Ever wondered why two companies with the same revenue can have drastically different profit margins? The answer often lies in how well they understand and control their operational costs. Operational expenses may seem like just another line item on your financial statement, but in reality, they are one of the most powerful levers for driving efficiency, profitability, and long-term growth.

Operational costs encompass everything from raw materials and labor to utilities, maintenance, and administrative expenses. While spending is inevitable, the real skill lies in identifying which costs are essential, which are wasteful, and how they align with your overall business strategy. This is where tracking the right metrics becomes more than just a financial exercise—it becomes a strategic advantage.

By consistently monitoring key operational cost metrics, businesses can spot inefficiencies before they spiral, uncover opportunities for cost optimization, and make informed decisions that boost competitiveness. Whether you’re running a small startup or a large enterprise, understanding these metrics is essential for sustaining profitability and scaling effectively in today’s competitive market.

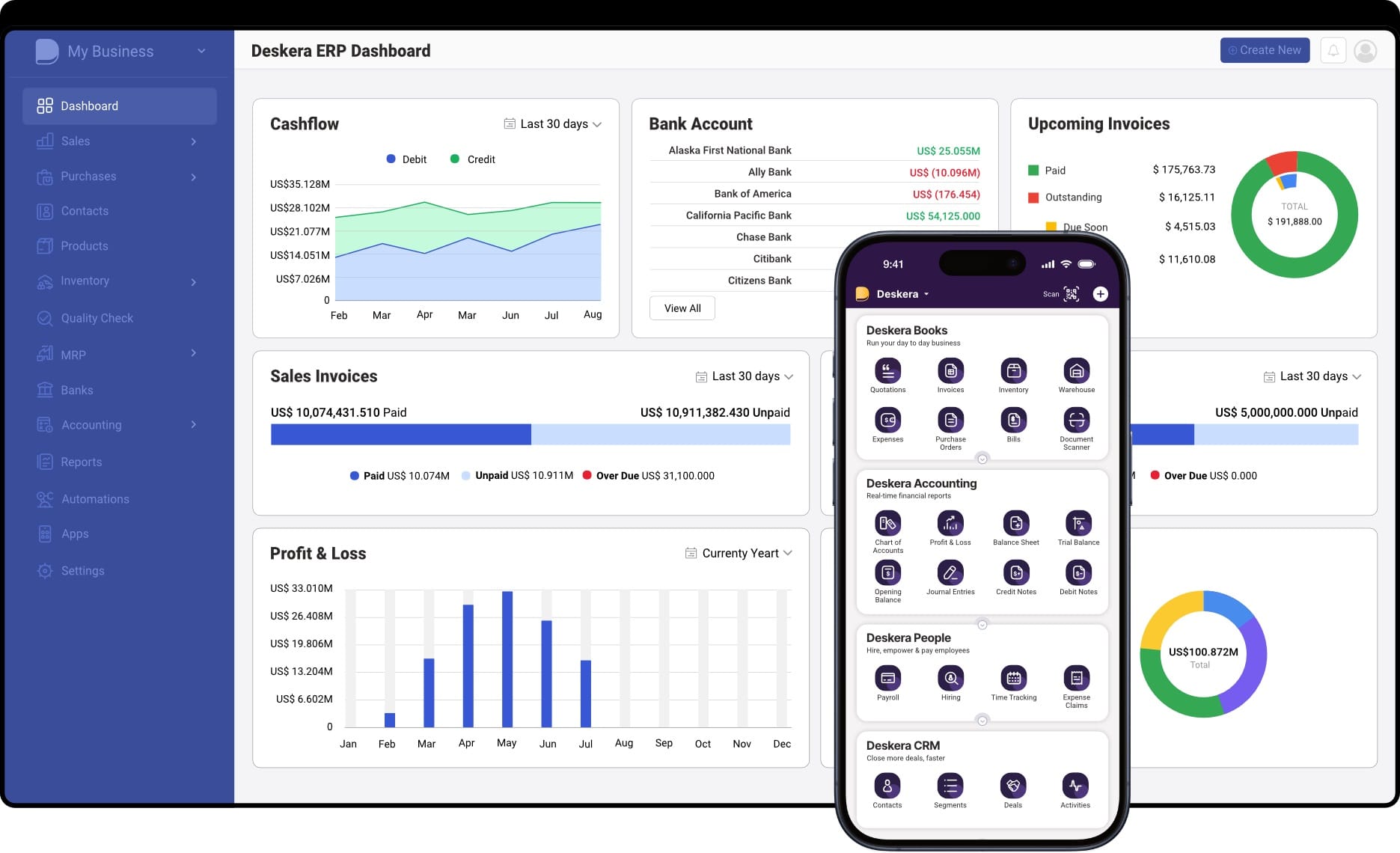

This is where Deskera ERP steps in as a game-changer. With its integrated accounting, inventory, and reporting features, Deskera ERP helps you track, analyze, and manage operational costs in real-time. From automated expense tracking to AI-driven insights, it provides business leaders with a clear picture of where their money is going and how to optimize it. By turning complex data into actionable insights, Deskera empowers you to make smarter decisions that directly impact your bottom line.

