Employers and businessmen always think of expanding their business to multiple regions to other states within or outside the country they are currently residing in. If you are a business owner in America and are planning to start a new business venture in Oklahoma, then it is essential that you have complete information about the payroll taxes in this state and how the deductions for withholding are calculated.

This is an important part of the yearly income tax an employer pays to the government. It is also required in the calculation of the gross income of the organization. Furthermore, it gives an understanding of how employees have contributed to the business.

This blog shall be covering the following topics in this article -

- What payroll taxes do employers need to pay in Oklahoma?

- What are the requirements for Oklahoma payroll tax withholding?

- How to do payroll?

- Oklahoma payroll taxes

- How to calculate the payroll taxes?

- Oklahoma state unemployment insurance

- Conclusion

- Key Takeaways

What payroll taxes do employers need to pay in Oklahoma?

According to the available information, doing payroll in Oklahoma consists of more than just giving paystubs to the employees. The business owner needs to file for the federal taxes in the U.S apart from filing the unemployment insurance taxes and state incomes taxes. The American government has provided tax exemptions for some employees such as spouses of military personnel and if the state has its own W-4 form, it will have different tax withholdings than those done for the federal taxes. The W-4 form is to be submitted by the employer for employees newly hired by the organization.

What are the requirements for Oklahoma payroll tax withholding?

Irrespective of the state a business owner sets up his business, he is liable to pay the payroll taxes to the government. If you are a small business owner who has just set up his business in Oklahoma, you should be aware of the procedure for tax withholding in this state. An entrepreneur needs to follow these steps -

Get an Employer Identification Number

When there is a business owner in Oklahoma or any other state in America with some number of employees working under him, he would need to get a federal employer identification number (EIN) from the government. It is mandatory that the entrepreneur must get his EIN number at the time of starting the business and even before the first employee is hired. According to the rule, this EIN is issued by the IRS and is the prime requirement for federal taxes in business. In some states, it is also used for the purpose of state withholding tax. It has been found that Oklahoma issues a separate state tax ID number to every employer.

A business owner needs to apply for EIN on the IRS website. Applying it online will ensures the employer gets it immediately.

Register with the Tax Commission

Once the employer has received his EIN, he would need to set up and start an Oklahoma withholding tax account with the Oklahoma Tax Commission (OTC). The employer can set up his account by registering business on paper or online. If he wants to register online, then he should click on the register section of the OTC website. Upon clicking this button, a link will take the employer to Oklahoma Taxpayer Access Point (OkTAP).

As per the available information, this registration process usually takes 5 days in Oklahoma. If the small business owner decides to do the whole process with paper, he will have to apply it using Form WTH10006, which is the Oklahoma Wage Withholding Tax Application. The employer can download this form from the Business Forms section of the OTC website. He can submit it via mail. As per the data available from the sources, this method usually takes up to 6 weeks for an employer to get his state tax ID number. The whole process can be completed by an employer in Oklahoma without any fees.

Income tax withholding table - https://oklahoma.gov/content/dam/ok/en/tax/documents/resources/publications/businesses/withholding-tables/WHTables-2021.pdf

Tell the new employees to fill W-4 form

The Oklahoma state rule is that a business owner must inform all his new employees to fill the federal Form W-4 which is available on the IRS website. The employees in this state do not have to worry about filing a separate state equivalent form. They just need to keep the completed forms with the business owner and update it as required.

Schedule your Tax withholding payments

An employer in Oklahoma can have three possible payment schedules for employees to withhold taxes. These are semi-weekly, monthly or quarterly. The employer in this state can decide which schedule he wants to follow on the basis of the average of the amount he wants to hold from the employee wages over the period. If the business owner withholds a specific amount from the employee salaries frequently, he would need to make multiple withholding tax payments.

As the threshold of dollar amounts varies significantly in the payment schedules in America and there are new rules, an employer will have to check OTC and be updated with the latest information at least once a time in a year. According to available information, the due dates for various payment schedules in Oklahoma are semi-weekly, monthly or quarterly.

