Is your business something whose products and services will cater to your buyer personas located in the State of Andhra Pradesh? Or is it a business whose raw materials will be most accessible if it is based in the State of Andhra Pradesh?

If your answer to any of these questions is yes, then that means that you will have to get acquainted with all the statutory requirements and obligations that you must comply with in order to ensure that your business runs smoothly and you are not penalized due to contravention. This will also ensure that your business has a reputable and positive standing in the eyes of the law and regulatory authorities.

Thus, it is Andhra Pradesh Shops and Establishments Act, 1988 and Rules, 1990, which you will have to get acquainted with. This Act is applicable to all the commercial establishments and shops in the State of Andhra Pradesh, with its main purpose being the protection of the rights of the employees, whether it is in terms of working hours, overtime, wages, holidays and leaves, close days, and many more such related aspects.

In order to be your complete guide for the Andhra Pradesh Shops and Establishments Act, this article will cover the following topics:

- Andhra Pradesh Shops and Establishments Act, 1988 and Rules, 1990

- Important Definitions in the Andhra Pradesh Shops and Establishments Act

- Registration of the Shops and Commercial Establishments under the Andhra Pradesh Shops and Establishments Act

- Opening and Closing Hours of Shops

- Selling Outside Prohibited, Before Opening Hours, and After Closing Hours of Shops

- Daily and Weekly Hours of Work in Shops

- Interval for Rest and Spread Over Periods of Work in Shops

- Closing of Shops and Grant of Holidays

- Opening and Closing Hours of Establishments

- Daily and Weekly Hours of Work in Establishments

- Interval for Rest and Spread Over Periods of Work in Establishments

- Holidays in the Establishments

- Employment of Children

- Conditions for Employment of Young Persons

- Conditions for Employment of Women

- Leave for the Employees

- Other Holidays for the Employees

- Pay During Leave and Holidays

- Compulsory Enrollment of Employees to Insurance cum Savings Scheme

- Payment of Wages to the Employees

- Wages for Overtime Work

- Deductions from Wages

- Health and Safety to be Maintained in the Workplace

- Fines for the Employees

- Conditions for Terminating the Services of the Employees

- Notice and Payment of Service Compensation to Employees in the Case of Transfer of Establishment

- Maintenance of Registers and Records and Display of Notices

- Restriction on Double Employment on a Holiday or During Leave

- Penalty for Obstructing Inspector, etc

- Penalties for Offenses Committed by the Employer

- Rights and Privileges Under Other Laws, etc., Not Affected

- Exemptions to the Andhra Pradesh Shops and Establishments Act

- Application of the Workmen’s Compensation Act, 1923

- Protection of Persons Acting in Good Faith

- Power of Government to Suspend Provisions of the Act During Fairs and Festivals

- Application of this Act to Cooperative Societies

- Statutory Forms for Compliance

- Some of the Most Important Rules from Andhra Pradesh Shops and Establishments Rules

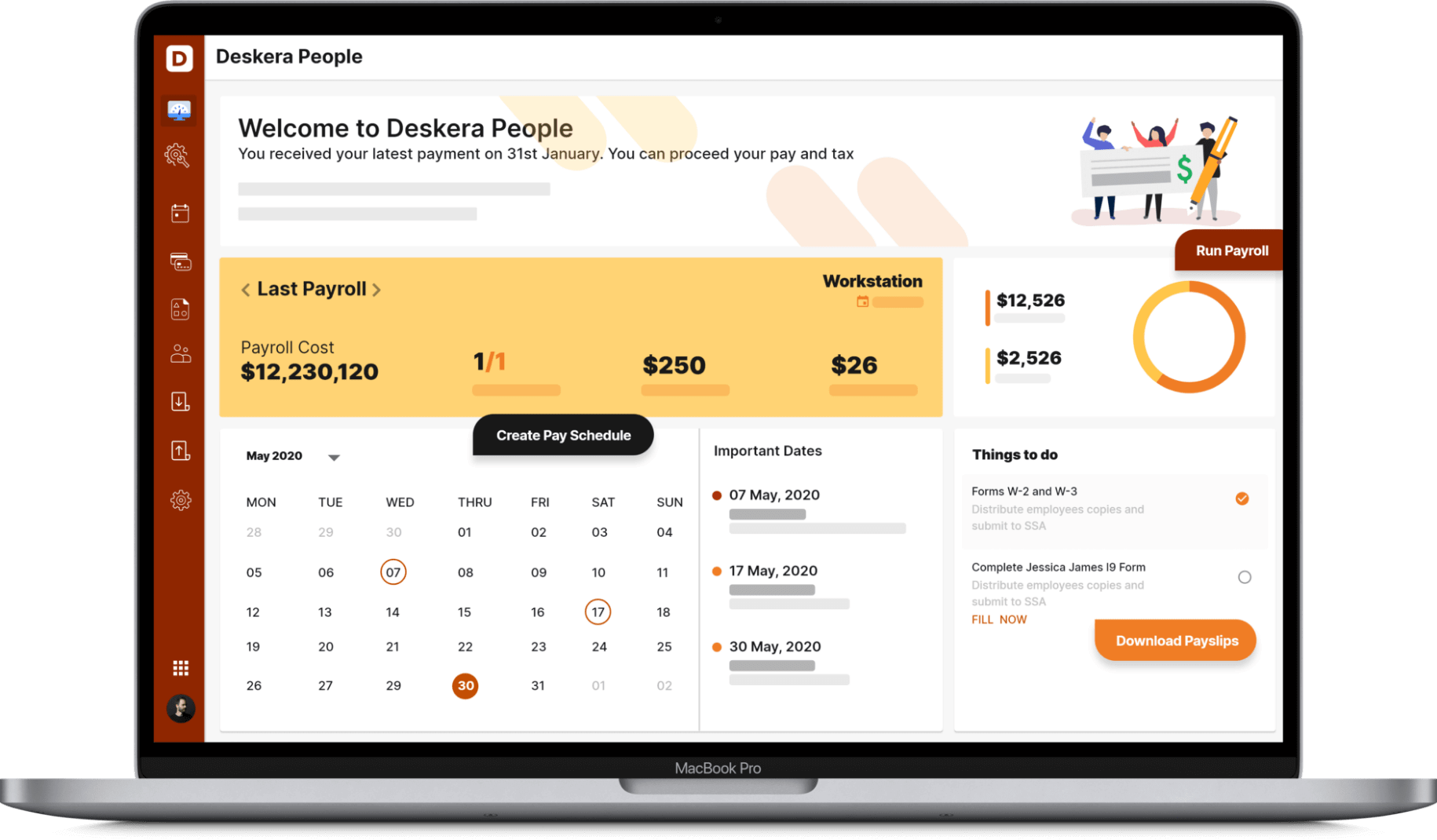

- How Can Deskera Help You?

- Key Takeaways

- Related Articles

Andhra Pradesh Shops and Establishments Act, 1988 and Rules, 1990

The Andhra Pradesh Shops and Establishments Act, 1988 and Rules, 1990 are applicable to all the commercial establishments and shops and commercial in the whole State of Andhra Pradesh as notified by the Government, with the main purpose being protecting the rights of the employees.

In order to do so, this Act provides regulations for:

- Payment of wages

- Work hours

- Terms of services

- Rest intervals

- Overtime work

- Opening and closing hours

- Closed days

- Holidays

- Leaves

- Work conditions

- Rules for employment of children

- Conditions for employment of women

- Conditions for employment of young persons

- Records maintenance

- Maternity leave and benefits

And every such aspect that will ensure the well-being of the employees in the State of Andhra Pradesh irrespective of whether he or she is a local employee, or an intra-state worker, or an inter-state migrant worker.

Important Definitions in the Andhra Pradesh Shops and Establishments Act

Some of the important definitions mentioned in the Andhra Pradesh Shops and Establishments Act are:

- Shop: It refers to any premises where any trade or business is carried on or where services are rendered to the customers. A ‘shop’ includes a shop run by a cooperative society, an office, a godown, a warehouse, a storeroom, or a workplace, whether on the same premises or otherwise, used in connection with such business or trade and such other establishments as the Government may by notification declare to be a shop for the purposes of this Act, but this does not include a commercial establishment.

