Efficient construction accounting and accurate bookkeeping are essential parameters in the construction industry. However, although construction accounting is built on standard accounting principles, it is a specialty due to construction companies' unique way of working.

Jason and Jeff Constructors are construction accountants who manage the expense and income of large individual projects and product lines, allowing companies to manage industry practices such as retainage or withholding, frequent change orders, special billing, and revenue recognition methods.

Construction accounting is a specialized concept and usually requires technical accounting skills.

Here's what the article covers

- What is construction accounting?

- Why is construction accounting different - Features of construction accounting and invoices

- Foundation of Construction Accounting

- Construction accounting billing formats and types of contracts

- Construction Accounting Payroll

- Employment Taxes in construction accounting

- Compliance Report in construction accounting

- Difference between Construction Accounting and Regular Accounting

- 4 best practices for construction accounting

- Most Common Construction Accounting Mistakes

- Reduce risk and improve construction accounting

- Conclusion

- Key Takeaways

What is Construction Accounting?

Construction accounting has its unique style of financial accounting and bookkeeping management. It is specially designed to allow contractors to track each job and its impact on the entire business. Contractors must reply to basic principles of general accounting, which have some critical and different characteristics. Let us understand what distinguishes construction accounting from the procedure applied by other industries.

Why is Construction Accounting Different?

Construction accounting differs in accounting and other characteristics compared to other industries such as retail and manufacturing.

Features of construction accounting and invoices

1. Project-based

Contractors operate their businesses primarily on projects. The economic focus of other industries relies on the activities of every store, every factory, every product line, or the entire company as a profit center. However, construction accounting should consider every construction project as its short-term profit center having inputs and requirements. Every project is affected by different site conditions and regional variables such as workforce, material costs, and laws.

In addition, projects are continuously open and closed on a contract-by-contract basis throughout the year. Ultimately, construction firms manage costs by tracking individual projects' actual expenses and production activities that make up the job costs. Finally, these numerous temporary costing centers are why construction accounting is based on job costing.

2. Distributed production

Production is not standardized at fixed locations. Instead, it is primarily done at various construction sites. Therefore, both equipment and workforce change frequently from place to place, resulting in a rise in mobilization costs. Equipment and labor costs also mean each site must have a distinguished wage rate.

In addition to various project requirements, construction is also unpredictable, characterized by long, often seasonal production cycles because of which contractors often cannot hold extensive inventories. Thus, the fluctuating production input costs and availability need to be planned and tracked differently.

3. Long-term contract

Construction contracts are longer than many other companies. In construction, a production contract can last for years and involves multiple rolling payments. The terms and conditions typically allow payment of invoices for 30 days, 60 days, and even 90 days or more. Reservations or disputes can delay payments even longer.

As a result, there are special considerations for tracking, reporting, revenue recognition, collection and cash flow strategies, and cash management in construction.

Foundation of Construction Accounting

Construction accounting relies on some key concepts to address some of the key differences from the general account.

1. Job Costing - How much does the job cost?

Usually, a general ledger is maintained to allow you to track transactions that affect the financial position of your entire company.

However, construction accounting is project-centric and production is decentralized, because of which it takes time and effort to track costs for specific projects, and production activities.

What does job costing do?

Construction accounting is based on two key areas - construction costing and general ledger. The general ledger looks at the entire company, and the job costing looks at the project level. Also, if the general ledger consists of accounts (such as material costs A / P), job costing consists of the following elements:

- Individual projects

- Cost activities (foundations, frames, etc.)

- The type of cost (labor costs, materials, etc.)

When all this job data is captured and organized, the result is a meaningful report that the project manager and foreman can use. Contractors can guide project managers and supervisors to monitor costs and production properly. Estimators can determine the break-even cost and have scorecards to check crew performance, learning and adjustments. With better quotations and cost control, contractors can protect tight margins and continue undertaking suitable projects.

Ultimately, the goal is to allow contractors to determine actual costs and profitability. It is complicated in an industry where there are a lot of variables between contracts. You can then use it to notify you of future estimates, budgeting, and decisions.

