Did you know Doing business as (or DBA for short) a different name is perfectly legal? In most jurisdictions, however, a person may only conduct business under his or her own name, and a corporation or limited liability company may only conduct business under the name on its formation document, unless the DBA name is registered, which is done by filing with the state.

Table of contents

- What is a DBA?

- What a DBA is not?

- Why use a fictitious name?

- The Basics of Getting Your Business Off the Ground

- All about Small-business financing

- What is an Employer identification number (EIN)?

- How can you expand your company?

- Which type of business is the simplest to launch?

- When do you think is the right time to start a business?

- Important Considerations for a Successful DBA Filing

- How do you register a DBA?

- When a DBA is filed, what happens next?

- Who should file for a DBA?

- How much does it cost to register a DBA?

- In what kinds of companies would a DBA be useful?

- Benefits of DBA you should know

- Key Takeaways

What is a DBA?

When a business has only one or a few owners, its legal name is the owner's or partners' names. When referring to a corporation, limited liability company (LLC), or other statutory entity, the name on its formation document is the official name (e.g., its articles of incorporation or articles of organization).

DBA registration is used to let the public know that a person or company is doing business under a name different from its legal name. Assumed name (DBA) laws are consumer protection laws. Businesses must register so that customers can identify who they are doing business with.

What a DBA is not?

Establishing a DBA is not the same as establishing a legal business entity. If you start doing business under a DBA instead of incorporating or forming an LLC, your state of incorporation will treat you like a sole proprietor.

You can use your fictitious business name to legally conduct business in that state as a sole proprietor, but you will not have the protections afforded by a corporation. That puts you on the hook for all of the company's financial obligations.

Those who form a limited liability company (LLC), a limited partnership (LP), a limited liability partnership (LLP), or a corporation (either a C corporation or a S corporation for income tax purposes) are shielded from personal responsibility for the debts and actions of the company. Business ownership and debts are the responsibility of the corporation, LLC, LP or LLP.

The investors, participants, or companions are not. That's a big perk of setting up a corporation. Documents for registering a DBA name must be filed after forming a corporation, LLC, or other entity if the business intends to use a name other than the one specified in the formation documents.

Take note that you will need to Foreign Qualify in each state where you intend to expand operations. There is a prohibition on unqualified corporations, limited liability companies, and other statutory business entities from engaging in commercial activity within a state.

Failure to comply will result in consequences. Your certificate of authority will reflect your legal name in the states where you are authorised to do business. To legally conduct business under a name other than your legal name, you must register your DBA name with the state government.

Why use a fictitious name?

The most common scenarios in which a company will register a DBA are discussed below. Keep in mind that these factors can change depending on the type of company being discussed. When compared to a corporation or limited liability company, the reasons for a sole proprietorship to use an assumed name are different.

In business, you should use a name other than your own. For sole proprietorships and general partnerships, this is a crucial choice. To avoid confusion between business and personal records, a DBA must be filed if a business name other than the owner's legal name is to be used. Thus, you may wish to change the name of your company to protect your privacy.

To put it another way, you're looking for a more memorable moniker. Perhaps the sole proprietor or business partner wants the name to stand out from the crowd or to convey the nature of the enterprise. The name John Smith Gardens would be the name of John Smith's gardening company.

However, you may prefer to operate under the name John's Flowers and Gardens. For general partnerships, the name of the business is the same as that of the partners. In order to conduct business under a name other than your own, a DBA must be filed with the state.

The formation of a business bank account at your bank calls for a DBA. A DBA is typically necessary for sole proprietors and partners in general partnerships to open a business bank account. Banks typically demand evidence of registration, such as a DBA filing or assumed name certificate, before allowing you to open an account under the new name.

Your company's new focus does not match the name it currently uses. When a company or LLC wants to expand into a different industry or start selling products and services under a name other than its official one, it will often register a DBA.

In some ways, it might help to have a name that's more specific. Let's say you run Summer Sprinkler Systems Inc., which instals and repairs sprinkler systems, and you want to expand your business by providing snowploughs service in the winter. For that aspect of your business, you could register a DBA as Plowing Specialists.

Doing business under an assumed name (DBA) allows you to pass yourself off as another company or website. In order to conduct business using the company's domain name, a DBA must first be filed. When your company name can't be used as a domain name, this is a great option. It's not uncommon to want to run multiple businesses or websites simultaneously.