- Commercial Establishment: This refers to an establishment that carried on any trade, profession, business, or any work in connection with or incidental or ancillary to any such trade, profession, or business or which is a clerical department of a factory or an industrial undertaking or which is a commercial or trading or insurance or banking establishment, and includes an establishment under the management and control of a cooperative society, an establishment of a factory or an industrial undertaking which falls outside the scope of the Factories Act, 1948 (Central Act 63 of 1948) and such other establishments as the Government may, by notification, declare to be a commercial establishment for the purposes of this Act, but this does not include a shop.

- Government: Here, Government means the state government of Andhra Pradesh.

- Day: It refers to the period of twenty-four hours beginning at midnight.

- Week: It refers to the period of seven days beginning at midnight on Saturday.

- Periods of Work: It refers to the time during which an employee is at the disposal of the employer.

- Child: This refers to an individual who has not completed fourteen years of age.

- Young Person: This refers to an individual who is not a child and has not completed eighteen years of age.

- Employee: It refers to an individual who is wholly or principally employed in and in connection with any establishment and includes an apprentice and any clerical or other staff of a factory or an industrial establishment who fall outside the scope of the Factories Act, 1948 (Central Act 63 of 1948), but does not include the wife, husband, daughter, son, mother, father, sister or brother of an employer or his partner, who is living with and depending upon such partner or employer, and is not in receipt of any wages.

- Employer: It refers to an individual who has the charge of or owning or having ultimate control over the affairs of an establishment and includes the Agent, Manager, or other person acting in the management or control of an establishment.

- Register of Establishment: It refers to the register maintained for the registration of establishments under this Act.

- Registration Certificate: It refers to the certificate issued under this Act.

- Wages: It refers to every remuneration. Whether in the format of the allowance, salary, or otherwise, expressed in terms of money, or capable of being so expressed which would, if the terms of employment, express or implied were fulfilled, be payable to an employee in respect of his employment or of work done in such employment. It includes:

- Any remuneration payable under any settlement between the parties or order of a Tribunal or Court.

- Any remuneration to which the employee is entitled in respect of holidays or overtime work or any leave period.

- Any additional remuneration payable under the terms of employment, whether called a bonus or by any other name.

- Any sum which by reason of the termination of employment of the employee is payable under any contract, law, or instrument which provides for the payment of such sum, whether with or without deductions, but does not provide for the time within which the payment is to be made.

- Any sum to which the employee is entitled under any scheme framed under any law for the time being in force but does not include-

I. Any bonus, whether under a scheme of profit sharing or otherwise, which does not form part of the remuneration payable under the terms of employment, or which is not payable under any award or settlement between the parties or order of a Court.

II. The value of any house accommodation, or of the supply of water, light, medical attendance, or other amenities or of any service excluded from the computation of wages by a general or special order of the Government.

III. Any contribution paid by the employer to any person or provident fund and the interest which may have accrued thereon.

IV. Any traveling allowance or the value of any traveling concession.

V. Any sum paid to the employee to defray special expenses entailed on him or her by the nature of his or her employment.

VI. Any service compensation payable on the termination of employment in cases other than those specified in previous main bullet-point number 4.

VII. The subscription paid by the employee to life insurance and the contribution paid by the employer to the life insurance of the employee under the provisions of this Act, and the bonus which may have accrued thereon.

VIII. House rent allowance payable by the employer.

Registration of the Shops and Commercial Establishments under the Andhra Pradesh Shops and Establishments Act

As per the provisions related to the registration of the shops and commercial establishments laid down in the Andhra Pradesh Shops and Establishments Act, you would have to submit an application form in Form A of Andhra Pradesh (Issuance of Integrated Registration and Furnishing of Combined Returns under various Labour Laws by certain Establishments) Act 2015 within 30 days from starting your business.

Once the Inspector has received such a statement, he or she will register the establishment in the register of establishments in such a manner as may be prescribed. Then, a Certificate of Registration will be issued under Form C of Andhra Pradesh (Issuance of Integrated Registration and Furnishing of Combined Returns under various Labour Laws by certain Establishments) Act 2015.

The need for renewal of registration was, however, exempted by Notification G.o.Ms.No.7, Labour Employment Training and Factories (Lab-I), dated 13th February 2019. In fact, through a recent amendment, the Labour Department has introduced the Auto-Renewal of Registration under the Act through Employer Self-Certification along with prescribed online fee payment instead of exempting the registration renewal.

The Andhra Pradesh Shops and Establishments Act requires that you display your registration certificate in a visible place inside the office premises. The benefits of registration under the Andhra Pradesh Shops and Establishments Act are:

- Your establishment or shop will have a legal identity to conduct business within the territory

- Your establishment or shop will be able to avail benefits under various Government schemes.

- Your establishment or shop will be able to operate business bank accounts.

As an employer, you are obliged to give intimation to the Inspector, in the prescribed form, in case any changes have taken place in any of the particulars in the statement given to him or her earlier. This needs to be done within fifteen days from the date on which the change has taken place.

Once the Inspector receives such an intimation and the fees prescribed, he or she will then make the change in the register of establishments in accordance with such an intimation and amend the registration certificate or issue a fresh registration certificate, if necessary.

In case you are closing your establishment, then you will have to give an intimation in writing of the same to the Inspector within fifteen days of the closure of the establishment. On receiving such an intimation, and if the Inspector is satisfied, then he or she will remove the name of your establishment from the register of establishments and cancel the registration certificate.

Remember, if the Inspector is satisfied either on a reference made to him on this behalf or otherwise, that the registration certificate granted or renewed has been obtained by fraud, misrepresentation, or suppression of any material fact or that as an employer, you have willfully contravened any of the provisions of this Act or the rules made thereunder, then the Inspector may, without prejudice to any other penalty to which you may be liable under this Act, revoke or suspend your Registration Certificate, after giving you an opportunity of showing cause.

If you want to appeal against such an order, then you will have to do so within thirty days from the date on which the order is communicated to you. You would have to appeal to such authority as may be prescribed. If you give an appeal after the end of the period of thirty days, then this would be entertained by the appellate authority only if they are satisfied that you were prevented from filing the appeal in time by a sufficient cause. On receiving your appeal, the appellate authority will give you an opportunity to be heard and then dispose of the appeal within two months.

Opening and Closing Hours of Shops

Under the Andhra Pradesh Shops and Establishments Act, the provisions for opening and closing hours of shops are:

- No shop shall on any day be opened earlier or closed later than such hour as may be fixed by the Government by general or special order on that behalf.

- For the purposes of this section, the Government may fix different hours for different classes of shops or for different areas, or for different times of the year.

Note: If any of your customers who were served or are waiting to be served in your shop at the hour fixed for its closing may be served during the quarter of an hour immediately following such hour.

Selling Outside Prohibited, Before Opening Hours, and After Closing Hours of Shops

As per the provisions of the Andhra Pradesh Shops and Establishments Act, no person shall carry on, in or adjacent to, a street or public place, the sale of any goods before the opening hours and after the closing hours as fixed by the Government for the shops dealing in any kinds of goods in the locality in which such street or public place is situated.

However, this section of this Act is not applicable to the sale of:

- Newspapers

- Flowers

- Pan

- Vegetables and fruits

And such other goods as the Government may by notification specify from time to time.

Daily and Weekly Hours of Work in Shops

Under the Andhra Pradesh Shops and Establishments Act, the provisions related to daily and weekly hours of work in shops are:

- Subject to other provisions of this Act, no employee in your shop/s shall be allowed or required to work therein for more than eight hours on any day and forty-eight hours in any week.

- However, your employee/s may be required or allowed to work in your shop/s for any period in excess of eight hours a day or forty-eight hours in a week if you pay them overtime wages for the same. However, this is subject to the following limitations:

- The total number of working hours, including overtime, on any day shall not exceed twelve hours.

