Understanding the concept of net revenue is quite essential for the business. We often calculate our profits based on our money, and we forget to make deductions such as rent, wages paid, etc. It might not give you an accurate picture of the profits that you are making. Therefore, you need to calculate your net revenue to understand how much money your business makes.

Understanding the concept of net revenue is quite crucial for every business, be it large or small. If you are still confused about net revenue or get confused between gross and net revenues, we are here to help. Here's everything that you should know about net revenue.

- What is net revenue?

- Difference between gross revenue and net revenue

- Transactions affecting net revenue

- Sales allowances

- Sales returns

- Sales discounts

- The reporting of gross revenue vs. net revenue

- Gross revenue reporting

- Net revenue reporting

- Usability: Gross revenue vs. Net revenue

- Net Revenue Management

- How do Net Revenue Management works?

- Final Thoughts

- Key Takeaways

What is net revenue?

The top-line money that every business makes is the company's gross revenue. It is essentially gross revenue when you earn money, and nothing is deducted. However, once you make all the deductions like costs, losses, etc., the revenue left is the net revenue. The deductible money is generally used for making payments toward business operations and the production costs associated with the product.

If you want to calculate the net revenue, you need to subtract discounts, allowances, commissions, and return value from the gross revenue. The lesser the difference between gross and net revenue, the better, as every business will want to maximize profits and lower the elements that can bring down revenue.

When you give a customer a discount or an allowance, it shows up on the income statement as a reduction in revenue. It signifies that the net revenue amount for the selected time is the "real" revenue or the actual amount you are pocketing after deducting everything else from your gross revenue.

Difference between gross revenue and net revenue

Your company's expenses equal the difference between your gross and net revenue. These include variable and fixed costs and direct costs of products sold (costs that are directly allocable to specific units or product lines).

Therefore, you can calculate the net revenue by applying the following formula:

Gross Revenue – Expenses = Net Revenue

Listed below are things that are responsible for the difference between gross revenue and net revenue:

- Cost of goods sold: This refers to the direct costs that the company incurs while producing or manufacturing the goods.

- Marketing costs: This refers to the expenses that a company incurs in promoting the product like advertising costs, website hosting fees, brand building costs, etc.

- Technology costs: A company has access to different kinds of software and subscriptions. These costs are also subtracted from the gross revenue to calculate the company's net revenue.

- Office supplies: Several things are used in the office to make our lives easier, be it a paper clip or a toilet paper. The cost of these supplies is deducted from the gross revenue.

- Legal and administrative costs: You might incur costs when hiring a lawyer or a consultant. These costs are also deducted from the gross revenue.

- Rent and utilities: Any amount paid as rent for the office space or the services in an office space like electricity, etc., must also be deducted from the gross revenue.

- Taxes: All taxes are deducted from the gross income to arrive at the net income.

- Employee compensation: All kinds of salaries, wages, bonuses, etc., that are paid to the employees are removed from the gross revenue.

Dividend payments usually are not deducted from gross revenue to determine net revenue. After you've estimated net revenue, those payments are subtracted later in the accounting process.

Transactions affecting net revenue

Several transactions impact the net revenue as they can drastically reduce the gross revenue. These transactions come into the picture when you make a sale of the product, which is the primary part of your business. Let's check out these transactions in detail:

Sales allowances

Sales allowances come into the picture when a customer is not happy with the product's state and wants to get the product at a reduced price. In this case, the person who will be selling the product to the user has already bought a product from the wholesalers, and hence the full amount of the sales are booked.

However, as the seller is now selling the product at a low price, the reduction will be credited as accounts receivable. The sales allowance account will be debited, which will increase in value. The value in the sales allowance account tends to reduce the gross revenue.

Sales returns

When a customer returns items, it is recorded as a sales return. This is especially typical in the retail industry, where returns are usually accepted within a set number of days of purchase. The money paid back to the customer is credited (reduced) to the accounts receivable or cash account.

In contrast, the amount given to the customer is debited (increased) to the sales returns account. Gross sales are countered and reduced by the sales returns account. In addition, depending on their condition, returned products are either restored to inventory or trashed.

