Every small businessman in the United States of America and even other nations is liable to pay a certain amount of taxes to the government as per the country’s rule. Businessmen or entrepreneurs across the world often use Business Tax Credits to lessen the amount of taxable income for the financial year in order to make substantial profits. Small business owners in the U.S are entitled to claim these tax credits for reducing the tax to be paid to the government.

Usually, businesses of all sizes often file tax credits which are considered a part of their annual tax filing process for the concerned year. In this article, we are going to understand what are the business tax credits and which credits should the business owners claim. The article would be covering the following points -

- What are Business Tax Credits?

- Why claim the Business Tax Credits?

- What is the difference between Tax Deduction and Tax Credit?

- What are the different business tax credits for small business owners?

- Should my tax accountant check for the business tax credits?

- Conclusion

- How can Deskera Assist You?

- Key Takeaways

What are Business Tax Credits?

Small business owners and even individuals often get rewards from the government and this policy exists across the world in the form of tax credits. It is given for small and large acts such as -

- Strengthening the economy

- Fighting climate change

- Being a good successful employer

- Improving the life of other people

The business tax credits can be defined as the credits offered to the businesses by the government as incentives for carrying out multiple activities. These activities are beneficial for the employees, society and for specific industries. For instance, the organisations involved in the medical sector or pharmaceutical industry can claim business tax credits for doing authenticate research and development which is essential for the improvement of the society as well as the industry.

It also includes providing health policy benefits for the employees to enhance their and their family lives. The businesses that assist the employees buy electric vehicles for fighting climate change can also claim this credit.

Why claim the Business Tax Credits?

Every business owner should be aware of the business tax credits his business is eligible for. It can make a substantial difference in the amount of income he is required to pay tax. It assists the employer to have a cut in the actual tax he pays as a small business owner. As per the available information, the small business tax credits are given dollar for dollar.

It means that for every dollar of the credits, the business owner will get a tax cut for a full dollar. It is considered to be a big amount for the small business owners and helps them recover a good cost for running their business successfully. It provides them with the much-needed capital small business owners need to enhance their business for growth and aids in prosperity.

Let us understand this with a simple example. If a small business owner owes fifteen thousand dollars in the small business taxes but files a claim of 5000$ in business tax credits, then he can subtract this amount from his income tax bill. Thus, his new tax bill would be for 10,000 dollars. The small business tax credits are easy, to sum up, and are an activity that must be carried out by the employer along with his tax professional while filing the taxes annual each time.

What is the difference between Tax Deduction and Tax Credit?

Business owners have often heard about the different tax deductions from their peers or through tax professionals. They are aware that small business owners are entitled to receive a tax deduction for every business expense they have made in the annual taxes. These expenses are related to office space rent, travel, work-related supplies and business-related subscriptions.

It means these deductions cut the taxable income of an employer. These tax deductions are considered to be more valuable once an employer’s taxable income sees substantial growth. For example, if the taxable income of a small business owner is in the 15% bracket, then every dollar would see a tax cut by 15 cents. In opposition to this, if the business owner has his income in the 35% bracket, then the dollar deduction would cut his tax by 35 cents.

However, in contrast to the information given above, the business tax credits work as a turbocharged tax deduction. In the credit, for every dollar of the credit, the business owner’s tax gets cut by a full dollar. These credits are considered to be more valuable for the taxpayers who fall in the lower brackets of tax. If the small business owner falls in the 35% bracket, then he would need a deduction of 2,857$ to have a credit which is worth a thousand dollars. On the other hand, if the small business falls in the 15% bracket, then he would need deductions of a whopping 6,667& to get a business tax credit of 1000 dollars.

What are the different business tax credits for small business owners?

Every small business owner must know the different business tax credits that will prove beneficial in business. The 9 small business tax credits a small business owner can claim are as follows -

- Work Opportunity Tax Credit

Small business owners can claim the Work Opportunity Tax Credit if any of their employees belong to the targeted group which has historically faced certain barriers while searching for employment. The examples of targeted groups include veteran professionals that have some disabilities, and ex-felons.

