Do you need additional time this year to file your business tax return? Form 7004 is your solution; you can submit IRS Form 7004, which will offer you an automatic six-month extension to submit your business tax papers. Form 7004 does not provide you with a tax payment extension.

Even if you anticipate owing taxes, you must pay them on time. Check out our guide on requesting a tax extension and calculating your tax liability. The following are the subjects covered:

- What Does Form 7004 Mean?

- Form 7004-related aspects

- How to Fill Form 7004

- Advantages and disadvantages of a business tax extension

- Why Should a Company File a Business Tax Extension?

- What tax consequences do charitable gifts have?

- Getting ready for tax season

- Key Takeaways

What Does Form 7004 Mean?

Form 7004 covers a wide range of returns and give you an extra six months to file them. It does not, however, extend payment deadlines, and the IRS must receive it by the usual tax deadline, which for some firms is March 15.

A business tax extension is guaranteed when you file Form 7004, but only if you estimate your tax owed correctly, file on time, and complete the form correctly. Form 7004 covers a wide range of returns and extends the deadline by six months. However, according to the IRS, you can only get this extension if you:

1. Complete Form 7004 clearly and accurately.

2. Calculate the amount of taxes you owe.

3. Submit Form 7004 before or on the deadline for the form for which you require an extension.

4. Pay any taxes owed.

When you file Form 7004, you're promised an extension, but only if you estimate your tax due correctly, file by the appropriate time, and complete the form appropriately.

Form 7004-related aspects

Who is required to submit Form 7004?

Most businesses can request an extension of time to file certain tax and information returns by filling out Form 7004. For corporations, S companies, partnerships, and multiple-member LLCs filing as partnerships, the form functions as an extension application.

Form 7004 is used to request an extension on:

• Form 1065, the partnership tax return

• Form 1120, the C corporation tax return

• Form 1120-S, the S corporation tax return

• Form 1065, the partnership tax return for limited liability corporations (LLCs).

It also applies to a number of other IRS forms, which we've mentioned below.

You must submit Form 7004 by the due date of the corresponding tax return. Because the approval process is automated, you will not receive notification if your request is approved. However, if the request is denied, the agency will contact you.

The majority of businesses that successfully file this form are granted a six-month extension.

An extension to file Form 1041-A, the "Trust Accumulation of Charitable Amounts," an information statement, is one exemption. Form 8868 can be used to request an extension of time to file this form.

If your company is located in Texas or another location where FEMA has declared a catastrophe due to winter storms in 2021, you won't need to file your 2020 taxes with an extension. The IRS has moved the filing and payment deadlines for businesses in certain areas from March 15 to April 15, 2021.

Who is unable to complete Form 7004?

Form 7004 will not be used by sole proprietors to request a tax-filing extension.

Because there is no legal separation between the business and the owner, sole proprietors can request an automatic filing extension by completing IRS Form 4868. This year's deadline is May 17, 2021, and the extension is valid until October 15, 2021. However, you must pay any taxes due by the May deadline.

Form 1041-A, which some firms utilize to submit charity information, is another exemption. Business owners should file Form 8868 to obtain an extension on this form.

It's useful to know: The IRS has extended the tax filing deadline for individuals and sole proprietors in Texas, Louisiana, and Oklahoma due to recent winter storms in the Southwest.

If you live in one of these states, you have until June 15, 2021 to file your federal income tax return. If you need to file your return after June 15, you can request an extension using Form 7004.

When is the deadline for Form 7004?

If you don't have tax software that can fill out the forms for you, the IRS website has copies of the forms and directions for completing them.

After you've finished, deduct your business expenses from your earnings to get your net profit or loss. You add the amount to your personal income tax form, together with all of your other items, and mail or electronically submit it.

Whether you have a corporation or a partnership, you calculate your taxable business income in the same way, though the paperwork is lengthier. These records would also be filed separately from your individual tax return.

Your 7004 must be submitted on or before the applicable tax return's due date. Keep in mind that if you file Form 7004 correctly, the IRS will automatically give you a tax extension, and the IRS will not contact you if your application is approved. They'll only contact you if your request for an extension is denied.

By filing Form 7004: Application for Automatic Extension of Time to File by the initial due date of the return, most business tax returns can be extended.

