GSTR-10 is a form of GST annual return that should be filed by individuals that are registered under the GST act when their GST registration is cancelled or surrendered. It is a statement containing a list of reserves or stocks held by said tax-paying citizens on the day before the date of revocation.

The GSTR-10 is a one-time final return designed to offer information about the ITC associated with closing stock (along with capital goods and inputs) to be overturned or paid by the tax-paying citizen. It must be submitted within three months from the date of revocation or the date of the cancellation order, whichever comes first.

What Is GSTR-10?

The Goods and Services Tax Return 10 is a single instance statement or document that is to be submitted by a registered tax-paying citizen whenever they withdraw their GST registration or shut down their business (either of their own accord or because of a government order). The GSTR-10 is also known as a final return.

Form GSTR 10 also includes information about the input tax credit (ITC) associated with closing stock (inputs and capital goods) that must be overturned or recompensed by the taxpayer. A tax-paying citizen can also fill in NIL GSTR 10. The form for the GSTR 10 return can be submitted both online and offline. It is crucial to highlight that the payer cannot submit Form GSTR-10 unless all obligations declared in this return have been discharged.

When Is GSTR 10 Due?

GSTR-10 should be submitted within three months from the date of the termination of the GST registration or the date of the issuance of the termination order, whichever comes after. For instance, if the GST registration of a tax-paying citizen is voided on January 1st, the GSTR-10 return will be due on March 31st.

Note: As of September 21, 2020, citizens who have not submitted GSTR-10, i.e., the final return, are now permitted to do so with a diminished late penalty of Rs. 500. The awaiting GSTR-10, on the other hand, must be submitted on or before December 31, 2020.

Who Should File GSTR-10?

Only those whose GST registration has been voided or relinquished are needed to submit GSTR 10. As a result, regular tax-paying citizens registered under GST are exempt from filing this return. Only GST-registered individuals who have decided to apply for GST registration surrender or cancellation are eligible.

What is the Difference Between a Final Return and an Annual Return?

Regardless of the turnover of an entity, all enrolled tax-paying citizens under GST must submit a yearly return. The return includes information such as the taxpayer's incoming/outgoing resources, taxes paid, refund claimed, demand raised, and ITC received. Except for the following, all enrolled tax-paying citizens are required to file GSTR-9:

- Casual taxpayers

- Distributors of Input Services

- Non-residents who pay taxes

- Taxpayers who deduct/collect tax at source under Sections 51 or 52

Note: Composition taxpayers have to file GSTR-9A, and E-commerce operators have to file GSTR-9B.

In contrast, only those whose GST registration has been voided or abdicated are needed to submit a final return. Regular GST-registered individuals are not required to submit this return. In other words, the following individuals are exempt from filing GSTR-10:

- Distributors of Input Services

- Composition of taxable individuals

- Taxpayers who are not residents of the United States

- Individuals required to deduct TDS under Section 51 of the CGST Act Individuals required to obtain TCS at the source under Section 52 of the CGST Act

What Is the Penalty for Not Filing GSTR 10 On Time?

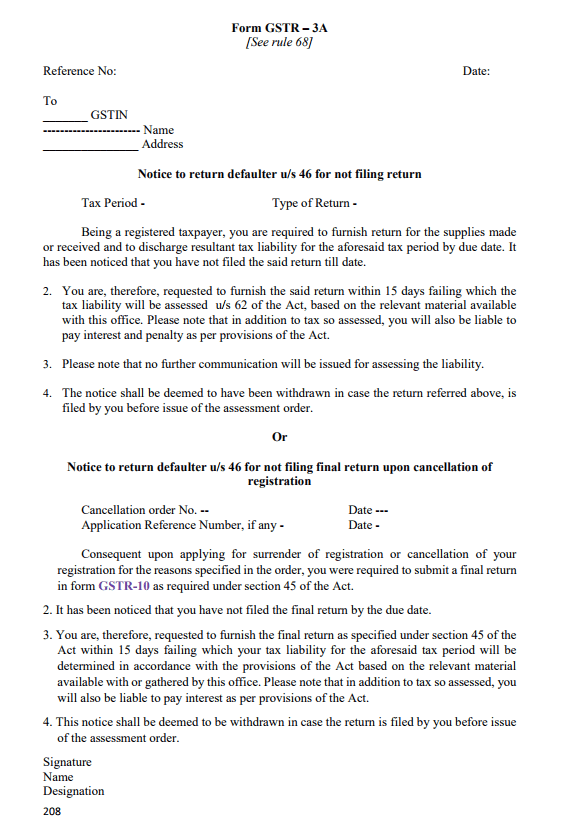

For a tax-paying citizen that hasn't submitted their GSTR-10 by the due date, a notification is sent to them. The individual is then afforded an additional 15 days to file the return with all the necessary documentation. If the individual continues to fail to submit the return, the tax office will issue the final verdict for termination, stating the amount of tax owed as well as any interest or penalty. The notice in question is shown below:

Note: Late fees capped at Rs. 500 for a delay in filing Final Return in Form GSTR 10 if it is filed between 22/09/2020 to 31/12/2020 vide Notification No. 68/2020 – Central Tax dated 21st September 2020.

Details to Be Provided in GSTR-10

GSTR 10 is divided into 11 segments. These segments that show up during system login are as follows:

- GSTIN: This section is auto-populated.

- Legal Name: This section is auto-populated.

- Business or Trade Name: This section is auto-populated.

- Address for any future correspondence: This section is auto-populated.

Below are the sections under which information needs to be furnished: - Effective Date of Surrender/Cancellation: In this section, you are required to specify the GST registration's date of cancellation as mentioned in the order.

- Reference number of Cancellation order: Tax prosecutors will share a unique ID when the cancellation order is issued.

- Date of Cancellation Order: As the name mentions, it is the date when the tax prosecutors issue the order of cancellation for the GST registration.

- Particulars of Closing Stock: The taxpayer must provide information about the closing stock reported at the time the business is closed. Any input tax credit held in these stocks must be recompensed along with this return.

- 8(a) Inputs in stock (invoice present).

- 8(b) Inputs in the stock of semi-finished or finished goods

(invoice present). - 8(c) Capital goods or machinery in stock.

- 8(d) Inputs in stock or in stock of semi-finished or finished goods (invoice not present).

- Tax payable amount and tax paid: Provide ITC reversal or tax payable along with the details of payment, and exchange from credit ledgers and electronic cash under the headings SGST, CGST, IGST, and cess.

- Interest, late fee payable, and paid: Offer a detailed breakdown of the interest and late fees that are owed and paid.

- Verification: Substantiate and validate the accuracy of the GSTR-10 details.

When all of the information is furnished accurately, the taxpayer must sign the form digitally by either using an Aadhar-based signature authentication or a digital signature certificate (DSC) to confirm the return.

