There's a lot to think about when recruiting staff for the first time, from onboarding and compliance to payroll - which may be one of the most difficult duties. Calculating and reporting payroll taxes, in particular, maybe a challenge for even the most seasoned business owners. However, if you don't pay your payroll taxes correctly, you risk facing financial penalties - and possibly criminal charges.

Let's start with a broad explanation of payroll taxes in Rhode Island, including what they are, how to compute them, and the penalty for late reporting of payroll taxes.

Table Of Contents

- What are Payroll Taxes?

- Calculating Payroll Taxes

- Penalties for Late Tax Filings

- Step-by-Step Guide for Rhode Island Payroll Taxes

- How You Can Affect Your Rhode Island Paycheck

- Bottom Line

- How Can Deskera Assist You?

- Related Articles

What are Payroll Taxes?

Payroll taxes are levied on both employers and workers and are usually computed as a percentage of the salaries paid to employees.

Payroll taxes are made up of numerous components. These include the following for employees:

Social Security*: This tax is used to cover the expense of payments for the aged, handicapped, and survivors of recipients.

Medicare*: A component of the Medicare insurance programme is funded by Medicare tax.

Federal income tax: The federal government withholds a specific amount of what employees earn over the course of a year.

State income tax: States will withhold income taxes in all but nine states.

Additional state and local tax: In certain regions, such as Rhode Island, there are additional withholdings, such as Temporary Disability Insurance (TDI) and New York City's local income taxes.

These taxes are removed from an employee's salary and then submitted to the US Treasury and applicable state agencies in what is known as a federal tax deposit, which we'll go over in more detail later.

An employer is also responsible for paying payroll taxes. You must, for example, match Social Security and Medicare taxes and, if applicable, pay into the federal and state unemployment funds. Other state and local taxes may apply to you, just as they do to workers, depending on your location.

* FICA taxes refer to the combination of Social Security and Medicare taxes.

Calculating Payroll Taxes

Some payroll taxes are fixed percentages depending on an employee's earnings, while others are dependent on the federal and state governments' tax rates.

Employees and employers pay the same percentage of Social Security and Medicare taxes:

Social Security: The current Social Security tax rate is 6.2% for employees (and correspondingly for employers), for a total of 12.4%. The Social Security tax has a wage base limit, which means that the tax only applies to a certain amount of money. The starting salary for 2021 is $142,800.

Medicare: The employee and employer share of the Medicare tax is 1.45%, for a total of 2.9%. If an employee's wages surpass $200,000 in a calendar year, they may be subject to an extra Medicare tax of.9%.

Additionally, as an employer, your federal unemployment tax (FUTA) is set. The present rate is 6.0%, and it only applies to the first $7,000 in wages each employee receives. However, if you pay state unemployment taxes on time, you may be eligible for a tax credit of up to 5.4%, lowering your rate to as low as.6%.

Income taxes, on the other hand, are calculated based on an employee's earnings as well as the information they provided on their Form W-4. The employee states their filing status, the number of dependents, other income, and expected credits and deductions when filling out this form. You'll then withhold the relevant taxes based on this information.

Similarly, 32 states presently require employees to submit a separate state W-4 for income taxes.

Employees should update and file a new federal or state W-4 if their circumstances change, such as if they have a kid, to ensure they are not underpaying or overpaying their taxes.

Penalties for Late Tax Filings

The IRS can levy fines and interest if you don't collect, transmit, and report federal payroll taxes. For example, if you're up to 5 days late on filing Form 941, you'll face a 2% penalty. With a maximum penalty of 15%, the amount increases the longer the taxes are not paid.

You're ultimately accountable for the deposits, and you may even be personally liable. In reality, the IRS has the authority to pursue business owners, check signers, and others who may have had a part in the failure to pay. And the repercussions can be severe, including time in prison.

Returning to the Rhode Island Payroll Tax. Pay your Rhode Island payroll taxes by following the instructions in the following step-by-step tutorial.

Step-by-Step Guide for Rhode Island Payroll Taxes

Step 1 - Obtain an Employer Identification Number (EIN)

If your small business employs people in the United States, you'll need a federal employment identification number, with a few exceptions (EIN). You should get an EIN as soon as possible, if not before you hire your first employee. The IRS issues EINs, and you'll need one for federal taxes first and foremost. For withholding tax purposes, several states provide distinct tax ID numbers. The EIN, on the other hand, is used in Rhode Island. To register with the state, you'll need an EIN (see below). On the IRS website, you may apply for an EIN. If you apply online, you should obtain your EIN almost quickly.

