Ever wondered what truly defines the value of a business? In accounting, assets represent the financial backbone of any organization. From cash in the bank to machinery and even intangible items like patents, assets encompass everything a business owns that adds to its worth. Understanding these assets, categorizing them correctly, and learning to calculate their value can unlock valuable insights into financial health and guide smarter decisions.

In this blog, we'll delve into the fundamentals of assets in accounting: identifying different types, understanding their unique characteristics, and exploring straightforward methods for calculating their value. We'll look at assets as current, fixed, intangible, and financial, breaking down the essentials so you can confidently manage asset reporting and valuation. Whether you're a business owner, accountant, or finance student, this guide will simplify what can seem like a complex part of financial management.

For businesses looking to streamline asset tracking and financial management, a reliable ERP solution can be invaluable. Deskera ERP provides a robust platform designed to manage assets, automate calculations, and simplify reporting, enabling businesses to maintain accurate and up-to-date financial records with ease. With Deskera, identifying and valuing assets becomes a straightforward, automated process, ensuring accuracy and efficiency at every step.

What Are Assets?

Assets are resources owned by an individual, business, or organization that hold economic value and can contribute to future financial benefits. In accounting, assets are essential components of a balance sheet and represent what a business owns that can generate cash flow, reduce expenses, or increase profitability. Assets come in various forms, including physical items like equipment, intangible items like patents, or financial investments.

Key Points About Assets:

- Economic Value: Assets have a measurable worth that can be quantified in monetary terms.

- Future Benefits: Assets are expected to bring future financial gains, either by generating revenue or reducing costs.

- Ownership: Assets belong to the entity (individual or business) and can be used, sold, or leveraged to support its financial goals.

In accounting, assets are generally classified into categories such as current assets (cash, inventory), non-current assets (property, equipment), intangible assets (trademarks, patents), and financial assets (stocks, bonds). Properly identifying and managing assets is crucial for accurate financial reporting and effective decision-making.

Types of Assets

Assets are typically classified into different types based on their characteristics, usage, and how quickly they can be converted to cash. Understanding these types helps businesses manage, report, and utilize their resources effectively. Here are the main types of assets in accounting:

1. Current Assets

- Definition: Current assets are short-term assets that can be converted to cash or used up within one year or within the operating cycle of the business, whichever is longer.

- Examples: Cash, accounts receivable, inventory, and short-term investments.

- Purpose: Current assets are used for day-to-day business operations, providing liquidity to cover immediate expenses and obligations.

2. Fixed (Non-Current) Assets

- Definition: Fixed assets, also known as non-current or long-term assets, are resources intended for long-term use in the business, typically lasting more than one year.

- Examples: Property, buildings, machinery, vehicles, and equipment.

- Purpose: Fixed assets are used in the production of goods or services, and they contribute to the operational capabilities of the business. They are not meant to be sold but depreciate over time.

3. Intangible Assets

- Definition: Intangible assets are non-physical assets that still hold value due to their legal or intellectual property rights.

- Examples: Patents, trademarks, copyrights, goodwill, and brand reputation.

- Purpose: Intangible assets provide competitive advantages, generate revenue, or contribute to brand strength. They are valued on the balance sheet and may be amortized over time.

4. Financial Assets

- Definition: Financial assets are investments held by a business that represent monetary value and are expected to generate financial returns.

- Examples: Stocks, bonds, mutual funds, and ownership stakes in other companies.

- Purpose: Financial assets serve as investments, providing returns through interest, dividends, or appreciation in value.

5. Operating Assets

- Definition: Operating assets are resources used directly in the day-to-day operations of the business.

- Examples: Equipment, vehicles, tools, and production machinery.

- Purpose: These assets are essential for producing goods or delivering services and help drive revenue generation.

Understanding these asset types enables businesses to better assess their financial standing, optimize asset usage, and enhance decision-making regarding resource allocation and investment.

