A muster roll with a wage register format is even more important for tracking employee attendance and settling salaries.

With respect to the Maharashtra form II muster roll cum wage register, the Maharashtra Shops, and Establishments Act has described the term "establishment" with specific characteristics.

According to the act's definition, an establishment is a structure that engages in any commercial or trade activity; manufactures goods; engages in media and printing-related work; conducts banking business; insurance and coverage; stocks and bonds; brokerage; or any profession; as well as any work-related to, incidental to, or ancillary to any such commercial or trade activities. This definition also includes any establishment run by a health care professional (including hospitals, dispensaries, clinics, polyclinics, maternity homes, and other facilities).

This definition involves a society registered under the section of the Societies Registration Act of 1860. It also comes under charitable or other trusts. However, it can be registered or not. The body dedicates itself to carrying on different processes, including business, trade, profession, or work in connection with or incidental or ancillary to. This motive is sometimes to gain a profit and sometimes not.

It also includes shops, residential hotels, restaurants, and eating establishments. This definition also applies to different community entertainment venues at which the laws and regulations of the Factories Act of 1948 are not implemented.

Enrollment Process Under the Maharashtra Shops and Establishments Act

With respect to the Maharashtra, form II muster roll cum wage register, the Maharashtra Shops, and Establishments Act has a distinctive enrollment process.

- Each company owner or employer must file an application for its organization on form "A" to enroll itself as an establishment within 60 days of the business's launch

- The certificate of registration or registered trademark of a company needs to be on display inside the office or commercial space

- The certificate of registration is valid for an organization for ten years. An application for the renewal of the company's legal establishment must be submitted for the following term before it expires

- According to Section 9 of the Act, any modification to the certificate of registration must be reported digitally to the Mediator on Form "I" within 30 days of the change happening or becoming effective, along with the supporting documentation that must be uploaded in accordance with the application's requirements and Part "D" of the Schedule

- After closing the business, the company owner or employer must submit the license or registration certificate to the appropriate authorities

With Regards to Maharashtra Form II Muster Roll cum Wage Register, what are the Advantages of Registering Under the Maharashtra Shops and Establishments Act?

In relation to the Maharashtra form II muster roll cum wage register, the advantages of registering under the Maharashtra shops and establishments act include:

- The establishment will possess a legitimate identification card to carry out business within the region

- The establishment can enjoy a range of government programs, benefits, and services

- The registration certificate enables an organization to handle bank accounts for businesses in a legal way

The Compliances Under The Maharashtra Shops And Establishments Act

The compliances under the Maharashtra Shops and Establishments Act include:

- Form B - Registration Certificate

- Form II - Muster Roll cum Wage Register

- Form N - Leave Card

- Form C - Register of Establishment

- Form M - Register of Leave

- Form D - Application for Renewal of Registration Certificate

- Form E - Renewed Certificate of Registration

- Form J - Register of Employment

- Form F - Application for Intimation or announcement

- Form G - Intimation Receipt

- Form H - Register of Establishment who have delivered intimation

- Form I - Notice of Modification

- Form J - Announcement of Closure

- Form K - Intimation of Closure (less than 10 employees)

- Form L - Women workers' consent agreement to work on the night shift

- Form M - Notification of Office Hours, Breaks, and Holidays

- Form N - Shift Rotation, Timetable, and Weekly Holiday Notice

- Form O - Leave Book

- Form P - Notice of Maximum Accrued Leave

- Form Q - Muster Roll - Wage Register

- Form R - Return received each year

- Form S - Employer's Application for Compounding Offense

- Form T - Information about the people doing managerial duties

- Form U - Information on those holding positions with a confidential nature

What Information Should be Included in the Maharashtra Form II Muster Roll cum Wage Register?

The information that an employer is entitled to fill up in the Maharashtra Form II muster roll cum wage register includes:

- Full name of the employee

- Age and sex

- Nature of work and designation

- Date of entry into service

- Working hours

- Intervals for rest or meal

- Total days worked

- Minimum rates of wages payable

- Actual rates of wages payable

- Total production in case of piece rate

- Total overtime hours worked

- Normal wages or salaries

- Rate of HRA

- HRA Payable

- Overtime earnings

- Gross wages payable

- Deduction Advances Fines Damages

- Net wages paid

- Previous Balance

- Leave Wages

- Earned during the month

- Availed during the month

- Balance at the end of the month

- Date of payment of wages

- Signature or thumb impression of the employee

So, it can be evident that employers put crucial employee information in the Maharashtra Form II muster roll having cum wage register. This record not only registers an employee's attendance and working hours but also, in its wage register format, helps the employer to keep track of their employees' wage and salary payment-related matters.

Conclusion

History suggests that the phrase "muster roll" was initially used in maritime law, where a captain employed an attendance list to keep track of each crew member's identity, age, country, etc. The army and other armed departments also followed the rule and operated in a similar manner. Since then, contractors and employers have used this style to document information on the worksite.