Step 2 - File a tax return with the Department of Revenue

You must additionally open a Rhode Island withholding tax account with the Rhode Island Department of Taxation in addition to your EIN (DOT). You create your account by enrolling your business with the Department of Transportation (DOT) either online or on paper. Use the DOT's Combined Online Registration Service to register online. The DOT may take up to four weeks to allocate your account if you register online. Use Form BAR, Business Application and Registration, to register on paper. The DOT website's withholding tax forms section has blank forms accessible. Fill out and mail in Form BAR.

The DOT might take 4-6 weeks to give your account if you register on paper. There is no cost to register your company as an employer with the Department of Transportation.

Step 3 - Ask new hires to fill out a withholding certificate

All new workers must fill out a federal Form W-4 as well as a Rhode Island Form RI W-4, Employee's Withholding Allowance Certificate. The DOT website has blank Form RI W-4s available for download under the withholding tax forms area. The completed forms should be kept on file at your company and updated as needed.

Step 4 - Submit Withholding Tax Payments and Returns on a Scheduled Basis

There are five different payment schedules for withholding taxes in Rhode Island: daily, quarterly, monthly, quarterly, and yearly. The average amount you keep from employee salaries over time will eventually determine your payout schedule. The more you withhold, the more withholding tax payments you'll have to make.

Only when very significant amounts are withheld in a single month does the daily schedule (payment due the next banking day) apply. When no tax needs to be withheld for the full year, the yearly schedule is used. Neither of these payment plans is usual for a small firm, thus they aren't discussed more here.

The specific monetary thresholds for the various payment plans, as well as other requirements, may vary over time, so check with the DOT at least once a year for the most up-to-date information.

The following are the dates for the three most common payment schedules:

Quarter-monthly: The first seven days of a calendar month, the eighth day through the fifteenth day of a calendar month, the sixteenth day through the twenty-second day of a calendar month, and the twenty-third day through the thirty-first day or that portion of a calendar month following the twenty-second day of such month are referred to as the "quarter-monthly period." After the last day of the quarter-monthly period, payments are required within three banking days (Monday – Friday).

Monthly: Payments are due on the 20th of the month after the month in which the tax was withheld for the eight months, rather than at the conclusion of calendar quarters. Payments are required on or before the last day of the next month for tax withheld for months at the end of calendar quarters (March, June, September, and December).

Quarterly: Payments are due quarterly on the last day of the month after the quarter's conclusion.

The due date is extended to the following business day if the payment is due on a Saturday, Sunday, or holiday.

The Department of Transportation (DOT) will give you preprinted coupons, commonly known as withheld refunds, to use when making payments. Your payment schedule will determine which return you utilise. Form 941QM is used by quarterly payers, Form 941M is used by monthly payers, and Form 941Q is used by quarterly payers. (Other refunds are used by daily and yearly payers.) The DOT website's withholding tax forms area has blank returns available for download. Electronic payments transmission is necessary for some firms (EFT). Furthermore, some firms choose to pay through the DOT's Online Services website.

Even if no tax is withheld, you must file returns for each pay period. A company that files quarterly returns, for example, must file successive filings for each quarter-monthly period. If no tax was withheld during a quarter-monthly period, a return for that period is still needed, along with an explanation of why no tax was withheld.

Check the most recent edition of the DOT's publication Rhode Island Employer's Income Tax Withholding Tables for help estimating how much to withhold, as well as additional information. The DOT website's withholding tax forms section has a copy available for download. Every year, the publication is updated.

Step 5 - Perform an annual reconciliation

You must file an annual reconciliation with the DOT after the end of the year that details the employee taxes you withheld during the year. In addition to the yearly reconciliation, you should provide each of your employees with a federal form W-2 that summarises their withholding for the year.

Use Form RI W-3, Reconciliation of Personal Income Tax Withheld by Employers, which is available on the DOT website's withholding tax forms area. (Annual filers, who don't have any withholding, utilise a separate form with a different deadline.) You should include copies of the federal W-2s that were mailed to all of your Rhode Island workers. W-2s must be sent electronically by larger firms, while smaller employers may opt to do so freely.

There is no need for a paper reconciliation form if you submit W-2 information online. The yearly reconciliation form must be mailed and received by the final day of February.

How You Can Affect Your Rhode Island Paycheck

Although you won't be able to influence every component of your salary, there are certain things you can do to influence your take-home money. Contributing to pre-tax accounts such as a health savings account (HSA), 403(b), or 401(k) is one option (k). When you put money into these accounts, you're doing it before taxes, which means you're lowering your taxable income. While not all workplaces provide these alternatives, if yours does, you should take advantage of them.

