The professional tax of Andhra Pradesh is an important part of the state’s tax system. It is a levy imposed on individuals and companies who are engaged in any profession, trade, calling or employment, which are not exempt from the tax. Every employee must pay this tax in order to obtain a Professional Tax Registration Certificate (PTRC) from the Andhra Pradesh State Tax Department.

This article covers the following:

- Who Pays Professional Tax in Andhra Pradesh?

- Professional Tax Rates in Andhra Pradesh

- Professional Tax Exemptions in Andhra Pradesh

- How to File Professional Tax in Andhra Pradesh

- Penalties for Non-Payment of Professional Tax in Andhra Pradesh

- Benefits of Professional Tax in Andhra Pradesh

- Recent Changes in Professional Tax of Andhra Pradesh

- FAQs on Professional Tax in Andhra Pradesh

Who Pays Professional Tax in Andhra Pradesh?

In Andhra Pradesh, all employed individuals are liable to pay professional tax for the services rendered to their employer. This includes salaried employees, self-employed professionals, business owners, and corporate employees.

Professional tax is imposed on the income earned by the individual as salary, wages, fees, or commission. The amount of tax to be paid is calculated on the basis of the individual's monthly or annual income.

The rate of professional tax varies from one state to another. In Andhra Pradesh, the professional tax is levied at the rate of Rs.200 per month or Rs.2400 per annum. The professional tax is to be paid to the Municipal Corporation of the respective city or district in which the individual is employed.

The tax is collected by the Municipal Corporations and deposited in the state government treasury. The amount collected as professional tax is used for various developmental activities in the state. The professional tax is required to be paid by the 15th of the month following the month of earning the income.

Late payments will attract a penalty of Rs.20 for every day of delay. It is important for the individual to keep a record of all the professional tax paid as it can be claimed as a tax deduction in the income tax returns.

The Government of Andhra Pradesh has made it mandatory for all employed individuals to pay professional tax. It is the responsibility of the employer to deduct the professional tax from the salary of the employees and remit it to the Municipal Corporation.

The employer must also provide a proof of payment to the employees. Non-compliance of professional tax payments may attract fines and penalties as per the rules and regulations of the state government.

Professional Tax Rates in Andhra Pradesh

The professional tax rates in Andhra Pradesh are as follows: • Up to Rs. 10,000 – Rs. 200 • Rs. 10,001 to Rs. 20,000 – Rs. 300 • Rs. 20,001 to Rs. 25,000 – Rs. 400 • Above Rs. 25,000 – Rs. 500

Professional Tax Exemptions in Andhra Pradesh

Professional Tax Exemptions in Andhra Pradesh:

1. All government employees are exempted from paying professional tax in Andhra Pradesh.

2. Ex-servicemen and their dependents are also fully exempted from paying professional tax in Andhra Pradesh.

3. Persons with Disabilities (PWD) are also exempted from paying professional tax in Andhra Pradesh.

4. Employees who earn Rs.15,000 or less per month are also exempted from paying professional tax in Andhra Pradesh.

5. Employees who are engaged in agricultural activities are also exempted from paying professional tax in Andhra Pradesh.

6. Employees who are engaged in handicraft activities are also exempted from paying professional tax in Andhra Pradesh.

7. Employees who are earning from activities such as poultry farming, sericulture, and beekeeping are also exempted from paying professional tax in Andhra Pradesh.

8. Employees who are working in the unorganized sector are also exempted from paying professional tax in Andhra Pradesh.

9. Employees who are employed in small-scale industries are also exempted from paying professional tax in Andhra Pradesh.

10. Employees who are working in organizations recognized by the Government of Andhra Pradesh are also exempted from paying professional tax in Andhra Pradesh.

How to File Professional Tax in Andhra Pradesh?

Professional tax is a type of tax levied by the government on the income of individuals from certain professions. In India, it is imposed by the state governments and not by the Central Government.

In Andhra Pradesh, the Professional Tax Act 1988 is applicable. The Act provides for the levy and collection of taxes from persons engaged in certain professions, trades, callings, and employments.

The Government of Andhra Pradesh, through the Professional Tax Department, is responsible for the collection and management of professional tax. All employers, firms, and companies are required to register and pay professional tax to the government.

Here is a step-by-step guide on how to file professional tax in Andhra Pradesh:

Obtain a Professional Tax Registration Certificate:

Every employer, firm, or company must obtain a Professional Tax Registration Certificate from the Professional Tax Department of the state government. The registration certificate must be renewed every year.

Calculate Professional Tax Payable:

The employer, firm, or company must calculate the amount of professional tax payable for the year based on the number of employees and their respective salaries.

Pay Professional Tax:

The employer, firm, or company must pay the professional tax to the government by the due date. The payment can be made through the online portal of the Professional Tax Department or at the local Professional Tax Office.