2. Realization of contract revenue

What is revenue recognition?

Revenue recognition in construction accounting is a way for a contractor to determine when a project makes money. It also helps you determine when you need record your expenses formally. Construction tends to be long-term, and payments are often delayed. Contractors may not always be able to sign, claim, and collect contracts in the same month, so there is a need to choose a revenue recognition method. It determines when income and expenses are counted.

You can simply use one method for your construction accounting and the other for your tax filing, maintaining consistency over the long term. Construction accounting is mainly on a cash basis, completed contracts, and completion rates. All contractors should consider ASC 606 revenue recognition standards with their construction CPA by all contractors.

3. Cash method

The easiest way to recognize income or profit is with the cash method. Everything relies on the real-time effect on the company's cash position. The contractor records revenue only when it receives payment and reports costs only when it makes a payment.

Therefore, there are no accounts payable (A / P) or accounts receivable (A / R). If the funds have not yet been replaced, there are no transactions to post to cash accounting.

- Cash accounting has several advantages, but it is not suitable for all construction companies. Many SMEs prefer cash accounting because of its simplicity and flexibility, but only a few contractors qualify

- According to the IRS, construction companies with less than the specified average annual income can only use the tax cash law. If your company's sales exceed this amount, you will need to use a different tax method. In this case, they can choose another way – the accrual method of construction accounting for their books as well

- Accrual accounting recognizes the costs incurred and the earned income, even if you have not yet received or paid the money

4. The completed-contract method

With the CCM Completed Contract Method, contract revenue and expenses are only recognized after the project is completed. The actual position of the project profitability can only be decided by the end of the project. This may mean that the contractor can defer taxable income if the contract is not completed by the next tax year.

The CCM also has certain restrictions from the IRS. To qualify, the contractor must not exceed the given annual sales, and the contract should be finished within the specified time frame.

5. Percentage of completion method - PCM

It allows contractors to record revenue as they earn revenue over time. As the project progresses towards completion, the contractor can charge for the work performed. You can record the revenue generated each time you issue an invoice.

This continues until they terminate the contract. You can choose from a variety of methods, such as cost-to-cost and estimated completion rate, to calculate the amount you earned from your billing contract.

5ASC 606 New Revenue Recognition Standards

The Financial Accounting Standards Board, which oversees the generally accepted accounting principles (GAAP) of the United States, has issued “ASC 606: Revenue from Contracts with Customers” as new rules for revenue recognition.

GAAP provides best practice accounting standards for all industries in the United States. As of December 2018, all companies reporting under GAAP must comply with ASC606. It also helps contractors decide whether to recognize book revenue at a particular time (such as CCM) or over some time (such as PCM). For ASC 606, the problem relies on the idea of delegating control.

6. Contract Retainage in construction accounting

Another characteristic feature to consider in construction is tax withholding or retaining practices. Retainage is a given amount of money that the owner may withhold until they are satisfied with the contract's settlement. A typical deduction is 5-10% of the contracted or billed amount, but it can often be less. Retainage is to provide customers with security against project flaws and errors.

Retainage mechanism in construction accounting

If the contractor makes a profit using accrual methods such as CCM or PCM, he has the right to invoice and post the amount as an A / R until it is collected besides retainage. According to commercial standards, the contractor does not have an ongoing right to retainage. Thus it cannot be treated as accounts receivable (A / R).

Instead, the contractor posts them to another asset account. When the contractor gets the right and fully fulfills the contract, the contractor issues the invoice and moves it from the asset account to the accounts receivable account for collection.

Retainage methods vary from state to state, but the owner can retain for more than a year in some cases. In addition, a retention rate of 5-10% can affect the contractor's profits by 20-50%. Retainage tracking is substantial in construction accounting due to the tight profit margins in the industry.

Specialized construction accounting or billing

Fixed prices and point-of-sale charges are used in many industries but not always in construction. Since it is project-based, decentralized, and long-term, contractors can use a variety of billing styles and methods. Tracking and generating these statements often requires special software.