You could also choose to have a certain amount deducted from each of your paychecks to cover your taxes. There's a section on the W-4 where you may type in any extra money you'd like your employer to deduct from each paycheck. Yes, your paychecks will be less, but instead of underpaying and owing money around tax season, you'll be spreading out your tax load throughout the whole year.

Bottom Line

In Rhode Island, payroll processing is a simple process. Keep in consideration the increased minimum wage and individual tax rates, when computing payroll. However, most of the restrictions are in line with federal norms, so you won't have to worry about rules clashing.

How Can Deskera Assist You?

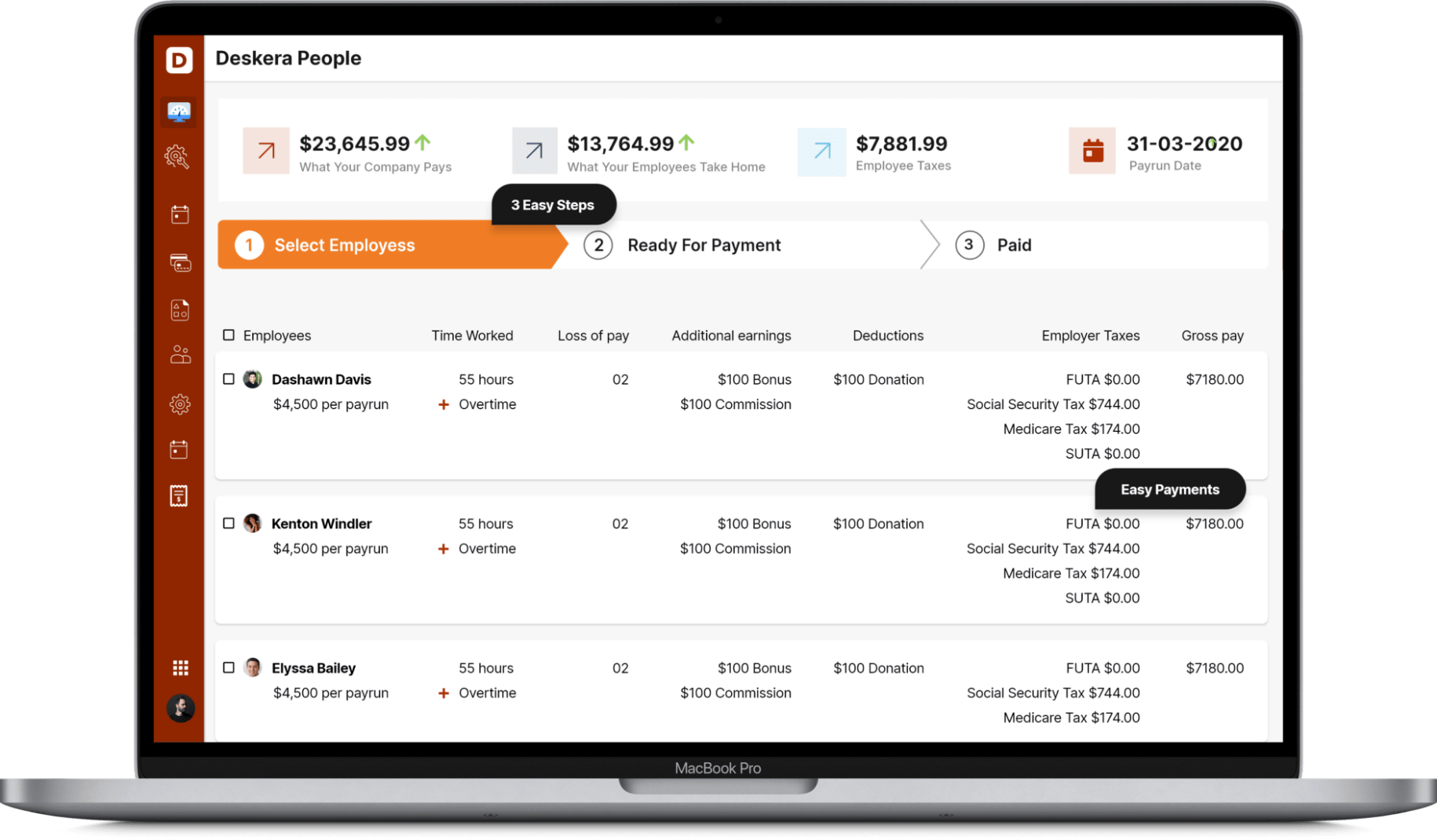

Deskera People make it simple to handle attendance, leave, payroll, and other processes so that you can focus on making the best decisions. For example, creating payslips for your employees is now simple since the platform also automates and digitizes HR tasks.

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Related Articles