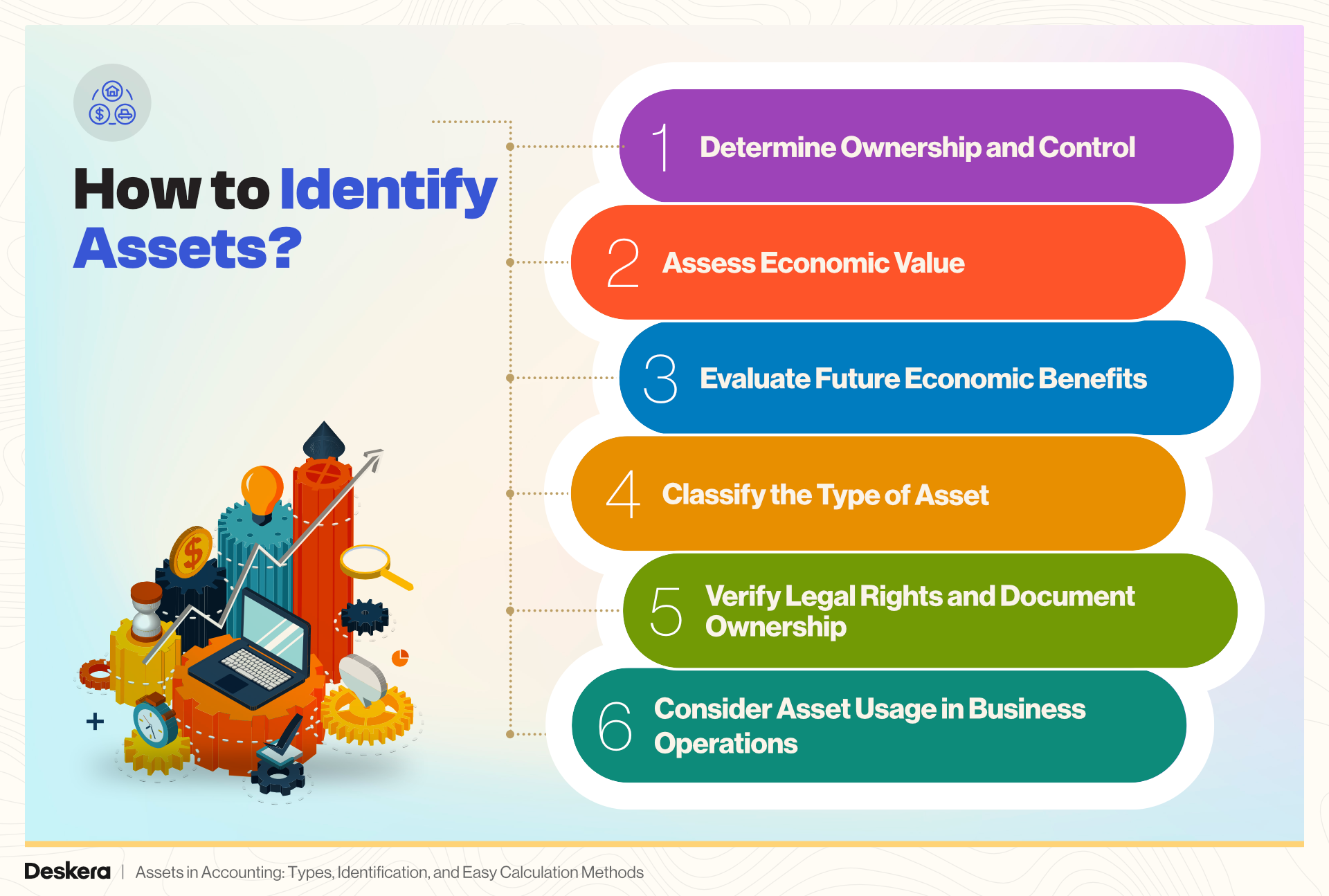

How to Identify Assets?

Identifying assets is a key part of accounting that involves recognizing what resources hold value for a business and classifying them accurately on financial statements. Here’s a guide on how to identify assets effectively:

1. Determine Ownership and Control

- Ownership: An asset is generally something the business owns or has rights to, meaning it can benefit from the resource directly.

- Control: The business should have control over how the asset is used. If the company can decide how to use, sell, or lease it to generate benefits, it can be considered an asset.

2. Assess Economic Value

- To qualify as an asset, the resource should have measurable economic value. This value can be either current (like cash) or potential (like property or equipment that helps generate revenue).

- Measurable Value: If the resource can be valued in monetary terms, it is typically considered an asset.

3. Evaluate Future Economic Benefits

- An asset is expected to contribute to the company’s future financial success, whether by generating income, increasing efficiency, or supporting other business activities.

- Revenue Potential: Assets should have the potential to increase cash flow, reduce expenses, or enhance profitability in the future.

4. Classify the Type of Asset

- Proper classification is essential for accurate financial reporting. Once an asset is identified, it should be categorized into one of the major types:

- Current Assets: Short-term, liquid assets expected to be used or converted to cash within a year (e.g., cash, inventory).

- Fixed (Non-Current) Assets: Long-term resources like property or equipment.

- Intangible Assets: Non-physical assets, like patents or trademarks, with value.

- Financial Assets: Investments such as stocks or bonds.

5. Verify Legal Rights and Document Ownership

- Some assets, like intellectual property, require proof of ownership through documentation (e.g., patents, trademarks).

- For physical and financial assets, official ownership records (e.g., purchase receipts, titles) confirm the asset's legitimacy and can help in accurate accounting.

6. Consider Asset Usage in Business Operations

- Assess how each resource contributes to the business’s daily operations. If a resource is essential for producing goods, providing services, or general operations, it qualifies as an asset.

- Functionality: Assets that are part of production or service delivery, like machinery or software, are critical for a business's operating activities.

Properly identifying assets enables businesses to maintain accurate financial records, which support strategic planning, resource allocation, and financial reporting.

