Withholding, submitting, and disbursing payroll deductions are all complex activities that you, as an entrepreneur, must master.

In most cases, businesses must deposit and report payroll taxes periodically. Payroll deductions include deductions from employees' salaries to cover the national, state, and regional income taxes and the workers' portion of Social Services and Medicare.

They also include the employer's FICA contribution and unemployment deductions. Businesses may face severe fines if they fail to withhold and deposit taxes.

Here are some payroll tax fundamentals every business should know.

Table of Content:

- What is Payroll Deduction?

- Different Types of Payroll Deductions

- How a Payroll Deduction Plan Works

- Examples of Payroll Deduction

- The Components of Payroll

- Voluntary vs. Involuntary Deductions

- How States Impact Deductions

- Bottom Line

- Frequently Asked Questions

- How can Deskera Help You?

- Key Takeaways

- Related Articles

Let's Start!

What is Payroll Deduction?

Payroll deduction withholds income from a worker's salary for reasons, most typically for incentives. Payroll deductions can be voluntary or involuntary.

An example of involuntary payroll deduction is when a business has to withhold salary for Social Security and Medicare. A voluntary payroll deduction occurs when a worker chooses and grants written permission to withdraw money for specific objectives such as a pension program, medical care, or insurance payments.

Different Types of Payroll Deductions

Payroll deductions are of three types:

1. Pre-tax deductions

A pre-tax deduction is a sum taken from the overall salary of your employee. Gross pay is the income before deducting any taxes from their paycheck.

Pre-tax deductions reduce a worker's gross earnings, which means they will spend less on tax or FICA. Businesses can also reduce their taxes like Unemployment insurance via pre-tax deductions.

Not all pre-tax deductions are equal. For example, some taxes are deemed pre-tax for all taxes, while others may still need withholding of some taxes. There are also limits on some things in the pre-tax category. For example, the IRS limits the amount you can contribute to a pre-tax 401(k) plan each year.

Pre-tax deductions include

· Pension Funds - Deposits to some retirement programs, such as a typical 401(k), maybe deductible before taxes.

· Medical coverage - You may be able to deduct health benefits such as Medicare before taxes. Deposits to a medical plan for your worker's insurance coverage may be pre-tax.

· Commuter Benefits - Some commuting benefits are available for pre-tax deductions, subject to certain restrictions.

2. Employee tax withholding

Employers deduct federal, state, and local taxes from a worker's compensation.

These are some examples:

· Federal income taxes

· State income taxation

· Any local taxes levied at the city, county, or municipality level

· FICA contribution made by the employee

· State Disability Insurance

3. Post-tax deduction

A Post-tax deduction is an amount deducted from an employee's paycheck after withholding all the taxes.

Post-tax deductions that are common include:

· Pension Schemes - Some pension schemes, such as a Roth 401(k), are tax-free.

· Wages Garnishments - If your worker is liable to garnishments, you will deduct the money after withholding their taxes.

· Payments to 529 education savings schemes, union dues, charity donations, and charitable donations

How a Payroll Deduction Plan Works

Payroll deduction programs provide employees with a simple option to contribute money to a recurring deposit. Workers, for example, may deduct a certain proportion of their earnings and invest it in regular IRAs or Roth IRAs. Employees can also elect to have insurance premiums taken from their salary, ensuring that they never miss payments.

In such circumstances, the worker enrolls in their company's stock option plan, and they use a part of each check to acquire shares of their company's stock at a lower rate.

Examples of Payroll Deduction

One of the most prevalent forms of optional payroll deductions is deposits to your retirement savings plan. In addition, many workplaces provide a 401(k) plan, which invests a portion of your income in a retirement account that earns interest over time.

In some situations, the employer will provide a match, which means they will contribute the same proportion of your salary to your savings account.

Let's go over how these calculations work:

Assume you earn $100,000 per year and have opted to contribute 11 percent of your monthly earnings to a 401(k) (k). If your employer does not match your contributions, your yearly contribution to your plan will equal the deduction multiplied by your salary:

11% x $100,000 = $11,000/yr

or roughly $211/week.

Let's take another example.

Consider that you both earn the same income, contribute the same amount, and your company matches 6% of your optional retirement contribution. Therefore, you will continue to contribute $211 every week, but you will also have a portion of your paycheck deposited into the plan.

$100,000 multiplied by 6% equals $6,000 a year, or about $115 every week in your account.

That implies that after the match, your weekly contribution will be approximately $326, which isn't bad for your future nest fund.

The Components of Payroll

The payroll process has several components. Let's take a closer look.

Employee information

Before you pay the employees, you must collect certain information from them. Your employees must complete the W4-form. At the time of hire, each worker should fill out the form. The W4-form contains information regarding the employee's income tax deductions. It also provides the employee's personal information, such as their name, social security number, and residence. This information will allow the business to execute the payroll and pay the employees.

Wage and salaries

You might pay the staff hourly or yearly. Workers are entitled to a set amount of pay during each pay period. Hourly employees, often known as wage earners, are paid hourly rates. The yearly statement of the employee may include gross salary, overtime compensation, time spent, reimbursements and perks payments, net pay, and other earnings.

Voluntary vs. Involuntary Deductions

Payroll deductions that workers opt to have taken out of their paychecks are known as voluntary deductions.