Corporation deadlines

If your company is established as a S corporation, you must file your income tax return or request an extension by the 15th day of the third month following the end of the tax year. If your company is a C corporation, the extension must be submitted by the 15th day of the fourth month following the end of the tax year.

If your C Corporation is a calendar year taxpayer with a December 31 year end, for example, you must file your 2021 tax return or request an extension by April 18, 2022.

Partnership deadlines

If your company is established as a partnership, you must file your income tax return or request an extension by the 15th day of the third month following the end of the tax year. If your partnership is a calendar year taxpayer with a December 31 year end, for example, you must file your 2021 tax return or request an extension by March 15, 2022.

Common deductions to consider

Once you've filed your business tax extension form, you can start looking for other ways to maximize your tax advantage. In the rush to file in the spring, many valuable write-offs are neglected, so take advantage of the extra time to look into common deductions like these:

Office equipment and technology

The majority of your office supply and technology purchases can be fully expensed, whether you're updating your phone, buying computers, or getting i Pads for everyone.

Thanks to COVID-19, this now includes sanitary items as well as home office equipment for employees. To ensure that you get the most out of your tax refund, keep note of all receipts and expenses.

COVID-19 provides tax relief.

Despite the fact that numerous programs have stopped, COVID-19 continues to have an impact on small business finances, and the IRS continues to offer tax relief. Current COVID-related tax choices are listed in this IRS advice.

Many businesses benefit from the Employee Retention Credit, which gives refundable tax credits against employment taxes. Others may be able to benefit from allowable deductions like paid time off and tax credits for businesses with less than 500 employees.

With a company tax extension, you have more time to investigate these deductions, but it can still be difficult.

Personal use deductions

If you use a vehicle for business, you can deduct those costs on your tax return. Mileage or real expenses might be used to compute this deduction.

The majority of business owners choose the mileage approach, which costs 58.5 cents per business mile.

Expenses related to travel

This deduction, which covers travel, housing, and transportation-related expenses such as rental cars, taxis, trains, tolls, and more, is frequently underutilized by business owners.

Travel expenses are totally deductible, unlike meals and entertainment, which are only eligible for a 50% deduction. Examine your prior year's travel and establish a record of any customer or vendor meetings, business meetings, facility visits, board or shareholder meetings, conferences, and so on.

Restaurants and nightlife

Dinners, lunches, and early-morning coffee meetings add up, especially if you utilized the time to discuss business with a partner, new client, vendor, or strategically.

In all of these cases, business owners are entitled to the full deduction, so be honest about your actual expenses rather than underestimating them.

Additional business expenses

Keep in mind that you can be eligible for considerably more tax breaks than you think. Business owners frequently miss out on additional deductions because they don't understand all of their possibilities or are scared about an audit.

If you keep good records, there's no reason not to include the full amount of all your business expenses. Even if the IRS disagrees, denying it is the IRS's worst alternative.

Warnings About Tax Return Extensions

Payments are not going to be extended! Make sure you send your tax payment along with your extension application by April 15, the deadline for filing your tax return, to avoid fines and penalties. This includes both your individual and business tax obligations.

Annual worker and contractor reporting will not be extended. Even if your employer intends to file an extension, the deadline for reporting on W-2 forms and 1099-MISC forms cannot be extended. The deadline for the next year is January 31.

Submissions on time

Knowing when to file your extension application can be challenging. In most situations, your request for an extension is due at the same time as your tax return.

However, establishing when a tax return is due, especially a corporation tax return can be difficult.

The actual due date for returns varies from year to year according to where the due date occurs on the calendar. If the due date falls on a weekend or holiday, the tax return is due the next working day.

Check for mistakes and update your information.

Make that your application and tax return is error-free. If you have income through a partnership or a limited liability corporation, you must file your business taxes on Schedule C or as part of your personal tax return (LLC).

Form 4868 must be filled out. The process of submitting an extension request is simple, but there are a few pitfalls to avoid. Your full name, mailing address, and social security number should all be included.

Ensure that you're using the correct tax ID number. Because your application is for a personal tax return, the tax ID number on your extension is your personal Social Security number, not the number for your business.

Include

(a) personal income,

(b) company income, and

(c) self-employment tax liability in your calculation, if appropriate.

This easy tax calculator may be useful.