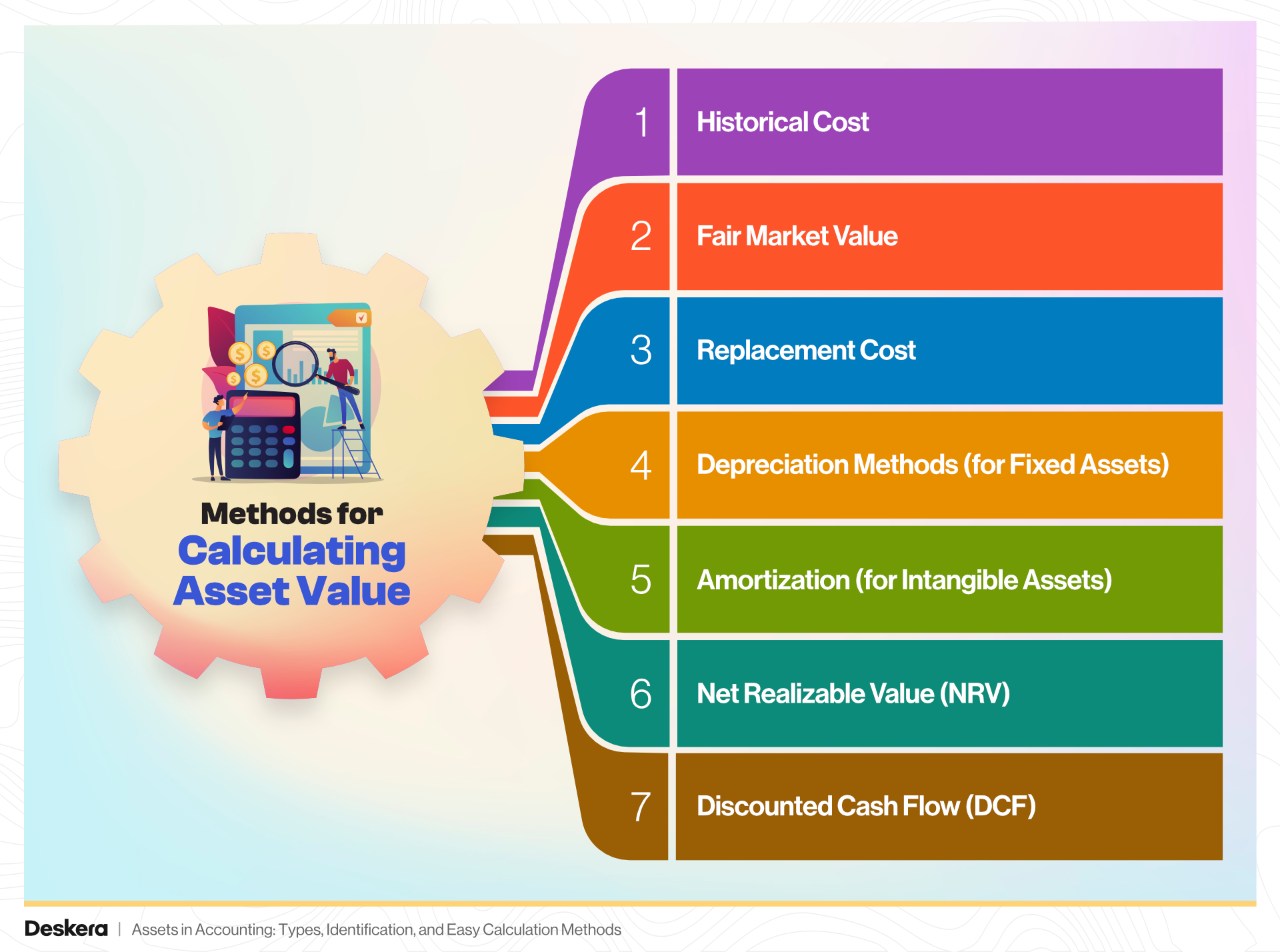

Methods for Calculating Asset Value

Calculating the value of assets accurately is essential for financial reporting, strategic planning, and decision-making. Different methods are used to determine asset value based on the asset type, purpose, and accounting practices. Here are the primary methods for calculating asset value:

1. Historical Cost

- Definition: This method values assets at their original purchase price, including any costs related to acquiring and setting up the asset (e.g., transportation, installation).

- Application: Commonly used for fixed assets, such as property and equipment.

- Pros and Cons: It’s straightforward and objective but may not reflect the asset's current market value, especially for assets held long-term.

2. Fair Market Value

- Definition: Fair market value represents the price an asset could sell for in an open market, reflecting current market conditions.

- Application: Often used for assets like real estate, investments, or intangible assets, where market prices are more relevant.

- Pros and Cons: This approach provides a realistic, current valuation but can fluctuate with market changes, making it less stable for long-term asset valuation.

3. Replacement Cost

- Definition: This method values an asset based on the cost to replace it with a similar asset at current prices.

- Application: Often used in insurance or for assets that lose value quickly and need to be replaced regularly, such as machinery or IT equipment.

- Pros and Cons: Replacement cost reflects current prices but may be challenging to estimate accurately for unique or hard-to-find assets.