- The spread over, inclusive of intervals of rest, shall not be more than thirteen hours on any one day.

- The total number of working hours in any week, including overtime, shall not exceed sixty-two.

- No employee shall be allowed to work overtime for more than seven days at a stretch.

- The total number of overtime working hours in any month (i.e., Calendar Month) shall not exceed fifty hours.

Interval for Rest and Spread Over Periods of Work in Shops

As per the provisions of the Andhra Pradesh Shops and Establishments Act, none of your employees shall be required or allowed to work for more than five hours on any day, without an interval for rest of at least one hour.

However, an employee who was serving a customer at the commencement of the interval may be required to serve him during the quarter of an hour immediately following such commencement.

This means that the periods of work of your employees should be arranged in such a manner that along with his intervals of rest, they should not spread over for more than twelve hours in any day.

However, if your employee/s are working on any day for the purpose of stock-taking and preparation of accounts, on such days, this spread-over should not exceed fourteen hours and provided that you pay them overtime wages.

Closing of Shops and Grant of Holidays

As per the provisions of the Andhra Pradesh Shops and Establishments Act,

- Every shop, whether with or without employees, must remain closed every Sunday, thereby making it a holiday for each of your employees too.

- However, the Chief Inspector may, by notification, specify in respect of any shop or class of shops or in respect of shops or class of shops in any area, any day in the week instead of Sunday on which day such shop or class of shops shall remain closed.

- Additionally, the Chief Inspector may, by notification, require in respect of any specified class of shops that in addition to the weekly holiday mentioned above, the shop be closed for one half-day in a week and as may be fixed by the Government. This means that if such a notification is applicable to your shop, then your employees will be allowed an additional holiday for one half-day in each week, as is fixed for the closing of the shop.

- For the purposes of the additional one half-day holiday in each week, the Chief Inspector may fix different hours for different classes of shops, or for different areas, or for different times of the year.

- As an employer, you are obligated to specify in a notice prominently exhibited in a conspicuous place in the shop the weekly day on which your shop will remain closed if it is required by your shop to give the additional one half a day per week’s holiday.

- As an employer, it would be unlawful of you to call an employee at or for employees to go to your shop or any place for any work in connection with your business on any day or part of the day on which you are supposed to keep it closed.

- No deduction shall be made from the wages of any of your employees on account of any day or part of a day on which it has remained closed, and if such employee is employed on the basis that he would not ordinarily receive wages for such day or part of a day, he shall nonetheless be paid for such day or part of a day, the wages, he would have drawn had the shop not remained closed or had the holiday not been allowed on that day or part of a day.

Closing of Shops in Public Interest During Special Occasions

In addition to the holidays discussed above, the Chief Inspector may, by notification and with the previous approval of the Government, require in respect of any specified class of shops that they shall be closed on any specified day or days in the public interest.

Opening and Closing Hours of Establishments

Under the Andhra Pradesh Shops and Establishments Act, the provisions for opening and closing hours of establishments are:

- On any day, no establishment should be opening earlier or closed later than such hours as may be fixed by the Government by general or special order on that behalf.

- For the purposes of this section, the Government may fix different hours for different classes of establishments or for different areas, or for different times of the year.

Note: In the case of a restaurant or eating-house, any customer who was being served or was waiting to be served therein at the hour fixed for its closing may be served during the quarter of an hour immediately following such hour.

Daily and Weekly Hours of Work in Establishments

Under the Andhra Pradesh Shops and Establishments Act, the provisions related to daily and weekly hours of work in establishments are:

- Subject to other provisions of this Act, no employee in your establishment/s shall be required or allowed to work therein for more than eight hours on any day and forty-eight hours in any week.

- However, your employee/s may be required or allowed to work in your establishment/s for any period in excess of eight hours a day or forty-eight hours in a week if you pay them overtime wages for the same. However, this is subject to the following limitations:

- The total number of working hours, including overtime, on any day shall not exceed twelve hours.

- The spread over, inclusive of intervals of rest, shall not be more than thirteen hours on any one day.

- The total number of working hours in any week, including overtime, shall not exceed sixty-two.

- No employee shall be allowed to work overtime for more than seven days at a stretch.

- The total number of overtime working hours in any month (i.e., Calendar Month) shall not exceed fifty hours.

Interval for Rest and Spread Over Periods of Work in Establishments

As per the provisions of the Andhra Pradesh Shops and Establishments Act, none of your employees shall be required or allowed to work for more than five hours on any day, without an interval for rest of at least one hour.

However, if your establishment is one that requires its employees to work for less than eight hours, then the Chief Inspector may reduce the interval for rest to half an hour on an application made by the employer, with the consent of the employees.

This means that the periods of work of your employees should be arranged in such a manner that along with his intervals of rest, they should not spread over for more than twelve hours in any day.

However, if your employee/s are working on any day for the purpose of stock-taking and preparation of accounts, on such days, this spread-over should not exceed fourteen hours and provided that you pay them overtime wages.

Holidays in the Establishments

Under the Andhra Pradesh Shops and Establishments, the provisions in regards to holidays in the establishment and for the employees are:

- You are obligated to allow in each week a holiday of one whole day to each of your employees.

- The Government may, by notification, require in respect of any specified class of establishments that every employee therein shall be allowed in each week an additional holiday on one half-day, commencing at such hour in the afternoon as may be fixed by the Government. In fact, for this purpose, the Government may fix different hours for different classes of establishments or for different areas, or for different times of the year.

- No deduction shall be made from the wages of any employee in an establishment on account of any day or part of a day on which a holiday has been allowed in accordance with this section, and if such employee is employed on the basis that he would not ordinarily receive wages for such day or part of a day, he shall nonetheless be paid for such day or part of a day the wages he would have drawn, had the holiday not been allowed on that day or part of a day.

- As an employer, it would be unlawful of you to call an employee at or for employees to go to your shop or any place for any work in connection with your business on any day or part of the day on which you are supposed to keep it closed.

Note: Nothing in this section of this Act will be applicable to any employee whose total period of employment in the week, including any days spent on authorized leave, is less than six days.

Employment of Children

As per the provisions of the Andhra Pradesh Shops and Establishments Act, no child shall be required or allowed to work in any establishment.

Conditions for Employment of Young Persons

In regards to the employment of young persons, the provisions and conditions laid down in the Andhra Pradesh Shops and Establishments Act are:

- No young person shall be allowed or required to work in any establishment before 6 a.m. and after 7 p.m.

- Notwithstanding anything in this Act, no young person shall be allowed or required to work in any establishment for more than 7 hours on any day and forty-two hours in any week.

- No young person shall be allowed to work overtime.

Conditions for Employment of Women

In regards to the employment of women, the provisions and conditions laid down in the Andhra Pradesh Shops and Establishments Act are:

- You should ensure that none of your women employees are allowed or required to work in your establishment before 6.00 a.m. and after 8.30 p.m.

- However, if your women employees are allowed or required to work between 8.30 p.m. and 6.00 a.m. in your establishment, then you should ensure that there are adequate safety security measures in place, as well as other safeguards as may be prescribed by the State Government. The safety and security measures referred to here shall include:

1. Provision of shelter

2. Restrooms

3. Night creches

4. Lunchrooms

5. Ladies' toilet

6. Adequate protection of their privacy, dignity, honor, and safety

7. Protection from sexual harassment

8. Employment of at least five women employees together

9. Transportation facilities between the factory premises and the doorstep of their residence

Note: The relaxation in working hours timings discussed in the immediately preceding point shall not be allowed to a women employee during a period of sixteen weeks before and after her childbirth, of which at least eight weeks shall be before the expected childbirth, and for such additional period if any, as specified in the medical certificate stating that it is necessary for the health of the women employee or her child.