The semi-weekly payments are due by Wednesday for the employee wages withheld for the previous Wednesday and the latter days. The employers in Oklahoma must clear the employee wages on or before the 20th of every month for the monthly and quarterly cycles. If the day happens to be a holiday or a weekend, the payment must be cleared on the next business day.

The OTC offers various methods of how much tax amount should be withheld from an employee’s salary by the employer in Oklahoma. He can get access to the current tax withholding tables in this state on OTC Packet OW-2, which is updated yearly by the state government.

Scheduled Withholding Returns

An employer in this state must file scheduled withholding returns even if he is not making any withholding from the employees' salaries for his decided payment schedules. He would have to use the Form WTH10001, Oklahoma Wage Withholding Tax Return and must file it through the mail. The due date to do this for the employer is as per your payment schedule.

Oklahoma Annual Reconciliation and other information

According to the available data, the employers in this state must file the annual reconciliation form of the federal government which is usually Form W-3 along with a copy of Form W-2. However, the businessmen in Oklahoma do not require to file an annual reconciliation. In addition to this, the tax rules are different for the independent contractors an employer decides to hire for his business.

How to do Payroll?

As per the available information from the trusted sources, doing payroll in this state in the U.S. includes a number of steps other than just paying the employees. The employer in this state has to file the federal tax as well as state income tax and unemployment tax. There is certain exemptions available for some workers that is applicable to military spouses. Also, the employer needs to fill the state W-4 form if he has hiring of new employees along with the different tax withholdings apart from the federal taxes. Here are steps that are involved in the payroll process in Oklahoma -

- EIN: The employer must first register his business with the IRS. He would require and Employer Identification Number (EIN) and an account in Electronic Federal Tax Payment System.

- Register your business: The business owner must register his business with state of Oklahoma and keep it current unless there is a change in the address or the ownership structure of the company. He must fill the WHT10006 for filing it through OKTAP.

The entrepreneur must then create his account with EZ Tax Express which will be helpful to pay the unemployment insurance

He must fill out an OES-1 to get a unique Oklahoma Unemployment Insurance Tax Account Number.

- Set up payroll: The Oklahoma state law is that the employers must pay wages to employees atleast twice every month.

- Gather employee payroll forms: When a business owner hires new employees, he has to collect all his information related to life such as marriage and children. The employer must fill State W-4 Form in addition to the federal version for every new employee in the company. Along with this, the business owner must also give information related to form I-9 and Direct Deposit information. If the entrepreneur has hired a non-resident employee who wants an exemption from the tax withholdings, then he should fill the form OW-11. If there is a worker who happens to be a military spouse and wants exemption from the tax withholdings, then he or she will have to fill out OW-9

- Approve time sheets: The business owners must keep a track of the work hours completed by the employees by documenting it in a time sheet.

- Calculate payroll taxes before paying wages: The employer must know the amount of payroll taxes to be deducted from employee wages before doing the scheduled payment. He can use the employee W-4 form and Oklahoma Tax Tables found online to understand how much amount is to be withheld from an employee’s wages for income tax.

- File the payroll taxes: The employer needs to file payroll taxes in Oklahoma state with federal as well as state government. He must read all the instructions for employees and even unemployment on IRS website.

The employer can file payroll taxes in this state electronically by using a payroll software such as OKTAP. Some of these payroll taxes software have a calculator inbuilt in them. The employer just needs to attach W-4 form when he is making calculations for each employee.

It is the rule of Oklahoma state that employer must report how many employees were paid, the wages deposited in their bank account and even the sales tax withheld from each of the wages in every quarter.

To remit the withholdings in payroll taxes, an employer must follow the schedule as given in the figure below -

The due dates in Oklahoma for state UI tax report are

- Document and store the payroll records: Every employer must document the payroll taxes record for all employees even if they have been terminated from service. This documentation is useful for many years.

- Year-end tax reports: Every business owner who files the payroll taxes in Oklahoma must include forms W-2, W-3 or form 1099 as required in the quarter.