Points to note while filling up details of stock:

- If billing statements for the declared contained in finished or semi-finished goods are not available, the amount should be approximated separately. At market value, it will be in accordance with CGST Rule 44(3). It should be accredited by a licensed cost accountant or chartered accountant and uploaded with GSTR-10.

- For ascertaining the price of machinery or capital goods, an equation is prescribed. It must be calculated as invoice value (minus) 1/60th per month or a portion thereof. This is calculated starting from the purchase date or and assuming a useful life of five years.

Prerequisites to File GSTR-10

The prerequisites for filing Form GSTR-10 can be found below:

- The individual must be an enrolled GST taxpayer with a 15-digit PAN-based GSTIN who is voiding his or her GST registration.

- The total revenue of the individual's business should be more than Rs. 20 lakhs (Rs. 10 lakh rupees in the case of NE India).

- On the GST website, tax-paying citizens must have a legitimate user ID and password.

- Taxpayers should have had formally requested an appeal for cancellation of registration to which a cancellation order should have been issued.

- An order for registration cancellation should be granted in the particular instance of ‘suo moto' discontinuation of registration by tax officials.

Step-by-step Guide for Filing GSTR-10 on the GST Portal

Here are the steps to create and file details in Form GSTR-10.

Step 1: Go to the GST portal and log into your account, and then navigate to the GSTR-10 page.

Step 2: You can visit the GSTR-10 page by clicking on 'Services', then selecting 'Returns', and then finally clicking on 'Final Return'.

Services > Returns > Final Return

Before you do go ahead and click on 'Prepare Online', make sure to read the section titled 'Important Message', which has been highlighted below.