Maternity Leave and Benefits

As per the Andhra Pradesh Shops and Establishments Act, the provisions related to maternity leave and benefits are:

- Every woman who has been for a period not less than six months preceding the date of her delivery in continuous employment of the same employer (here, you), whether in the same of different shops or commercial establishments, shall be entitled to receive from you, for the period of:

- Six weeks immediately preceding the day of delivery and

- Six weeks following the day of, such maternity benefit and in such manner as may be prescribed

- The periods of absence from duty in respect of which a woman employee is entitled, as discussed above, will be treated as authorized absence from duty, and the woman employee shall be entitled to maternity benefit, but not to any wages for any of those periods.

Note: None of your women employees shall be entitled to receive such a benefit for any day during any of the aforesaid periods on which she attends work and receives wages thereof.

Leave for the Employees

Under the Andhra Pradesh Shops and Establishments Act, the provisions for leave for the employees are:

- For each of your employees who have served your establishment for two hundred and forty days or more during a continuous period of twelve months, he or she will be entitled to have a leave with wages for a period of fifteen days during the subsequent period of twelve months. However, such a leave with wages may be accumulated up to a maximum period of sixty days, the conditions for which are:

- Provided that any continuous period of service in an establishment preceding the date on which this Act applies to that establishment shall also count.

- Provided further that any leave accumulated by an employee in your establishment under the law applicable to your establishment preceding the date on which this Act applies to it shall not be affected.

- Provided also that every employee in your shop or establishment shall be entitled to encashment of the leave with wages for a period of eight days in every year.

- To apply for the leave as discussed in the bullet point preceding this one, your employee will be required to apply for it in writing, at least seven working full days in prior to the date on which he or she is going to avail the leave. This will give you the time to allow all the leave that your employee has applied for or any portion of it thereof. (Note: This is applicable only as long as the number of installments for taking leave does not exceed three during a period of twelve months.)

- An employee who has been allowed leave for at least five days in accordance with the preceding bullet point shall, before his or her leave begins, be paid the wages due for the period of the leave allowed if he or she makes a request therefor.

- For each of your employees who have served for a period of at least two hundred and forty days during a continuous period of twelve months in your establishment shall be entitled for encashment of eight days of leave with wages that have accrued to him under the first bullet point in this section during the subsequent period of twelve months. As an employer, you shall have to pay to the employee the wages for the leave encashed by your employee within a week of receipt of the application for such encashment from the employee.

- Each of your employees in your establishment shall also be entitled during his or her first twelve months of continuous service and during every subsequent twelve months of such service,

- To leave with wages for a period not exceeding twelve days on the ground of any sickness or accident.

- To casual leave with wages for a period not exceeding twelve days or any reasonable ground.

- Each of the employees in your establishment who has put in at least six months of service under you will also be entitled to a special casual leave not exceeding six days only once during his entire service if he has undergone a vasectomy or tubectomy operation, subject to the production of a certificate therefor from an authorized medical practitioner under whom he has undergone the operation.

- If you discharge any of your employees, or if he or she quits your employment, or if the leave applied for by such an employee has been refused, but this employee was entitled to any leave as per the first bullet point of this section, and that employee has not been availed or allowed to him or her, then you will have to pay him or her the amount, payment under his Act in respect of the period of leave.

- If your employee is lawfully discharged by you when he or she is sick or suffering from the result of an accident, then as the employer, you shall pay to him or her an amount payable under this Act in respect of the period of leave to which he was entitled at the time of his or her discharge, in addition to the amount, if any, payable to him or her as per the third bullet point of this section.

- If your employee is in a hostel attached to a school or college or in an establishment maintained in connection with the boarding and lodging of pupils and resident masters, then all the privileges discussed above in this section will be allowed to him or her. However, these will be reduced proportionately to the period for which he or she was employed continuously in the previous year or to the period for which he or she will be employed continuously in the current year, as the case may be. Additionally, all references to the periods of leave in the first five bullet points of this section shall be construed accordingly, fractions of less than half a day being disregarded.

Note: The Government may, by notification, increase the total number of days of leave allowable under the provision as discussed in the first bullet point of this section and the maximum number of days up to which such leave may be accumulated in respect of any establishment or class of establishments.

Other Holidays for the Employees

Under the Andhra Pradesh Shops and Establishments Act, the provisions for other holidays for the employees are:

- Every employee in your establishment will be entitled to nine holidays with wages in a year, in addition to the leaves discussed above. These nine days of holidays would be as specified by the Government through a notification and will include 26th January (Republic Day), 1st May (May Day), 15th August (Independence Day), 2nd October (Gandhi Jayanti), and 1st November (Andhra Pradesh Formation Day). As per this Act, all the establishments, with or without employees, will remain closed on every such holiday.

- Notwithstanding anything contained in the previous bullet point of this section, the Chief Inspector may, having due regard to any special or emergency circumstances prevailing in the State or any part thereof, notify any other day or days as holidays with wages to employees or class of employees as he or she may deem fit. All such holidays, as notified, shall be considered as additional holidays.

- Nothing discussed in the first bullet point of this section will be applicable in respect to any establishment where the number of holidays with wages allowed by you as an employer is more than the holidays notified by the Government in that provision. However, here you will have to send a list of holidays with wages allowed by you, which shall also include the five holidays specified in the first bullet point of this section, to the Inspector and to the Chief Inspector, and you shall also have to display this list at a prominent place of the establishment.

Note: If your establishment is a residential hostel, eating-house, theater, restaurant, or any place of public amusement or entertainment, then your employees may be required to work in such establishments on any such holiday as declared in accordance with the first two provisions of this section. This, however, is subject to the condition that in lieu thereof, you will have to give to your affected employees a compensatory holiday with wages within thirty days from the date of such holiday.

Pay During Leave and Holidays

As per the provisions discussed through the first five-pointers in the section- ‘leave for the employees’ and ‘other holidays for the employees’, each of your employees will have to be paid at a rate equivalent to the daily average of his or her wages for the days on which he or she actually worked during the preceding month exclusive of any earning in respect of overtime.

Compulsory Enrollment of Employees to Insurance cum Savings Scheme

The provisions as per the Andhra Pradesh Shops and Establishments Act for the same are:

- Each of your employees who has worked in your establishment for at least a year shall have to subscribe to the Insurance Scheme, or Insurance cum Savings Scheme, as may be notified by the Government to be applicable to your establishment at the rates stipulated by the Government in the notification either in a lump sum every year or in monthly installments, as may be prescribed by the Government in the notification. For this purpose, as an employer, you will have to make the payment to the authority notified by the Government on behalf of the employee on or before the stipulated date and recover the same from the wages payable to your employees.

- In addition to the subscription of the employee discussed in the preceding point, each of your employees to which the scheme of insurance or insurance cum savings is made applicable by the Government shall also pay such percentage of annual wages of employees as may be notified by the Government, from time to time to the authority notified for the purpose as employer’s contribution on or before the specified date every year.

Payment of Wages to the Employees

Under the Andhra Pradesh Shops and Establishments Act, every employer is responsible for the payment to his or her employees of all the wages and sums as are required to be paid under this Act and its provisions.

As an employer, you are obliged to fix wage periods in respect of which all the wages will be payable. However, while doing so, you will have to make sure that none of the wage-period exceeds one month.

In fact, some of the provisions for the time of payment of wages under this Act are:

- The wages of each of your employees shall have to be paid before the expiry of the fifth day after the last day of the wage period in respect of which the wages are payable.

- Where the service of any of your employees is terminated by you or by someone on your behalf, then the wages earned by such employees shall be paid before the expiration of the second working day from the day on which his or her employment was terminated.

- The Government may, by general or special order and for reasons stated therein, exempt you- an employer from the operation of this section in respect of the wages of any employee or class of employees to such extent and subject to such conditions as may be specified in the order.

- All payments of wages shall be made on a working day.

Note: All wages shall have to be paid in the current coin or currency notes or in both.

Wages for Overtime Work

The provisions under the Andhra Pradesh Shops and Establishments Act for the same are:

- If any of your employees are required to work overtime, then he or she shall be entitled to wages at twice the ordinary rate of wages in respect of such overtime work.

