Employers across the world are looking for options to save taxes and hence, are compelled to withhold a certain amount from the salaries of their employees. The industrialists in Ohio have been under a progressive tax system and are liable to pay the payroll taxes as per the government norms. Let us understand the payroll taxes and other taxes for the employers in Ohio in more detail through this blog -

We have included the following topics in this blog -

- What are the new Withholding rules effective from 2022?

- What is the tax information an employer should know in Ohio?

- How to complete Form W-4?

- What about the other local taxes in Ohio?

- Ohio State Unemployment Insurance (SUI)

- Ohio State Disability Insurance (SDI)

- What about the termination pay for employees?

- Guide to Ohio Payroll taxes and Registration

- Ohio School District Income Tax

- More on the Payroll Taxes in Ohio

- Conclusion

- Key Takeaways

What are the new Withholding rules effective from 2022?

According to available information from trusted sources, the state government of Ohio has announced new municipal tax withholding requirements for the employers which are effective from the start of this financial year which is 1 January 2022. The rule states that employers must withhold municipal taxes from employees’ salaries on the basis of the nature of their work.

Under this rule of municipal income tax withholding, the employer must withhold taxes for the employees for each portion of the day by taking into account the services for which the employee has performed services. This is applicable to the employees even if they have worked for different municipalities on the same day.

Even if this rule applies to all the Ohio municipalities with income taxes, it does have some exceptions -

- 20-Day Occasional Exception: As per this exception, a qualifying employer is allowed to withhold taxes for the municipality for employees if the location happens to be their principal and main place of work. The only condition is he should not work in any other municipality in Ohio for more than 20 days.

- Independent Contractor Occasional Entrant Exception: This applies to the employees who earn non-wage compensation from the employers for offering personal services inside a municipality.

- Small Employer Exception: In Ohio, small employers are given an exception if their business income is less than 500,000 dollars in the previous taxable year, then he has the right to withhold municipal income tax for an existing fixed location of their company. This is allowed even if his employees work for other taxable municipalities.

If the business owners have any doubts related to the new municipal income tax rules, they can check out their queries with the Ohio Society of CPAs which has released a document for Municipal Income Tax Withholding and Refund Q&A Guide.

Link: - https://ohiocpa.com/docs/default-source/tax_resources/muni_tax_withholding_2021_faq_document.pdf

What is the tax information an employer should know in Ohio?

A small business owner or employer who has just started a business in Ohio must do the following steps in this state -

- The employer must register his name and company details on the Ohio Department of Taxation website

- He should fill out the employee’s withholding tax exemption certificate form IT-4 for every employee

- The supplemental rate in Ohio is fixed at 3.5 per cent

- The state government of Ohio uses a Formula Withholding Method

How to complete Form W-4?

A business owner or an employer who is just starting his business in Ohio can get confused when it comes to filling out Form W-4. Here is a step-by-step guide for the entrepreneurs for this form -

This information is for the employees working at New Ohio university in the education department. The workers who fall in the category of non-resident aliens but have their job in this state are required to fill out the Glacier questionnaire which would help to determine their tax status.

The employees must first fill and complete the New Employee Tax Compliance Notification form and upload it to the University Human Resources department through a secure file upload website. It will give them access to the Glacier software for the university’s site. Once the employee has submitted the form, he will get an individual password and detailed instructions on how to access and operate the Glacier software at his provided email address. This software then provides the appropriate tax forms in Ohio for the employees.

Glacier Nonresident Alien Tax Compliance - https://www.online-tax.net/glogin.asp

As per the government website, Internal Revenue Services (IRS), the non-resident aliens are required to fill and complete the Form W-4 by following these steps -

- Fill the Lines 1, 2 and 4 on the form as per the instructions given in the Form W-4

- The employee working in this university in Ohio has to claim his/ her status as “single” irrespective of his actual marital status in Line 3

- In Line 5, the employee has to claim that he has no more than one allowance. An important point to be noted here by the employees is a non-resident alien who has his residence in Mexico, South Korea or Canada can claim more than one allowance

- The individual must write “Non-resident alien” which is NRA on the dotted line on Line 6. In this line, he may request an additional withholding amount from the employer

- On line 7, a non-resident alien should not fill anything and leave it blank as he cannot claim any exemption in this form.

The individual must duly sign the form along with the date before submitting it to the employer in Ohio.

What about the other local taxes in Ohio?