4. Depreciation Methods (for Fixed Assets)

- Straight-Line Depreciation: This method spreads the asset's cost evenly over its useful life, offering a consistent expense each year.

- Declining Balance Depreciation: Accelerated depreciation method that applies a higher depreciation rate in the asset's early years, which gradually decreases.

- Units of Production Depreciation: Based on usage, this method depreciates the asset according to the output it produces (useful for machinery).

- Application: Used primarily for tangible, long-term assets like equipment, machinery, and vehicles.

- Pros and Cons: Depreciation methods allocate the asset’s cost over time but may not reflect market value and vary by industry or usage needs.

5. Amortization (for Intangible Assets)

- Definition: Amortization allocates the cost of an intangible asset (e.g., patents, copyrights) over its useful life, similar to depreciation for fixed assets.

- Application: Commonly used for intangible assets that have a finite useful life, like patents or software licenses.

- Pros and Cons: Amortization helps spread costs over time, making expenses predictable, but may not account for market conditions or intangible assets with indefinite lifespans.

6. Net Realizable Value (NRV)

- Definition: NRV is calculated as the estimated selling price of an asset minus any costs associated with selling or disposing of it.

- Application: Often used for inventory valuation, especially if items are near expiration or subject to obsolescence.

- Pros and Cons: NRV provides a realistic measure of inventory value but requires periodic reassessment to reflect changes in market demand.

7. Discounted Cash Flow (DCF)

- Definition: This approach calculates an asset's value based on the present value of expected future cash flows it will generate, discounted back to today’s value.

- Application: Common for investments, financial assets, or projects with long-term benefits.

- Pros and Cons: DCF offers an in-depth, forward-looking valuation but relies heavily on accurate forecasting and discount rates, which can introduce uncertainty.

Each method serves a different purpose and is chosen based on the asset’s nature, market conditions, and reporting requirements. Combining these valuation methods helps create a comprehensive picture of a business’s asset value, supporting sound financial analysis and decision-making.

How to Calculate Assets?

Calculating assets involves identifying and summing the values of all owned items that contribute to a company's financial worth. Here’s a step-by-step guide to calculating assets:

1. Identify All Types of Assets

- Current Assets: These are short-term assets that can be converted to cash within a year, such as cash, accounts receivable, and inventory.

- Fixed Assets: These are long-term assets used for operations, including buildings, machinery, equipment, and land.

- Intangible Assets: Non-physical assets with value, such as patents, trademarks, and goodwill.

- Financial Assets: These include investments in stocks, bonds, and other securities.

2. Calculate Current Assets

- Formula: Sum of cash, accounts receivable, inventory, and other short-term assets.

- Example Calculation:

- Cash: $50,000

- Accounts Receivable: $20,000

- Inventory: $30,000

- Total Current Assets = $50,000 + $20,000 + $30,000 = $100,000

3. Calculate Fixed Assets (Net of Depreciation)

- Formula: (Total Fixed Assets) - (Accumulated Depreciation)

- Example Calculation:

- Total Fixed Assets (original value): $200,000

- Accumulated Depreciation: $50,000

- Total Net Fixed Assets = $200,000 - $50,000 = $150,000

4. Calculate Intangible Assets

- Formula: Sum of the value of all intangible assets.

- Example Calculation:

- Patent: $15,000

- Trademark: $10,000

- Goodwill: $25,000

- Total Intangible Assets = $15,000 + $10,000 + $25,000 = $50,000

5. Calculate Financial Assets

- Formula: Sum of investments, securities, and other financial holdings.

- Example Calculation:

- Stocks: $5,000

- Bonds: $10,000

- Total Financial Assets = $5,000 + $10,000 = $15,000

6. Calculate Total Assets

- Formula: Current Assets + Fixed Assets + Intangible Assets + Financial Assets

- Example Calculation:

- Total Current Assets: $100,000

- Total Fixed Assets: $150,000

- Total Intangible Assets: $50,000

- Total Financial Assets: $15,000

- Total Assets = $100,000 + $150,000 + $50,000 + $15,000 = $315,000

Additional Tips

- For accuracy, regularly update asset values and consider market fluctuations.

- Use accounting software or ERP systems, like Deskera, to streamline asset tracking and calculate depreciation automatically, ensuring consistent and accurate asset valuation.

By following these steps, businesses can get a clear picture of their total asset value, helping to inform financial strategies and maintain accurate accounting records.

What is the Debt to Asset Ratio?

The debt-to-asset ratio is a financial metric that measures the proportion of a company's assets financed by debt. It provides insight into the company's financial leverage and the risk level associated with its capital structure.

Formula: Debt-to-Asset Ratio = Total Debt / Total Assets

- Total Debt includes both short-term and long-term liabilities (e.g., loans, bonds, and other financial obligations).

- Total Assets refers to all assets owned by the company (both current and non-current assets).

Interpretation:

- A high debt-to-asset ratio suggests that a large portion of the company’s assets is financed by debt, implying higher financial risk. This means the company may be more vulnerable to financial difficulties, especially in economic downturns or rising interest rates.