Note: Provided that the normal hours of work in your establishment are ordinarily less than eight hours a day and forty-eight hours a week, then your employee would be entitled in respect of work in excess of such normal hours up to eight hours a day and forty-eight hours a week to wages at the ordinary rate of wages and in respect of work in excess of eight hours a day and forty-eight hours a week at twice the ordinary rate of wages, in addition to the wages for the normal hours of work.

Deductions from Wages

Under the Andhra Pradesh Shops and Establishments Act, the provisions related to deductions from wages are:

- You should pay wages to your employees without deduction of any kind except those authorized by or under this Act.

- Deductions from the wages of your employees shall be made only in accordance with the provisions of this Act and may be of the following kinds only, namely:

- Fines and other penalties lawfully imposed

- Deductions for absence from duty

- Deductions for damaged to or loss of goods expressly entrusted to the employee for custody or for loss of money for which he is required to account, where such loss or damage is directly attributable to his default or neglect.

- Deductions for house accommodation provided by you

- Deductions for such services and amenities supplied by you as the Government may, by general or special order, authorize.

- Deductions of profession tax or income tax payable by the employee

- Deductions for adjustment of over-payments of wages or recovery of advances

- Deductions are required to be made by order or a Court or other authority competent to make such order

- Deductions for subscriptions to, and for repayment of advances from, any provident fund to which the Provident Funds Act, 1925 applies or any recognized provident fund as defined in Section 2 (38) of the Income-Tax Act, 1961, or any provident fund approved in this behalf by the Government during the continuance of such approval.

- Deductions for payments to cooperative societies approved on this behalf by the Government or any officer authorized by them on this behalf or to a scheme of insurance maintained by the Indian Post Office or the Life Insurance Corporation of India established under Life Insurance Corporation Act, 1956.

- Deductions are made with the written authorization of the employee in furtherance of the purchase of securities of the Central or State Government or any savings scheme approved by the Government.

Health and Safety to be Maintained in the Workplace

Under the Andhra Pradesh Shops and Establishments Act, the provisions related to maintaining the health and safety in your workplaces to ensure the well-being of your employees are:

- Cleanliness: The premises of every shop and establishment shall be kept clean and free from effluvia arising from any drain or privy to other nuisance and shall be cleaned at such times and by such methods as may be prescribed.

- Ventilation: The premises of every shop and establishment shall be ventilated as provided for in the laws relating to the municipalities, gram panchayats, or other local authorities for the time being in force.

- Precautions for the Safety of Employees in Your Establishments:

- In every establishment other than such establishments or class of establishments as the Government may, by notification, specify, such precautions against fire shall be taken as may be prescribed.

- If power-driven machinery is used, or any process which, in the opinion of the Government, is likely to expose any employee to serious risk of bodily injury is carried on in any establishment, such precautions, including the keeping of a first aid box, shall be taken by the employer for the safety of the employees therein, as may be prescribed.

- Maximum Permissible Load:

- No employee in any establishment shall be required or permitted to engage in the manual transport of a load therein which by reason of its weight is likely to jeopardize his or her health or safety.

- For the purposes of this section, the Government may prescribe different maximum limits of weight for different classes of employees in any establishment.

Fines for the Employees

As per the provisions of the Andhra Pradesh Shops and Establishments Act for fines for the employees,

- You cannot impose any fines on your employees, save in respect of such acts and omissions for which you have gotten previous approval of the Government or of the prescribed authority, which may be specified through a notice.

- A notice specifying such acts and omissions should be exhibited in the prescribed manner on the premises in which the employment is carried on.

- You should not impose any fine on your employee until you have given him or her the opportunity of showing cause against the fine or otherwise than in accordance with such procedure as may be prescribed for the imposition of fines.

- The total amount of fine which may be imposed in any one wage period on any employee should not exceed an amount equal to three paise in the rupee of the wages payable to him in respect of that wage period.

- You cannot impose any fines on employees who have not completed the age of fifteen years.

- You cannot recover any fines from an employee after the expiration of sixty days from the date on which it was imposed.

- Every fine shall be deemed to have been imposed on the day of the Act or omission in respect of which it was imposed.

- You are obliged to record all the fines and realizations thereof in a register in such form as may be prescribed, and all such realizations shall be applied only to such purposes beneficial to the employees in your establishment as are approved by the prescribed authority.

Conditions for Terminating the Services of the Employees

Under the Andhra Pradesh Shops and Establishments Act, the provisions related to the conditions for terminating the services of the employees are:

- Without a reasonable cause, you cannot terminate the services of any of your employees who have been in your employment continuously for a period of at least six months without giving such an employee at least one month’s notice in writing or wages in lieu thereof and in respect of an employee who has been in your employment continuously for at least a year, a service compensation amounting to fifteen days average wages for each year of continuous employment. One of the main requirements that you will have to fulfill here before any termination is that you give a written copy of the termination orders to the Inspector having jurisdiction over the area within three days of such termination.

- You cannot terminate the service of any employee when that particular employee has made a complaint to the Inspector regarding the denial of any benefit accruing to him under any labor welfare enactment applicable to your establishment and during the pendency of such complaint before the Inspector.

- Additionally, you cannot terminate the services of any of your employees under misconduct except for such omissions or acts and in such manner, as may be prescribed in this Act.

- For each of your employees who has been in your continuous employment for at least a year, they will be eligible for service compensation amounting to fifteen days of average wages for each year of continuous employment under these cases:

- On voluntary cessation of his work after completing 60 years of age

- On his or her resignation

- On mental or physical infirmity duly certified by a Registered Medical Practitioner

- On his or her death or disablement due to accident or disease

Note: The completion of continuous service of one year shall not be necessary where the termination of the employment of an employee is due to disablement or death. In case of the death of an employee, service compensation payable to him or her shall be paid to his or her nominee or, if no nomination has been made, then to his or her legal heir.

- Where a service compensation is payable to your employee as per the provisions of this section of this Act, he or she shall be entitled to receive his or her wages from the date of cessation or termination of his services until the date on which the service compensation so payable is actually paid.

Note: The payment of service compensation as per the provisions of this section of this Act shall not apply in cases where the employee is entitled to gratuity under the Payment of Gratuity Act, 1972, and gratuity has been paid accordingly consequent on the cessation or termination of service.

- If your employee is placed under suspension pending an inquiry into grave misconduct, then you shall have to pay him or her a subsistence allowance equivalent to fifty percent of the last drawn wage for the first six months and at seventy-five percent of the last drawn wage beyond six months during the period of suspension. The period of suspension shall not exceed one year in any case. If the misconduct is not established or the total period of suspension exceeds one year, then your employee shall be entitled to full wages during the suspension period, and the period of suspension shall be treated as on duty.

Note: If your employee has completed sixty years or who is physically or mentally unfit, having been declared so by a Registered Medical Practitioner or who wants to retire on medical grounds or to resign his or her service, may give up his or her employment after giving you a notice of at least fifteen days. If no such notice is given, the service compensation payable to him or her shall be forfeited to the extent of fifteen days in lieu of the notice.

Appointment of Authority to Hear and Decide Appeals Arising Out of Termination of Services

Under the provisions of the Andhra Pradesh Shops and Establishments Act regarding the same,

- The Chief Inspector may, by notification, appoint for any area as may be specified therein, any authority to hear and decide appeals arising out of the termination of service of an employee as discussed above.

- On the administrative grounds, the Chief Inspector may transfer any appeal arising in the territorial jurisdiction of any authority to the file of another authority for disposal, and such authority to whom the appeal is transferred by the Chief Inspector shall dispose of the appeal so transferred.

- Any employee whose services have been terminated may appeal to the authority concerned within such time and in such manner as may be prescribed.

- The appellate authority may, after an inquiry in the prescribed manner, dismiss the appeal or direct the reinstatement of the employee with or without wages for the period he was kept out of employment or direct payment of compensation without reinstatement or grant such other relief as it deems fit in the circumstances of the case.

- However, the authority concerned shall, without delay, hear such appeal and pass such orders within a period of three months from the date of receipt of such appeal. If the authority considers it necessary or expedient to do so, it may, for reasons to be recorded in writing, extend such period by such further period as it may think fit.