- Contributions towards retirement

- Health-care coverage

- Plans for saving for college

Life insurance is generally considered a personal cost and is not tax-deductible. However, some firms provide free group term insurance coverage of up to $50,000. Employees who want to add life insurance for a dependent have the payments taken from their post-tax income.

Involuntary deductions are mandatory payroll deductions that you must deduct from an employee's salary, such as:

- Income Taxation

- Insurance against disability

- Taxation

- Wages Garnishment

Wage garnishment occurs when a part of a worker's income deduction settles a past-due obligation. It covers child support, alimony, and past-due loans. The amount garnished is determined by the kind of debt. For example, unpaid child support obligations may result in a garnishment of 50% to 65% of your salary. Student loans can garnish up to 15% of your earnings. Garnishment estimates include all wages.

How States Impact Deductions

While 42 states have state income taxes, they don't work the same way. For example, some states have a single rate of taxation, but Hawaii has 12 tax bands.

How much you pay in state taxes is affected by where you reside and how much you earn.

Bottom Line

Payroll deduction programs fund employee perks by directly deducting contributions from an employee's wages. Although the computations for these deductions can be complicated, they streamline the procedure and guarantee that they make medical care, pension, and medical costs on time. In addition, they can make some claims from pre-tax income, which can significantly affect an employee's tax obligation.

Frequently Asked Questions

What are insurance payroll deductions?

Many Americans who have health insurance do so through payroll deductions from their workplaces. The premiums deductions from their salaries on a pre-tax basis under a Section 125 plan offer significant cost savings. Employees, in reality, do not pay for their health premium but rather reimburse their employer, who pays the health insurance provider.

How to record payroll deductions?

You use the following paperwork for submitting employee tax deductions and completing the mandatory business tax payments to the national government:

- Form 940.

- Form 941.

- Form 944.

These documents can be submitted on paper or electronically. However, because each state has its unique rules for reporting payroll deductions, you must verify with your local authorities.

What are LTD deductions from paychecks?

Employees who are wounded or too unwell to work for a lengthy period are eligible for a percentage of their salary under the long-term disability deduction. Employees pay less for premiums with LTD pre-tax deduction, but any benefits earned are subject to federal income tax. Post-tax LTD deductions result in employees getting less take-home pay every pay period, but their benefits are not subject to additional taxation.

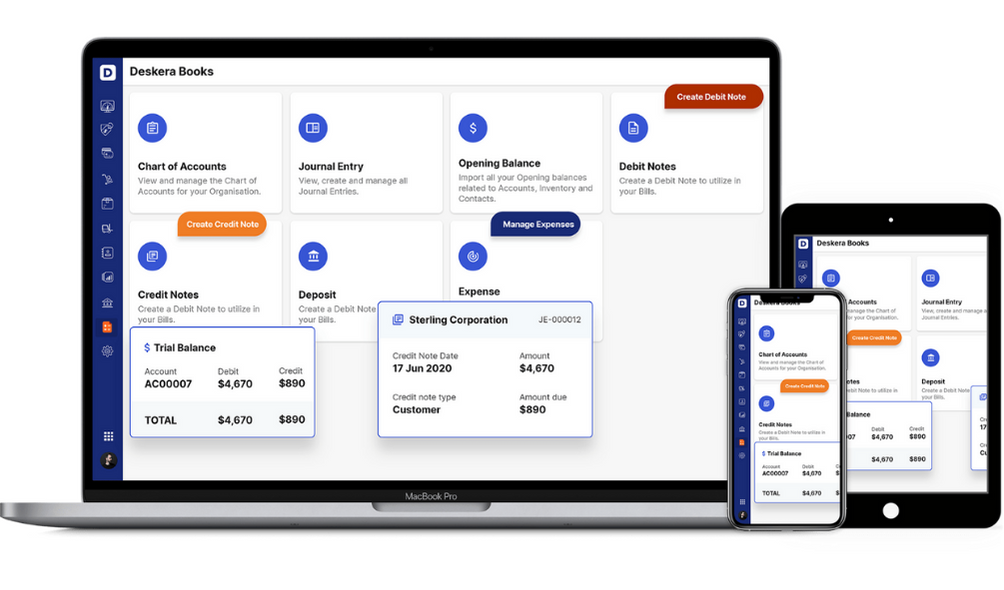

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- Payroll deduction withholds income from a worker's salary for reasons, most typically for incentives.

- Payroll deductions are of three types:

- Pre-tax deductions and contributions

- Local, state, and federal taxes

- Post-tax deductions and contributions

- Payroll deduction programs provide employees with a simple option to contribute money to a recurring deposit.

- One of the most prevalent forms of optional payroll deductions is deposits to your retirement savings plan. Many workplaces provide a 401(k) plan, which invests a portion of your income in a retirement account that earns interest over time.

- The payroll process has various components like employee information and salaries.

- Payroll deductions that workers opt to have taken out of their paychecks are known as voluntary deductions.

- Involuntary deductions are mandatory payroll deductions that you must deduct from an employee's salary.

- While 42 states have state income taxes, they don't work the same way. For example, some states have a single rate of taxation, but Hawaii has 12 tax bands.

Related Articles