Oklahoma Payroll Taxes

The payroll taxes in this state are to be paid by the employers from their pockets include which are the federal tax applicable for all states in America -

- State unexmployment tax - SUTA

- Social security and Medicare

- FICA

Oklahoma has an state income tax applicable to the employers. There is no local or municipal tax in this state. Hence, the employer needs to have a system to withhold a certain amount from the employee’s paystub for taxation.

The contributions to the taxes by employer and employees for payroll taxes in Oklahoma can be understood from the figure below -

Reference: https://papayaglobal.com/countrypedia/country/united-states-oklahoma/

How to calculate the payroll taxes?

An employer in Oklahoma must remember that even if the employee is working for a full time or part-time basis as per the hourly rate, the federal taxes remain the same for all employees. Here is a stepwise information on how to calculate the payroll taxes in this state -

- Calculate gross wages: If the employee works on an hourly basis, the HR in employer’s firm needs to calculate his pay simply by multiplying the number of hours with the per hour rate. For salaried employees, the calculation is annual salary divided by the number of pay periods. The employer needs to include bonuses, commissions and even tips in the gross wages for a salaried employee.

- Deduct pre-tax withholdings - A few employees often opt for participate in benefits such as HSA, FSA, 401(k) and others given by the employers in Oklahoma. These need to be subtracted from the gross income of an employee before his income tax calculation is done.

- Deduct Federal income taxes: The employer has deduct the subtract a specific amount for income tax from every employee’s wages. It is variable depending on each worker’s income tange and can range from 0 percent ot 37 percent. The employer can get all information about the deduction of federal income tax from employee wages here .

- Deduct FICA: The employer in this state must deduct FICA under payroll taxes. The social security tax which is 6.2% and calculates to 147,000$ of the taxable wages must be deducted from every employee’s wages per year. The employer has to pay an equal amount to the government.

In addition to this, the employer has to deduct Medicare tax which is considered to be 1.45% of the first 200,000$ of the taxable wages. The employer has to equally contribute dollar for dollar to match the employee’s contribution. If the employee has additional medicare tax, the rate is 2.35% and an employer is exempted from this tax. He just needs to match with the initial tax rate.

- FUTA tax: The employees are responsible for paying the federal unemployment tax to the government under payroll taxes. Every employee has to contribute 6% of the first 7000$ from his taxable income. If an employer is in small business or is self-employed, he must refer to the IRS guidelines for proper details regarding this tax.

- Post-tax withholdings: An employer must deduct the post-tax withholdings after completion of the payroll taxes in Oklahoma from employee wages.

Oklahoma State Payroll Taxes

There are 6 marginal tax brackets applicable on the employees and employers which are based up the taxable income. It implies the payroll taxes in Oklahoma can be considered to be progressive and the tax rates in this state range from 0.25% -4.75%. The employers need not be worried about the local taxes in this state as their is just state income tax applicable for the businessmen and employees.

Oklahoma state unemployment insurance

Under payroll taxes, this state has a State Unemployment Insurance (SUI) for the business owners. It ranges from 0.3%-7.5%. The state government has fixed a wage base of 24,800$ for SUI of each employee’s taxable income. If you are a new employer in this state, the rate is 1.5%

Conclusion

Every state in the U.S. has its own rules for payroll taxes. While some states follow the rules set by the federal government, some have different state taxes. Oklahoma abides by the rules set by the federal government for payroll taxes. Deskera People provides a detailed information about the payroll taxes in multiple states in America. We have blogs related to payroll, income tax and business which will assist the employers in Oklahoma for starting and expanding their business.

How Deskera Can help You?