What Are Operational Costs?

Operational costs, also known as operating expenses (OPEX), are the day-to-day expenses a business incurs to keep its operations running smoothly. They include everything from employee wages and raw materials to rent, utilities, and maintenance.

Unlike capital expenditures, which are investments in long-term assets, operational costs represent the ongoing spending needed to produce goods or deliver services.

Operational costs can be broadly divided into direct and indirect costs:

- Direct Costs – These are expenses that can be directly tied to the production of goods or services. Examples include raw materials, manufacturing labor, and equipment used in production.

- Indirect Costs – These are expenses that support overall business operations but are not directly linked to a specific product or service. Examples include administrative salaries, utilities, insurance, and office rent.

Understanding the distinction helps in accurate cost allocation, better budgeting, and more informed pricing strategies.

Effective management of operational costs is crucial because it directly influences a company’s profitability. When costs are monitored and optimized, businesses can improve efficiency without sacrificing quality.

Lower operational costs mean a higher portion of revenue is retained as profit, enabling reinvestment in growth, innovation, and customer satisfaction. Poor cost management, on the other hand, can erode margins and limit competitiveness.

While operational cost analysis benefits all businesses, it is especially critical in:

- Manufacturing – To control production costs, reduce waste, and improve margins.

- Retail – To optimize supply chain, inventory management, and store operations.

- Services – To manage labor costs, streamline processes, and maintain profitability in competitive markets.

- Logistics and Transportation – To balance fuel, labor, and maintenance costs while maintaining service quality.

In these industries, even small cost adjustments can have a significant impact on profitability and market positioning.

Importance of Operational Costs

Operational costs are more than just figures on a financial statement—they are the heartbeat of a business’s daily operations. They influence pricing strategies, profitability, and the ability to adapt to changing market conditions.

Businesses that actively track and optimize these costs can unlock higher efficiency, maintain healthier margins, and achieve sustainable growth.

1. Driving Efficiency and Profitability

When operational costs are carefully monitored, businesses can allocate resources more effectively, reduce waste, and improve output without compromising quality. This cost control directly boosts profitability, allowing companies to reinvest in innovation, employee development, and market expansion.

2. Ensuring Financial Stability

Keeping operational costs in check creates a cushion for financial resilience. Businesses with optimized expenses are better prepared to handle seasonal demand fluctuations, economic slowdowns, or unexpected challenges, all while maintaining stable cash flow and creditworthiness.

3. Gaining a Competitive Advantage

Cost efficiency is not just about saving money—it’s a market differentiator. Businesses that deliver top-quality products or services while maintaining lean operations can offer competitive pricing, attract more customers, and strengthen brand loyalty in cost-sensitive markets.

4. Enabling Strategic Decision-Making

Accurate operational cost data empowers leaders to make informed decisions about expansion, pricing adjustments, technology investments, or process changes. Without this insight, strategic planning becomes guesswork, leading to missed opportunities and potential overspending.

5. Supporting Long-Term Sustainability

In an era where sustainability is a growing priority, managing operational costs often goes hand in hand with resource efficiency. Reducing energy usage, optimizing supply chains, and minimizing waste not only cut expenses but also enhance the company’s environmental and social responsibility profile.