Picture your company as one that produces and retails handbags for women. You also make bags for preteens and teens, right? You file a DBA to register the fictitious business name and establish a separate website aimed squarely at this demographic, knowing full well that they would never buy from the same company or website as their mothers.

To improve trustworthiness in the company. If you're a one-man show or a loose alliance, using a DBA name can lend your business some serious gravitas.

Publicly announcing your new business identity. When a business registers a name to be used in commerce under a different legal structure, this is called a doing business as (DBA) name, and it becomes part of the public record. Keep in mind that a DBA filing may not shield you from another person registering the same name in some states.

To give it a catchier moniker, obviously. It's possible that the official name is too complicated for its own good, be it too long, too difficult to pronounce, too easy to forget, or too unfriendly to search engines.

The Basics of Getting Your Business Off the Ground

There are some obvious things to do, like come up with a name and a logo, but what about the other, less glamorised but no less crucial steps? There are a lot of things to do when starting a business, such as coming up with a business plan and a marketing strategy.

You need to hone your concept

You probably know what it is you want to sell online, or at least what market you want to target, if you're considering starting a business. Find some companies that are already established in the field you want to enter.

Investigate the practices of successful brands in your industry to see where you can make improvements. If you have a unique selling proposition, or if you can provide the same product or service at a lower cost and in a shorter amount of time than the competition, then you may be ready to develop a business plan.

Contemplate establishing a franchise

One more choice is to launch a franchise similar to an already successful business. Everything except a suitable location and initial capital is in place, including the idea, the brand name recognition, and the business model.

Brainstorm your business name

No matter what course of action you take, it is essential that you fully grasp the thinking behind your plan. Business by Dezign owner and former Covation Center director of operations and women's business programmes Stephanie Desaulniers advises start-up founders to determine the value of their idea before writing a business plan or coming up with a company name.

Gather market intelligence

Crafting a business plan requires extensive market research into your chosen field and the demographics of your target customers. This can be accomplished through the use of surveys, focus groups, search engine optimization (SEO), and public information.

You can learn more about your ideal clientele, their wants and habits, and the market as a whole by conducting market research. To better understand opportunities and limitations within your market, many small business professionals advise compiling demographic data and conducting a competitive analysis.

Best-in-class small businesses offer something unique to the market. That will change the competitive landscape and help you convey special value to potential customers.

While developing your business plan, it is also prudent to think about how you might eventually leave the company. Building a plan for when you'll leave the company forces you to consider the long term.

Josh Tolley, CEO of both Shyft Capital and Kavana, has observed that many first-time business owners fail to devote enough time to developing an exit strategy because they are so focused on building their company and attracting customers.

Determine your current financial situation

As with any endeavour, there will be expenses associated with getting your business off the ground, and you'll need a plan for dealing with them. Will you need to take out a loan to get your business off the ground, or do you already have the capital you need? Have you saved enough money to get by until your business turns a profit if you decide to quit your day job? It is important to estimate how much money you will need to get started.

For many new businesses, not having enough capital to operate until they turn a profit is the ultimate death knell. Overestimating the amount of startup capital you need is a good idea because it may take some time for the business to generate sustainable revenue.

Have a look at the break-even analysis

Performing a break-even analysis is one method for estimating the amount of capital required. This is a cornerstone of financial planning because it tells business owners when they can expect to see a return on their investment in a given venture, product, or service.

This formula tells you what level of performance your business must reach in order to break even, so it should be a standard tool for any entrepreneur. As an added bonus, knowing the source of your revenue will assist you in setting realistic targets for your production efforts.

Keep an eye on your costs

Start-up costs can quickly add up, so it's important to be careful. It's important to know what kinds of purchases are practical for your company, so you don't waste money on things that won't help you succeed. Keep an eye on your company's spending to make sure you're not going over budget.

Jean Paldan, CEO and founder of Rare Form New Media, has observed a common problem among startups: frivolous spending. We helped out a startup that only had two workers but was paying for space for twenty.

They also leased a high-end, professional printer better suited for a group of 100, complete with key cards to monitor who prints what and when. Reduce your initial outlay to a minimum, and invest only in the core elements of your business. When you've made a name for yourself, you can treat yourself to the finer things in life.

Think about your financial choices

There are a number of places you could look to for seed money to launch your company. Several factors, including creditworthiness, the amount required, and the available options, will determine the best way to acquire funding for your business.

