Sales taxes are taxes imposed by the state, city, county, or other local government on goods and services. Each state has its own rules for what is taxable and what is not.

This type of tax applies only to the final sale price of an item, not to any fees or shipping costs. A sales tax can be either a percent of the sale price or a flat dollar amount.

Here is an overview of what we have in store for you:

- What is a sales tax report?

- Why is it essential to do a sales tax report?

- When should you conduct a sales tax report?

- Check your Sales Tax Rate in the sales tax report

- How to file your sales tax report

- Example of a Sales Tax Report

What is a Sales Tax Report?

The sales tax report requires you to list each sale with a corresponding invoice number, the amount charged, the date sold, and taxes collected. If you are using a point-of-sale system, this information should be available to you automatically.

You can also use your purchase invoices to guide what to include on the sales tax report. Remember that if you are using both an invoice number and a receipt number on your invoices, they will also be included in your sales tax report.

Sales Tax will be added to any product or service purchased online or off-line if goods are shipped to the state in which the customer resides.

Most states require vendors to charge sales tax on products purchased for use in their jurisdiction, even if the vendor is located out of state. Tax rates vary by state and are subject to change at any time without notice.

Some states require sellers to collect sales tax from their customers while others do not. If you are selling goods in more than one state, you need to keep track of all your sales tax information to prepare your sales tax report correctly.

The best way to determine if you are required to collect sales taxes is to contact your local revenue department for exact requirements about how you handle sales taxes in your state.

Sales tax is a legal responsibility for all businesses that sell goods and services to buyers within a state. Tax laws vary by state, so it's in your best interest to learn the specifics in the states where you do business.

Your sales tax responsibilities may depend on how your business is organized, whether or not you have employees, and your commercial activity volume. Some companies aren't required to collect sales tax at all, but many are, and failure to comply with the law can result in substantial penalties and fines.

Why is it essential to do a Sales Tax Report?

The sales tax report is a powerful tool that helps you understand which products are taxed or not. It also allows you to keep track of the sales taxes collected on each order. Sales tax report helps you to identify the areas where your business is lacking or making mistakes.

This type of report also helps you to assess the level of sales tax compliance in your business. This information can help you to improve the efficiency of your business by identifying common problems. If your sales tax reports show that you are not collecting enough sales taxes, it will be easier for you to take the necessary action.

If the sales tax report show that you are collecting too much sales tax, it will be easy for you to get rid of unnecessary costs for your business.

The sales tax report will track every sale that you make over time and the total amount of sales that you had. Did you sell anything on credit? If so, then your sales tax report should include credit sales too.

The information on your sales tax report can help your state government with their calculations when it comes time to collect sales tax from businesses like yours that operate within their state borders.

Even though it may seem tedious, filling out a sales tax report is vital to your business financials. A sales tax report will help you determine if you owed the State or federal government money. It will also let you know which states you have made purchases from so that you can file those states' returns as well.

When should you conduct a Sales Tax Report?

The best time to complete the sales tax reports is when you have completed the quarter. This will ensure that you have all of your numbers for the quarter.

If you conduct an occasional business, you might not need to file a sales tax report. States have different rules, so check with your agency's website for information on how to file. However, if you have a regular business with consistent transactions, you'll need to keep track of all your sales and purchases and pay any taxes due every quarter.

Corporations must report their income and pay taxes quarterly. As a corporation owner, you are personally responsible for paying the corporate taxes even if the company is not profitable.

Investors want to see that you are keeping up with your quarterly reports because they show that you are responsible for your finances. If you are not keeping up with this report, it can affect your relationship with investors. It's essential to make sure you are keeping up with your quarterly reports to make sure you don't run into issues when working with investors.

The frequency of your sales tax report depends on the regulations in your state. Some states require businesses to submit monthly, quarterly, or annually, while others don't have any rules.

Once you've decided when to file your sales tax report, it's time to gather the required information to complete the process promptly.

The first step is to ensure you have all of your previous year's sales figures. This information will be used to create an invoice for this year's taxes. If you cannot locate this information, contact your accountant to help you find these figures.

Check your Sales Tax Rate in a Sales Tax Report

If you're selling on a state-by-state basis or selling products that you ship to a customer from a different state, you need to know your sales tax rate.

The seller generally collects sales taxes on products shipped from one state to another. It's important to check this rate before claiming your sales tax. The rate is the sales tax you must add to your gross taxable income to determine your State and local income tax liability.

Sales tax rates vary based on the type of product and the location where you sell it.

