Are you aiming towards having a healthy cash flow for financial stability of your business? This entails keeping an eye on your financial statements and computing financial metrics like total sales.

In this article, we will define revenue, explain the calculation of revenue with examples and guide you in managing revenue for your business. Following are the topics covered:

- What is Revenue?

- Revenue Formula

- Revenue Comparison

- Types of Revenue

- Why is total revenue important?

- Revenue on the Income Statement

- Managing Revenue

- Key takeaways

What is Revenue?

The sum of the company's revenues from the sale of its products and services is known as revenue. Therefore, the most crucial criterion in determining how well a business is doing is its income. The revenue is calculated using the revenue formula. In other terms, revenue is the total amount of sales of goods and services that a business records for a given time period.

Revenue, often known as sales or income, is the first line of a firm's income statement and is frequently referred to as the "Top Line" of a company. A company's profit, also known as net income, is calculated by deducting expenses from its revenue.

- Total revenue, commonly referred to as total sales, is the total amount of money that your business made from all of its sales of products or services.

- The total income of your business might be a helpful indicator when assessing its financial standing. Your company is making more money the higher your total revenue is.

- This can be very useful if you have a lot of expenses to pay for. You'll probably have enough money to meet these costs and the means to continue operating and making money for the foreseeable future if your overall revenue is high.

However, if you notice a drop in this figure, it may be time to review your pricing plan, marketing approach, or both. Total revenue may also include interest and profits from investments, depending on the nature of your organization.

You can use total revenue to:

• Assess the financial situation of your company;

• Identify potential issues; and

• Modify your price.

Your income statement has complete revenue. The gains and losses for a given time period are shown on your income statement. On your income statement, total revenue typically shows as a separate line item.

It can also be characterized as a company's overall sales that are supported by its cash revenues. There must be a source document for each sale, which is typically a cash receipt.

Total revenue, if your company uses cash accounting, is the sum of sales revenue and cash received. Total revenue, also known as accrued revenue, in accrual accounting is money that has been recognized but has not yet been received. Revenue is recorded in cash accounting as soon as it is received.

If you utilize accrual accounting in your company, revenue is recognized at the time of the transaction rather than at the time of payment. Only the smallest companies typically employ cash accounting.

Although total revenue is defined differently in economics, it has the same meaning as it does in accounting. It is described as the money a company makes from the sale of its goods.

Revenue Recognition Principle

According to the accounting principle of revenue recognition, when ownership advantages and risks have been transferred from a seller to a buyer or when services have been rendered, revenue is recorded.

Note that the actual receipt of payment for the goods or services is not included in this definition. This is due to the fact that businesses frequently give clients credit, which means they won't be paid right away.

- When products or services are sold on credit, the revenue is recorded, but as cash payment has not yet been received, the value is also recorded as accounts receivable on the balance sheet. Later, when the cash payment is really received, no further income is recorded, but the cash balance increases and the accounts receivable decreases.

- The revenue recognition principle and the matching principle, two crucial GAAP principles, are in line with accrual accounting. According to the revenue recognition principle, regardless of when an invoice is paid, revenue is reported on the income statement at the moment it is earned.

- According to the matching principle, all expenses incurred in producing the revenue are reported during the same time period.

To comprehend total revenue, you must grasp what it represents, how it is calculated, what it might reveal about your company, and other income streams that it can be compared to.

Revenue Formula

Most businesses use a common formula to determine their revenue. Regardless of the technique, businesses frequently report net revenue instead of gross sales (which removes things like discounts and refunds).

- By dividing the sum of the number of sales by the selling price, we can compute the revenue. The several components of the revenue formula will be covered in this section, along with an understanding of the variables at play. With certain cases that have been solved, let's learn the revenue formula.

- The term "revenue" refers to the sum of money that a business makes from the sale of goods and services during the course of its operations. Total earnings or the profit a corporation makes are other names for revenue. The company's operations have an impact on the revenue formula.

For instance, a product sale is computed by multiplying the total number of product sales by the average price at which the goods are sold. In the case of service businesses, revenue is computed by dividing the total number of clients by the typical service cost.

The number of items sold and the average selling price of the items are multiplied to determine revenue. The revenue formula is as follows:

If your company provides services, replace the average selling price per unit with the average selling price per service, and the quantity sold with the quantity of services sold. For instance:

Your overall revenue is the outcome of these calculations. No matter how minor or large the change in your company's finances, make sure you're accounting for it.