All about Small-business financing

If you're in need of financial aid, a commercial loan from a bank is a good place to start, though it can be challenging to actually get one.

Monetary aid for established businesses

Grants for businesses function similarly to loans but do not necessitate repayment. To be considered for a grant, a business usually has to compete with many others and fulfil several requirements. You should search for small business grants that are tailored to your specific needs. Grants specifically for women- and minority-owned businesses, as well as grants from the government, are all viable options.

Investors

Initial capital is often needed for startups, and it may be a good idea to seek out an investor. Many investors are willing to put a million dollars or more into a startup in exchange for a say in the company's management.

Crowdfunding

On the other hand, you could start an equity crowdfunding campaign to collect smaller donations from many donors. A large number of businesses have benefited from crowdfunding in recent years, and today there are dozens of trustworthy crowdfunding platforms catering to various industries.

Establishing the appropriate organizational framework

Determining the legal status of your business is a prerequisite to registering it. Everything from tax filing to your own personal liability is affected by the legal form your business takes.

Individual or entity engaged in business for its own profit. Registering as a sole proprietorship is an option if you intend to be solely responsible for the company's debts and obligations and have complete ownership. Don't forget that going this route can have a direct impact on your credit score.

Partnership

The alternative is a business partnership, in which the owners are two or more people who share personal liability for the company's debts and obligations. If you can find a business partner whose skill set complements your own, you can avoid going it alone. When looking to grow your business, it's often wise to bring on additional hands.

Declare your identity to the state and the IRS

For your business to function legally, you'll need to secure a number of permits and licences. There's federal, state, and local registration requirements to meet. Before you can register, you'll need to gather a few things.

You must register your business with the government so that it can legally operate. Articles of incorporation are required to form a corporation and should include the company's name, purpose, corporate structure, stock details, and other pertinent information. Like corporations, limited liability companies (LLCs) may need an operating agreement.

You must register your business name, which can be your legal name, a fictitious DBA name (if you are a sole proprietor), or a name you've come up with for your company if you don't have articles of incorporation or an operating agreement. Additionally, you may wish to protect your company's name legally by registering a trademark.

A DBA is necessary in the vast majority of states. One requirement for doing business as a general partnership or sole proprietor under a fictitious name is to file for a DBA certificate. If you want to know the exact filing requirements and costs, you should get in touch with or go to your county clerk's office. In most cases, you'll need to pay a fee to join.

What is an Employer identification number (EIN)?

You may need to apply for an EIN from the IRS after registering your business. While this isn't strictly necessary for sole proprietorships without any employees, it can help keep your business and personal finances distinct.

All about Tax returns

In addition, you must submit the appropriate tax forms to the appropriate authorities in order to meet your federal and state income tax responsibilities. Business structure is a key factor in determining the forms you'll need to file. If you want details on taxes that are only applicable in your state, you should look at the site for that state.

In order to conduct business legally, corporations and sole proprietors engaged in specific professions must obtain appropriate licences. One example of a professional business licence is a commercial driver’s licence (CDL). Buses, tank trucks, and tractor-trailers, among others, require a CDL holder to operate safely and legally. A CDL is divided into three classes: Class A, Class B and Class C.

Your business may also require a seller's permit from the local and state governments in order to legally charge and collect sales tax from your customers. It's worth noting that each state has its own set of regulations, and those regulations go by different names. Apply for a seller's permit on the state government website of the state (or states) in which you will be selling goods.

Consider investing in some sort of insurance

Getting the right insurance for your business is an important step to take before you officially launch, but it's easy to put off until someday. It's important to make sure you're covered in the event of things like property damage, theft, or even a customer lawsuit.

Several different kinds of insurance cover businesses, but most small companies only need a few basic policies. If your company will be employing people, for instance, you will need to provide them with at least workers' comp and unemployment insurance.

General liability (GL) insurance, also known as a business owner's policy, is highly recommended for most small businesses. Additional types of coverage may be required, depending on your location and industry. To put it simply, general liability insurance will pay for repairs to damaged property as well as medical bills if you or someone else is injured.

Professional liability insurance is something to think about if your company provides a service to the public. To put it another way, it protects you from liability in the event that you make a mistake or fail to take necessary precautions while running your business.