Sales tax is collected on the state level, so the best policy is to check your state's website for information on how to figure out what you owe. If your home state has an address verification service, they may be able to tell you automatically whether or not you owe taxes on an item without you needing to file anything.

How to file your sales tax report?

Whether you're a business owner or an individual, sales tax is to keep track of for the state and local governments. At the end of each year, you have to file a sales tax report with your state. If you don't, you could face penalties and fines.

The sales tax reporting process differs from State to State. Some states will send you a form by mail, while others require that you submit your information online. The method may also vary depending on whether you're filing as an individual or as a business.

The report lists individual transactions and breaks down taxes by type — general sales taxes, local taxes and special taxes like gas and cigarette taxes. If you're exempt from paying certain taxes (for example, because you're located in a rural area), that will also be listed on the report.

You need to calculate the amount you owe to the state for this period and then pay it.

Below, we have covered the significant aspects of reporting that are common to all states:

- When do you have to file?

Sales tax reports are typically due on February 15 (dates may vary). However, some states offer extensions if you need more time to compile the necessary information.

- What information do you need?

You should find this information on the previous year's forms (if applicable), receipts, and invoices. Here are the essential elements that should be included in your report:

- What are the details of the Sales?

Name of the vendor, Amount paid for each transaction, Description of what was purchased, Line item number, Date of purchase, and location where the purchase was made

- Do you get taxed twice?

For most states, yes. Most states require that consumers pay sales tax.

- Who has to file a sales tax return?

The short answer is that any business collecting more than $500 in taxable sales must file a sales tax return with their state. This includes businesses registered as sole proprietorships, LLCs, and corporations.

Businesses can register with their state by completing a one-page form usually available from the state's revenue department. The form requires basic information about the company, such as name and location. In most cases, this is all that's necessary to register your business for sales tax purposes.

Example of a Sales Tax Report

A sales tax report is a document that summarizes the revenues collected from a business' operations. In most cases, the revenue figure listed on the report is broken down to include gross sales, net sales, and total taxes collected. It will also detail any applicable tax-exempt purchases made by customers during the reporting period.

A sales tax report can be sorted by date or item sold to compare products and periods listed on a spreadsheet. Most jurisdictions require businesses to submit their tax reports electronically as part of an ongoing effort to reduce paperwork.

A good sales tax report will have all of the information you need from the previous month's sales, including:

- Number of transactions

- List of any refunds or adjustments

- The total amount collected from each sale

- Taxable total Cost of goods sold

- Shipping costs Gross profit

Sales tax reports are typically due at the same time as your Federal Quarterly Tax Reporting requirement. However, you should check with your state's department of revenue to be sure.

When you file your sales tax report, you must include all taxable sales (and exempt sales) subject to sales tax during the previous reporting period. The due date for the information is usually 10 to 15 days after the end of the month being reported. The report may be filed online or by mail.

How Can Deskera Help You with US Sole Proprietorship Taxes?