You would need to take this change into account because it could affect your calculations, for instance, if you changed the price of the product or service sold. Don't forget to factor in any non-operating income, such as dividend income or gains from investments, in your computations.

You can also determine your average revenue per user to get more detailed financial data. To enhance revenue performance management, you can utilize these formulae to create a complete picture of your company's revenue.

The aforementioned formulas can be greatly expanded to add more information. For instance, a lot of businesses model their revenue estimate all the way down to the level of each individual product or customer.

What Is Income?

Despite being related, income and revenue are not the same. While revenue represents the money that enters the company's cash account, operating income is calculated by deducting expenses from that revenue.

Despite the fact that some people confuse the terms revenue and income, when financial experts refer to "income," they typically mean gross revenue or net income, which is revenue less expenses.

Revenue vs. Income

Although the term "revenue" is most frequently used to refer to the sale of a good or service, businesses can also make money from sources unrelated to their main operations or sales revenue, such as interest from investments.

Companies typically only disclose the net gain or loss from these non-operating income sources. On a company's income statement, these amounts are denoted as non-operating income or occasionally as "other" income.

Types of Income

Companies commonly compute and report the following forms of income in addition to any non-operating income:

- Gross income, or Gross profit is a metric used to determine how profitable a company's goods or services are. It is determined by deducting revenue from cost of goods sold (COGS). Only expenses directly connected to the creation of goods or services are included in COGS.

- Operational income is derived by deducting operating expenses from gross income. All indirect costs needed to run a business are referred to as operating expenses. They consist of COGS, or the direct expenses related to a company's core operations, as well as ancillary expenses like depreciation and amortization.

- The profit remaining after deducting taxes and other non-operating expenditures is known as net income. As a result, net income is frequently less than operational or gross income.

Examples Using Revenue Formula

Example 1

T-shirts are purchased by a corporation for $70, and they are sold for $110 each. If the customer uses cash to pay, they give a 3 percent discount. If a consumer purchases a t-shirt from the business and pays cash, the gross revenue reported by the business will be $220 ($110 multiplied by 2 pairs).

However, the discount must be taken into account when calculating the company's net sales; as a result, the net revenue recorded by the company is $213 ($220 x 97%). This $213 is the sum that typically appears on the income statement's top line.

Example 2

Say you charge $70 for watches. You made $300 during the month selling watches. Fill in the numbers in the formula to get your total revenue for the time period.

Total Sales = 300 X $70

You made $21,000 in total from watches this month.

The formula can also be used to assist with pricing. Let's say you're thinking of making your timepieces $50 a pair. Use the following formula to determine how many watches you would need to sell to generate a total income of $21,000:

Quantity equals $21,000/$50.

If your watches cost $40 apiece instead of $100, you would need to sell 420 watches rather than 300 to make a total of $21,000.

What to do after your total revenue calculation

Once you know your entire revenue, you can compare it to your total expenses to see if your business is producing enough money to stay in business. Your business is in deficit if your expenses are much more than your total income.

If your firm can be saved, you'll need to make the necessary adjustments to your budget and finances. One strategy to boost revenue is to change the prices of your products and services. However, if you raise pricing, some customers might decide they are no longer interested in purchasing any of your products or services. Make sure the price adjustments you make are ultimately worthwhile.

You can determine any revenue growth over time by calculating your total revenue and comparing it to previous years' totals. Subtract the entire revenue from one year from the other to get this.

Nearly every part of your organization benefits from knowing your revenue. When examining financial ratios or gross margin, it is crucial. This gives you a better idea of how much money your company produces once the initial expenses are paid. However, this is completed before recording your expenses.

Revenue Comparison

Total revenue vs. net revenue

What distinguishes total revenue from net revenue, then? The amount that remains after deducting all business costs, such as cost of goods sold, from your gross revenue is known as net revenue or net income. Once more, total revenue is the income of your company before deducting costs.

Look at both your total and net sales to ensure profitability and sound financial management. While your net revenue takes expenses into account, your total revenue provides more insight into your capacity for revenue generation.