If you are an employer in Ohio and have no clear idea about the insurance and other labor laws in this state, check out the information given below -

This is as per the data available for the year 2021

Ohio State Unemployment Insurance (SUI)

- Ohio Wage Base: $9,000 for 2021

- Ohio SUI Rates range from: 0.8% to 12.8% for 2021

- Ohio new employer rate: 2.7% for 2021

- Ohio new construction employer rate: 5.8% for 2021

Ohio State Disability Insurance (SDI)

The employer can get state disability insurance for his employees at the address given below -

Address - Industrial Commission

30 W. Spring St.

Columbus, OH 43215-2233

Phone: 614-466-6136

Ohio State Labor Laws

As per the available data, the Ohio Minimum Wage has been fixed at 8.80$ per hour for the employees.

What about the Termination pay for employees?

The employers and business owners have to abide by the state laws in Ohio when they are terminating the employees from the job. As per the data from trusted sources, if a business owner fies the employee on the first of the month, then he is given wages earned in the first half of the previous month. In case, he is terminated on the fifteenth of the month, then his wages would be as per the wages earned in the last half of the earlier month.

In other case, if the employee quits and has resigned from the job on the first of the month, then he would be given paystaub earned in the first half of the previous month. On the other side, if he has quit on the fifteenth of the month, then he would receive wages as per the last half in the previous month.

Guide to Ohio Payroll taxes and Registration

If you are an employer who has no idea about the payroll taxes in this state and want to gain knowledge about the complete process, you are reading the right blog. In this section, we will give details about how to fill payroll taxes in a step by step manner -

1. Account Number: The companies who pay the employees in Ohio must have an independent company account number. The employer musy register the company name and full details with the OH Department of Taxation. He must then request for a Withholding Account Number and also raise a request for Employer Account Number in the OH Dept of Job and Family Services (ODJFS).

As per the available information, this Withholding Account Number for payroll taxes given by the Ohio Department of Taxation is of 9 digits. For instance,

Ohio Department of Taxation Withholding Account Number: 59-999999-9 (9 digits)

2. Ohio Business Gateway: The next step for payroll taxes in this state is the employer must apply for getting Ohio Busines Gateway online to receive the number upon completion of the application. To complete this process, the employer must search for an existing Withholding Account Number on the form IT-501 and know about the Employer’s Payment of Ohio Tax Withheld by contacting the Dept. of Taxation.

The Ohio Dept of Job & Family Services Employer Account Number is of 10 digits and is given by the state government. Example - 9999999-99-9 (10 digits)

3. Get your payroll number: To complete the payroll taxes procedure, the employer must apply online at the Employer Resource Information Center to get the number after filling and completing the application online. For this, he needs to find an existing Employer Account Number on Form JFS-66111. He should contact the contacting the Dept. of Job and Family Services to get data related to quarterly contribution given by the employer and wage report in payroll taxes. The industrialist needs a payroll documentation for successfully completing this step.

4. Third Party Access: The industrialist in Ohio needs a third-party of POA for the completion of payroll taxes. It gives him the approval “YES” from hio Department of Taxation for withholding taxes and even from Ohio Department of Job and Family Services for unemployment taxes. The employees and employers working in Ohio must remember that the local income taxes are imposed in this state.

If the employer wants to know the rates of taxes applicable in Ohio, he can check the following sites -

- Dept. of Taxation for understanding the details regarding withholding taxes applicable to both employees and employers.

- Dept. of Job and Family Services for unemployment taxes

Ohio School District Income Tax

The employees in Ohio have to also pay for the School District Income Tax (SDIT) apart from the personal income tax. The calculation of SDIT is done as per the residential address of the employee. As per the data from trusted sources, the funds collected through this tax are used to support the district schools in Ohio. This tax is collected through withholding, just like the state income tax.

School District Income Tax Finder

Employers and employees can make use of the Ohio Department of Taxation's Finder tool to determine and know an employee’s school district for SDIT withholding purposes by address.

The employers are responsible for withholding the SDIT from employees paycheck when he withholds the Ohio state income tax. He has to remit these payments to Ohio state government which are then distributed to the districts. The employer has to follow norms like -

- He must ask each employee the district of his residence.

- The employer can make use of OH Withholding Account Number to make a identification not of the deposits made the taxation of state government.