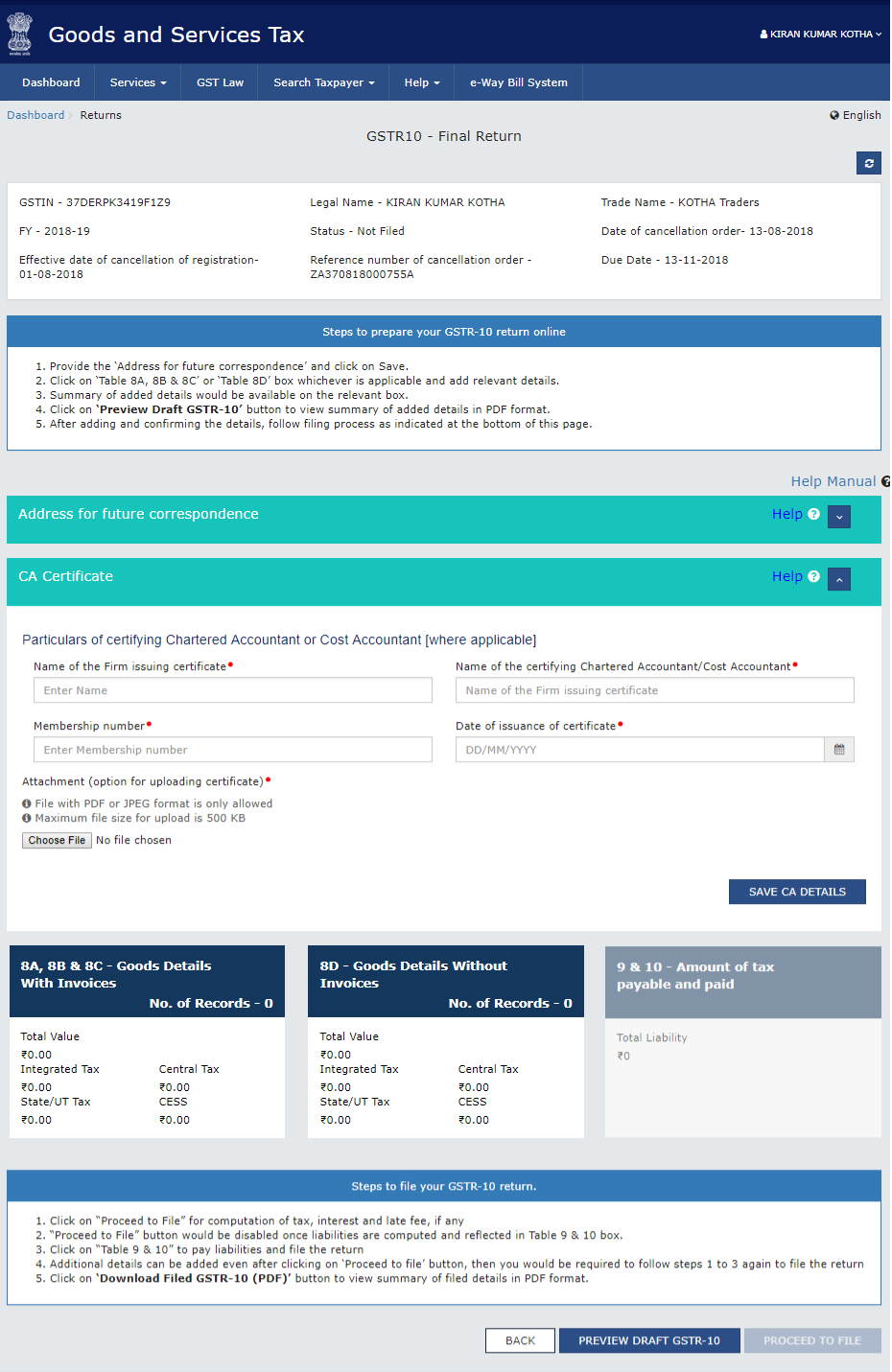

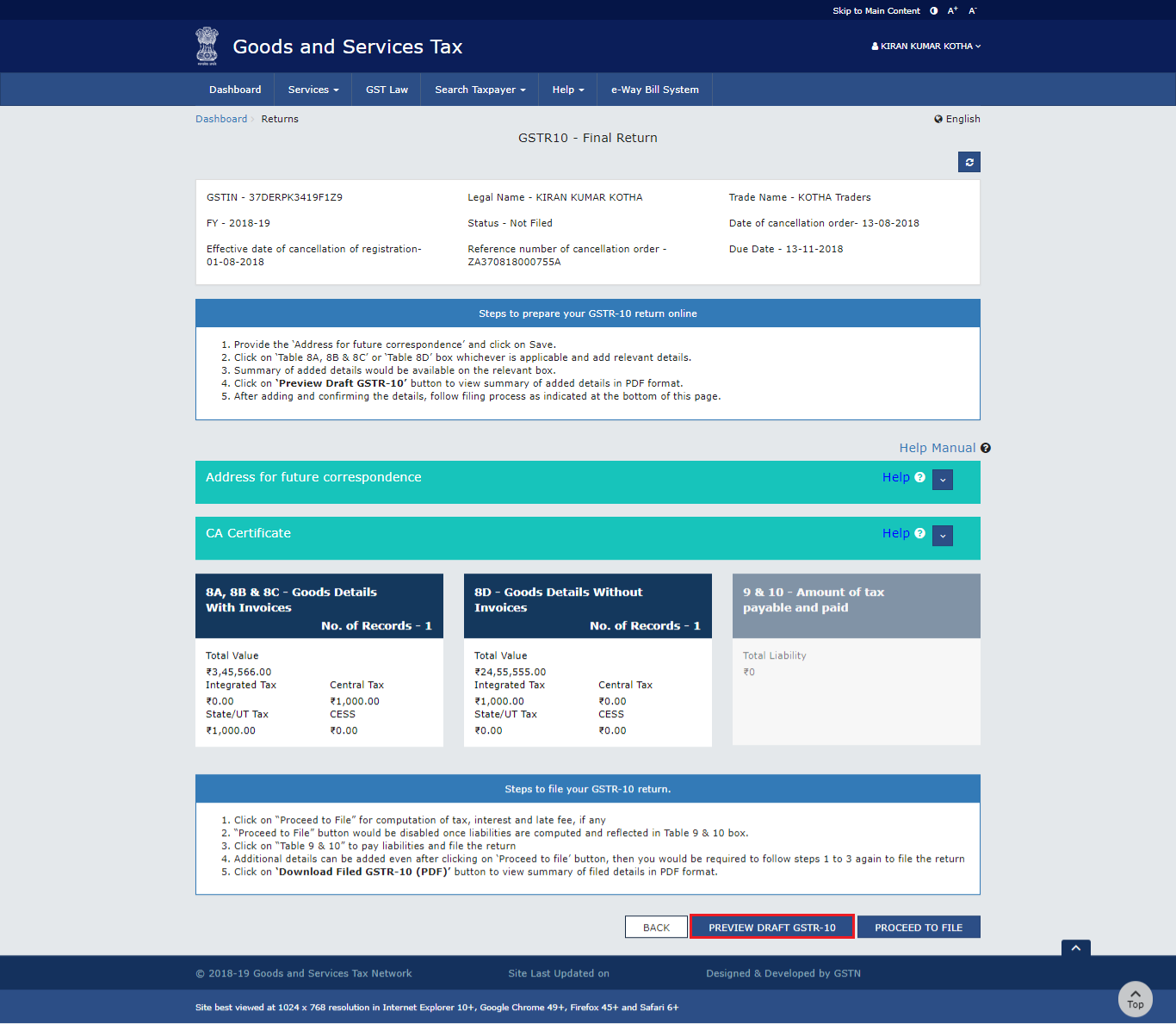

The GSTR-10 - Final Return page will then show up on your screen as displayed below:

Step 3: Select the 'Prepare Online' option and then start filling in or updating the details of your address correctly for further correspondence.

Fill in the address and click on 'Save' after which a message highlighted in green will pop up confirming that the request has been accepted successfully.

Step 4: Refresh and update the information about the Chartered Accountant or Cost Accountant. Filling in the GST invoice section will necessitate the below information:

- Under the section ‘Particulars of certifying Chartered Accountant or Cost Accountant,' fill in/update the below information about Cost Accountant or Chartered Accountant details.

- The accounting firm's name.

- The name of the Cost Accountant or Chartered Accountant who has been in charge of issuing the certificate.

- The certifying firm's membership number.

- The date on which the certificate was obtained.

- Include a digitized copy of the certificate.

- After you have completed filling in all of the requested details, select the 'Save CA Details' option and a confirmation message will be displayed on the screen.

Step 5: Fill in the required information of goods held in stock (either as inputs in semi-finished/finished goods, on which ITC has been taken) in the below tiles:

- The ones that have invoices are to be updated in tables 8A, 8B, and 8C.

- The ones without invoices are to be updated in table 8D.

The information is needed to overturn the ITC that was previously claimed, either under the pre-GST regime or the GST regime.

How to fill the tables 8A, 8B, and 8C for GSTR-10

1. Click on the first tile titled '8A, 8B and 8C – Goods with invoices'.

2. Select the 'Add Details' option.

3. Click on the option 'Supplier Registered Under' and choose the suitable option from the drop-down list.

4. Fill in the invoice details under any one of the two options - GST or CX (Central Excise)/VAT regime, as shown in the image highlighted above. After filling in all the details in the invoice by clicking on the 'Add' button, select the 'Save' option to proceed.

Details required for GST invoice:

- GSTIN Number

- Invoice/Bill of Entry Number

- Invoice/Bill of Entry date

- Item details

Details required in case of Central Excise/VAT invoice

- CX/VAT Number

- Invoice/Bill of Entry Number

- Invoice/Bill of Entry date

- Item details

The tax-paying citizen will be taken to the landing page of the GSTR-10 dashboard and the Table 8A, 8B and 8C tile will be updated with the relevant information like the value of goods, the total number of records, etc.

Filling Table 8D for GSTR-10

In much the same manner that table 8A, 8B, and 8C were updated, update the information in table 8D – details of goods without invoices. After that, click on the 'Save' option. Here, rather than filling in the invoice details, a tax-paying citizen is expected to update the description of goods, type of goods, taxable value, and total quantity.

The tax-paying citizen will be taken to the GSTR-10 page with the updated details in Table 8D – details of goods without invoices if the data is successfully updated.

Step 6: Preview the Form GSTR-10

After having entered all of the information, tap on ‘Preview Draft GSTR-10' to preview the Form GSTR-10 draft summary page. The draught summary page of Form GSTR-10 is then downloaded for review by clicking this button. The viewer can download the summary page and read an overview of the entries made in various sections. The draft's watermark appears in the PDF file.