Form 7004 Filing Requirements

The deadline for submitting extensions on any federal income tax return is the same as the deadline for filing the return. The deadline for filing a tax return varies from year to year. If the due date falls on a weekend or holiday, it will be postponed to the next working day.

The IRS moved the deadline for submitting 2020 individual income tax returns from April 15 to May 17, 2021 in 2021. Individuals, including those who pay self-employment tax, are only affected. It excludes partnerships, companies, and anyone else who would be required to file Form 7004.

You don't have to worry about your request being approved because this is an automatic extension. Then, by the extension deadline, you must file your tax return.

What should you bring to your tax preparer?

You'll need to give some vital documentation if you're dealing with a tax preparer. They will need to verify your identity first. If they are preparing your taxes on your behalf, you must provide your Employer Identification Number, often known as a tax ID.

Your financial condition will also be needed by your tax preparer. Total sales or service receipts, sales records, returns, business bank account interest, and other sources of income, as well as business tax extensions, are all included.

It also includes your inventory, the total dollar amount of beginning inventory, the total dollar amount of ending inventory, goods that were removed for personal reasons, and necessary materials and supplies. A tax preparer will also need information on your business expenses, as you may be qualified for certain deductions and credits that minimize your overall tax liability.

Recognize qualifying credits and deductions.

The importance of tax credits and deductions in the filing process cannot be overstated. Using deductions lowers taxable income for a company, while using credits lowers your overall tax burden.

A variety of tax credits for businesses are available.

The IRS website lists a number of business tax credits, such as those for utilizing bio-diesel or providing specialized services to employees, such as childcare.

Check with your tax preparer or, if you're using a tax prep software tool, answer questions about your business operations to ensure you don't miss out on any possible deductions or credits.

How to Fill Form 7004

Calculate the amount of tax you owe

You get more time to file your tax return with an extension, but not more time to pay the tax you owe. So, if you owe the IRS money, you must still pay by the original due date.

• Here are the dates as a reminder: March 15 is the deadline for submitting Form 1065, U.S. Return of Partnership Income, by partnerships and limited liability companies (LLCs), and Form 1120S, U.S. Income Tax Return for a S Corporation, by S corporations.

• April 15 for sole proprietorship and single-member LLCs filing Schedule C, Profit or Loss From Business, and April 15 for C corporations filing Form 1120, United States Corporation Income Tax Return

If you pay your taxes beyond the initial due date, the IRS may charge you penalties and interest, so figure out how much you owe and include a payment with your extension request.

To complete a 7004, you'll need the following information:

• Your name, address, and phone number

• The type of business organization you have and which tax forms you need to file • The total tax amount you estimate to owe

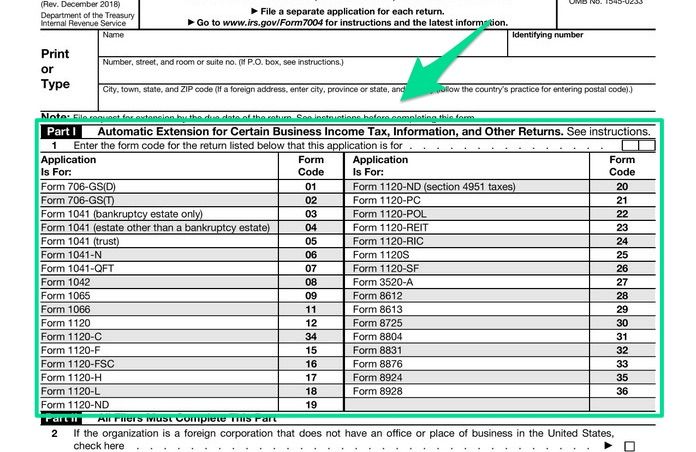

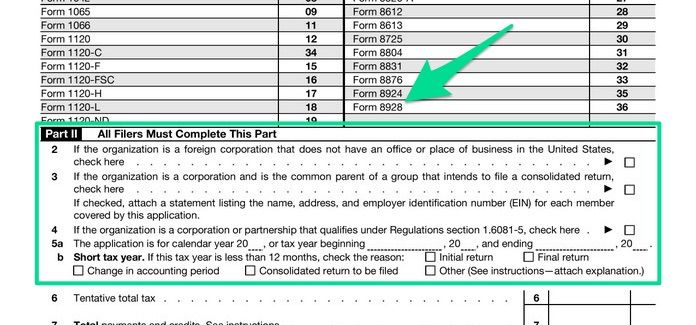

Form 7004 is split into two sections.