- No proceedings before such authority shall lapse merely on the grounds that any period specified in this sub-section of this Act had expired without such proceedings being completed.

- Against any decision of the authority taken by the appellate authority as discussed above, a second appeal shall lie to such authority as may be notified by the Government within thirty days from the date of communication of the decision, and the decision of such authority on such appeal shall be final and binding on both the employer and the employee and shall be given effect to within such time as may be specified in the order of that authority.

- Remember, the second appeal will not be entertained unless you have deposited the entire amount of back wages as ordered by the appellate authority as per the provisions discussed above or the amount of compensation ordered as the case may be. However, if the second appeal is against the order of reinstatement given by the appellate authority during the first appeal, then your employee shall be entitled to wages last drawn by him during the pendency of the proceedings before the appellate authority.

- If, in any case, an appellate authority by its award directs reinstatement of any employee and you challenge such award in any Court of Law, then you shall be liable to pay such employee during the pendency of such proceedings, full wages last drawn by him, if the employee had not been employed in any establishment during such period, and an affidavit by such employee had been filed to that effect in such Court. If, however, the Court is satisfied that the employee has been employed and has been receiving remuneration during any such period or part thereof, the Court shall order that no wage shall be payable under this subsection for such period or part, as the case may be.

Note: Any amount directed to be paid under this section may be recovered if:

- The authority appointed as the first appellate authority is a Magistrate, by the authority, as if it were a fine imposed by him as Magistrate.

- The authority is not a Magistrate, by any Magistrate, to whom the authority makes application on this behalf as if it were a fine imposed by such Magistrate.

Notice and Payment of Service Compensation to Employees in the Case of Transfer of Establishment

If the ownership or management of an establishment is transferred, whether by operation of law or by agreement, from the employer in relation to that establishment to a new employer, then every employee who has been in continuous employment for at least six months in that establishment immediately before such transfer takes place, shall be entitled to the notice and the service compensation in accordance with the provisions discussed in the preceding section of this Act regarding the same.

However, none of these provisions will apply to an employee in any case where there has been a change of employers by reason of the transfer if:

- The employment of the employee has been interrupted by such a transfer.

- The terms and conditions of employment applicable to the employee after such transfer are not in any way less favorable to that employee than those applicable to him immediately before such transfer.

- The new employer is, under the terms of such transfer or otherwise, legally liable to pay to the employee in the event of termination of his services, service compensation on the basis that his employment has been continued and has not been interrupted by the transfer.

Maintenance of Registers and Records and Display of Notices

The provisions as per the Andhra Pradesh Shops and Establishments Act regarding the same are:

- Subject to the control of the Government, you are obliged to maintain such registers and records, and display such notices, as may be prescribed. All such registers and records shall be kept, and all such notices shall be displayed on the premises of the establishment to which they relate.

- If so demanded, you shall have to produce or cause to be produced for inspection by an Inspector all the registers, records, and notices required to be kept by or under this Act.

- You shall have to submit such returns relating to his business, in such manner, within such period, and to such authority, as may be prescribed.

- Under this Act, you are obliged to give an order of appointment of your employee in your establishment before that employee joins the service. You shall also have to furnish a copy of such order to the Inspector having jurisdiction over the area within three days of issue of such order.

Restriction on Double Employment on a Holiday or During Leave

As per the Andhra Pradesh Shops and Establishments Act, no employee shall work in your establishment, nor should you knowingly permit your employee to work in your establishment on a day or part of a day on which your employee is given a holiday or is on leave in accordance with the provisions of this Act.

Penalty for Obstructing Inspector, etc

Under the Andhra Pradesh Shops and Establishments Act, if you wilfully obstruct an Inspector in the exercise of any power conferred to him or her by or under this Act, or if you lawfully assist such Inspector in the exercise of such power, or if you fail to comply with any lawful decision made by such an Inspector, shall be punishable with imprisonment for a term which may extend to three months or with fine, or with both.

Penalties for Offenses Committed by the Employer

As per the Andhra Pradesh Shops and Establishments Act, the provisions related to offenses committed by the employer are:

- If you make a false or incorrect statement under the section of this Act titled: ‘Registration of the Shops and Commercial Establishments under Andhra Pradesh Shops and Establishments Act,’ you shall be punishable with a fine which may extend to one hundred rupees.

- In the case of the first offense, there would be a fine of up to one hundred rupees, in the case of the second offense, the fine would be of at least two hundred and fifty rupees up to a maximum of five hundred rupees. In case of the third or subsequent offenses, there would be imprisonment for a term of up to three months, along with a fine of a minimum of five hundred rupees, to a maximum of one thousand rupees. This is applicable if you contravene any of the provisions of the sections of this Act titled as:

- Registration of the Shops and Commercial Establishments, including provisions for renewal as well as revocation or suspension of the registration certificate

- Opening and Closing Hours of Shops

- Daily and Weekly Hours of Work in Shops

- Interval for Rest and Spread Over Periods of Work in Shops

- Closing of Shops and Grant of Holidays

- Opening and Closing Hours of Establishments

- Daily and Weekly Hours of Work in Establishments

- Interval for Rest and Spread Over Periods of Work in Establishments

- Holidays in the Establishments

- Employment of Children

- Conditions for Employment of Young Persons

- Conditions for Employment of Women

- Leave for the Employees

- Other Holidays for the Employees

- Pay During Leave and Holidays

- Compulsory Enrollment of Employees to Insurance cum Savings Scheme

- Payment of Wages to the Employees

- Wages for Overtime Work

- Deductions from Wages

- Health and Safety to be Maintained in the Workplace

- Fines for the Employees

- Conditions for Terminating the Services of the Employees

- Notice and Payment of Service Compensation to Employees in the Case of Transfer of Establishment

- If you contravene the provisions in the sub-section titled as- ‘Selling Outside Prohibited, Before Opening and After Closing Hours of shop, then in the first offense, you would be punished through a fine of up to one hundred rupees, whereas in case of second or subsequent offenses, you would be punishable through a fine of up to two hundred and fifty rupees.

- If you contravene the provisions as discussed in the 4th, 5th, 6th, 7th, and 8th bullet points in the section titled as- ‘Appointment of Authority to Hear and Decide Appeals Arising Out of Termination of Services, then on conviction, you shall be punishable with a fine of up to fifty rupees for each day during which the offense continues.

Power to Compound Offenses

Under the Andhra Pradesh Shops and Establishments Act, the Chief Inspector may authorize by notification any officer to accept from any person who is reasonably believed to have committed an offense under the sections of this Act titled as:

- Registration of the Shops and Commercial Establishments

- Opening and Closing Hours of Shops

- Selling Outside Prohibited, Before Opening and After Closing Hours of Shops

- Interval of Rest in Shops

- Closing of Shops and Grant of Holidays

- Opening and Closing Hours of Establishments

- Daily and Weekly Hours of Work in the Establishments

- Intervals for Rest in the Establishments

- Employment of Children

- Other Holidays for the Employees

- Penalty for Obstructing Inspector

For the offenses made against the provisions mentioned in the section discussed above, a sum of money not exceeding one hundred rupees in case of each violation by way of compounding such offense.

Any proceedings taken against such a person in respect of such offense shall on payment of such money be withdrawn, and no further proceedings shall be taken in respect of such offense.

Rights and Privileges Under Other Laws, etc., Not Affected

Nothing in this Act affects any rights or privileges which your employees in your establishment are entitled to, on the date on which this Act applies to your establishment, under any other law, contract, custom, or usage applicable to such establishment, if such privileges or rights are more favorable to him or her than those to which he or she would be entitled under this Act.

Exemptions to the Andhra Pradesh Shops and Establishments Act

As per the Andhra Pradesh Shops and Establishments Act,

- Nothing in this Act shall apply to employees in any establishment in a position of management and having control over the affairs of the establishment, whose average monthly wages exceed sixteen hundred rupees.