Total Revenue and Marginal Revenue

Although revenue is a single number, there are numerous ways to interpret it. Let's examine how total revenue and marginal revenue are related. The sum of money a business makes by selling its products and services is known as total revenue. In other words, businesses utilize this statistic to assess how effectively their primary sources of revenue are generating profits.

Total revenue is directly correlated with marginal revenue. It gauges the rise or decrease in revenue brought on by the sale of a new good or service.

The overall revenue will rise as long as the marginal income is greater than the cost of generating a new unit. But it makes sense to discontinue manufacturing if the cost is higher than the marginal profit.

To calculate marginal revenue, use the following formula:

For example, suppose a Shop sells bouquets — and each cake costs the Shop $7 in materials to make. They sell the bouquets for $16, meaning the profit for each bouquet is $9.

Now, suppose they receive a special order for a custom bouquet. It still costs $7 to make, but this time they sell it for $21. The profit for the bouquet is $14 — which is greater than the average profit for other bouquets. This is an example of increasing marginal revenue.

Revenue vs. Net Income

In general, net income should rise together with rising revenue. This won't be the case, though, if operational or non-operating costs increase more quickly than revenue.

Even if sales increase, a company's net income could nevertheless decline if operating, selling, or administrative expenditures increase more quickly than revenues. When sales increases but net income decreases, a company needs to figure out why and search for cost-cutting measures.

Conversely, by establishing more effective manufacturing or administrative procedures, it is still possible to enhance net income even if revenue remains constant.

Additionally, since net income also includes non-operational costs, one-time occurrences like a significant litigation, the sale of a subsidiary, or a write-down of an asset may have a greater impact than adjustments to revenue or operating costs.

Turnover Vs Revenue

The phrases revenue and turnover are sometimes used interchangeably in business. That's not necessarily incorrect because they frequently turn out to be the same item. However, a company's income may occasionally originate from sources other than the sale of goods and services. For instance, businesses in the financial services industry may produce income from investment capital that is not considered turnover in the eyes of HMRC.

It's important to emphasize once more the distinction between total income and sales revenue. Total revenue takes into account all sources of income. This covers any income derived from transactions, investments, or marketing activities. Contrarily, sales income solely takes into account money made from real sales.

Recognized Revenue Vs Deferred Revenue

When evaluating the health of a company using gross revenue, especially subscription-based businesses, there are various dangers to watch out for. These companies frequently get paid upfront for goods or services (i.e., before they are delivered or received). It's crucial to understand the difference between recognized and deferred revenue.

Regardless of whether the goods or service has been delivered, recognized revenue is a record of all sales. The transaction is recorded as soon as the payment is made.

Money received in advance for goods or services that will be provided in the future is known as deferred revenue. Deferred revenue is referred to as "unearned" revenue in accrual accounting and is shown as a liability on the balance sheet. Cash accounting records undelivered products or services that have been paid for as a receipt rather than as revenue.

Types of Revenue

Accrued and deferred revenue

There are essentially two categories of revenue. Accrued and deferred revenue are what they are known as. Revenue that a company receives for goods or services that have been provided but have not yet been paid for by the customer is known as accrued revenue.

Revenue is reported at the time of the transaction, not necessarily when the money has been received, in the accrual method of accounting. Contrarily, deferred or unearned revenue. Here, the customer pays the business in advance for goods or services that haven't yet been provided.

Until the goods or services are received to the customer's satisfaction, the money is recorded as a liability. By prohibiting the company from spending money that is not yet technically available to it, this can help avert cash flow issues.

Other Types of Revenue

A line item labeled "other revenue" may appear in a financial statement. The money a firm makes through ventures unrelated to its core business is known as this revenue. For instance, the amount of money is listed if a clothes store sells some of its inventory.

The money made from these commercial activities is recorded under "other revenue" if the store leases a structure or certain equipment. There are numerous other sorts of revenue streams, but there are two main types of revenue that are pertinent to small enterprises. The two major types of revenue are:

Operating Revenue

Your company's primary line of business generates operating revenue. Operating revenue is the money you make from selling your goods or services and the money you get in return. Because non-operating revenue is irregular in nature, you only utilize operational revenue in the calculations when analyzing your revenue position.

Non-Operating Revenue

Any extracurricular activities that your company engages in generate non-operating revenue. One illustration would be to sell some of the tools or cars you no longer require. These sales wouldn't provide consistent, recurring revenue from operations, so the money from them would be classified as non-operating revenue.