Let's take a look at some construction accounting billing formats and types of contracts:

1. Fixed price Construction Accounting

Fixed invoices, also known as flat-rate contracts, rely on estimates that show the total cost of the entire project. It can also be displayed in two types: hard-bid fixed and negotiated fixed prices.

- Hard Bid puts the risk on the contractor as it says, "No matter what, build it for that amount." If there is an overrun due to changes in the construction site conditions or input costs, the contractor shall bear the burden

- On the other hand, the negotiated flat rate can consider some emergency events. Fixed-price contract billing is often based on completion rates while withholding retainage

2. Time and Material construction accounting

Time and material billing determine the contract price based on hourly labor and material costs. Contractors can apply standard mark-up for both labor and material components. This incorporates the rate of return into the amount and considers overhead costs.

3. Unit price construction accounting

In a unit price contract, the contractor charges the customer a fixed price per unit price. This is usually useful when producing a project's work cannot be estimated very reliably. Unit prices are popular among highway contractors and utilities. In the case of unit price, the risk is usually shared between the contractor and the customer, as the final production quantity can be higher than the estimate.

In this case, the contractor can increase sales if the unit price is estimated correctly. Otherwise, they risk losing money when unit prices fall.

4. AIA progress construction accounting request

A common billing form for construction work is the so-called AIA bill, named after the American Institute of Architects, which creates a standard form based on the work completed during that billing period. This invoice usually consists of a signed summary sheet and a statement of value detailing what has been completed and accounted for.

Taken together, these documents are considered "requests or applications" for payment. This is because the recipient has the opportunity to confirm the registration of the value and accept or challenge the invoiced amount. If you disagree, the customer can make a "red line" for the contractor to correct and resubmit the AIA claim request.

5. Construction Accounting Payroll

Construction accounting incorporates a complex payroll processed with multiple profit centers, decentralized production, and strict compliance requirements. This is because the industry has the following complexities:

- Applicable wage requirements and certified payroll accounting

- Multiple wage rates, states, and locations

- Other compliance reports

6. Certified Payroll & Prevailing Wage

Contractors working on public projects usually need to navigate general salaries. It is often referred to as the "Davis Bacon payroll" after the ground-breaking Davis Bacon method. Under applicable wage law, contractors must pay regular or general wages for each worker's grade and certify compliance for each project using certified payroll reports, varying by state or institution.

- This system of construction accounting could be complex because of the following reasons:

- General salaries may or may not include in-kind benefits called "fringe benefits" such as medical care and education

- The prevailing wage rate depends not only on the sector but also on the classification of a particular worker

- Each jurisdiction may have specific provisions regarding which professional duties fall into which category and at what level within that class. Therefore, an employee can have multiple general wage rates and additional requirements for a job, depending on what they do every hour

- These rates are also subject to change every six months for up to 1 year

7. Union Payroll and reporting in construction accounting

Union contract partners face the same situation as collective bargaining agreement partners. Certified payroll usually tracks government wages and ancillary obligations, while union payroll needs to track wages and ancillary obligations and report them to the local union. When it comes to payroll accounting between unions, it gets even more complicated.

Reasonable margins and deductions should be assigned to the correct local level and reported accordingly. The reporting requirements for a particular partnership may be national or local. Contractors can usually determine their needs by checking with their local union manager, especially if they are moving to another jurisdiction.

8. Multiple rates, states, and locations in construction accounting

In addition to multiple common wages and union tariffs, contractors often handle multiple tariffs for various other reasons. Employees working at construction sites in multiple cities and states can receive multiple tax credits within a single payslip.

Beware of double taxation in construction accounting

Some jurisdiction contractors need to be aware of double taxation, which is especially problematic if the employee lives in one state and works in another. However, if the states are interrelated, the worker's country of residence may issue a tax deduction paid on income earned outside the state. They don't pay twice, but this requires attention to time cards and payslips.