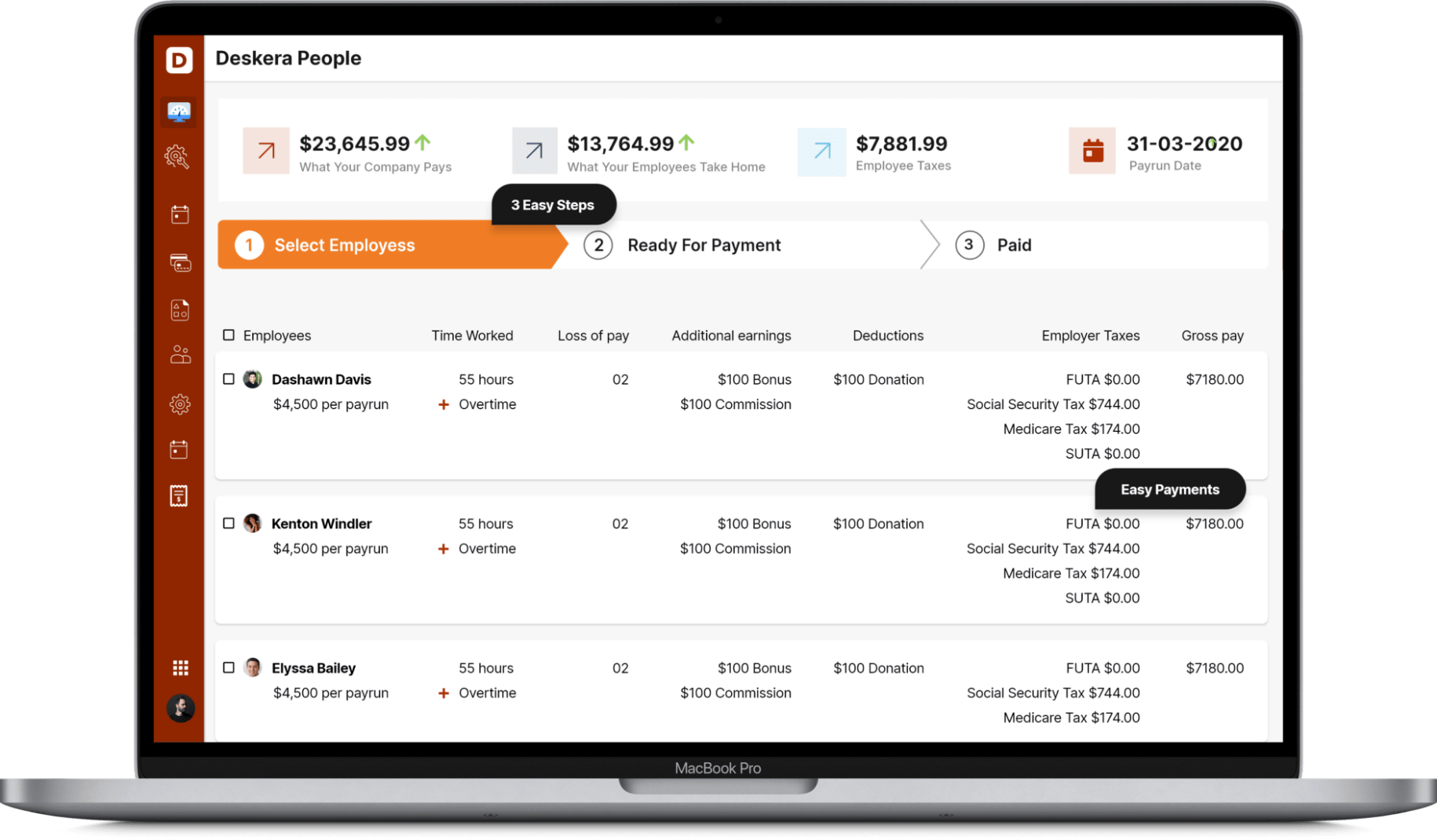

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key Takeaways

- The employers in Oklahoma must have and EIN number to start business in any state and must be registered with the state’s tax commission. Every business owner has to fill the form W-4 for each new employee hired in the organization.

- The business owner must schedule the paychecks for his employees to ensure the payroll taxes and other withholding deductions happen on time as per the calendar set for the quarter.

- The employer can deduct payroll taxes that include FUTA, FICA, state unemployment tax, social security and medicare, state unemployment insurance from the employee’s wages as per the rates decided by the federal government for withholding certain amount from employee wages.

- The business owner can register for his business in Oklahoma with form WHT 10006 and file it via OKTAP.

- Oklahoma state follows the same rate for payroll taxes and does not have any state municipal tax or local tax to be applied on employees or employers.

Related Articles