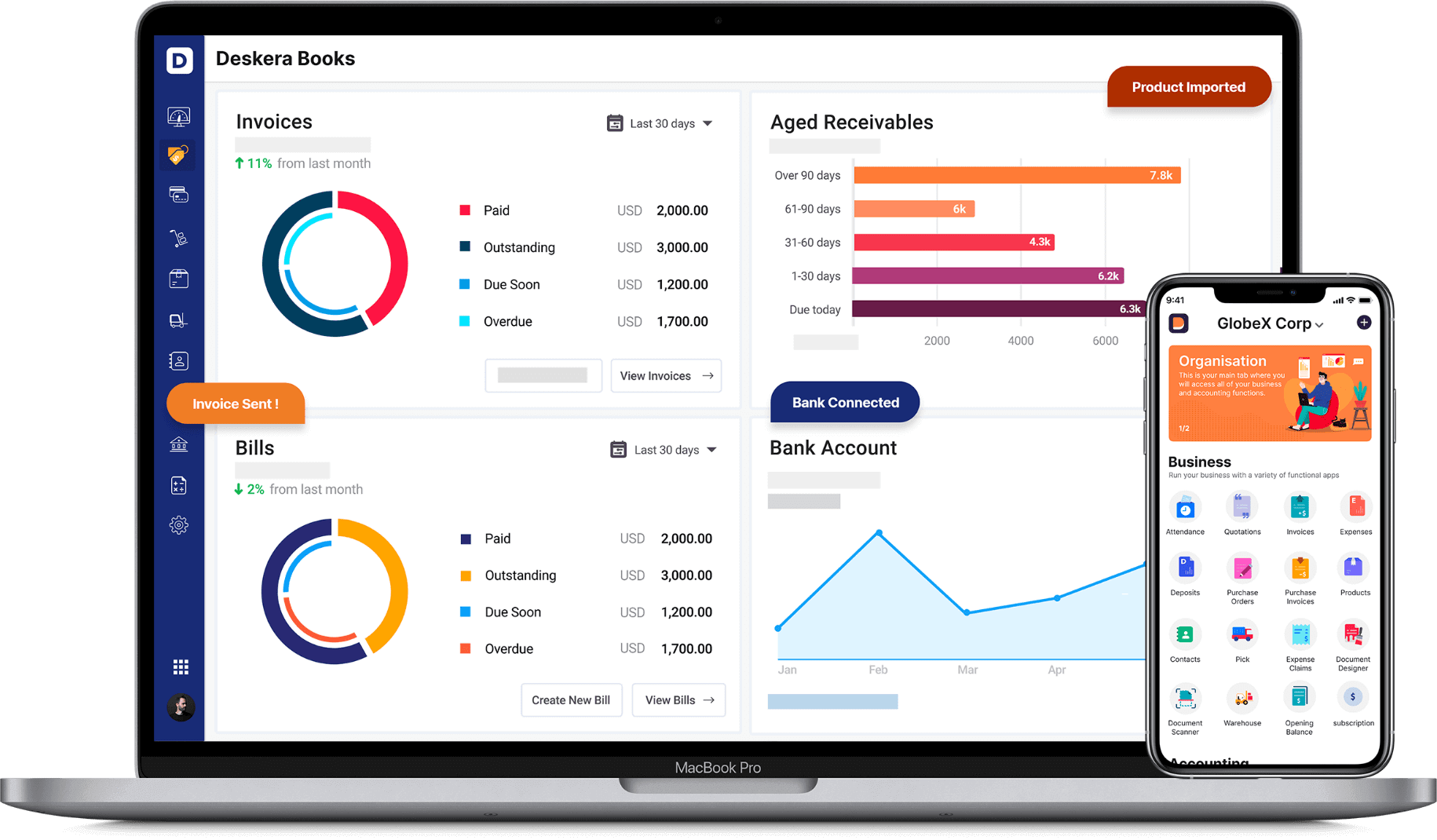

Deskera Books is an online accounting, invoicing, and inventory management software that is designed with the sole purpose of making your life easier. It is a one-stop solution that caters to all your business needs like creating invoices, tracking expenses, getting insights through financial KPIs, creating financial reports and financial statements, and so much more.

This platform works exceptionally well for all the small businesses that are being set up or need some help, especially in accounting. Whether it is recording your operating income, account payable, account receivable, or even returns on investments, or it is about updating your debit and credit notes, Deskera Books has made it all very easy as well as accessible.

In fact, the software comes updated with pre-configured accounting rules, invoice templates, tax codes, and a chart of accounts, to name a few, which makes it super easy for you to comply with sole proprietorship taxation. Deskera Books will also allow you to transfer your data from your previous accounting software by just updating the details on the spreadsheet available on Deskera Books.

Deskera Books also allows you to add your accountants to your Deskera Books accounts for free. You will just have to invite them. Once they are in, they would be able to check your financial reporting and statements like profit and loss statements, income statements, cash flow statements, balance sheets, and bank reconciliation statements. Your accountants will be able to help you navigate through all the taxation regimes in a faster and more efficient way through Deskera Books.

Wrapping Up

Sales tax is an integral part of tracking all taxable revenue so that you can report it to state and local government. If you sell items online, you'll need to know the sales tax codes in your region.

Key Takeaways

Sales Tax Report is a quick and convenient way to print out reports of your sales tax transactions. Learning the ins and outs of sales tax is necessary for maintaining good business practices.

You can run this report using one of the following options:

By Tax Period – This option allows you to select a specific tax period and then select the date range you want to include in the report

By Tax Location – This option allows you to select a specific tax location and then select the date range you want to include in the report. All transactions for the selected area will be included in the report. All locations – This option allows you to choose the date range you want in the report. All transactions will be included in the report

The Sales Tax Report prints out all of your sales tax transactions by vendor, with an indication of whether or not they were taxable, as well as the amount of sales tax collected for each marketing.

There are software solutions that can help you compile and generate these reports quickly and easily without calculating everything manually. Many states offer free tools that will help you file these reports electronically and keep up with all of the new laws and regulations regarding them.

Related Articles