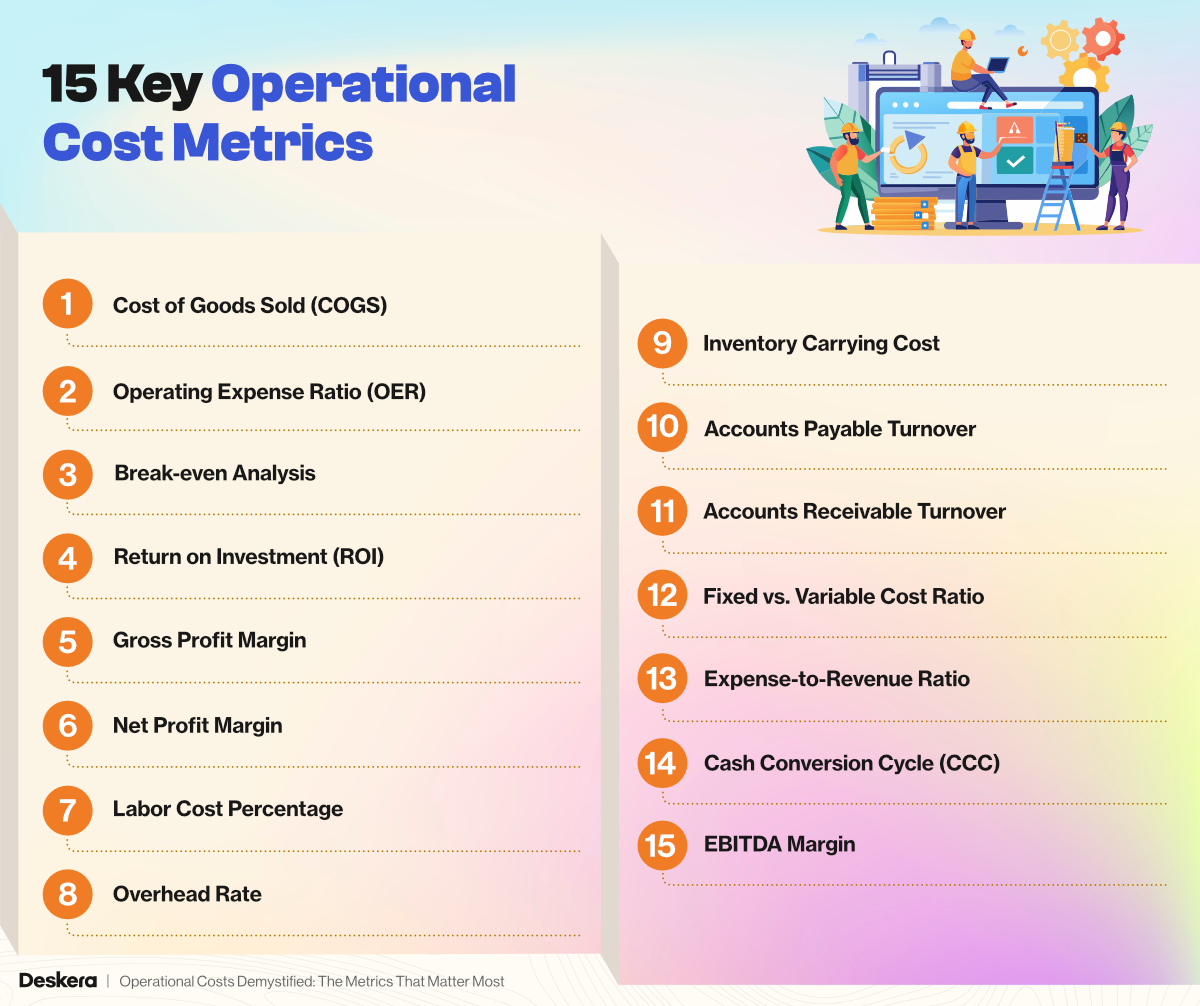

15 Key Operational Cost Metrics

Understanding and tracking the right operational cost metrics allows businesses to make smarter decisions, maintain efficiency, and protect profitability. Here are the most important metrics every business should monitor:

1. Cost of Goods Sold (COGS)

COGS represents the total direct costs involved in producing goods or delivering services. It includes raw materials, direct labor, and other costs directly tied to production. Calculating COGS helps determine the true cost of making each product, allowing businesses to set prices strategically.

Tracking COGS over time reveals patterns, highlights inefficiencies, and uncovers opportunities for cost-saving measures such as better supplier negotiations or production optimization.

- Formula: COGS = Beginning Inventory + Purchases During Period – Ending Inventory

- Why it matters: It directly impacts gross profit margins and pricing strategies. Lowering COGS without compromising quality can give a competitive advantage.

2. Operating Expense Ratio (OER)

The OER measures how efficiently a company manages its operating expenses relative to its revenue. Operating expenses include administrative salaries, rent, utilities, and other ongoing costs.

By calculating OER, businesses can determine how much of their revenue is consumed by daily operations. Tracking this metric over time can help identify cost control opportunities and assess operational efficiency.