A small business owner needs to know how to claim the Work Opportunity Tax Credit as it requires some prior work to be done before the claim is filed. The business owner must file Form 8850 when the concerned employee starts working at his business. It will verify with the state agency that the employee belongs to the targeted group. The business owner can file the business tax credits by using Form 1040. Also, he needs to file a Form 3800 or Form 5884 for the employees depending on the sources of business income

2. Child and Dependent Care Credit

This is a business tax credit that a business owner can file on his individual taxes. It is counted as the credit no employer would want to forget. If the business owner pays for the childcare or dependent care of his spouse or any other dependent member of the family who cannot care for the self while working or searching for a new opportunity, then he qualifies for the Child and Dependent Care Credit.

As per the available information, the IRS has given an extensive list of qualifications, questions and flowcharts to help the business owners or even individuals understand whether they can qualify for this credit.

According to the available data, this credit is worth 20-35% of childcare expenses which is up to 3000 dollars per child. It provides a maximum credit of 6000 dollars per family. The individual cal claim for the Child and Dependent Care credit using Form 2441.

3. General Business Tax Credit

Small business owners can file for this catchall tax credit as it comprises various individual tax credits. It has been designed to motivate the business owners to undertake specific activities which will provide a boost to their business It includes the purchase of qualified electric vehicles and entering into new markets which will assist in the expansion of the business. This tax credit also motivates retaining employees. The employer would need to fill separate form for each of the business tax credits mentioned here and then he can add them all up using the General Business Tax Credit—Form 3800.

4. Credit for Small Employer Health Insurance Premiums

A small business owner must know what is needed to qualify for the Small Employer Health Insurance Premiums Credit in order to avail of these business tax credits. The employer must satisfy the following criteria for this credit -

- He should be a business owner having less than 24 full-time workers/employees

- The average wage of the employee must be less than 51,600$ per year

- The business owner must provide a payment for at least half the amount for all the employee's health insurance premiums in the organization

- He should have purchased the insurance plans through the Small business Health Options Marketplace

If the business owner satisfies all the above conditions, then he would be able to claim business tax credits under this option. If you are a small business owner who wants to understand the worth of this credit, then as per the available information, the credit is worth fifty per cent of the amount an employer has paid towards the premiums. It means only thirty-five per cent of it is exempted from the tax. Also, it is important to note that a business owner can claim this credit only for 2 consecutive years.

If the employer wants to claim the credit for Small Employer Health Insurance Premiums, then he would have to file Form 8941.

If the business owner is confused about whether to avail of this credit now or wait for some more time as it is available only for 2 consecutive years, then he needs to understand that it depends on the prospective growth of his business. Also, there are several factors involved while filing a claim for this credit which can be understood by an accountant if the employer wants to file it immediately.

5. Retirement Plan Startup Costs Tax Credit

As per the available information, if a small business owner is planning to start a retirement plan for his employees, then the IRS is known to reimburse a part of it which is termed as the “ordinary and necessary” for the startup. If the small business has a hundred or even lesser employees, then the business owner can qualify for this business tax credits by meeting specific criteria as given on the IRS website.

A business owner can claim this credit for the first 3 years of his startup in which he needs to plan the retirement plan for his organization. According to the available information, the credit is worth fifty per cent of the startup costs to 500$ per year.

The small business owner can claim this tax credit by filing Form 8881. He must first check whether he qualifies for this business tax credit. If the entrepreneur failed to qualify for the previous year, then he should speak to his CPA about the possible options for starting the retirement plan next year. This is important as the business owner can claim this credit in the tax year prior to the year it becomes effective for the employees.

6. Research and Development Tax Credit

A small business owner can use the Research and Development tax credit if he has the expenses to perform qualified research and development costs in the United States of America. It is popularly known as the R&D Tax Credit.

As per the available information, for a business owner to be eligible for these business tax credits, he must have less than 5 million dollars in the gross receipts for the credit year. Furthermore, he should not possess more than five years of such gross receipts. If the business owner is wondering how much credit is worth through this claim, then he should know that the credit may qualify for an exorbitant amount that goes up to 1.25 million dollars or 250,000 dollars per year for a period of 5 years of the federal R&D Tax Credit.

The business owner would be required to file a claim for this tax credit by filing Form 6765.

7. Disabled Access Credit

It is a different credit among the multiple business tax credits. It encourages the businesses to make their offices, workshops and other business facilities accessible for the employees who have some kind of disabilities. It can include the installation of ramps within the office premises, improving storage and display units, providing braille texts and upgrading the restrooms for the comfort of special employees.