Pick your suppliers

It's likely that you and your team won't be able to handle every aspect of running a business on your own. The role of external vendors is crucial in this case. Whether it's human resources or a new phone system, there's a company out there ready to become a business partner and help you succeed.

Careful consideration must be given when searching for B2B partners. It is crucial to find a company you can trust, as they will have access to crucial and potentially sensitive business data.

Our experts advise that when interviewing potential vendors, you inquire about their background in your specific industry, their success rate with current clients, and the level of growth they've facilitated for previous customers.

Although not every company will require the same suppliers, there are certain goods and services that are indispensable. The following procedures are important for any business.

Taking payments from customers

By accommodating a variety of payment methods, you increase the likelihood of closing a deal with your target audience. In order to get the best credit card processing rate possible for your business, you should shop around and find the best provider for you.

Internet address of the firm

Create a website for your business and expand your brand online. The majority of consumers now use the internet as their primary research tool, and having a website is the digital equivalent of having physical signage for your storefront. Connecting with existing and potential clients is facilitated as well.

Communications in the digital age

Spread the word about your new venture on social media, and use it as a marketing tool by giving away discounts and coupons to followers once you open for business. Depending on who you're trying to reach, different social media platforms will be more effective than others.

CRM

You can better market to your customers by storing their information in the best CRM software solutions. Reaching customers and keeping in touch with your audience can be facilitated greatly by a well-planned email marketing campaign. Successful email marketing campaigns begin with a well-maintained contact list.

Logo

Build a logo that represents your brand well, and use it consistently across all of your marketing materials. Solicit permission to contact customers about your products and services.

As you grow your business and your brand, it's important to get the okay from current and potential customers before sending them marketing materials. Using opt-in forms is the simplest method for accomplishing this. According to Dan Edmonson, CEO of Dronegenuity, these are forms of consent given by website visitors, allowing you to contact them with more information about your business.

To gain the trust and respect of potential customers, opt-in forms are an excellent first step. Not only are these forms necessary, they are mandated by law. The FTC established regulations for commercial email in 2003 under the Can Spam Act. The law applies to any electronic mail message whose primary purpose is the commercial advertisement or promotion of a commercial product or service, not just bulk email.

How can you expand your company?

Just because you've launched and made some sales doesn't mean your work as an entrepreneur is done. To maintain profitability and survival, a company must constantly seek new opportunities for expansion. Investing time and energy into your business will pay off in the end.

In order to expand, it's a good idea to work with companies that are already well-known in your field. Reach out to competing businesses and offer to promote them in exchange for free samples or services. Join forces with a good cause and help spread the word by donating your time or goods.

While these suggestions will get you off the ground and ready for growth, remember that no business plan is foolproof. In spite of your best efforts at preparation, there will inevitably be hiccups when you launch your business. If you want to be a successful business owner, you need to be able to roll with the punches.

Which type of business is the simplest to launch?

If you want to get into business for yourself, you should look for a venture that doesn't call for a large initial investment or a lot of time and effort to master. Dropshipping businesses are among the most accessible to start up.

When you use a dropshipping service, you won't have to worry about keeping track of or managing any stock. Instead, you'll outsource order fulfilment to a third party. This service will handle stock control, packaging, and distribution for your company. To launch an e-commerce platform, you can start by selecting partner-provided catalogue items for curation.

When do you think is the right time to start a business?

The best time for you to launch a business is different for everyone. When starting a business, your top priority should be giving it your full attention. If your business offers a seasonal good or service, you should launch it three months before peak season.

Spring and fall are common times for nonseasonal businesses to debut. Many first-time business owners wait until the start of a new fiscal year to have their LLC or corporation officially recognised. This makes the winter the least popular time to launch.

Important Considerations for a Successful DBA Filing

Obtaining a DBA certificate requires completing the necessary paperwork and paying the required filing fee before conducting business under a different name. It's possible to file with a state agency, a local or county clerk's office, or both, depending on the state.

As a result, before starting operations in a new state, double-check that the required DBA paperwork has been filed with the appropriate authorities there. The next step is to double-check that your business or entity type has no special DBA filing requirements.

In some jurisdictions, business entities such as corporations, limited liability companies, and limited partnerships must file their paperwork with a different agency than do sole proprietorships and general partnerships. It's possible that the actual forms will vary as well. You can start using your DBA name once you've filed for and received your fictitious name certificate.