- Formula: OER = (Operating Expenses ÷ Net Sales) × 100

- Why it matters: A lower ratio indicates better cost efficiency and higher profitability.

3. Break-even Analysis

Break-even analysis identifies the point at which total revenue equals total costs, meaning the business is operating without a profit or loss. It helps business owners understand how many units must be sold or how much revenue must be generated to cover expenses. This insight is vital for financial planning, especially when introducing new products, adjusting pricing, or entering new markets.

- Formula: Break-even Point = Fixed Costs ÷ (Selling Price per Unit – Variable Cost per Unit)

- Why it matters: Essential for setting sales targets, pricing strategies, and investment planning.

4. Return on Investment (ROI)

ROI evaluates the profitability of an investment compared to its cost. It is a simple yet powerful way to measure how effectively money has been used to generate returns.

Businesses use ROI to compare multiple investment options and select the most lucrative ones. A consistently high ROI indicates strong decision-making and effective capital allocation.

- Formula: ROI = [(Net Profit – Investment Cost) ÷ Investment Cost] × 100

- Why it matters: Guides strategic decisions and highlights the most profitable opportunities.

5. Gross Profit Margin

Gross profit margin measures how much profit a business makes after accounting for the cost of producing goods or delivering services. It reflects operational efficiency in production and pricing strategies. By monitoring this metric, companies can quickly detect changes in production costs or shifts in market pricing.

- Formula: Gross Profit Margin = [(Revenue – COGS) ÷ Revenue] × 100

- Why it matters: Helps assess overall product or service profitability.

6. Net Profit Margin

Net profit margin reflects the percentage of revenue that remains after all expenses—operational, financial, and tax—are deducted. It offers a complete picture of a company’s profitability. This metric is especially useful for evaluating long-term business health and making strategic adjustments to improve margins.

- Formula: Net Profit Margin = (Net Profit ÷ Revenue) × 100

- Why it matters: Reflects the company’s ability to convert sales into actual profit.

7. Labor Cost Percentage

Labor cost percentage measures the proportion of revenue spent on wages, benefits, and other employee-related expenses. In labor-intensive industries, this metric plays a critical role in ensuring workforce costs remain sustainable. It also assists in budgeting and workforce planning.

- Formula: Labor Cost % = (Total Labor Costs ÷ Total Revenue) × 100

- Why it matters: Helps in staffing decisions and controlling payroll expenses.

8. Overhead Rate

Overhead rate calculates the percentage of indirect costs relative to direct costs or labor. Indirect costs include rent, utilities, and administrative salaries. A high overhead rate may indicate inefficiency, while a lower rate suggests lean operations.

- Formula: Overhead Rate = (Indirect Costs ÷ Direct Costs) × 100

- Why it matters: Helps control non-production costs that impact profitability.

9. Inventory Carrying Cost

This metric represents all costs associated with holding inventory, including storage, insurance, depreciation, and obsolescence. It highlights the financial impact of excess stock and slow-moving items. By reducing carrying costs, companies can free up capital for other operational needs.

- Why it matters: Reducing carrying costs improves cash flow and operational efficiency.

10. Accounts Payable Turnover

Accounts Payable Turnover measures how efficiently a company pays its suppliers. It’s a reflection of the company’s cash management strategy and supplier relationship health.

- Formula: Accounts Payable Turnover = Total Supplier Purchases ÷ Average Accounts Payable

- Why it matters: Indicates financial stability and supplier relationship management.

11. Accounts Receivable Turnover

This metric measures how quickly a company collects payments from customers. It’s crucial for maintaining liquidity and reducing bad debt risks.

- Formula: Accounts Receivable Turnover = Net Credit Sales ÷ Average Accounts Receivable

- Why it matters: Faster collection cycles improve liquidity and reduce bad debts.

12. Fixed vs. Variable Cost Ratio

This ratio compares fixed costs, such as rent and salaries, to variable costs, like raw materials and utilities. Understanding the balance helps businesses optimize their cost structures for stability and scalability.

- Why it matters: Helps in budgeting, forecasting, and cost structure optimization.

13. Expense-to-Revenue Ratio

The Expense-to-Revenue Ratio reveals what portion of revenue is consumed by expenses. It’s a high-level metric that quickly indicates if a business is overspending relative to income.

- Formula: Expense-to-Revenue Ratio = (Total Expenses ÷ Total Revenue) × 100

- Why it matters: High ratios may indicate inefficiency or overspending.

14. Cash Conversion Cycle (CCC)

The CCC measures how long it takes for a company to convert investments in inventory into cash from sales. It combines inventory turnover, receivables collection, and payables turnover.

