As prescribed by the Professions, Trades, Callings, and Employment Act of 1947, all individuals who earn an income from their chosen field or profession are liable to pay profession tax. Field or profession includes doctors, lawyers, chartered accountants, and any individual who has an income is subject to the professional tax. It is also mandatory for all organizations except government bodies to subtract professional tax from their employees’ salaries.

If you are an employee who has observed a professional tax deduction in their salary slip but is unaware of what it is, then this article will answer all your questions. Professional Tax is applicable to all employees and freelancers.

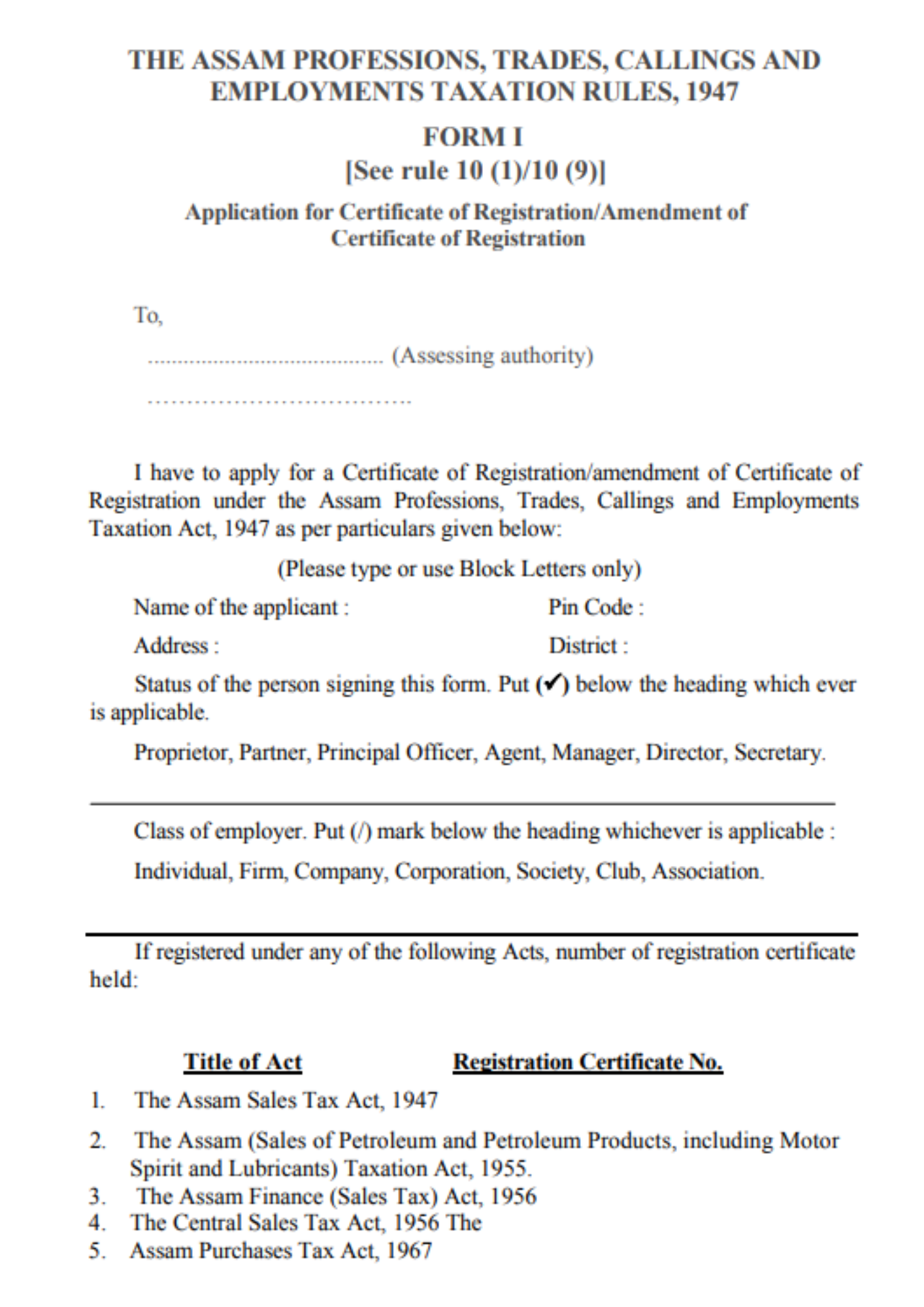

The amount of deductions differs from state to state across the country. Form I is the application for a certificate of registration and is a part of the Assam Profession Tax Act; it facilitates the process of applying for the certificate of registration. Let’s dive in deeper to know what exactly is Form I under the PT Act of Assam.

Here is what we shall learn about the Form:

- What is Form I Application for Certificate of Registration as PT Act?

- Related Compliances

- Brief Overview of Assam Professional Tax Act, 1947

- What are the Professional Tax Slabs?

- How can Deskera Help You?

- Key Takeaways

What is Form I Application for Certificate of Registration as PT Act?

We must note that the Profession tax applies to employees from almost all sectors. It is a direct tax imposed on all professions, trades, and employments in Assam. As the deductions are paid directly to the government, it is counted as revenue.

Speaking of professional tax registration in Assam, Form I, which is the application for the certificate of registration, plays an important role. Here is what the process of professional tax registration in Assam comprises:

The letter is addressed to the concerned assessing authority with the following undertaking:

I have to apply for a certificate of registration or amendment of the certificate of registration under the Assam Professions, Trades, Callings, and Employment Act of 1947 as per particulars given below:

Name of the Applicant:

Applicant’s Address:

Applicant’s Pin code:

Applicant’s district:

This information is followed by submitting the correct status of the person signing the form. Proprietor, partner, agent, principal officer, manager, director, or secretary are the dignitaries that can sign and apply for the form.