Other Revenue Streams

Some of the most typical types of additional revenue streams are listed below:

Deferred revenue is another name for unearned revenue. Income received for a good or service that has not yet been provided to your business

- Advertising fees

- Rent revenue

- Brokerage fees

- Dividend revenue

- Interest revenue

This list is not all-inclusive. Depending on the sector they operate in and the pursuits they make, businesses generate various forms of revenue.

Recording Revenue

When revenue is earned, which may not necessarily coincide with when money is exchanged, it is reported on a company's financial statements. As an illustration, some businesses permit clients to purchase things and services on credit, which implies they will receive the products or services now and pay the business later.

As a result, the business will create a "accounts receivable" account on the balance sheet and include the revenue on the income statement.

The accounts receivable account is therefore reduced when the customer makes a payment; but, revenue is not increased because it was already recorded when it was earned (not when the payment was received).

What is the Purpose of Revenue Reporting?

When studying financial ratios like gross margin percentage (gross margin/revenue) or gross margin (revenue minus cost of goods sold), revenue is crucial. This ratio is used to determine a company's profit before deducting other costs and after subtracting the cost of the goods sold.

As you may guess, businesses can use their top line management to almost artistic effect. For instance, they could lease the goods or charge more for them if they wished to reduce the price of their products to make their top-line margins appear higher. If they were to simply sell the good or service at cost, they wouldn't make as much money using this strategy.

Why is total revenue important?

The company's success in producing sales is gauged by its revenue. Since businesses normally expand by generating more income, it's also a crucial indicator of business growth.

- Your company's performance can be gauged by looking at how much revenue it generates. Before any costs or deductions, the amount of total revenue is revealed. In other words, this indicator tells you how much money the company makes from selling its goods or services. It is essential to comprehend and monitor it if you want to assess and develop your business.

- The cost of goods or a service as well as the volume of units sold have an impact on revenue. Depending on how many units are sold at the lower price, discounts may result in higher sales but lower revenue.

- On the other side, seasonal spikes in demand or effective marketing campaigns might boost sales without needing to lower prices, bringing in more money. In reality, a lot of businesses look at how marketing initiatives or promotions affect sales to gauge their effectiveness.

- You can calculate how much more sales you'll need to generate if you have to lower the price of your goods. Using the same calculation, you may calculate how much additional sales are necessary to raise gross profit. If you wish to lower the price of your product, use the opposite of this equation.

In a small business, pricing your products is a challenging problem, but these two total revenue calculations can help you get started. Use the same equation if you offer several products. Simply multiply the sum of the sales of each product to enter the calculation.

In order to assess your company's financial situation, you can also compare your overall sales year over year and perform a trend analysis. Take it a step further and conduct an industry analysis to compare your overall revenue to that of your competitors. Trend research and industry analysis both provide useful information about the financial health of your company.

Revenue Forecast

Revenue forecasting is a crucial component of business planning. In addition, while deciding whether to provide a business a small business loan; lenders typically need a sales estimate. Based on information from the company as well as from customers and the sector, businesses can forecast their income.

You multiply the anticipated number of units to be sold by the average selling price using financial statements, anticipated demand, and past performance. Here is an illustration of a company's forecast depending on various factors, such as:

- Return and refunds

- Website traffic

- Discounts

- Conversion rates

- Product prices

- Volume of different products

There is much more that can be included in a forecast than just the number of units x average price, as you can see in the example above.

Financial forecasting is frequently a challenging endeavor because there are numerous factors that might affect sales, such as the economy, revenues, and expenses, as well as cash flow, gross margin, etc., as well as competition and production problems.

Making simple estimates under the premise that past trend would continue while accounting for seasonal fluctuations is one way to forecast financial data. Regression models that account for many internal and external factors are among the more sophisticated techniques.

How does price elasticity affect total revenue?

Price elasticity describes the relationship between a product or service's price and its demand. If demand is elastic, then as prices decline, demand will rise and as a result, so will revenue. Price increases or decreases don't have as much of an impact on overall revenue if demand is inelastic.

How Can You Use Your Entire Revenue Data?