- Formula: CCC = Days Inventory Outstanding + Days Sales Outstanding – Days Payable Outstanding

- Why it matters: Shorter cycles improve liquidity and reduce financing needs.

15. EBITDA Margin

EBITDA margin reflects operational profitability before accounting for interest, taxes, depreciation, and amortization. It provides a clearer view of a company’s core operational efficiency.

- Formula: EBITDA Margin = (EBITDA ÷ Total Revenue) × 100

- Why it matters: Offers a clear view of core operational performance, excluding financial and accounting adjustments.

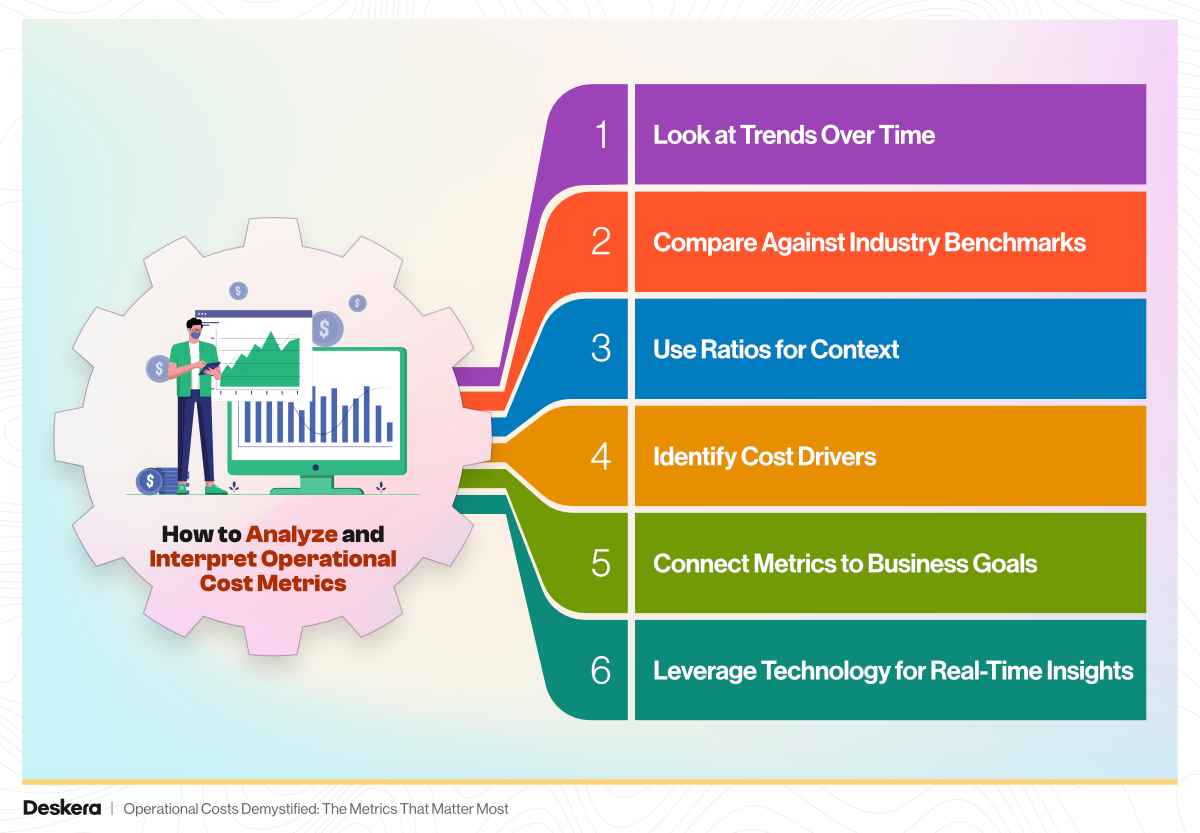

How to Analyze and Interpret Operational Cost Metrics

Tracking operational cost metrics is only the first step—knowing how to interpret the numbers is what turns raw data into actionable insights. Here’s how to get the most value from these metrics:

1. Look at Trends Over Time

Single data points can be misleading. Track each metric consistently over weeks, months, or quarters to identify trends. For example, a gradual rise in COGS may signal supplier price increases, while a drop in gross profit margin could indicate production inefficiencies.

2. Compare Against Industry Benchmarks

Every industry has different cost structures. Comparing your metrics to industry averages helps determine whether your costs are competitive or unusually high. Benchmark data can guide goal setting and highlight areas for improvement.