Alternatively, the form also provides the class of employees to be selected as applicable: Individual, Firm, Company, Corporation, Society, Club, or Association.

The applicant must also provide information about the registration under any of the following acts and the corresponding registration certificate number:

Although the form mentions so many Acts, it must be noted that the Acts at serial numbers 1, 2, 3, and 5 have been repealed. Furthermore, the applicants are required to provide names and addresses of other workplaces in Assam, if they have any. It should be provided in the following format:

Now, provide the Number of Certificates of registration and the basis on which the applicant seeks amendments.

Finally, they must provide the date, signature, and status after undertaking that all the statements and information provided are true.

The last paragraph includes an Acknowledgment that must be filled in by the applicant. Enter the name, complete postal address, and date. This would be signed by the receiving officer.

Related Compliances

There are various compliances related to the Assam Professional Tax, 1947. Each of these compliances is meant for diverse applications and maintenance of various registers. Here’s the list of those compliances:

- Form IA - Certificate of Registration

- Form II - Application for a Certificate of Enrolment / Amendment of Certificate of Enrolment

- Form IIA - Certificate of Enrolment

- Form IIB - Certificate to be furnished by a person to his employer

- Form IIC - Certificate to be furnished by a person who is simultaneously in the employment of more than one employer

- Form III - Return

- Form IIIA - Application for permission to furnish returns covering a quarter, six months, or a year

- Form IV - Statement of Recovery

- Form V - Information to be furnished

- Form VI - Notice to a defaulting enrolled person

- Form VII - Notice for showing cause against non-enrolment

- Form VIIA - Assessment Order

- Form VIIB - Notice of Demand

- Form VIIC - Challan

- Form VIICC - Challan

- Form VIID - Assessment Register

- Form VIII - Refund Voucher

- Form IX - Refund Register

Brief Overview of Assam Professional Tax Act, 1947

As we know now, a Professional tax is a tax imposed by a state government on all individuals who earn an income through their profession or trade. The Act applies to the entire state of Assam, and the Commercial Tax Department of the state is the authority that collects it.