Employment Taxes in construction accounting

Construction accounting should consider overpayment of unemployment taxes if workers work in multiple states. In many cases, unemployment is owed to only one state per worker. And if it is incorrectly paid to all the states in which they worked; the contractor should not expect to be contacted for a refund. It is not always clear where the unemployment allowance should go, so the Ministry of Labor proposes to consider the following factors in order:

- Localization of service

- The base of operations of the employees

- The place, direction, or control

- The federal state in which your employees live

Compliance Report in construction accounting

Construction accounting may revolve around specific parameters that the contractors must follow. It may include union reporting, workers' accident compensation, new hires, and compliance with minority equality employment opportunities (EEO) regulations.

Difference between Construction Accounting and Regular Accounting

Construction accounting comes with industry-specific concepts and challenges. Construction companies usually ensure the profitability of each project which is large and unique, so accurate job costing is essential.

This is especially difficult because corporate projects are usually spread across multiple locations, hiring mobile workers, and fluctuating costs. Construction accounting can be for multi-year projects subject to many transformations over their lifetime. Let us look at the key differences between both kinds of accounting.

1. Project-related construction accounting

Compared to Retail or Manufacturing, Construction Accounting usually focuses on custom projects and needs to manage everything for profitability. Due to the unique complexity of each project, it can be challenging to evaluate and get your bids on track in a competitive yet profitable way.

2. Mobile and decentralized Production

Production is usually done at the project site in the construction business, which could vary in location, thus affecting the transportation, workforce, and equipment costs.

Companies also need to comply with local wage rates and regulations that apply at each location and need to buy materials or rent machines from stores near each location. Leasing accounting has its challenges. Mobile technology helps companies stay on top of project progress and costs.

3. Long-term, uneven, and diverse contracts

Construction accounting is done for projects that are usually long and span multiple accounting periods or years. Due to problems such as lack of raw materials and bad weather, even small projects can be postponed.

Based on the work completed so far, there is a need to maintain multiple payment schedules throughout the contract period. In addition, work is usually seasonal, and it is often difficult to predict when new work will appear.

4. Various direct and indirect costs in construction accounting

It is difficult to estimate the cost of a project because the direct and indirect costs are constantly changing. Labor and material prices can change significantly throughout long-term projects, and it is not easy to predict these changes.

Contractors are particularly vulnerable to changes in material costs due to the difficulty of pre-stocking construction materials. Overhead costs such as administration and insurance are also subject to change during the multi-year contract.

5. Limited sale

Construction companies, especially those undertaking large-scale projects such as commercial construction and municipal construction, may only receive a few orders each year.

Therefore, a contractor's general chart of accounts looks different than it is for a manufacturer or a mass retail or hospitality business. Sales reps also have different salaries, and accounting needs to pay close attention to the customer's financial position.

6. Change order

This is not always easy, as contractors often start making changes before they are officially approved and priced. The contractor should document the change order process in the original project contract.

7. Profitability Predictive

Each project has its challenges, but the situation is further complicated by order changes and cost fluctuations throughout the project. This makes it difficult to gauge whether a project is profitable, or is losing money.

Best Practices for Construction Accounting

Applying construction accounting best practices can bring benefits to your entire organization. For example, accurate job costing can help a company identify where it makes or loses money and respond quickly before it negatively impacts profitability.

1. Concentrate on appropriate job costing

As a contractor is a project-based business, analyzing and marking the cost of each project is the key to bringing out better revenue and profitability. Appropriate and consistent job costing helps companies accurately estimate projects and keep a stringent track of actual and estimated costs. However, calculating costs is not easy.

To accurately estimate the expenses and incomes that can be incurred and earned in a job, you need to understand all aspects of its labor costs, material costs, and overhead costs.

Labor costs are challending to track when mobile workers are used in various projects. It's easier to prioritize the cost of work so that all employees understand their contribution and value to the company. Good construction accounting software and clear, intuitive coding for every job and expense category make that easy.

2. Use cash accounting

Cash accounting is an attractive option for many small businesses. Its simplicity usually means lower construction accounting costs than accrual accounting, which provides a clear overview of the company's actual cash position. This is especially useful for small businesses with limited funding.

