Irrespective of your business's size, type, and domain, accurate accounting will always be at the top of the priorities list. Accounting brings us to the debits and credits which sit at the opposite end of each other. Both should be noted down in a synchronized way and eventually balance the equation.

With time, the business expands; business owners tend to find it increasingly difficult to manage accounts. There are more assets to account for, more employees, their salaries, operating expenses, more infrastructure, higher taxation, and what not!

The subject is conspicuously relevant to the bookkeepers or accountants who use the double-entry technique of accounting.

In other words, your transactions involve more intricacies and complexities. However, you must maintain clean and tidy account books and keep a close watch on your business’s growth.

There are many advantages of being informed about accounting, basic accounting principles, and recording every tiny detail about your income and expense. How can we do that? Through a clear understanding of debits and credits.

The following is what we shall learn about in this article:

- What is Double-Entry Accounting?

- Debits Vs. Credit in Accounting

- Credits and Debits with Different Account Types

- FAQs

- How can Deskera Help You?

- Key Takeaways

What is Double-Entry Accounting?

The key aspect of this system is that the debits and credits must always match to allow for transactions to be error-free. The double-entry bookkeeping system follows the accounting equation given here:

Listed below are some important definitions that we frequently encounter in the process of balancing transactions:

- Assets = All the money or cash owned by the company

- Liabilities = All the things that the company owes

- Owner’s equity = The amount invested by the owner in the company

- Income = Money generated by the business through the sale of products and services

- Expense = Money used by the company for business operations

Once we have a grip over these basic entities, it becomes a lot easier to account for all the transactions happening within the company. With this, you must also understand that double entry is all about balancing the equation on both sides. Let us take a simple example to gain an insight into this.

Let’s say with a starting balance of $3000, you purchase furniture for your office worth $1000.

You pay rent for the office space, $1200.

Then, you have an invoice from your client for $800.

We observe that in all three transactions, the sum of debit and credit values comes to $3000.

Debits Vs. Credit in Accounting

To comprehend the difference between debits and credits, we must first know what they mean. When it comes to debits and credits, consider them to work in tandem. A debit should always exist with the corresponding credit. For every debit or dollar recorded, an equal amount must be entered as a credit to balance the transaction.

The two impacts of an accounting entry are traditionally known as Debit or Dr and Credit or Cr. This brings us to discuss the Duality Principle. It says the accounting system is built on the principle that there will always be an equal number of Credit entries for every Debit entry.

For example, if you need to buy new printers for your office, it would be a credit in your cash account because money is leaving your business to buy something. However, if you observe your equipment list, the printers are now added to your asset list. As we must also account for the money used to purchase the goods (printers, in this case), it is critical to record the transaction with the necessary debit.

Owing to this purchase transaction, your cash account gets decreased or credited, and your asset account gets debited or increased. The printers are now your company’s assets which can be used and, further down the line, can be sold.

However, a very vital point here is that not all businesses have it that simple. Your account books are not going to be so easy to balance. It will be laced with a lot more transactions and many more entries. Just like in the case of printers, we will have to consider the depreciation which an asset undergoes over the years of use. The tangible and intangible assets will have to be considered for depreciation and amortization accordingly.

Credits and Debits with Different Account Types

Whether it is a sole proprietorship or a small firm, accounting is an integral part of all kinds of businesses. Debits and credits work differently depending on the type of account, and they might be recorded in different places on a company's general ledger. However, the equation should still be balanced and correct. If the equations seem abrupt and do not tally, you must check the numbers and the entries for any mistakes.

A company's chart of accounts consists of five major accounts and several subaccounts that belong under each category. These can be customized to meet the demands of a company. These 5 major accounts are as follows:

- Assets

- Liabilities

- Income

- Expense

- Equity

Precise documentation is critical because a single transaction may involve debits and credits in several subaccounts spanning different categories. Each sort of account is described in the upcoming sections.

Assets

Objects owned by a corporation that can be sold or utilized to create products are called assets. This applies to both tangible or the physical assets and intangible or the intangible goods. Assets can be classified into three categories based on their convertibility, physical existence, and usage.

Current assets and Fixed assets are the two kinds of assets based on the convertibility of the assets.

Examples of current assets: cash, cash equivalents, debt bonds, equity, etc.

Examples of Fixed assets: furniture, office building, machinery, software, etc.

Based on physical existence, the assets can be tangible (physical) or intangible (non-physical).

Examples of tangible assets: cash, vehicles, inventory, etc.

Examples of intangible assets: goodwill, licenses, software, patents, trademarks, etc.

Based on the usage the assets can be classified as either operating assets or non-operating assets.

Operating assets are the ones that are required daily for business operations.

Examples of Operating assets: prepaid expenses, cash, Accounts receivable, inventory, etc.

Non-operating assets are the assets that do not contribute to the day-to-day operation of the company.