Sales discounts

Sales discounts are early payment discounts that are availed by the customers when they pay the bill generated by the sellers. For instance, if the seller promises a 5% discount if a customer makes the payment in the first seven days, the 5% amount will be recorded in the sales discounts account.

The sale is initially booked at the full price, and then the discount is recorded separately as no none can predict which customers will be making an early payment. The accounts receivable account is reduced by the discount amount offered, while the sales discounts account is debited. These are subtracted from the gross revenue to reach the net revenue.

The reporting of gross revenue vs. net revenue

For accountants, reporting and recognizing the type of revenue is a complex problem. The difference between the gross and the net revenue must be handled responsibly as there can be several tax repercussions if the differential amount is mishandled. Every income that a company earns forms a part of the gross or net revenue.

Gross revenue reporting

When the gross revenue is recorded in the books of accounts, all the proceeds from a sale are recorded in the income statement. Generally, the gross revenue is the untouched income from the sale where none of the expenditures are deducted from the amount. For instance, if you have a pair of shoes priced at $100 and a customer buys it at the same price, the $100 that you receive from the customer is gross revenue. Even if you decide to give a discount of 40% to your customer, the sale value, i.e., $100, will be considered the gross revenue.

The cost of goods sold is not considered when a company's gross revenues are reported. It talks about the money received from the customer or the direct sales made to a client.

Gross revenues are always reported as top-line revenues whenever you record the amount in an income statement or a cash flow statement. It is the inflow of money that is coming to your business.

Net revenue reporting

Any allowances or discounts are deducted from the gross revenue when the net revenue is reported in the books of accounts. For instance, if you have a pair of shoes priced at $100 and provide a 30% discount on the pair to your clients, the net revenue will come down to $70. Further, you may deduct any costs incurred during the product's sale to reach the final net revenue. These costs may include rent, salaries of the people involved in closing the sale, etc. Anything that can be labeled as a cost to the shoemaker can be deducted from the amount to reach the net revenue.

Net revenue is always reported as the bottom-line revenue as all the expenses are reduced from the gross revenue, and you come at a final number that will be made out of a sale.

Usability: Gross revenue vs. Net revenue

Gross revenue is beneficial for tracking sales volume and ensuring that your company's market share increases and your salespeople meet their targets. However, it offers little insight into the overall profitability of your business.

On the other hand, net revenue is an excellent way to track your profitability and provides more information than gross sales. However, net revenue has its limitations. You can't always identify why net income changes, for example. You can't tell if your business's net income is shifting due to sales or expense adjustments without looking at the gross revenue during the same period.

Therefore, you need to track both the gross revenue and the net revenue to understand the company's performance. If you are looking forward to a strategic expansion, you will have to consider both your top-line and bottom-line to make any strategic decisions.

Gross revenue is a minimum qualification condition for most lenders, from your local bank to any modern lending institution. It means that, like other investors, they want to learn more about your company's ability to raise funds. This assists lenders in determining how much money is suitable to lend to a certain firm while also determining your ability to repay the loan using your business credit, personal credit, and cash flow. To evaluate how easy or difficult it will be to service the loan, make sure you understand your net revenue.

Net Revenue Management

So, Net Revenue Management is concerned with managing sales and profits. This word has recently gained popularity and is primarily a data-driven approach. Net revenue management involves making decisions based on shopper data. This is done to improve product performance to increase sales and profit.

It would be best to optimize prices and your trade spending to manage your net revenues. Therefore, it is crucial for you to develop a strategy that will help you achieve the desired net revenue figures.

Increased sales translate to more earnings. You will be a higher functioning business if you optimize your sales. You will also become more lucrative if you invest in net revenue management. Companies have attempted this from the beginning of time. The NRM perspective emphasizes using data to make a business smarter. Whether they're altering rates like an airline or a motel or focusing on promotions like a supermarket supplier, they're all doing something. The issue is not whether to use NRM but which techniques to use and then focusing on getting more done with less.

How do Net Revenue Management works?