3. Use Ratios for Context

Ratios such as OER, labor cost percentage, and expense-to-revenue ratio provide context by relating costs to revenue or output. This makes it easier to spot when costs are growing faster than income.

4. Identify Cost Drivers

Don’t just look at the totals—dig deeper to find what’s causing the changes. If inventory carrying costs are rising, check if it’s due to overstocking, slower sales, or inefficient warehouse management.

5. Connect Metrics to Business Goals

Interpret metrics in light of your broader strategy. If your goal is to scale production, a temporary rise in certain operational costs may be acceptable, provided they lead to long-term profitability.

6. Leverage Technology for Real-Time Insights

ERP tools like Deskera ERP make it easier to track and visualize these metrics in real-time, reducing the risk of delayed decision-making. Automated dashboards help spot trends, generate reports, and alert you to potential cost overruns before they become serious problems.

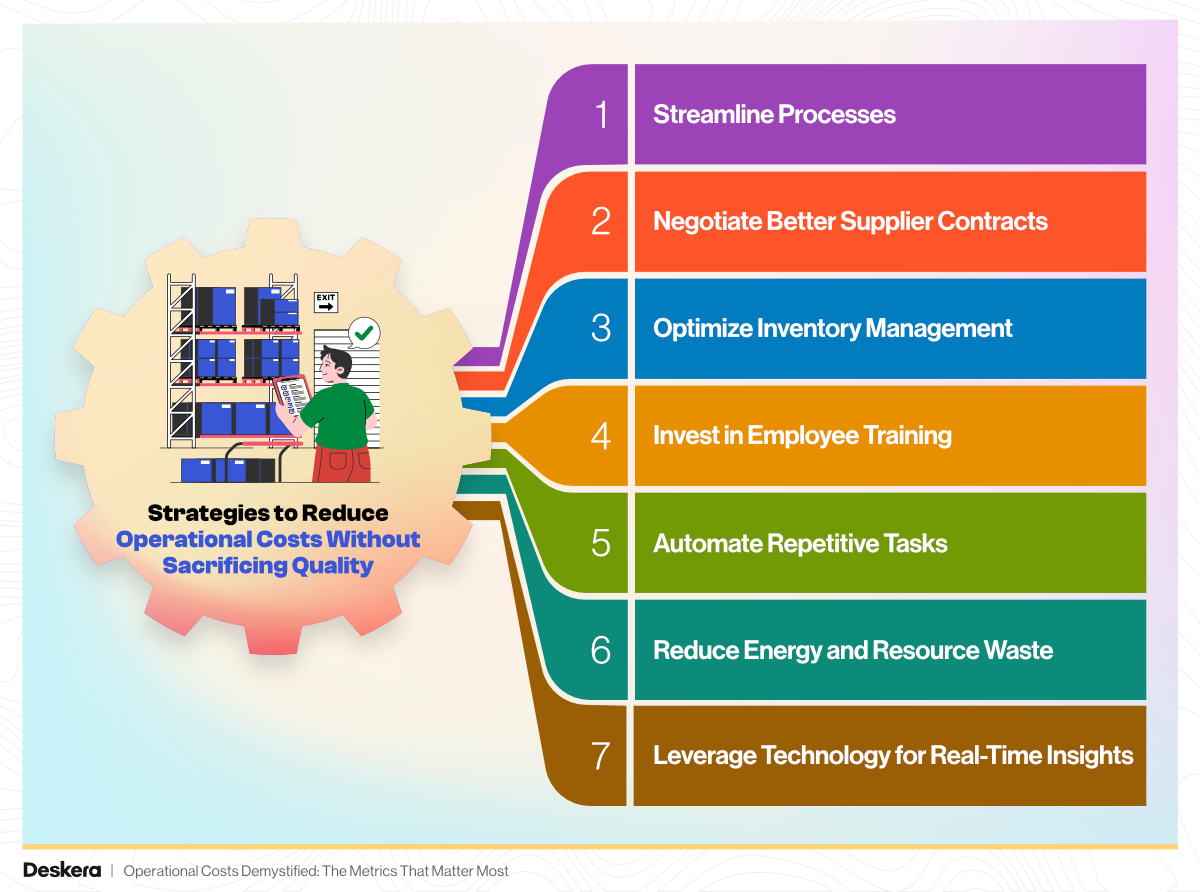

Strategies to Reduce Operational Costs Without Sacrificing Quality

Cutting costs doesn’t have to mean cutting corners. The goal is to optimize processes, eliminate waste, and leverage technology so that quality remains high while expenses go down. Here are proven strategies to achieve this balance:

1. Streamline Processes

Start by mapping each step of your workflow to identify delays, bottlenecks, or redundant tasks that add no value. Applying Lean or Six Sigma principles can cut waste, speed up operations, and improve consistency.