In the case of an employee, the employer is responsible for deducting the tax from their employee’s salary. The employer must then submit this tax collected to the state government and provide a return to the state government. They must complete the task within a stipulated time and in the prescribed format (as prescribed by the Professional tax rules).

What are the Professional Tax Slabs?

Not all states in India deduct the Professional tax, and only a few impose it. While profession tax is a mandatory deduction, it is a small amount that cannot be more than Rs. 2500 in any Indian state. The following table indicates the slab brackets and the applicable tax rate.

Every person who is a trader or carries out a business or an individual who is under employment must register and enroll themselves under the professional tax. They must pay the tax to the state every financial year except in cases where they have been exempted through a notification.

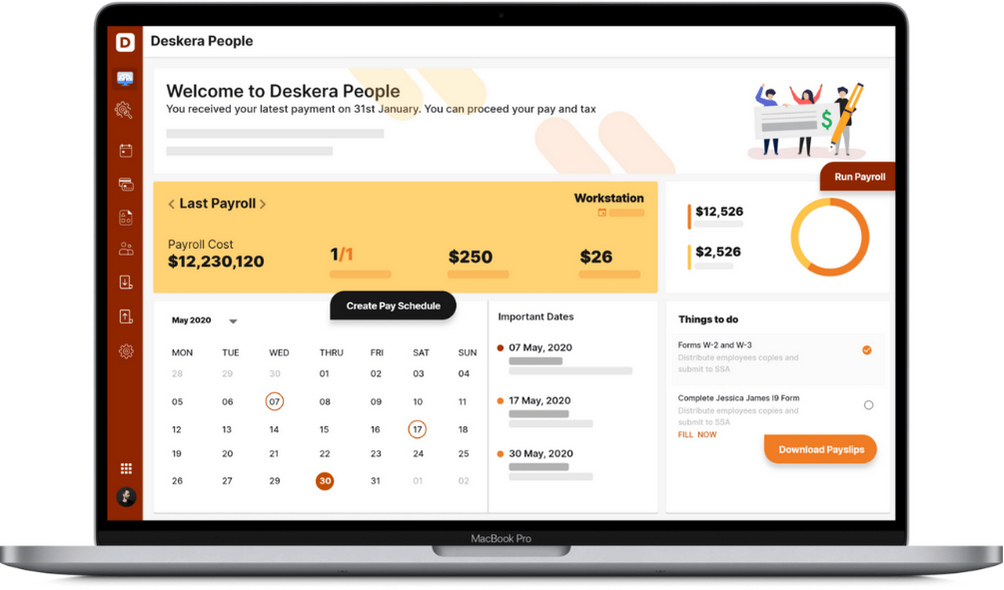

How can Deskera Help You?

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning and uploading expenses, and creating new leave types, it makes your work simple.

Key Takeaways

- As prescribed by the Professions, Trades, Callings, and Employment Act of 1947, all individuals who earn an income from their chosen field or profession are liable to pay profession tax.

- Field or profession includes doctors, lawyers, chartered accountants, and any individual who has an income is subject to the professional tax.

- It is also mandatory for all organizations except government bodies to subtract professional tax from their employees’ salaries.

- Form I is the application for a certificate of registration and is a part of the Assam Profession Tax Act; it facilitates the process of applying for the certificate of registration.

- The letter is addressed to the concerned assessing authority with the following undertaking:

- I have to apply for a certificate of registration or amendment of the certificate of registration under the Assam Professions, Trades, Callings, and Employment Act of 1947 as per the prescribed particulars.

- While profession tax is a mandatory deduction, it is a small amount that cannot be more than Rs. 2500 in any Indian state.

- The employer must then submit this tax collected to the state government and provide a return to the state government. They must complete the task within a stipulated time and in the prescribed format (as prescribed by the Professional tax rules).

Related Articles