More on the Payroll Taxes in Ohio

The employers can have a better understanding of the payroll taxes in Ohio by knowing how it works. It is broken down as follows -

- Social security: Social security is the tax which is also known as Old Age, Survivors, and Disability Insurance (OASDI) tax. In this tax, both employees and employers have to pay a percentage of their wages which is currently set at 6.2%. It is applicable for a certain amount according to the tax year. For the year 2022, in Ohio, have to contribute 147,000$ of the employee’s annual earnings. The employer shall give an equal amount to the Ohio state government.

- Medicare tax: The medicare tax is the tax in which both employer and employee will contribute 1.45 percent of their respective wages irrespective of their income.

- Unemployment tax: The unemployment tax is be given under the Federal Unemployment Tax Act (FUTA). According to latest information, there has been a 0.3% rise in its tax rate. It implies for the year 2022, the employer has to contribute 0.0& on an employee’s first 7000 dollars wages. Also, the Ohio state government can apply additional state taxes along with the existing payroll taxes.

Conclusion

The payroll taxes in Ohio can be confusing for an employer who has just started business. It is always better to approach a tax consultant for clearing the yearly taxes or take help of a professional who works in this department.

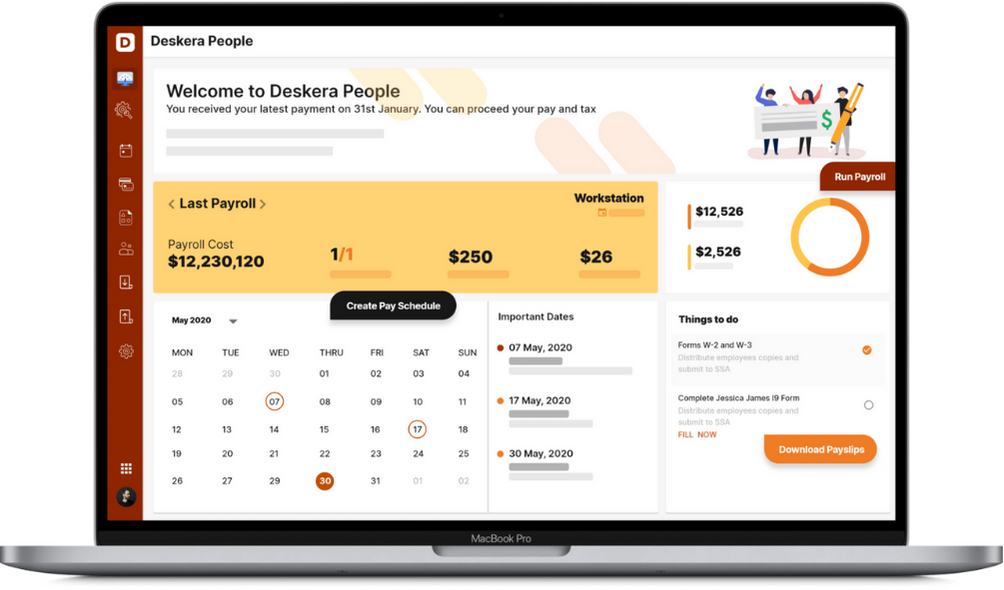

At Deskera, you can easily get information related to various taxes for business in different states in the United States of America. Furthermore, using our software, an employer can have an accurate information of the employees and business payroll, accounting and other departments necessary in the business.

How Deskera Can Assist You?

As a business, you must be diligent with the employee payroll system. Deskera People allows you to conveniently manage payroll, leave, attendance, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- The new municipal tax rules for Ohio have been effective from 1 January 2022. The employers must withhold taxes from the employees on the basis of the work and which department the employee has worked for the day. THe business owner must also take into account exceptions such as 20-Day Occasional Exception, Independent Contractor Occasional Entrant Exception, Small Employer Exception while withholding amount from the employees salary.

- An employer or business owner has to fill the form W-4 in Ohio before submitting the payroll taxes for the financial year. He must also contribute for the local state taxes such as SUI, SDI and follow the Ohio state labor laws for per hour rate.

- The employee and employer have to contribute School District Income Tax (SDIT) which is used to support the district schools in the state. They also have to pay for the local income tax in Ohio.

- In payroll taxes, the employer has to withhold Social security tax known as OASDI, Medicare and FUTA from the employee’s salary according to the rates specified by the state government.

- Consulting a tax professional or using a payroll software can assist the business owner do accurate calculation of the payroll taxes to be submitted for the financial year in Ohio

Related Articles