If your small business employs Rhode Island residents, you must withhold and pay Rhode Island income tax on their wages. This is on top of the fact that the same employees are required to withhold federal income tax. The following are the fundamental guidelines for withholding state income taxes in Rhode Island for employees.

Table of Contents

- South Carolina Payroll Tax: A General Overview

- Connection Between Your Paychecks and Payroll Taxes in South Carolina

- Impact on Your Paychecks in South Carolina

- Step-by-Step Guide for Payroll Taxes in South Carolina

- Bottom Line

South Carolina Payroll Tax: A General Overview

Payroll/Withholding Tax is deducted from employee earnings and applied to the employee's total yearly income tax due. Every employer/withholding agent with a South Carolina employee who is obliged to submit a return or deposit with the IRS must also file a return or deposit with the SCDOR for any taxes withheld for state reasons. Withholding is required in South Carolina from:

- Wages\prizes\royalties

- Winnings

- Contractors who are not residents (contracts exceeding $10,000)

- Nonresidents who own five or more residential properties or one or more commercial establishments in South Carolina get rental payments.

- Nonresident sellers of real estate and related tangible personal property in South Carolina will receive net profits.

Unless an employee works in a jurisdiction that does not withhold state income tax, wages are taxed in the state where they are earned. If the employee works in South Carolina, regardless of where he or she lives, the money made in South Carolina is subject to South Carolina taxation. If a resident of South Carolina earns wages in a state without a state income tax, the withholding should be for South Carolina.

Connection Between Your Paychecks and Payroll Taxes in South Carolina

Since your company withholds money to pay taxes, your paychecks never exactly total up to your reported income or hourly rate. FICA taxes and federal income taxes must be paid regardless of which state you work in.

Social Security and Medicare taxes are included in FICA taxes. Each pay period, Social Security taxes account for 6.2 percent of your income, and Medicare taxes account for 1.45 percent. Your employer matches such contributions, making your total FICA tax contributions twice what you pay. If your income exceeds $200,000, you'll additionally have to pay a 0.9 percent Medicare surtax. This surtax is not matched by your employer.

While most businesses cover half of their employees' FICA taxes, if you are self-employed or a contract worker, you may be responsible for the full amount. Fortunately, if you must pay the entire FICA taxes, you may be entitled for a tax reduction for the employer part. It's always a good idea to speak with a financial counsellor if you want further help decreasing your tax burden while optimising your profits.

You must fill out a new Form W-4 when you start a new employment or go through a big life change, such as getting married or having a kid. Your employer is responsible for ensuring that all of your income withholding corresponds to the information you provided on this form. The present version of the W-4 incorporates significant improvements made in recent years. Allowances are no longer used, and you must input yearly dollar amounts for items like income tax credits, non-wage income, itemised and other deductions, and total annual taxable earnings. A five-step approach is also used on the form to allow filers to designate any extra income or occupations.

If you have access to employer-sponsored health or life insurance, the premiums will be taken from your paycheck as well. Pre-tax payments are those that are made before income taxes are deducted. Employer-sponsored retirement plans, such as 401(k)s, are also tax-deferred. That means you may save for retirement while lowering your taxable income at the same time. Health savings accounts (HSAs) and other accounts for medical bills are also pre-tax.

South Carolina residents are taxed in one of six different income tax rates. With growing income levels, these categories are subject to higher tax rates. Each year, the state adjusts these brackets to account for inflation.

South Carolina's lowest tax rate is 0%, therefore earners with taxable income up to $3,110 won't have to pay any state income tax. South Carolina's maximum tax rate of 7% applies to taxable income of $15,560 or more. Regardless of filing status, all taxpayers are subject to the same income tax brackets.

South Carolina's property taxes are still cheap. Mortgage rates are significantly lower than the national average, making the Palmetto State an attractive place to buy a house.

A South Carolina financial counsellor can help you understand how taxes fit into your overall financial objectives. Financial advisers may also assist with investment and financial planning, such as retirement, housing, and insurance, to ensure that you are well prepared for the future.

Impact on Your Paychecks in South Carolina

In South Carolina, the information reported on the W-4 form you submit at the start of a new job might have an impact on your take-home income. You just need to fill out a new W-4 if you ever wish to make a change.

Consider placing more money into pre-tax accounts if you expect to have a large tax burden. Before taxes, the money you put into a 401(k) or 403(b) retirement plan is taken from your paycheck. You may reduce your taxable income by raising your contribution to an account like this, which might help you save money on taxes.