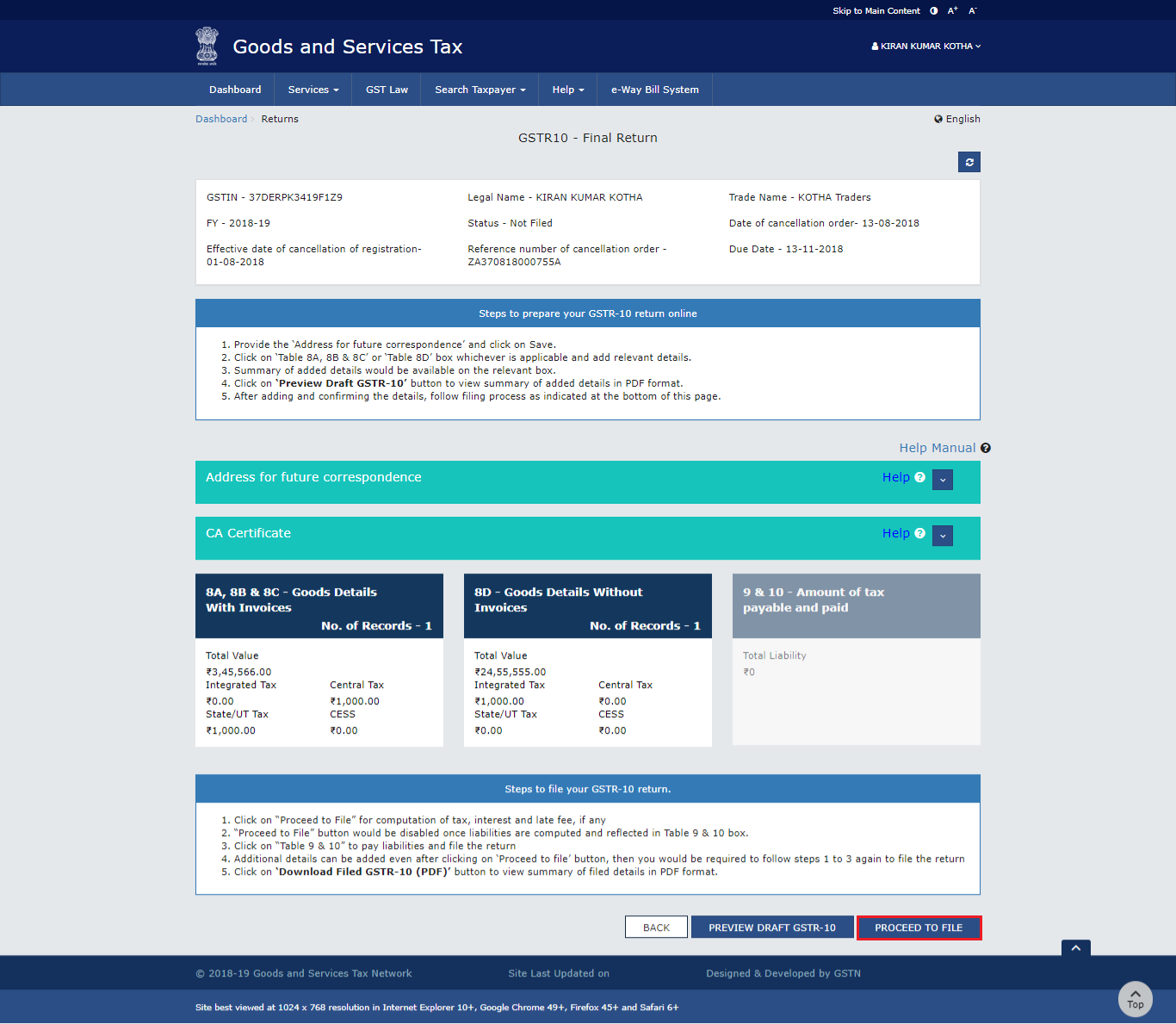

Step 7: Make the payment to file the Form GSTR-10

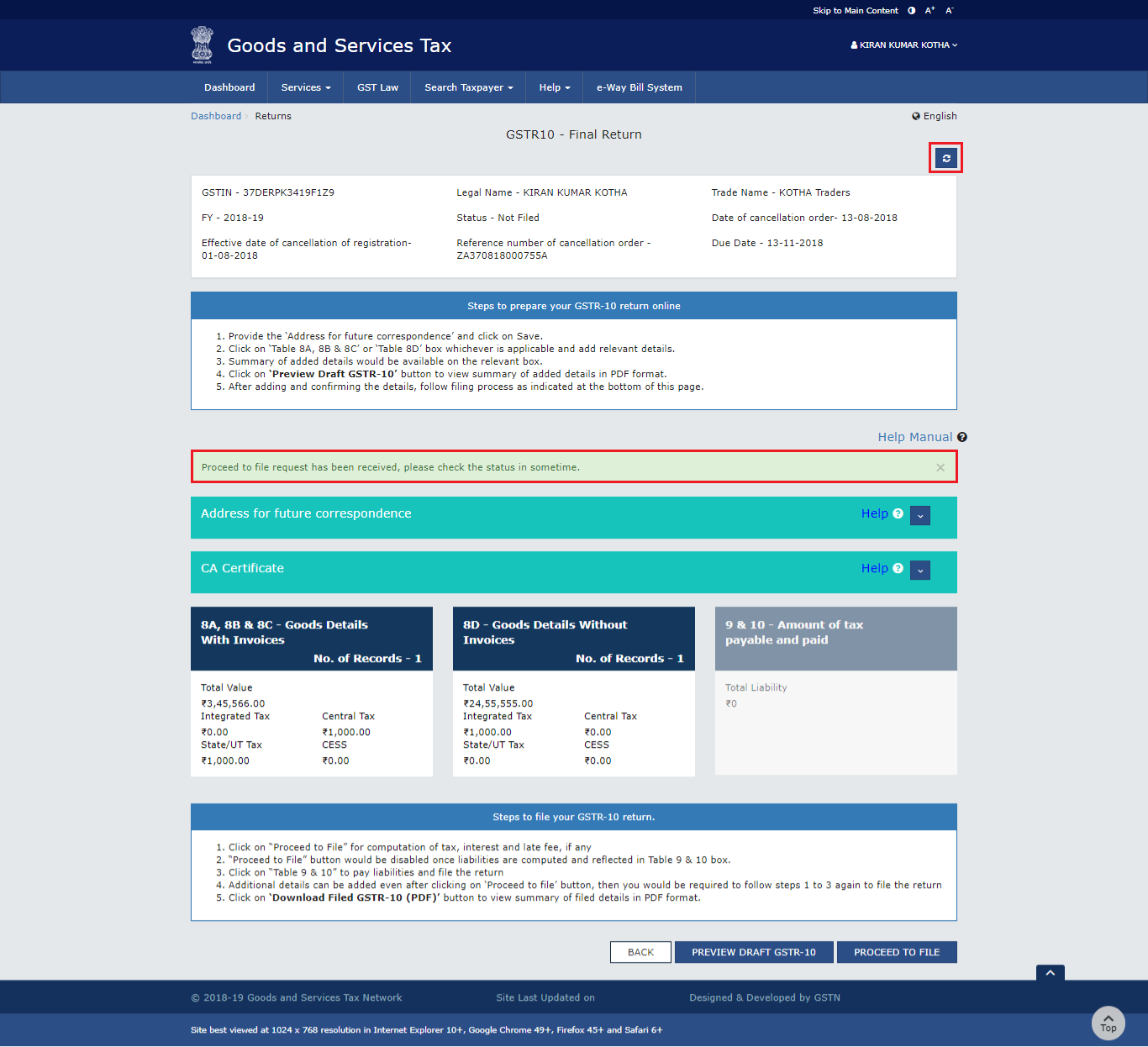

Click on the 'Proceed to file' button.