As per the available information, a small business is eligible for this credit if its total revenue is 1 million dollars or even less than that. Also, if the company has 30 or even less than 30 full-time employees, then the business owner can claim this tax credit. He can cover up to fifty per cent of the disabled access expenditures which range from two hundred and fifty dollars to ten thousand dollars. The maximum credit available in this claim is 5000$ for an expenditure of 10,000$ for an employer.

He can claim this credit using the Form 8826

8. The Premium Tax Credit

An employer should not over the Premium Tax Credit which is another individual credit. The individual can qualify for this tax credit if he has purchased his own health insurance through the Health Insurance Marketplace. As per the available information from the internet, the amount of credit given in this varies to a great extent. It is dependent on an individual’s income and location in America. Furthermore, a document from the Center on Budget and Policy Priorities is known to provide specific examples and answers to the frequently asked questions by people related to this claim.

An individual can file for this claim by using Form 8962.

9. Employee Retention Credit

Among the different business tax credits, this tax credit was created as a part of the CARES Act in response to the Covid-19 pandemic. It assisted the business owners to incentivise their businesses and ensure their employees remained on the payroll. The business owner is eligible for Employee Retention Credit if they have kept the employees in employed despite business closure or decrease in sales that are business receipts. In this tax credit, an employer can claim a credit which is worth of 5000 dollars for each employee in 2020 and 7000 dollars per employee for every quarter for the year 2021.

To claim the credit, the eligible employers will have to report the total qualified wages and related health insurance costs on Form 941.

Furthermore, after 2017, after the Tax Cuts and Jobs Act (TCJA), the business owners are allowed pass-through entities which include sole proprietors, S-corporations and partnerships to deduct up to 20 percent of the qualified business income. Since the legislation is still in its evolving phase, the IRS has put certain limits on this business tax credit. The entrepreneurs in any industry can take the 20 per cent deduction if their taxable income falls below 157,500$ if they are single and if the applicant is married then it goes to 31,500$.

For more information, review the IRS TCJA comparison for businesses.

Should my tax accountant check for the business tax credits?

If you are a business owner who has hired a small business accountant, then it is very natural to expect timely suggestions from him to save the money. Usually, good accountants do tell every possible method to get business tax credits to their employers. However, to err is the human nature and hence, even great accountants can miss out some key tax credits for the businessman they are employed with.

Even though it is the duty of the accountant to point out the common business tax credits and even notify the deductions that a business owner is entitled to take, it is always a good practice that the business owner himself keeps knowledge of the same. It will ensure that he remembers the common ones at the time of filing taxes for the financial year. The employer can get all the general business credits available from the list given on the IRS website.

Conclusion

Claiming for business tax credits is not a simple do it once activity as it keeps changing in each financial year. Hence, they are difficult to parse if the accounting numbers are not kept in order. The small business owners must hire a tax professional to file the claim for these credits or make use of a trustworthy and certified software to get approximate accounting reports that are tax-ready. As per the industry experts, small business owners who have orgainzated and investigated about the small business credits in detail are bound to be successful in their journey.