Similarly, you can utilise a health savings account (HSA) or a flexible spending account if your workplace offers them (FSA). The money you put into these accounts is similarly tax-free, and it may be used to cover medical expenditures such as copays and medications. However, an FSA can only carry a $500 balance from year to year. If you have more than $500 in your FSA at the end of the year, you may lose money.

Step-by-Step Guide for Payroll Taxes in South Carolina

Step 1: Register your company as an employer.

You must apply for an employee identification number (EIN) and create an account in the Electronic Federal Tax Payment System on the federal level (EFTPS).

Step 2: Get your business registered in South Carolina.

The South Carolina Department of Revenue allows you to open a withholding account online. After registering online, you will gain your South Carolina withholding file number and tax deposit schedule within 24 hours.

In addition, you'll need to open an unemployment tax account. There’s an online registration process for the South Carolina Department of Employment and Workforce. Two to three weeks after enrolling, you will get a seven-digit South Carolina State Tax ID and an unemployment tax rate in the mail.

Step 3: Choose a payroll system.

Whether you perform your own payroll or utilise payroll software, you'll need to figure out a payroll procedure that works for your company and complies with South Carolina's rules and regulations. This includes, among other things, deciding when and how to pay employees, how to collect and submit payroll forms as needed, and how and when to verify employee hours worked.

Step 4: Compile employee payroll documents

During the onboarding process, it's important to gather employment forms from new recruits. The W-4, I-9, and a direct deposit permission form are all federal payroll forms. Employees in South Carolina must additionally complete an extra paperwork known as the SC W-4 for state withholding.

Step 5: Collect, evaluate, and approve time sheets.

Regular paydays must be created and presented to all employees in writing upon hiring, according to South Carolina law. Collect and approve timecards a few of days before payday to ensure your staff is always paid on time and in compliance. If you don't have have a time and attendance system in place, use one of our free timesheet templates to get started.

Step 6: Compute your payroll and pay your workers.

There are several methods for calculating payroll, and you must choose the one that is ideal for your company. Payroll software, a calculator, or even Excel can be used.

Step 7: File your payroll taxes with the IRS.

EFTPS is needed for federal tax payments. According to the IRS schedule allocated to your firm, you must deposit federal income tax withheld, as well as both employer and employee Social Security (6.2 percent of each employee's wages) and Medicare taxes (1.45 percent). You may be assigned to one of the following depositing schedules by the IRS:

Monthly Depositor: This option requires you to deposit employment taxes on payments received throughout the month by the 15th of the following month.

Semiweekly Depositor: Requires you to deposit employment taxes by the following Wednesday for payments made on Wednesday, Thursday, and/or Friday. Taxes paid on other days must be deposited by the following Friday.

It's vital to remember that the deposit and reporting of taxes follow different schedules. Employers who deposit both monthly and semiweekly should only file Form 941 or Form 944 quarterly or yearly to report their taxes.

Step 8: Submit your payroll taxes to the South Carolina Department of Revenue.

Employers in South Carolina must submit and pay taxes withheld from employee earnings. Filings are required quarterly, and payments are due quarterly or monthly, depending on the amount withheld.

Payments are required quarterly if the total withholding amount is less than $500 every quarter and the remittance is due by the last day of the month after the end of the quarter.

Payments are required monthly if the total withholding amount is greater than $500 every quarter and the remittance is due by the 15th of the following month.

Returns and payments can be mailed to the correct address or submitted electronically using the MyDORWAY website. Employers who withhold more than $15,000 per quarter or make more than 24 withholding payments per year must file and pay electronically.

Step 9: Document and archive your payroll data to keep track of it.

It's critical to retain records for all of your employees for at least three to four years, even if they've been fired.

Step 10: Compile the year's payroll reports.

For all workers, W-2s must be prepared, and for all independent contractors, 1099s must be done. By January 31 of the following year, both employees and contractors must have received these documents. Individual copies for each employee, as well as a form that summarises the information on each employee, must be sent to the IRS (W3 Form summarises all W2 forms, and Form 1096 summarises all 1099 forms).