- Nothing in this Act shall apply to the establishments under the Central and State Governments, local authorities, the Reserve Bank of India, a railway administration operating any railway as defined in the Clause 20 of Article 66 of the Constitution and Cantonment Authorities.

- Nothing in this Act shall apply to establishments in mines and oil fields

- Nothing in this Act shall apply to establishments in bazaars in places where the fairs or festivals are held temporarily for a period not exceeding one month at a time.

- Nothing in the sections of this Act titled as- ‘Opening and Closing Hours of Shops’ and ‘Opening and Closing Hours of Establishments’ shall apply to:

- Hospitals or other institutions for treatment or care of the sick, the infirm, the mentally unfit, or the destitute.

- Such chemists’ and druggists’ shops as the Government may, by general or special order, specify.

- Hair-dressing shops, educational institutions, clubs and residential hotels, hostels attached to schools or colleges, and establishments maintained in connection with the boarding and lodging of pupils and resident masters.

- Refreshment rooms and stalls at railway stations, docks, wharves, airports, ports, or bus stands.

- Establishments wholly or principally engaged in the sale of ice or aerated waters.

- Establishments wholly or principally engaged in the sale of funeral requisites.

- Nothing in the sections of this Act titled as- ‘Opening and Closing Hours of Shops,’ ‘Daily and Weekly Hours of Work in Shops,’ ‘Closing of Shops and Grant of Holidays,’ ‘Opening and Closing Hours of Establishments’ shall apply to:

- A person whose work is of an intermittent nature, such as traveling staff, sweeper, caretaker.

- Persons employed for loading and unloading of goods at godown.

- The Government may, by notification, exempt either permanently or for any specified period, any establishment or class of establishments, or persons or class of persons, from all or any provisions of this Act, subject to such conditions as they may deem fit.

- Notwithstanding anything in the foregoing sub-sections, the Government may, by notification, apply any of the provisions of this Act to any class of persons or establishments mentioned in those subsections other than the chemists’ and druggists’ shops as mentioned by the Government through a general or special order. In fact, the Government can modify or cancel any such notification.

Application of the Workmen’s Compensation Act, 1923

The provisions of the Workmen’s Compensation Act, 1923 and the Rules thereunder shall, so far as may be, apply to every employee to whom this Act applies.

Protection of Persons Acting in Good Faith

No suit, prosecution, or other legal proceedings shall lie against any person for anything which is in good faith done or intended to be done under this Act.

Power of Government to Suspend Provisions of the Act During Fairs and Festivals

On any special occasion in connection with a festival of fair or a succession of public holidays, the Government may, by notification, suspend for a specified period the operation of all or any of the provisions of this Act, subject to such conditions as may be specified in such notification.

Application of this Act to Cooperative Societies

Notwithstanding anything in the Andhra Pradesh Co-operative Societies Act, 1964, the provisions of this Act shall apply to the Cooperative Societies.

Statutory Forms for Compliance

As per the Andhra Pradesh Shops and Establishments Act, the statutory forms for compliance are:

Form A: Integrated Application for Registration

|

1[SECOND SCHEDULE |

|||||

|

[See Sections 2(d) and 4] |

|||||

|

[ Form A [sec. 4(1)],

Form B [sec.4(6)] and Form C [sec. 4(2)] |

|||||

|

FORM – A |

|||||

|

APPLICATION FOR INTEGRATED REGISTRATION OF ESTABLISHMENT UNDER

LABOUR LAWS |

|||||

|

REGISTRATION / LICENSE

REQUIRED UNDER (Specify the Act with tick mark) |

|||||

|

1 |

A.P. Shops & Establishments Act, 1988 |

|

2 |

Motor Transport Workers

Act, 1966 |

|

|

3 |

Contract Labour (R&A) Act, 1970 (Principal employer Establishment & Contractor Establishment) |

|

4 |

Inter State Migrant Workmen (RE&CS) Act, 1979 (Principal

employer Establishment& contractor Establishment) |

|

|

5 |

Building and Other Construction Workers(RE&CS) Act, 1996 |

|

6 |

Payment of Gratuity Act, 1972 |

|

|

7 |

Beedi & Cigar Workers (COE) Act, 1966 |

|

|

|

|

|

|

ESTABLISHMENT DETAILS |

||||

|

1 |

Name of the Establishment |

|

|||

|

2 |

Classification of Establishment (Proprietor firm, Partnership

firm, Pvt. Ltd, Public Ltd, Cooperative, Society etc.) |

|

|||

|

3 |

Categoryof Establishment [Shop,Establishment, Commercial Establishment Motor Transport undertaking, Building or other

construction Establishment, Contract Labour (Prl. Employer / Contractor) Establishment] |

|

|||

|

4 |

Address of establishment |

|

|||

|

5 |

Natureof Business/ work/

construction activity |

|

|||

|

6 |

Date of commencement of business

/ work / construction / activity |

|

|||

|

7 |

Date of completion of work / construction/ activity(ifapplicable) |

|

|||

|

8 |

Date of agreement |

|

|||

|

9 |

No .of transport vehicles |

|

|||

|

10 |

Whether Form-V/ Form-VI issued by Principal Employer |

|

|||

|

11. |

Agreement No/Plan approval No. |

|

||||||||

|

12 |

Date of agreement /Plan approval |

|

||||||||

|

13 |

Estimated cost of construction

& other Details (in case of building or other construction work) |

|

||||||||

|

14 |

Details of contractors (Contract Labour Act/Inter State Migrant Workmen Act) |

|

||||||||

|

15 |

Details of contract works ( Contract

Labour Act/Inter State

Migrant Work men Act) |

|

||||||||

|

16 |

Total No. of Workers |

|

||||||||

|

17 |

Details of workers |

Regular |

Casual/ Badilli |

In case of

beedi or cigar est. |

||||||

|

|

|

Male |

Female |

Male |

Female |

Industrial premises workers |

Home workers |

|||

|

|

|

|

|

|

|

Male |

Female |

Male |

Female |

|

|

18 |

Workers employed in shops &Esstts. |

|

|

|

|

|

|

|

|

|

|

19 19 |

Motor Transport Workers |

|

|

|

|

|

|

|

|

|

|

20 |

Building & other construction workers |

|

|

|

|

|

|

|

|

|

|

21 |

Contract workers |

|

|

|

|

|

|

|

|

|

|

22 |

Inter State Migrant Workers |

|

|

|

|

|

|

|

|

|

|

23 |

Beedi & Cigar workers |

|

|

|

|

|

|

|

|

|

|

24 |

Factory workers |

|

|

|

|

|

|

|

|

|

|

25 |

Any

other Category workers (specify the category |

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER DETAILS (Enclose Passport size photo |

|||||||||

|

26 |

Employer Name |

|

||||||||

|

27 |

Designation |

|

||||||||

|

28 |

Father/husband Name |

|

||||||||

|

29 |

Contact details |

|

||||||||

|

|

Applicants Details |

|

||||||||

|

30 |

Applicant Name |

|

||||||||

|

31 |

Designation |

|

||||||||

|

32 |

Father /husband name |

|

||||||||

|

33 |

Contact details |

|

||||||||

|

|

DECLARATION |

|||||||||

|

34 |

I/we hereby

declare that i/we have

compiled with all relevant

provisions of the Labour Acts applicable to the establishment. In case the

information furnished above

is found to be flase,

misrepresented or suppressed and material information or evaded to furnish the information, I/we are liable

for prosecution as per law besides cancellation of the registration / license |

|||||||||

|

|

Date |

Signature of the Employer |

||||||||

|

|

Place |

Name & Designation of the Employer |

||||||||

Form B: Annual Returns for the Year Ending 31st March

FORM-B

COMBINED RETURN UNDER LABOURLAWS AS ON 31ST MARCH,20

(SECOND SCHEDULE (See sec.2 (d) and sec.4(6)