NRM is about making decisions based on facts in its most basic form. This isn't something new. NRM resembles Category Management in that it is based entirely on data. Data was supposed to be used in Category Management. NRM certainly does. It's all about being more strategic to boost sales and profits.

For a regular business, you can get into NRM by understanding how much the business spends yearly on promotions, and then you can find out your returns from suppliers and shoppers. Once you know the entire expenditure beforehand, it becomes pretty easy for you to make necessary adjustments in the expenses to maximize your net revenues.

Final Thoughts

You know that the income you earn from making a sale is gross revenue, but you get the net revenue when you remove all kinds of deductions from it. Net revenue is an important concept as it helps you understand your profit structure and the money you are making at the end of everything. However, this does not discount the value of gross revenues as both of these concepts are equally important.

You must be careful while calculating the net revenue as several deductions have to be made. The number that is important for all financial elements is net revenue. It's the one to look forward to determining where earnings are high and low, determining which parts need to be eliminated and which parts need to be grown, and making a strategic decision on what to do to increase profits.

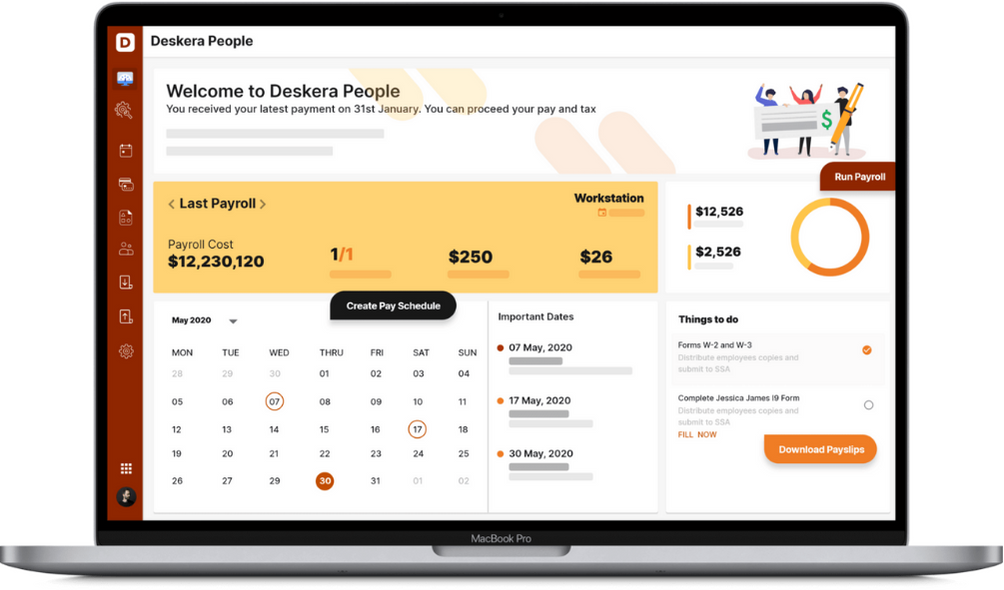

How can Deskera Help You?

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

Net revenue is a company's revenue after removing all expenses incurred by a company. You can derive the net revenue by subtracting these costs and expenses from the gross revenue.

The difference of amount between the gross revenue and the net revenue comes from the following aspects of the business:

- Cost of goods sold

- Marketing expenses

- Cost of office supplies

- Rent and other utilities

- Compensation given to the employees

- Taxes

- Administrative and legal costs

- Technological costs

The net revenue can be calculated by applying the following formula:

Gross revenue – Cost of goods sold – Overheads - Other variable expenses = Net revenue

Some transactions that have a direct impact on the net revenues are:

- Sales allowance

- Sales returns

- Sales discounts

You must also know the difference between gross and net revenue reporting. Also, there are some differences in the usability of these revenues, and you need to understand those differences. While gross revenues can explain the sales projections and the volume of sales, the net revenue will provide you with a picture of the company's profitability.

You must also know the benefits of net revenue management as that will help you increase the business's profitability in different ways. Net revenue management works on additional facts, and you must consider those facts while making any decisions that might impact the net revenue.

Related Articles