- A low debt-to-asset ratio indicates that the company relies less on debt financing, which is generally considered safer and more stable, but could also suggest underutilization of debt for growth.

Example: If a company has:

- Total Debt = $500,000

- Total Assets = $1,000,000

The debt-to-asset ratio would be:

Debt-to-Asset Ratio = 500,000 / 1,000,000 = 0.5

This means 50% of the company's assets are financed by debt.

The debt-to-asset ratio helps assess a company's financial health and its reliance on debt financing. It allows investors and analysts to gauge the financial risk of a company.

How to Calculate Return on Assets (ROA)

Return on Assets (ROA) is a financial metric that measures how effectively a company uses its assets to generate profit. It shows the percentage of profit a company earns for every dollar of assets it owns.

Formula: ROA = Net Income / Total Assets

- Net Income: This is the profit of the company after all expenses, taxes, and interest have been deducted. It can be found on the company’s income statement.

- Total Assets: This refers to the total value of all assets owned by the company, including both current and non-current assets. It can be found on the company's balance sheet.

Example:

If a company has:

- Net Income = $200,000

- Total Assets = $1,000,000

The Return on Assets (ROA) would be: ROA = 200,000 / 1,000,000 = 0.2 or 20%

This means the company generates a profit of 20 cents for every dollar of assets it owns.

ROA is a key indicator of how efficiently a company is utilizing its assets to produce profit. A higher ROA indicates better asset management and operational efficiency, while a lower ROA may signal inefficiencies in asset usage.

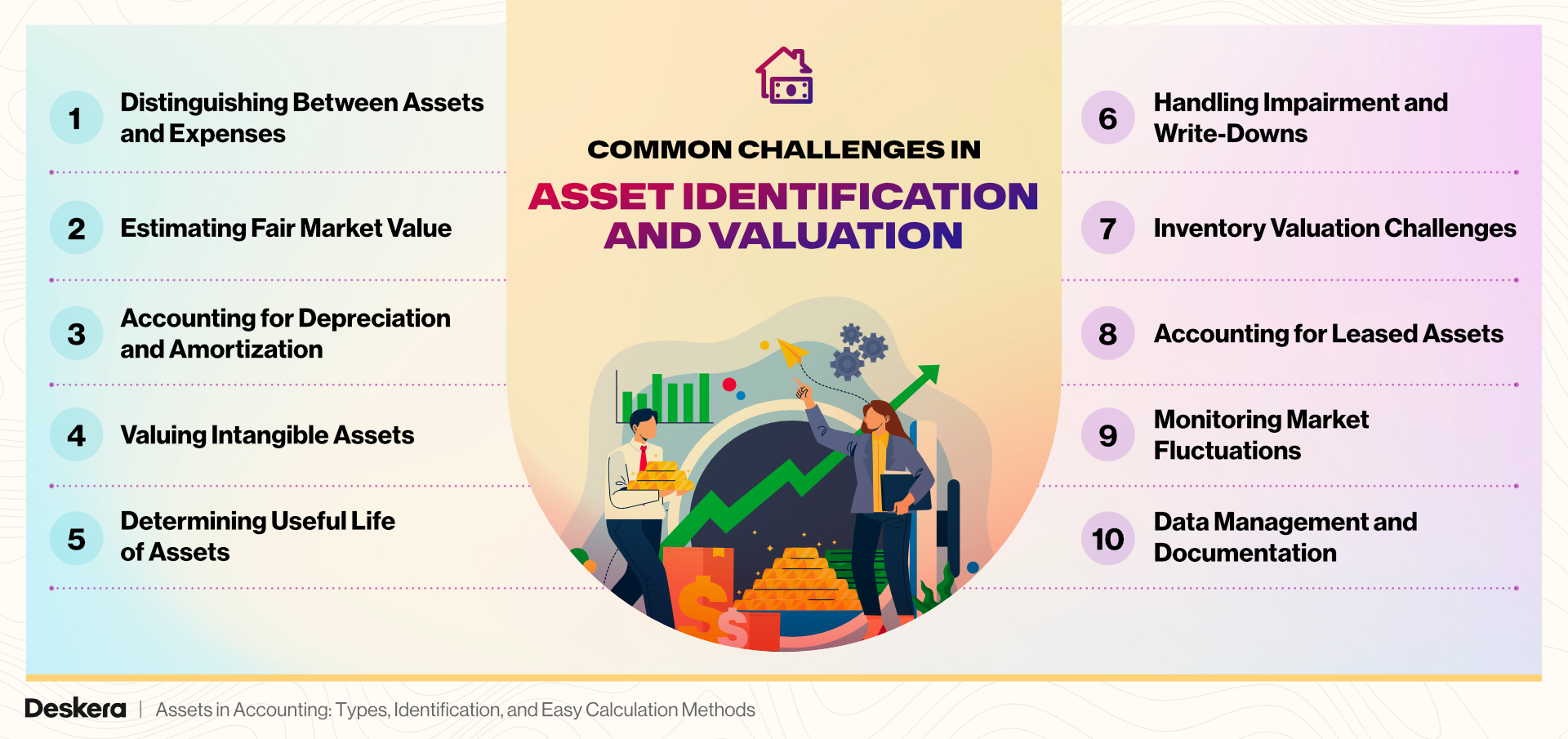

Common Challenges in Asset Identification and Valuation

Identifying and valuing assets accurately is crucial for businesses, but this process comes with several common challenges. These obstacles can impact financial reporting, tax compliance, and overall business decision-making. Here are some of the key challenges:

1. Distinguishing Between Assets and Expenses

- Challenge: Determining whether an item should be classified as an asset (long-term benefit) or an expense (immediate cost) can be difficult, especially for smaller items or operational costs.