Making careful to calculate your revenues accurately can help to guarantee that your company remains profitable in the long run. Your accounting and bookkeeping procedures may be significantly affected by a mathematical error. You might gain insights into potential new company prospects by accurately measuring revenue.

- You can more effectively budget for running costs, both now and in the future. This may involve paying vendors and suppliers as well as paying for total inventory, staff costs, and salaries. Additionally, you might choose and prepare for growth-oriented initiatives.

- Implementing past revenue data can help you steer your company in the direction you want it to go in the future. Additionally, you can determine more accurately how much you can spend on research and development. Or, how much money you have available to spend on improving your property or equipment.

- Your pricing plan may be updated and optimized, which is one of the most important things you can do with all your revenue data. You can determine whether you're charging too much or too little for your product or service by looking at and evaluating your revenue. When compared to your expenses, you may determine whether you are making a sufficient profit.

Revenue and Accounting/Bookkeeping

The accounting method the corporation employs determines how it reports revenue. The two main accounting techniques are accrual basis and cash basis. Although accrual basis accounting can provide a more accurate view of a company's financial status, cash basis accounting is simpler.

While many small firms employ cash basis accounting, all publicly traded companies and many other larger organizations, including companies with annual revenues of more than $25 million, are mandated to adopt accrual accounting.

Additionally, accrual basis accounting is required by the Financial Accounting Standards Board's (FASB) set of accounting guidelines known as Generally Accepted Accounting Principles (GAAP).

Cash accounting records sales revenue in the general ledger when the payment is received, regardless of when the company actually provides the good or service. When a business spends money on goods and services, the costs are reported as expenses.

Using Financial Management Software for Revenue Forecasts

Businesses can automate forecasting using planning and budgeting software, enabling teams to cooperate on planning based on information obtained from across the organization. Consumer expenditure surveys and statistics pertaining to certain industries are among the data sources produced by the U.S. Bureau of Labor Statistics. -

One of the first figures someone will focus on when starting a business is revenue, and for good reason. It's an essential indicator for evaluating a company's financial situation and prospects for the future. Only when an organization is aware of its revenue can it assess whether it is profitable, whether it needs to reduce spending, and whether its trajectory is upward or downward.

When a business employs accrual accounting, when does it record revenue?

If a business employs accrual accounting, revenue is recognized at the time the transaction occurs rather than when the money is received.

The method for figuring out a company's revenue is rather simple. However, accountants can legally manipulate the figures such that interested parties must delve deeper into the financial statements than just glancing at a single statistic to gain a better knowledge of income generating. This is particularly true for investors who need to understand how a company's revenue changes from quarter to quarter in addition to its overall revenue.

Revenue on the Income Statement

Sales are a company's lifeblood since they enable it to pay its employees, buy inventory, pay suppliers, invest in R&D, construct new property, plant, and equipment (PP&E), and be self-sufficient.

- A corporation will need to use an existing cash balance on its balance sheet if it doesn't have enough income to pay for the aforementioned expenses. The money can come through financing, which means that the business raised it or borrowed it (in the case of debt) (in the case of equity).

- Understanding how the three financial statements are connected and how a company either uses its sales to fund the business or must turn to financing alternatives to fund the business are crucial for performing a thorough analysis of a company.

The income statement, which is a complete history of how your company performed over a specific time period, can be used to find total revenue. This can be done every month, every three months, or even every year, though we advise checking your financial statements every month.

In comparison to other reports, the income statement is quite easy to understand. The main portions are summarized in the following list:

• Total Revenue: The income statements' first part lists all of the money your business earned over the accounting period. This can come from both your main source of income and any additional sources. Remember that your accounting approach will determine what you "recognize" as revenue.

• Cost of goods sold (COGS): This item details the costs associated with producing the goods you sold during this accounting period. This section should contain anything necessary for the development of your product (think personnel, software, materials, etc.). You obtain Gross Profit by deducting COGS from Revenue.

• Operating Expenses: Unlike COGS, everything you spent running your business during the accounting period is included in this area. These expenses are not necessary for the creation of the goods you sold. It covers items like rent, office food, and marketing expenses. Net Income, or what most people would simply refer to as "profit," is obtained by deducting Operating Expenses from Gross Profit.

You may see the total revenue figures from the past at the top of the income statement. Prior to deducting cost of goods sold and operating expenses, the income statement starts with an overview of all revenue streams throughout a specific time period. It should be noted that gross revenue is another name for total revenue. Both of those terms are used equally.