In many cases, a corporation or limited liability company's DBA application will ask for documentation showing that the entity is in good standing. You can get this from the secretary of state by requesting a certificate of good standing.

To satisfy the public's right to be informed of the DBA registration, some states and counties require that it be published in a local newspaper or publication.

Investigate the various ways of payment and documentation that are recognised. In some jurisdictions, such as the state or county, you can pay the filing fee with a debit or credit card, while in others, you must use a money order or cashier's check. You can submit paperwork to some government bodies electronically, while others will only accept notarized hard copies of your documents via regular mail.

Either your Social Security number or an EIN (Employer Identification Number or Federal Tax ID Number) can be used to legally identify your business, but EINs are more commonly recommended by accountants and other professionals who work with small business owners.

Using a fictitious name for commercial purposes without first registering it is illegal in this state. There are severe penalties imposed by some states. There may be legal repercussions as well as personal consequences.

It's important to anticipate any delays that may occur while waiting for a DBA filing to be processed by a county clerk's office or a state agency. Registration of a fictitious business name has a finite lifespan in many states and must be renewed before it can no longer be used. Typically, agreements are for five years. If the DBA name is crucial to the success of your business, make sure to renew it before it expires.

In addition, if any of the details listed in the original fictitious name filing such as the business's address, legal name, or officers (for corporations), partners (for general partnerships), or members (for limited liability companies) change, a new filing will be necessary in the majority of states (for LLCs). Certain states require the filing of amendments. In some cases, fresh registration is essential.

Your company's name is one of its most valuable assets, so taking precautions is essential. Using a Doing Business As name (DBA) can be a useful tactic in running a business. If this is the case, it is essential to register the DBA name with the state and keep the registration active. Now that you know the basics about DBA names and DBA filings, it's time to get to work with your business advisor and compliance partner to make sure everything is in order.

How do you register a DBA?

When you file for a DBA, you'll need to fill out some paperwork and pay a filing fee. All of this can be done with a county or municipal office, though in some states, you'll need to file with a state office in addition to or instead of the county. The filing of a DBA usually necessitates giving public notice of the change through publication in a local newspaper; this requirement varies by state and county.

In the state of New York, for instance, it is required of all sole proprietorships and general partnerships to register their assumed names with the appropriate county clerk's office. However, the New York Department of State requires the filing of assumed names by corporations, limited liability companies, limited liability partnerships, and limited partnerships. Kansas, on the other hand, does not mandate that business fictitious names be registered.

When a DBA is filed, what happens next?

The next step after deciding on a name for your business and having it registered locally is to seek trademark protection through the United States Patent and Trademark Office. Words, names, symbols, sounds, and colours that identify your products and services are safeguarded by trademark law.

If you feel overwhelmed by the paperwork and filing process, a business attorney can help you register your DBA name. The American Bar Association maintains a directory of respected legal professionals who specialise in business law.

Who should file for a DBA?

If you plan to use a business name other than your own or that of a business partner, you must register a DBA with your state. The Small Business Administration is a great resource for those who are unsure if they need to register a DBA.

A DBA may also be necessary if your bank insists on it before opening a business checking account for your company, if a potential client insists on one before hiring you for a job, if your company is expanding into a new line of business that doesn't match its current name, or if your company runs more than one business or website.

However, it must be stressed that merely having a DBA registered does not equate to being in business. Business entities such as corporations and limited liability companies are not created, as stated by Hanlon. It just tells the public who is behind a certain name. One person or organisation might operate under several DBAs to target various consumer groups with their goods and services.

How much does it cost to register a DBA?

Babbitt stated that the fee ranges from $5 to $50 (with an average of $20) but can go as high as $100 in some states. Registration is cheap, but the fees and fines for not doing so can add up to several thousand dollars.

This serves the purpose of safeguarding consumers. When a consumer files a complaint, the state needs to know who to get in touch with. This is typically taken care of when a company applies for its business licence, but some states do not mandate such licences. The registration of a DBA is mandatory in nearly all jurisdictions.

While there is no hard cap on the total number of names one person can register, doing so can quickly rack up a hefty bill.

In what kinds of companies would a DBA be useful?

DBAs aren't necessary for every company. It is contingent upon the type of business entity, local regulations, and the owner's personal preferences.