You don't have to pay taxes on sales you haven't collected yet, because you only record sales when you receive payment. You also need to keep track of expenses at the time of payment to reduce your tax bills this year by buying additional consumables towards the end of the year.

3. Analyze and fix the best tax strategy

In construction accounting, several considerations affect a contractor's income tax liability, such as the choice of revenue recognition method, the type of project undertaken, and the business structure. The best tax strategy depends on the company and its needs.

Most contractors use the completion rate method of construction accounting to recognize the revenue of large contracts, which helps in smoothing revenue fluctuations because the income and costs are tracked over the life of the project.

Contractors working on a home construction project may be able to use a closed contract alternative, where revenues and expenses are not recognized until the end of the project. This can benefit companies seeking to reduce their tax obligations for the current year as revenue and income tax are deferred to a later period.

The owner or shareholder of a construction company should carefully consider the tax implications of the business structure. For example, a company configured as a pass-through company such as a sole proprietor or many LLCs can reduce its income tax burden by deducting business losses.

4. Invest in construction accounting software

Modern construction accounting software simplifies financial management and helps contractors comply with tax laws. It automates many of the otherwise cumbersome job costing tasks. The reporting feature allows you to track your projects and analyze your company's entire finances in real-time so you can quickly identify and fix problems before it's too late.

A good construction accounting software manages accounts receivable and payable and helps contractors collect a debt and ensure that they maintain good relationships with their suppliers. It also ensures accurate tax filing with sufficient flexibility to support the various revenue recognition methods used in the construction industry.

Most Common Construction Accounting Mistakes

It can be difficult for a growing construction company to manage a busy schedule, which can lead to several construction accounting mistakes, from inaccurate estimates to signing contracts without due diligence.

1. Confusion in construction accounting

Maintaining well-organized construction accounting is not easy, especially for small construction companies. Careful construction accounting may not be a top priority if you are trying to grow your business while keeping track of a fluid project schedule and a constantly changing workforce. However, failure to establish a well-organized construction accounting process can lead to losing control of the project's cost and tax issues.

The same applies to labor cost determination, real-time financial tracking, and the implementation of powerful construction accounting software to help meet tax requirements.

2. Insufficient contract cost estimates in construction accounting

Inaccurate estimates can cause business problems. If the quote is too low, it can lead to deficit projects and troublesome renegotiations with customers. If the quote is too high, your competitors may lose your order.

Poor estimates can lead to revenue recognition issues for companies using the completion rate method. To create an accurate labor cost estimate, it is essential to understand all overhead cost factors such as overhead costs, labor costs, and materials.

3. Inaccurate understanding of joint ventures in construction accounting

Joint ventures are when companies collaborate to pool resources and share risks. However, companies must use an appropriate construction accounting structure from the beginning so that each company's investments, returns, and profits are reported accurately.

The choice of accounting method for a joint venture usually depends on the level of ownership and control of the joint venture, which construction companies may not be aware of until it is too late.

4. Incorrect Overhead Calculation in construction accounting

Contractors typically assign overhead costs to a project as a percentage of the total project cost. Therefore, incorrect calculation of overhead expenses can lead to inaccurate cost calculations and reduced profits.

Contractors usually have a high overhead that changes frequently, and it is challenging to ensure that all items are included and up to date. It is essential to check all costs regularly and ensure they are included in the overhead calculation. Overheads may consist of office expenses, insurance, maintenance, and training.

5. Improperly managed change orders in construction accounting

When properly managed, change orders can continue to satisfy customers and at the same time increase project revenue. However, contractors often accept change orders based on brief on-site discussions, resulting in poorly documented, incorrect pricing, or proper accounting for the project's finances.

Additional work that has not been done will occur. This can increase costs and distort the overall picture of profitability. It can be time-consuming, but it is important to make a thorough cost estimate and document and approve each change order before starting.

6. Accepting Inappropriate Contract Terms in construction accounting

Growing companies often find it difficult to discuss terms and conditions. Especially if the contract is large and the revenue and reputation of the company in the community and industry are significantly improved.