- Impact: Misclassifying expenses as assets (or vice versa) can lead to inaccuracies in financial statements, potentially affecting profitability and tax obligations.

2. Estimating Fair Market Value

- Challenge: Fair market value fluctuates due to changes in demand, market conditions, and asset depreciation, making it challenging to assess accurately.

- Impact: Using outdated or inaccurate market data can result in an asset’s undervaluation or overvaluation, impacting balance sheets and misleading stakeholders.

3. Accounting for Depreciation and Amortization

- Challenge: Selecting the right depreciation or amortization method for an asset’s useful life can be complex, especially for assets with unpredictable wear and tear or obsolescence.

- Impact: Incorrect depreciation rates can distort an asset's true value, affecting profitability and tax calculations.

4. Valuing Intangible Assets

- Challenge: Intangible assets, like intellectual property, goodwill, and trademarks, lack physical presence and have subjective valuation criteria.

- Impact: Under- or overvaluing intangible assets can misrepresent a company’s true worth, especially in sectors where intellectual property is critical.

5. Determining Useful Life of Assets

- Challenge: Estimating how long an asset will provide economic value is often challenging, especially for technology, which may become obsolete quickly.

- Impact: Incorrect estimates of useful life affect depreciation schedules and long-term asset management strategies, impacting the accuracy of financial statements.

6. Handling Impairment and Write-Downs

- Challenge: When an asset's value drops significantly below its recorded book value, an impairment or write-down may be necessary, but recognizing and calculating these adjustments can be challenging.

- Impact: Delaying impairment can lead to overstated asset values, while frequent write-downs may suggest instability to stakeholders.

7. Inventory Valuation Challenges

- Challenge: Valuing inventory correctly involves methods like FIFO (First-In, First-Out), LIFO (Last-In, First-Out), or weighted average cost, each with its benefits and drawbacks.

- Impact: Choosing the wrong valuation method or mismanaging inventory costs can distort profitability and complicate tax reporting.

8. Accounting for Leased Assets

- Challenge: With changing accounting standards, many leases must now be recorded as assets, but determining which leases qualify and calculating their value can be complex.

- Impact: Failing to account for leased assets correctly can lead to non-compliance with accounting standards and inaccurate financial statements.

9. Monitoring Market Fluctuations

- Challenge: Market values for assets like real estate, securities, and commodities can fluctuate widely, impacting asset valuations if not regularly updated.

- Impact: Failing to account for market changes may lead to inaccurate valuations, affecting financial decision-making and strategic planning.

10. Data Management and Documentation

- Challenge: Accurate asset identification and valuation require robust record-keeping, which can be challenging without proper tools or systems.

- Impact: Incomplete documentation can hinder accurate valuation and make it challenging to verify ownership or calculate depreciation.

Addressing these challenges requires a strategic approach that includes reliable data, regular assessments, and adherence to accounting standards. Many businesses leverage ERP systems like Deskera to streamline asset management, ensuring up-to-date valuations, compliance, and efficient reporting processes.