Companies with only one owner and companies with multiple owners

If you are a sole proprietor or general partner and want to do business under a name other than your own or your partner's full legal name, you must file a DBA. Unlike corporations, unincorporated businesses such as sole proprietorships and general partnerships are exempt from submitting entity formation papers or registering their business name with the state.

Franchises

Franchisees can operate without a DBA, but many do so so they can distinguish themselves from similar businesses in the area. Let's pretend you've invested in a Burger King franchise in your area.

Others in the legal system

Corporations (S corporations and C corporations), limited partnerships, and limited liability companies, or LLCs, technically do not need to file a business as name unless the state, city, or county requires it. These types of businesses, unlike sole proprietorships and general partnerships, have already established themselves legally and obtained their business names from the appropriate authorities.

However, a company that chooses to operate under one of these legal structures retains the right to register a DBA name if it so chooses. If they did that, they could use a name other than the one listed on their articles of incorporation when transacting business.

For most companies, registering a DBA name is done so that they can use the name in a particular market segment. A corporation can avoid forming an entirely new company if it simply wants to do business under a different name by filing a name for a new branch of the business. John's Cosmetics Inc. is one such company.

As a result, a growing company doesn't have to spend the time and resources necessary to form a new legal entity (such as a limited liability company or corporation). Remember that if you register a DBA without first forming a legal entity, the state will treat your business like a sole proprietorship.

Formalities and fees for registering a DBA range from $10 to $100 on average, depending on the state, county, city, and type of business involved. Your options for filing paperwork are with the state government or the county clerk's office.

A fictitious name advertisement in a local newspaper may also be required by some states. Publicizing your company's name in this way satisfies the public notice requirement in some jurisdictions.

Doing so may lead customers to believe that your company is legitimate and has corporate status when in fact it does not. Except for those exceptions, any name can be registered as a DBA. To make sure no other company is using your DBA name, however, it is prudent to conduct a simple business name search within your jurisdiction.

You now know how to file a DBA, so let's go over a few important things to remember:

When applying for a DBA as a limited liability company (LLC) or corporation, a certificate of good standing is typically required.

Online payments are accepted by some states, while others may insist on a money order or cashier's check. Furthermore, some states will permit you to submit your paperwork online, while others will require notarization.

Operating under an assumed name without first registering it can result in hefty fines from the relevant state agency.

Many states require renewals after a certain period of time has passed. If you fail to renew your DBA when it is due, it could have a devastating effect on your brand's visibility in the marketplace.

Changes to the information provided in the original DBA filing, such as a change in officers (for a corporation), partners (for a general partnership), or members (for an LLC), may necessitate filing a new DBA in some states (for an LLC). Keep in mind that in some jurisdictions, all it takes is to file an amendment to remedy the situation.

To file a business entity, it is usually unnecessary to retain an attorney. Since it is so straightforward, most company owners can do it on their own. It is recommended to consult an expert if you are unsure of the procedure or if your business situation is particularly complex.

Benefits of DBA you should know

If you don't want to use your given name or the name under which your company is registered for legal purposes, you can register a DBA. In addition to the aforementioned cases, there are a few other crucial reasons to consider registering a DBA name.

Facilitates banking for businesses greatly

Business owners should always maintain a distinct bank account for their company. Reason being, if you keep your business and personal finances separate, you will be able to avoid losing personal possessions in the event of a lawsuit, keep your personal credit rating intact in the event of a business failure, have an easier time keeping accurate financial records and filing your taxes, and appear more professional to your clients (and small-business lenders).

For a sole proprietorship or general partnership, however, this presents a problem: An EIN, or employer identification number, cannot be obtained until a business has been officially registered with the state. You also need an EIN to open a business bank account. However, you can obtain an EIN at the same time as filing a DBA.

Supports your company's continued compliance with applicable laws

When a business is organised as a limited liability company (LLC) or a corporation (corporation), the owners enjoy certain legal benefits. But if you use a name different from the one listed in your articles of incorporation and fail to file, you will be breaking the law.

For this reason, if your company is legally recognised as John's Cosmetics Inc. but you sign a contract with a client as John's Skincare Solutions without registering the latter as your DBA, the contract will be null and void.

While operating under a DBA won't shield you from liability, it will put more distance between you and your company. Assuming the worst case scenario occurs and your company is sued, you can use the DBA to prove that your company is legally distinct from you and your personal assets.

It's also possible that some customers won't do business with you unless you have a DBA, and some lenders won't give you a small business loan unless you have one.