However, accepting improper terms and conditions can lead to major problems later. To avoid problems, carefully review the contract with the help of a lawyer as needed and ask the client to consider the inappropriate terms.

7. Reduce risk and improve construction accounting

It is highly recommended for construction companies to get professional expertise and comprehensible software to manage labor, material, and overhead costs within budget. Cloud-based construction accounting software simplifies and automates data, reduces manual labor, and helps construction companies manage costs, improve profitability, and comply with tax laws.

Contractors can view real-time financial reports on financial information integrated with project status from across the organization. Mobile support means that users can immediately access this data wherever they are, whether in the office, on a project site, or on the go. Construction accounting software helps businesses mitigate management burdens, ease financial reporting, and enhance ROI and profitability.

Conclusion

Construction accounting can be complicated because of its unique nature. Besides debits, credits, and financial statements, contractors have many additional aspects that need to be managed and accounted for. Job costing helps you track many variables in your project-centric decentralized business.

You can track revenue recognition using Retainage practices for long-term contracts paid overtime. In addition, construction salaries are also crucial to monitor. The most important thing for a contractor is to get professional help, whether they have experience in the industry or are just starting.

How can Deskera Help You?

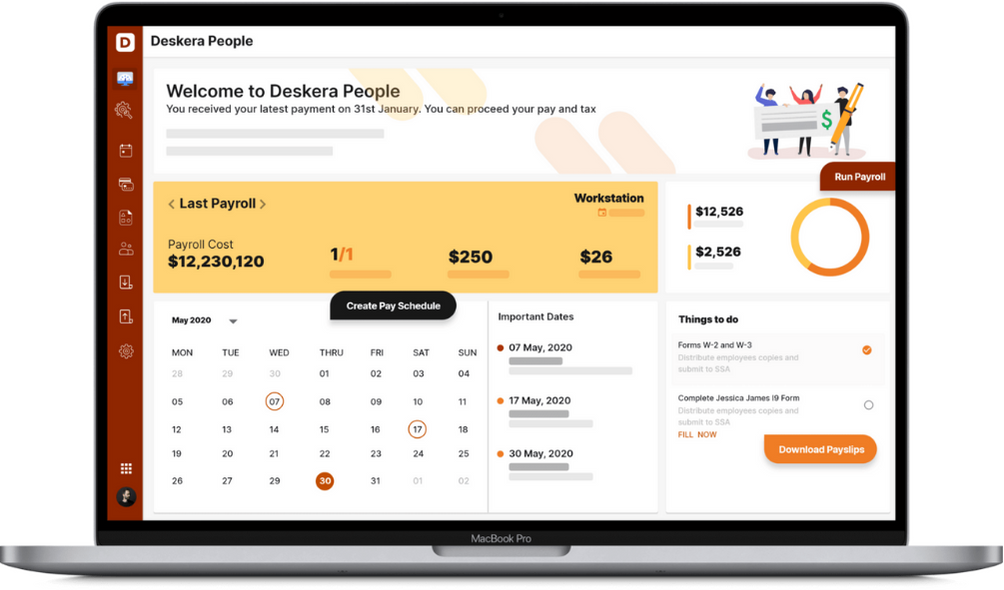

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Give top priority to the best construction accounting practices as it is important to keep your books organized. Construction accounting helps you manage your expenses to make better business decisions later

- It includes recording financial transactions, filling out payslips, tracking important expenses, and operating costs

- Construction accounting helps contractors pay attention to daily records regularly. It will be much more difficult to track a construction company's financial position without accurate records

- You can use easy-to-use apps that make construction accounting easy on the go, even when you're working away from your desk

- Tax deadlines should be stringently followed, and contractors must fill out tax returns correctly

- Managing cash flow is an important consideration that must be taken in construction accounting. A large amount of spending on complex work should also lead to a large income. Be sure to bill your clients regularly or request a prepayment of expensive materials and effort

- Construction accounting is all about invoice creation, assessing the contractor's bank account, keeping a strict tab on expenses and payments, tracking important dates and deadlines, using spreadsheets to track your company's cash flow, and developing standard operating procedures to document construction business processes

Related Articles