Fill out the form Part One

To obtain an extension, most businesses fill out Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. Partnerships, multiple-member LLCs, S corporations, and C corporations are all included.

Sole proprietors and single-member LLCs are the only exceptions. Single-member LLCs and sole proprietorship do not file separate company tax returns. Instead, they use Schedule C to disclose their business profits and losses. As a result, these entities must submit Form 4868 to request a personal extension.

You only have one line in this part to specify which tax form you require an extension for. You must file a separate Form 7004 for each tax form if you intend to file more than one. The following is a list of options:

- Form 706-GS(D), Generation-Skipping Transfer Tax Return For Distributions

- Form 706-GS(T), Generation-Skipping Transfer Tax Return For Terminations

- Form 1041, U.S. Income Tax Return for Estates and Trusts

- Form 1041-N, U.S. Income Tax Return for Electing Alaska Native Settlement Trusts

- Form 1041-QFT, U.S. Income Tax Return for Qualified Funeral Trusts

- Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

- Form 1065, U.S. Return of Partnership Income

- Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return

- Form 1120, U.S. Corporation Income Tax Return

- Form 1120-C, U.S. Income Tax Return for Cooperative Associations

- Form 1120-F, U.S. Income Tax Return of a Foreign Corporation

- Form 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation

- Form 1120-H, U.S. Income Tax Return for Homeowners Associations

- Form 1120-L, U.S. Life Insurance Company Income Tax Return

- Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons

- Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return

- Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations

- Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts

- Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies

- Form 1120-S, U.S. Income Tax Return for an S Corporation

- Form 1120-SF, U.S. Income Tax Return for Settlement Funds (Under Section 468B)

- Form 3520-A, Annual Information Return of Foreign Trust With a U.S. Owner

- Form 8612, Return of Excise Tax on Undistributed Income of Real Estate Investment Trusts

- Form 8613, Return of Excise Tax on Undistributed Income of Regulated Investment Companies

- Form 8725, Excise Tax on Greenmail

- Form 8804, Annual Return for Partnership Withholding Tax (Section 1446)

- Form 8831, Excise Taxes on Excess Inclusions of REMIC Residual Interests

- Form 8876, Excise Tax on Structured Settlement Factoring Transactions

- Form 8924, Excise Tax on Certain Transfers of Qualifying Geothermal or Mineral Interests

- Form 8928, Return of Certain Excise Taxes Under Chapter 43 of the Internal Revenue Code

Fill out the Request for Extension Form.

It's simple to fill out the extension form. You don't even have to sign the extension request or explain why you need more time to the IRS.

Fill out Form 7004 as follows:

• At the top of the form, enter your company name, tax identification number, and address.

• Select the appropriate form code in Part I to identify the type of tax return your company submits (i.e., Form 1120 for a C corp, Form 1065 for a partnership, etc.)

• In Part II,

o If the extension request is for a foreign corporation that does not have a place of business in the United States, check the box on line 2 in Part II.

o If your firm is the parent company for a group of companies that files a consolidated tax return, check the box on line 3.

o If your firm qualifies for an extended deadline, check the box on line 4 to make your tax filing by June 15. Partnerships and corporations that keep their books and records outside of the United States, foreign corporations with a place of business in the United States, and domestic corporations whose primary source of income is from the United States and its possessions are all eligible for the extended deadline.

o On line 5, state the calendar or tax year for which you're asking an extension by filling in the fields.

o Fill in your projected tax liability, any payments you've already made or credits you plan to take that will lower your tax burden, and the amount due that you'll pay with your extension request on lines 6 through 8.

You'll answer questions about your business structure, the tax year you're filing for, and the amount of tax you plan to owe in this part. Here's a breakdown of the section by line:

• Line 2: If your company is a foreign corporation with offices outside the United States, check this box.

• Line 3: If your company's parent company intends to file a combined return, check this box. You must include a list of all members of the consolidated group, including their names, addresses, and EIN numbers.

• Line 4: Check this box if your company is a corporation or partnership that qualifies under Regulations section 1.6081-5.

• Line 5a: Fill in the details for the tax year your company utilizes.

• Line 5b: Select the appropriate option to explain why you have a short tax year.