The website page will display a message on the top of the screen stating that the 'Proceed to file request has been received'. By clicking the 'Refresh' button, the status will get changed.

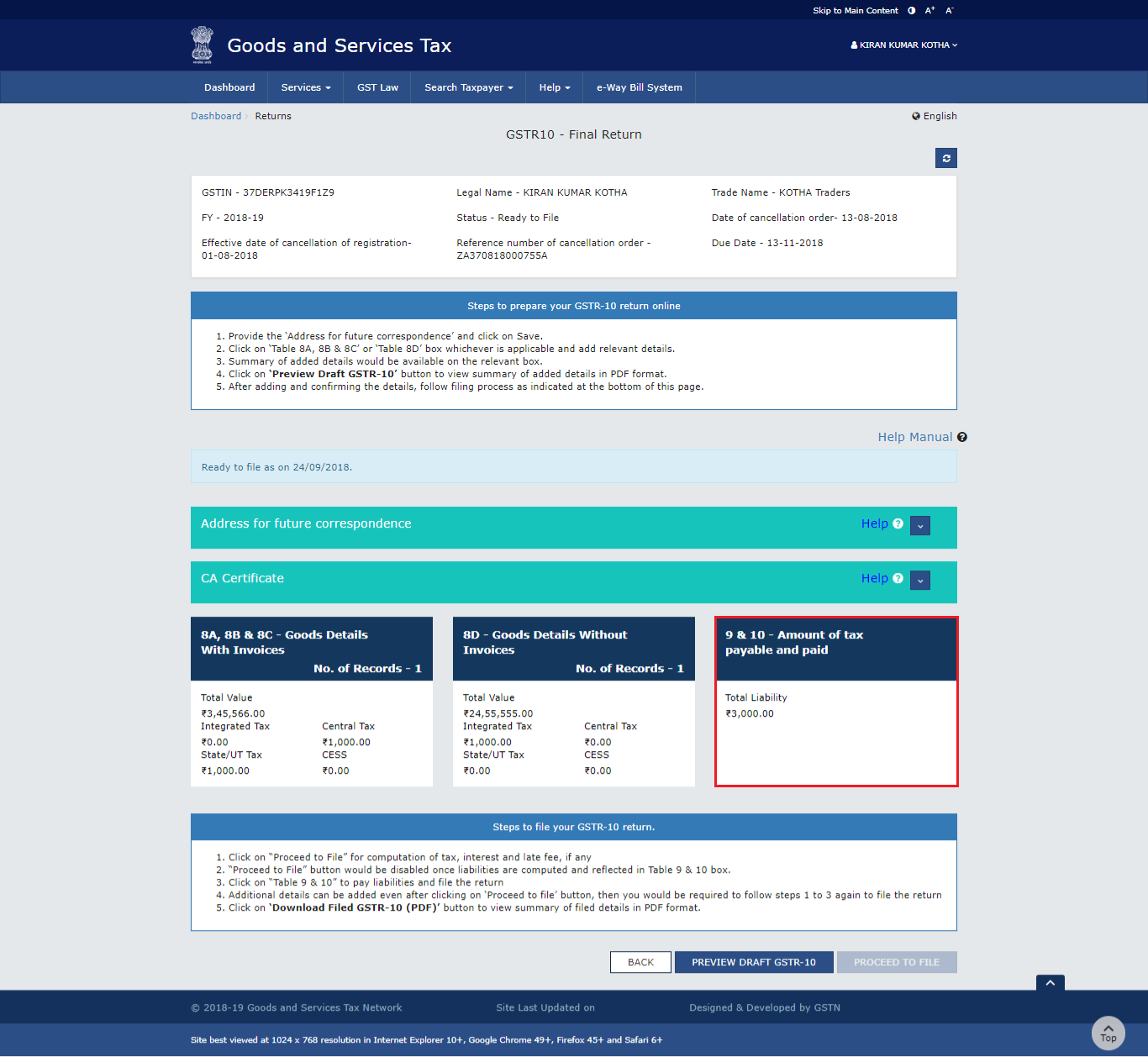

Once the status of Form GSTR-10 changes to 'Ready to file', the 'Amount of tax payable and paid' tile gets enabled. Click on that tile.