Bottom Line

Payroll processing in South Carolina is a rather straightforward procedure. You'll have to withhold state income tax and make sure it's sent to the DOR on time, but you won't have to worry about municipal or city taxes or intricate overtime calculations. This is fantastic news for businesses in South Carolina or anybody wishing to expand there. When it comes to payroll processing in South Carolina, you won't have to make many changes as long as you follow federal requirements.

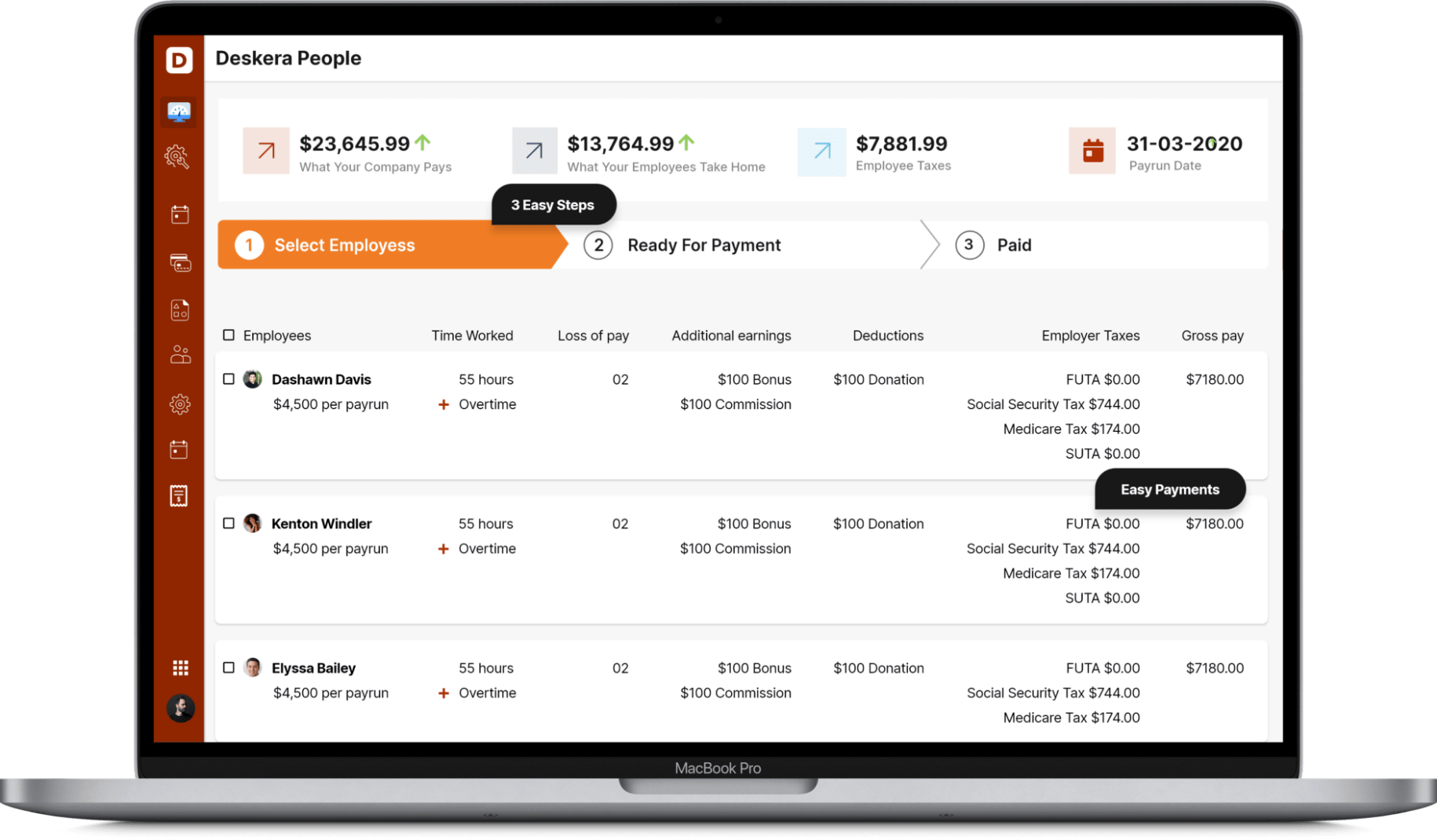

How Can Deskera Assist You?

Deskera People make it simple to handle attendance, leave, payroll, and other processes so that you can focus on making the best decisions. For example, creating payslips for your employees is now simple since the platform also automates and digitizes HR tasks.

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Related Articles