Revenue in Different Sectors

We will examine what the term "revenue" means in several industries below. You'll notice that it can be made up of a large variety of elements and varies greatly depending on the industry as to what the most typical instances are.

Corporate finance:

- Interest

- Sale of goods

- Dividends

- Sales of services

Personal finance:

- Rental income

- Salaries

- Interest

- Bonuses

- Dividends

- Hourly wages

Non-profits:

- Product/service sales

- Membership Dues

- Sponsorships

- Fundraising

Public finance:

- Duties and tariffs

- Income tax

- Sales tax

- Corporate tax

Public finance, personal finance, and corporate finance are the three primary sub-sectors that traditionally make up the finance sector. The many sources of revenue for each category can range greatly, as we have shown above. Although the categories above are not all-inclusive, they do provide you a basic idea of the most typical forms of revenue you'll come across.

Managing Revenue

How to Increase Total Revenue

The traditional approach to boosting your company's profit is to cut costs while raising sales. Your expenses might be fixed or have a cap on how low they can go, but the room for income growth is virtually endless. You can do this by: Increasing the quantity of your clients. Increasing the frequency of purchases as well as the quantity of purchases made in each transaction.

They are all excellent approaches to increase overall revenue. Increasing your prices, employing successful marketing techniques, and developing client incentive programmes will all have a favorable effect.

How to Prevent Revenue Loss?

Many start-ups and small businesses struggle to keep their net revenues positive. Numerous issues and undetected expenses might adversely affect your bottom line without your knowledge. At first, the losses might not seem like much, but after a year, your firm might take a serious impact.

Therefore, it's crucial to determine the causes of your company's delayed financial success. The quicker the crack is located, the quicker the leak may be fixed. What are some of the causes of your financial losses, and what can you do to stop them?

Failure in converting the right customers

There were many clicks but no conversions? Lots of website traffic might be produced by an effective SEO approach. An increase in internet traffic does not necessarily translate into more revenues for all firms, though.

The difference is evident. If this describes you, your content marketing or pay-per-click advertising may be focusing on the wrong keywords. It's crucial to consider the search term's intent while choosing keywords. For instance, the term "time management suggestions" suggests that the consumer is looking for helpful ideas and tricks.

- A corporation will need to use an existing cash balance on its balance sheet if it doesn't have enough income to pay for the aforementioned expenses. The money can come through financing, which means that the business raised it or borrowed it (in the case of debt) (in the case of equity).

- Understanding how the three financial statements are connected and how a company either uses its sales to fund the business or must turn to financing alternatives to fund the business are crucial for performing a thorough analysis of a company.

Such keywords should be included in your website because they are significantly more likely to result in a sale.

Incorrect price point

Finding the ideal price for your goods or services can be challenging. Undoubtedly, a higher price might result in a larger profit margin. However, it may also turn away clients. On the other hand, purposefully lowering your rates might draw in more customers. Higher gross revenue is the benefit, but it comes at a price: reduced margins per unit.

For large businesses with higher sales volumes and lower production costs, cost cutting may be an effective strategy. These businesses can afford to run with low margins. For start-ups and small enterprises, however, lowering pricing is problematic because it can be difficult to raise prices afterwards.

Once competitors see the opportunity and start lowering their prices as well, it might potentially reduce the market's worth. Perform a market analysis, research your competitors, and use customer data to test various price points on each audience segment to help you determine the right price.

You aren't making enough investments in your brand.

A weak value proposition or poor branding can also be linked to revenue losses. Knowing your target market is what it comes down to in the end. Perhaps you should start by updating your buyer personas. Most organizations typically have two or three fictitious personas based on their target market and current clients

- Each one may have both general information—such as age, location, and income—and details—such as requirements and issues. However, you must carry out in-depth market research in order to pinpoint your target market.

- You can clearly identify critical contact points for each market segment and determine the aspects of your products or services that appeal to them most by collecting data through customer surveys and competition audits. You'll basically have a clearer idea of your unique selling points and how to clearly convey these on your website and packaging with the appropriate brand image, language, positioning, and personality.

- Correct message will boost conversions and stop potential revenue losses.