This approach helps eliminate unnecessary steps without reducing quality. By continuously reviewing processes, you maintain flexibility and can quickly adapt to changes, ensuring both cost savings and a high standard of output.

2. Negotiate Better Supplier Contracts

Regularly reviewing supplier contracts allows you to lock in better terms, such as lower rates, bulk discounts, or extended payment timelines. Strong supplier relationships can also open doors for preferential pricing during market fluctuations.

When negotiating, focus on mutually beneficial terms that keep material quality intact while reducing procurement costs. Periodic renegotiation ensures your supply chain remains cost-efficient and competitive without sacrificing product standards.

3. Optimize Inventory Management

Excess inventory ties up working capital, increases warehousing costs, and raises the risk of obsolescence. Using just-in-time (JIT) inventory methods or advanced demand forecasting tools ensures stock aligns closely with sales trends.

This balance minimizes storage expenses while preventing stockouts that could harm customer satisfaction. Smart inventory management maintains quality service levels while freeing up resources for other business priorities.

4. Invest in Employee Training

Well-trained employees work more efficiently, make fewer mistakes, and uphold high-quality standards. Investing in training—whether for technical skills, safety practices, or new technologies—reduces waste, rework, and costly errors.

Training also improves employee morale and retention, lowering recruitment costs. By empowering your workforce with the right skills, you create a culture of excellence that delivers consistent results and long-term operational savings.

5. Automate Repetitive Tasks

Manual, repetitive work like order processing, data entry, or invoicing consumes valuable time and labor resources. Automation through ERP systems or specialized software can drastically reduce these workloads while improving speed and accuracy.

This not only cuts labor costs but also frees employees to focus on strategic, revenue-generating tasks. Over time, automation boosts productivity, reduces errors, and ensures smooth operations without compromising service quality.

6. Reduce Energy and Resource Waste

Energy costs often make up a significant portion of operational expenses. Switching to LED lighting, optimizing HVAC systems, or investing in energy-efficient machinery can significantly lower bills.

Small adjustments like better insulation or powering down idle equipment also add up. These practices not only reduce costs but also support sustainability goals, improving your brand image while maintaining operational efficiency.

7. Leverage Technology for Real-Time Insights

Data-driven decision-making is key to controlling costs without impacting quality. Solutions like Deskera ERP offer real-time visibility into expenses, production efficiency, and resource utilization.

Automated reports and AI recommendations help identify inefficiencies early, enabling faster corrective action. With instant access to accurate data, businesses can make proactive decisions that optimize spending and enhance performance before problems escalate.

Common Mistakes to Avoid in Operational Cost Analysis

When analyzing operational costs, even small oversights can lead to misleading conclusions and poor decision-making. Avoiding these common pitfalls ensures your cost analysis remains accurate, actionable, and truly reflective of business performance.

1. Ignoring Indirect Costs

Many businesses focus solely on direct expenses like raw materials, labor, or shipping, overlooking indirect costs such as utilities, administrative salaries, office rent, and software subscriptions. These overheads can significantly affect profitability and may be growing unnoticed.

Including all indirect costs in your analysis gives a more accurate picture of your true operational expenses, enabling better budgeting and cost-control strategies. Failing to do so often results in underestimated total costs and misinformed decisions.

2. Using Outdated or Inaccurate Data

Cost analysis is only as good as the data it’s based on. Using old or incomplete figures can distort insights and lead to misguided cost-cutting measures. Market conditions, supplier pricing, and operational needs change constantly.

Regularly updating your data sources, verifying their accuracy, and ensuring they reflect current realities is essential. Without this, decisions may be based on assumptions that no longer match your business environment, potentially leading to costly errors.

3. Overlooking Seasonal or Market Fluctuations

Costs are rarely static. Ignoring factors like seasonal demand spikes, raw material price volatility, or temporary labor costs can make forecasts unreliable. For example, energy usage may increase during extreme weather, or demand may surge during holidays.

By incorporating historical trends, market data, and seasonality into your analysis, you create a more resilient cost strategy. Overlooking these patterns often leads to unexpected budget overruns or inventory shortages.