• Line 6: Determine how much you anticipate owing for the tax year. Enter 0 if you don't expect to owing taxes.

• Line 7: Enter the amount here if you've previously made payments or claimed refundable credits.

• Line 8: To calculate your balance owing, subtract line 7 from line 6 and enter it here.

Submit the form.

Form 7004 can be submitted in two ways:

• E-file: Business owners can create an e-services login profile and use the IRS's e-filing system to submit Form 7004 to the IRS.

• Mail it in: Owners can also send Form 7004 to one of the IRS's mailing addresses. Returns are deemed timely filed if they are postmarked by the applicable form's due date.

You have a few months after submitting the form to get your papers in order. Meanwhile, make sure you're paying your quarterly estimated taxes and getting started on your company taxes.

• Make electronic payments. To make federal tax payments, most firms must use the Electronic Federal Tax Payments System (EFTPS). You can plan direct debits of tax payments from your business bank account using this technology. You can enroll online or request an enrollment form by calling EFTPS Customer Service at 800-555-4477. If you're utilizing EFTPS for the first time, the IRS will verify your information by sending a personal identification number (PIN) to your IRS address of record. This method takes five to seven business days, so it's not a viable choice for paying taxes on the spur of the moment.

Submit Your Business Tax Return before the Extended Deadline

When you request an extension, you usually have an additional six months to file your business tax return. The extended deadline for calendar-year taxpayers is:

Partnerships, multiple-member LLCs, and C companies have until September 15 to file.

• The deadline for sole proprietors and single-member LLCs is October 15.

The deadline is moved to the next working day if any of the days indicated fall on a weekend or holiday.

Remember to factor in state income taxes! Some states accept the federal extension, while others insist on using a state-specific form. To guarantee you don't miss your state tax filing deadline, check with your state's Department of Revenue or your tax preparer.

Advantages and disadvantages of a business tax extension

As tax deadlines approach, businesses may wonder if they should request for a tax extension.

The IRS has made a provision with both advantages and disadvantages. Consider some of the advantages and disadvantages that a company can face if it files for a tax extension.

Avoid paying a late filing fee.

By obtaining a company tax extension, you may be able to avoid the late filing cost. According to the IRS, the penalty for filing late is normally 5% of the due taxes for each month or portion of a month that a tax return is late.

This penalty starts accruing the day after the tax filing deadline and is capped at 25% of your unpaid taxes.

More time to complete your taxes

A tax extension could extend your deadline by up to six months. Once the typical tax deadline has gone, an accountant will be less irritated and will have a clear time frame for getting into a business's financial situation. With the extra time, an accountant may be able to find deductions that would otherwise go unreported.

The extra time will also allow the company to double-check calculations, preventing the need for future tax returns.

A business can know exactly how much money it owes and plan its budget accordingly.

It's not difficult. Because they don't want to deal with the lingo, many small business owners would rather not fill out any additional IRS paperwork. Filing for an extension, on the other hand, is usually a simple and quick procedure. In addition, the generally held belief that asking an extension will result in an audit is unfounded.

Disadvantages

Unsuitable Timetable

Because of the extra time required to file taxes, other company duties may be postponed in order to complete the taxes before the deadline. Important customer targets and initiatives may fall off your to-do list while you focus on doing your taxes.

Late payment may result in penalties.

While requesting a business tax extension can help avoid late filing penalties, firms may still be subject to a separate penalty if they pay their taxes late. Even if a tax extension is granted, businesses can save money by filing their taxes as soon as possible.

The late payment penalty is 0.5 percent to 1% of the amount outstanding, and it accrues monthly from the day after the tax filing deadline, or company tax extension.

A company could have to wait for a loan.

If a corporation wants to take out a loan, delaying tax filing could make the procedure more complex. Some lenders require a copy of the most recent tax return as proof of the business's revenue. If a company fails to file a tax return, it may be impossible to acquire the necessary funds.

There are benefits and drawbacks to filing a business tax extension. By familiarizing themselves with tax legislation, businesses can make the greatest decision for their circumstances and needs.

Tax preparation programs can help.

The bulk of individual taxpayers will file their returns electronically this year. As the IRS has made it easier to do so and the use of tax preparation software has risen in popularity, the figure has topped 80% in recent years.

Several companies that prepare returns for electronic submission charge for e-filing, even though the IRS does not. Business tax extensions are available for free or at a reasonable cost.