File Professional Tax Return

The employer, firm, or company must file a professional tax return by the due date. The return must be filed online through the Professional Tax Department’s website.

Obtain Professional Tax Receipt

Once the professional tax return is filed, the employer, firm, or company must obtain a Professional Tax Receipt from the Professional Tax Department. The receipt must be kept in safe custody. By following these steps, employers, firms, and companies can easily file professional taxes in Andhra Pradesh.

Penalties for Non-Payment of Professional Tax in Andhra Pradesh

Penalties for Non-Payment of Professional Tax in Andhra Pradesh

1. Interest: If the professional tax is not paid on time, a penalty of 1.5% per month of the total amount due will be levied.

2. Penalty: A penalty of Rs 500 for each month of delay or part thereof, up to a maximum of Rs 10,000, will also be charged.

3. Prosecution: If the taxpayer defaults on the payment of professional tax for more than 6 months, he/she may be prosecuted under Section 40 of the AP Professional Tax Act.

4. Other charges: The taxpayer may also be liable to pay other charges such as lawyer’s fees, court costs, and other incidental expenses as may be directed by the court.

5. Cancellation of registration: The registration of the taxpayer may be canceled if the professional tax is not paid within 6 months from the due date.

6. Seizure of assets: In case of default in payment of professional tax, the assessing authority may seize the movable and immovable assets of the taxpayer and may even order the attachment of the property.

7. Payment of arrears: The arrears of professional tax shall be paid with interest and penalty to the assessing authority. Any arrears not paid within the stipulated time shall be recoverable as arrears of land revenue.

Benefits of Professional Tax in Andhra Pradesh

Professional tax is a tax imposed on people who are engaged in certain professions, trades, callings, or employments in Andhra Pradesh. It is a source of revenue for the state government and is used to fund various developmental projects.

The professional tax rate in Andhra Pradesh is Rs.200 per month for salaried individuals and Rs.500 per month for self-employed professionals. This tax is deducted by the employer or collected directly by the government.

The main benefit of professional tax in Andhra Pradesh is that it helps to fund various social welfare schemes and infrastructure projects. It also funds the state’s basic amenities, such as health and education.

The professional tax also helps to create employment opportunities in the state. Professional tax is also beneficial to taxpayers as it helps to reduce their income tax burden. This is because professional tax is exempted from income tax and can be used to reduce taxable income.

This helps to reduce the amount of income tax payable by the taxpayer. Overall, professional tax is beneficial to the citizens of Andhra Pradesh as it helps to fund important social welfare schemes and also reduces their income tax burden. It is an important source of revenue for the state and helps to fund various developmental projects.

Recent Changes in Professional Tax of Andhra Pradesh

Professional tax is a state-levied tax that is applicable to employees as well as to self-employed professionals in India. In Andhra Pradesh, the professional tax is administered by the Commissioner of Commercial Taxes.

Recently, the government of Andhra Pradesh has revised the professional tax rates. The new professional tax rates applicable in Andhra Pradesh are as follows:

1. For those earning less than Rs. 20,000 per month, the professional tax rate is Rs. 200 per month.

2. For that earning between Rs. 20,001 and Rs. 50,000 per month, the professional tax rate is Rs. 250 per month.

3. For that earning between Rs. 50,001 and Rs. 1 lakh per month, the professional tax rate is Rs. 500 per month.

4. For those earning more than Rs. 1 lakh per month, the professional tax rate is Rs. 750 per month. The revised professional tax rates will come into effect from 1st April 2019.

The government of Andhra Pradesh has also announced other changes to the professional tax system. It has made it mandatory for all employers to deduct the professional tax from the salaries of their employees.

The employers are required to deposit the collected amount to the government. The government has also made it mandatory for professionals to register themselves with the Commercial Taxes Department before 1st April 2019.

The government of Andhra Pradesh has taken these steps to ensure that all professionals pay their taxes in a timely manner. This move is also aimed at helping the government to increase its revenue. The new professional tax rates and other changes are expected to bring in more tax revenue for the state.

FAQs on Professional Tax in Andhra Pradesh

Q: How is the Professional Tax amount computed in Andhra Pradesh?

The amount of Professional Tax payable by an individual varies based on the individual's monthly income.

For instance, individuals earning a monthly income between Rs. 10,000 and Rs. 15,000 are liable to pay Rs. 150 as Professional Tax.

Q: How is Professional Tax paid in Andhra Pradesh?

Professional Tax can be paid either online or offline.

To pay online, individuals can visit the official website of the Andhra Pradesh Professional Tax Department. Alternatively, individuals can also visit any Professional Tax office and pay their Professional Taxes in person.

Q: What is the due date for paying Professional Tax in Andhra Pradesh?

Professional Tax must be paid by the 10th of every month.

Q: Are there any exemptions for Professional Tax in Andhra Pradesh?

Yes, certain categories of individuals are exempt from paying Professional Tax in Andhra Pradesh. These include individuals below the age of 18 years, individuals with a monthly income below Rs. 10,000, and certain categories of disabled individuals.