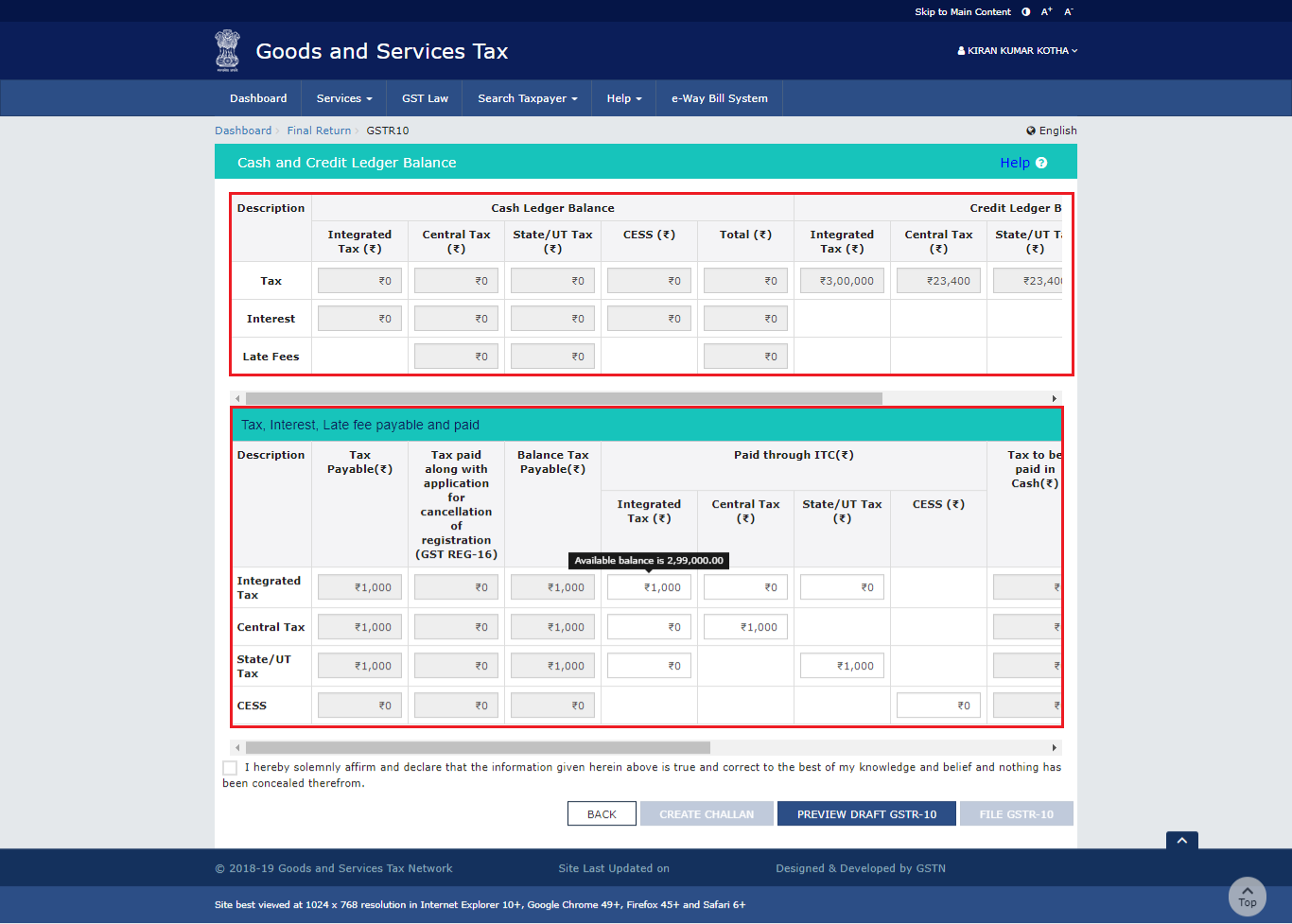

On clicking the 'Amount of tax payable and paid', the available balance in cash and credit ledger is then shown on the screen.

Now, there can be two cases:

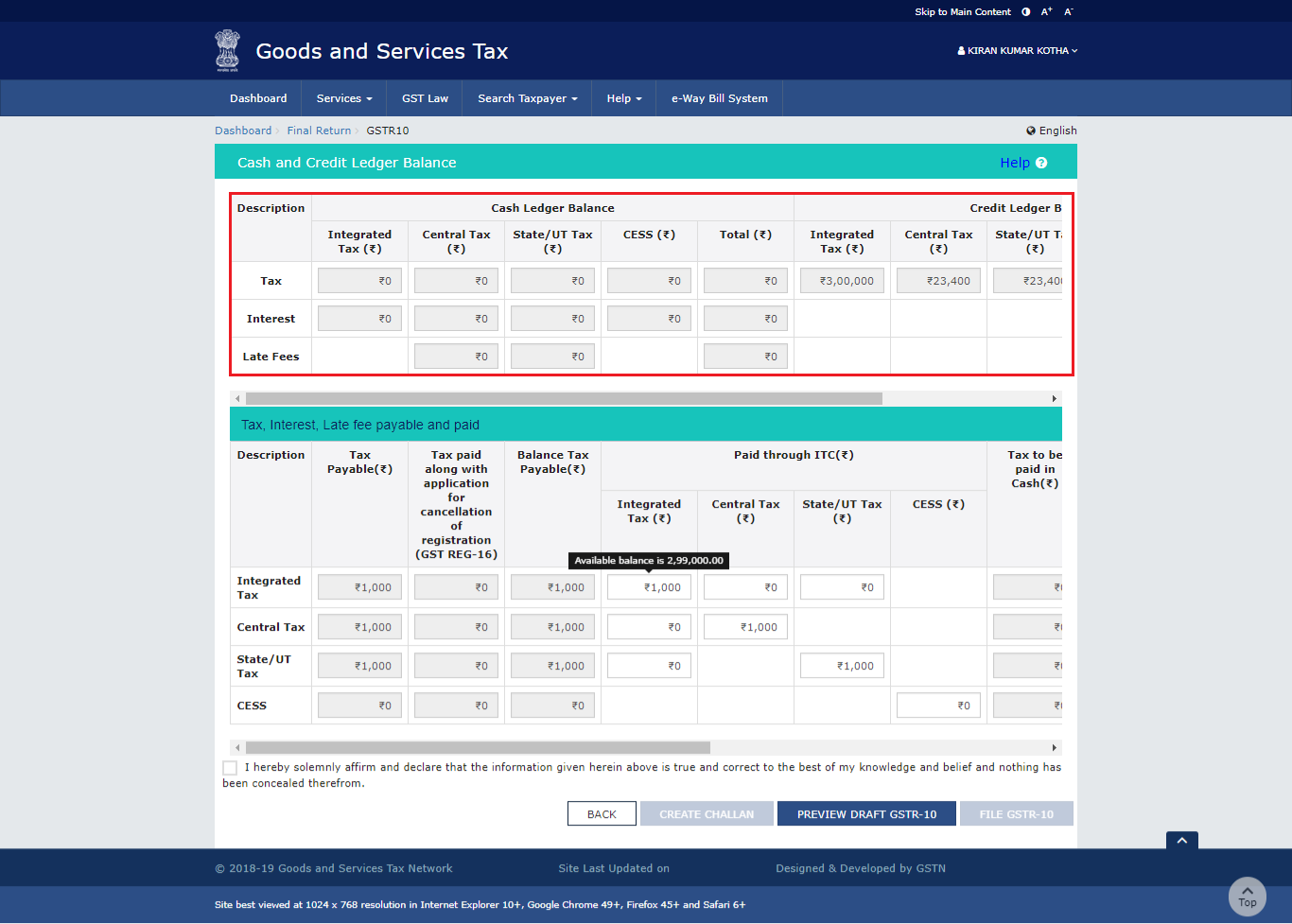

Case 1: Available balance in cash/credit ledger is less than the amount required to offset the liabilities:

If the outstanding balance in the Electronic Cash Ledger/ Credit Ledger is below the amount needed to equalize the obligations, a portion of the liability payment can instead be made from the available balance in the Electronic Cash Ledger/ Credit Ledger.

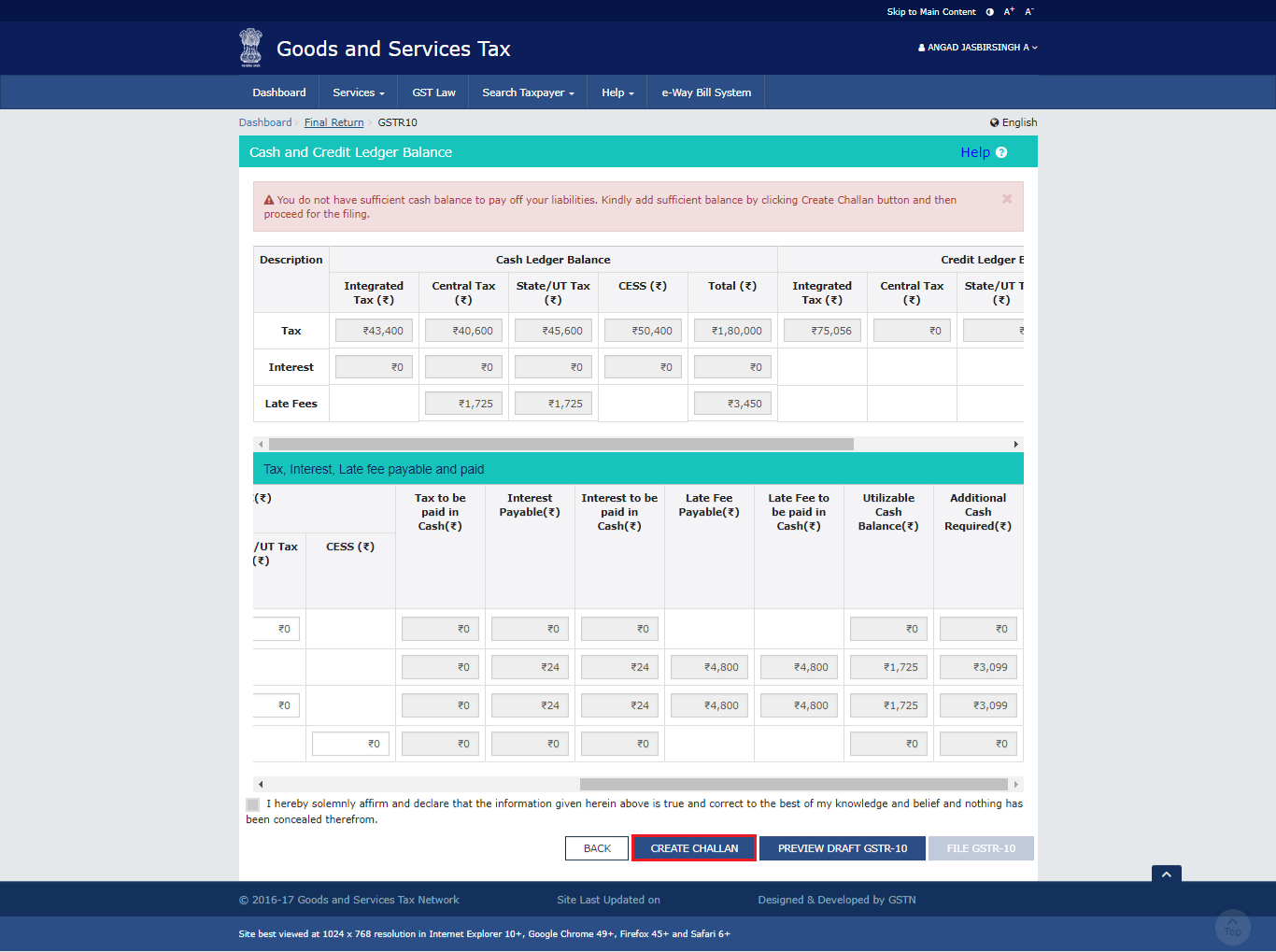

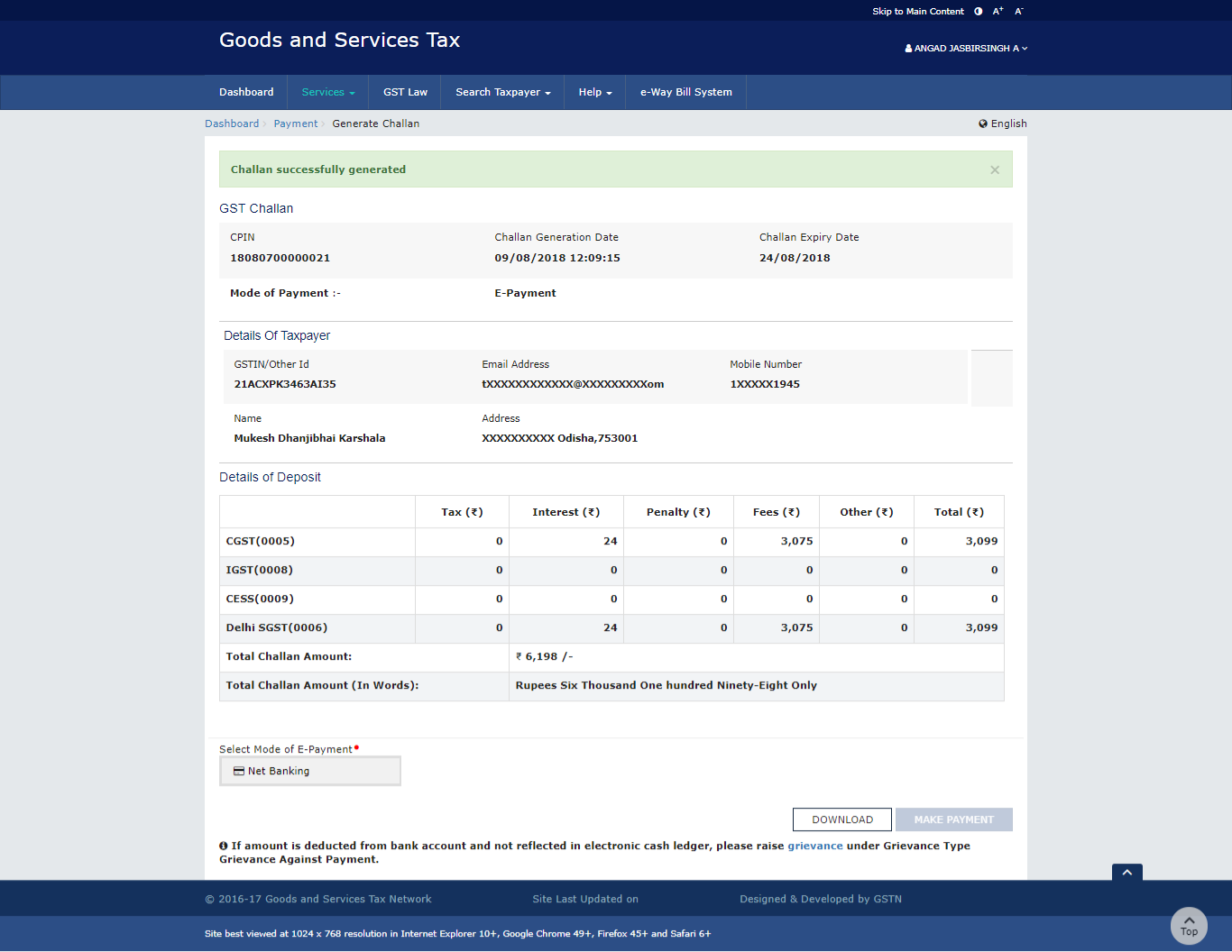

In this case, by selecting the 'Create Challan' button, the taxpayer can directly generate a challan for the payment of the remaining portion of the liability. Then, the screen displays the following page.

Now, the taxpayer can make the payment by using the below options:

- Net banking: The website redirects the taxpayer to the chosen bank's Net Banking page. The amount that must be paid is shown on the screen. If the taxpayer wishes to adjust the amount, he or she must cancel the payment and then generate a new challan. When a payment is successful, the taxpayer is rerouted to the GST Portal, where the payment status is shown.