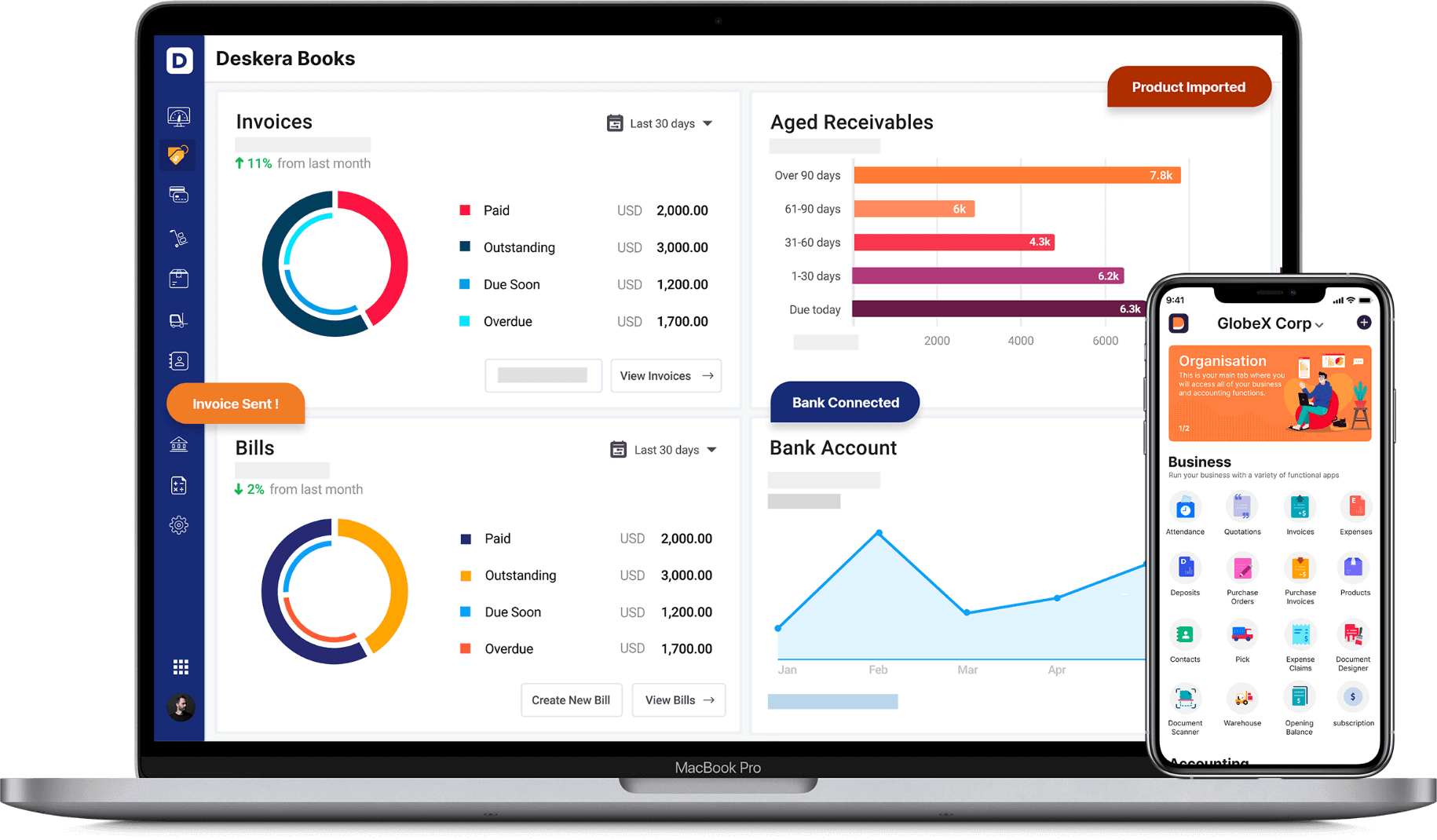

How can Deskera Assist You?

Deskera Books provides an online accounting software that is exactly what the small business owners need. It is trusted by more than 5 lakh businesses worldwide and helps business owners to perform tasks such as create and send invoices, manage purchase and expenses. The software can be easily connected with the employer’s bank accounts and can be used to generate accurate financial reports which are a pre-requisite at the time of filing taxes.

Deskera Books can help you automate and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Learn about the exceptional and all-in-one software here:

Key Takeaways

- Small business owners must keep appropriate information about the different types of business tax credits to reduce the taxable income for the financial year.

- Business tax credits can be defined as the incentives or rewards offered by the government to business owners for carrying out multiple activities. It could include steps taken to improve the life of other people, taking actions that are good and support actions required to lessen the climate change, assisting to strengthen the economy etc.

- The small business owners and budding entrepreneurs must claim these various credits as they can be a big support to establish their business in the industry. It can also assist in running the venture smoothly.

- The different types of small business tax credits which the employers can claim include Work Opportunity Tax Credit,Child and Dependent Care Credit, General Business Tax Credit,Credit for Small Employer Health Insurance Premiums, Retirement Plan Startup Costs Tax Credit etc.

- It also includes Research and Development Tax Credit, Disabled Access Credit, The Premium Tax Credit and Employee Retention Credit

- A small business owner must hire an accountant or take the help of a tax professional while claiming these business tax credits. He can use an online accounting software to generate the required financial reports necessary while filing the taxes and credits from the government.

Related Articles