The Maharashtra Form II muster roll with the wage register format is essential for Maharashtra employers to keep in order to run their businesses legally by keeping employee attendance and wage records.

How Can Deskera Assist You?

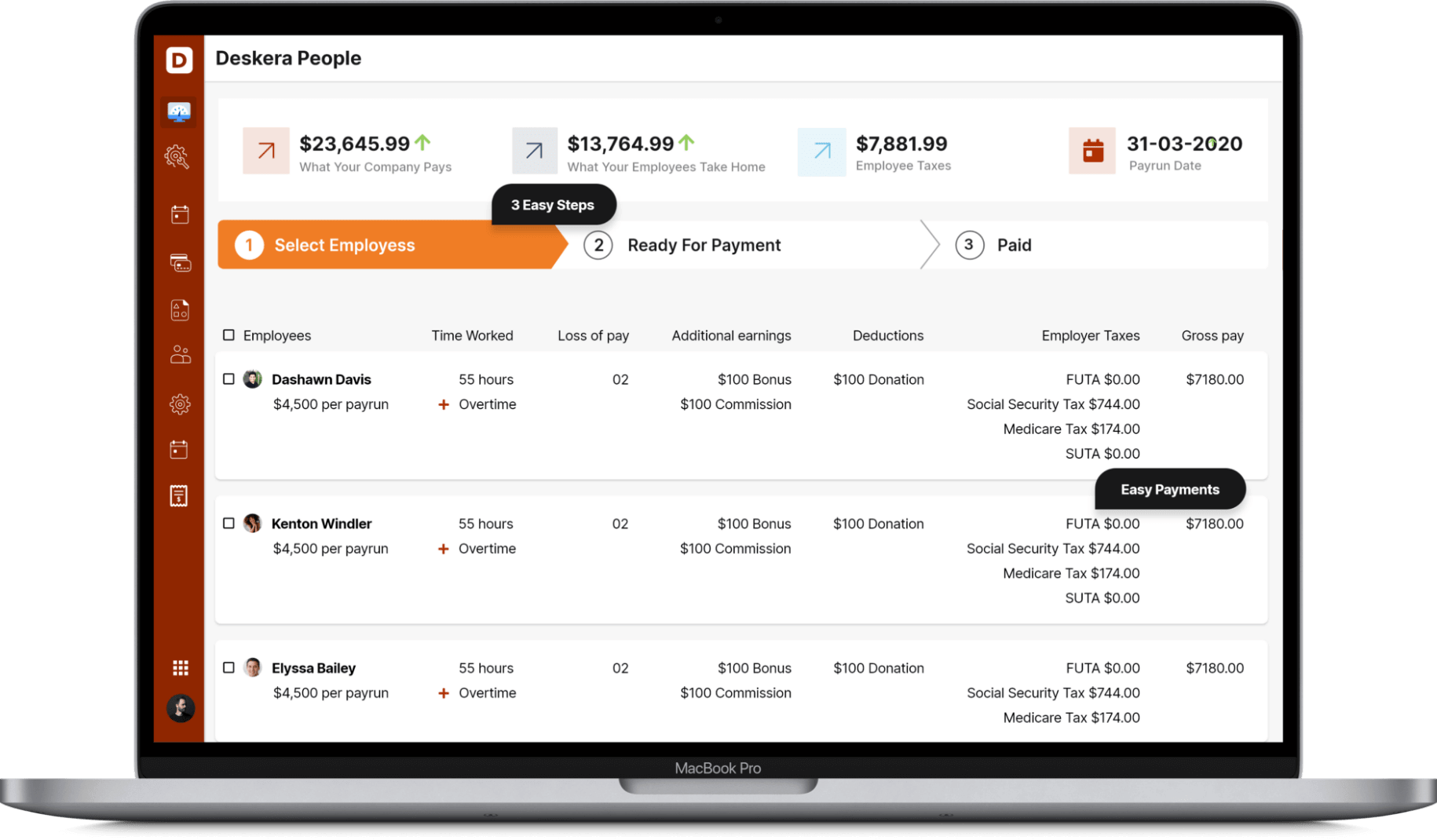

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key Takeaways

The wage register format of the Maharashtra Form II muster roll is a significant aspect for not only employers but also employees. Since this record is equipped to keep track of employee working hours and overtime, it delivers precise wage and salary-related information through the wage register format.

The wage register format holds information regarding-

- Normal wages or pay

- The amount of HRA

- Payable HRA

- Income from overtime

- Wages payable in gross

- Fines and salary deductions for damage

- Paid in net wages

- Previous balance

- Leave wages

- Income for the month

- Income utilized during the month

- Balance at the month’s end

- The paycheck’s due date

Related Articles