It's in the name, and the name is everything

One of the first things people notice about a company is its name. Your company's name, ideally, will be descriptive of what you sell and entice potential customers to make a purchase. Who would know what Laura Smith sold if she ran her business under her own name? And what could possibly draw them inside that store?

It can be challenging to find the ideal name for your company before it even opens its doors. When your business is in its infancy, who knows where you’ll be in five years? Business name generators can help when you're stuck trying to think of a great name for your DBA.

Opens up expansion possibilities

By filing for a DBA, a company can serve as the legal entity for multiple subsidiaries. This eliminates the need to form new legal entities for each new business venture. A separate DBA registration should be filed for each potential branch of your business, such as a new website, store, service, restaurant, etc.

Keep in mind that if you plan on doing business in more than one state, you'll need to file a foreign qualification in each state where you intend to do business. The name on your certificate of authority is the name under which your business operates legally in the states where you are authorised to do so. If you want to use a different name, you'll have to register a DBA in that state.

You Wish To Introduce A Website

To conduct business under the name of your company, a DBA must first be filed. This is helpful if you want to expand your business into e-commerce but cannot secure the domain name containing your company name.

Making it simpler to set up a company

Ultimately, registering a business name through a DBA filing is the simplest way for sole proprietors to set up their companies as legal entities distinct from themselves. Price-wise, it's not too bad either.

Filing a DBA name is simple; you just have to follow the rules set forth by your state or county. The optimal time to complete all of these steps is between 30 and 60 days before opening for business under the intended name.

Approval decisions are typically communicated within a span of one to four weeks. Once your DBA name has been approved, you are free to open for business, begin accepting customers, and open a business bank account.