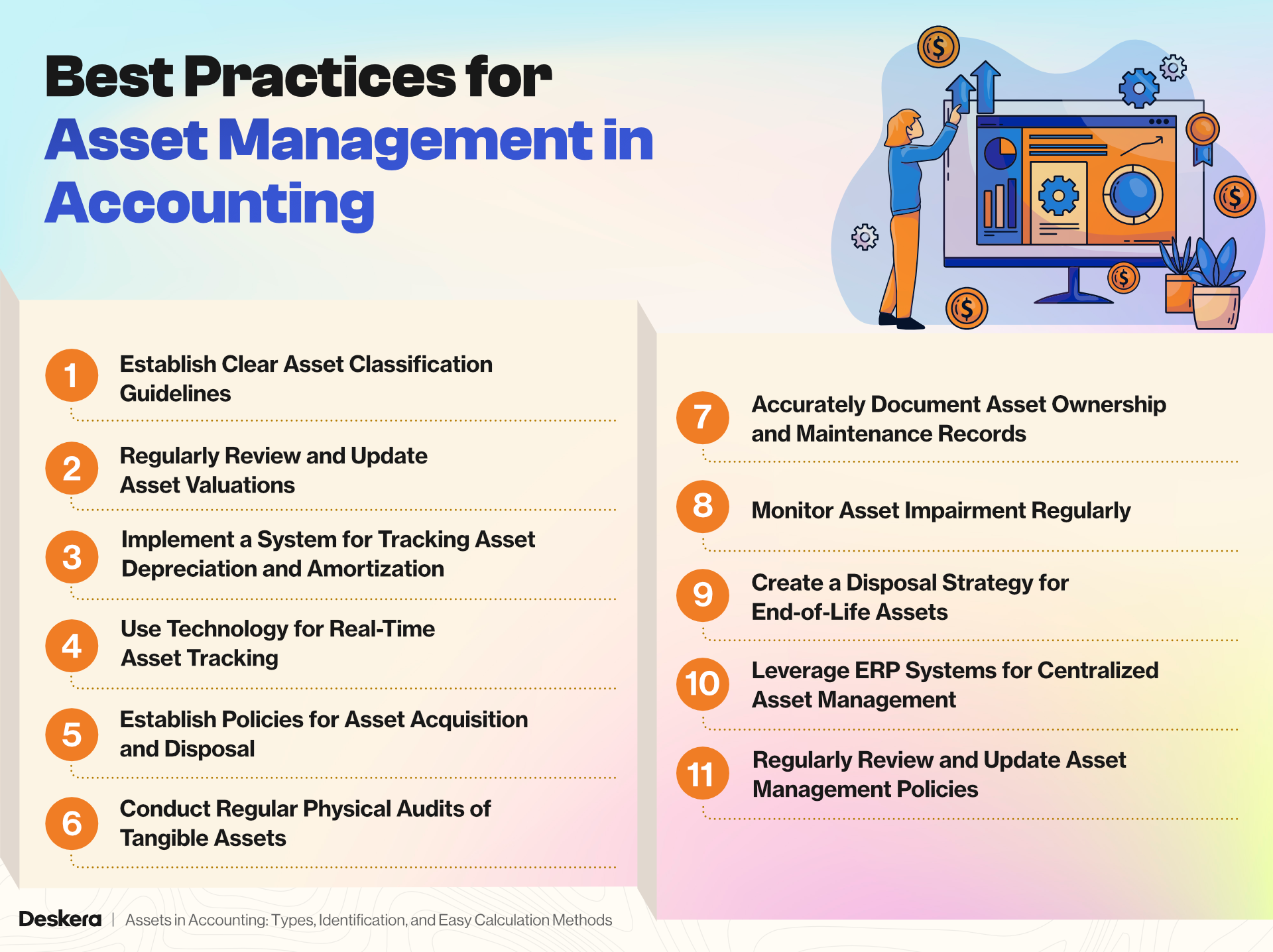

Best Practices for Asset Management in Accounting

Effective asset management in accounting is crucial for maintaining accurate financial records, ensuring compliance, and maximizing resource efficiency. Here are some best practices for managing assets in accounting:

1. Establish Clear Asset Classification Guidelines

- What to Do: Create a clear framework to classify assets, distinguishing between current, fixed, intangible, and financial assets.

- Why It Helps: Standardized classification helps in tracking and reporting assets consistently, reducing the risk of misclassification and enhancing reporting accuracy.

2. Regularly Review and Update Asset Valuations

- What to Do: Schedule periodic reviews of asset valuations, considering market trends and asset conditions.

- Why It Helps: Regular updates ensure assets are valued accurately, preventing outdated valuations that could mislead stakeholders and impact financial statements.

3. Implement a System for Tracking Asset Depreciation and Amortization

- What to Do: Use a systematic approach for calculating depreciation (e.g., straight-line or declining balance) and amortization for tangible and intangible assets.

- Why It Helps: Proper tracking helps allocate asset costs over time, reflecting accurate asset values in financial statements and aiding in tax calculations.

4. Use Technology for Real-Time Asset Tracking

- What to Do: Employ asset management or ERP software (e.g., Deskera ERP) to track asset locations, usage, and depreciation automatically.

- Why It Helps: Real-time tracking improves visibility and control, reduces manual errors, and enhances the ability to manage assets efficiently across multiple locations.

5. Establish Policies for Asset Acquisition and Disposal

- What to Do: Define clear policies and approval processes for purchasing and disposing of assets, including documentation and valuation standards.

- Why It Helps: Consistent acquisition and disposal policies help avoid unnecessary purchases, optimize asset usage, and ensure accurate valuation and documentation.

6. Conduct Regular Physical Audits of Tangible Assets

- What to Do: Periodically verify the physical presence and condition of tangible assets, such as equipment and inventory.

- Why It Helps: Audits prevent misreporting, identify lost or obsolete assets, and provide accurate data for updating asset records.

7. Accurately Document Asset Ownership and Maintenance Records

- What to Do: Maintain detailed records of asset ownership, including purchase receipts, titles, maintenance logs, and warranties.

- Why It Helps: Complete documentation aids in verifying ownership, planning maintenance, and ensuring compliance, especially during audits.

8. Monitor Asset Impairment Regularly

- What to Do: Assess assets for impairment regularly and adjust their book values when necessary, especially for assets that lose value due to market changes or damage.