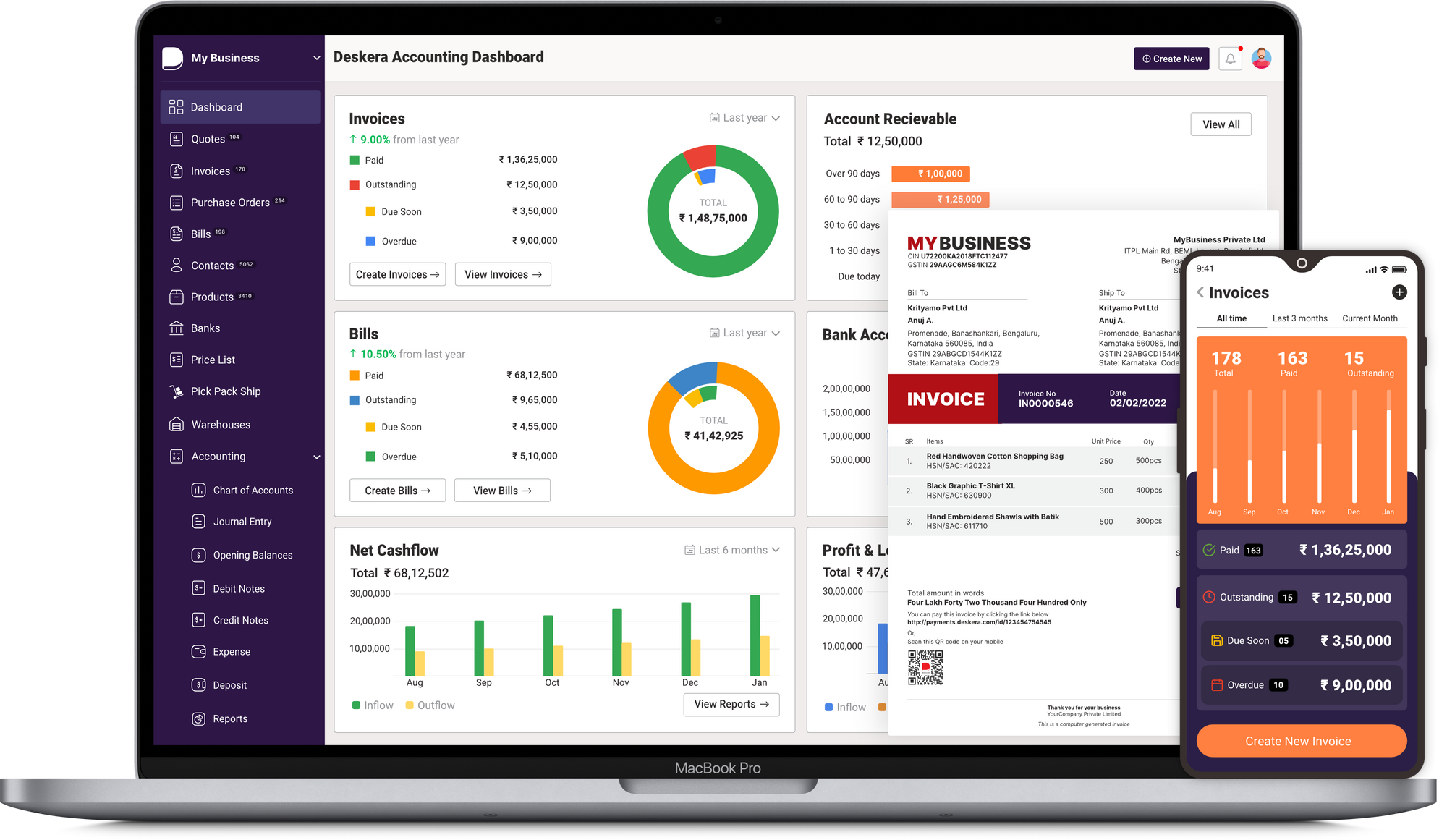

How Can Deskera Assist You?

Whether you are a sales manager or running your own business, there are tons of duties and responsibilities that you have to fulfill. Using the Deskera CRM system, you can manage your contacts, leads, and sales deals.

You can use the CRM system to manage all customer data and manage your leads, sales negotiations, and deals. Doing so will help you to save the time taken in transferring customer data between the different systems. Having a good CRM system will help you manage your financial and sales reports and be prepared to kick off your meetings.

Deskera can also assist you with real-time updates about your business, like cash flow status, customer satisfaction, inventory management, sales, purchases, purchase orders, customer tickets, customer satisfaction, managing leads, revenues, profit and loss statements, and balance sheets.

Moreover, it would also help in integrating sales methodology across different platforms into one system so that you have a consolidated list for email campaigns, leads management, and sales pipeline, to mention a few.

Related Articles: