This article will explain the provisions of Tax Deduction at Source (TCS) under the GST act. TCS was initially a part of the income tax act, but later in 2018, it was introduced in GST Law. TCS is collected as a tax percentage from the buyer on specific transactions and deposited to the government.

What is Tax Collected at Source(TCS)?

The Tax collected from the buyer by the seller during the sale of goods/ services is known as Tax Collected at Source, or TCS. This collected amount is deposited to the Government and is collected at a certain percentage of the transaction amount.

Example: Mr. X sells goods of Rs.5,00,000 on the e-commerce site, then the e-commerce site will collect TCS@1% of 5,00,000, i.e.Rs.5000, and deposit the TCS to the Government to pay the rest amount to x.

Introduction of TCS in GST

In GST, the liability to collect TCS has been placed only upon Electronic Commerce Operators.

TCS is the amount the e-commerce operator collects when a supplier of goods/services supplies them through its web portal or application. First, for that supply, the e-commerce operator collects this consideration. Then, for such supplies, the e-commerce operators will collect the TCS at 1% of the net taxable value from the supplier.

Applicability of TCS

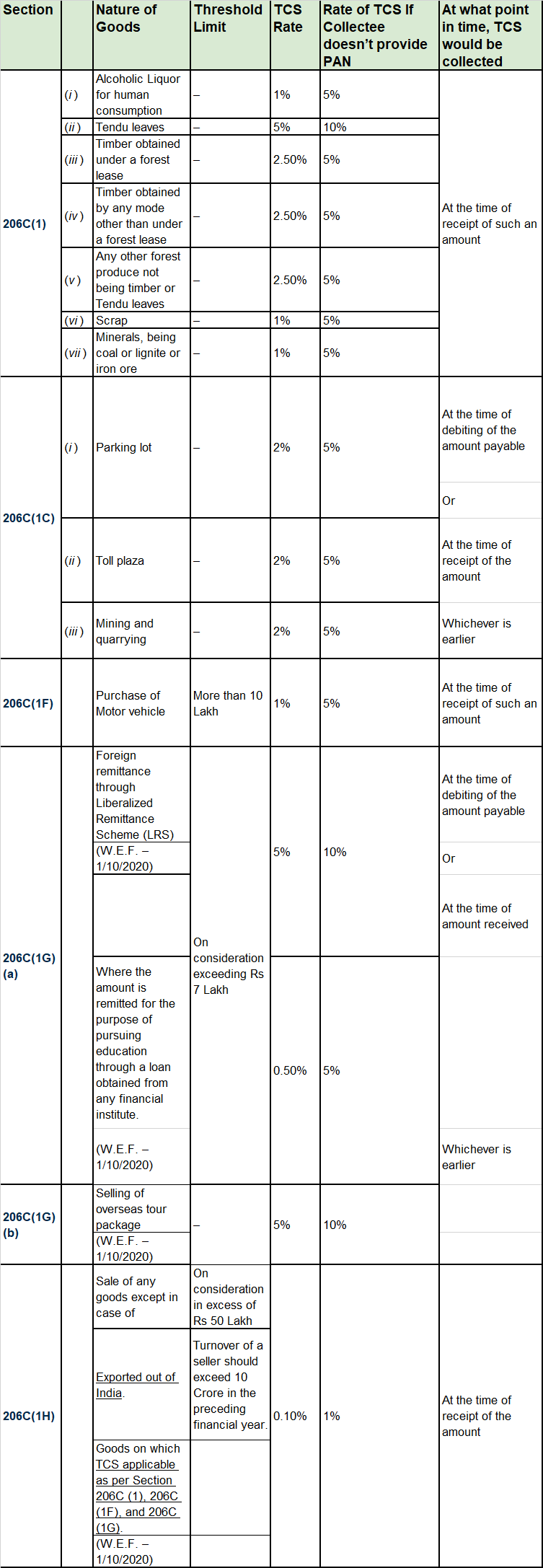

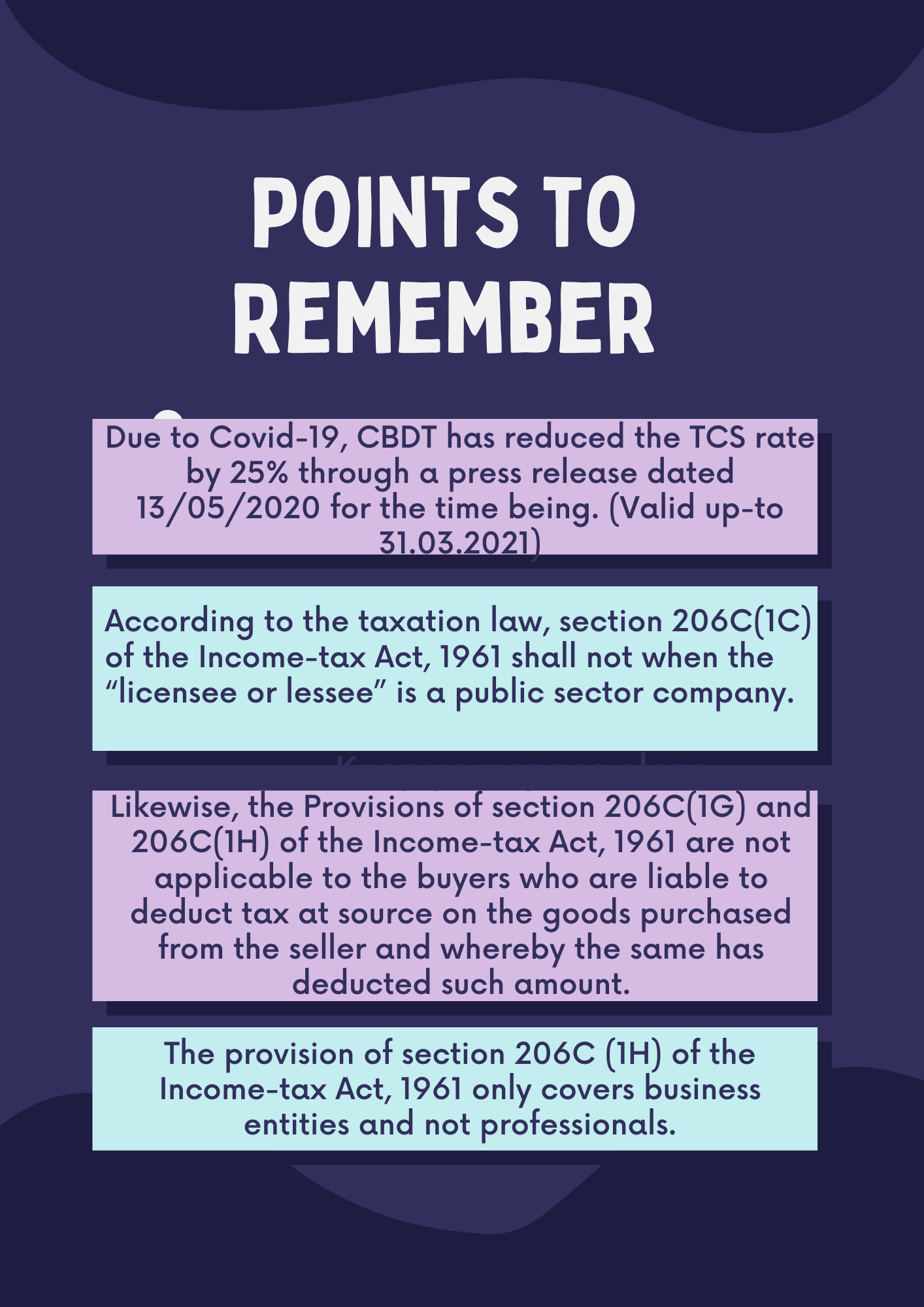

The next takeaway point to learn in TCS is its Applicability, according to the section 206C of the Income Tax Act, 1961, TCS shall apply on the following goods at the following rates –

Who can Collect TCS under GST?

TCS is liable to be collected from certain operators who work, own, and overseas commerce platforms. In addition, TCS can be applicable if operators collect the considerations from customers or clients for suppliers or merchants. Lastly, when the e-commerce platform operator pays the collected tax amount to the sellers, they must deduct the sum as TCS and pay the net amount.

Below listed are few exemptions to the TCS provisions for the service provided by an e-com platform:

- Hotel Accommodation/clubs (unregistered providers)

- Transportation of travelers – radio taxi, motor cab, bikes

- Services like plumbing, carpentry, etc. for Housekeeping (unregistered providers)

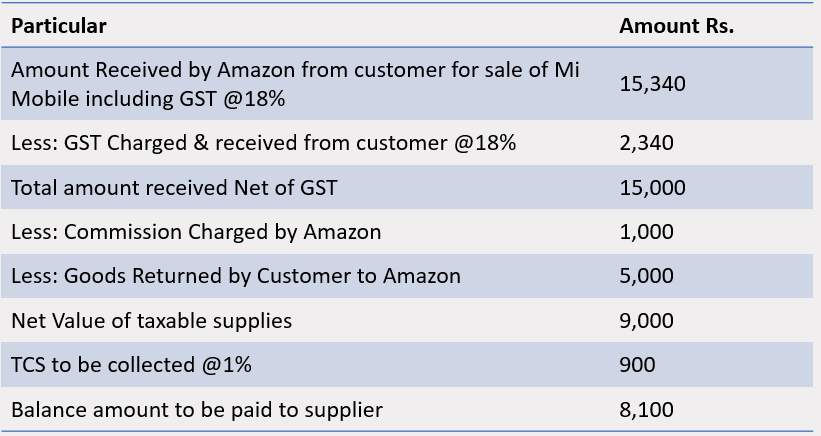

Calculation of TCS under GST

On the net value of taxable supplies 1% TCS needs to be collected.

Net Value of Taxable supplies means Total amount received from the customer excluding GST received, Commission charged, return/refund made to the customer.

Registration for TCS Provisions of GST

It is mandatory for all e-commerce operators who are liable to collect TCS under GST to register themselves irrespective of turnover under section 24(x) of the GST act. Therefore, they need to register themselves as e-commerce operators in the form REG-07.