4. Not Segmenting Costs by Department or Process

When all expenses are lumped together, identifying the root causes of cost issues becomes nearly impossible. Breaking down costs by department, production line, or operational process helps pinpoint inefficiencies.

For instance, marketing costs may be rising faster than production expenses, signaling a need for budget reallocation. Without segmentation, managers may address the wrong issues or miss opportunities to optimize specific areas. Detailed cost mapping is key for effective decision-making.

5. Misinterpreting Cost Reductions as Efficiency Gains

Reducing expenses doesn’t always mean operations are more efficient. Sometimes, cuts come at the expense of product quality, customer service, or employee satisfaction. For example, cheaper raw materials may lead to higher defect rates, ultimately costing more in returns and reputational damage.

True efficiency improvements maintain or enhance quality while reducing waste. Always evaluate whether cost reductions are sustainable and aligned with long-term business goals before celebrating them as efficiency wins.

6. Failing to Review Costs Regularly

Operational cost analysis is not a one-time project but an ongoing necessity. Waiting too long between reviews allows small inefficiencies to snowball into major financial burdens.

Regular cost reviews—monthly or quarterly—help detect early warning signs, track the impact of changes, and adapt to market shifts quickly. Businesses that review costs infrequently often find themselves reacting to crises instead of proactively managing expenses for stability and growth.

7. Neglecting the Role of Technology

Relying solely on manual methods or outdated spreadsheets can slow analysis and introduce errors. Modern tools like ERP systems provide real-time tracking, advanced analytics, and integrated reporting, making it easier to identify trends and anomalies.

By automating data collection and analysis, businesses gain faster, more accurate insights. Ignoring technology means missing opportunities to streamline processes, reduce human error, and make better-informed decisions that can directly improve profitability.

How Can Deskera ERP Help in Operational Cost Analysis?

Effective operational cost analysis requires more than just tracking expenses—it demands a centralized system that integrates data, automates workflows, and provides actionable insights. Deskera ERP is designed to meet these needs, helping businesses optimize cost management without compromising productivity or quality.

Here’s how Deskera ERP can support your operational cost analysis:

- Centralized Data Management – All cost-related information from finance, inventory, production, and HR is stored in one platform, ensuring accuracy and consistency.

- Automation of Repetitive Processes – Automates invoicing, payroll, inventory tracking, and production scheduling, saving time and reducing human error.

- Real-Time Cost Tracking – Monitors direct and indirect costs as they occur, allowing for quicker response to budget deviations.

- AI-Powered Insights with David – Deskera’s AI assistant, David, analyzes trends, detects anomalies, and suggests cost-saving strategies.

- Advanced Reporting and Dashboards – Offers customizable reports and visual dashboards for in-depth cost breakdowns and performance analysis.

- Integration Across Departments – Ensures seamless flow of information between departments to prevent miscommunication and inefficiencies.

- Forecasting and Budget Planning – Uses historical data and trends to predict future costs and optimize budget allocation.

With these capabilities, Deskera ERP not only helps track and analyze operational costs but also enables proactive decision-making. Businesses can quickly identify areas of waste, prioritize high-impact improvements, and ensure that resources are allocated efficiently.

Whether you’re in manufacturing, retail, or services, Deskera ERP provides the tools you need to balance cost control with operational excellence—ultimately driving profitability and long-term growth.

Key Takeaways

- Knowing what operational costs are—and differentiating between direct and indirect costs—helps you gain a clear picture of where your money goes and how it impacts your bottom line.

- Importance of Operational Costs: Tracking and managing operational costs ensures resource optimization, improves budgeting accuracy, and strengthens profitability while maintaining a competitive edge.

- Key Metrics to Monitor: Metrics like Operating Expense Ratio, Cost per Unit, and Gross Profit Margin provide actionable insights into cost efficiency and operational health.

- How to Analyze and Interpret Metrics: Regularly reviewing cost-related KPIs allows you to identify trends, pinpoint inefficiencies, and make informed, data-driven decisions.

- Strategies to Reduce Costs Without Sacrificing Quality: Implementing lean processes, leveraging automation, and negotiating supplier contracts can lower expenses while preserving operational excellence.

- Common Mistakes to Avoid: Ignoring indirect costs, relying on outdated data, and focusing on short-term cuts over long-term savings can derail your cost management efforts.

- How Deskera ERP Can Help: Deskera ERP streamlines operational cost tracking through automation, real-time reporting, and integrated modules for finance, inventory, and production—empowering businesses to cut waste and boost profitability.

Related Articles