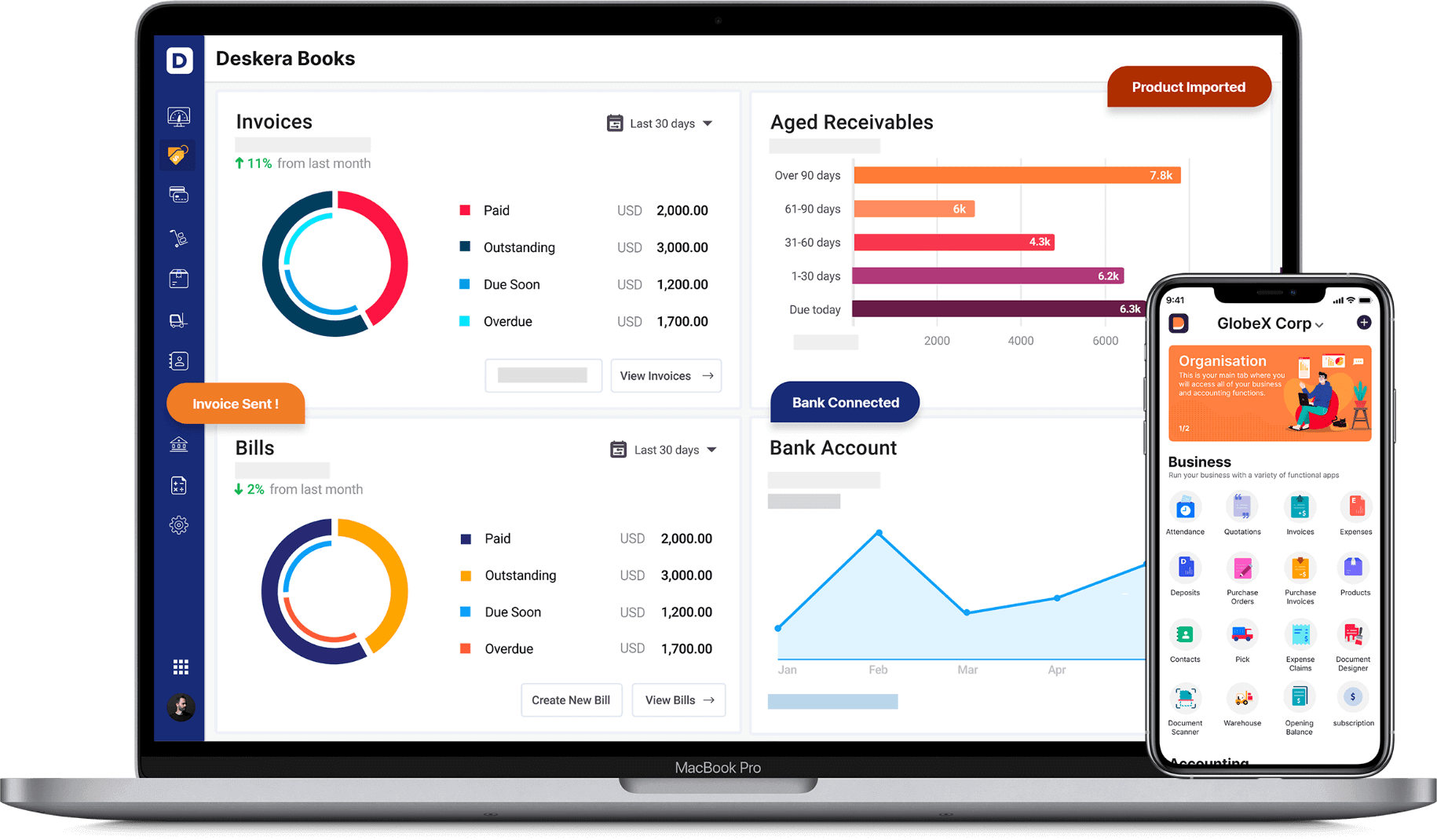

To manage your costs and expenses you can use many available online accounting software.

How Can Deskera Help?

It is Deskera Books, cloud-based accounting software that would be the most helpful to you here. Deskera Books is equipped with features that will automate all your accounting tasks, including invoicing, expenses, billing, taxes, payments, bank reconciliation, reporting, approval flows, and more.

The dashboard of this software will look into all the transactions and operations performed by a business and give your insights and analytics about the same. This will help you not only with the due diligence of the business you are interested in but also help you assess your business’s performance once you become its owner.

In fact, with Deskera Books, you would be able to focus on running your business, as it will do all the heavy lifting behind the scenes just for you. This includes, but is not limited to, management of charts of accounts, journal entries, general ledgers, and tracking of all changes via audit trail.

Key Takeaways

When a business has only one or a few owners, its legal name is the owner's or partners' names. When referring to a corporation, limited liability company (LLC), or other statutory entity, the name on its formation document is the official name (e.g., its articles of incorporation or articles of organization).

DBA registration is used to let the public know that a person or company is doing business under a name different from its legal name. Assumed name (DBA) laws are consumer protection laws. Businesses must register so that customers can identify who they are doing business with.

The most common scenarios in which a company will register a DBA are discussed below. Keep in mind that these factors can change depending on the type of company being discussed. When compared to a corporation or limited liability company, the reasons for a sole proprietorship to use an assumed name are different.

In business, you should use a name other than your own. For sole proprietorships and general partnerships, this is a crucial choice. To avoid confusion between business and personal records, a DBA must be filed if a business name other than the owner's legal name is to be used. Thus, you may wish to change the name of your company to protect your privacy.

You may need to apply for an EIN from the IRS after registering your business. While this isn't strictly necessary for sole proprietorships without any employees, it can help keep your business and personal finances distinct.

In addition, you must submit the appropriate tax forms to the appropriate authorities in order to meet your federal and state income tax responsibilities. Business structure is a key factor in determining the forms you'll need to file. If you want details on taxes that are only applicable in your state, you should look at the site for that state.

Your business may also require a seller's permit from the local and state governments in order to legally charge and collect sales tax from your customers. It's worth noting that each state has its own set of regulations, and those regulations go by different names. Apply for a seller's permit on the state government website of the state (or states) in which you will be selling goods.

When you file for a DBA, you'll need to fill out some paperwork and pay a filing fee. All of this can be done with a county or municipal office, though in some states, you'll need to file with a state office in addition to or instead of the county. The filing of a DBA usually necessitates giving public notice of the change through publication in a local newspaper; this requirement varies by state and county.

In the state of New York, for instance, it is required of all sole proprietorships and general partnerships to register their assumed names with the appropriate county clerk's office. However, the New York Department of State requires the filing of assumed names by corporations, limited liability companies, limited liability partnerships, and limited partnerships. Kansas, on the other hand, does not mandate that business fictitious names be registered.

To conduct business under the name of your company, a DBA must first be filed. This is helpful if you want to expand your business into e-commerce but cannot secure the domain name containing your company name.

Related Articles