Examples of Non-operating assets: loan receivable, outdated machinery, excessive plot or land, idle equipment, etc.

Liability

Accounts that represent the amount owed to various creditors by the company are called liabilities. This can include things like bank loans, taxes, delinquent rent, and money owed for credit purchases. Bank loans and unpaid taxes are examples of liabilities subaccounts.

Equity

The equity account represents the money left with a company after it sells its assets and pays off all of its liabilities. It is also termed the net worth of the business. The remaining funds belong to the company's owners or shareholders.

It is often termed stockholder's equity, as well.

Income or Revenue

Revenue accounts are reported on the income statement and used to track a company's earnings or income. This income could be from the sales of goods or services, interest income, and income from investments.

Expense

The amount that indicates what a company must spend in order to operate is called the expense account. Rent for the office space, supplies, utilities, and employees’ salaries are just a few examples.

To remember how debits and credits work in different accounts, look at the chart below. As a rule, the debits go on the left, and credits go on the right. You will also note that both debit and credit are the exact opposite of each other.

FAQs

This section discusses some of the common questions regarding debit and credit in accounting.

What Are the Benefits of Double-Entry Accounting?

Single-entry accounting is a simplified representation of a single transaction that simply shows yearly net income. When compared to single-entry accounting, double-entry accounting provides a considerably more thorough view of your organization. Double-entry accounting allows you to examine how complex transactions are balanced across a variety of aspects of your firm, including inventory, depreciation, sales, and expenses.

How can I know if something is a debit or a credit?

When it comes to debits and credits, small-business accounting can be perplexing. Some accounts are increased or decreased in different amounts depending on the transaction. Although there are intricacies in every trade, understanding debits and credits becomes straightforward if you are mindful of the following:

- More assets, less liability, and less equity = Debits

- Fewer assets, more liability, and more equity = Credits

How can Deskera Help You?

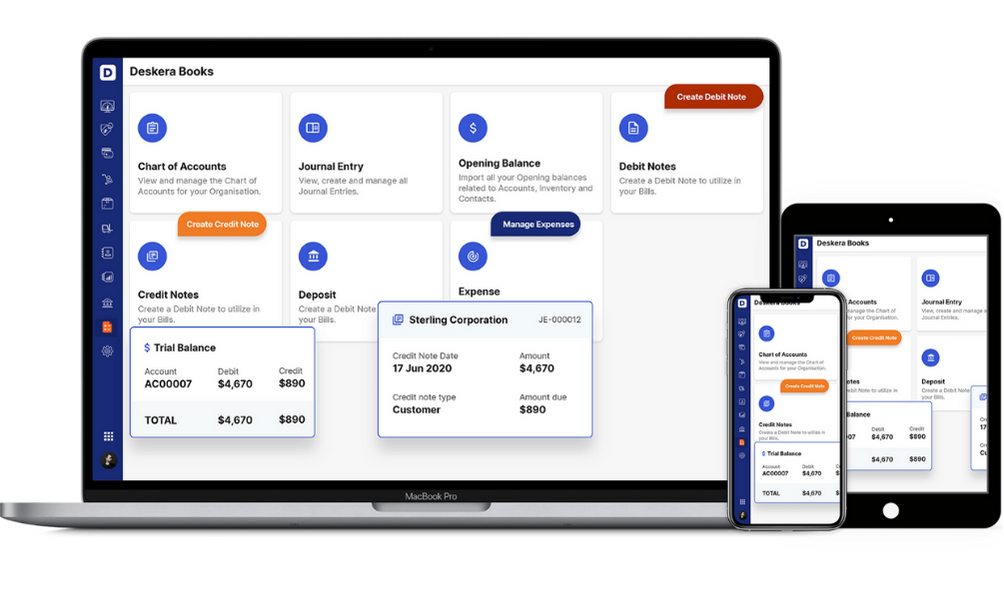

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- Debits and credits depict the giving and receiving aspects of business transactions, allowing for a complete image of a company's operations and, consequently, keeping the books clean

- Double-entry accounting is ideal for recording debits and credits since it enables complex transactions to be recorded across numerous accounts

- Debits are on the left side of the ledger, whereas credits have always been recorded on the right

- Because debits and credits behave differently depending on the account type, it's essential to comprehend how each account operates

- The two impacts of an accounting entry are traditionally known as Debit or Dr and Credit or Cr. This brings us to discuss the Duality Principle

- There are 5 major accounts: Assets, liabilities, expenses, income, and equity

- Objects owned by a corporation that can be sold or utilized to create products are called assets

- Accounts that represent the amount owed to various creditors by the company are called liabilities

- The equity account represents the money left with a company after it sells its assets and pays off all of its liabilities

- Revenue accounts are reported on the income statement and used to track a company's earnings or income

- The amount that indicates what a company must spend in order to operate is called the expense account

- Debits and credits perform differently with each of these accounts

Related Articles