- Over the counter: The taxpayer must print the challan and then go to the designated bank. The transaction can be made in cash, by check, or by demand draft. The GST Portal updates the payment status after receiving the chosen bank's confirmation.

- NEFT/RTGS: The taxpayer must print the challan and then go to the designated bank. A mandate form is created at the same time. The taxpayer must pay by cheque or by using the account debit facility. The payment is approved by the bank, and the payment is confirmed by the RBI within two hours. The GST portal then updates the status on the portal after verification.

Here is a look at the challan that is generated.

Case 2: Available balance in cash/credit ledger is more than or equal to the amount required to offset the liabilities:

If the account balance available in Credit Ledger or the Electronic Cash Ledger is equal to or greater than the amount needed to offset the liabilities, the taxpayer must pay the liabilities with the funding available.

The Credit Ledger can also be used to pay tax liabilities by the taxpayer. The portal auto-populates the Credit Utilization, which the tax-paying citizen can modify as needed. To make things easier for the taxpayer, the portal also auto-populates the reference to the amount paid when suspending the registration in the payment table.

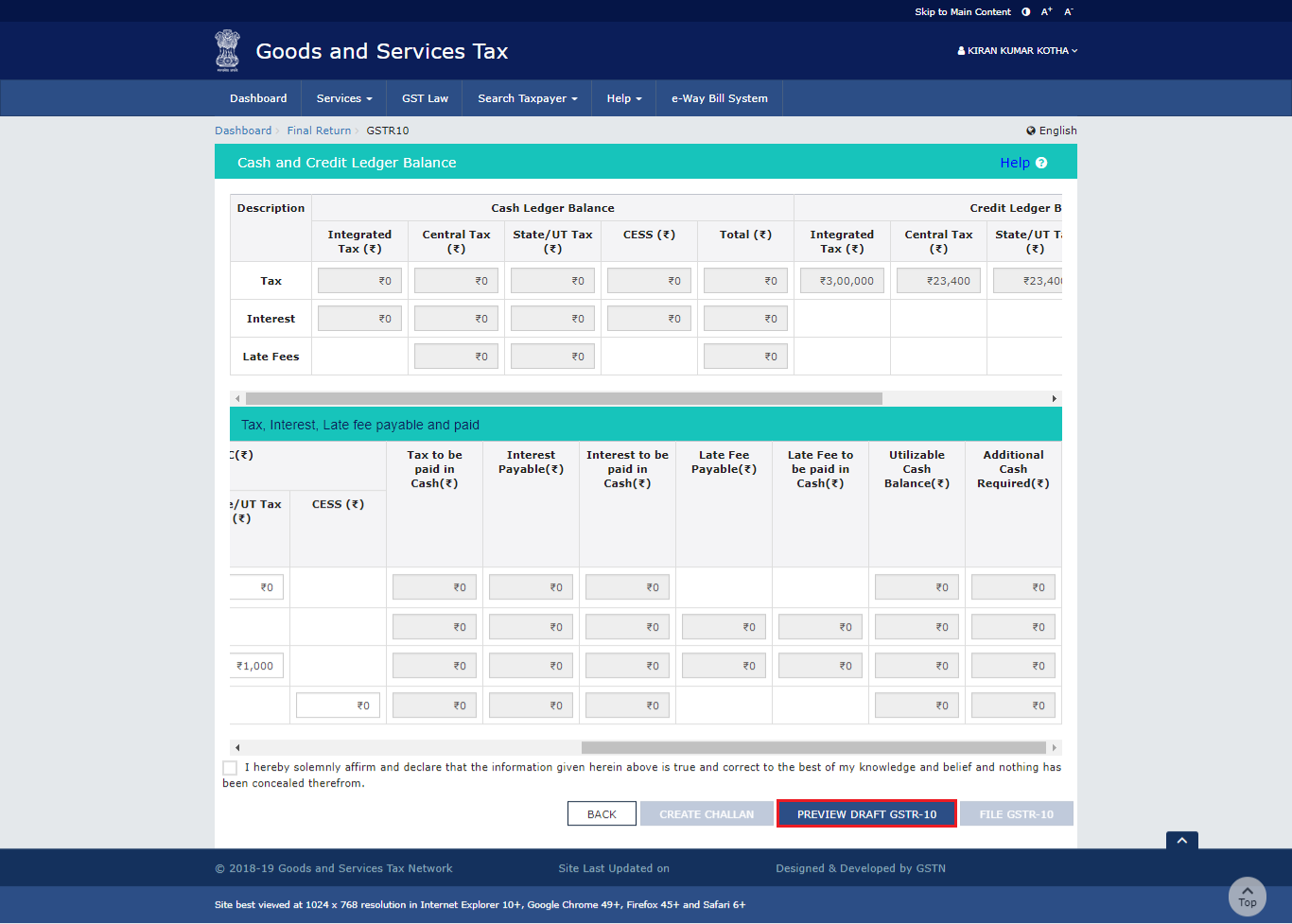

Step 8: Preview draft GSTR-10

The taxpayer then should click on the 'Preview Draft GSTR-10' option to preview the summary page for the Form GSTR-10.

Once again, check the draft GSTR-10 before making the payment.

Step 9: Submit and file the Form GSTR-10

Click on the 'Declaration' checkbox, and then signatory information from the drop-down list, and then select the 'File GSTR-10' option. Finally, select the 'Yes' option on the pop-up message to proceed.

After this, the 'Submit application' webpage will show up. The taxpayer can then file their GSTR-10 Form with either DSC or EVC.

Records to Be Maintained After the Cancellation

A taxpayer is expected to continue to keep maintaining the below records:

- Register of purchase

- Register of stock

- Register of sales

- Register of goods produced

- Liability of output tax

- ITC availed

- Output tax paid

How can Deskera help you in your business?

Deskera Books is a user-friendly accounting system that is equipped with a plethora of features to assist you. Besides managing products, services, and inventory, we also manage journal entries.

With our software, it becomes quite easy to handle cash flow statements, profit and loss statements, income statements, and balance sheets.

In India, the GST system requires you to create and manage invoices regularly. With Deskera Books by your side, you can generate GST-compliant invoices. This innovative software can be quite beneficial for you in updating yourself with a lot of information related to invoices, creating and sending invoices, and a lot more.

You can even learn how to manage and set up India GST and get familiarize with the process in just a few minutes.

Be it managing your work contacts, invoices, bills, and expenses, Deskera can help you in every aspect.

Key Takeaways

All taxpayers must file their GSTR-10 Form on time and within the due date to prevent any liabilities from creeping up or from falling into litigation. Furthermore, all the information filled in the GSTR-10 Form must be true to the taxpayer's knowledge to avoid the consequences of misinformation outlined in the GST Act.

Related Articles