|

ANNUAL RETURN

FOR THE YEAR

ENDING 31ST MARCH |

||

|

1. |

Establishment Registration /License No.(LIN) |

|

|

2. |

Establishment Name |

|

|

3. |

Address |

|

|

4. |

Establishment details |

|

|

5. |

Classification of Establishment |

|

|

6. |

Employer details |

|

|

7. |

Establishment category |

|

|

8. |

Nature of work/

activity/business/industry of the Establishment |

|

|

9. |

Total. No. of Workers (furnish details in Annexure-1) |

|

|

10 |

Details of payment of wages (furnish details in Annexure-2) |

|

|

11 |

No. of the workers allowed to work

overtime in the

year |

|

|

12 |

Amount of over time

wages paid in the year |

|

|

13. |

No.of workers

covered under EDF |

|

|

14 |

No. of workers covered under ESI |

|

|

15 |

Details of Gratuity |

|

|

16 |

Details of Bonus paid |

|

|

17 |

Details of Employees Compensation paid |

|

|

18 |

Leave eligibility |

|

|

19 |

Details of payment of maternity benefit |

|

|

20 |

Details of weekly off & other

holidays allowed |

|

|

21 |

Details of Welfare fund

contribution |

|

|

22 |

Details of settlements / Strikes/Lock-outs/Lay-offs/

Retrenchments closures etc. |

|

|

23 |

Whether Works

Committee constituted |

|

|

24 |

Details of Trade Union existing in the establishment /industry |

|

|

25 |

Details of contractors under

Contract Labour Act |

|

|

26 |

Details of contractors under Inter State Migrant Workmen

Act |

|

|

27 |

Whether muster

roll, wages register etc, maintained |

|

|

28 |

Whether appointment letters/Identity cards issued |

|

|

29 |

Details of building or other construction work |

|

|

30 |

Note:- Combined

Annual Return for the ending 31 March shall be furnished online before

30th June of the following year |

|

|

|

DECLARATION |

|

|

|

I/we hereby declare that /we have complied

with all relevant provisions of the Labour Act applicable to the

establishment. In the case the information

furnished above is found to be false, misrepresented or suppressed any material information or evaded to furnish

the information, I/we are liable for

prosecution as per law besides cancellation of the registration /license granted. |

Signature of the

Employer |

|

|

Date |

|

|

|

Place |

Name &

Designation of the Employer |

Form C: Certificate of Registration

GOVERNMENT OF ANDHRA PRADESH LABOUR DEPARTMENT

FORM-C

CERTIFICATE OF REGISTRATION / LICENSE OF ESTABLISHMENT – Sec. 2(d) and 4(2)

The Andhra Pradesh (Issuance of Integrated Registration and Furnishing of Combined Returns under various

Labour Laws bycertain Establishments) Act, 2015

1. Registration / License Number(LIN):

2. Name of the Establishment:

3. Address of theEstablishment:

4. Employer Name:

5. Employer Address:

6. Category of Establishment: No. of workers Nature of Date of Date of completion

work/business commencement

7. Date of issue:

8. Registration valid up to:

It is hereby certified that the establishment has been Registered / Licensed under The Andhra Pradesh Issuance of Integrated Registration and Furnishing of Combined Returns under variousLabour Laws by certainEstablishments) Act, 2015.

The License is granted for doing the work of in the Establishment of

(Principal Employer).

Note:

REGISTERING / LICENSING OFFICER

1. The Registration / License is valid from the date of Registration / License, to 31st March of the third year. Registration / License shall be renewed for the next three years before 31st March of the third year.

2. If the information furnished by the employer is subsequently found that any of the particulars furnished are wrong, or essentialinformation is suppressed or misrepresented,

the Registration / License is liable for cancellation without any notice and the employer will be liable for penal action as per law.

3. The Certificate of Registration / License is generated instantaneously, based on the information furnished by the employer in the application, which can be verified online in the mee-seva website at www.ap.meeseva.gov.in. ]

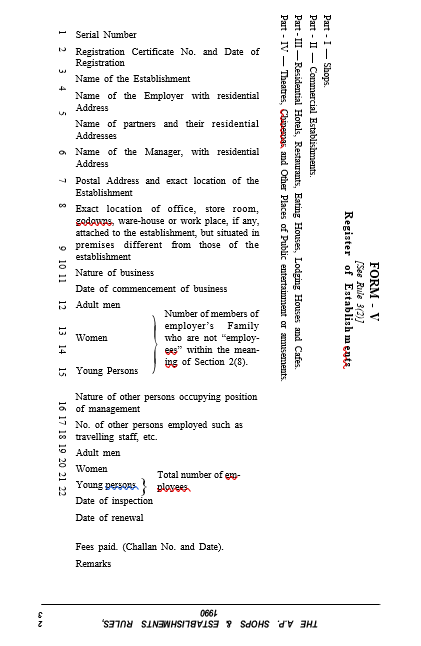

Form 5: Register of Establishments

Form VI: Notice of Loss of Registration Certificate and Application

[See Rule 5]

Notice of Loss of Registration Certificate and Application for Issue of Duplicate Certificate

Name of the Establishment : Address :

Registration No.:

To,

The Inspector,

Sir,

This is to inform you that the Registration Certificate of this establishment

has been lost/destroyed/defaced. Pleaseissue a duplicate Certificate.

Challan No. Date. for Rs. is enclosed herewith.

Yours Faithfully,

Date : (Signature of employer)

Form VII: Notice of Change

[See Rule 6]

Name of the Establishment already registered :

Name of the Employer :

Registration Certificate Number :

Address :

Dated the day of 19

To,

The Inspector,

Notice is herebygiven that the following changehas taken placein respect of information forwarded to you in Form ‘A’ which pleasenote.

The Registration Certificate and Challan No.

Dated for Rs. is enclosed.

Signature of Employer.

Note :- The notice of Change in this Form shall be sent together with such fees as are prescribed in Schedule-II.

Form VIII: Register of Appeals

[See Rule 8 (5) ]

Register of Appeals

|

Sl. |

Name and |

Date of |

Date of Presen- |

Date of |

Date of |

Whether |

|

No. |

address of the applicant |

appeal |

tation of appeals. |

hearing |

final order. |

allowed or rejected |

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

Form IX: Certificate of Age

[See Rule 9]

Certificate of Age

I hereby certify that I have personally examined(Name) ....................

................................................ Son/Daughter of........................................residing at

............................... and that he/she has completedhis/her fourteenth/eighteenth year of age.

Description marks are :-

1.

2.

Signature or thumb impression of employee.

Medical Practitioner.______________

Form X: Register of Fines

[See Rule 17(3)(a)]

Register of Fines

Name of the Establishment:________________

|

Sl. |

Name |

Father’s or |

Act of |

Whether |

Total |

Amount |

Date on |

Date on |

Remarks |

|

No. |

of the |

Husband’s |

Commis- |

workmen |

Wages |

of fine |

which |

which |

|

|

|

Employee |

name |

sion for |

showed |

for the |

|

fine |

fine |

|

|

|

|

|

which |

cause |

wage- |

|

imposed |

realised |

|

|

|

|

|

fine |

against |

in which |

|

|

|

|

|

|

|

|

imposed |

fine or |

the fine |

|

|

|

|

|

|

|

|

|

not, and |

imposed |

|

|

|

|

|

|

|

|

|

if so, |

|

|

|

|

|

|

|

|

|

|

date on |

|

|

|

|

|

|

|

|

|

|

which |

|

|

|

|

|

|

|

|

|

|

cause was |

|

|

|

|

|

|

|

|

|

|

shown |

|

|

|

|

|

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

Form XI: Register of Deduction for Damage and Loss

[See Rule 17(4)]

Register of deductions for the Damage or Loss caused to the Employer by the Neglect or Default of Employees

Name of the Establishment :

|

Sl. |

Name |

Father’s or |

Damage |

Whether |

Amount of |

Date on |

No. of |

Date on |

Remarks |

|

No. |

of the |

Husband’s |

or loss |

worker |

deduction |

which |

instal- |

which |

|

|

|

Employee |

name |

caused |

against |

imposed |

deduction |

ments |

total |

|

|

|

|

|

|

showed |

|

imposed |

if any |

amount |

|

|

|

|

|

|

cause |