- Why It Helps: Monitoring impairment prevents overstatement of asset values, ensuring that financial records reflect the actual worth of assets.

9. Create a Disposal Strategy for End-of-Life Assets

- What to Do: Plan for asset disposal at the end of its useful life by assessing resale value, donation options, or recycling programs.

- Why It Helps: A disposal strategy optimizes resource use and prevents obsolete assets from cluttering records or physical space, ensuring more accurate asset tracking.

10. Leverage ERP Systems for Centralized Asset Management

- What to Do: Use an ERP system like Deskera, which offers features for asset tracking, depreciation management, and reporting.

- Why It Helps: ERP systems centralize asset data, automate calculations, and simplify reporting, making asset management more efficient and accurate across departments.

11. Regularly Review and Update Asset Management Policies

- What to Do: Periodically update asset management policies to reflect changes in business operations, industry standards, and regulatory requirements.

- Why It Helps: Adapting policies ensures compliance, reflects the latest best practices, and keeps asset management aligned with organizational goals.

Adopting these practices can enhance asset utilization, improve financial accuracy, and support compliance, especially for organizations managing large portfolios of assets.

How Deskera ERP Can Streamline Asset Management and Enhance Accuracy

Deskera ERP offers a comprehensive suite of tools designed to simplify and automate various accounting and asset management processes.

Here’s how Deskera ERP can help in managing assets more efficiently:

Automated Asset Tracking

Deskera ERP enables real-time tracking of assets across various departments, ensuring that all assets are accounted for accurately. Whether it’s tangible items like machinery or intangible assets like intellectual property, Deskera centralizes asset data for easy access and monitoring.

Depreciation Management

The software automatically calculates depreciation based on predefined rules (e.g., straight-line or declining balance), reducing manual errors. This feature ensures that asset values are updated accurately on financial statements, keeping your records in compliance with accounting standards.

Real-Time Reporting

Deskera provides detailed, real-time asset reports, including balance sheets and depreciation schedules. These reports help businesses gain instant insights into asset performance, maintenance costs, and asset value, enabling smarter decision-making.

Asset Lifecycle Management

With Deskera, businesses can track the entire lifecycle of an asset—from acquisition to disposal. This feature ensures that assets are properly maintained, and any impairments or write-offs are recorded accurately.

Inventory Management Integration

Deskera ERP seamlessly integrates asset management with inventory management, ensuring that any changes in asset status are automatically reflected in the overall inventory system. This integration helps maintain accurate financial and inventory records, reducing the risk of discrepancies.

Compliance and Audits

Deskera’s audit trails and compliance features ensure that all asset-related transactions are properly documented and easily accessible for audits. This feature reduces the risk of non-compliance with regulatory requirements and helps prepare businesses for financial audits with minimal effort.

By leveraging Deskera ERP, businesses can optimize their asset management processes, ensuring accurate financial reporting and improved operational efficiency.

Key Takeaways

- Assets play a crucial role in accounting as they represent resources that can generate future economic benefits. Accurately identifying and calculating assets is essential for accurate financial reporting and decision-making.

- In accounting, assets are valuable resources owned by a business, classified based on their usage and liquidity. Proper understanding of assets ensures correct financial representation and guides business strategies.

- Assets are categorized into current, fixed, intangible, and financial assets, each with unique characteristics and accounting treatment. Understanding these categories helps businesses manage resources effectively and maintain accurate financial records.

- Identifying assets requires distinguishing them from liabilities and expenses. Proper asset identification ensures accurate financial statements and supports effective decision-making regarding resource allocation.

- Calculating asset value involves summing up the individual values of current, fixed, intangible, and financial assets, adjusting for factors like depreciation. This process ensures businesses have an accurate picture of their total asset value.

- The debt-to-asset ratio measures a company's financial leverage, indicating the proportion of assets financed by debt. A higher ratio suggests greater financial risk, as the company relies more on borrowed funds, while a lower ratio implies less reliance on debt, suggesting greater financial stability. This metric is essential for assessing a company's risk level and its ability to manage debt obligations.

- Return on Assets (ROA) measures how efficiently a company uses its assets to generate profit. By dividing net income by total assets, businesses can assess their asset utilization. A higher ROA indicates better efficiency in turning assets into profit, while a lower ROA may suggest the need for improved asset management or operational efficiency.

- Challenges such as estimating fair market value, dealing with asset impairments, and valuing intangible assets can complicate asset management. Recognizing these challenges helps businesses adopt better strategies for accurate asset tracking and reporting.

- Implementing best practices like regular asset audits, accurate classification, and leveraging technology (such as ERP systems) enhances asset management efficiency and ensures consistent financial reporting.

- Deskera ERP simplifies asset management by automating tracking, depreciation calculations, and real-time reporting. It integrates asset data seamlessly into the overall accounting system, ensuring accuracy and compliance while streamlining asset lifecycle management, helping businesses improve operational efficiency and make informed financial decisions.

Related Articles