As previously said, if your firm uses bookkeeping or accounting software, exporting all necessary data into the most popular tax preparation software is rather simple. The programs will walk you through a series of questions to figure out the deductions you are eligible for and will prepare your tax return for you. The program will then allow you to e-file your business tax extension directly from it.

You may prepare and file your taxes utilizing a number of reputable software programs, such as company tax extension. Each of these tax software programs follows a guided interview format that takes you through dozens of screens. The software calculates the answers and enters them into the appropriate fields on IRS forms and schedules after you answer the questions.

Importing W-2s, 1099s, and other income records, as well as guaranteed accuracy for computations, aid if you're audited, and technical support, are all key features to look for.

You can also have your return prepared by a professional accountant or tax preparer. If you choose this route, make sure you give yourself plenty of time to gather the proper documentation and book an appointment so you don't get caught off guard. The tax season has begun, and as the filing deadlines near, it will only become busier.

Why Should a Company File a Business Tax Extension?

Business taxes, on the other hand, can be challenging.

Getting all of your receipts together can feel like a full-time job, especially if you're not the most organised person on the planet.

There will be times when events are beyond your control. However, there may be compelling reasons to request a tax extension for your business.

You have more time to save for retirement when you work for yourself. Some individuals advise against filing a business tax extension, but if you find yourself in this situation, a business tax extension permits you to continue contributing to your retirement funds for another six months.

You can contribute to a Simplified Employee Pension IRA (SEP-IRA) if you're self-employed and have one up until the tax filing deadline, including a company tax extension.

By extending the deadline from April 15 to October 15, you can contribute to your retirement plan for an extra six months. This is helpful if you're behind schedule and didn't fulfill your previous year's investment goal of 15%.

What tax consequences do charitable gifts have?

If they itemize their deductions on their income tax returns, individuals who make qualifying charitable contributions can deduct up to 60% of their adjusted gross income. For taxpayers who take the standard deduction, charitable contributions are not deductible.

Corporations can deduct certain charitable contributions; however they can only deduct 10% of their pre-tax revenue per year.

Over-payments are allowed to be carried forward for a maximum of five years. The sort of gift you give, such as cash, real estate, or stock, may have an impact on how your contributions are evaluated.

Some charitable contributions can be deducted as business expenditure. If your firm received a benefit in exchange for the donation, such as ad space or event sponsorship, it may be considered a business expense.

Getting ready for tax season

You can prepare for tax season by doing a few things. The IRS offers a paycheck inspection tool to ensure that the correct amount is deducted from each paycheck.

The projected business tax extension withholding is also compared using a tax withholding estimator.

These resources should be utilized in conjunction with any internal analysis that your accountant performs as part of their spending review.

Knowing the laws governing business tax extensions, on the other hand, may help you or your business team make the best decision when it comes to submitting before the deadline or delaying it for six months.

Working closely with your business tax extension preparer can help you determine if filing a business tax extension is the right decision for your company. Businesses should be aware of any changes in expenses or other tax legislation idiosyncrasies.

There's no reason not to take advantage of the IRS's extension if you believe it will help you.

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key Takeaways

- Filing a business tax return is a necessary element of running a company, but the deadline might sneak up on you. Don't panic if you're still working on your bookkeeping or going through receipts for tax deductions. The IRS will extend the deadline for filing your tax return by six months. All you have to do now is submit an extension request.

- You'll need to give some vital documentation if you're dealing with a tax preparer. They will need to verify your identity first. If they are preparing your taxes on your behalf, you must provide your Employer Identification Number, often known as a tax ID.

- Small businesses file their business taxes on Schedule C with the owner's personal tax return. These are single-member sole proprietorship and limited liability companies (SMLLCs). Both the business and personal components of the tax return are covered by the Form 4868 business tax extension application.

- You have more time to save for retirement when you work for yourself. Some individuals advise against filing a business tax extension, but if you find yourself in this situation, a business tax extension permits you to continue contributing to your retirement funds for another six months.

- A second extension beyond the one granted until October 15 is not possible. A return can still be filed after this date, but expect to pay additional penalties. However, it's better to be late than never in this situation to prevent additional penalties as a result of further delaying the filing of a return. According to the IRS, a failure-to-file penalty is frequently higher than a failure-to-pay penalty.

Related articles