After all, investing money in print or digital advertising is pointless if consumers don't like what they see or are unfamiliar with your brand. In fact, 70% of users who are browsing search results click on well-known businesses.

Your business image can get the facelift it needs to appeal to the right customers by investing in skilled graphic designers, photographers, and copywriters. The text and images on your website or packaging must accurately reflect what your brand is all about.

You don't have a presence online

Nearly everyone is online these days. So, where do you think someone will begin their search if they want to find a new company to buy from?

- You could lose out on a lot of consumers if people can't find your goods or services online. Every company therefore requires an online presence. An SEO-optimized website will help people find your business and can help you rank better in search results, even if you don't sell anything online. A website shouldn't be the only element of your internet presence.

- Create social media profiles and keep them updated with interesting information to get the most out of the Internet. A strong brand following may be developed through social media by showcasing your products, generating interest in upcoming events, and more.

- Creating social evidence also heavily relies on your online presence. Customers rarely purchase from companies they don't believe in. Encourage clients to leave evaluations on your website, social media, or review sites for your sector.

It's crucial today that you claim your company on Google. Google accounts for over 90% of all internet searches, and 46% of those searches are for local businesses. You may improve your company's visibility by changing your Google My Business listing.

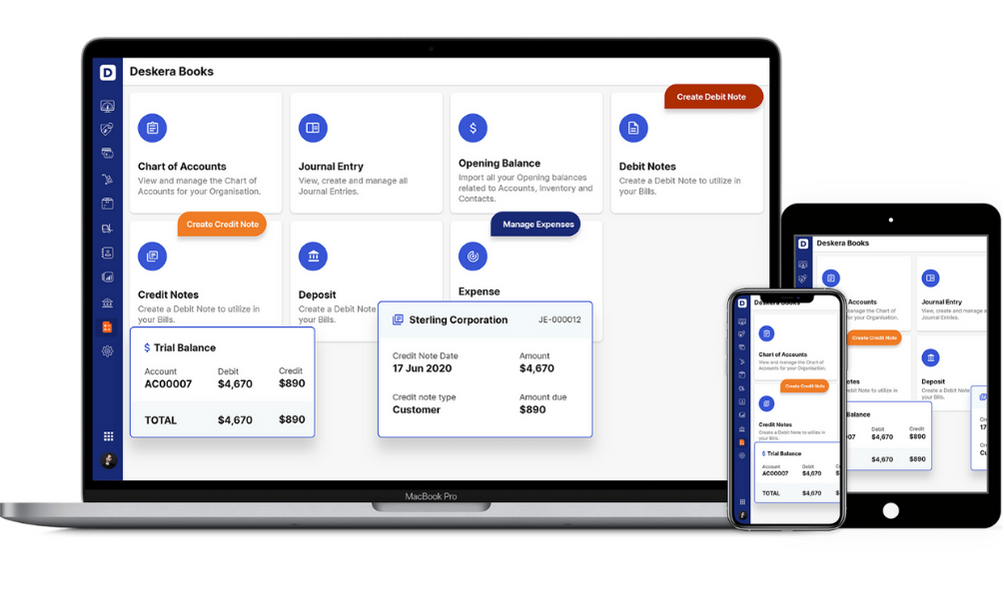

How can Deskera Help You?

Deskera Books can help you automate and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Sign up now to avail more advantages from Deskera.

Key Takeaways

- The complete sales of your products and services are the only source of your sales revenue. It doesn't account for any earnings from additional sources of income. Therefore, it's crucial to remember that sales income just takes sales into account.

- You can perform a trend analysis and an industry study to examine your overall revenue and determine whether it is appropriate.

- Before your expenses are taken out on the income statement, your total revenue is the sum of your sales revenue. Compared to the bottom line, which is net income or net profit, it is the top line of the income statement. The measure used to describe what remains after expenses are eliminated is called net income.

- Business owners must take their expenses into account in addition to their desire to be profitable and ability to generate money. Employee pay, construction expenditures, office supply costs, electricity charges, and other costs are examples of expenses. Many of these costs may potentially turn out to be one-time charges.

Related articles

-5.jpg?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=MnwxMTc3M3wwfDF8c2VhcmNofDN8fGJ1c2luZXNzfGVufDB8fHx8MTY1ODg0MTM5NQ&ixlib=rb-1.2.1&q=80&w=2000)