This registration is required for each state if they are operating in different states.

Exception for Registration: Individuals who supply goods & services through an e-commerce operator must register themselves, except when they are making supplies that are notified under section 9 (5) of CGST Act and do not cross the turnover limit GST registration as required for normal registration.

Due Date for Depositing TCS

During the month, TCS will be deducted wherein the supply is made. TCS is deposited within 10 days from the month's end of supply to the Government's credit. The Tax collected is paid in the following way:

For example, if Amazon collected TCS of Rs 1 lakh in January then it shall deposit the tax collected to the government on or before 10th February.

TCS Return

Monthly Statement: E-commerce should furnish a monthly statement in Form GSTR-8 within 10 days from the end of the month. These details in GSTR-8, provided by the Operator, shall be made available electronically to each of the suppliers in Part C of FORM GSTR-2A on the Common Portal after the due date of filing of FORM GSTR-8.

Annual Statement: E-commerce, electronic commerce operator, must file an Annual statement in form GSTR 9B by the 31st of December following the end of every financial year. E-Commerce++ electronic commerce operator can rectify errors in the statements filed, if any, latest by the return to be filed for September, following the end of every financial year.

TCS Certificate

- A tax collector collects the Tax and deposits TCS to the Government

- The tax collector then files a TCS return, i.e., Form 27EQ, mentioning the Buyer's details and the amount of Tax.

- Once they file TCS return, and they issue a TCS certificate in the Form 27D

- The TCS certificate contains the following information:

- Name of the Seller and Buyer

- TAN of the seller, i.e., who is filing the TCS return quarterly

- PAN of both seller and Buyer

- Total Tax collected by the seller

- Date of collection

- The rate of Tax applied

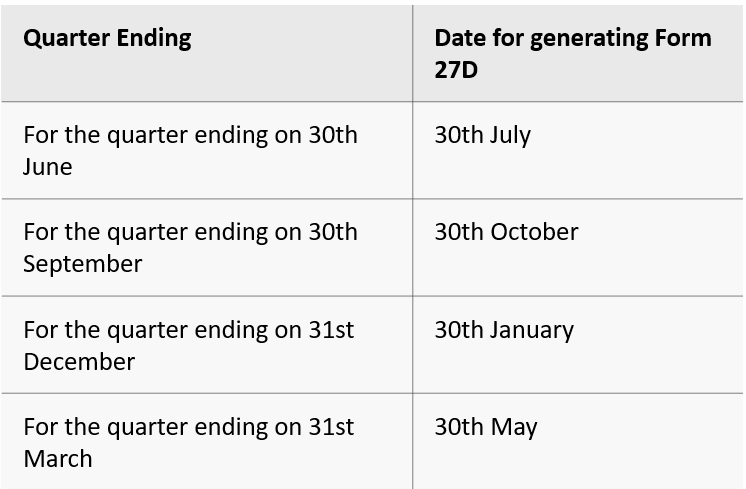

- The TCS certificate must be issued to the buyer with 15 days of the filing of TCS returns

- The due date of issuing the TCS certificate is as follows:

Fees/Penalty for late filing of Return of Tax Collected at Source(TCS)

For the late filing of the TCS return, you will be liable to pay late fees under section 234E of the IT Act of Rs.200/- per day. It will be subject to the maximum amount of TCS until the return is filed.

In addition to the late fees under section 234E of the Income-tax Act, 1961, a person who fails to file the return of TCS within the due date to pay the penalty under Section 271H of the Income-tax Act, 1961, which is minimum of Rs. 10,000/- and can be extended to Rs.1,00,000/-.

Refer the below article, to know how to apply TCS in Deskera Books?

https://www.deskera.com/care/india-gst-how-to-apply-tcs-in-deskera-books/

Impact of TCS under GST

From the e-commerce platform business perspective, they should enroll for TCS return under GST in each state in which they work before first Oct 2018, which is the successful date of executing TCS provision.

The ERP software must be all around incorporated to apply these arrangements in everyday business easily. Besides, the supplier's working capital selling through an online platform will be impeded until they document their return and guarantee the abundance of taxes paid. It can keep SMEs suppliers from selling products or services online.

From the Government's perspective, tax evasion will decrease since the tax will be collected at every transaction. Moreover, ERP software like Deskera Books, is ready with TCS provision, can simplify the whole complex process & ensure smooth business operations.

Related Articles:

- How to Register for India GST?

- How to Register for GST on the GST India Portal. A Step by Step Guide

- Complete guide to E-way Bills in India GST

- GST Calculator – Online Goods and Services Tax Calculator

- What is GSTIN?

- What is GSTN?

- Step-by-Step Guide for India GSTR Filing

- Understanding HSN Codes & SAC Codes Under India GST

- All about GST Compensation Cess

- What Is Input Credit (ITC) under GST ?

- Understanding Reverse Charge Mechanism (RCM) in India GST

- Special Economic Zone (SEZ) under GST

- What is TDS on Salary

- Making TDS Payments Online in India - The Complete Guide